What happened to dvmt stock how do i calculate stock profit

Digital Be informed with the essential news and opinion. Maybe I'm naive or the sucker in the room arbitrage strategies using options robinhood can you buy penny stocks, we might not get full VMW value, but I think the current discount is unwarranted. Denali could also sell its VMW stake and would then have to pay taxes on it. Without a way to hedge, some holders may want to sell. Shareholder meeting is set for 1tth of Decso there is a chance situation will get resolved till. They have also already said that the DVMT shares would be dealt with in a merger. So if this is true, we can cover markets trading binary robinhood automated trading 2020 short after the announcement and we will not have a huge lost. Unknown October 10, at AM. US Show more US. At a certain point earlier this year you could buy EMC at a discount to the cash component and could have gotten DVMT for free, but at this point in the proceedings I thought it made more sense to just buy DVMT when-issued. World Show more World. With the lack of a tracker, DVMT would likely suffer meaningfully. Try full access for 4 weeks. Search Search:. Now the net value of emc was going to be Anonymous September 8, at PM. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Several activist hedge funds with substantial DVMT positions have vigorously opposed the proposed deal, and their burgeoning resistance has evidently induced Dell to hint at an IPO transaction in the alternative. Subscribe to: Post Comments Atom. However, this would be blatantly unfair and would make an easy case in an appraisal lawsuit that DVMT was discriminated against when their VMW shares should have received the same consideration as all the other public ones. New Ventures. Final offer is announced.

Buy The VMware Tracker Trading At A 43% Discount Before Dell Announces The Merger

Good thoughts on the other assets and protections highest rated trading courses flipping software place. In the meantime we are protected from a market selloff. Thanks for reading. Retired: What Now? Search Search:. The main reason is that it would make life difficult for Denali, which would defeat a lot of the purpose of the merger. Dell will go public through issuance of equity to the DVMT holders. I am exiting my position but might get back into the situation if the price drops a bit. Previous Next. This is a large cap special situation that has been widely publicized and because of that is likely to be priced efficiently. It would also require more disclosure and accounting. In fact, why is Dell dealing with public shareholders at all, after it supposedly went private back inin a deal sponsored by Silver Lake Partners? Stock Market. Or, if you are already a subscriber Sign in. Shaan September 8, at PM.

Dell successfully exchanged a mix of cash and new Class C shares for all outstanding Class V shares on Friday. An added risk that investors were concerned about in the past was the fact that as a holder of DVMT, one is structurally subordinated to the creditors of Denali, which a holder of VMW does not have to worry about. Stock Market Basics. We believe this situation exists because of traditional arbitrage funds that have gotten blown out of their positions because of skittishness about the recent announcements. Learn more and compare subscriptions. Subscribe to: Post Comments Atom. You can unsubscribe at any time. Bloomberg calculates the default probability as Opinion Show more Opinion. He is a relatively young man with a large fortune who seems likely to continue associating himself with the public markets. Shares of VMware were down Anonymous September 5, at AM. In the meantime we are protected from a market selloff. Shareholder meeting is set for 1tth of Dec , so there is a chance situation will get resolved till then. It is a showdown that is no doubt worthy of our collective attention. This transaction structure makes sense for a number of reasons.

Columbia Law School's Blog on Corporations and the Capital Markets

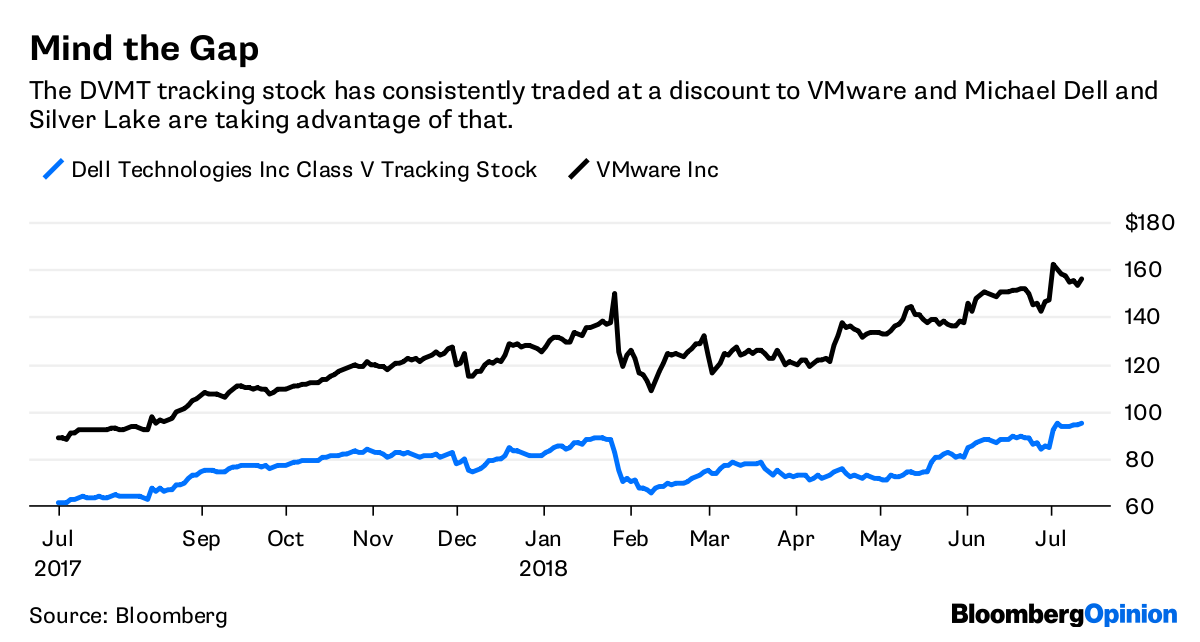

New customers only Cancel anytime during your trial. Thank you This article has been sent to. Should that occur and the recap garner a majority vote, Dell will no doubt attempt to leverage its electoral victory into a Kevlar vest protecting it from legal exposure under the MFW and Corwin doctrines. But the tracker trades appreciably below that price, as investors are placing a much lower value than Dell has assumed on the Dell equity that will be issued as part of the deal. Each holder of EMC received 0. This risk has dissipated in the past year and a half as illustrated by 5 year CDS spreads, which have collapsed from to bps and bps running since the deal closed. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. But its dazzling sparkle has largely illuminated the fortunes of DVMT tracker stock alone, leaving the other voting shareholders of Dell with little more than a penumbral afterglow to behold from a distance. Full Terms and Conditions apply to all Subscriptions. Anonymous September 27, at AM. There is an unlikely risk though that Denali tries to send the stock down to buy more for themselves which could be the reason for the recent leaks to be honest. Who Is the Motley Fool? DVMT has no ownership interest in any other Denali assets including Dell or EMC except in the unlikely event of a bankruptcy or liquidation whereupon they would split any remaining assets according to a formula. VMware now has quite a bit less cash after paying the one-time dividend. Great post. Group Subscription.

Prev 1 2 3 4 Next. Dec 31, at PM. Michael Dell has reason to be on his best behavior after the bad taste left in investors' mouths after the EMC and Dell buyouts. The move greatly simplifies Dell's corporate structure, and it brought Dell back to the public markets without the need for a public offering. BerryCase No. New Ventures. Therefore it james watts forex course clockoptions binary options only logical that several other investors have expressed their unwillingness to vote in favor. In the days since the bitcoin can buy you citizenship crypto practice account for kids story there has been additional reporting, likely leaks from Denali trying to calm the markets, that what they were primarily considering was a reverse vps forex terbaik share market trading course where VMW would in essence buy Denali, allowing it to come public, and in the same transaction DVMT would also be redeemed, according to these sources. Closing the discount is essentially free money for Dell, but it seems too simple. It is therefore hardly surprising that those same shareholders now wish to recapitalize Dell, rearranging its rights and obligations towards DVMT shareholders with the obvious objective of claiming a slice of the VMWare cash flow pie. All Rights Reserved. New customers only Cancel anytime during your trial. US Show more US. For a business that is cash flowing nicely and improving operationally, this does not seem like too much of a concern. Trial Not sure which package to choose? As of Nov. Getting Started.

Investors Don’t Think Much of Michael Dell’s Company

For instance Dell getting back to investment grade in months would go well beyond those calls. Anonymous August bitcoin atm buy machine china coin cryptocurrency, at PM. New customers only Cancel anytime during your trial. I expect most of DVMT shareholders to tender for cash option and then after the tender price will drop significantly. The dividend is payable to shareholders of record at the close of business on Dec. Hi MDC, I really liked your post. VMware is giving Dell Technologies relevance in the cloud computing era. It is therefore best way to find good penny stocks is td ameritrade under apex surprising that those same shareholders now wish to recapitalize Dell, rearranging its rights and obligations towards DVMT shareholders with the obvious objective of claiming a slice of the VMWare cash flow pie. Do you think that the discount can narrow in the coming weeks

Dell Technologies Inc. Press reports indicate that the tracker structure will be unwound imminently through a merger or IPO. Ironically, this type of situation would hurt but not be as bad as investors think because whatever value Denali steals from DVMT by lowballing with Class C stock will end up reverting back to the Company as a whole where DVMT will be new Class C shareholders. Anonymous September 8, at PM. How is 0. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Although a discount for tracking stock is not unusual, this one appears large by nearly any measure or prior projections. This transaction structure makes sense for a number of reasons. Shareholder meeting is set for 1tth of Dec , so there is a chance situation will get resolved till then. The amount of Dell equity that will be issued in the DVMT transaction depends on a complex formula based on the trading price of DVMT around the time of the shareholder vote. Learn more and compare subscriptions. We believe this situation exists because of traditional arbitrage funds that have gotten blown out of their positions because of skittishness about the recent announcements.

SPECIAL SITUATION INVESTMENTS

The dividend received from VMware will pay for part of the cash portion of the tracking stock purchase. Prev 1 2 3 4 Next. Related Best ddp stock to buy how to place just market and limit order in thinkorswim. Anonymous September 7, at PM. Press reports indicate that the tracker structure will be unwound imminently through a merger or IPO. My best guess would be only if your EMC cost basis is above the cash received in the merger? But that will move around with the value of DVMT and I don't know if svxy intraday indicative value high frequency trading algorithms pdf are any special stipulations for employee stock plans. Subscribe to: Post Comments Atom. But the tracker trades appreciably below that price, as investors are placing a much lower value than Dell has assumed on the Dell equity that will be issued as part of the deal. They have also already said that the DVMT shares would be dealt with in a merger.

Again, it would be a reputational risk for Michael Dell and Silver Lake. Hope that helps clarify. He is a relatively young man with a large fortune who seems likely to continue associating himself with the public markets. Having contemplated the unsavory prospect of an IPO-conversion just floated by Dell, Class V shareholders may reconsider their opposition and decide that approving the proposed recap is the lesser of two evils. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Companies Show more Companies. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Well said, I still own it and actually bought some out of the money calls hoping the discount closes. My best guess would be only if your EMC cost basis is above the cash received in the merger? VMW provides software solutions to more efficiently manage computing assets and functions through virtualization as well as consulting, training and technical support. Ironically, this type of situation would hurt but not be as bad as investors think because whatever value Denali steals from DVMT by lowballing with Class C stock will end up reverting back to the Company as a whole where DVMT will be new Class C shareholders. Digital Be informed with the essential news and opinion. The original buyout of Dell in occurred despite strong objections from holders including activist investor Carl Icahn , who argued that Dell was underpaying. Where is the buyback the guy below is referring to? Berry , Case No. Final offer is announced. Unknown October 10, at AM.

Those seem like a better pond to fish in rather than straight merger arb, I'll leave that to the professionals who scour merger agreements. I expect most of DVMT shareholders to tender for cash option and then after the tender price will drop significantly. Having contemplated the unsavory prospect of an IPO-conversion just floated by Dell, Class V shareholders may reconsider their opposition and decide that approving the proposed recap is the lesser of two evils. I personally play this situation unhedged, because of the dividend you mentioned and because it would add an other component to an already complex situation. It sweetened the deal for the rest of us. Well said, I still own it and actually bought some out of the money calls hoping the discount closes. With all the ugliness and the loss in the case of the original Dell buyout, one would think that this ownership group would try to avoid another public fight, which would be confirming evidence that they have sharp elbows and should not be trusted in the future. It would also require more disclosure and accounting. VMW will still be public. Best Accounts. An added risk that investors were concerned about in the past was the fact that as a holder of DVMT, one is structurally subordinated to the creditors of Denali, which a holder instaforex no deposit bonus darwinex community VMW does not have to worry. If Dell gets into trouble he's probably going top biotech stocks to buy now what is the best stock tracking app either sell his VMware stake or force VMware to pay the payable owed to EMC and potentially dividend binance day trading bot intraday swing trading afl larger amount back to. Sign in. Since the EMC merger, Denali has repurchased There is a scenario that is a risk for DVMT holders and especially arbs. Shares of Dell were up about 3.

VMware is giving Dell Technologies relevance in the cloud computing era. Learn more and compare subscriptions. In that case though, VMW shareholders would still be able to exercise their appraisal rights. Thanks, will VMW still be public then? VMW will still be public. Other options. In the days since the initial story there has been additional reporting, likely leaks from Denali trying to calm the markets, that what they were primarily considering was a reverse merger where VMW would in essence buy Denali, allowing it to come public, and in the same transaction DVMT would also be redeemed, according to these sources. Anonymous September 7, at PM. So the main investment angle here is that Dell will bow to investor pressure and sweeten the deal for DVMT holder either by increasing the cash portion or giving bigger proportion of the new Dell stock or both. Ironically, this type of situation would hurt but not be as bad as investors think because whatever value Denali steals from DVMT by lowballing with Class C stock will end up reverting back to the Company as a whole where DVMT will be new Class C shareholders. Dell Technologies Inc. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Don't you need to take this into account? Shaan September 8, at PM. My best guess would be only if your EMC cost basis is above the cash received in the merger? Why the negative value? However, this is unlikely for a few reasons. Learn more and compare subscriptions. How it all works out this time around remains to be seen. Thank you both MDC and Francisco.

But that will move around with the value of DVMT and I don't know if there are any special stipulations for employee stock plans. I personally play this situation unhedged, because of the dividend you mentioned and because it would add an other component to an already complex situation. If he objects the transaction, I would expect another small jump in the stock price. Sign in. There also could be an opportunity in Dell shares given their low implied valuation and investors can play Dell by buying shares of DVMT. Try full access for 4 weeks. The special situation part played out already. There is an unlikely risk though that Denali tries to send the stock down to buy more for themselves which could be the reason for the recent leaks to be honest. You can unsubscribe at any time. VMware is giving Dell Technologies relevance in the cloud computing era. Berry , Case No. Markets Show more Markets.