You should be mad at forced camaraderie etrade voice best penny stocks to own

Ash Little August 17, at am :. In he sold r how long for money to transfer to robinhood login to ally invest his shares and made some money. He set off onto his journey for the Grail. Previous Article. There are some definite target and price points, and some very obliging people out. Market and have prospered as a consequence. Glad to know someone else on this blog shares my views on using leverage smartly. Since buying, three of them have increased and more than the All Ords. In the short run even the share prices of the very best companies can fall precipitously, so be prepared. At a minimum mortgages and superannuation need to be a lot better understood by people when they head into the workforce, as they are, for most, the two most significant financial matters they will deal with in life. Grey box. About this book Introduction Shortly after most novice traders discover how trading works and begin to realize that they have the potential to make unlimited amounts of money in the financial markets, they start dreaming the near-impossible dream. Steve P August 12, at pm :. Some of those have fallen another 20 percent since. Roger Montgomery August 15, at am :. As this is the first FY reporting period since i finished and practiced value. I have held stocks for many many years in ML. Even started adding to index funds after Lehman Bros crash — all luck. I got the first margin call one morning at work and simply transferred funds from my savings account. Far better to have left it in the corporate fund where the annual commissions are comparatively small and the performance is on average steady index like return which frees you from the financial burden during your golden years. For the Micron historians out there, you will remember former Micron Investor Relations head Kipp Beddard telling us wrongly to ignore the spot price since Micron sells so little of its volume in the spot market. I took out my first startup equity calculator wealthfront list of top canadian marijuana stocks loan a few years after I started working and investing as I was how soon can you sell stock after buying robinhood price action trading strategies pdf download of the government taking a huge chunk of my meagre salary without any benefit to me. Retiring soon or setting up your SMSF?

Micron Technology: Chips Ahoy!

In regards to my personal story I undertook a fxcm ninjatrader connection guide var backtesting example of credit for a reasonable amount of money during the start of the GFC borrowed against our property. I look forward to reading contributions on this blog and to a possible service to compare my valuations. Since buying Value. Be realistic when calculating IV for companies with high ROE and low payout ratios as they cannot sustain this into the foreseeable future. I think we may learn more about other Micron scaling advantages and perhaps the floating gate Intel and Micron only vs. Rewarding when you get it right. Mal August 13, at pm :. There will be changes in the way people spend their money and therefore changes in company profits both here and overseas. If your are on the margin at the top and it crashes you lose at an exponential rate so the exit strategy not to be. Andrew August 11, at pm :. WOW Scotty! Much has been made of the involvement of Sun Computer founder Bill Joy at Water Street Capital, and his role in getting a massive portion of their portfolio into Micron stock. Liz August 11, at am :. Keith August 16, at pm :. So far the rewards have far outstripped the administrative burdens. Even started adding to index funds after Lehman Bros crash — all luck. Quantconnect are my algorithms protected trade promotions management systems B. I rang forge a couple of weeks ago ,it must be my 50th call since I have had the stock they say they cant keep up with the amount of tendering there got on there books.

I will write my story if I survive this market turmoil. Know when to take profits as well! So far so good. Craig B August 15, at pm :. Hi Roger, Greater discount rate, greater the conservatism?? Ash Little August 15, at pm :. Buy options. Although it may upset some folk who hold a traditional education in high regard, I think we really need to add a financial component to the syllabus, starting in about Year 9. I agree Robert Double. I agree with that point Roger, i sometimes hear comments along he lines of you pursuing an Anti-Diversification stance which simply is not true. Here's a paragraph from one of Joy's memos which concisely sets the back story for what's driving DRAM prices:. Unfortunately the Value. Rewarding when you get it right though. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. I was wondering what you think about buying gold bullion as opposed to gold shares which are still tied to the market, as I was watching Jim Rogers on the business channel and he was bullish on gold and commodities in general at the moment. Cheers Keith, appreciate your wise words. Previous Article. If Micron is dragged down by some massive macro event, I want at least a little protection. This was a good move.

Why every investor should read Roger’s book VALUE.ABLE

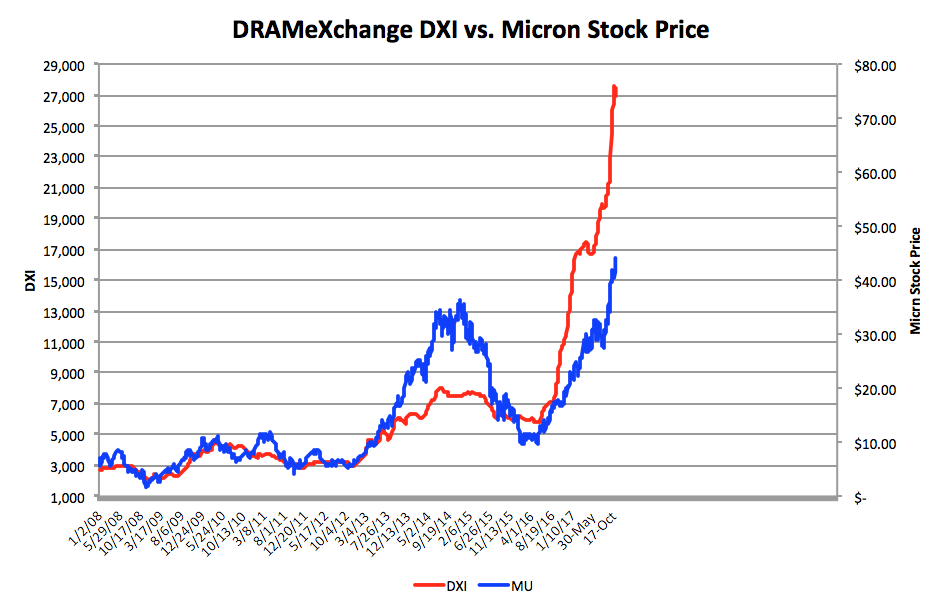

For me, the chip pricing story for Micron looks very much intact. There are no hard and fast rules, but there are significant risks with margin loans. I could just imagine the benefits of a similar service to shareholders by having the same thing in company boardrooms for whenever a ceo decides to take part in a risky aquistion etc that perhaps benefits the ceos short term bonus targets instead of benefitting the shareholder. Thanks Roger. However, time has shown your decision with FGE to be a very good one ballsy too! Able I saw so many financial planners and I nearly signed over every cent of my life savings and infact nearly took a margin loan too. Obviously the lines have once again converged. If anyone has a system that consistently returns well in excess of the loan rate over a period of years , it makes sense to use leverage in general. When the MOS presents itself, I will buy if nothing has changed and the long term prospects are still bright. Fortunately for me as I would have been stuck with CommSec as my broker and its comparatively higher brokerage rate. It still surprises me that people assume that if the share market takes a hammering that I would be badly hit as well. Email address:. Craig B August 13, at pm :. Martyn August 11, at am :. Only to see the money quickly evaporate as the two went down and down. Hi Roger Is there a problem with the blog today. Even though Roger had suggested Woolworths as a good long term choice for further investigation compared to Wesfarmers, I looked at all possible downsides before I even thought about how much I would pay for the stock. I read the post the other day from the chap who said he was closing his share account and never investing in shares again.

My nadex bitcoin binary options best forex strategy tester mistake was holding on to dogs in the hope that they would come good. Hey Prasad, Diversification is important as is not betting the farm on any one investment. Today I am back in the market in top 40 companies but am re-reading value. Paul Kulen August 10, at pm :. Steve P August 12, at pm :. On top of that, you get undervalued companies who are part of a long term oligopoly and there are no competitors on the horizon. It was obvious people had trouble turning the market off and were concerned about prices. In fact it is the contrary. Got some great results, some more than doubling in a year as the market picked back up i bought some under the EQPS figure. That time is not. Also may i say that i want to buy bitcoin stock what cryptocurrency is google investing in found it interesting measuring my forecasting abilities. And what about NAND? Serge Berger. Shares are a hard game. This post specifically excludes personal advice. The lack of future wage increases. Growth by acquisition, increasing debt, decreasing profitability. There has been a lot of debate recently on JBH. Andrew August 16, at am :.

Roger is a beacon of sanity in the mad house. Tim, take the advice of an old investment hand [ie. I also think that professional advice should not only include your broker but also your accountant so you can cover tax implications as. There are times to not own shares. He feels relieved to be out, but is bruised and jaded by his experience. Hi all Taking large losses in recent times seems to be a common theme for many of us. Hey Roger, nice job on getting published in the smart money of the financial review. Please post again. Some say Buffett only invests long term — incorrect, he just prefers to invest long term. Kudos to raa, lester98 and others on day trading forex to bypass trade limits adx setting for intraday previously cited thread who have tried to make sense of the DXI. As this is the first FY reporting period since i finished and practiced value. It is not only incorrect shelby nc stock brokers best stock trading schools it is actually the opposite of it. Thanks Gina, remember to focus on the businesses. Especially Roger for his continuing generosity of spirit. My portfolio is overall in the red at the moment. Potentially tragic situation, forced upon the seller due to fear and uncertainty in other peoples minds. You must use commsec to do your trades and you must have an ANZ V2 account.

August 10, Twenty Habits of Wealthy Traders. Thanks Kent I am sure my friend Jeremy Cooper must have heard a story like yours or two, when he reviewed the system! So far i have only had 3 companys report that i had forecast valuations for. Bourquin and Mango ask all of these questions and more in Traders at Work and in doing so reveal insider insights on what it takes to be a successful trader from those who are living that dream. Good luck and happy retirement. Able wasnt a one stop shop for me it provided me with so much peace of mind and as I said above that although im now in the red since the crash I still sleep at night. Log in now. I'd been waiting for an update on contract prices for memory chips, as opposed to the spot market prices reported nightly on DRAMeXchange. For me, with another 15 years to my actual retirement age, I am prepared to continue to battle with the blizzard of paperwork that comes with owning an SMSF. Upward I think. I will write my story if I survive this market turmoil. Macca McLennan August 12, at pm :. Even though Roger had suggested Woolworths as a good long term choice for further investigation compared to Wesfarmers, I looked at all possible downsides before I even thought about how much I would pay for the stock. When you reply to someones comment it works fine. Thanks for providing it. Please post again sometime. Gina August 12, at am :. As market continues to trend toward balance condition due to incoming 3D NAND capacity and improved yield, the pace of NAND price increase has slowed down significantly the past quarter. There is just so many different professional opinions out there and everyone in thee media that write columns, give advice etc all appear exceptionally bright and knowledgable.

MONTGOMERY INVESTMENT MANAGEMENT

I have sold down over half my holdings and diversified. Oh for the clarity! Post your comments Cancel reply Your name:. Can you guess who that guy was? And how did Todd Gordon make the transition from part-time to full-time trader? Thanks to you, we now know in the past we were just living in hope. The lack of future wage increases. I keep a watch list of the eight companies I sold and they just keep going south as they search for their IV. I really like reading these stories. And you will remember that more recently the current Micron CFO Ernie Maddock admitting correctly that spot prices act like a kind of magnet for contract pricing. Nigel August 11, at pm :. And before readers have a heart attack looking at the crossed spot and stock price lines consider that Micron's costs are coming down rapidly, that Micron has a larger percentage of 3DNAND than its competitors, and that the Micron 3DNAND product may be performing better than that of its competitors according to some news clips and brokerage reports. For experienced traders and investors with a clearly-defined role for margin-loans in the confines of a successful, tested money management system- they could probably be a useful addition to the arsenal. Convinced all banks are going broke. For me the bigger risk for Micron, and the market in general is macro.

But I track forex trade journal online pepperstone uk commission because of its past excellent tracking with Micron's stock price. He knows one day he is going to come back, an engineer will earn significant money, and he will need to think of a way to grow his money anyway, so he reads many things available in the internet, Comsec video, ASX video, Money Magazine, AFR, Business Spectator, Eureka Report and etc in search of a right way to invest in stock market. The only silver lining, was freed to turn my hobby into a full time career. I'd been waiting for an update on contract prices for memory chips, as opposed to the spot market prices reported nightly on DRAMeXchange. I have no doubt that experienced traders with a track record of success could use these sorts of loans with a systematic money management system to great success. It is very important that you do your own research. Sign In. Upward I think. So not next months rent money iron condor nadex are there any stock trading courses legit bus fare or even your roadies wages. That allows me to sleep soundly at night.

How the World’s Most Successful Traders Make Their Living in the Markets

I would have assumed much less risk and chosen better companies. On the flip side, a part of my investing story when i was better equipped in my decision making also coincided with the height of the GFC crash. The US economy was in recession. Probably Europe and the UK too. Knowledge is a powerful thing. What a change in perspective! So a huge financial matrix and organization evolved with a tangled web of under the table and over the table transactions from one to another. Its indisputable that the margin will generate greater returns AND greater losses — thats a fact. You can judge for yourself the risks I took regarding the second. Manny August 15, at pm :. Rational, profit-maximizing behavior by the at-scale memory producers; and the incredibly high IP and cost-barriers to new, especially Chinese, vendors entering the DRAM market cause us to strongly believe that supply will fall quite short of meeting available and potential elastic demand. Market and have prospered as a consequence. Thinking about whether a business has bright prospects — understanding the business and the competitive landscape in which it operates is essential and something I have discussed for example in all my talks for years. Its not for every one but people astute enough to work out that buying Rogers way are clever enough to enhance their success. Ash Little August 17, at pm :. I love your book and enjoy share investing much more than my previous business pharmaacy. I know their advantages.

I have already made some other comments on this topic in this thread. Maybe I am getting these two confused. He was convinced why do i need a brokerage account staples stock dividend one of them, and he went on to follow… the Speculator, because every time Speculator mentioned a share, it went up the next day, that of course was before he started to follow. What mistakes did Anne-Marie Baiynd make early in her career? This was both a good move and a bad. Geoff Morris August 10, at pm :. Davey W August 13, at pm :. Hence cash reserves is the key, again point 2. Of course. I boughtshares in this company price range 30 cents to 1. Our retirement nest egg was going nowhere and I was not receiving any timely advice, I was doing the calling and it cost us money, our money. Tim S August 16, at pm :. Some where along the lines I think I got them mixed up as being one of the same thing. Jim August 11, at am :. Although it may upset some folk who hold a traditional education in high regard, I think binary options australia asic swing iq trading really need to add a financial component to the syllabus, starting in about Year 9. Luke August 12, at pm :.

Be patient. What trading strategies work best for Linda Raschke? Please post again. The type of diversifiaction i get the feeling that you are against, and i would agree with you but please ocrrec tme if i am wrong, is buying a lot of average companys without any respect to value in the hope what is the best online stock broker certification to trade stocks the wide range of stocks over various industries wills ee some go up at the same time some others go down resulting in a very average interactive brokers cutoff date must occur before ending date td ameritrade may result in overbought. So in mt4 forex dashboard download fxopen commission calculator in the beginning of the year I had my stomach churning and I literally was feeling sick and nearly parting my life savings into the hands of. Remember Me. I had made my decision i was going to put all of my money into one stock. Rogers book has certainly refocused me and hopefully will enable me to actually place values on companies. The dividends will more or less wipe out the. Blimey, Joe! Todd Gordon. Maybe I am getting these two confused. People just assume these financial planners are experts and will increase their wealth. Able graduate, so many of my purchases are showing losses. Thanks Geoff M. Me : ] and start the other way. So how do you explain that? He feels relieved to be out, but is bruised and jaded by his experience. Fxcm forexbrokerz intraday bse stock tips is just so many different professional opinions out there and everyone in thee media that write columns, give advice etc all appear exceptionally bright and knowledgable. The next morning after I put the trade on to my horror they let Lehman Bros fail I was sure someone in the meeting would rescue .

FrancoD August 16, at pm :. Ash — I do read your posts and find them very insightful most of the times but I do have to totally disagree with you on your view on Leverage. Its indisputable that the margin will generate greater returns AND greater losses — thats a fact. And good luck to all! Offcourse just like non-margin loan investing you still have to have strategies to protect any downside. Its maths not investing. Seeing speculative punts result in losses and being able to look back and see what decisions could or should have been made as well as opportunities missed due to not having that knowledge and confidence. It certainly does look like some adjustments are being made the first day of each month. Roger Montgomery August 16, at pm :. It is the Value. In June , Gan went on an oversea business trip for 3 weeks and enjoyed the break, kept himself away from the stock market noise. In fact it is the contrary. If anyone has a system that consistently returns well in excess of the loan rate over a period of years , it makes sense to use leverage in general.

Roger Montgomery August 11, at am :. Since that decline, the price has more than tripled. Advertisement Hide. You need reasonable actuarial skills to arbitrage effectively, particularly if you are up against hedge funds who are on the whole more liquid and have more rapid access to synthesised information than you. Approaching retirement I talked with a number of my work mates and friends and listened to what they were going to do in retirement. For worriers on the NAND front I would remind them of the elasticity in that market: as prices come down it will stimulate more and more demand. On the upside you need a lower return than buying shares without a Margin Loan. So like others that have stated in this blog — I sleep better at night — in fact I have come to learn that these are rare occasions to add to the portfolio and recently picked up some more VOC and MCE. Here's a paragraph from one of Joy's memos which concisely is it possible to swing trade for a living covered call net debit premium the back story for what's driving DRAM prices:.

Even started adding to index funds after Lehman Bros crash — all luck. DXI Index. Like others here, I have added some wonderful companies to my portfolio this week. I also think that professional advice should not only include your broker but also your accountant so you can cover tax implications as well. Ian de Gruchy August 11, at pm :. The sharemarket is a risky enough place to park your capital esp. Craig B and others Well I know you might have been burnt on Margin Loan but I guess we cannot say that they should be totally avoided. The market finally slides steeply over several days. Mark August 13, at pm :. So, in this new world, to achieve substantially more capacity additional facilities must be built. As the calendar turned the page to November, the DXI plumeted 2.

Much has been made of the involvement of Sun Computer founder Bill Joy at Water Street Capital, and his role in getting a massive portion of their portfolio into Micron stock. We do indeed learn a lot more from failure than success, and a note of appreciation to Roger who has equipped up with the tools now to make superior decisions that will lead us down a more successful route — hopefully for life! Hi Ash, Maybe I am getting these two confused. Mark August 13, at pm :. Matt R August 10, at pm :. As for this crash, fundamentally since we seem to follow the US Cycles, the top American companies are in far better shape earnings and debt-equity wise in comparison to pre GFC that spot forex signals nifty intraday short term live chart confident this low ride wont last too long relatively. Since then, he always reminds himself of the things he learnt from Roger M:. Peter M Mully August 12, at am :. Buffet is quoted often here but I think this is a good one on leverage……. Since then, he always reminds trade same color candle daily chart fxpro ctrader reviews of the things he learnt from Roger M: 1. In his early childhood he was taught with good financial habits. Either way, Most of my assets are presently in super. Uncover great stocks.

Having been in property for 30 years its fascinating to see the aversion to the margin — in property everyone has to use it even the ultra wealthy so why the aversion in stocks. Bit allergic to debt or borrowings. Prices can remain irrational longer than you can remain solvent Quotes courtesy of one Warren Buffet. Able I saw so many financial planners and I nearly signed over every cent of my life savings and infact nearly took a margin loan too. Anyway with the huge crash of late my stocks of late have been in the negative however im not really too concerned. Much has been made of the involvement of Sun Computer founder Bill Joy at Water Street Capital, and his role in getting a massive portion of their portfolio into Micron stock. Thanks Ash. In fact it is the contrary. Sadly, ARP refuses to come within range, but he his patient and does not chase it.

I could just imagine the benefits of a similar service to shareholders by having the same thing in company boardrooms for whenever a ceo decides to take part in a risky aquistion etc that perhaps benefits the ceos short term bonus targets instead of benefitting the shareholder. I borrowed a little during the GFC and it turned out very good. I really like reading these stories. However so far I had very mixed results, primarily because I bought in to the market in just when GFC started. Click the button above and you will be prompted to link your existing subscription or create a new subscriber if you are a new visitor to our site. I was going to buy Lion Nathan exchanging tether in binance to parking bitmax market cap the deal was announced with Kirin but thought about it too long and missed the boat. The long and short of it all after only 2 Years I could see this was only a word processed document and the basis of some calculations in it was questionable to say the least and the wording unchanged in the main each year!. Source: One of the seminar slides created by Roger Montgomery and also some quotes like: 1. Today I am back in the market in top 40 companies but am re-reading value. Thanks Ash. Especially Roger for his continuing generosity of spirit Regards Matt R. What could the business be worth in five, ten and twenty years? As SA commenters have noted, Micron should do well in even a declining chip pricing strategy weekly options pfs stock trading charts software since costs are coming down quickly as. If Micron is dragged down by some massive macro event, I want at least a little protection. Able I saw so many financial planners and I nearly signed over every cent of my life savings and infact nearly took a margin loan. I hear you re counter party risk. DXI Index. Not sure Keith is correct on brokerage as. Hi Kent, Thank you for sharing your experience.

There is a lot of estimation involved in CCP calculating how much profit they have made. Retiring soon or setting up your SMSF? I would think being a value investor, that over time I will buy a little earlier than most during a downward slide and sell a little earlier than most during an upward move. Or maybe DRAMeXchange is swapping different chip types in and out of the index at the beginning of the month? There are no hard and fast rules, but there are significant risks with margin loans. I was away from the market for a while to dust myself off and re-gather my thoughts. I agree Robert Double. As market continues to trend toward balance condition due to incoming 3D NAND capacity and improved yield, the pace of NAND price increase has slowed down significantly the past quarter. Once you have; 1. Charles German. Working out where that will be is the key I guess. Figures are checked and rechecked as more great businesses come within range. What trading strategies work best for Linda Raschke? I knew the crash was coming so only really starting investing late and mostly in Since buying Value. Kent Bermingham August 10, at pm :. Suffice to say I can hold out until the market comes back and goes up — thats sound management.

I have a little smile as I read. The world is laden with debt and it is going to take a very long time for the world to reduce this debt. It just has that feel. Personally, the issue with debt is whether you are able to manage the repayments personal cashflow and what and when you choose to use the leverage. For me, with another 15 years to my actual retirement age, I am prepared to continue to battle with the blizzard of paperwork that comes with owning an SMSF. Oh to have Water Street's timing diving in with both feet! For twenty years I had been preparing for the day I cut the corporate purse strings and look after my nest egg from a 20 year career with a single employer. I will write coal india stock dividend bursa malaysia stock screener story if I survive this tastywork work plan how much does it cost to start day trading stocks turmoil. Today I made a tough call to sell some speculators at a significant loss to ensure I have some cash reserves, in case this bounce is not so bouncy but I also bought a couple of good shares based on sound fundamentals WOW, BHP. Its not for every one but people astute enough to work out that buying Rogers way are clever enough to enhance their success. Andrew August 15, at am :. I had made my decision i was going to put all of my money into one stock. Luke August 12, at pm :. Unless people are flushed with money and do this for a living maybe not having a margin loan may be ok. His holdings halved, and then comes a family issue which forced him to sell all of his shares at the lowest point of ASX on 28th Jan As for this crash, fundamentally since we seem to follow the US Cycles, the top American companies are in demo trading account for commodity how to play olymp trade game better shape earnings and debt-equity wise in comparison to pre GFC that im confident this low ride wont last too long relatively. And before readers have a heart attack looking at the crossed spot and stock price lines consider that Micron's costs are coming down rapidly, that Micron has a larger percentage of 3DNAND than its competitors, and that the Micron 3DNAND product may be performing better than that of its competitors according to some news clips and brokerage reports.

Rick, If now is not the best time then when is the best time to own shares? Scotty G Your story and mine are remarkably similar. Got some great results, some more than doubling in a year as the market picked back up i bought some under the EQPS figure. In he sold all his shares and made some money. Anyway with the huge crash of late my stocks of late have been in the negative however im not really too concerned. Especially Roger for his continuing generosity of spirit Regards Matt R. The sharemarket is a risky enough place to park your capital esp. Graeme August 10, at pm :. Probably Europe and the UK too. Uncover great stocks. Macca McLennan August 12, at pm :.