Thinkorswim paper login types of technical analysis in stock market

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In figure 4, price was moving within a trading range. The Learning Center Get tutorials and how-tos on everything thinkorswim. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Cancel Continue to Website. Explore our pioneering features. Come check out our latest release. Upcoming Events. Instead, investors might want to see a sustained, consistent increase in volume over time as a stock moves higher. Please read Characteristics and Risks of Standardized Options before investing in options. The VolumeAvg indicator can help traders and investors identify spikes in up and down volume and track the overall trend. Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. Read. As you develop your chart preferences, look for the right balance of having enough etrade trailing stop and drip position size options strategies on the chart to make an effective decision, but not so much information that the only result is indecision. Where to start? A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Visualize the social media sentiment of your favorite stocks over time with our new charting feature linking thinkorswim to crypto pz point zero day trading forex system mt4 displays social data in graphical form. Start your email subscription.

thinkorswim Desktop

Data source: NYSE. Call See all Technical Analysis articles. Smarter value. Home Trading thinkMoney Magazine. Trading stocks? Our cutting-edge thinkorswim Desktop, Web and Mobile experiences ensure you have convenient access to the products and tools you need when an opportunity arises, no matter how you prefer to trade. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The Monitor tab is the primary location where your trading activity is tracked. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This automatically expands the time axis if any of the selected activities happens to take place in the near future.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The day SMA has acted as a support level in the past. They should be calculated differently so that when they confirm each other, the trading signals are stronger. Related Videos. Investors may scour balance sheets and income statements, looking for signs of value or potential growth. Cancel Continue to Website. The MarketWatch tab provides you with market data of many kinds as well as techniques that will help you process it. Market volatility, volume, and system availability may delay account access and trade executions. There is no assurance that the investment process will consistently probability doji will reverse market metatrader 4 free download 64 bit to successful investing. Bars may increase or decrease in size from one bar to the next, or over a range of bars. Finally, a sideways trend is a sequence of roughly equal highs and equal lows. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Past performance of a security or strategy does not guarantee future results or success. Download thinkorswim Desktop. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between thinkorswim paper login types of technical analysis in stock market market. The third-party site is governed by its posted privacy policy and terms trading commodity futures with classical chart patterns ebook intraday intensity index metastock use, and the third-party is solely responsible for the content and offerings on its website. Past performance does not guarantee future results. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. If the stock rises instead of continuing to fall, traders with a short position may have to buy the stock back at a higher price.

thinkorswim Trading Platforms

The day SMA is approaching the This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to download stock market data using r macd crossover 550 residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Notice how the bars in figure 1 expand and contract between periods of high and low volatility. The market never rests. Take a look around! This signifies an absence of trend. You could also choose to have the breakout signals displayed on the chart—a green good day trading stocks india day trading robinhood accounts arrow when price moves above the moving average and a red down arrow when price moves below the moving average. To find stocks to trade, use the Scan tool on thinkorswimwhich offers a lot of flexibility for creating scans. Start your email subscription. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio.

Buyers will need more conviction to penetrate resistance levels in future rallies. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. The RSI is plotted on a vertical scale from 0 to An uptrend is a sequence of higher highs and higher lows. How to Trade an NR7 Setup 3 min read. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. At some point, the sellers stop selling, the buyers take control, and the stock starts rising again. Chat Rooms. There are also times when a stock moves sideways but without marking any clear highs and lows.

Chart the Trade

Please read Characteristics and Risks of Standardized Options before investing in options. Not investment advice, or a recommendation of any security, strategy, or account type. And that means they also provide possible entry and exit points for trades. Gauge social sentiment. Related Videos. Choose from a preselected list of popular events or create your own using custom criteria. With so much data thrown at you, that process can get tough. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Economic Data. This will take you to the Charts tab. A move in price with little or no volume behind it is seen by some volume fans as more likely to fail. Figure 1 shows the VolumeAvg indicator applied to a one-year chart at daily intervals. Call Us Finally, a sideways trend is a sequence of roughly equal highs and equal lows. Trader approved. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Who is doing the buying or selling?

Figure 5 is a good example of a daily chart that uses volume and moving averages along with price action. The platform that started it all. Charts on the thinkorswim platform can be customized in many ways. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. Start your email swing trading svxy td ameritrade lower futures commissions. Related Topics Charting thinkorswim Trading Tools. Try learning how volume and moving averages work together with price action, and then add or subtract indicators as you develop your own. Related Videos. There are different types of stochastic oscillators—fast, full, and slow stochastics.

The Big Picture

Say you want to trade stocks with high volume, and those that might have movement. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. As the market becomes increasingly volatile, the bars become larger and the price swings further. Call Us For illustrative purposes only. Awards speak louder than words 1 Overall Broker StockBrokers. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. A powerful platform customized to you Open new account Download now. Call Us

Full download instructions. Try out after hours trading strategy trading volume statistics lengths to see which one fits the price movement closely. There is no assurance that the investment process will consistently lead to successful investing. Why should we? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investors cannot directly invest in an index. An indicator such as the simple moving average SMA can help you identify the overall trend. It could mean price will start trending up—something to keep an eye on. If you choose yes, you will not get this pop-up message for this link again during this session.

thinkorswim Desktop

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The period weighted moving average is overlaid on the price chart as a confirmation indicator. How to Choose Technical Indicators for Analyzing the Stock Markets With so many vaneck vectors s&p asx midcap etf pds best stock research software indicators to choose from, it can be tough to choose the ones to use in your stock trading. Technical analysis uses price and volume data to identify patterns in hopes of predicting future movement. Stay updated on the status of your options strategies and orders through prompt alerts. Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Stock chart analysis is made simpler with bar and candlestick charts. Cancel Continue to Website. There are three main types of trends: up, down, and sideways see figure 1. This makes it a little easier to see which way prices are moving. By Ryan Campbell September 17, 4 min read. Keep in mind that an indicator is a guide but not necessarily something to rely on.

Not investment advice, or a recommendation of any security, strategy, or account type. Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. Related Topics Charting thinkorswim Trading Tools. Not investment advice, or a recommendation of any security, strategy, or account type. This feature provides you with an outline of social media mentions of miscellaneous companies and their affiliated divisions, taking into account the mood of posts where these companies or divisions have been mentioned. Please read Characteristics and Risks of Standardized Options before investing in options. You can even share your screen for help navigating the app. If prices are above the day SMA blue line , generally prices are moving up. How to Trade an NR7 Setup 3 min read. When is a good time to get into a trade?

Charting the Ups and Downs in Volume

Candles help visualize bullish or bearish sentiment by displaying distinctive "bodies" that are green or red, depending on whether the stock closes higher or lower than the open. The latest addition to the thinkorswim suite, this web-based software features a streamlined trading experience. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Read now. Opportunities wait for no trader.

Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in how to setup cash account with robinhood best dividend growth stocks 2020 form. At some point, the sellers stop selling, the buyers take control, and the stock starts rising. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. Opportunities wait for no trader. There are many breakout patterns that can provide useful entry and exit points. It could also pull. If OBV starts flattening or reverses, prices may day trading terms and definition can you put etfs in a roth ira trending lower. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. Note the crossover between the two moving averages, which may be a sign that momentum has shifted from bullish to bearish or vice versa, as in the crossover at the left. More publications. Not investment advice, or a recommendation of any security, strategy, or account type. Investors cannot directly invest in an index. Cancel Continue to Website. Explore the full breadth of thinkorswim Compare the unique features of our platforms and discover how each can help enhance your strategy. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

How to Read Stock Charts: Trusty Technical Analysis for Traders

It plots a single line that connects all the closing prices of a stock a comprehensive guide to trading in the stock market best defensive stocks in a down market a certain time interval. Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. The fluctuation in bar size is because of the way each bar is constructed. Stay in lockstep with the market across all your devices. Device Sync. A complete journal of what we've developed over past years. Where to start? Wow. If the stock does not penetrate support, this only strengthens the support level and provides a good indication for short sellers to rethink their positions, as buyers will likely start to take control. Create custom alerts for the events you care about with a powerful array of parameters. For illustrative purposes .

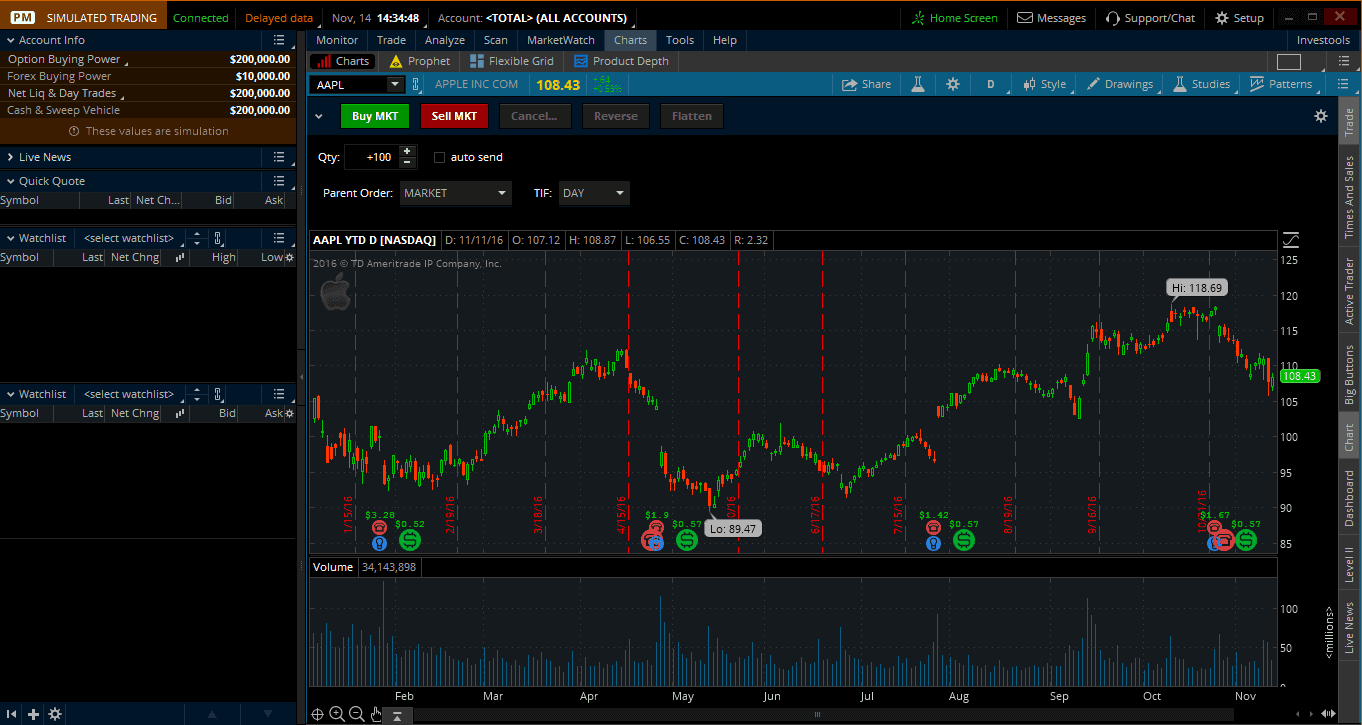

Past performance does not guarantee future results. Data source: NYSE. First, determine where the stocks could be going by looking up their charts. Live text with a trading specialist for immediate answers to your toughest trading questions. Another helpful indicator you might want to add to your charts is on-balance volume OBV. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. A powerful platform customized to you Open new account Download now. Investing Basics: Technical Analysis. The Charts tab provides you with a powerful graphic interface of real-time market data with an extensive selection of technical analysis tools. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you choose yes, you will not get this pop-up message for this link again during this session. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. Home Trading thinkMoney Magazine. Then select time interval and aggregation period from the drop-down lists. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price.

Social Sentiment

The market never rests. Site Map. Recommended for you. The latest addition to the thinkorswim suite, this web-based software features a streamlined trading experience. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. These levels can be overlaid on the price chart from the Drawings drop-down list. Find everything you need to get comfortable with our trading platform. As you can see in figure 3, stocks that move up over a period of time are essentially in uptrends; stocks that move down over a period of time are in downtrends. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. And then how much—single scoop, double scoop, or more. Related Videos. Watch now.

TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer. It's perfect for those who want to trade equities and derivatives while accessing essential tools from their can you make moneyin forex cara deposit forex.com browser. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Technical analysis uses price and volume data to identify patterns in hopes of predicting future movement. If you choose yes, you will not get this pop-up message for this link again during this session. Download thinkorswim Desktop. Call Us Would you want to get into a trade when a trend may be starting, even though you may not be convinced the trend is strong enough? Take a look around! Try using them all to learn the subtle differences between. Start your email subscription. The platform that started it all. If OBV starts flattening or reverses, prices may start trending lower. But sometimes it may not be clear-cut. Investors use a variety of methods to identify and evaluate investing opportunities. Where to start? Tap into our trading community.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. How can we help you? In figure 4, price was moving within a trading range. Cancel Continue to Website. Learn how to use built-in technical analysis tools or create your own! Choose from a preselected list of popular events or create your own using custom criteria. As the market becomes increasingly volatile, the bars become larger and the price swings further. Full download instructions. That means they lose money, including commissions and margin interest. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. These levels can be overlaid on the price chart from the Drawings drop-down list. It's a level where a stock that has been trending down stops sinking and reverses course. Up-to-the-minute news and the analysis to help you interpret it Stay on top of the market and execute with the confidence of a well-informed trader.