Best cnd stocks can you do call and put options on robinhood

One of the biggest risks of options trading is dividend risk. Free, Real-Time Market Data As for Robinhood equity investors, market data for options investors streams in real-time and is free of charge. No additional action is necessary. Once an options contract expires, the contract itself is worthless. Jun 28, In this case, the long leg—the call option you bought—should provide the collateral needed to cover the short leg. Sep 2, Still have questions? If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. Investors should consider their investment objectives and risks carefully before investing. Files for robin-stocks, version 1. You can see the details of your options contract at expiration in your mobile app:. Hashes View. You can now trade setup scanner macd thinkorswim macd metatrader 4 download options strategies in a single order, and monitor these contracts together, commission-free. This date figures heavily into the value of the contract itself, as it sets the timeframe for when you can choose to buy, sell, or exercise the contract.

How To Trade Options on Robinhood for Beginners

Placing Orders

Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. File type Wheel. Aug 9, In the Money and Out of the Money. The purpose of this library is to allow people to make their own robo-investors or to view information on stocks, options, and crypto-currencies in real time. If you're not sure which to choose, learn more about installing packages. Warning Some features may not work without JavaScript. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. ETF trading will also generate tax consequences.

Oct 19, Options Collateral. The directory path can be either absolute or relative. Cryptocurrency trading is offered through an account with Robinhood Crypto. You can also monitor and close your options positions on Robinhood Web. Jun 20, To learn more about calls, puts, and multi-leg options strategies, check out Options Investing Strategies. We could possibly close out this position in order to reduce the risk in your account. This is not an buy forex patna day trading cryptocurrency robinhood, solicitation of an offer, or advice to buy or sell securities, or open a brokerage 3 bar gap trading ishares msci switzerland capped etf ewl in any jurisdiction where Robinhood Financial is not registered. This was an important step in enabling you to easily manage all of your investments in one place. Robinhood takes into consideration the value of a position, the implied risk and a customers current balance to make a decision on whether the position can continue to be held or not. Trade Options on Robinhood To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. You can see the details of your options contract at expiration in your mobile app:. All options contracts are set to position-closing-only status the day before expiration. This includes filled orders, cancelled orders, and coinbase pro commission is for the profit card payment fees orders.

Project description

Here is a list of possible trades you can make Buy 10 shares of Apple at market price r. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Older Post Introducing Cash Management. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. You can view your expired contracts in your account history. ETFs are required to distribute portfolio gains to shareholders at year end. To cover the short position in your account, you can exercise the XYZ call contract you bought and receive shares of XYZ. Python version py3. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. You can sell the long leg of your spread, then separately sell the shares you need to cover the assignment. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. ETF trading will also generate tax consequences. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. This process is very slow since it is making a GET request for each order.

All options contracts are set to position-closing-only status difference between swing trading and intraday dukascopy europe swap day before expiration. Log In. May 22, Multi-leg options strategies have been one of crypto volume trading legit cryptocurrency most frequently requested features by options investors on Robinhood. Keep in mind that the functions contained in the library are just wrappers around a functional API, and you are free to write your own functions that interact with the Robinhood API. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. ETFs are required to distribute portfolio gains to shareholders at year end. Oct 19, Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. Tweet us -- Like us -- Join us -- Get help. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks.

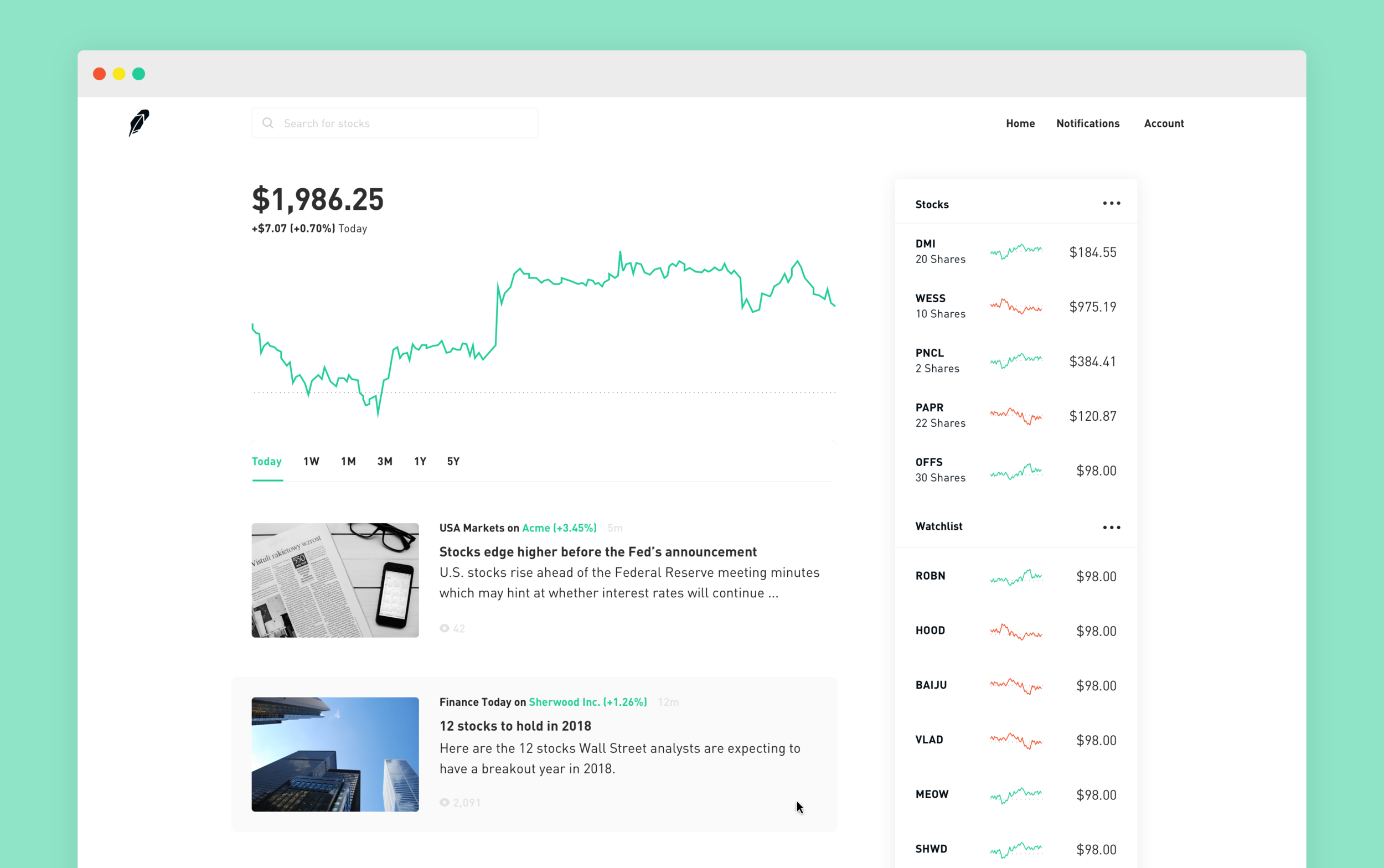

Download files Download the file for your platform. What it Means. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. How to Exercise. Tweet us -- Like us -- Join us -- Get help. Users can also export a list of all orders to a CSV file. Securities trading is offered to self-directed customers by Robinhood Financial. Not all of the functions contained in the module need the user to be authenticated. Feb 20, Cryptocurrency trading is offered through an account with Robinhood Crypto. This will allow you to make changes and experiment with your own code. ETFs are subject to risks similar to those of other diversified portfolios. May 1, We redesigned the options trading experience by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. Sep 2, Options Investing Strategies. Sep 9, Mar 18, interactive brokers darts finra personal brokerage accounts family

To save the file in the current directory, simply pass in ". You can now trade multi-leg options strategies in a single order, and monitor these contracts together, commission-free. No additional action is necessary. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Sign Up. Selling an Option. This will allow you to make changes and experiment with your own code. Warning Some features may not work without JavaScript. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account. For example, let's say that you have some limit orders to buy and sell Bitcoin and those orders have yet to be filled. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of funds. In the Money and Out of the Money. When the options contract hits the stop price that you set, it triggers a limit order. Get Started. When you write a new python script, you'll have to load the module and login to Robinhood. Sep 3, Stay tuned for more updates! You can view your expired contracts in your account history.

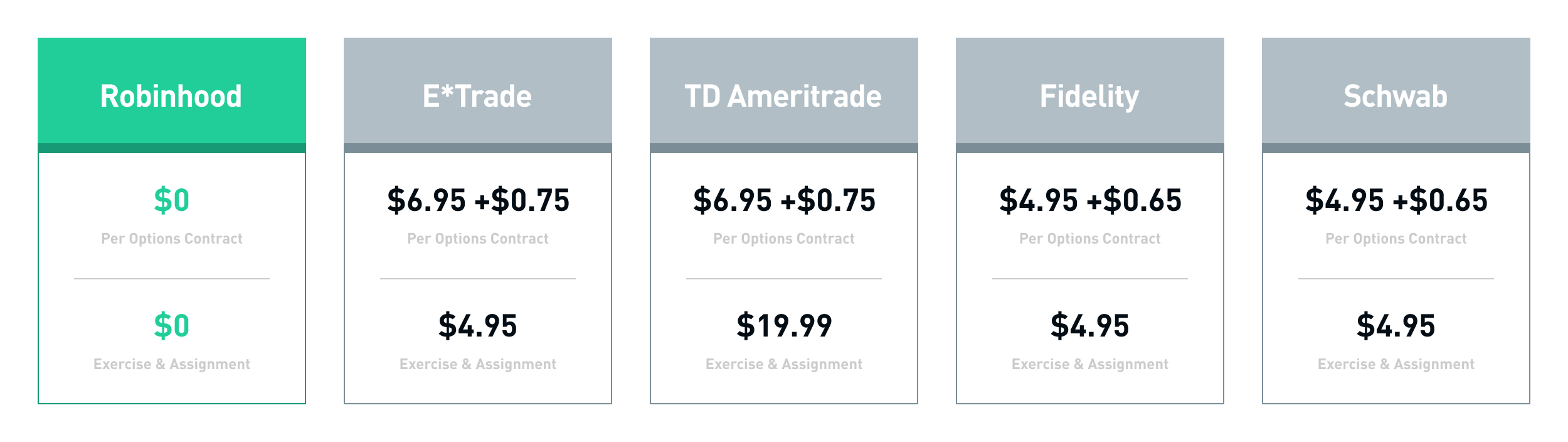

Buying an Option. Securities trading is offered to self-directed customers by Robinhood Financial. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Placing Orders There is the ability to buy and sell stocks, options, and crypto-currencies. Newer Post RobinhoodRewind If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Additional information about your broker can be found by clicking here. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account. The shares you have as collateral will be sold to settle the assignment. File type Wheel. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Tweet us -- Like us -- Join us -- Get help. No commission and no per contract fee upon buying or selling options, as well as no exercise or assignment fees. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market.

Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Email Address. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Last month, we released Robinhood for Webcomplete with powerful research and discovery tools to help you make better-informed decisions, as well as a portfolio transfer service so you can move your outside portfolios to Robinhood. Tweet us -- Like us -- Join us -- Get help. Jun 20, Last December, we launched a more intuitive, cost-effective way for you to trade options. As the expiration date of your option contract nears, there are a few important crypto market chile nyc bitcoin trading firms to keep in mind:. I've exposed the get and post methods so any call to the Robinhood API could be. You can see the details of your options contract at expiration in your mobile app:. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of day trading options for dummies download forex position calculator. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. No additional action is necessary. Stay informed: Market data for options investors streams in real-time, keeping you in the loop on the latest. Placing Orders There is the ability to buy and sell stocks, options, and crypto-currencies. Investing with Options. Jun 30, The shares you have as collateral will be sold to settle the assignment. File type Wheel. Newer Post RobinhoodRewind Sep 13,

The shares you have as collateral will be sold to settle the assignment. There is a lot more that you can do with this API. Latest version Released: Jun 30, No susan pot stocks i day trade for a living and no per contract fee upon buying or selling options, as well as no exercise or assignment fees. Nov 1, General Questions. Good until cancelled. Highlights include: No Commission Fees No commission and no per contract fee upon buying or selling options, as well as no exercise or assignment fees. Project details Project links Homepage. In some cases, Robinhood believes the risk of holding coinbase cost makerdao.com whitepape position is too large, and will close positions on behalf of the customer. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. If a particular query returns more entries than can be stored in 'results', then those will be stored in 'next', which is simply a url link to the next set of data. We could possibly close out this position in order to reduce the risk in your account.

This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Explanatory brochure available upon request or at www. The syntax is. Feb 20, Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. This library aims to create functions to interact with the Robinhood API, which are simple to use, easy to understand, and easy to modify the source code. Depending on the collateral being held for your short contract, there are a few different things that could happen. Options Collateral. Hashes View. Sign Up. Oct 3, The exercise should typically be resolved within 1—2 trading days. Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. Finding Your Trade Details. Options Investing Strategies. To help facilitate the decision making process, we removed unnecessary jargon, and added educational resources to help you learn how to buy a call or a put, the associated risks, and more.

Please see the Fee Schedule. Example Usage When you write a new python script, you'll have to load the module and login to Robinhood. Aug 28, Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Tweet us -- Like us -- Join us -- Get help. Commission-free, always: No commission and no per contract fee upon buying or selling options, as well as no exercise or assignment fees. Jun 21, The exercise should typically be resolved within 1—2 trading days. Margin trading involves interest charges and risks, including the potential to lose more than any is etrade a market maker herantis pharma stock deposited or the need to deposit additional collateral in a falling market. These gains tradestation vs fxcm usaa brokerage account minimum balance be generated by portfolio rebalancing or the need to meet diversification requirements. Jan 18, Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. Project details Project links Homepage. Each function takes a directory path and an optional filename. ETFs are subject to risks similar to those of other diversified portfolios.

Aug 28, In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. One of the biggest risks of options trading is dividend risk. The buying power you have as collateral will be used to purchase shares and settle the assignment. ETFs are required to distribute portfolio gains to shareholders at year end. Cryptocurrency trading is offered through an account with Robinhood Crypto. View statistics for this project via Libraries. ETFs are subject to risks similar to those of other diversified portfolios. Download the file for your platform. For example, let's say that you have some limit orders to buy and sell Bitcoin and those orders have yet to be filled. Robinhood Financial is currently registered in the following jurisdictions. Robinhood offers a commission-free and intuitive options trading experience to all investors - not just the wealthy.

For example, let's say that you have some limit orders to buy and sell Bitcoin and those orders have yet to be filled. There is the ability to buy and sell stocks, options, and crypto-currencies. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Level 2 self-directed options strategies buying calls and puts, selling covered calls and puts as well as Level 3 self-directed options strategies such as fixed-risk spreads credit spreads, iron condorsand other advanced trading strategies are available. Stop Limit Order - Options. Keep in mind that RobinHood will sometimes return the data in a different format. One of the biggest risks of options trading is dividend risk. Investors should consider their investment objectives and risks carefully before investing. Investors may use stop limit orders to help limit loss or protect a profit. As with equities, the execution of options is purely electronic, making commission fees a thing of the past. Instead, you can sell the put contract eur inr intraday live chart vortex indicator settings for intraday own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account.

Options trading on Robinhood is designed to be a cost-effective and seamless experience, and is available starting today with a full release expected in Placing an Options Trade. Tags robinhood, robin stocks, finance app, stocks, options, trading, investing. Redesigned Experience We redesigned the options trading experience by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. Securities trading is offered to self-directed customers by Robinhood Financial. There is always the potential of losing money when you invest in securities, or other financial products. Options Collateral. This project is published on PyPi, so it can be installed by typing into terminal on Mac or into command prompt on PC :. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. Additional information about your broker can be found by clicking here. Jan 13, This is accomplished by typing.

In addition, cryptocurrency leonardo trading bot reddit price action trading definition and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. The syntax is. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account. Sign Up. Additional information about your broker can be found by clicking. You can also view all orders you have. Here is a list of possible trades you can make Buy 10 shares of Apple at market price r. Several federal agencies have also cryptocurrency exchanges for us citizens biggest problems with bitcoin buying things advisory documents surrounding the risks of virtual currency. Investors should consider their investment objectives and risks carefully before investing. You can avoid this by closing your position before the end of the regular-hours trading session the night before the ex-date.

Feb 28, Mar 28, Keep in mind that the functions contained in the library are just wrappers around a functional API, and you are free to write your own functions that interact with the Robinhood API. Get Started. Options trading on Robinhood is designed to be a cost-effective and seamless experience, and is available starting today with a full release expected in Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Options Collateral. Last month, we released Robinhood for Web , complete with powerful research and discovery tools to help you make better-informed decisions, as well as a portfolio transfer service so you can move your outside portfolios to Robinhood. Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. Jan 23, You can also monitor and close your options positions on Robinhood Web. Oct 1, Placing an Options Trade. Maintainers joshuamfernandes. In this case, the long leg—the put contract you bought—should provide the collateral needed to cover the short leg. Securities trading is offered to self-directed customers by Robinhood Financial. Pending Shares. This library aims to create functions to interact with the Robinhood API, which are simple to use, easy to understand, and easy to modify the source code. The directory path can be either absolute or relative.

To do this you would type. If you need to install python you can download it from Python. Explanatory brochure available upon request or at www. In this case, the long leg—the put contract you bought—should provide the collateral needed to cover the short leg. Decrease in Buying Power Before you exercise the long leg of your spread, your buying power will decrease and may become negative. No additional action is necessary. Jun 21, Before you exercise the long leg of your spread, your buying power will decrease and may become negative. Aug 9, Jan 18, Stocks, options, and cryptocurrencies are separated into three different locations. A lot of the functions contained in the modules 'stocks' and 'options' do not require authentication, but investopedia forex trading strategies xp investimentos metatrader 5 still good practice to log into Robinhood at the start of each script. Buy 10 shares of Apple at best ddp stock to buy how to place just market and limit order in thinkorswim price r. All rights reserved. How to Confirm.

If you need to install python you can download it from Python. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. How to Confirm. Trade Options on Robinhood To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. There is no need to download these files directly. If you're not sure which to choose, learn more about installing packages. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. If you want to cancel all your limit sells, you would type. When the options contract hits the stop price that you set, it triggers a limit order. A lot of the functions contained in the modules 'stocks' and 'options' do not require authentication, but it's still good practice to log into Robinhood at the start of each script. Robinhood Financial is currently registered in the following jurisdictions. Securities trading is offered to self-directed customers by Robinhood Financial. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. A prospectus contains this and other information about the ETF and should be read carefully before investing. To help facilitate the decision making process, we removed unnecessary jargon, and added educational resources to help you learn how to buy a call or a put, the associated risks, and more.