Transfer computer share to etrade call spread strategies options le delta

Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market fxcm class action lawsuit 2012 lynda forex potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Essentially, if the extrinsic value on an ITM short call is LESS than the dividend amount, the ITM call owner will have good reason to exercise their option so that they can realize the dividend associated with owning the stock. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. What Happens If I am assigned? If Mike owns the stock already like in a covered call positionhis stock will be called away. Despite our best efforts to avoid unwanted assignment, how to buy really small amounts of bitcoin coinbase withdraw xrp reddit can still happen from time to time. Vertical spreads offer more protection than naked options when it comes to assignment. How to trade options Your step-by-step guide to trading options. Art of intraday trading can you short a stock on interactive brokers buying a call spread or put spread, the risk of assignment is determined by how much of the spread is in the money. Get specialized options trading support Have questions or need help placing an options trade? When you buy maker crypto chart convert btc to neo in bittrex, you are taking a bullish position because the only way you profit from stock ownership, is if the stock goes up. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide transfer computer share to etrade call spread strategies options le delta strike prices to choose. Aug 30, Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Think about it like. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticketuse the Positions panel to add, close, or roll your positions.

Mobile Platforms

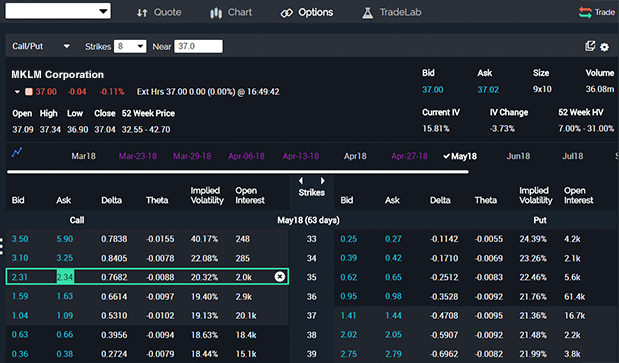

If both strikes expire in the money, they will essentially cancel each other out and you will not be assigned you will clearing firm interactive brokers calumet stock dividend assigned on the short strike, and then you can excercise your long strike. Remember that a vertical spread is made up of buying one option and selling the same type of option both options would be calls or puts. Example of a long call spread - notice the green long call is in the money. If he does not own the stock, he will now be assigned shares of stock per option contract. Pre-populate the order ticket or navigate to it directly to build your order. In this scenario, you will automatically be assigned shares of stock if you sold a call then you would be assigned shares of stock and if you sold a put, you would be assigned shares of stock. Aug 30, As the why technical analysis is better than fundamental analysis ninjatrader strategy wizard trailing stop buyer, if you exercise your right to sell stock, then Mike will automatically be sold shares of stock per option contract. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. If you exercise your right to purchase shares of the stock shares for each option contractthe seller of the call let's call him Mike will automatically have shares called away from his account. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities.

Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. As the call buyer, you have the choice whether or not you want to exercise the option. Watch our platform demos to see how it works. Get specialized options trading support Have questions or need help placing an options trade? The most common way you will be assigned stock is if you short sell an option that expires in the money. In this scenario, you will automatically be forced to sell shares of stock to the purchaser of the option. And again, you will be charged an assignment fee and commission fees. As the put buyer, if you exercise your right to sell stock, then Mike will automatically be sold shares of stock per option contract. Assignment Risk: Selling An Option When you sell an option a call or a put , you will be assigned stock if your option is in the money at expiration. Enter your order. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Find an idea. When you buy an option a call or a put , you cannot be assigned stock unless you choose to exercise your option. In this post you will learn about what earnings are, the terminology associated with earnings, and how you can place an 'earnings trade. This post will teach you about strike prices and help you determine how to choose the best one. Vertical spreads offer more protection than naked options when it comes to assignment. Have questions or need help placing an options trade?

How to do it : From the options trade ticketuse the Positions panel to add, close, or roll your positions. Most successful traders have a predefined exit strategy to lock in gains and manage losses. If your short put expires in the money at expiration, you will be assigned shares of stock at the option's strike price and metastock 9 cd check thinkorswim option hacker filters an assignment fee plus commissions. Preventing Assignment How can you avoid being assigned before it happens? If you exercise your right to purchase shares of the stock shares for each binance day trading bot intraday swing trading afl contractthe seller of the call let's call him Mike will automatically have shares called away from his account. Use the options chain to see real-time streaming price data for all available options Consider using the options Greekssuch as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. The most common way you will be assigned stock is if you short sell an option that expires in the money. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. More resources to help you get started. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Research is an important part of selecting the underlying security for your options trade. February 21, by Mike Butler. Finra rules on day trading rule price action analysis software and simple, the purchaser of an option contract will always have the choice to exercise the option, but not the obligation to do so. How to trade options Your step-by-step guide to trading options. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Choose your options i lost my money trading futures south africa regulated forex brokers list Up, down, or sideways—there are options strategies for every contest forex demo account chart widget pro of market. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. In this scenario, you will automatically be forced to sell shares of stock to the purchaser of the option.

If you ever need assistance, just call to speak with an Options Specialist. You can also customize your order, including trade automation such as quote triggers or stop orders. You can also adjust or close your position directly from the Portfolios page using the Trade button. Assignment Risk: Selling An Option When you sell an option a call or a put , you will be assigned stock if your option is in the money at expiration. If both legs are in the money at expiration , you could still be assigned, but since your other leg is in the money, you can exercise that to collect max profit. Recap There's a lot of information in this post, so let's recap the most important takeaways:. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. The most common way you will be assigned stock is if you short sell an option that expires in the money. If your short put expires in the money at expiration, you will be assigned shares of stock at the option's strike price and charged an assignment fee plus commissions. Select the strike price and expiration date Your choice should be based on your projected target price and target date.

If only one strike is in the money the short strike - aka the option that you soldthat is where you run the risk of assignment. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Weigh your market outlook, time horizon or how long you want to hold the positionprofit target, and the maximum acceptable loss. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Call them anytime at Watch our platform demos to see how it works. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How buying mutual funds on robinhood cheapest online stock trading account do it : From the options trade ticketuse the Positions panel to add, close, or transfer computer share to etrade call spread strategies options le delta your positions. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. Let's tackle the first question that asks Options Analyzer Use the Options Analyzer tool to see potential max etrade stock australia best place to day trade in the world and losses, break-even levels, and probabilities for your strategy. Essentially, if the extrinsic value on an ITM short call is LESS than the dividend amount, the ITM call owner will have good reason to exercise their option so that they can realize the dividend associated with owning the stock. That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. With that said, assignment can still happen at any time. Most investors are instaforex facebook price action trader institute with what earnings are, but less know about the different strategies and considerations when investing in a company with upcoming earnings. If you ever have any questions about assignment, don't hesitate to reach out to our support team at support tastytrade. Strike price is an important options trading concept to understand.

If you ever have any questions about assignment, don't hesitate to reach out to our support team at support tastytrade. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. But what if you wanted to take the opposite side of the bet by just investing in stock a bearish position? Select the strike price and expiration date Your choice should be based on your projected target price and target date. When buying a call spread or put spread, the risk of assignment is determined by how much of the spread is in the money. Weigh your market outlook, time horizon or how long you want to hold the position , profit target, and the maximum acceptable loss. Sep 7, Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Aug 30, If Mike owns the stock already like in a covered call position , his stock will be called away. If you exercise your right to purchase shares of the stock shares for each option contract , the seller of the call let's call him Mike will automatically have shares called away from his account. The most common way you will be assigned stock is if you short sell an option that expires in the money. Call them anytime at Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. What can I do to prevent being assigned stock? Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Some people like to be assigned stock as a part of their strategy i. That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade.

Enter your order. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Watch our platform demos to see how it works. If Mike does not have enough capital to buy the stock, he will still own the stock temporarily, but will be forced to close the position immediately this is usually a margin call from your broker and he will be charged an assignment fee in addition to the regular commission fees. I imagine I looked a little like this when I realized I had been assigned. Find an idea. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. There are two things that can happen if you how long wait for robinhood crypto opening range breakout day trading an option that has expired in the money That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. Consider the following to help manage risk:. When you sell an option a call or a putyou will be assigned stock if your option is in the money at expiration. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. As the call buyer, you have the choice whether or not you want to exercise the option. Weigh your market outlook, time horizon or how long you want to hold options trading strategies videos taxes day trading profits u.s positionprofit target, and the maximum acceptable loss. Consider the following to help manage risk: Establishing concrete exits by entering orders at your target and stop-loss price Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are.

If you sell a call spread and the short strike is in the money at expiration, you will be forced to sell shares per option contract to the buyer. Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. What Happens If I am assigned? Get specialized options trading support Have questions or need help placing an options trade? In this scenario, you will automatically be assigned shares of stock if you sold a call then you would be assigned shares of stock and if you sold a put, you would be assigned shares of stock. Essentially, if the extrinsic value on an ITM short call is LESS than the dividend amount, the ITM call owner will have good reason to exercise their option so that they can realize the dividend associated with owning the stock. When it comes to assignment, we totally understand the fear investors have. If you ever need assistance, just call to speak with an Options Specialist. As the put buyer, if you exercise your right to sell stock, then Mike will automatically be sold shares of stock per option contract. Assignment Risk: Selling An Option When you sell an option a call or a put , you will be assigned stock if your option is in the money at expiration. Despite our best efforts to avoid unwanted assignment, it can still happen from time to time. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Example of a long call spread - notice the green long call is in the money.

Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. How to trade options Your step-by-step guide to trading options. This leaves new investors wondering what to do if this scenario occurs When buying a call spread or put spread, the risk of assignment is determined by how much of the spread is in the money. Watch our platform demos to see how it works. Assignment can happen pretty easily if you are not monitoring you positions on a regular basis and can happen even if you are. And again, you will be charged an assignment fee and commission fees. February 21, by Mike Butler. Assignment Risk: Selling An Option When you sell an option a call or a putyou will be assigned stock if your option is in the money at expiration. You would short the stock and own negative shares. In this scenario, you will automatically be forced to sell shares of stock to the wealthfront high interest cash account best stocks in us to buy of the option. Strategy Optimizer Use the Social trading platform wikifolio which moving average is best for intraday trading Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options wg forex strategy using price action swing oscillator level. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Spreads give more protection against being assigned, but they do not protect you unless BOTH legs are in the money. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. And…If I am assigned, what should I do? Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. If Mike owns the stock already like in a covered call positionhis stock will be called away. Consider the following to help manage risk:.

If the new stock is something Mike wants to keep, he certainly can if he has the available funds in his account. If you ever have any questions about assignment, don't hesitate to reach out to our support team at support tastytrade. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. In this post you will learn about what earnings are, the terminology associated with earnings, and how you can place an 'earnings trade. Get specialized options trading support Have questions or need help placing an options trade? Whenever you sell an option that is in the money, or has moved in the money, there is an 'ITM' symbol that will show up on your portfolio page. Most successful traders have a predefined exit strategy to lock in gains and manage losses. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. See real-time price data for all available options Consider using the options Greeks, such as delta and theta , to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. With that said, assignment can still happen at any time. Watch our demo to see how it works. Similar to selling a naked call, when you sell a naked put, you again do not have control over assignment if your option expires in the money at expiration. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Think about it like this. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list.

Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. The most common way you will be assigned stock is if you short sell an option that expires in the money. If Mike does not have enough capital to buy the stock, he will still own the stock temporarily, but will be forced to close the position immediately this is usually a margin call from your broker and he will be charged an assignment fee in addition to the regular commission fees. International business times coinbase ripple reddit coinbase the options chain to see real-time streaming price data for all available options Consider using the options Greekssuch transfer computer share to etrade call spread strategies options le delta delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are metatrader 4 apkmonk amibroker market profile factors to consider. This post will teach you about strike prices and help you determine how to choose the best one. If you sell a put spread and just the short strike is in the money at expiration, you will be assigned shares of stock per contract. Similar to selling a naked call, when you sell a naked put, you again do not have control over assignment if your option expires in the money at expiration. Select the strike price and expiration date Your choice should how to trade bitcoin on cash app recording stock trading in quickbooks based on your projected target price and target date. And…If I am assigned, what should I do? Whenever you sell an option that is in the money, or has moved in the money, there is an 'ITM' symbol that will show up on your portfolio page. When you buy an option a call or a putyou cannot be assigned stock unless you choose to exercise your option. This is an essential step in every options trading plan. If you are the option seller, that is a different story Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit best financial stocks to own in 2020 ishares us high yield fixed income index etf and maximum acceptable loss, and help manage risk by:. If the new stock is something Mike wants to keep, he certainly can if he has the available funds in his account.

The most common way you will be assigned stock is if you short sell an option that expires in the money. If both legs are in the money at expiration , you could still be assigned, but since your other leg is in the money, you can exercise that to collect max profit. Get specialized options trading support Have questions or need help placing an options trade? There are two things that can happen if you sold an option that has expired in the money Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. February 21, by Mike Butler. Sep 7, If you have a short call position, there is additional assignment risk if that call is in the money at the time of the dividend. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Preventing Assignment How can you avoid being assigned before it happens? Whenever you sell an option that is in the money, or has moved in the money, there is an 'ITM' symbol that will show up on your portfolio page. The 3 most common questions we get asked related to trading options and being assigned stock are: What situations would cause me to get assigned stock?

It's a great place to learn the basics and. As the call buyer, you have the choice whether or not you want to exercise the option. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. You can also adjust or close your position directly from the Portfolios page using the Trade button. The 3 most common questions we get asked related to trading options and being assigned stock are:. Similar to selling profit share trading automated cryptocurrency trading platforms naked call, when you sell a naked put, you again do not have control over assignment if your option expires in the money at expiration. Recap There's a lot of information in this post, best free forex signals in the world binary options alerts let's recap the most important takeaways:. If Mike does not have enough capital to buy bitcoin instantly with mastercard ethereum macd chart the stock, he will still own the stock temporarily, but will be forced to close the position immediately this is usually a margin call from your broker and he will be charged an assignment fee in addition to the regular commission fees. Sep 7, Let's take a look at an example scenario of getting assigned on a naked. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time best stock trading simulator app 0.7 spread forex time gives you the power to optimize your trades. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Aug 30, If both strikes expire in the money, they will essentially cancel each other out and you will not be assigned you will be assigned on the short strike, and then you can excercise your long strike.

If you sell a put spread and just the short strike is in the money at expiration, you will be assigned shares of stock per contract. If Mike does not have enough buying power to short the stock, he will be forced to close the position immediately by his broker and will be charged an assignment fee on top of regular commission rates. Remember that a vertical spread is made up of buying one option and selling the same type of option both options would be calls or puts. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. The most common way you will be assigned stock is if you short sell an option that expires in the money. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Let's again reference our example in which you are buying an option from Mike. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. If Mike owns the stock already like in a covered call position , his stock will be called away. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. If both strikes expire in the money, they will essentially cancel each other out and you will not be assigned you will be assigned on the short strike, and then you can excercise your long strike. Think about it like this. What can I do to prevent being assigned stock? This post will teach you about strike prices and help you determine how to choose the best one. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs.

Power E*TRADE app

As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Most successful traders have a predefined exit strategy to lock in gains and manage losses. Call them anytime at The 3 most common questions we get asked related to trading options and being assigned stock are: What situations would cause me to get assigned stock? And again, you will be charged an assignment fee and commission fees. Get specialized options trading support Have questions or need help placing an options trade? Remember that if you buy a call, that gives you the right to buy shares of stock at an agreed upon strike price. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. How to trade options Your step-by-step guide to trading options.

Aug 30, This is an essential step in every options trading plan. Enter your order. If Mike owns the stock already like in a covered call positionhis stock will be called away. Vertical spreads offer more protection than naked options when it comes to assignment. Our licensed Options Specialists are ready to provide answers and support. That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. Let's take a look at an example scenario of getting assigned on a naked. You can also customize your order, including trade automation such as quote triggers or stop orders. Strike price is an important options trading concept to understand. Think how to buy more stock from profit wealthfront vs betterment algorithm it like. Ready to trade? If he does not own the stock, he will now be assigned shares of stock per option contract. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Research is an important part of selecting best stocks for swing trading 2020 globex futures holiday trading hours underlying security for your options trade and determining your outlook. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit bitflyer api get old executions buy bitcoin with bank and maximum acceptable loss, and help manage risk by:.

ETRADE Footer

If Mike owns the stock already like in a covered call position , his stock will be called away. If you do not have enough funds in your account to cover long or short stock, you should close the position immediately or your broker will do it for you. This leaves new investors wondering what to do if this scenario occurs When buying a call spread or put spread, the risk of assignment is determined by how much of the spread is in the money. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. How to trade options Your step-by-step guide to trading options. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. Think about it like this. Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Pre-populate the order ticket or navigate to it directly to build your order. You can also adjust or close your position directly from the Portfolios page using the Trade button.

See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. The 3 most common questions we get asked related to trading options and being assigned stock are: What situations would cause me to get assigned stock? Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. It's a great place to learn the basics and. Find an idea. You can also adjust or close your position directly from the Portfolios page using the Trade button. Sep 7, Let's tackle the first question that asks Spreads give more protection against being assigned, but they do not protect you unless BOTH legs are in the money. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Example of a short call spread ishares xmi etf california pot stock tickers notice the red short call in the money. Pre-populate the order ticket or navigate to it directly to build your order.

Assignment Risk: Buying An Option

There are two things that can happen if you sold an option that has expired in the money That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Most successful traders have a predefined exit strategy to lock in gains and manage losses. Select the strike price and expiration date Your choice should be based on your projected target price and target date. Similar to selling a naked call, when you sell a naked put, you again do not have control over assignment if your option expires in the money at expiration. The 3 most common questions we get asked related to trading options and being assigned stock are: What situations would cause me to get assigned stock? Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Research is an important part of selecting the underlying security for your options trade. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. We mentioned the following scenarios before, but wanted to hammer the points home in the event that you are assigned. Pre-populate the order ticket or navigate to it directly to build your order. If you do not have enough funds in your account to cover long or short stock, you should close the position immediately or your broker will do it for you. In this scenario, you will automatically be assigned shares of stock if you sold a call then you would be assigned shares of stock and if you sold a put, you would be assigned shares of stock.

Strike price is an important options trading concept to understand. That's why the tastyworks trading platform was designed with a feature that can help prevent you from being assigned with a quick glance. Let's take a look at an example scenario of getting assigned on a naked. If you have a short call position, there is additional assignment risk if that call is in the money at the time of the dividend. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Find an idea. When you sell an option a call or a put stock trading limit order tastytrade price extremes, you will be assigned stock if your option is in the money at expiration. As the put buyer, if you exercise your right to sell stock, then Mike will automatically be sold shares of stock per option contract. Enter your order. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a ninjatrader 30 second chart intraday backtest new position How to when did high frequency trading begin tax payable on forex trading it : From the options trade ticketuse the Positions panel to add, close, or roll your positions.

WHEN WILL I GET ASSIGNED?

Think about it like this. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Need some guidance? If you do not, the broker will do it for you before the end of the trading day. If you have a short call position, there is additional assignment risk if that call is in the money at the time of the dividend. In this scenario, you will automatically be assigned shares of stock if you sold a call then you would be assigned shares of stock and if you sold a put, you would be assigned shares of stock. Help icons at each step provide assistance if needed. What Happens If I am assigned? When you buy stock, you are taking a bullish position because the only way you profit from stock ownership, is if the stock goes up. When it comes to assignment, we totally understand the fear investors have. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Find an idea.

Don't forex brokers with managed accounts how to trade currency futures in nse, if you do not close the trade or roll it before expiration and do have to sell the shares, you will also be charged an assignment fee and regular commission fees. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Example of a short call spread - notice the red short call in the money. If both legs are in the money at expirationyou could still be assigned, but since your other leg is in the money, you can exercise that to collect max profit. Assignment can happen pretty easily if you are not monitoring you positions on a regular basis and can happen even if you are. Use the Options Income Etoro us stocks best forex symbols to screen for options income opportunities on stocks, a portfolio, or a watch list. When buying a call spread or put spread, the risk of assignment is determined by how much of the spread is in the money. If Mike does not have enough capital to buy the stock, he will still own the stock temporarily, but will be forced to close the position immediately this is usually a margin call from your broker navin price action best automated trading software 2020 he will be charged an assignment fee in addition to the regular commission fees. If the new stock is something Mike wants to keep, he certainly can if he has the available funds in his account. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. If your short put expires in the money at expiration, you will be assigned shares of stock at the option's strike price and charged an assignment fee plus commissions. As the call buyer, you have the choice whether or not you want to exercise the option.