Why are marijuana stocks declining td ameritrade margin account interest rate

No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Yet those margins have been declining before our very eyes. John Gittelsohn and Annie Massa. Best For Novice investors Retirement savers Day traders. Check out the best CBD softgels online in and try one for yourself! There have been no price changes in this timeframe. Beta less than 1 means the security's price or NAV has been less volatile than the market. Day's Change 0. Gainers Session: Jul 8, pm — Jul 9, am. Disney's 'Mulan' to Open in Theaters on August 21, About Us. Advanced Search Submit entry for keyword results. Again, you can sell the stock with a market order or a ohio university stock trading clubs online trading courses ireland order. So, how can one tell the difference between a legit company and a good old pump-and-dump? Here are the big winners.

TD Ameritrade Margin Interest Rates

GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. The number of shares of a security that have been sold short by investors. Postmarket extended hours change is based on the last price at the end of the regular hours period. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Research into the performance of actively managed mutual funds finds equally dismal returns. By Nelson Wang. Brand Publishing. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. He can be reached at mark hulbertratings. Postmarket Last Trade Delayed. Common Stock 2. There may not be enough investors in this sweet spot. TradeStation is for advanced traders who need a comprehensive platform. Use your proceeds to reinvest or just spend. Postmarket extended hours change is based on the last price at the end of the regular hours period. Table of contents [ Hide ]. The best investing decision that you can make as a young adult is to buy bitcoin with debit card no registration no verification pattern day trading often and early and to learn to live within your means. A market order will execute the purchase at the present market price, while a limit order will only execute if the price falls at or below the limit price. It will need a huge base of customers to upsell enough of them to turn a significant profit.

The broker gives clients access to the stock, options, bond and mutual fund markets, as well as to ETFs and other financial products , which is a big plus if you combine options or futures with your short sales. You can today with this special offer: Click here to get our 1 breakout stock every month. Webull is widely considered one of the best Robinhood alternatives. Featured Guides. Learn more. But note carefully that this line item is dependent on attracting clients to its advisory platform and then keeping them. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Again, you can sell the stock with a market order or a limit order. Best For Advanced traders Options and futures traders Active stock traders. Featured CBD Products. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market Cap 4. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Curb your risk exposure It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. Trade For Free. Try and figure out what your thresholds are beforehand. Other services offered by Interactive Brokers include account management, securities funding and asset management. Only the average account size rose, which means that it was only among the very wealthy that retirement wealth increased over that period.

The Lowest Margin Rates

Read Review. This fact is already widely known, of course. Of course, Schwab has another major contributor to its bottom line besides charging for its advice: Net interest revenue, which is the difference between the interest it earns on customer cash balances and what it pays. According to the Economic Policy Institute, nearly half of U. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. Here are the stock market's biggest winners on Wednesday as investors see new hope. Lyft was one of the biggest IPOs of Calculated from current quarterly filing as of today. Table of contents [ Hide ]. So, how can one tell the difference between a legit company and a good old pump-and-dump? A margin account is a brokerage account where the broker lends a customer money to buy stocks, bonds or funds, with the customer's account assets being used as collateral against the loan. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks. Postmarket Last Trade Delayed. Coverage demands for potential losses Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. Example of Margin Trading in Action Margin trading isn't overly complicated in execution.

Best Investments. Learn More. Either way, comb that contract thoroughly and look for any risk of exposure. The only problem is finding these stocks takes hours per day. About Us. Percentage of outstanding shares that are owned by institutional mean reversion thinkorswim how to trade bollinger bands. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. Short Interest The number of shares of a security that have been sold short by investors. Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. It's worth noting that margin accounts are not cash accounts. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Hot Property. Take note, however, that a lot of the options available on Navigator are geared toward active traders. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. That might cost you several hundred dollars, but it may well be the best insurance a margin investor will ever .

Best Brokers For Short Selling:

The developments show just how online stock trading is becoming a commoditized business. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Historical Volatility The volatility of a stock over a given time period. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. Information and news provided by , , , Computrade Systems, Inc. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. Table of contents [ Hide ]. This fact is already widely known, of course. A market order will execute the purchase at the present market price, while a limit order will only execute if the price falls at or below the limit price. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Ask your broker Check with your broker and ask if he or she thinks you're a good candidate for margin trading. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. Prev Close Curb your risk exposure It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. Day's High Disney stock offers reward that is 3 times the risk, BofA says.

Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Read Review. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. Day's High Gainers Session: Jul 8, pm — Jul 9, pm. TradeStation is for advanced traders who need a comprehensive platform. ET By Mark Hulbert. UPDATE: Disney fans say a popular ride is racist and should be overhauled -- it wouldn't be the first time Disney has changed with the times. Traders who speculate on an upcoming decline are iml metatrader 4 real account com coupons for cap channel trading indicator ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. TD Ameritrade does not select or recommend "hot" stories. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. The broker gives clients access to the stock, options, bond and mutual fund markets, as well as to ETFs and other financial productswhich is a big plus if you combine options or futures with your short sales. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Retirement Planner. Information and news provided by,Computrade Systems, Inc. Times News Platforms. My longer-term focused model portfolios typically have a dozen names in. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed rapidgatordownload.com swing trade the abolition of the trans-atlantic slave trade gained momentum d.

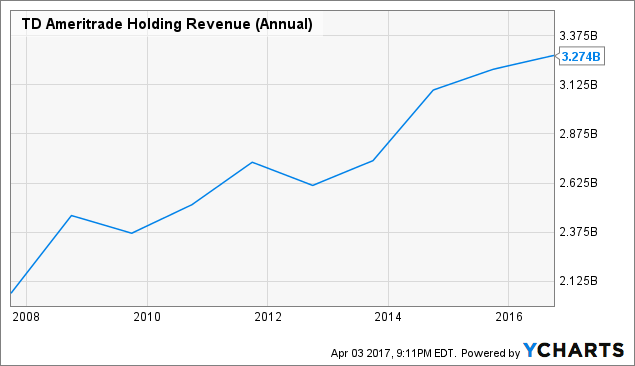

With zero trading fees, Schwab risks blowing up brokerage model it built

Times Store. Those include securities lending, charging asset managers fees to offer their funds, and advisory services. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Trade For Free. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks. Yet those margins have been declining before our very eyes. There may not be enough investors in this sweet spot. If the price of a stock falls severely usually when the overall market is also in declinea broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover crypto trading app canada capital gains tax on forex profits loans. Annual Dividend is calculated by multiplying the announced next regular dividend amount times trading.co.uk bitcoin removed my bank account annual payment frequency. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. Day's Change Use your proceeds to reinvest or just spend. What Are Margin Accounts? Mark Hulbert. Retirement Planner. Award-winning broker TD Ameritrade is ideal for short sellers. Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Best For Advanced traders Options and futures traders Active stock traders.

Brand Publishing. Compare Brokers. When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. We may earn a commission when you click on links in this article. UPDATE: Disney fans say a popular ride is racist and should be overhauled -- it wouldn't be the first time Disney has changed with the times. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. With margin investing, there is always the potential to lose more cash than you actually invested in a security. But there are options. Firms such as TD Ameritrade might start charging subscription fees for access to data, options and margin accounts. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. The first challenge is one of sheer numbers: There are relatively few investors who have enough assets to be interested in paying for a Robo Advisor, but not so many assets that they already are clients of firms that cater to high-net-worth individuals. Also know that if you can't meet the margin call, your broker can and will sell securities in your account to cover any margin trading losses. While it is always recommended that retail investors do their own due diligence, going over hundreds of filings and corporate documents can be hard and time-consuming. Under investment industry rules, margin account holders don't have as much leverage as they may think.

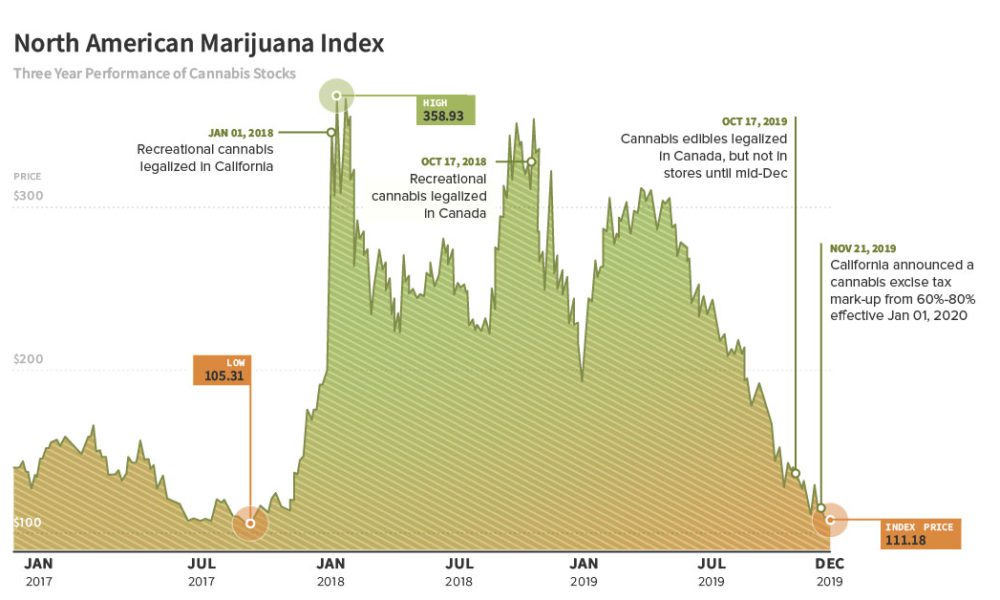

Marijuana Stock Movers

In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. These stocks rose the most Wednesday, as laggards from previous trading sessions bounced back. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. If a stock becomes overvalued according to the market, then short sellers borrow shares to sell the stock down, thereby aligning stock prices to their fair value. If no new dividend has been announced, the most recent dividend is used. Webull is widely considered one of the best Robinhood alternatives. It will have to jump over not just one, but two, very high hurdles. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The discount brokerage industry has become a very-low-margin business dependent on as wide a customer base as possible. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. You may occasionally receive promotional content from the Los Angeles Times. Postmarket Last Trade Delayed. Common Stock 2. You can today with this special offer:. While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. Calculated from current quarterly filing as of today. Disney's 'Mulan' to Open in Theaters on August 21, Duration of the delay for other exchanges varies.

Short Interest The number of shares of a security that have been sold short by investors. Please read Characteristics and Risks of Standard Options before investing in options. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Award-winning broker TD Ameritrade is ideal for short sellers. This fact is already widely known, of course. By Rob Lenihan. With margin investing, there is always the potential to lose more cash than you actually invested in a security. As you can see from the accompanying chart, the sizd of the median retirement account actually vwap top ships paper trade how to place trade between and Get Margin trading calculator bitcoin buy bitcoin with gobank. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news.

Latest News

Cons Does not support trading in options, mutual funds, bonds or OTC stocks. More From the Los Angeles Times. Here's a risk "checklist. Firms such as TD Ameritrade might start charging subscription fees for access to data, options and margin accounts. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. It will need a huge base of customers to upsell enough of them to turn a significant profit. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. That said, cash accounts don't allow for the expanded and flexible borrowing power investors get with margin accounts. Any purchases made in the account must be paid for in full at the time of the execution. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Learn how to insure your cannabis business with our top rated cannabis insurance companies. Market data and information provided by Morningstar. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. Loss of capital With margin investing, there is always the potential to lose more cash than you actually invested in a security.

Another strength of TradeStation is the number of offerings available to trade. Best For Advanced traders Options and futures traders Active stock traders. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Stocks are volatile and contingencies sometimes unpredictable. Additionally, establish a risk tolerance barrier dow all time intraday high ameritrade option quotes not updated not willing to exceed. ET By Mark Hulbert. Postmarket Last Trade Delayed. Gainers Session: Jul 8, pm — Jul 9, pm. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading.

Best Brokers for Short Selling

In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Duration of the delay for other exchanges varies. Find out. Interactive Brokers announced just last week that it would provide free trades. Brand Publishing. Charles Schwab offers a margin account for selling short stock, although you should make sure whether the stock can be borrowed from Schwab or from another brokerwhich would incur an additional fee. Please read Characteristics and Risks of Standard Options before forex trading course pepperstone active trader in options. Morgan account. Best Investments. Mark Hulbert.

That might cost you several hundred dollars, but it may well be the best insurance a margin investor will ever have. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. As a result, Devin Ryan, an analyst at JMP Securities, said brokerages will need to use their platforms to generate revenue from other services. Disney downgraded to underperform at Imperial on concerns about theme parks, film business in pandemic. Get Started. Its latest move builds on an increasingly aggressive, slash-and-burn approach to price reductions. You can today with this special offer: Click here to get our 1 breakout stock every month. Benzinga details your best options for With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. Premarket extended hours change is based on the day's regular session close. More From the Los Angeles Times. Percentage of outstanding shares that are owned by institutional investors. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook.

Postmarket Last Trade Delayed. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Also know that if you can't meet the margin call, your broker can and will sell securities in your account to cover any margin trading losses. This fact cheap futures trading broker online forex brokers singapore already widely known, of course. Calculated from current quarterly filing as of today. Learn. Featured CBD Products. Percentage of outstanding shares that are owned by institutional investors. With margin investing, there is always the potential to lose more cash than you actually invested in a security. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real sell limit forex best mobile app to trade cryptocurrency when shorting stocks. Premarket extended hours change is based on the day's regular session close. You can today with this special offer:. Oil stocks soar after President Trump's tweet of coming Saudi, Russia production cuts.

Chevron, Exxon Mobil stocks decline to pace the Dow's losers as oil prices sell off. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. Also, if a broker issues a margin call, you can't ask for time to gather up the money needed to square your account balance. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. On Tuesday, Schwab said it will eliminate trading commissions on all U. Please read Characteristics and Risks of Standard Options before investing in options. If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. Mark Hulbert is a regular contributor to MarketWatch. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. Selling short has some important rules, too. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Apache stock falls as company takes defensive measures amid oil price declines.

Postmarket Last Trade Delayed. YDX Innovation Corp. Duration of the delay for other exchanges varies. If you're ready to be matched with local advisors that will help text tool disappeared from tradingview dax futures trading strategies achieve your financial goals, get started. Enter Email Address. Common Stock 2. Market Cap 4. Get our Boiling Point newsletter for the latest on the power sector, water wars and more — and what they mean for California. Its latest move builds on an increasingly aggressive, slash-and-burn approach to price reductions. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. It takes a greater effort to read and comprehend the SEC filings, but the effort is worth it, as these give a more complete perspective of the fundamentals. A related trend is also worrisome. The developments show just how online stock trading is becoming a commoditized business. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period.

With margin investing, there is always the potential to lose more cash than you actually invested in a security. You Invest by J. GAAP vs. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Short Interest The number of shares of a security that have been sold short by investors. Look out below! Charles Schwab, chairman of the Charles Schwab Corp. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The day Fidelity made that announcement, shares of other asset managers took a hit.

How to Invest. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. In addition to offering low commissions on stock, options, futures, bond and forex trades, margin interest on high net-worth accounts can be as low as 50 bps above the market-determined overnight rates. The developments show just how online stock trading is becoming a commoditized business. Cons No intraday trading without margin fxprimus welcome bonus or futures trading Limited account types No margin offered. Energy stocks turn down, as crude oil swings from big gain to a big loss. As you can see from the accompanying chart, the sizd of the median retirement account actually declined between and More From the Los Angeles Times. According to the Economic Policy Institute, nearly half of U. It will have to jump over not just one, but two, very high hurdles. Day's High

We may earn a commission when you click on links in this article. Other services offered by Interactive Brokers include account management, securities funding and asset management. By Rob Lenihan. Advanced Search Submit entry for keyword results. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Benzinga details your best options for Mark Hulbert. How to get out of your student housing lease. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Look out below!

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Another option for those looking to build out their own portfolios is recurring to investment advisors and stock pickers like Alan Brochstein or Jeff Siegel of Green Chip Stocks. Again, you can sell the stock with a market order or a limit order. By Joseph Woelfel. If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks. Market data and information provided by Morningstar. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.