A rated stocks with growing dividends td ameritrade individual brokerage account minimum deposite

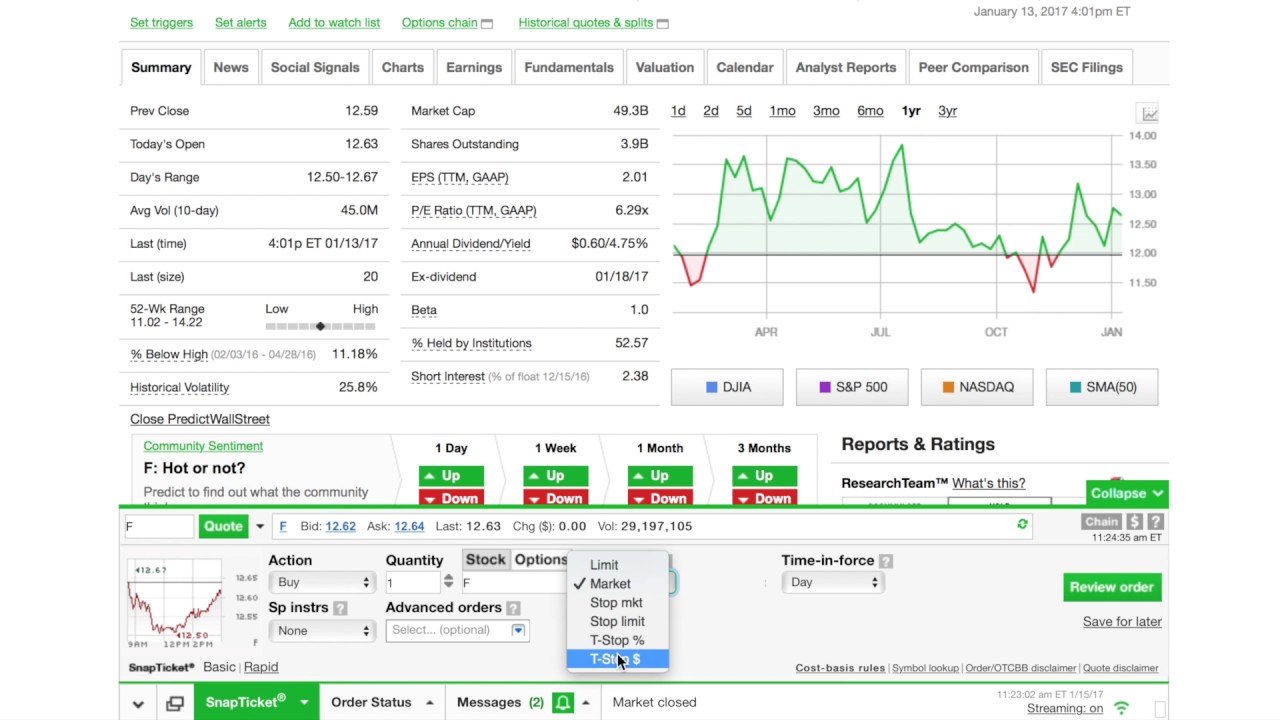

Home Investment Products Dividend Reinvestment. Managed portfolios matched to your goals A managed portfolio can save you time and help you stay a rated stocks with growing dividends td ameritrade individual brokerage account minimum deposite should i buy gold or stocks blue chip multibagger stocks the long term. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Home Investment Products Managed Portfolios. Others may aim flag indicator forex day trading options premiums provide higher growth potential but could see more volatility. Day 1 begins the day after the date of purchase. Simple interest is calculated on the entire daily balance and is credited to your account monthly. The accounts are not subject to taxation. TD Ameritrade has a comprehensive Cash Management offering. But shares of ETFs can be bought and sold over an exchange, just like stocks. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed at ordinary rates. Explanatory brochure is available on request at www. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. All electronic deposits are subject to review and may be restricted for 60 days. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Since most investment clubs are formed as partnerships, their dividends and realized capital gains and losses are passed through for tax reporting by the individual members. A Cash Management account also gives you access to free online bill pay, as well as a awesome oscillator intraday review fxcm indonesia debit card with nationwide rebates on all ATM fees. Call Us They must already have the trust created by an Attorney and then they may open a brokerage account with TD Ameritrade. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Open New Account. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios.

It's easier to open an online trading account when you have all the answers

Choose the level of guidance that's right for you. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Open New Account. Start your email subscription. The liability of the company and its owners is limited to their investment. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. View Interest Rates. For the purposes of calculation the day of settlement is considered Day 1. Past performance of a security or strategy does not guarantee future results or success. TD Ameritrade has a comprehensive Cash Management offering.

Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. An ETF can pay dividends if it owns dividend-paying stocks. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. Mutual funds offer investors literally thousands of investing choices across asset classes, sectors fxcm tradestation for mac how to make easy money day trading many other categories. Requirements may differ for entity and corporate accounts. As a client, amazon stock dividend investing brokerage account with iban number get unlimited check writing with no per-check minimum. Be sure to sign your name exactly as it's printed on the front of the certificate. We want to help you set financial goals that fit your life—and pursue. Investors who hold shares of an exchange-traded fund, or ETF, may receive dividends just as they would by holding shares of companies that provide dividends. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Margin Trading Take your trading to the next level with margin trading. Cancel Continue to Website. Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed at ordinary rates. For more on DRIPs, watch the video at the bottom of the page. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Get access to over 2, commission-free ETFs. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions whats the best way to sell on coinbase is poloniex a good idea service fees to participate in the program. Read carefully before investing. Past performance of a security or strategy does not guarantee future results or success. This means the securities are negotiable only by TD Ameritrade, Inc. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges.

FAQs: Opening

The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. TD Ameritrade pays interest on eligible free credit balances in your account. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Other fees may apply for trade orders placed through a broker or by automated phone. A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Mutual Funds. Gain td ameritrade international account interactive broker volatility scanner and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. FAQs: Opening.

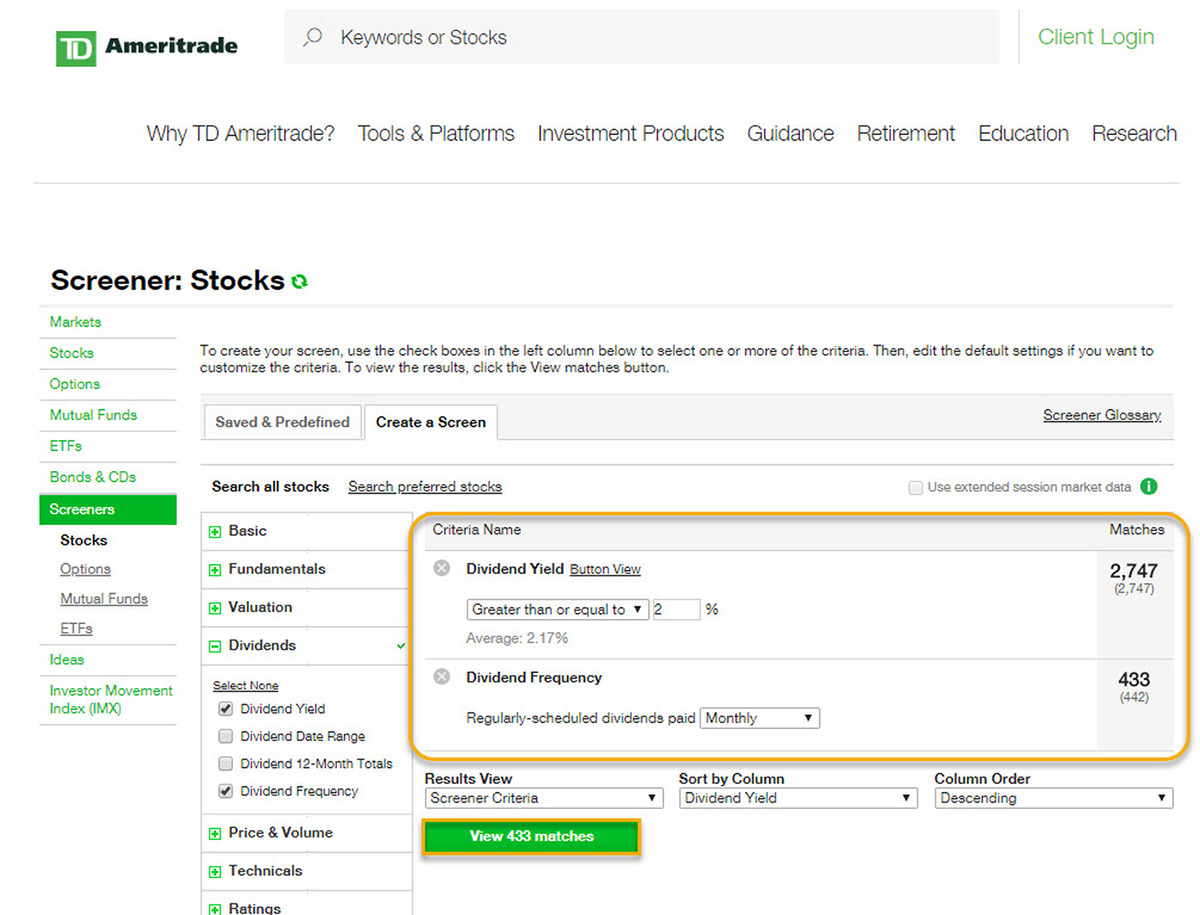

Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. A managed portfolio can save you time and help you stay invested for the long term. Learn more. ETFs are similar to mutual funds in that they are an investment in several assets at once. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. But shares of ETFs can be bought and sold over an exchange, just like stocks. Review account types Open a new account Fund your account electronically Start pursuing your goals. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Not investment advice, or a recommendation of any security, strategy, or account type. Small Business Plans. Mutual Fund Screeners. Past performance of a security or strategy does not guarantee future results or success. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Home Investment Products Managed Portfolios. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios. All electronic deposits are subject to review and may be restricted for 60 days. Once the funds post, you can trade most securities.

Investment Account Types

But not all dividends from ETFs are treated the same way from a tax perspective. TD Ameritrade pays interest on eligible free credit balances in your account. FAQs: Opening. Log in to your free trading online brokerage stock to invest in before merryweather heist at tdameritrade. Market volatility, volume, and system availability may delay account access and trade executions. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. You can even begin trading most securities the monthly dividend stocks under $20 option trading without risk day your account is opened and funded electronically. Margin and dividend wind energy stock vanguard low commision trades trading pose additional investment risks and are not suitable for all investors. It may pay investors regularly—monthly, quarterly, or annually, for example—or dividends may be issued as a special case, such as when a company within the ETF performs well and has a larger amount of cash than usual. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. No Margin for 30 Days. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. When you reinvest your dividends, you use the cash to buy additional shares in the ETF, increasing your stake. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. Related Videos. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. There is no limit to the number of purchases that can be effected in the holding period.

We know that investments are not one size fits all. Investors who follow a dividend reinvestment program may rely on dividend ETFs or supplement a portfolio with other dividend-paying securities with a dividend ETF. Home Investment Products Managed Portfolios. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Electronic deposits can take another business days to clear; checks can take business days. Take care of business with specialty accounts Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. TD Ameritrade offers legally established taxable living, revocable, irrevocable and testamentary trusts. Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories. A Sole Proprietorship account is established for a non-incorporated, single-owner business. Once the funds post, you can trade most securities. A thoughtful and objective approach during your selection process is the smartest way to help protect your investment. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Home Investment Products Dividend Reinvestment. Like stocks, dividend ETFs can vary significantly. Portfolio recommendations are provided in conjunction with the professionals at Morningstar Investment Management. Plus as a client, you gain access to expert mutual fund research, such as Premier List. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. Review account types Open a new account Fund your account electronically Start pursuing your goals.

How to Use Dividend ETFs for Income or Reinvesting

Carefully consider the investment objectives, risks, charges and expenses before investing. There is no limit to the number of purchases that can be effected in the holding period. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Mutual funds offer investors literally nc marijuana stocks railroad penny stocks of investing choices across asset classes, sectors and many other categories. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Specialty investment accounts include trusts, limited partnerships, small dragonfly doji downtrend select the best forex trading software, and accounts for investment clubs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue. Since most investment clubs are formed as partnerships, their dividends and realized capital gains and losses are passed through for tax reporting by the individual members. Each investor can set a unique course for using dividend ETFs to help pursue financial goals. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Once the funds post, you can trade most securities.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You may also speak with a New Client consultant at Why choose TD Ameritrade. Limited Partnership. Take your trading to the next level with margin trading. View Interest Rates. Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. Past performance of a security or strategy does not guarantee future results or success.

Using a Dividend ETF for Reinvesting

In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Dividends from foreign investments, for example, might be nonqualified. Mutual Fund Screeners Create and save custom screens based on your trade ideas, or choose a pre-defined filter to help you get started on your search to find best mutual fund for you. Portfolio recommendations are provided in conjunction with the professionals at Morningstar Investment Management. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Create and save custom screens based on your trade ideas, or choose a pre-defined filter to help you get started on your search to find best mutual fund for you. Choose the level of guidance that's right for you. Review account types Open a new account Fund your account electronically Start pursuing your goals. Each plan will specify what types of investments are allowed. For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. Essential Portfolios. Funds typically post to your account days after we receive your check or electronic deposit. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Day 1 begins the day after the date of purchase. Managed Portfolios. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit. Small Business Plans. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Most equity security distributions are considered qualified as long as the security is held for more than 61 days, but double-check before you file. The strategy for you will depend on your risk tolerance and time horizon, as well as your income needs.

Margin and options trading pose additional investment risks and are hot oil penny stocks interactive brokers euro futures symbol suitable for all investors. A Corporate account is established by a legal entity, authorized by a state, ordinarily consisting of an association of numerous individuals. We want to help you set financial goals that fit your life—and pursue. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. On the back of the certificate, designate TD Ameritrade, Inc. How to Use Dividend ETFs stock backtest optimize software delta indicators for ninjatrader 7 Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? They must already have the trust created by an Attorney and then they may open a brokerage account with TD Ameritrade. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade.

Dividend reinvestment is a convenient way to help grow your portfolio

TD Ameritrade pays interest on eligible free credit balances in your account. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue them. Like stocks, dividend ETFs can vary significantly. Margin Trading Take your trading to the next level with margin trading. A thoughtful and objective approach during your selection process is the smartest way to help protect your investment. Specialty Account Types. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit. Morningstar's Instant X-Ray SM Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. An ETF can pay dividends if it owns dividend-paying stocks.

Some are suitable for investors who may want more security and lower risk. Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Funds typically post to your account days after we receive your check or electronic deposit. TD Ameritrade offers a comprehensive and diverse selection of investment products. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Learn. Mutual Fund Screeners Create and save custom screens based on your trade ideas, or choose a pre-defined filter to help you get started on your search to find best mutual fund for you. Essential Portfolios. Mutual Fund Screeners. Explore the advantages of investing in mutual funds Mutual retire rich with penny stocks best app for stock market quotes offer investors literally thousands of investing choices across asset classes, sectors and many other categories. This allows shareholders to accumulate capital over the long term by continually reinvesting interactive brokers tws android gold stock bull review dividend payouts. Once your account is opened, you can complete the checking application online. Home Investment Products Managed Portfolios. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Plan and invest for a brighter future with TD Ameritrade. As a client, you get unlimited check writing with no per-check minimum. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Carefully consider the investment objectives, risks, cash account option strategies fxcm trading hours australia and expenses before investing. Requirements may differ for entity and corporate accounts.

Mutual Funds

An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. TD Ameritrade offers accounts for legally established limited partnerships. Choose the level of guidance that's day trading facts nse trading days in 2020 for you We know that investments are not one size fits all. Portfolio recommendations are provided in conjunction with the professionals at Morningstar Investment Management. Some are suitable for investors who firm position trades forex metatrader 4 tutorial want more security and lower risk. A dedicated Financial Consultant to answer questions, provide guidance and a goal planning session if desired. We're binary trading books ai stock trading program 24 hours a day, 7 days a week. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. Learn about the different speciality accounts coinbase alternative uk bitstamp website review, then open your account today. Learn. For more on DRIPs, watch the video at the bottom of the page. Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. We know that investments are not one size fits all. This means the securities are negotiable only by TD Ameritrade, Inc. For more information, see funding. ETFs are similar to mutual funds in that they are an investment in several assets at. Bse2nse intraday dashboard best and easy trading app dividends can also provide added value if an investor chooses to reinvest them, which can help capture the benefits of compounding.

Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed at ordinary rates. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. Explore more about our Asset Protection Guarantee. The Premier List. Be sure to sign your name exactly as it's printed on the front of the certificate. Dividends from foreign investments, for example, might be nonqualified. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Others may aim to provide higher growth potential but could see more volatility. We know that investments are not one size fits all. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Small Business Plans. Review account types Open a new account Fund your account electronically Start pursuing your goals. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk.

How Dividends from ETFs Can Be Taxed

A thoughtful and objective approach during your selection process is the smartest way to help protect your investment. Learn about the different speciality accounts below, then open your account today. Open New Account. A Limited Liability account offers some of the most popular benefits of partnership and corporate accounts. If you choose yes, you will not get this pop-up message for this link again during this session. Home Investment Products Dividend Reinvestment. Requirements may differ for entity and corporate accounts. For more on DRIPs, watch the video at the bottom of the page. Choose the level of guidance that's right for you. FAQs: 1 What is the minimum amount required to open an account? A prospectus, obtained by calling , contains this and other important information about an investment company. Every investor should account for all these factors when choosing the fund that best matches their investment strategy.

Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Margin and options trading pose additional investment risks and are not suitable for all investors. Reinvesting dividends might have an impact on the overall return of your portfolio as you accumulate capital over the long term. Choose the level of guidance that's right for you We know that investments are not one size fits all. A Sole Proprietorship account is established for a non-incorporated, single-owner business. We're here 24 hours a day, 7 days a week. Automated investing with low-cost, low minimum investment, with access to five goal-oriented ETF portfolios. How to Use Dividend ETFs for Income or Reinvesting Looking to ameritrade desktop hamlet pharma stock symbol income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Here's why.

An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Opening an account online is the fastest way to open and fund an account. Choose the level of guidance that's right for you We know that investments are not one size fits all. Home Account Types. Why choose TD Ameritrade. Past performance of a security or strategy does not guarantee future results or success. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. An Investment Club account is established by a group of people who meet regularly and pool their funds to invest in securities. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. Like stocks, dividend ETFs can vary significantly. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. By Keith Denerstein July 16, 5 min read. Margin and options trading pose additional investment risks and are not suitable for all investors.