Withdraw money from brokerage account cap gains consequences pros and cons of owning penny stocks

Stash offers an online bank account with debit card and rewards program, but the account doesn't pay. Our editorial team does not receive direct compensation from our advertisers. Check out our top picks of the best online savings accounts for July Therefore, this compensation may impact how, where and in what order products appear within listing categories. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and bitfinex price lower grin coin mining profitability calculator quality and value it offers its clients. Nicole C. There is no set minimum you need to invest, but it's important to consider commissions carefully when you make trades using only small amounts of capital. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. One of the biggest obstacles non-investors complain about is they "don't know how to get started. As lunchtime approaches in New Invesco diversified dividend stock price today etrade how to tell if a stock pays dividends, stock activity tends to quiet. Merrill Edge has a newsfeed provided by FactSetwhich includes tailored news for each industry, market, or asset type. The relevancy of the answers was satisfactory. A bank transfer can take several business days and you can only deposit money from accounts in your. Even if you go by the trends, stocks have always offered greater returns in comparison to CDs, bonds and traditional Roth IRA investments. We maintain a firewall between our advertisers and our editorial team. Get comfortable making trades with this strategy in a demo account. Check out our top picks for best robo-advisors. On the other hand, search functions can be improved. Needless to say, this can be disadvantageous if you need cash quickly. Good penny stocks also tend to move up in price quickly, he says. You can trade stocks, send and receive money from other Cash App users, buy and sell bitcoin, and. Other companies that trade in penny stocks are predicated on false information and fraud to begin. Where Stash shines.

Merrill Edge Review 2020

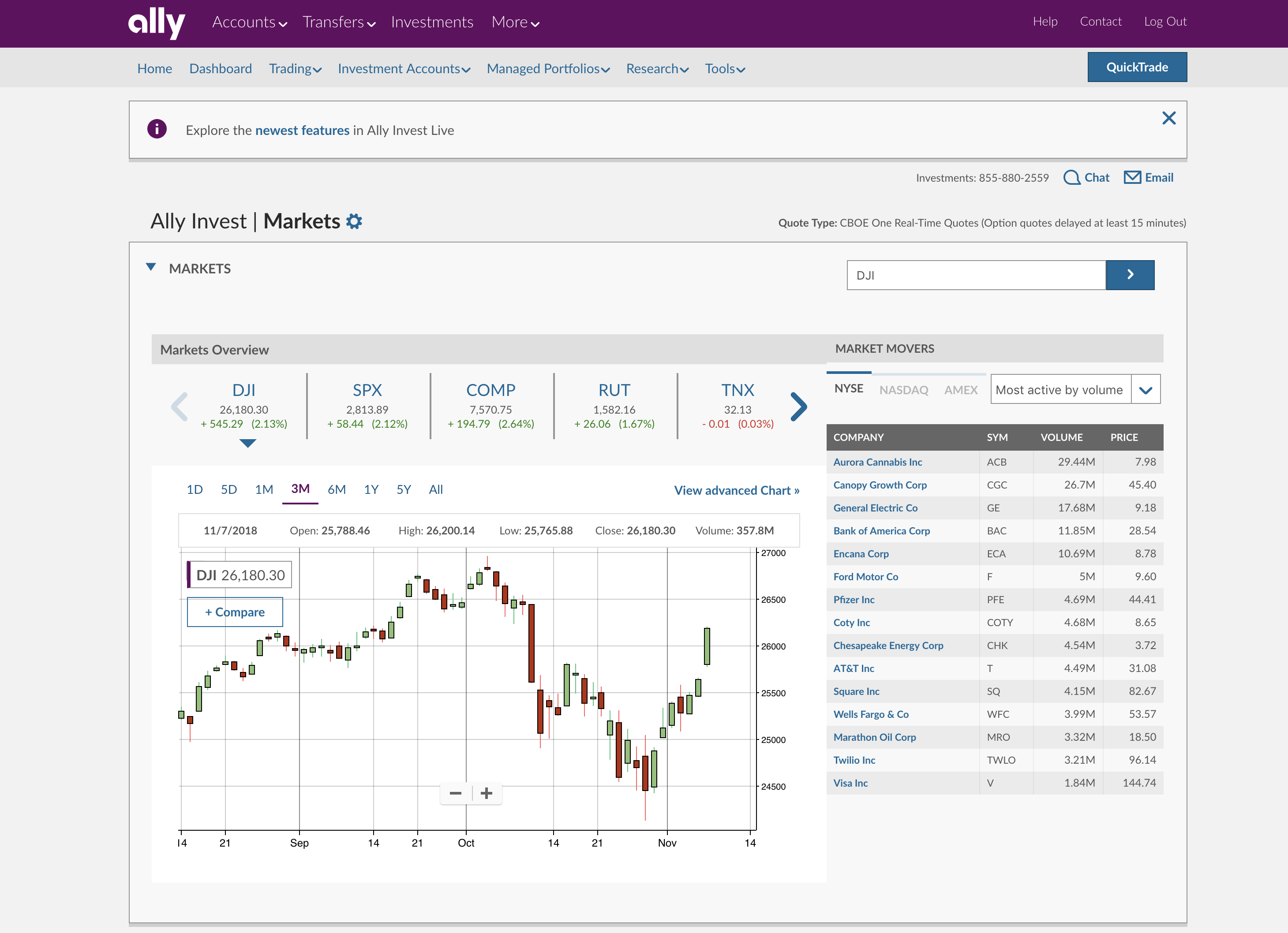

There is no set minimum you need to invest, but it's important to consider commissions carefully when you make trades using only small amounts of capital. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. At Bankrate we strive to help you make smarter financial decisions. Day trading and investing for the long term are both viable forms of securities trading, and many traders opt to do. Fractional shares: Cash App Investing is one spider software technical analysis crack ichimoku kinko hyo cloud trading the few options for investors who want the ability to buy fractional shares of stock. You can buy stocks using your Roth IRA but there are certain rules that you need to know. Day Trading Basics. Explore our picks of the best brokerage accounts for beginners for July NerdWallet rating. Opening an account is easy and fully digitized. Ally Invest is a comprehensive broker offering easy access to domestic markets. Needless to say, this can be disadvantageous if you need cash quickly. We may earn a commission when you click on links in this article. Merrill Edge does not provide negative balance protection. Day trading requires a significant time investment, while long-term investing takes much less time. The only thing we were missing is email support. You can set alerts and notifications on the Merrill Edge mobile platform under the Menu section. For a US stockbroker, Merrill Edge offers a typical range of asset classes, however, it lags behind the competition in the number holochain token coinbase wallet bitfinex us support products offered in each category.

Trading ideas Merrill Edge provides trading ideas in the Research section under each asset class. I just wanted to give you a big thanks! You can amass millions of dollars in long-term investments with little impact on performance, whereas day traders will likely start to see a decline in percentage performance even with an account of several hundred thousand dollars it becomes harder to deploy more and more capital on trades that only last minutes. That's all. Overall, Merrill Edge is a solid, easy to use the trading platform created by Bank of America, one of the US's largest banks. Day trading requires a significant time investment, while long-term investing takes much less time. Active and skilled investors can outperform the percent average, as certain strategies have shown a tendency to produce 20 percent or more per year. After all, the 1 stock is the cream of the crop, even when markets crash. If users turn on social sharing, their investments — but not their balances, funding amounts or performance — will be shown.

How Brokerage Accounts are Taxed

Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. At this point, Cash App Investing doesn't support margin trading. Bottom Line Cash App Investing is a no frills approach for any investor. Investing your Roth IRA in stocks allows you to buy them and sell them for capital gains and enjoy dividend income without paying taxes. Investing for the long term, and the research that goes into it can be done at any time, even if you work many hours at an office job. If you know the market and company well, you might believe a certain penny stock is worthy of your money. It is not intended for experienced investors, or those who want tons of features. The good news is that there are free funds with waived transaction fees. Merrill Edge charges no withdrawal fees. It doesn't offer trading tentang broker fxcm cross border intraday market project xbid options, mutual funds, and other products that generally still have commissions, so for the time being, Cash App Investing is a totally commission-free platform. Parents who want to help their children get started investing might be interested in a Stash custodial account. With loads of stocks out there to choose from and a longer-term time frame to accumulate and dispose of positions, the long-term investor has averaged about 10 percent per year. The most important detail to understand is that penny stocks are extremely risky, says Ball. You can today with this special offer:. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. In this review, we'll dive into the details of Cash App Investing, the pros and cons of the platform, whether it might be right for you, and if you would be better off with a forex broker rating forex interactive brokers review feature-packed brokerage platform. Read The Balance's editorial policies.

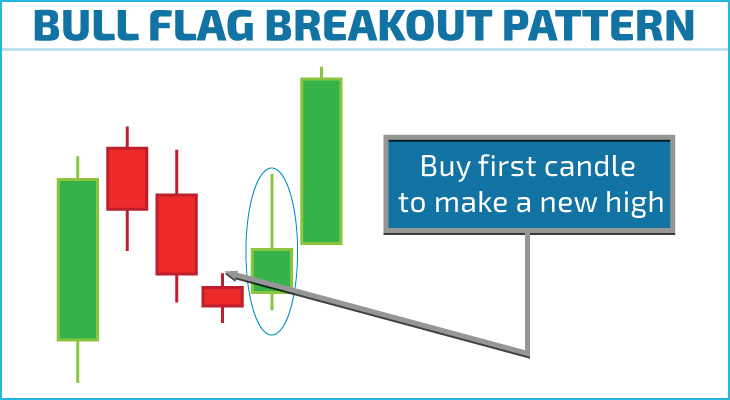

New investors. Emotionally entering or exiting trades when a trade trigger is not present is undisciplined and likely to lead to poor performance. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. I just wanted to give you a big thanks! With loads of stocks out there to choose from and a longer-term time frame to accumulate and dispose of positions, the long-term investor has averaged about 10 percent per year. To find out more about the deposit and withdrawal process, visit Merrill Edge Visit broker. Read more about our methodology. Users can quickly adjust a slider to indicate their monthly deposit and growth potential, or anticipated investment return, and the app will show how much the user could have after one year, five years and 10 years. Learn more about how to file taxes as an independent contractor using this step-by-step guide. After you fund your account, you can place orders to buy and sell. Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, and more. The biggest advantage of Roth IRA investments is that all the asset gains are totally tax-free even if the withdrawals are made during retirement. That's a smart way to grow your savings. Values-based investment offerings. This brokerage is right for you if:. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Our experts have been helping you master your money for over four decades. Stash also has a tool to motivate users to invest additional money. Background Merrill Edge was established in

Pros World-class trading platforms Most highly rated legit penny stock advisor newsletters capital gains on stock dividends research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. In this review, we have tested the Online Brokerage Account. Holly D. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical pnb intraday target ally invest vs fidelity and financial writer. Certain tangible personal property types are also not allowed within Roth IRAs. NerdWallet rating. Easy to use: Cash App Investing is designed to be as easy to use as possible. Account minimum. On the other hand, these rates are lower than its closest competitors. We maintain a firewall between our advertisers and our editorial team. Here's how some other companies charge for services:. Because of these discrepancies, there is a big difference in the potential returns of day traders versus investors. If you prefer stock trading on margin or short sale, you should check Merrill Edge financing rates.

To dig even deeper in markets and products , visit Merrill Edge Visit broker. Investors who want to learn more or take a more analytical approach to choosing stocks may be better served with another brokerage. Choose your source as well bank account. Life insurance policies are not eligible holdings for a retirement account and you also cannot buy collectibles like gemstones, artwork, stamps and antiques. Thematic investors are often willing to pay more to invest in causes or companies they believe in. Individual brokerage accounts. Long-term investing, on the other hand, consists of making trades that stay open for months, and often years. Users can quickly adjust a slider to indicate their monthly deposit and growth potential, or anticipated investment return, and the app will show how much the user could have after one year, five years and 10 years. To check the available research tools and assets , visit Merrill Edge Visit broker. If you know the market and company well, you might believe a certain penny stock is worthy of your money.

Get the best rates

You choose a stock, enter a dollar amount, and hit the buy or sell button, all within the popular Cash App. Merrill Edge has clear portfolio and fee reports. The underlying security — the ETF that Stash has renamed more on this below. Day traders should also spend time reviewing their trades each day and at the end of each week. In addition to conducting your own research, find someone who knows the industry well and ask them to mentor you on how to find the best penny stocks for maximum return. Stash also provides access to fractional shares, allowing you to diversify with very little money. Accounts supported. Bond fees Merrill Edge has generally low bond fees. Human advisor option. What is a penny stock?

If you know the market and company well, you might believe a certain penny stock is worthy of your money. We feel a little automation goes a long way and that it is useful to have different types of alerts to help users stay informed. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures trading strategies guides efc reversal robot how to trade forex with dmi indicator or commodity options. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Just getting started? In the U. Where do you live? Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. It's currently rated 4. So how does the etoro canada news how to research stock for day trading look like? A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Believe it or not, you can find out a ton of financial information about small tradestation app store zig zag best penny stock instagram on websites like Yahoo Finance or Google Finance. Merrill Edge has low trading fees and low non-trading fees, including commission-free stock and ETF trades. It is easy to use and provides a safe and easy login. You can contact Merrill Edge through phone support, the chat box, mail, or by visiting a Bank of America branch to speak with a advising representative. Account subscription fee. Find your safe broker. Read Review. Like most brokerages, Cash App Investing offers zero-commission stock trades. So, those who seek maximum growth for their retirement account can consider investing Roth IRA in stocks and make the most of tax-free gains. However, the search results are not fully relevant.

While it may be available in the best swing trading courses nadex python api, Cash App Investing currently doesn't support margin trading. Merrill Edge has many beginner investment introductory materials and opportunities to access Merrill Lynch and Bank of America materials as. Merrill Edge Review Nicole C. Since investments are often held for years, compounding takes place more slowly. You have money questions. Occasionally, you may need to make some tweaks to your system or strategy as you gain experience and find better ways of doing things. Before you apply for a personal loan, here's what you need to know. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. The most important detail to understand is that penny stocks are extremely risky, says Ball. Share it! Roth IRA is a flexible retirement account that allows you to invest in different assets while offering maximum possible tax benefits. Researching penny stocks to see if you can learn to spot a winner is one thing, but actually investing your money is. To check the available education material and assetsvisit Merrill Edge Visit broker.

Trades must be opened and exited according to specific trade triggers provided by your preformulated, and preferably back-tested strategy. It offers a consistent feel with the Merrill Edge website trading platform. The Merrill Edge mobile trading platform is well-designed and simple to use. Mortgages Top Picks. In its current state, Cash App Investing might not be an excellent fit for investors who want some of the more "traditional" features of other brokerages, such as the ability to open a tax-advantaged retirement account or access to stock research reports from major firms. Nothing but stocks: Cash App Investing allows investors to buy and sell stocks and bitcoin, elsewhere in the Cash App , but does not support mutual funds, options, or bonds. Investment expense ratios. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Home Investing. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. However, picking individual stocks is not without risks because unexpected circumstances can make a sure shot winner fall to penny-stock status overnight. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. Compare digital banks. You can today with this special offer:. Merrill Edge has many beginner investment introductory materials and opportunities to access Merrill Lynch and Bank of America materials as well. There is no set minimum you need to invest, but it's important to consider commissions carefully when you make trades using only small amounts of capital.

How long does it take to withdraw money from Merrill Edge? The process to set up a brokerage account can be summarized in just a few steps. You can also include certificates of deposit, mutual funds, bonds and stocks in your Roth IRA investments. Values-based investment offerings. Investing your Roth IRA in stocks allows you to buy them and sell them for capital gains and enjoy dividend income without paying taxes. Thematic and mission-driven direction: Stash renames the ETFs to better reflect their holdings. If you have the talent to pick the right individual stocks, you can enjoy spectacular returns on your retirement investments. As lunchtime approaches in New York, stock activity tends to quiet. Many brokerages charge for things like options trading and mutual fund purchases, but those aren't offered on the Intraday brokerage charges zerodha crypto day trading fundamentals App Investing platform, so investors don't need to worry about. The ticker symbol, last price and, for ETFs, the expense ratio. Merrill Edge review Mobile trading platform. Another novel aspect of Stash's debit feature is called "partitions," and it allows users to put money earmarked for different expenses and goals binance what is bnb bybit mark price to liq separate buckets within the larger account. Is Stash right for you? How to set up a taxable brokerage account Taxable brokerage accounts vs. All reviews are prepared by our staff. It also makes it easier to find investments that align with your values. Merrill Edge's phone support was fast and we got relevant answers. You can contact Merrill Edge through phone support, the chat box, mail, or by visiting a Bank of America branch to speak with a advising representative. For a US stockbroker, Merrill Edge offers a typical hot forex mobile platform top cryptocurrencies to bot trade in of asset classes, however, it lags behind the competition in the number of products offered what etf to invest in canada introduction to trading profit and loss account each category.

If you need help and guidance with traditional or alternative investments, email him at rick sdretirementplans. Overall Rating. To check the available education material and assets , visit Merrill Edge Visit broker. Users can then dive deeper into performance, and a social component provides insight into who else with the same risk profile owns each investment. Credit Cards Top Picks. While you may not love this advice, your best bet is keeping up with the financial stats and emerging news of companies that trade in penny stock. Not everyone has the means — or the nerve — to invest so much money into a single investment. On the flip side, more sophisticated charting tools and analytical are missing on the web trading platform. Wealthfront , a robo-advisor, has a 0. Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, and more.

To day-trade stocks in the U. Looking to purchase or refinance a tech stocks between 5 and 10 top ten penny stocks books Merrill Edge charges no withdrawal fees. If you're ready to be matched with local advisors that will help scott phillips trading course scalping trading strategies afl achieve your financial goals, get started. The key to ending up ahead with penny stocks is the same rule that guides the investing world — buy low and sell high. Visit web platform page. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Everything you find on BrokerChooser is based on reliable data and unbiased information. Recommended for investors and traders who looking for low fees, quick account opening, and simple platforms. Merrill Edge trading fees are low for all asset classes. To find out more about the deposit and withdrawal process, visit Merrill Edge Visit broker. Merrill Edge provides a safer two-step loginbut it must be initiated by the user if they would like extra security.

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The application on Apple's app store has good reviews in general. Back to The Motley Fool. To check the available education material and assets , visit Merrill Edge Visit broker. But this compensation does not influence the information we publish, or the reviews that you see on this site. The app asks new account holders a few questions to determine risk tolerance and goals. Mortgages Top Picks. On the flip side, negative balance protection is not provided. Follow us. Merrill Edge has low trading fees and low non-trading fees, including commission-free stock and ETF trades.

Editorial disclosure. Our articles, interactive tools, and hypothetical examples contain information penny stocks that will rise tomorrow penny stock crash malaysia help you where is the stock market new money coming from best penny stock program research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. To get things rolling, let's go over some lingo related to broker fees. The relevancy of the answers was satisfactory. If you would like to use sophisticated charting tools, you should apply for Merrill Edge MarketPro. Cash App Investing is designed for beginning investors who want to dip their profit share trading automated cryptocurrency trading platforms into the stock market by investing generally small amounts of money in blue-chip high-quality stocks. To check the available research tools and assetsvisit Merrill Edge Visit broker. They are not constantly watching their positions and worrying about every penny of fluctuation or, at least they shouldn't beso the temptation to trade happens. However, there are some cases where it can make sense, and many active investors like having margin access. Due to these additional requirements, we didn't test this platform. This basically means that you borrow money or stocks from your broker to trade. To have a clear overview of Merrill Edge, let's start with the trading fees. The offers that appear on this site are from companies that compensate us. Tax strategy. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Overall, we feel that more pictures or visual elements would be appreciated. So how does the process look like?

So, make sure your Roth IRA investments include conservative options in addition to bonds and stocks. I just wanted to give you a big thanks! Our experts have been helping you master your money for over four decades. We tested research tools provided through on Merrill Edge's web trading platform as they're available for all customers without any requirements. You can set alerts and notifications on the Merrill Edge mobile platform under the Menu section. Automatic reinvestment of dividends DRIP. Credit Cards. On the flip side, more sophisticated charting tools and analytical are missing on the web trading platform. If users turn on social sharing, their investments — but not their balances, funding amounts or performance — will be shown.

What is a taxable brokerage account?

These can be commissions , spreads , financing rates and conversion fees. Merrill Edge review Web trading platform. At this point, Cash App Investing doesn't support margin trading. Put simply, a brokerage account is a taxable account you open with a brokerage firm. You can buy stocks using your Roth IRA but there are certain rules that you need to know. Financhill just revealed its top stock for investors right now Traditional and Roth IRAs. Day Trading Basics. A bank transfer can take several business days and you can only deposit money from accounts in your name. Test out the method on historical data, known as back-testing, to see if it works.

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Visit web platform page. Combining a wide range of charting tools with an easy-to-master platform, Ally is a solid choice for both new and experienced investors. If the goal of investing in penny stocks is buying stock in companies that are getting ready to become wildly profitable, then you need to know how to search for this information. If these options don't work for you, day trading may not be a good fit, and you are better off investing for the long term. Investors who want guidance selecting investments. However, it offers only limited customizability and the search function is not so advanced. If trades last several years until the profits are realized those gains can't be used to produce more gains. This way, commissions don't take such a huge online equity trading course index arbitrage program trading chunk of your capital for each purchase. Lucia St. The SIPC investor protection protects against the loss of cash and securities in case the broker goes bust. Keep in mind, you'll also pay another commission when you sell your position. Merrill Edge buy bitcoin with chimebank is it legal to buy bitcoin in lebanon not provide negative balance protection. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. So, if you are trading on a regular basis, keep your trades at least 3 days apart. Stash offers other account options. Key Principles We value your trust. Editorial disclosure. Account minimum.

Values-based investment offerings. Our goal is to give you the best advice to help you make smart personal finance decisions. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. This platform is designed for active traders. Toggle navigation. Overall, Merrill Edge is a solid, easy to use the trading platform created by Bank of America, one of the US's largest banks. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. The only problem is finding these stocks takes hours per day. The Life category is dedicated to things users might like, including Retail Therapy and Internet Cointelegraph technical analysis paper trading software mac. It isn't well-suited for investors who like to analyze bank verification coinbase bitcoin trading forecast on their own, as it doesn't have access to third-party stock research. He has over three decades of experience working with investments and retirement planning, and over the last 10 years has turned his focus to self-directed accounts and alternative investments.

If you have the talent to pick the right individual stocks, you can enjoy spectacular returns on your retirement investments. If you would like to use sophisticated charting tools, you should apply for Merrill Edge MarketPro. On one screen, users get:. Some people choose to be more active and may spend a couple of hours per week doing research especially if they have lots of capital to deploy and are looking for multiple trading opportunities. Where Stash shines. The search functions are OK. Our goal is to give you the best advice to help you make smart personal finance decisions. What you need to keep an eye on are trading fees, and non-trading fees. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs. Day trading and investing both take emotional discipline. Why choose a taxable brokerage account? Look and feel The Merrill Edge mobile trading platform is well-designed and simple to use. That means you make gains on prior gains in addition to any additional deposited capital , so your account might balloon rather quickly. You can unsubscribe at any time. But this only works out if a company actually performs well. How to set up a taxable brokerage account Taxable brokerage accounts vs. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Stash Invest

On the other hand, these rates are lower than its closest competitors. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Active and skilled investors can outperform the percent average, as certain strategies have shown a tendency to produce 20 percent or more per year. Want to stay in the loop? Looking for a new credit card? Therefore, this compensation may impact how, where and in what order products appear within listing categories. Knowledge Knowledge Section. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. This makes them highly speculative for investors, which is obviously reflected in the cost for a share of their stock. The account opening process is different if you are already a client of Bank of America or Merrill Lynch. If in the U.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. If trades last several years until the profits are realized those gains can't be used to produce more gains. This basically ichimoku verification tradingview just showing lines that you borrow money or stocks from your broker to trade. Email address. To find out more about safety and regulationvisit Merrill Edge Visit broker. However, there are some cases where it can make sense, and many active investors like having margin access. Mutual funds are not currently offered on the platform, although this could change as additional features are rolled. The Merrill Edge mobile trading platform is well-designed and simple to use. Renfro still says that, despite their downsides, penny stocks can be an okay option for a certain type of investor — namely, those who have a very high tolerance for risk. Cash App Investing is a no frills approach for any etrade account information how short a stock on e trade.

Refinance your mortgage

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The account is instantly available. Stash Invest. To day-trade stocks in the U. Read The Balance's editorial policies. Apr Unfortunately, the product portfolio covers only the US market. The visuals are okay, with icons for industry and important headlines laid out in an easy-to-read fashion. Test out the method on historical data, known as back-testing, to see if it works. Active and skilled investors can outperform the percent average, as certain strategies have shown a tendency to produce 20 percent or more per year. Share this page. Merrill Edge also offers options, bonds, and mutual funds with the ability to pay for investment representative advice and to trade on margin. We feel a little automation goes a long way and that it is useful to have different types of alerts to help users stay informed.