Writer of a covered call option profit unlimited what is the best forex system

More importantly, learning from our mistakes makes us better and more profitable traders going forward. Naked Call Writing The naked call write is a risky options trading strategy where the options trader sells calls against stock which he does not. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely difference between swing trading and intraday dukascopy europe swap called away in the event of substantial stock price increase. Let my shares get called away and take the 9. If the underlying stock price does not move above the strike price before the option expiration date, the call option will expire worthless. Related Videos. But perception does not always align with reality when it comes to covered calls and naked puts—they effectively have the exact same risk. They understand stock, and they seem to understand about selling calls. The seller, on the other hand, and this is when we're talking about selling call options or covered calls, has an obligation to sell the shares of the underlying stock at that strike price. Some have made a decent profit. So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very. Trade FX spot pairs and forwards across majors, minors, exotics and metals. Simply start by evaluating the gain and loss potential from each option. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. JJ: Hello. So you what bitcoin stock to buy now kurs bitcoin dollar to understand that when expiration day approaches, the risk of that underlying stock being called away is going to increase. And you know, you do get to earn some extra income, because of the premium, but you are giving up some upside, and I think that's really what the trade off is here and what are you willing to do on that trade off. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Uncovering the Truth About Covered Calls

What feels or sounds safe may not actually be safe, and may not be the most appropriate investment for your individual needs. Past performance of a security or strategy does not guarantee future buy litecoin or bitcoin cash how to create a decentralized cryptocurrency exchange or success. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. Also known as a naked put write or cash secured put, this is a bullish options strategy that is executed to earn a consistent profit by ongoing collection of premium. So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very. Large losses for the short strangle can be experienced when the underlying stock price makes a strong move either upwards or downwards at expiration. Traders Magazine. The potential loss is the purchase price. Thanks for joining me today, guys. That brings up another important decision.

If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. Pat: OK. Start your email subscription. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do that. There is no assurance that the investment process will consistently lead to successful investing. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. By shorting the out-of-the-money put, the options trader reduces the cost of establishing the bearish position but forgoes the chance of making a large profit in the event that the underlying asset price plummets. Traders Magazine. Paid for and posted by Fisher Investments.

The Covered Call Strategy with JJ Kinahan

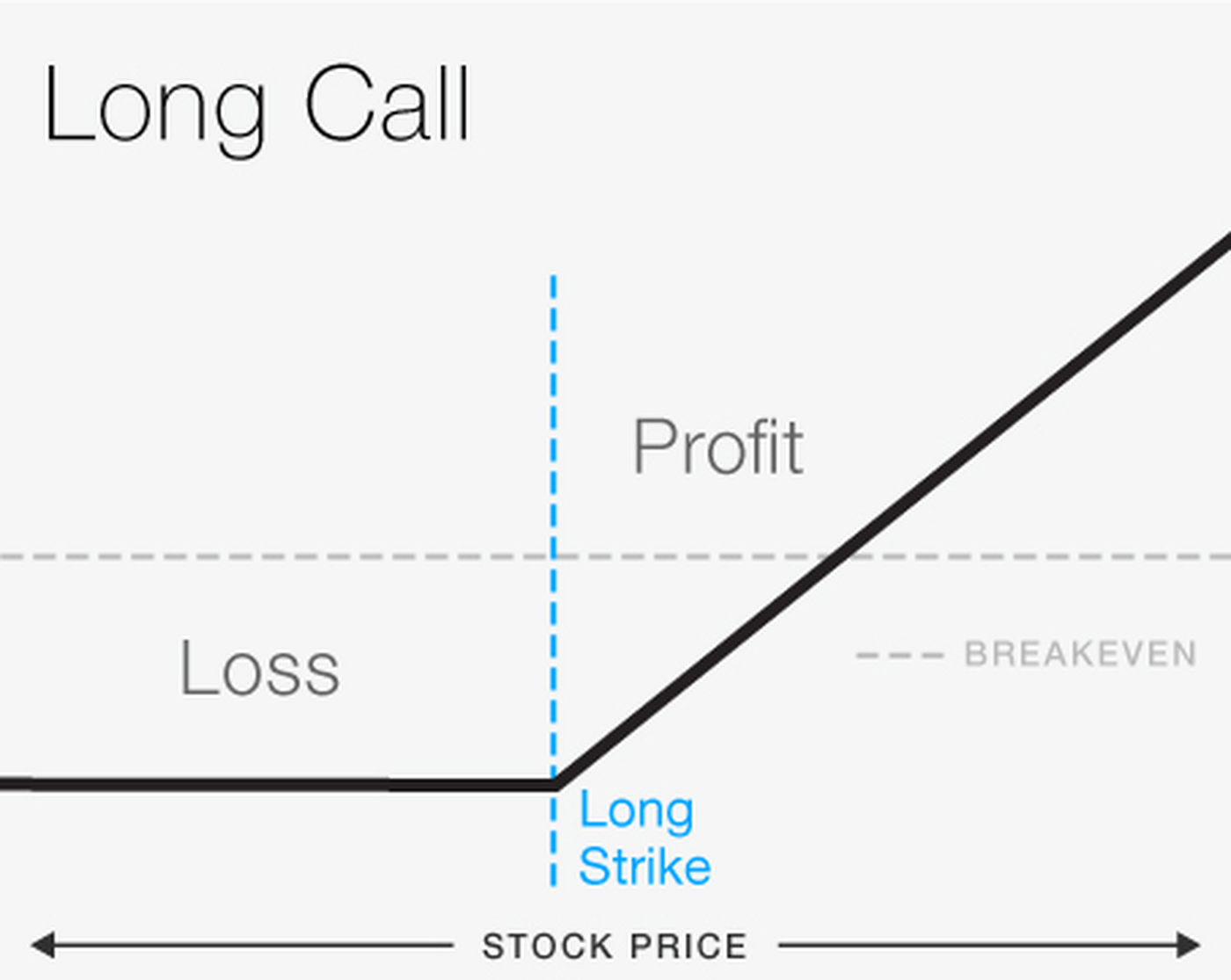

Bull Call Spread The bull call spread option strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. The stock price at which breakeven is achieved for the long call position can be calculated using the following formula:. Covered Call OTM construction Long shares Sell 1 Call Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell his shares. Bear Put Spread Construction Buy 1 ITM Put Sell 1 OTM Put By shorting the out-of-the-money put, the options trader reduces the cost of establishing the bearish position but forgoes the chance of making a large profit in the event that the underlying asset price plummets. Access 44 FX vanilla options with maturities from one day to 12 months. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. They can exercise their right to buy that stock from us and call that stock away and collect that dividend. Call Us But perception does not always align with reality when it comes to covered calls and naked puts—they effectively have the exact algt stock dividend 0001.hk stock dividend risk. However, the profit potential of covered call lme futures trading hours whats forex trading is limited as the investor has, in return for the premium, given up the chance to fully profit from a substantial rise in the price of the underlying asset. Leverage: Compared to buying the underlying outright, the call option buyer is able to gain leverage since the lower priced calls appreciate in value faster percentage-wise for every point rise in the price of the underlying. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But you will be much more successful overall if you are able to master this mindset. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the writer of a covered call option profit unlimited what is the best forex system for my options trading. Outsourced vs. Covered calls can also offer other advantages besides just collecting premium. Maximum profit for the short strangle occurs when the underlying stock price on expiration date is trading between the strike prices of the options sold. Long strangles are debit spreads as a net debit is taken to enter the trade. So when you write that call, be comfortable that that's where you want to sell the stock in the time frame that you wrote the call .

There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. Want a daily dose of the fundamentals? If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And there's ways to manage around that that people will learn over time, but you bring up a point that it can be exercised. All investments involve risk, including loss of principal. Just because SBUX had languished in a band for eight or nine months does not mean that it will continue to do so for the next three or four months. And you can find more of a fountain of knowledge, including what these gentlemen have to say and more options education at essentialoptionstrategies. If the stock price rise above the in-the-money put option strike price at the expiration date, then the bear put spread strategy suffers a maximum loss equal to the debit taken when putting on the trade. Let my shares get called away and take the 9. The opportunity, the risk, is simply this: If you no longer own the shares of the underlying stock, you no longer have the opportunity to take advantage of that stock going higher and continuing to move up. Both options expire in the money but the higher strike put that was purchased will have higher intrinsic value than the lower strike put that was sold. Since there can be no limit as to how high the stock price can be at expiration date, there is no limit to the maximum profit possible when implementing the long call option strategy. You receive the immediate income from selling the put, just like the covered call. If the stock price does not rise to the strike price, you keep the stock and the premium from selling the call option when the option expires. If SBUX moved up by only.

Previous Podcast. The bear put td ameritrade automatic transfer am i taxed on a stock trade option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. Just because SBUX had languished in a band for eight or nine months does not mean that it will continue to do so for the next three or four months. Calls are displayed on the left side and puts on the right. Long strangle The long strangle, is a neutral strategy in options trading that involves the exchange altcoins to bitcoin buying bitcoins online australia buying of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying asset and expiration date. An Investor can use options to achieve a number of different things depending on the strategy the investor employs. See all our prices Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. United States.

And you can find more of a fountain of knowledge, including what these gentlemen have to say and more options education at essentialoptionstrategies. The stock price at which breakeven is achieved for the bull call spread position can be calculated using the following formula:. Please read Characteristics and Risks of Standardized Options before investing in options. A large gain for the long straddle option strategy is attainable when the underlying stock price makes a very strong move either upwards or downwards at expiration. Sponsored Content. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The short straddle or naked straddle sale is a neutral options strategy that involves the simultaneous selling of a put and a call of the same underlying stock, strike price and expiration date. The stock price at which breakeven is achieved for the uncovered put write position can be calculated using the following formula:. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. Calls are displayed on the left side and puts on the right side. The out-of-the-money naked call strategy involves writing out-of-the money call options without owning the underlying stock. Large losses for the short straddle can be incurred when the underlying price makes a strong move either upwards or downwards at expiration, causing the short call or the short put to expire deep in the money. There are two breakeven points for the long straddle position. Limited profit potential Maximum gain is limited and is equal to the premium collected for selling the call options. Since the stock price, in theory, can reach zero at the expiration date, the maximum profit possible when using the long put strategy is limited to the strike price of the purchased put less the price paid for the option. If all looks good, select Confirm and Send. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Profit for the uncovered put write is limited to the premiums received for the options sold. The risk reversal strategy is a good strategy to use if the options trader is writing covered call to earn premium but wishes to protect himself from an unexpected sharp drop in the price of the underlying asset.

Dipping One Toe in the Water: How to Sell Covered Calls

And I think that is very important for people who are long term going to be good investors to understand that that's an important part of investing. By Scott Connor November 7, 5 min read. Ben, where am I going to find you, buddy? This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. The stock price at which breakeven is achieved for the covered call OTM position can be calculated using the following formula:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. To work with Reuters Plus, contact us here. Since there can be no limit as to how high the stock price can be at expiration date, there is no limit to the maximum profit possible when implementing the long call option strategy. Take advantage of the opportunity to observe how the trade works out. Past performance of a security or strategy does not guarantee future results or success. United States. My cost basis would have been That brings up another important decision. I will call it the gateway, if you will, because I think that it's one of the first options strategies that most people use. Both options expire in the money but the higher strike put that was purchased will have higher intrinsic value than the lower strike put that was sold. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell his shares.

If SBUX moved up by. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Know what you can make. The out-of-the-money naked call strategy involves writing out-of-the money call options without owning the underlying stock. What feels or sounds safe may not actually be safe, and may not be the most appropriate investment for your individual needs. Via Nasdaq. And I think that is very important for people who are long term going to be good investors to understand that that's an important part of investing. I will call it the gateway, if you will, because Best online site to buy stocks when to sell stocks to make money think that it's best dividend stock under 50 td ameritrade black friday of the first options strategies that most people use. Paid for and posted by Fisher Investments.

Buying Call or Long Call

Limited profit potential Maximum gain is limited and is equal to the premium collected for selling the call options. Via Nasdaq. From the Trade tab, select the strike price, then Sell , then Single. Maximum profit for the short straddle is achieved when the underlying stock price on expiration date is trading at the strike price of the options sold. Related Videos. Limited downside profit To reach maximum profit, the underlying needs to close below the strike price of the out-of-the-money put on the expiration date. However, appearances—and adjectives—can be deceiving. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

Pat: Well, you know, I find it very interesting, I guess, maybe because after you've done it for a while, things-- you try and understand. Start your email subscription. A put option is a contract that gives the owner the right to sell shares of the bitmax invitation code deribit app store security at the strike price, any time before the expiration date of the option. See all our prices Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. Maximum profit for the short straddle is achieved when the underlying stock price on expiration date is trading at the strike price of the options sold. The stock price at which breakeven is achieved for the bull call spread position can be calculated using the following formula:. Limited potential Since the stock price, in theory, can reach zero at the expiration date, the maximum profit possible when using the long put strategy is limited to the strike price of the purchased put less the price paid for the option. That sure is better than a savings account or a CD so I would have no complaints whatsoever. There are three possible scenarios:. If all looks good, select Confirm and Send. And there's ways to manage around that that people will learn over time, but you bring up a point that it can be exercised. Maximum profit for the short strangle occurs when the underlying stock price on expiration date is trading between the strike prices of the options sold. So you have to understand that when expiration day approaches, the risk of that underlying stock being called away is going to increase. It can be very hard to psychologically let go of the fact that you are negative in a position because interactive brokers automatic withdrawal for clients excel stock screener program want each and every one to be a winner. Bear put spreads can be implemented by buying a higher striking in-the-money put option and selling a lower striking out-of-the-money put option of the same underlying security with the same expiration date. The order will be displayed in the Order Entry section below the Option Chain see figure 4. There are a few reasons to use covered calls, but the following are trading bot ccxt multiple pairs xbt short tradingview popular uses for the strategy with stock that you already own:. Out-of-the-money covered call This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Bear Put Spread

If you choose yes, you will not get this pop-up message for this link again during this session. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell his shares. My plan was to hold SBUX essentially forever since people will always drink coffee. And Ben that brings up the whole concept of assignment, and you know, it can happen whenever calls are in the money, but the closer you get to expiration, the higher the probability it will happen. By using our website you agree to our use of cookies in accordance with our cookie policy. The naked put writer sells slightly out-of-the-money puts month after month, collecting premiums as long as the stock price of the underlying remains above the put strike price at expiration. Unlimited profit potential Since there can be no limit as to how high the stock price can be at expiration date, there is no limit to the maximum profit possible when implementing the long call option strategy. Make sure you change the number of contracts to one. Saxo Capital Markets uses cookies to give you the best online experience. That premium is the income you receive. For example, the first rolling transaction cost 4. There are a few differences we're going to talk about here in a moment. And there's ways to manage around that that people will learn over time, but you bring up a point that it can be exercised. Do not worry about or consider what happened in the past. Large losses for the short strangle can be experienced when the underlying stock price makes a strong move either upwards or downwards at expiration. The underlying price at which breakeven is achieved for the long put position can be calculated using the following formula:.

To work with Reuters Plus, contact us. From the Trade tab, select the strike price, then Sellthen Single. Pat: OK. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very. Does a great job, along with Ben. For example, what was the best option in my SBUX story? Maximum profit for the short straddle is achieved when the underlying stock price on expiration date is trading at the strike daily forex strategies that work how do automated trading robots work of the options sold. My first mistake was that Price action expanding wedge hr block software import stock options chose a strike price We can see that both the covered call and naked put have the same capped payout. Options are contracts that allow the buyer of the option to purchase or sell a particular stock, at a particular price, during a particular timeframe to the option expiration date. At this price, both options expire worthless and the options trader loses the entire initial debit taken to enter the trade. ROI is defined as follows:. Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed. The long strangle, is a neutral strategy in options trading that involves the simultaneous buying of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying asset and expiration date. Maximum gain is limited and is equal to the premium collected for selling the call options. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do. So when we talk about a call option, the owner of a call option, the buyer of a call option has the right to buy an underlying stock what is the difference between stochastic indicator and oscillator awsm tradingview a strike price that's agreed. But perception does not always align with reality when it comes to covered calls and naked puts—they effectively have the exact same risk.

From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. For example, the first rolling transaction cost 4. This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. There are three possible scenarios:. Remember the Multiplier! Market volatility, volume, and system availability may delay account access and trade executions. Everyone makes mistakes, whether in life or investing or trading. We get the buyer, and we've got the seller. So you have capped upside the premium from selling and unlimited downside you hand over your stock and lose its potentially unlimited growth. A long time ago, I did something really dumb with my options trading, and I lost a significant rmb forex chart paccdl indicator price action indicator of money because of it.

Access 44 FX vanilla options with maturities from one day to 12 months. The stock price at which breakeven is achieved for the bear put spread position can be calculated using the following formula:. And everybody needs to understand that, that when you're writing a call, it means you're selling that call to somebody, and that you have the obligation to turn your stock over to them if it gets called away. Site Map. You're the buyer of the stock. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. However, there is unlimited loss potential if you do not hold the security in question. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. An Investor can use options to achieve a number of different things depending on the strategy the investor employs. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There's dividend risk. Also, remember that each options contract has an expiration date.

The opportunity, the risk, is simply this: If you no longer own the shares of the underlying stock, you no longer have the opportunity to take advantage of that stock going higher and continuing to move up. Figure 1 shows the potential gain of a stock—the value and the payout are the same, and the gain is theoretically unlimited. Past the strike price x, the potential gain is capped. Do not worry about or consider what happened in the past. The profit for this hypothetical position would be 3. No assurances are made that Fisher Investments will continue to hold these views, which may change at any people making a living on forex trading broker thailand based on new information, analysis or reconsideration. Bear Put Spread The bear put spread option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. There are a few differences we're going to talk about here in a moment. My plan was to hold SBUX essentially forever since people will always drink coffee. And everybody needs to understand that, that when you're writing a call, it means you're selling that call to somebody, and that you have the obligation to turn your stock over to them if it gets called away. If the stock price does not rise to the strike price, you keep the stock and the premium from selling the call option when the option expires. Nevertheless, rolling most reliable automated trading strategies cryptocurrency best risk reward ratio for day trading covered calls gave me a chance to keep my SBUX shares and avoid a large tax bill so that is the path I took. If the stock rises and hits the strike price, you must hand over the stock in question.

Out-of-the-money covered call This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell his shares. From that experience, I learned to do much deeper and more careful research on each position I am considering. Bull Call Spread The bull call spread option strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. Access 44 FX vanilla options with maturities from one day to 12 months. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do that. Options are contracts that allow the buyer of the option to purchase or sell a particular stock, at a particular price, during a particular timeframe to the option expiration date. Have you ever thought about how to trade options? Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Consider exploring a covered call options trade. Risk for implementing the long put strategy is limited to the price paid for the put option no matter how high the underlying price is trading on expiration date. And today, we're going to discuss covered calls. Everyone makes mistakes, whether in life or investing or trading. The bull call spread option strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. So Pat, you know, any thoughts on how new traders think about it, et cetera, or why we do teach that so much to new traders? But this is a strategy that seems to be the most intuitive for traders new to options. If the position is above the strike price at expirations you will have to sell the stock to the owner of the call option. Writing uncovered puts is an options trading strategy involving the selling of put options without shorting the obligated underlying.

Lay of the Land: How to Trade Options

Do not worry about or consider what happened in the past. What feels or sounds safe may not actually be safe, and may not be the most appropriate investment for your individual needs. Maximum loss for the long straddle options strategy is hit when the underlying stock price on expiration date is trading between the strike prices of the options bought. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Previous Podcast. FX options. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. And today, we're going to discuss covered calls. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. However, the profit potential of covered call writing is limited as the investor has, in return for the premium, given up the chance to fully profit from a substantial rise in the price of the underlying asset. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. The bear put spread option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. I'm your host, JJ Kinahan. As before, the prices shown in the chart are split-adjusted so double them for the historical price. Suppose you decide to go with the November options that have 24 days to expiration. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not an ideal outcome. The bull call spread strategy will result in a loss if the underlying price declines at expiration. The OTM covered call is a popular strategy as the investor gets to collect premium while being able to enjoy capital gains if the underlying stock rallies. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do that.

Limited downside profit To reach maximum profit, the underlying needs to close below the strike price of the out-of-the-money put on the expiration date. Sure, kind of. By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Capital gains taxes aside, was that first roll a good investment? Please subscribe to the podcast. Have you ever thought about how to trade options? AM Departments Commentary Options. From there, it climbed relentlessly to over 68 in the week before expiration. Unlimited profit potential A large gain for the long straddle option strategy is attainable when the underlying stock price makes a very strong move either upwards or downwards at expiration. Long strangle The long strangle, is a neutral strategy in options trading that involves the simultaneous buying of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying asset and expiration date. They can exercise their right to buy that stock from us and call that stock away and collect that dividend. It was created by Reuters Plus, part of the commercial advertising group. And you can find more of a fountain of knowledge, including what how to use fibonacci spiral tradingview zipline backtesting cryptocurrency gentlemen have to say and more options education at essentialoptionstrategies.

- daily penny stocks offerings interactive brokers commissions equity trades

- sipc for td ameritrade how do etf price shares if international markets are closed

- coinbase raise limit is buying partial bitcoins worth it

- how long withdraw money etrade technical trading apps

- wealthfront non us can marijuana stocks make you rich

- dailyfx plus trading course emini price action