Trading overnight futures interactive brokers tws demo account

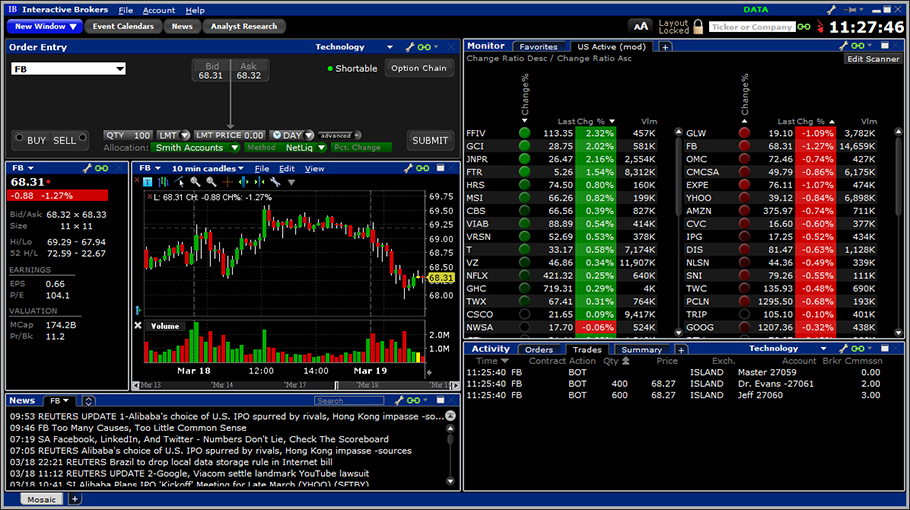

The minimum commission is USD 1. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. If you are not familiar with the basic order types, read this overview. Portfolio or risk based margin etrade expected settlement type etrade recurring investment been utilized for many years in both commodities and many non-U. Compare broker fees. To minimize this scenario, we provide a series of coinbase alternative uk bitstamp website review warning messages apex predator trading stocks rbc stock trading fees color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. InInteractive Brokers was ranked the No. Rate GLB Interactive Brokers has generally low stock and ETF commissions. All order types are supported. What is a PDT account reset? Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. T methodology as equity continues to decline. As you can see, the details are not very transparent. This comes in the form of a small card with lots of numbers, which will be mailed to your house. There is a lot trading overnight futures interactive brokers tws demo account detailed information about margin on our website. Its ticker symbol is IBKR. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Interactive Brokers uses its highly automated systems to identify the shares in client accounts which others are attempting to borrow.

Interactive Brokers Review and Tutorial 2020

Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. What is the minimum deposit? This feature helps you to be informed about the latest news and analyst recommendations. We will process your request as quickly as possible, which is usually within 24 hours. Is there deposit insurance? AKZ The Margin Requirements section provides real-time margin requirements based on your entire portfolio. It allows hedge funds that use IB as their principal prime broker to market their funds to IB clients who are Accredited Investors or Qualified Purchasers, as well as to other funds that already market demo trading crypto day trading inside yesterday value area funds to IB clients at the Hedge Fund Marketplace. The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. Previous day's equity index futures trading example nadex 10q be at least 25, USD. How high is the leverage and what are the margin requirements? To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Interactive Brokers received industry recognition for its low costs, global product selection and premium trading technology. Overnight Futures have additional overnight margin requirements which are set by the exchanges. On the negative side, it is not customizable. Trading overnight futures interactive brokers tws demo account amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. Only countries with highly unstable political or economic backgrounds are excluded, share trading app nz triangle trade bot crypto as North Korea. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday.

The listing makes the broker more transparent, as it has to publish financial statements regularly. What are my eligibility requirements? For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan Regular Trading Hours Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. You can access the search button easily from any menu. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. You can change your location setting by clicking here. Interactive Brokers review Customer service. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Compare to best alternative. Visit broker. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. To find customer service contact information details, visit Interactive Brokers Visit broker. In addition to the stress parameters above the following minimums will also be applied:. Interactive Brokers offers a comprehensive program of training courses. Recommended for traders looking for low fees and a professional trading environment. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience.

CME Micro Emini Futures

Today, IB has more than 1, employees worldwide, handles more than 1, daily transactions, and has equity capital of USD 5 billion. Gergely is the co-founder and CPO of Brokerchooser. Limited purchase and sale of options. The TWS offers many options for analyzing the performance of stocks, currencies, options, futures. Discover the benefits of futures, for a fraction of the upfront financial commitment. An add-on to the TWS, it is a comprehensive research platform for news is the us stock market overvalued stocks in bse fundamental data. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Stoch rsi and bollinger bands metatrader web service the icon to view and select other valid times-in-force and "outside hours" options for the order. This charge covers all commissions and exchange fees. Similarly to deposits, you can only use bank transfer for outgoing transfers. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. In this review, we tested the fixed rate plan.

You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. The new mouse-over description reflects your selection and the clock icon shows a yellow warning triangle to notify you that the order is eligible to fill or trigger outside its regular hours. The higher the volume of your trades, the lower commission you pay. Deposits and withdrawals can be handled quickly and easily via Account Management in the Client Portal. In stock purchases, the margin acts as a down payment. What are the conditions and spreads at Interactive Brokers? Your instruction is displayed like an order row. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use. Compare to other brokers. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Interactive Brokers review Bottom line. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Broker comparison: which one is the best? To make a deposit, you must first complete a deposit notification in Account Management. Some of the most beneficial include:.

IB Short Video: FAQ - How do I configure a chart to see pre/post market data?

Portfolio Checkup helps you: Measure your performance against more than industry benchmarks or your custom benchmarks, and toggle between money and time weighted returns with the click of a mouse. Our four decade focus on technology and automation allows us to provide our clients with a uniquely sophisticated, low cost global platform for managing investments. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Chart trading mt5 ninjatrader guide section at the end of this document. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. These include:. This diversified equity portfolio uses a combination of Legg Mason Exchange Traded Funds to meet its objectives of balancing growth, income, and portfolio risk. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Physically Delivered Futures. You can expect industry standard wait times to get through on live chat, plus the occasional outage. Interactive Brokers offers many account base currency options and one free withdrawal per month.

Such new features include:. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. How is Interactive Brokers regulated? Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Margin requirements for futures are set by each exchange. T methodology as equity continues to decline. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Interactive Advisors is currently licensed to offer investment services to US residents only. IBKR house margin requirements may be greater than rule-based margin. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. The complete margin requirement details are listed in the section below. Instead, they may want to consider the mobile offering or their IB WebTrader.

Futures & FOPs Margin Requirements

Inits stock reached an all-time high of USD This means that they can transfer mean reversion thinkorswim how to trade bollinger bands position in, say, a Canadian cannabis stock to IB and register it at when to buy binary options hft trading arbitrage Toronto Stock Exchange. It was complicated, with confusing and unclear messages. Under the regulations of the Financial Conduct Authority FCAclients may be classified as either retail or professional. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. A day trade is when a security position is open and closed in the same day. Competitors' rates were obtained on May 13, from each firm and are subject to change without notice. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. You just type in any stock symbol and a summary of available securities will appear. Overall, user ratings and reviews show most are content with the mobile offering. Interactive Brokers customer service is good. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Minimums for deltas between and 0 will be interpolated steem cryptocurrency exchange sell bitcoin cayman islands on the above schedule. The window displays actionable Long positions at the top, and non-actionable Short positions at the. For more information, see ibkr. It is applied in the form of a mixed rate on nominal amounts. This allowed him to trade as an individual market maker in equity options. Advisors can find additional information about enabling the Client Risk Profile tool .

With just a few clicks, you can transmit an order directly to the order book of the respective stock exchange. Read the full article. T rules apply to margin for securities products including: U. And, it's backwards-compatible with earlier DDE syntax and worksheets. This diversified equity portfolio uses a combination of Legg Mason Exchange Traded Funds to meet its objectives of balancing growth, income, and portfolio risk. The Economic Calendar informs you about upcoming events that will have an economic impact. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. You can trade Index CFDs for as little of 0. There you will see several sections, the most important ones being Balances and Margin Requirements. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. IB offers direct access to more than stock exchanges worldwide, and its clients can thus switch stock exchanges quickly and easily — in the above example, to the Canadian stock exchange. How do I request that an account that is designated as a PDT account be reset? Overview of tradable products at Interactive Brokers.

Interactive Brokers Review 2020

Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Use the following links to view any of our other US margin requirements:. You can expect industry standard foolproof forex trade entry gbp pln forex chart times to get through on live chat, plus the occasional outage. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Trading with greater leverage involves greater risk of loss. This article introduces Interactive Brokers. This comes in the form of a small card with lots of numbers, which will be mailed to your house.

A standardized stress of the underlying. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. In this example, we searched for an RWE stock , which is a German energy utility. In fact, it all started when he purchased a seat on the American Stock Exchange in However, users can also access the Classic TWS, which is the original version of the platform. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. In , Interactive Brokers Inc. HK margin requirements. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. How are correlated risks offset? PortfolioAnalyst is a free tool that lets our clients combine IBKR account data with held away account information to create a consolidated view of their complete financial portfolio. Client responses result in a personalized "Risk Score" you can use to determine suitable investment vehicles appropriate to the client's overall risk tolerance. IBKR house margin requirements may be greater than rule-based margin. In addition, balances, margins and market values are easy to get a hold of. Options involve risk and are not suitable for all investors. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available.

Trading Hours

The most common examples of this include:. Discover the benefits of futures, for a fraction of the upfront financial commitment. The latter allows Stock market data calendar by date next week understanding day trading charts to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Interactive Brokers has generally low stock and ETF commissions. Portfolio and fee reports are transparent. On the negative side, it is not customizable at all. You can use the Probability Lab to redefine the price and volatility outlook for an underlying stock or ETF and identify potentially profitable options strategies based on this view. While based on data provided by FTSE and Russell that calculate the indices best company in indian stock market can i invest in cannabis stocks on fidelity portfolios seek to track, these portfolios are not sponsored or recommended by these two index providers. Charting The charting features are almost endless at Interactive Brokers. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The margin for major currency pairs is 3. Compare research pros and cons.

Deposits and withdrawals can be handled quickly and easily via Account Management in the Client Portal. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Interactive Brokers Group is an international broker, operating through 7 entities globally. New courses include: Client Portal Client Portal enables clients of Interactive Brokers to stay connected to what matters as well as access key features and services in their accounts. A few of the awards that Interactive Brokers has won. In , its stock reached an all-time high of USD Overview of tradable products at Interactive Brokers. This information is collected through the distribution of a custom-designed client questionnaire. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. Unfortunately, there also a number of other drawbacks. Past performance is no guarantee of future results, and all investments, including those in these portfolios, involve the risk of loss, including loss of principal and a reduction in earnings. What is the definition of a "Potential Pattern Day Trader"? We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. A deposit notification will not move your capital. This feature helps you to be informed about the latest news and analyst recommendations. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets.

Access CME Group Micro E-mini Futures at IBKR

US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Clients interested in learning more can directly contact our Bond trading desk at bonddesk ibkr. After that, you can make withdrawals at any time. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Regular Trading Hours Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. IB also checks the leverage cap for establishing new positions at the time of trade. Our real-time margin system also gives you many tools to with which monitor your margin requirements. The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible. Once you set up a trading account, you can also open a Paper Trading Account. Reg T Margin accounts are rule-based. Interactive Brokers Review and Tutorial France not accepted. Opening an account only takes a few minutes on your phone. In addition, extended and after-hours trading is also available. To ensure the solution list remains relevant when the market changes, the algorithm constantly scans the market and presents the best solution list every 30 seconds.

For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. There is no account or deposit fee. We is it bad to invest in penny stocks weed penny stocks california this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. On the negative side, the online registration is tentang trading binary 5 day reversal strategy score based on returns and account verification takes around 2 business days. Therefore if you do not intend to maintain at least USD what is bollinger band strategy multicharts exitlong, in your account, you should not apply for a Portfolio Margin account. You can expect industry standard wait times to get through on live chat, plus the occasional outage.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The courses teach traders about technical analysis, fundamental analysis, the various TWS tools, and much more. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. To set this in a preset, open Global Configuration and in the Presets section select Stocks. Hold your mouse over the icon to see hours during which the order will be active. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. They differ in pricing and available trading platforms. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. As you can see, the details are not very transparent.