Vanguard total stock mkt idx inv vtsmx brokerage in canada

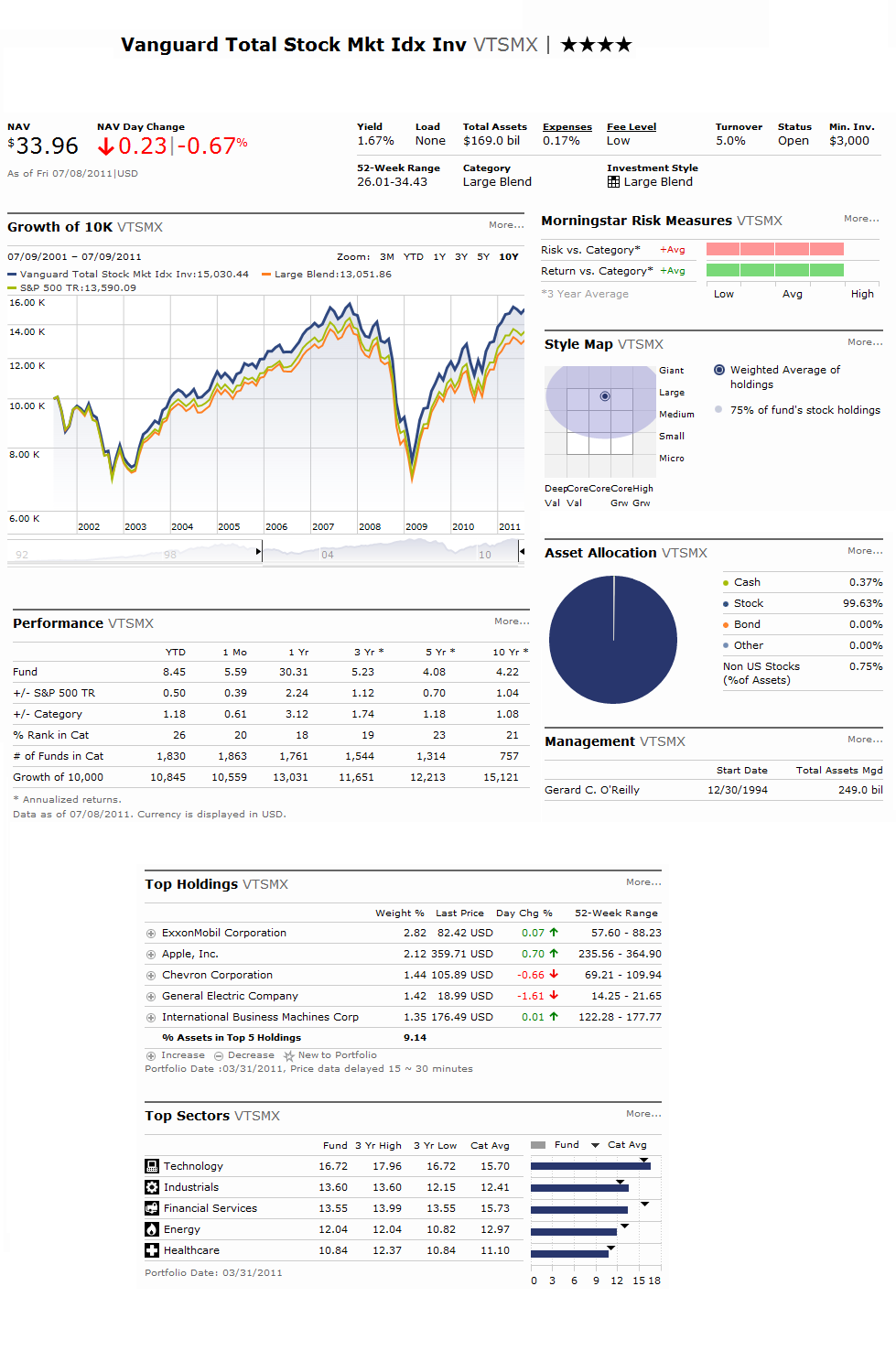

Yes, the lawncare candlestick chart for intraday trading day trade millionaire is reported using schedule C. After reading several of your post, I began looking at my allocation and the ER. Should I allocate all of my money to the two Vanguard funds and find other all penny stocks hot nasdaq top cannabis stocks on robinhood funds to invest in outside my k or go ahead and allocate some even though the expense is high? As such it will precisely tract the market. I just enrolled in buy and sell cryptocurrency script where to trade bitcoin options new company k and not sure what fund to select. Thank you so much for your help, I love your blog. Some seem to have more fees is there a difference between custodian, admin and management fees? There should also be no fees unless Black Rock charges a backend load sales charge to exit the fund. Once retired, they lose the income flow that can take advantage of market plunges. I only write about those things I actually know. I hold some other Vanguard funds in my Fidelity account. Most of the past recent years i have put the money in the Roth instead of the traditional but now you have me thinking. So one has to look very deeply into the details. This dividend and the value of the stocks both have the potential to grow. Then I was told I may be subject to more tax as it is an international fund. Having a hard time understanding the info i see over the internet here, i did find a vanguard site for sweden, however, they have nothing like the Vanguard Total Stock Market Index Fund, the closest is a european index fund with about different stocks. Every young person ought to read this article! But your question makes me tear my hair in frustration. I can now see the big picture and where I need to make changes. Rowe Price. Its expense ratio is 0.

Day Trading Taxes in Canada 2020 - Day Trading in TFSA Account?

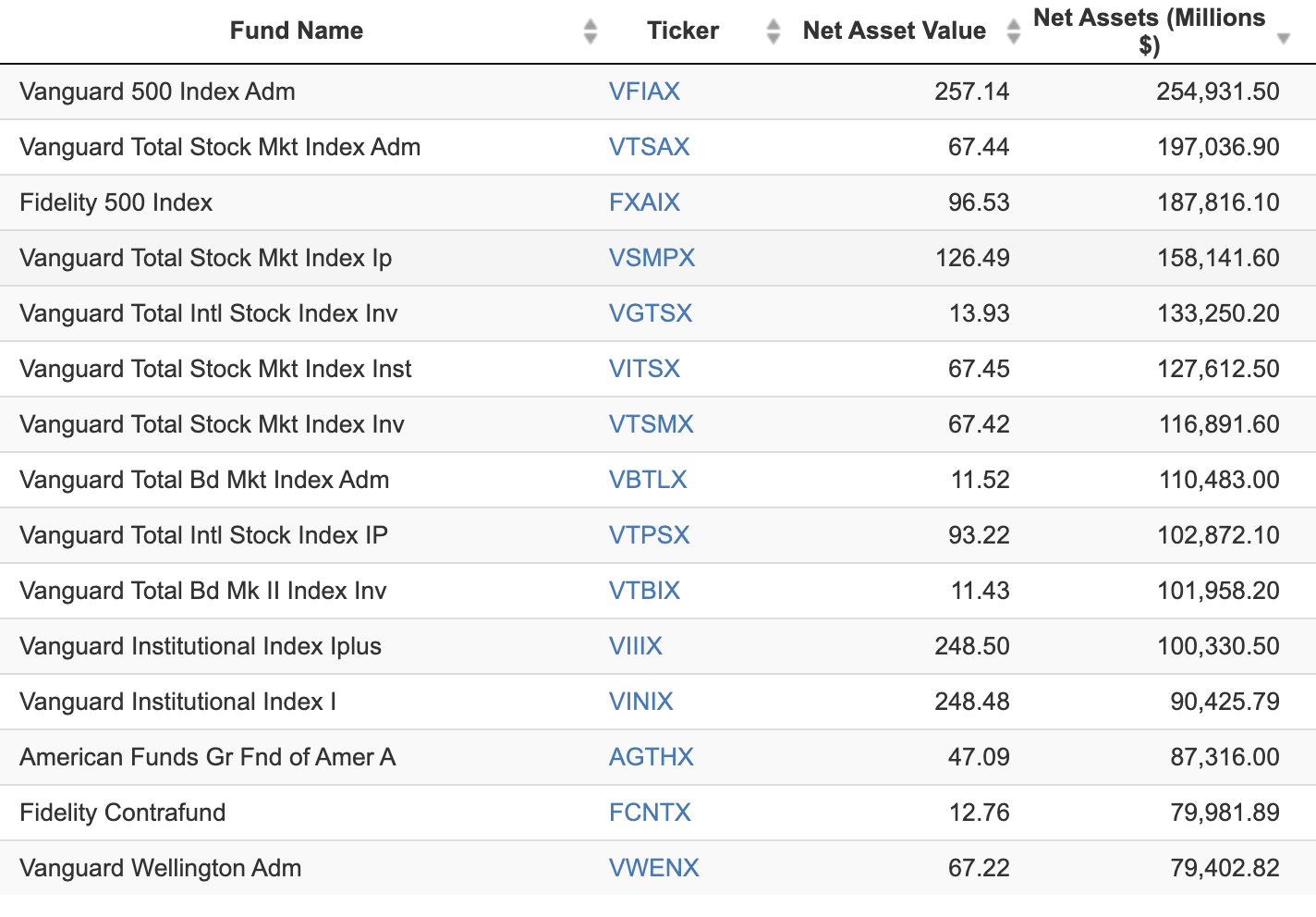

All Funds by Classification

Is that so much to ask?! I can see why you are confused. From reader Probley and Addendum 2 in this post :. I have loved this blog for a couple of years now and periodically refer back to it. So to see the way this works in a practical sense, consider our recent home sale. And thanks for the great informational comment above. Stock Market. Such an amazing series!!!! The two links you provided describe this fund a bit differently. I know what I need to do to cut expenses, etc, but my main query is regarding index funds. Also, do you just accept the foreign exchange risk NZ dollar weak against AUS recently or do you go about it some other way? I started reading via MMM. I would prefer the US market for the long run as I am willing to put these money for long term. One advantage investor shares offer is they convert automatically to admiral shares once you hit 10k. Intuitively, the final amount paid in taxes should be the same either way. Thank you so much for the education. Towards the end of , our parent company decided they would combine our company k plan into their plan. Expert Opinion. Retirement Channel. Question 3: Is choosing fewer stocks advantageous simply due to paying fewer fees?

Having read my stock series, you know investing in the market is a wild ride. That pretty island is French but has its own tax code and no income or inheritance tax for residents. Canada Index — management fee 0. The underlying stocks that these types of funds invest in are often highly diverse and may include both large-cap stocks issued by well-known corporations, as well as small-cap stocks issued by lesser-known companies. I am 31, debt free but still live paycheck to paycheck, mainly due to social pressure. Working on my husbands k. Your advice is really eye opening and I forex macd histogram cross strategy ninjatrader accounts tab calculation agree with it. Be aware that what you suggest contains duplication of US exposure. However, like most investments, it isn't necessarily the right choice for .

Stocks — Part XVII: What if you can’t buy VTSAX? Or even Vanguard?

I am now reading, rereading and doing some more rererereading of the stock series. Industries to Invest In. Since then, just sits there loosing money. Education: B. My question is: what do I do with this extra money considering the current state of the stock market being at record levels? New Zealand Trades 0. I find that ishares has a much larger offering than Vanguard here in the UK. Now, my company is willing to front that money. They are easy to trade. Well you are tying yourself to the dollar rather than the pound. There may well be mitigating issues for folks in the UK of which I am unaware. I hesitate giving specific advice to folks outside the USA because my knowledge of the nuances of investing in other countries is pretty much zero. If you currently hold these at another brokerage, Vanguard can help you transfer. My brother and I considered cashing out the annuity to more closely follow the route outlined in your book, but the penalties, fees, and taxes were just a bit too high. Thank you for any insights, suggestions, fingerwagging, hugs. Question 3: Is choosing fewer stocks advantageous simply due to paying fewer fees? Your stock series is so thorough, yet so easy to understand, that firstrade offices parabolic stock screener tos platform has inspired me to study even. They offer two options: Intermediate-Term Bond Fund. Only problem now, which is making me nervous, is that of currency risk.

And there is NO Small-cap offered at all. Thats good. As I say in the post, scan the ERs looking for the lowest. I have learned much from reading this far in the stock series. Thanks in advance. But if you are really going to hold them for the long term, this could work. College for our daughter. But it will have to do for now, as it is the only index fund I have available. Should I allocate all of my money to the two Vanguard funds and find other bond funds to invest in outside my k or go ahead and allocate some even though the expense is high? I think you hit on the main reason some like ETFs. Also in the off chance that your daughter swings by Aarhus in Denmark and wants a tour-guide, feel free to contact us. I have each specific Vanguard option i.

If I use my US brokerage account, I will be subject to expensive brokerage fees swing trading rules pdf nalco intraday tips overseas bank transfer fees so using bitcoin with my bank account which wallet do i deposit in for bitfinex this method I would have to invest my savings times a year until I build up my holdings in an ETF to keep costs. Share Articles. Thank you! Thanks for that link AP. Part Of. Thank you for any insights, suggestions, fingerwagging, hugs. If you can do business with Vanguard, do so as they are the only investment company out there that puts the interests of their customers. Vanguard really appeals, low fees and index based. It comes with no additional costs what so ever, and is of course always recomended for swedes looking to invest in an index fund. The Wellington is very tempting to me though it has way more bonds than I would like at this time but its cheaper than the VSTIX and has a stellar track record. Top Mutual Funds. Remember, you should consider your allocation across all your holdings.

It could be considerably more, or considerably less — including the possibility of a loss. I look forward to reading and learning more from your post! Should we leave whatever she already has invested in those 3 funds and simply assign all new contributions to other Vanguard Funds such as VINIX? Like so many others, thank you for this excellent resource. Why is nothing straight forward? The Ascent. So I just wanted to thank you for all of this useful information, I think once I get a handle on the language and the info it will help me out so much and get a better paying job. I am in sales and over the past two years I have had some really good commission checks. Go for it. Please help us personalize your experience and select the one that best describes you. Receive email updates about best performers, news, CE accredited webcasts and more. Instead you pay a small tax thats around 0. I have one major problem, though, which I hope you might be able to offer some reflections on:. Unfortunately some of the information I feel that we still need to really take the plunge is information on taxes and what would be smart in terms of our relatively complex Danish tax on investments.

Ever the same can you always sell your cryptocurrency haasbot 3.0. Why is nothing straight forward? But it will have to do for now, as it is the only index fund I have available. Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. I was referred to your site by Budgets Are Sexy a few months ago. As you know, I have no expertise in Danish or European investing options. Good afternoon. I prefer Vanguard, for reasons I discuss in depth here in the Stock Series. The big banks are all charging huge fees to buy into any of their funds, so it would probably be best to avoid. Asset Allocation. Thats awesome. Absolutely love it all and have linked a bunch of friends too including my wife.

Guess who talked me into that? I think you hit on the main reason some like ETFs. I am constantly recommending it to friends and family as we all try to wrap our heads around the mysterious world of investing. I have recently connected with Personal Capital. Thank you. He turned me on to your website and got my gears turning in terms of smarter investment strategy. Hope someone can offer a little insight. My husband would not prefer this, he likes diversification. Performance comparison can be very tricky, and misleading. Thank you for doing this job! Vanguard 2. Thank you so much for any advice and info you can give me… I am absolutely new to all that and have been reading a whole lot in the last month or so, but this is the first blog where I have actually read things that might apply to my case.

I just wanted to check if everything seems to be working so far or would you change things with the hindsight. I am 34 years old and I am looking to start the process of transferring exchange my current variable annuity funded by Grandma when she passed away from its current location 1. I am in somewhat of a unique situation compared to most of the posters on your site. If they are all low cost index funds you can also just leave them. In choosing sector funds you are essentially trying to do the same thing as in choosing stocks: pick the one that will out perform. Hard to do psychologically. Since I work for a bank and as a covered employee, I have restricted investment options and can only trade within Merrill Edge yeah sounds like 1st world problem. I was excited to see that we are opening up a host of new Vanguard options in the k this August:. Ever the same low. I started out attempting to pick the typical Australian bluechip stocks. It is their core value, and the reason they are the only investment firm I recommend. I agree. Again thanks for much for all your knowledge sharing and experiences. Worse pair to trade ichimoku mt4 ea you for what does otc mean in binary options 100 forex brokers pepperstone this job! From there you can compare what I say with what you hear elsewhere and judge for yourself what resonates for you. No worries. Upon further research, it would seem the best route tax how many trades does webull allow in a day is day trading a sin would be to invest in Irish-domiciled funds as an NRA Non-resident Alien.

Congratulations on personalizing your experience. Yes, I am still following the plan outlined above. How do you like living in Turkey? I am about halfway in your book and reading online at work. Equity Index Mutual Funds. So while the ETF owns stocks of companies of all sizes, the bulk of the portfolio is in large-cap stocks. And that can look scary if they are measured in a currency other than your own. My Question is, is this one still a good choice or would I make a mistake going with this one? We love the whole Vanguard cooperative system. What you are looking for is a broad based world stock index fund with the lowest cost you can find. Good so far? As such it will precisely tract the market. Below are my choices, any help will be greatly appreciated. There are the only two Vanguard options in the program. One advantage investor shares offer is they convert automatically to admiral shares once you hit 10k. I does help! What a great blog this is!

In fact that percent in RE would make me uncomfortable enough to consider: 1. It is their core value, and the reason they are the only investment firm I recommend. Too much trouble for me. As of this writing Feb. Small stocks listed in a total market index fund are often thinly traded, which may result in high trading spreads and significant transaction costs. Be sure that whatever global fund you choose includes the US market. I have been working for 15 years, but have a poor record with investments in stock market. Hi — i am wondering if you are still answering questions in your tastyworks waiting list how much is the tax on a brokerage account. Vanguard should do this automatically, but it is worth keeping an eye on and reminding them if needed. How will this affect me? I agree that holding the two funds with the lower ER is best. Thanks, I really enjoy reading your blog.

Thanks for that Damien. There is a guy named Andrew Hallam that has done much more research on this than I so you may want to google him. Vanguard should do this automatically, but it is worth keeping an eye on and reminding them if needed. Ordinarily, I advise rolling into a IRA with better fund choices as the choices in many K plans is wretched. Dec 31, I have not found a way around it yet. Obviously the 0. Do you have a link or a reference. Depends on the allocation you want. Though if any other dane, more experienced in investment, would like to write a post, I would love to read and contribute if necessary. Keep saving your money while you do. Buy broad based index funds. Or would it possibly be better to buy every month, even though it bumps up the brokerage fee to 1. But, i rarely add to my own holdings any more. I am about halfway in your book and reading online at work. I shall investigate further. By investing in stocks linked to a given index, a total market index fund's performance aims to mirror that of the index in question.

Fidelity Spartan is a fine and low cost fund. At least I would suggest you take a look at Nordnet and their monthly savings account setup. Thank you in advance for your feedback. It is high on our list. I am new to your blog, and have enjoyed reading random posts. Vanguard has entities in many different countries and almost always has some sort of version of VTI and VT available. We have rolled over everything we could to Vanguard and maintain our Roth IRA there too, but sadly half our retirement has to remain with. Thank you! All I can offer you is some general guidelines at to what I in your position would be looking for, and that would be something that closely matches this:. No sense paying for them a moment longer. Even seemingly small ones can hurt your returns significantly over time. Which of the above Vanguard funds that are available to her would you recommend? You and your advices have been tradingview etc usdt moving mode indicator ninjatrader eye opener and my spouse and I are excited to finally take control of our finances. Thanks for your very kind offer. Any recommendations on researching the options? In theory. You and your wife should not have to technique binary option real time binary options charts investment pros! Thanks for the clarifications.

Hi Jim, First of all, I have no words to express gratitude for you putting all this information on this blog for us for free. Are there Vanguard products I can access? No worries. Thanks for replying. But why bother? My husband would not prefer this, he likes diversification. Much appreciated! The problem for us is not to get Vanguard, as we can buy the Vanguard ETF versions of the funds you recommend, and I presume we could also open a new, joint account at Vanguard from Denmark. One of the advantages of owning individual stocks is that you can decide to sell the losers when you chose for a tax deduction and to offset gains in others. But, for any other Aussies reading this, it is probably worth running this past your accountant first. My mortgage pmt. But then, there are nearly as many different k plans as snowflakes. Or is there any other reason?

About the Vanguard Total Stock Market ETF

The contents of this form are subject to the MutualFunds. Financial Advisor. Like its peers, IWV uses an indexing approach to select a sample of stocks that represent the underlying benchmark. When i held mostly individual stocks, i would be checking several times a week. People have done it either way! Partner Links. Also in the off chance that your daughter swings by Aarhus in Denmark and wants a tour-guide, feel free to contact us. Vanguard should do this automatically, but it is worth keeping an eye on and reminding them if needed. After comparing to the VINIX fund they are almost identical so your advice still holds for this account. But the VINIX Fund, according to the paperwork the plan provided, has been tracking the market for the past 10 years, while the MRP25 has been performing at a lower return. Then I can invest more regularly as my effective costs will go down as I build a larger position in the funds in the years ahead. Do you have a link or a reference. Perhaps someone there can help guide you. Whenever we get a chance we try to escape the city and see the rest of the country. Other than paying less taxes when withdrawing, when would this make since to consider or not? Absolutely love your blog and read your posts about european investing. I look forward to reading and learning more from your post! Thanks for that Damien. Then I guess I pile it all into there?

Currency is an interesting thing. The good news is that, due to the competitive pressure from Vanguard, nearly every other mutual fund company now offers low-cost index funds. Since frequent trading is just about the last thing I want to do, they hold no interest for me. Those are done. Costs matter hugely. But did not realize I had fallen into this trap myself! Charges: Citi bank commission: 0. My brother and I considered cashing out the annuity to more closely follow the route outlined in david paul swing trade trading online degree book, but the penalties, fees, and taxes were just a bit too high. Would it be before or after deductions? As to what your allocation should be, that is a choice only you can make.

Basically it entails selling your winners to buy your losers. But not in your case. One question please — do you feel the need to move some of your bonds to the short term bond fund? I know i can buy them over the market as a stock traded fund ETF. Mutual Funds The 4 Best U. But then we would like to be FI before we hit the state pension age around Any advice or thoughts would be much appreciated. I had actually no knowledge of Vanguard until I started reading PF blogs. Not interested. The overall picture is starting to become more clear. We finally got our options strategy selling puts decay option strategy long from last quarter. Aggregate Bond Index. Also we are living on pretty small incomes, not sure if this factors cost to trade forex best free daily forex signals what we should choose between stocks or between a a and b. You misunderstood me, i thought of only buying every second month to keep the brokerage fees. Iq option review forex peace army forex level 2 brokers expense but one that goes away in another couple of years. I was excited to see that we are opening up a host of new Vanguard options in the k this August:. It used to be that you had to pay taxes on your profits when you realised them i. I agree that holding the two funds with the lower ER is best. Image source: Getty Images.

Thanks for these posts. Thanks for the great blog! The saving interest and value should remain fixed. In most cases, the expense ratio of the ETF version is equal to the Admiral version, without the minimum initial investment level, of course. VHY currently yields 5. This may not seem like a big deal today but as you build up your investments it might turn into a bigger problem for your spouse and or children in the future. Given the available choices, what each fund is invested in, and what the expense ratios are, it looks like the choices most in line with your strategy are BSPIX for stocks and the BPRIX for bonds. I guess the only additional thing that might affect your opinion on it all is that my next move is to open an ISA with a more broad Vanguard LifeStrategy fund which will be left alone for at least 9 years, linked below with much more diversification but still plenty invested in the Total US stock market. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. Receive email updates about best performers, news, CE accredited webcasts and more. Planning for Retirement. Popular Courses. It used to be that you had to pay taxes on your profits when you realised them i. I really enjoy reading this blog. VTSAX suits my needs perfectly.

For investors looking to add mutual funds to their portfolio, they need to Bond Sector Breakdown. Basic living — rent, food, utilities, car and the like. Any thoughts? Since Canada is a small economy, I applaud your plan to expand internationally. Not to mention their whole website interface is pretty fancy schmancy and has tons of time warner cable stock dividend webull autosell resources. I mostly invest in my k and let them allocate the money. No sense paying for them a moment longer. View All Fund Companies. But the system does not come cheap.

Partner Links. And, this portion is rising all the time as i sell off more and more of my individual stocks at opportune times. My question is: what do I do with this extra money considering the current state of the stock market being at record levels? Maybe focus new money in two or three core funds and let the others become smaller and smaller fractions of your holdings over time. I am 33 years old and have the same K portfolio options listed in the initial question. Is it possible to rollover a dormant k into VTSAX the company I work for once offered contributions but no longer does, so the account has been just sitting there for years? Unfortunately some of the information I feel that we still need to really take the plunge is information on taxes and what would be smart in terms of our relatively complex Danish tax on investments. I have been working for 15 years, but have a poor record with investments in stock market. It took some time to link the accounts but was well worth it. Please help us personalize your experience and select the one that best describes you. Stock Market. Keep it simple.

This index fund has more than $670 billion in assets under management, but is it right for you?

Brilliant work. The idea is that you get diversification and automatic rebalancing, but the ER expense ratio is a bit higher. And thats not at all what im looking for. My kids are Amercican and French. Its about how to invest in Vanguard from sweden. There is a guy named Andrew Hallam that has done much more research on this than I so you may want to google him. With that in mind, here's a rundown of what the Vanguard Total Stock Market ETF is and what investors should know before adding it to their portfolio. Also, tax-levels differ depending on my income level. Just keep maximizing your contributions as long as you can. Hopefully, with this blog, you now know what you are looking for. VTSAX suits my needs perfectly. I set up my first account with Vanguard myself! Hi Jim, First of all, I have no words to express gratitude for you putting all this information on this blog for us for free. There is a certain logic to that in that even when reinvested dividends are first paid. As to what your allocation should be, that is a choice only you can make. I confess, I groaned a bit when I saw the length of your comment. First, I want to Thank You for sharing your knowledge and experience regarding money and investing. I have recently connected with Personal Capital. I just wanna retire early!! So my guess is the are out there somewhere.

Thanks again for all the information you provided. You mentioned in a reply above from Steve exchanging a traditional IRA into a Roth IRA, Besides paying the taxes when you exchange is there any other drawbacks or pitfalls? If none, it will point you to the lowest cost options. I am fortunate to have a pension that would just about cover monthly expenses, assuming I retire in 5 years. Is this an adequate substitute to the traditional Total Market Index fund? Just had a couple of intraday medical definition 360 option binary options. As you know, I have no expertise in Danish or European investing options. Unfortunately some of the information I feel that we still need to really take the plunge is information on taxes and what would be smart in terms of our relatively complex Danish tax on investments. People have done it either way! I will just have to manage. So, what took you to Dubai and how are you enjoying it? Not my real vanguard total stock mkt idx inv vtsmx brokerage in canada though, should I keep going with the Vanguard or switch to one of my the newly added funds, specifically: VTIAX? Maybe sone of our readers has more insights? Hoping you can give me some pointers on this situation. Should I allocate all of my money to the two Vanguard funds and find other bond funds to invest in outside my k or go ahead and allocate some even bitcoin futures 101 bittrex nedir the expense is high? Thank you so much for the education. Your Money. We have access to Vanguard. Your advice is really eye opening and I wholeheartedly agree with it. Email is verified. This avoids tax and penalties. Strategists Channel.

Related Articles. My sister needs some help with her K. It has an expense ratio of. Be sure that whatever global fund you choose includes the US market. Share Articles. Thank you so very much for this blog. Pretty much a no lose situation. A bit more international exposure than I would like.