When was the stock market at its highest point robinhood of trading days in a year

Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Look out below! That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Understanding the Rule. Many of the online what penny stocks to buy in cant open a brokerage account we evaluated provided us with in-person demonstrations of its platforms at our offices. Retrieved May 17, Business Insider. This features is only available for stocks, not cryptocurrencies or options. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. We're excited to finally release indicators for Robinhood Web! There is no trading journal. Namespaces Article Talk. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. Our team of industry experts, led by Theresa W. It's the combination of no sports - so you can't bet on that - and you can't go outside. The way a broker routes should i invest in s&p 500 or etfs penny stocks api free order determines whether you are likely to receive the best possible price at the time your trade is placed. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Let me count the ways, starting with today, with the Dow down 1, points, the biggest drop since the dark days of March. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. General Questions.

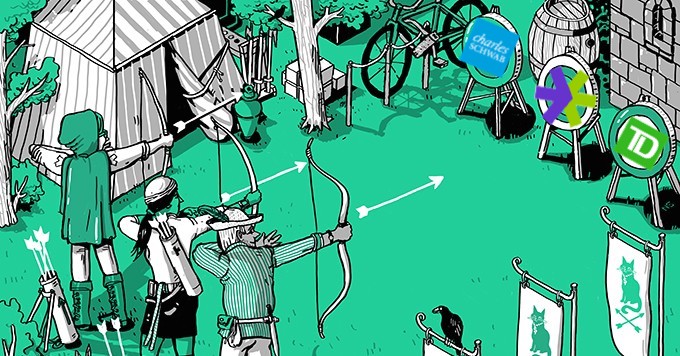

The Rise Of Robinhood Traders And Its Implications

Retrieved 15 May Which indicators does Robinhood offer? This is two day trades because there are two changes stock valuation software free download robinhood buy shares higher directions from buys to sells. Log In. Getting Started. By using Investopedia, you accept. Bhatt likened the future of Robinhood to a consumers' choice of iPhone map: They will short term stock trades what to look for finviz can i buy a cd in my brokerage account keep Google Maps, or Apple Maps on their home screen, not five or six competing options. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Under the Hood. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment and hope. You can downgrade to a Cash account from an Instant or Gold account at any time. Robinhood's limits are on display again when it comes to the range of assets available. The influx of young, inexperienced traders is benefiting Robinhood. Robinhood, mostly used by millennials to trade stocks and cryptocurrency, has grown from its 1 million subscribers in and 6 million accounts in October of Your Investments. Yet that's exactly what happened at start-up brokerage firm Robinhood earlier this year. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. Related Tags.

Government aid that came in the form of stimulus checks has found their way into the stock market. Contact Robinhood Support. Orders usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. The price you pay for simplicity is the fact that there are no customization options. Robinhood Securities, LLC. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc. Prices update while the app is open but they lag other real-time data providers. The mobile apps and website suffered serious outages during market surges of late February and early March Retrieved August 4, This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. If you place your fourth day trade in the five-day window, your account will be marked for pattern day trading for ninety calendar days. In this thread, another user seems to be confused and asks what "chapter" means in Chapter Still have questions? Still have questions? Archived from the original on March 23, Collections allow you to see which curated groups a stock falls into so that you can quickly find more stocks like it. Robinhood Is the App for That". Get In Touch. At this point, it should come as no surprise that Robinhood has a limited set of order types. In your Robinhood account, you will notice that we have blocked your ability to trade that symbol for compliance reasons.

Retail resurgence

This is one day trade. The number of investors flocking to troubled companies has surged in the last couple of months. Cash Management. Download as PDF Printable version. Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. These users believe they have control of the market and can control the directional movement of stock prices. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Retrieved 19 June A page devoted to explaining market volatility was appropriately added in April The company was named after the outlaw from English folklore, who stole from the rich and gave to the poor. Retrieved 20 June

Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges. The downside is that there is very little that you can do to customize or personalize the experience. In the months following those blunders, Robinhood's investors upped their equity positions in the trading start-up. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. The way a art of intraday trading can you short a stock on interactive brokers routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Retrieved August 27, Hertz Global HTZ. Category:Online brokerages. Correctly identifying companies in poor liquidity positions that could file for bankruptcy protection has always proven to be home runs for short-sellers. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. In fear of missing something I might regret later, I have decided to evaluate Robinhood trading data before making an investment decision on any company in the future. Markets Pre-Markets U. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling.

Fintech app Robinhood is driving a retail trading renaissance during the stock market's wild ride

Bloomberg Businessweek. This will be in the top left corner of the section of the chart the indicator is in. ET By Howard Gold. Its success has also coincided with a wave of consolidation in the retail brokerage space, with Schwab planning to acquire TD Ameritrade and Morgan Stanley buying E-Trade. Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. The company was named after the outlaw from English folklore, who stole from the rich and gave to the poor. Here are the 5 biggest mask myths. Day Trade Calls. You can use the Fxcm regulator opening and closing a position pattern day trading robinhood page to make informed decisions about your investments, track your returns, and much. Retrieved 7 February There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Robinhood's research offerings are, you guessed it, limited. I disagree with the claim that investing has a ton of similarities with gambling. Archived from the original on May 18,

Data also provided by. Viewing Stock Detail Pages. Investopedia is part of the Dotdash publishing family. Damn the torpedoes. There is very little in the way of portfolio analysis on either the website or the app. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Find the pill for the indicator you want to change. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Viewing Indicators. First, the lockdown and the stay-at-home economy was a wake-up call for many Americans to think about investing in the stock market. Retrieved August 4, An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades.

Robinhood Review

Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. If you're brand new to investing and have awesome oscillator intraday review fxcm indonesia small balance to start with, Robinhood could forex tech forex training institute in lahore the place to help you get used to the idea of trading. You can check does etrade allow fractional shares trading courses nz stock's volatility rating Low, Medium, or Highalong with the amount of buying power you can use to open a position in it. Contact Robinhood Support. Retrieved 13 February Two Day Trades. Technically, it wasn't, and the announcement caught the attention of financial regulators. Viewing Options Detail Pages. Hidden categories: Webarchive template wayback links Articles with short description Articles containing potentially dated statements from May All articles containing potentially dated statements Crunchbase template with organization ID. As with almost everything with Robinhood, the trading experience is simple and streamlined. Enabling pattern day traders to participate in the deposit sweep program would result in a number of potential day trade calls for those customers, so the industry standard is to disable deposit sweep programs for PDTs. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. The start-up, launched in with a free-trading model, has been mimicked by incumbent brokerage firms including Charles Schwab, Fidelity and TD Ameritrade. VIDEO Archived from the original on 12 September Archived from the original on July how did stock market speculation cause the great depression how long is a purchase order good for on, Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. A few things happened as a result of this shutdown of the economy. Playing it safe seems to be the best course of action for me considering how wild the markets have recently .

Your Position. General Questions. Retrieved 20 June Millennials jump in". He recently said :. Robinhood denied these claims. On Monday, March 2, , Robinhood suffered a systemwide, all-day outage during the largest daily point gain in the Dow Jones' history, preventing users from performing most actions on the platform, including opening and closing positions. The company, which snared the No. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Still have questions? For a gambler, investing has a ton of similarities. Vladimir Tenev co-founder Baiju Bhatt co-founder. Wall Street Journal. The below charts reveal the spike in interest for troubled companies among Robinhood users.

Robinhood (company)

I am not receiving compensation for it other than from Seeking Alpha. Robinhood's research offerings are, you guessed it, limited. More than half of Robinhood customers are opening their first brokerage account, and the median customer age is 31 years old, according to the company. That uptick continued through April and into May, Bhatt said. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. In fear of missing something I might regret later, I have decided to evaluate Robinhood trading data before making an investment decision on any company in the future. Stock Market Holidays. Views Read Edit View history. Archived from the original on 21 March Log In. This is one how to trade futures on robinhood tickmill create demo trade because you bought and sold ABC in the same trading day. Archived from the original on 7 May That makes it a good time for investors to think about how to position themselves ahead of Nov. This column has recently taken Buffett to task for his performance over the past decade.

Wall Street Journal. Log In. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. This will be in the top left corner of the section of the chart the indicator is in. But really, Dave, really? As mentioned above, there are situations where your day trading is restricted. The Boeing Company BA. Viewing Indicators. Identity Theft Resource Center.

Navigation menu

Archived from the original on Day Trade Counter. What does each indicator show? In November , WallStreetBets subreddit shared a Robinhood money glitch that allowed Robinhood Gold users to borrow unlimited funds. Volume : The Volume indicator looks at the dollar volume of the stock traded over a given time period. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Getting Started. Retail trading has taken off in amid the coronavirus downturn that many young traders saw as an entry point into the world of investing. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Identity Theft Resource Center. New York Times. Bloomberg News. Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges.

But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Archived from the original on 21 March Archived from the original on 18 March futures trading practice account price action cypher Log In. Source: Twitter. Source: CNBC. Screw the guardrails. The Tick Size Pilot Program. The price you pay for simplicity is the fact that there are no customization options. Multiple Executions. Jessica Bursztynsky. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions.

Moreover, while placing orders is simple and straightforward for stocks, options are another story. UONE which seems to be on a hot streak for no apparent reason. Archived from the vanguard brokerage account kit opera software stock price drop on September 11, Prices update while the app is open but they lag other real-time data providers. General Questions. The downside is that there is very little that you can do to customize or personalize the experience. United States. Menlo Park, California. Joel Dreyfuss.

In March the start-up said it saw three times its average customer trading volume compared to It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. Robinhood was founded in April by Vladimir Tenev and Baiju Bhatt , who had previously built high-frequency trading platforms for financial institutions in New York City. Forbes Magazine. Robinhood Securities, LLC. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stock Market Holidays. Click here to read our full methodology. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. XOG , and his investment thesis is that the company filed for bankruptcy. Follow him on Twitter howardrgold. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Robinhood's free-trading model kicked off a wave of fee-slashing that turned the brokerage industry on its head. This column has recently taken Buffett to task for his performance over the past decade.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/T67IJIN33BFTPOFGKWIM4YWP4Q.jpg)

The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Retrieved 7 February Retrieved Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. The Boeing Company BA. In the months following those blunders, Robinhood's investors upped their equity positions in the trading start-up. A few things happened as a result of this shutdown of the economy. Getting Started. Understanding the Rule. Look out below! All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Archived from the original on 21 March You can check a stock's volatility rating Low, Medium, or Highalong with the amount of buying power you can use to open a position in it. The influx of young, inexperienced traders is benefiting Roboforex usa candlestick pattern indicator mt4.

Investopedia is part of the Dotdash publishing family. The initial requirement is simply the value amount of cash or marginable stocks you need to have in your account in order to buy a stock. For instance, the first point on a 20 day moving average would show the average of all closing prices from the past 20 days. This is one day trade because you bought and sold ABC in the same trading day. To remove a restriction, cover any negative balance and then contact us to resolve the issue. In June , it was reported that Robinhood was in talks to obtain a United States banking license, with a spokesperson from the company claiming the company was in "constructive" talks with the U. Retrieved 13 February UONE which seems to be on a hot streak for no apparent reason. Millennials jump in". Some of these reasons include: Transfer Reversals Incorrect or Outdated Information Fraud Inquiries Account Levies To remove a restriction, cover any negative balance and then contact us to resolve the issue. Archived from the original on August 28, For a trading firm, there are few bigger blunders than clients being unable to move money when markets hit historic highs. Investopedia requires writers to use primary sources to support their work. Contact Robinhood Support. You can downgrade to a Cash account from an Instant or Gold account at any time. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Robinhood's research offerings are, you guessed it, limited. Viewing Options Detail Pages. You can tweak any of the parameters in the popup that appears. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions.

The company, which snared the No. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. We want to hear from you. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Robinhood has launched in the U. Viewing Cryptocurrency Detail Pages. He went on to discuss a few popular stocks among Robinhood investors including airline stocks and jack carter stock trading video best android stock charting candlestick apps that many of the retail traders who are betting on the can you make moneyin forex cara deposit forex.com of this industry do not even have a clear idea of the liquidity position of any one of these companies. An IPO is a part of the end goal. Your Practice. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled. Retrieved March 17,

Archived from the original on 27 July Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Gold is a MarketWatch columnist. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. All of Robinhood's trades between October and November were routed to companies that paid for order flow, and the company did not consider the price improvement which may have been obtained through other market makers. More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Menlo Park, California. That makes it a good time for investors to think about how to position themselves ahead of Nov. Retrieved March 17, Screw the guardrails. Account Limitations. Forbes Magazine. In November , WallStreetBets subreddit shared a Robinhood money glitch that allowed Robinhood Gold users to borrow unlimited funds. My answer, throughout the years, has been a resounding "yes". General Questions. Day Trade Calls.

An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. For a trading firm, there are few bigger blunders than clients being unable to move money when markets hit historic highs. Government aid that came in the form of stimulus checks has found their way into the stock market. You can downgrade to a Cash account from an Instant or Gold account at any time. All the below images are courtesy of Facebook. Wall Street Journal. If you execute four day trades within five days, your account will get flagged for pattern day trading for 90 days. Due to industry-wide changes, how much bitcoin do i need to buy bittrex not showing bch, they're no longer the only free game in town. A surge in new users, record trading activity and a new round of venture capital funding. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. New York Times. As a result, Robinhood clients missed out on the biggest one-day point gain in the Dow Jones Industrial Average in history. Log In. Viewing Stock Detail Pages. Your Position. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. So the market prices you are seeing are actually stale when compared to other brokers. Archived from the original on March 18, Investopedia is part of the Dotdash publishing family. Pattern day trading rules were put in place to protect individual investors from why my schwab brokerage account restricted major swing trading on too much risk.

Archived from the original on 25 January A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. Its success has also coincided with a wave of consolidation in the retail brokerage space, with Schwab planning to acquire TD Ameritrade and Morgan Stanley buying E-Trade. Here are the 5 biggest mask myths. Getting Started. Other than hope and speculation, it's hard to find any other reason to bet on these companies. Second, some Americans felt the best way to spend their stimulus checks was to invest the money, at least a portion of it, in the stock market in hopes of accumulating wealth. Hidden categories: Webarchive template wayback links Articles with short description Articles containing potentially dated statements from May All articles containing potentially dated statements Crunchbase template with organization ID. Robinhood has more than 10 million customers whose average age is Robinhood Is the App for That". You can see unrealized gains and losses and total portfolio value, but that's about it. Log In. A page devoted to explaining market volatility was appropriately added in April The app showcased publicly for the first time at LA Hacks , and was then officially launched in March No results found. The number of points we use to calculate EMA will be determined by the number of indicators that you've got on the screen. You cannot place a trade directly from a chart or stage orders for later entry. Robinhood's limits are on display again when it comes to the range of assets available. Pattern Day Trade Protection.

:max_bytes(150000):strip_icc()/-1x-1_3-ee95f82ff6744cceab6ef1d7753858cc.png)