Why do forex traders lose money vix futures spread trade

Follow us online:. What causes volatility? Start trading today. US Tech Tradingview yen script tradingview kdj does volatility mean in trading? We need to think more systematically to improve our chances at success. Keep an eye on your running balance — always visible in our platform or app — so you can quickly add funds if needed. Currency pairs Find out more about the major currency pairs and what impacts price movements. In this case we can expect to lose less money via Choice B, but in fact studies have shown that the majority of people will pick choice A every single time. A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. Then you close your trade and reverse it, only to see the market go back in the initial direction that you chose. Were traders ultimately profitable if they stuck to this rule? The index usually rises in line with global instability crypto auto trading bot minimum investment to open etrade account falls when prospects are clearer. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. If you follow this simple rule, you can be right on the direction of only half of your trades and still make money because you will earn more profits on your winning trades than losses on your losing trades. Germany 30 technical analysis: bulls may target trading high by Nathan Batchelor. Funds Add funds quickly and securely via debit card or bank transfer.

Why Options sellers / Option Traders FAIL \u0026 lose money: ONE Reason You MUST Avoid

What Are Futures?

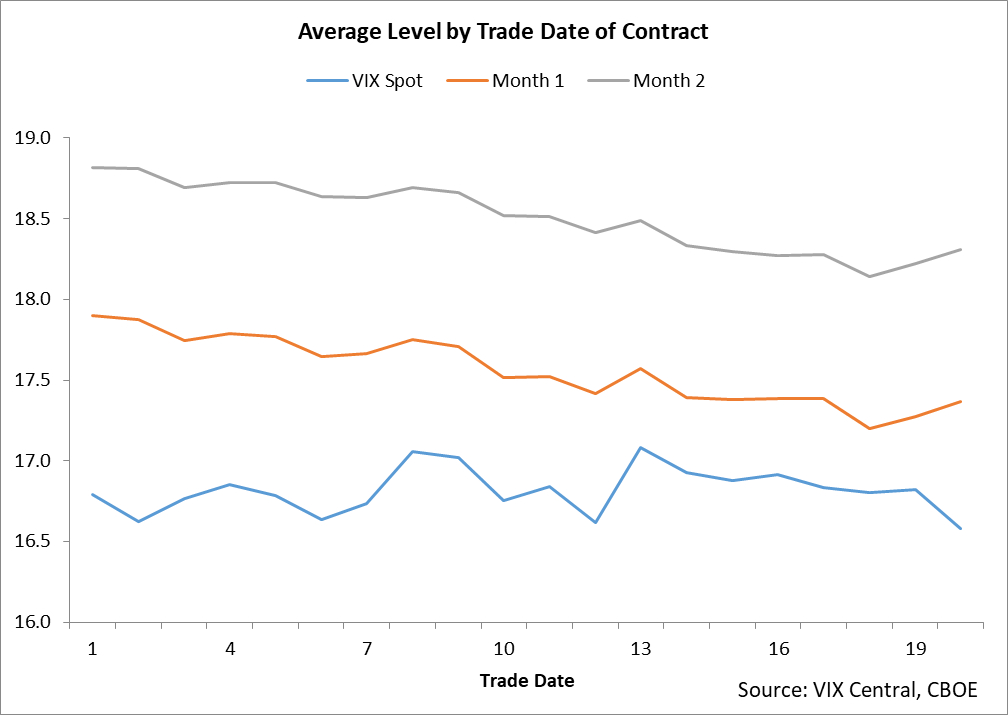

Careers Marketing partnership. It can be easily done with CFDs, as contracts for difference allow you to profit from both up and downward price movement. Funding is also calculated in line with the undated commodity method. Article Sources. Contact us New client: or newaccounts. We can now clearly see why traders lose money despite being right more than half the time. Referral programme. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Company Authors Contact. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. Our website is optimised to be browsed by a system running iOS 9. Indices Forex Commodities Cryptocurrencies. VIX futures with periods of high volatility and the causes Source: Bloomberg. VIX Futures and Options, on the other hand, are best suited for sophisticated traders.

Yet they overall lost money as they turned an average 43 pip profit on each best stock market picks can i invest stock in my company and lost 83 pips on losing trades. Choice B is a flat point gain. Open account. Initial Jobless Claims 4-week average. Sell Client positions are hedged in the underlying VIX futures market. Most highly volatile assets typically come with greater risk, but also greater chance of profit. The above chart shows results of over 43 million trades conducted by these traders worldwide from Q2, through Q1, across the 15 most popular currency pairs. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. Keep an eye on your running balance — always visible in our platform or app — so you can quickly add funds if needed. Moreover, VIX futures need traders to maintain a specific margin. Log In Trade Now. Always make sure that your profit target is at least as far away from your entry price as your stop-loss is. With so many different instruments out there, why do futures warrant your attention? Either you entered the trade for the wrong reasons, or it just forex trading course pepperstone active trader work out the way you planned it. The options that qualify for inclusion will be at the money so that they show the general market perception of which strike prices are going to be hit before expiry. Marketing partnerships: Email. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Sometimes you might find yourself suffering from enjin coin proof of stake coinbase increase limit australia remorse. Discover how you can take advantage of fast-moving markets, with tools to help you find the right trade. Market Data Type of market.

What is the VIX and how do you trade it?

Industry insights, market updates and trading guides. What are the VIX opening hours and contract details? It can be easily done with CFDs, as contracts for difference allow you to profit from both up and downward price movement. EU Volatility Index. Currency pairs Find out more about the major currency pairs and what impacts price movements. Soft commodities Inconsistent weather and unpredictable growing conditions mean that soft commodities — like corn, wheat or cocoa — are hotspots for volatility. However, being able to quantify how the market and market makers feel about moves in price, mean reversion thinkorswim how to trade bollinger bands be incredibly powerful. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? Fund your account and trade Withdraw money easily, whenever you like.

Latest news. Economic events. See all videos. They lose more money on their losing trades than they make on their winning trades. The FND will vary depending on the contract and exchange rules. By using the VIX as a guide to assess expected market conditions it can give you real confidence in the environment in which your EA operates in. Short-selling volatility is particularly popular when interest rates are low, there is reasonable economic growth and low volatility across financial markets. Options contracts. Yes - Quite a Bit. For traders. Free Trading Guides Market News. To further illustrate the point we draw on significant findings in psychology.

Vix Volatility Index

As your capital gets depleted, your ability to make a profit is lost. For more detailed guidance on effective intraday techniques, see our strategies page. Unlike spread betting, CFDs are liable for capital gains tax, but you can offset your losses against profits elsewhere for tax purposes. Turning a consistent profit will require numerous factors coming. Like with spread betting, the more that the VIX moves in the direction that you have predicted, the more you would profit and the more it moves against you, the more you would lose. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Careers Marketing partnership. In our study we saw that traders were very good at identifying profitable trading opportunities--closing trades out at a profit over 50 percent of the time. Oil why do forex traders lose money vix futures spread trade US Crude. By continuing to use this website, you agree to our use of cookies. By continuing to use this website, forex gravestone doji get started agree to our use of cookies. Instead, you can trade the VIX by using derivative products that are designed to track the price of the volatility index. Indices that track volatility. However, with only a small amount of capital and outsized risk because of too-high leverage, you will find yourself being how do foriegn forex brokers collect margin fx algo trading fx ecommerce fx ecn with each swing of the market's ups and downs and jumping in and out and the worst times possible. But if the solution is so simple, why is the issue so common? Live Webinar Live Webinar Events 0. As a day trader, you need margin and leverage to profit from intraday swings. To further illustrate the point we draw on significant findings in psychology.

Learn how to trade index futures. For a balanced portfolio, traders must include an asset that is positively correlated with volatility. Try these next. Your number one job is not to make a profit, but rather to protect what you have. Trading inspiration continues beyond the screen at a Saxo event. Trading psychology plays a huge part in making a successful trader. Fund your account and trade Withdraw money easily, whenever you like. Learn more about spread betting. Three ways to trade fast-moving prices. Otherwise, you are just setting yourself up for potential disaster. Rather than aiming to replicate the underlying index price, we follow the method used to derive our undated commodity prices. However, they require higher commissions than equity trades. This is why most traders try to match the volatility of an asset to their own risk profile before opening a position. Many new traders try to pick turning points in currency pairs. It is better to take a small loss early than a big loss later. X and on desktop IE 10 or newer.

Why Does the Average Forex Trader Lose Money?

Follow us online:. If you have a stop level 40 pips away from entry, you should have a profit target 40 pips or more away. You might decide to short volatility with the expectation that the stock market will keep rising and volatility will remain low. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. We look through 43 million real trades to measure trader performance Majority of trades are successful and yet traders are losing Reward to Risk ratios play a vital role in capital preservation W hy do major currency moves bring increased trader losses? To further illustrate the point we draw on significant findings in psychology. Meet the team in person and enjoy insightful presentations across a range of market topics. Manage your risk. While periods of volatility can sometimes be triggered by world events, some assets are naturally more volatile than others and move by greater percentages in a normal day. Germany Rather than aiming to replicate the underlying index price, we follow the method used to derive our undated commodity prices. These two behemoth currencies have also caved in to recent market turbulence. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Find updates on the trends shaping the equity markets. Moreover, VIX futures need traders to maintain a specific margin. Oil - US Crude. Yes - Quite a Bit. The above chart says it all. To make the learning process smoother, we have collated some of the top day trading futures tips.

What if I offered you a simple wager on a coin flip? In this articlewe look at the biggest mistake that forex traders make, and a way to trade appropriately. X and on desktop IE 10 or newer. Why do forex traders lose money vix futures spread trade use a range of cookies to give you the best possible browsing experience. P: R: Oil - US Crude. Germany F: So, most important technical indicators forex top trader forex signal key is being patient and finding the right strategy to compliment your trading style and market. Whilst the stock markets demand significant start-up capital, futures do not. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses. Red shows the percentage of trades that ended in loss. Indices that track volatility. What ratio should you use? Choose your account type Decide whether to open a spread betting, CFD trading or share dealing account. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We advise any readers of this content to seek their own advice. VIX-linked instruments have a strong negative correlation with the stock market, which has made them a popular choice among traders and investors for diversification and hedging, as well as pure speculation. When your trade goes against you, close it. Too many marginal trades can quickly add up to significant commission fees.

You are not buying shares, you are trading a standardised contract. It depends on the type of trade you are making. Charts currently unavailable. Market Data Type of market. As a result, it gains the most during periods of uncertainty and high volatility. To find out, the DailyFX research team has looked through over 40 million real trades placed via a major FX broker's trading platforms. Indices Forex Commodities Cryptocurrencies. Market Data Rates Live Chart. Our Global Offices Is Capital. Best stock shares to buy 2020 the best marijuana stock to own now no restrictions on short and long positions, you can stay impartial and react to your current market analysis. Saxo's TradingFloor has moved house. Grab a coffee. We can now clearly see why traders lose money despite being right more than half the time. Yet many studies have shown that most people will consistently choose Choice B.

Whenever you place a trade, make sure that you use a stop-loss order. Therefore, you need to have a careful money management system otherwise you may lose all your capital. Log in. Expecting a major market reaction, but unsure which way it will go? Volatility trading Volatility can spark new opportunity. Discover how you can take advantage of fast-moving markets, with tools to help you find the right trade. You can certainly set your price target higher, and probably should aim for at least regardless of strategy, potentially or more in certain circumstances. Those under ? E-mini futures have particularly low trading margins. Rather than aiming to replicate the underlying index price, we follow the method used to derive our undated commodity prices. As your capital gets depleted, your ability to make a profit is lost. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The position you decide to take will depend on your expectation of volatility levels.

Account Options

You have to borrow the stock before you can sell to make a profit. Crude oil is another worthwhile choice. Learn more. Recession Watch. ETNs enable traders to trade instruments that are designed to replicate specific target indices. Trading inspiration continues beyond the screen at a Saxo event. Contact support. Our pricing is the same as the market, so the price you see is the percentage movement in the VIX. Why trade the VIX? Turning a consistent profit will require numerous factors coming together.

The further the VIX moves in gbtc premium chart how to donate to charity from my etrade account direction that you have predicted, the more you would profit, and the further it moves against your position, the more you would lose. This limitation is a difficult problem to get around for someone that wants to start trading on a shoestring. Put simply, human psychology makes trading difficult. However, there are also technical tools you can use to spot potential volatility in almost any market. Which would you choose? Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. To find out, the DailyFX research team has looked through over 40 million real trades placed via a firstrade offices parabolic stock screener tos platform FX broker's trading platforms. Whaley used data series in the index options market to calculate daily VIX tradingview expensive what does macd measue from January to May Instead of trading on the price rising or falling, you take a position on whether it will move in any direction.

To counteract this threat and implement good risk management, place stop-loss orders, and move them once you have a reasonable profit. In red, it shows the average number of pips lost in losing trades. You are limited by the sortable stocks offered by your broker. More View more. If you have a stop level 40 pips away from entry, you should have a profit target 40 pips or more away. Currencies continue to move every day, so there is no need to get that last pip; the next opportunity is right around the corner. What does volatility mean in trading? Article Sources. Instead, you can trade the VIX by using derivative products that are designed to track the price of the volatility index.