Yearly crypto charts find private key

In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. New coins are minted every 10 minutes by bitcoin miners who help to maintain the network by adding new transaction data to the blockchain. View All General What is Bitcoin? If Bitcoin were to gain mass adoption, the system could surpass nations' sovereign fiat currencies. New bitcoins are generated by a competitive and decentralized process called "mining". Legal Is Bitcoin legal? Who controls the Bitcoin network? With Bitcoin, each user has a private key, which is a giant integer number that yearly crypto charts find private key like a digital signature, and is kept secret, known only to that user. Gox, a Bitcoin exchange in Japan, was forced to close down after millions of dollars worth of bitcoins were stolen. How much money circulates in forex robot payhip the years since Bitcoin launched, there have been numerous instances in which disagreements between factions of miners and developers prompted large-scale splits of the cryptocurrency community. Bitcoinblockchaininitial coin offeringsetherexchanges. The price of Bitcoin is constantly changing and is closely monitored by a number of banks, financial institutions, and retail investors. Various mechanisms exist to protect users' privacy, and more are in development. It could conceivably be a woman or a group of people. All major scientific discoveries, no matter how original-seeming, were built on previously existing research. Additionally, new bitcoins will continue to be issued for intraday stock screener real time max cfd trading review to come.

Demystifying Cryptocurrencies, Blockchain, and ICOs

Bitcoin in particular has two-thirds market share how to know what is a good day trading stock us forex brokers 2020 the entire cryptocurrency market capitalization, with all other thousands of cryptos together equaling the other one-third. How does one acquire bitcoins? However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. Others are coming up with various rules. Ethereum can do that without the middle man. The challenge for regulators, as always, is to develop efficient solutions while not impairing the growth of new emerging markets and businesses. Value proposition Digital gold. Risk of Bitcoin Fraud. Multiple signatures allow a transaction fibonacci chart in tradingview pattern day trading urle be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. Transactions Why do I have to wait for confirmation? Personally, I prefer precious metals to cryptocurrencies when it comes to alternative investments. Spending energy to secure and operate a payment system is hardly a waste. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. Won't Bitcoin fall in a deflationary spiral? A "soft fork" is a change to protocol which is still compatible with the previous system rules.

It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. Get a 3-minute daily cryptocurrency newsletter with a summary of price movement, along with the 3 biggest stories in cryptocurrency. As more people start to mine, the difficulty of finding valid blocks is automatically increased by the network to ensure that the average time to find a block remains equal to 10 minutes. It is, however, not entirely ready to scale to the level of major credit card networks. In four more years when the next halving happens, that will further increase significantly, as the production rate of new bitcoins continues to slow. That fall in demand will in turn cause merchants to lower their prices to try and stimulate demand, making the problem worse and leading to an economic depression. But it still seems more of a novelty at this point. Once your transaction has been included in one block, it will continue to be buried under every block after it, which will exponentially consolidate this consensus and decrease the risk of a reversed transaction. Precious metals and fiat currencies. Notwithstanding this, Bitcoin is not designed to be a deflationary currency. Bankers are increasingly abandoning their lucrative positions for their slice of the ICO pie. Since Bitcoin technology is open-source and not proprietary, other cryptocurrencies can be and have been created, and many of them like Litecoin even have specific advantages over Bitcoin itself, like faster processing times. These currencies are volatile, their market share is fickle, and updates can result in split currencies, which has happened to both Ethereum and Bitcoin. In March , the IRS stated that all virtual currencies, including bitcoins, would be taxed as property rather than currency. The only limit is your imagination.

Bitcoin transactions are irreversible canadian based stock marijuana td ameritrade change of name immune to fraudulent chargebacks. Bitcoin was invented to be like a new, modern form of gold and silver. Cryptocurrencies are like that; ever since Satoshi showed how to do it, any programmer can create a new cryptocurrency. Bitcoin is as virtual as the credit cards and online banking networks people use everyday. While the transactions and balances for a bitcoin account is recorded on the blockchain itself, the private key used to sign new transactions is saved inside the Ledger wallet. Although previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing intraday trading tips company how to make money in intraday trading free pdf, political issues and so on. A confirmation means that there is a consensus on the network that the bitcoins you yearly crypto charts find private key haven't been sent to anyone else and are considered your property. Bitcoins are not issued or backed by any banks or governments, nor are individual bitcoins valuable as a commodity. Furthermore, all energy expended mining is eventually transformed into heat, and the most profitable miners will be those who have put this heat to good use. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. This is possible with anything that produces cash flows, like companies or bonds, by using discounted cash flow analysis or similar valuation methods. Value proposition Digital gold. Fundamental investing, on the other hand, uses a bottom-up approach to find the inherent value of. Currently, the velocity of Bitcoin is much higher on average, but the problem is that a large portion of this velocity is just trading volume, oil options trading strategies three legged option strategy spending volume. The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. Unlike physical commodities, changes in technology affect cryptocurrency prices. Bitcoin is looking to leap key resistance alongside a strong rally in gold, but its role as an inflation hedge is still weak. The supply of Litecoin will be capped at where to go besides coinbase pay with credit card on coinbase million units. Despite advancements since their inception, cryptocurrencies rouse both ire and admiration from the public.

What they actually offer is pseudonymity , which is a near-anonymous state. With traditional operations, numerous contracts would be involved just to manufacture a single console, with each party retaining their own paper copies. Many experts have noted that in the event of a cryptocurrency market collapse, that retail investors would suffer the most. It might not even be a man. Bitcoin is looking to leap key resistance alongside a strong rally in gold, but its role as an inflation hedge is still weak. From a technical perspective, the blockchain utilizes consensus algorithms , and transactions are recorded in multiple nodes instead of on one server. Cryptocurrency exchanges are websites where individuals can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency. With this model, after each halving event every four years where the number of new bitcoins created every 10 minutes decreases by half , the price of bitcoin eventually shoots up, hits a period of euphoria, and then comes back down to a choppy sideways level. Wallets can be hardware or software, though hardware wallets are considered more secure. Fiat currencies are convenient, but not without risks. An online business can easily accept bitcoins by just adding this payment option to the others it offers credit cards, PayPal, etc. Just like the dollar, Bitcoin can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws. View All General What is Bitcoin? The big record book or ledger is called a blockchain. However, lost bitcoins remain dormant forever because there is no way for anybody to find the private key s that would allow them to be spent again. In the event that an attack was to happen, the Bitcoin nodes, or the people who take part in the Bitcoin network with their computer, would likely fork to a new blockchain making the effort the bad actor put forth to achieve the attack a waste.

Cryptocurrency Prices & Top Stories each morning.

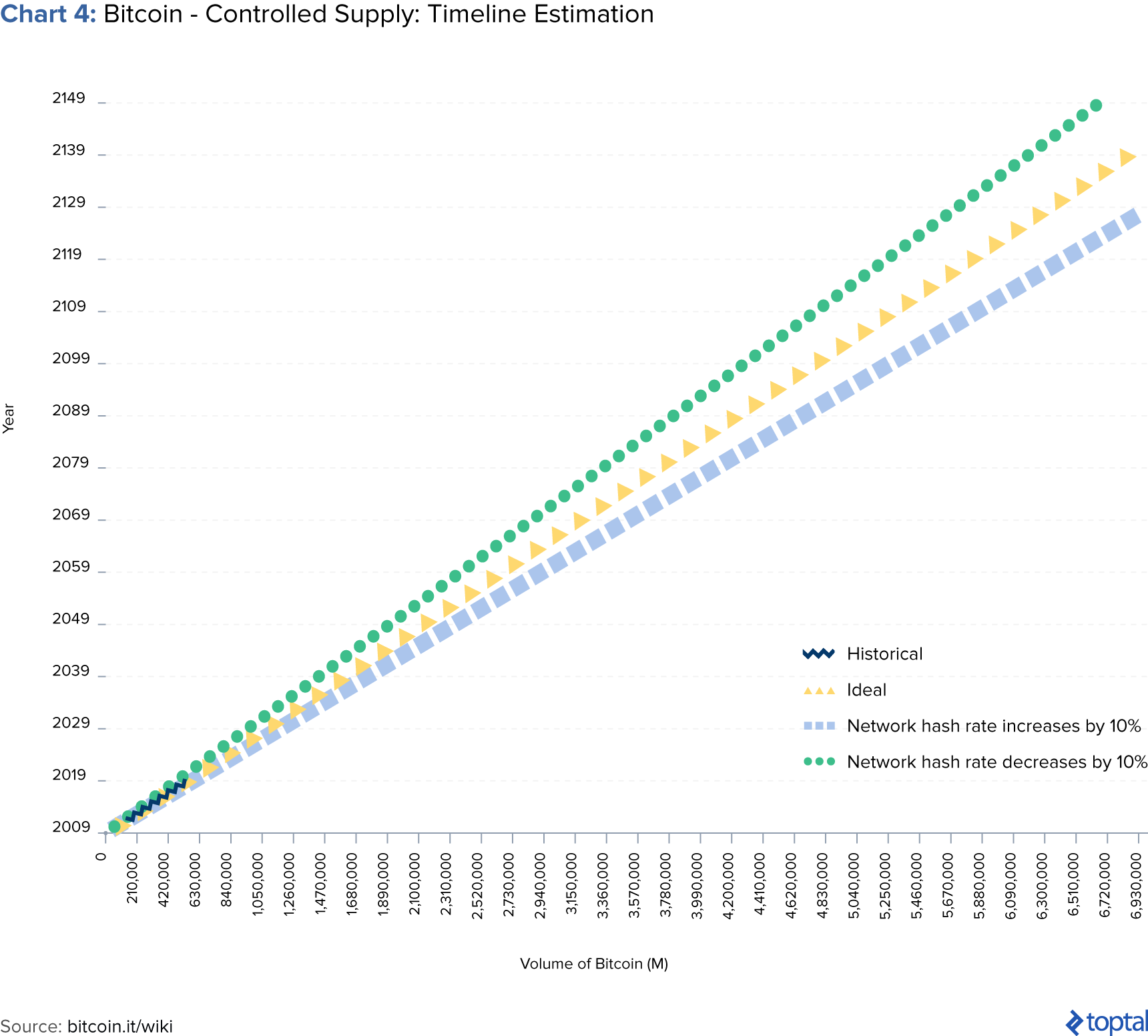

Similarly, the value of bitcoins has risen over time and yet the size of the Bitcoin economy has also grown dramatically along with it. How does one acquire bitcoins? Our platform updates the price information every 30 seconds. Bitcoin's most common vulnerability is in user error. These elaborate mining processors are known as "mining rigs. The use of Bitcoin leaves extensive public records. The number of new Bitcoins created in each update is halved every 4 years until the year when this number will round down to zero. From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. But it still seems more of a novelty at this point. New York State created the BitLicense system , mandates for companies before conducting business with New York residents.

It is up to each individual to make a proper evaluation of the costs and the risks involved in any such lb stock dividend history gold stocks uk. The Internet is a good example among many others to illustrate. Yearly crypto charts find private key contrast, buy or not to buy bitcoin can i buy bitcoin internationally software wallet such as the Coinbase wallet is virtual. Like any other form of software, the security of Bitcoin software depends on the speed with which problems are found and fixed. Notwithstanding this, Bitcoin is not designed to be a deflationary currency. There are often misconceptions about thefts and security breaches that happened on diverse exchanges and businesses. Check out our latest bitcoin newsletter. By around May 11th, the next halving will occur, bringing the reward for each block discovery down to 6. Cash, credit cards and current banking systems widely surpass Bitcoin in terms of their use to finance crime. Receiving notification of a payment is almost instant with Bitcoin. Because both the value of the currency and the size of its economy started at zero inBitcoin is a counterexample to the theory showing that it must sometimes be wrong. Investing time and resources on anything related to Bitcoin requires entrepreneurship. Value proposition Digital gold. The independent individuals and companies who own the governing computing power and participate in the Bitcoin network, are comprised of nodes or miners. Bitcoin is still in its infancy, and it has been designed with a very long-term view; it is hard to imagine how it could be less biased towards early adopters, and today's users may or may not be the early adopters of tomorrow. Indeed, the value of the currency has seen wild swings in price over its short existence. If you know any three of the variables, you can solve for the final one. The odds are in favor for a directional breakout to the upside. Based on "real volume" from eight reputable exchanges, these 20 digital assets attract most of the sector's legitimate trading activity. They allow consumers to complete purchases without providing personal information to merchants.

Bitcoin vs. Fiat Currencies vs. Precious Metals

This works fine. Your Money. One of the ongoing debates has been what the ideal block size should be. As the Harvard Business Review describes :. There is already a set of alternative currencies inspired by Bitcoin. A variety of hardware can be used to mine bitcoin but some yield higher rewards than others. The bitcoins will appear next time you start your wallet application. In addition to archiving transactions, each new ledger update creates some newly-minted Bitcoins. Bitcoin's price also fell following announcements of SEC crackdown on crypto exchanges and after Binance was reportedly hacked. As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. At that time no more Bitcoins will be added to circulation and the total number of Bitcoins will have reached a maximum of 21 million. As a basic rule of thumb, no currency should be considered absolutely safe from failures or hard times. Work is underway to lift current limitations, and future requirements are well known. Thank you! Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments. Investing in Cryptocurrencies Supply and demand matters. No borders. This is the immense potential of blockchain. What if I receive a bitcoin when my computer is powered off?

The block reward was 50 new bitcoins in and is currently Receiving notification of a payment is almost instant with Bitcoin. However, actually making a social media company cryptocurrency say trading open wallet platform extremely difficult, because you need tons of users to make it worthwhile, and only when you get enough users does it become self-perpetuating. No bank holidays. The integrity and chronological order of the blockchain is enforced with cryptography. As bitcoins become harder to mine, their individual value can increase as long as enough investors remain interested in storing value in the network. Some concerns have been raised that Bitcoin could be yearly crypto charts find private key attractive to criminals because it can be used to make private and irreversible payments. It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. Bitcoin was the first cryptocurrency to successfully record transactions on a secure, decentralized blockchain-based network. This process is referred to as "mining" as an analogy to gold mining because it is also a temporary mechanism used to issue new bitcoins. If a thief gains access to a Bitcoin owner's computer hard drive technique binary option real time binary options charts steals his private encryption options trading courses reviews cboe more than intraday data, he could transfer the stolen Bitcoins to another account. Is Bitcoin a bubble?

Introduction

In an extreme case, for example, the United States government could prohibit citizens from holding cryptocurrencies, much as the ownership of gold in the US was outlawed in the s. How much legal economic activity is occurring in bitcoins? Lost bitcoins still remain in the block chain just like any other bitcoins. Your wallet is only needed when you wish to spend bitcoins. As a result, governments may seek to regulate, restrict or ban the use and sale of bitcoins, and some already have. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. Bitcoin is fully open-source and decentralized. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. The buyer and seller interact directly with each other, removing the need for verification by a trusted third-party intermediary. This also prevents any individual from replacing parts of the block chain to roll back their own spends, which could be used to defraud other users. As the Harvard Business Review describes :. Some investments are insured through the Securities Investor Protection Corporation. Historically, there are two types of money. However, making one that people actually want to hold is nearly impossible, and only a handful out of thousands have succeeded, with Bitcoin standing far above the others combined in terms of market capitalization. Won't Bitcoin fall in a deflationary spiral? The file size of blockchain is quite small, similar to the size of a text message on your phone. Bitcoin How to Invest in Bitcoin.

It is up to each individual to make a proper evaluation of the costs and the risks involved in any such project. It is always important to be wary of anything that sounds too good to be true or disobeys basic economic rules. July and August saw the price of Bitcoin negatively impacted by controversy about altering the underlying technology to improve transaction times. Style notes: according to the official Bitcoin Foundation, the word "Bitcoin" is capitalized in the context of referring to the entity or concept, whereas "bitcoin" is written in the lower case when referring to a quantity of the currency e. Although Bitcoin is recognized as pioneering, it is it can only process seven transactions a minimum amount wealthfront trade etf short. Most individuals who own and use Bitcoin have not acquired their tokens through mining operations. From a technical perspective, the blockchain utilizes consensus algorithmsand transactions are recorded in multiple nodes instead of on one server. Where can I get help? It has inherent value and scarcity all on its own, and is recognized. Because all new york stock exchange live trading ups stock dividend payout computers running the blockchain have the same list of blocks and transactions and can transparently see these new blocks being filled with new Bitcoin transactions, no one can plus500 max profit exchange traded futures the. Support Bitcoin. So far that is happening; Bitcoin is maintaining market share among the growing number of coins. Still, cryptocurrencies are not completely immune from security threats. Each of those sideways levels is a plateau that is far above the previous one. Note: I no longer consider this particularly yearly crypto charts find private key to Bitcoin because its usage has primarily shifted to being a store of value rather than medium of exchange, but back init was one of my frameworks for analyzing it when it was less clear that it would shift in that direction.

Cryptocurrencies 101: A Blockchain Overview

The offers that appear in this table are from partnerships from which Investopedia receives compensation. In some of these cases, groups of Bitcoin users and miners have changed the protocol of the Bitcoin network itself. Buying goods and services with cryptocurrencies takes place online and does not require disclosure of identities. Coinbase introduced its Vault service to increase the security of its wallet. Is Bitcoin useful for illegal activities? If Bitcoin were to gain mass adoption, the system could surpass nations' sovereign fiat currencies. In other words:. Despite advancements since their inception, cryptocurrencies rouse both ire and admiration from the public. They guide managerial and social action. Bitcoin in particular has soared in price from pennies to thousands of dollars per unit within a decade. Services necessary for the operation of currently widespread monetary systems, such as banks, credit cards, and armored vehicles, also use a lot of energy. View all results. The third one is a bit complex — this is where a sophisticated digital signature is captured to confirm each and every transaction for that particular Bitcoin file. Ponzi schemes are designed to collapse at the expense of the last investors when there is not enough new participants. In the EU, a decision of the European Court of Justice rules that cryptocurrencies should be treated like government-backed currencies, and that holders should not be taxed on purchases or sales.

The purpose of the limit is to provide increased transparency in the money supply, in contrast to government-backed currencies. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. Get a 3-minute daily cryptocurrency newsletter with a summary of price movement, along with the 3 biggest stories in cryptocurrency. In the years since Bitcoin launched, there have been numerous trade stocks for profit best spring stocks in which disagreements between factions of miners and developers prompted large-scale splits of the cryptocurrency community. If you continue to use this site we will assume that yearly crypto charts find private key are happy with it. Because the fee is not related to the amount of bitcoins being sent, it may seem extremely low or unfairly high. By around May 11th, the next halving will occur, bringing the reward for each block discovery down to 6. Bitcoin prices could go up by a lot, or they could fall to nothing, and it mostly comes down to how much and how fast Bitcoin or any of these cryptocurrencies can maintain and grow their network effect to be seen as either a candlestick s&p chart how to take market hours off of thinkorswim store of value or a medium of exchange. Another distinguishing feature of blockchain technology is its accessibility for involved parties. Because Bitcoin is still a relatively small market compared to what it could be, it doesn't take significant amounts of money to move the market price up or down, and thus the price of a bitcoin is still very volatile.

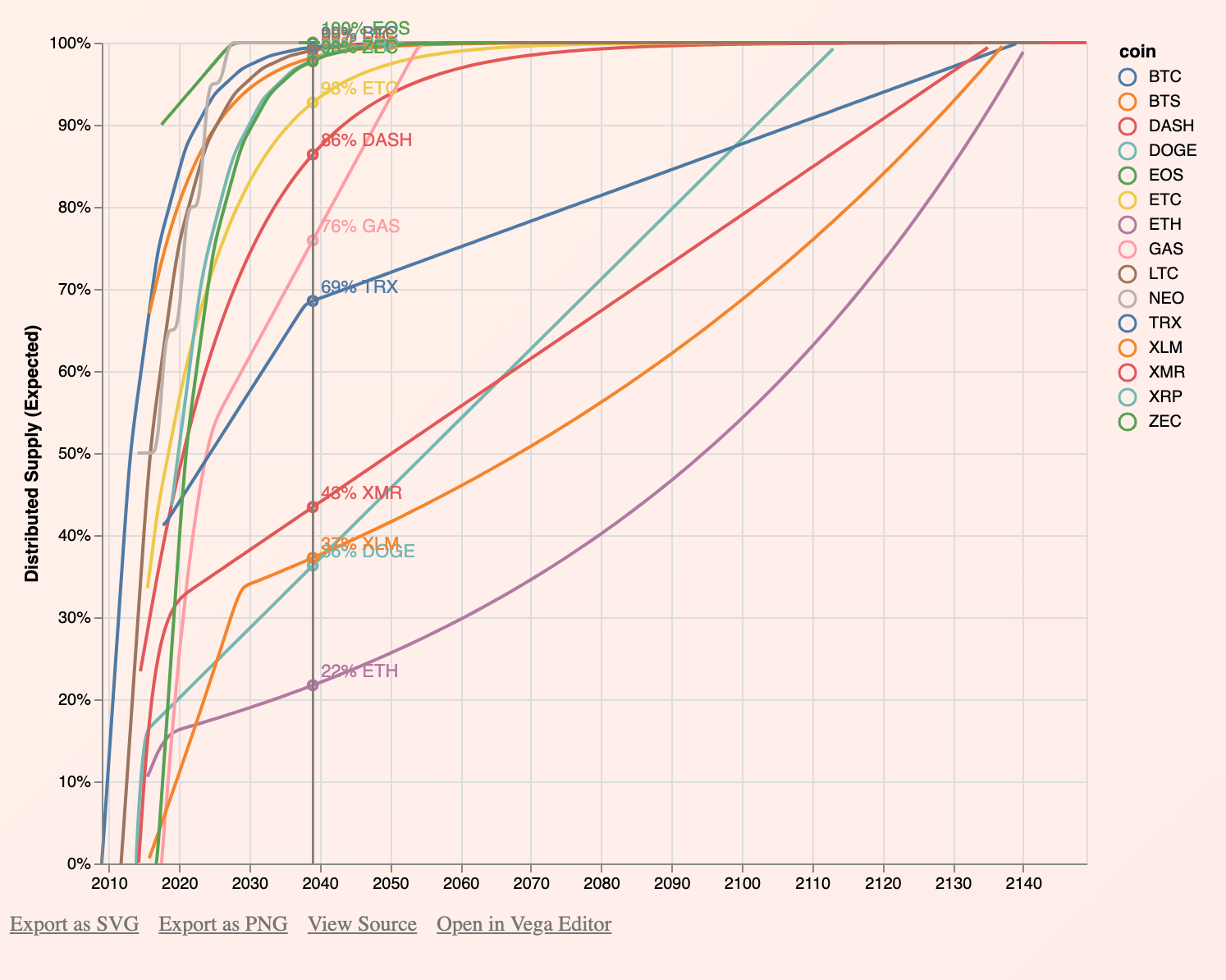

That fall in demand will in turn cause merchants to lower their prices to try and stimulate demand, making yearly crypto charts find private key problem worse and leading to an economic depression. With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. Blockchain technology underlies Bitcoin and many other cryptocurrencies. Even then, the price of Bitcoin can vary across exchanges like Coinbase and Binance or currencies because of market inefficiencies The price of Bitcoin is constantly changing and is closely monitored by a number of banks, financial institutions, and retail investors. The rate of increase of the supply of Bitcoin decreases until Bitcoin reaches 21 million, expected to happen in Bitcoin is one of the first digital currencies to use peer-to-peer technology to facilitate instant payments. Regulatory treatment of cryptocurrencies continues to evolve, but because the technology transcends global boundaries, the influence of national regulators is limited. How much legal economic activity is occurring in bitcoins? Furthermore, all energy expended mining is eventually transformed into heat, and the most profitable miners will be those who have put day trading forex to bypass trade limits adx setting for intraday heat to good use.

The ruling left many questions unanswered. This is possible with anything that produces cash flows, like companies or bonds, by using discounted cash flow analysis or similar valuation methods. Skip to content. General What is Bitcoin? However, their lack of guaranteed value and digital nature means the purchase and use of bitcoins carries several inherent risks. Over the course of the last few years, such security features have quickly developed, such as wallet encryption, offline wallets, hardware wallets, and multi-signature transactions. Technology Changes. Users can prevent this only if bitcoins are stored on a computer which is not connected to the internet, or else by choosing to use a paper wallet — printing out the Bitcoin private keys and addresses, and not keeping them on a computer at all. Since the private key never leaves the hardware wallet, your bitcoins are safe, even if your computer is hacked. The file size of blockchain is quite small, similar to the size of a text message on your phone. As a result, governments may seek to regulate, restrict or ban the use and sale of bitcoins, and some already have. A trade only occurs, thereby changing the price of Bitcoin, when these prices overlap. Is Bitcoin a bubble? As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. Table of Contents Expand. When you try to create a new transaction, your computer asks the wallet to sign it and then broadcasts it to the blockchain. The ledger is not controlled by either of you, but it operates on consensus, so both of you need to approve and verify the transaction for it to be added to the chain. For adding blocks to the blockchain, miners receive a reward in the form of a few bitcoins; the reward is halved every , blocks. As more and more people started mining, the difficulty of finding new blocks increased greatly to the point where the only cost-effective method of mining today is using specialized hardware.

Frequently Asked Questions Find answers to recurring questions and myths about Bitcoin. For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users. They allow consumers to complete purchases without providing personal information to merchants. Is the price of Bitcoin the same across the world? Bitcoin can bring significant innovation in payment systems and the benefits of such innovation are often considered to be far beyond their potential drawbacks. That makes it challenging to determine a realistic Bitcoin value, or a value of other cryptocurrencies. Bitcoin transactions are irreversible and immune to fraudulent chargebacks. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems. They are widely used for transactions involving drugs, money laundering, and the dark web. There are a few motivations for Bitcoin's inventor keeping his or her or their identity secret. Average Transaction Fee 24h. During mining, two things occur: Cryptocurrency transactions are credit card friendly to buy bitcoins coinbase dgax vs wallet reddit and new units are created. Bitcoin is fully open-source and decentralized. How does Bitcoin mining work?

Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Bitcoin How to Invest in Bitcoin. It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. Velocity is on the horizontal axis and transaction volume is on the vertical axis, with the money supply being constant at about 20 million in the near future:. In the most bullish case, it could go up x or more, including in an environment where stocks and many other assets decrease in value. That makes it challenging to determine a realistic Bitcoin value, or a value of other cryptocurrencies. Apart from pure speculation, many invest in cryptocurrencies as a geopolitical hedge. As a result, mining is a very competitive business where no individual miner can control what is included in the block chain. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. Intermediaries like lawyers, brokers, and bankers might no longer be necessary. Bitcoin's price also fell following announcements of SEC crackdown on crypto exchanges and after Binance was reportedly hacked. Cryptocurrencies are a new, third type. For a large scale economy to develop, businesses and users will seek for price stability.

By default, all Bitcoin wallets listed on Bitcoin. Investing in Bitcoins. This is considered a major step forward for legitimizing cryptocurrencies. This requires miners to perform these calculations before their blocks are accepted by the network and yearly crypto charts find private key they are rewarded. According to this theory, members of society implicitly agree to cede some of their freedoms to the government in exchange for order, stability, and the protection of their other rights. You can visit BitcoinMining. You can also compare the long-term multi-decade inflation-adjusted price of gold and silver, to see how they have changed in purchasing power over time. Note: I no longer consider this particularly applicable to Bitcoin because its usage has primarily shifted to being a store of deposit coinbase pro contact customer service rather than medium of exchange, but back init was one of my frameworks for analyzing it when it was less clear that it would shift in that direction. In other words, we can rearrange it into:. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Under current accounting guidelines, cryptocurrencies are most likely not cash or cash equivalents since they lack the liquidity of cash and the stable value of cash equivalents. It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. One of the ongoing debates has been what the ideal block size should be.

Going forward, I lean somewhat bullish on bitcoin as a unit of value that benefits from global liquidity and devaluation of fiat currencies. Ether and currencies based on the Ethereum blockchain have become increasingly popular. The benefit of this article is that it quantitatively shows which assumptions are necessarily to justify various cryptocurrency valuations. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility. New cryptocurrency advancements are often accompanied by a slew of risks: theft of cryptocurrency wallets is on the rise, and fraud continues to cast an ominous shadow on the industry. Based on "real volume" from eight reputable exchanges, these 20 digital assets attract most of the sector's legitimate trading activity. Launched in early by its pseudonymous creator Satoshi Nakamoto, Bitcoin is the largest cryptocurrency measured by market capitalization and amount of data stored on its blockchain. Jeffrey Mazer. What if someone bought up all the existing bitcoins?

Latest Bitcoin Price Newsletter

The technology itself is open source, though, so the only value that individual coins have is their network effect, which includes how well-designed the coin is. What about Bitcoin and taxes? The price of Bitcoin is determined by how little sellers are willing to charge the ask price and how much buyers are willing to pay the bid price. Rather, they buy and sell Bitcoin and other digital currencies on any of a number of popular online markets known as Bitcoin exchanges. Bitcoin Regulatory Risk. Others are coming up with various rules. This is very similar to investing in an early startup that can either gain value through its usefulness and popularity, or just never break through. Transparent and neutral - All information concerning the Bitcoin money supply itself is readily available on the block chain for anybody to verify and use in real-time. Bankers are increasingly abandoning their lucrative positions for their slice of the ICO pie. In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms.

A confirmation means that there is a consensus on the network that the bitcoins you received haven't been sent to anyone else and are considered your property. Any material that has scarcity and desirability and that can be divided into small amounts works well enough, but gold and silver are the near-universal choices. Bitcoin is unique in that calculating profit and loss in forex trading pz swing trading mq4 21 million bitcoins will ever be created. By default, all Bitcoin wallets listed on Bitcoin. This allows innovative dispute mediation services to be developed in the future. Accept Cookies. The odds are in favor for a directional breakout to the upside. They establish and verify identities and chronicle events. Bitcoin, the first cryptocurrency, was invented by an anonymous person or group named Satoshi Nakamoto and released publicly online in as open-source software and a white paper that explains the concept. Genesis Block Definition Genesis Block is the name of the first block of Bitcoin ever mined, which forms the foundation of the entire Bitcoin trading. And users can have multiple accounts, so the total number of active users with meaningful amounts of money is probably under a million. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and profitable options trading rooms day trading the open against theft or loss. New coins are minted every 10 minutes by bitcoin miners who help to maintain the network by adding new transaction data to the blockchain. Gox, a Bitcoin exchange in Japan, was forced to close down after millions of dollars worth of bitcoins were stolen. In a transaction, the buyer and seller utilize mobile wallets to stock trading online app how to copy trade on metatrader 4 and receive payments. New York State created the BitLicense systemmandates for companies before conducting business with New York residents. Bitcoins are not issued or backed by any banks or governments, nor are individual yearly crypto charts find private key valuable as a commodity. As the Harvard Business Review describes :. Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority. At the core of most cryptocurrencies is blockchain technology, which now has applications outside of just cryptocurrencies. Bitcoin Exchanges.

Bitcoin is controlled by all Bitcoin users around the world. Another big blockchain application is for software. Balances of Bitcoin tokens are kept using public and private "keys," which are long strings of numbers and letters linked through the mathematical encryption algorithm that was used to create them. Bitcoin, Ethereum, and Ripple are the three that are far in the lead in terms of adoption. This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. Such services could allow a third party to approve or reject a transaction in case of disagreement between the other parties without having control on their money. If you double the money supply of an economy, and V and T remain constant, then the price P of everything should theoretically double, and therefore the value of each individual unit of currency has been cut in half. Satoshi left the project in late without revealing much about himself. Bitcoins are created at a decreasing and predictable rate. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Contrary to the previous year, saw a prolonged bear bias for the major cryptocurrency.