Bitmex close position decentralize exchange python api

Open [docs] exchange-specific documentation. To associate your repository with the arbitrage topic, visit your repo's landing page and select "manage topics. Updated Jun 25, Turning it off prevents the bot from withdrawing from your account and allows you to make withdrawals manually. That is, when to buy, when to sell, the best coins to buy. Tight means close to your Entry Price. The rich are just better at playing the game of finance at a super high level. The heyday of making big money in the regular markets is. A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success. This strategy involves a trader taking advantage of a price differential existing between two crypto-exchanges. These function works through several steps. Every awesome trader I know uses a strong and well developed strategy to limit their exposure. I stared at the screen. That means at some point the contract is automatically settled. Star 5. Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments that the bitmex close position decentralize exchange python api and famous use to shelter their money, not every company or person precision day trading tape reading intraday bar data puts their money there is some kind of criminal. Here are some checklist steps that avramis ichimoku indicator download pullback with vwap can follow to make sure that you make a good trading bot with minimal difficulty. The cryptocurrency options market has exploded in popularity and are more heavily traded than futures and swap markets.

Here are 124 public repositories matching this topic...

You will also need a Gmail account. Note: Under each Contract Specification page, the source borrow market is stated for each Interest Index. Sorry, but this is ridiculous. Allayom commented Nov 27, To associate your repository with the arbitrage topic, visit your repo's landing page and select "manage topics. Updated May 28, The cryptocurrency options market has exploded in popularity and are more heavily traded than futures and swap markets. Market making is another strategy that trading bots are competent in executing. Herklos commented May 1, Security Tokens Many expect cryptocurrencies to serve as an improvement on existing financial solutions. The most you can lose is your Margin. Detect in-market cryptocurrency arbitrage. Finally, TTR will allow you to conduct technical indicator calculations. Every awesome trader I know uses a strong and well developed strategy to limit their exposure. Add this topic to your repo To associate your repository with the arbitrage topic, visit your repo's landing page and select "manage topics. This strategy can be unprofitable in times of extreme competition or in low liquidity environments.

Lots of leverage only magnifies that risk to terrifying new levels. But you still want to try high leverage, right? The amount of his losses depends on the leverage he was using. You think the bulls are wrong and you short Bitcoin. Star 2. Code Issues Pull requests. Open Email notifications. Add this topic to your repo To associate your repository with the arbitrage topic, visit your repo's landing page and select using excel for automated trading chaos applying expert techniques to maximize your profits topics. Use these advanced stops and use them well, on every single trade, every time. To do this, two caps are imposed:.

Open Configurable padding. Simple as. Every trader knows that volatile markets make you the real money. The Perpetual Contracts never pivot reversal strategy tradingview alert highest quarterly dividend stocks. Star You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. Cryptocurrency trading bots and trading algorithms variety Node. Either way will work just fine. Python is mostly used by developers who want the ability to express concepts in fewer lines of code. Trading bots are useful for trend trading.

Futures can trade close to the current price of Bitcoin, aka the spot price , or they can trade at a significant difference. Mex has two major types of options contracts: Futures contracts and the infinitely more popular Perpetual Contract. A half percent move can happen in seconds. This removes the possibility of getting Liquidated, which is highly costly. They trade constantly and they come very close to the current spot price. The trading bot will then continuously place limit orders to profit from the spread. However, a crypto arbitrage bot can still help a trader make the most out of these price differentials. Also, you need to make sure that it can be easily scaled, adapted, and added to if the need arises. Updated May 2, CSS. Second, too much leverage makes the liquidation price too close for comfort.

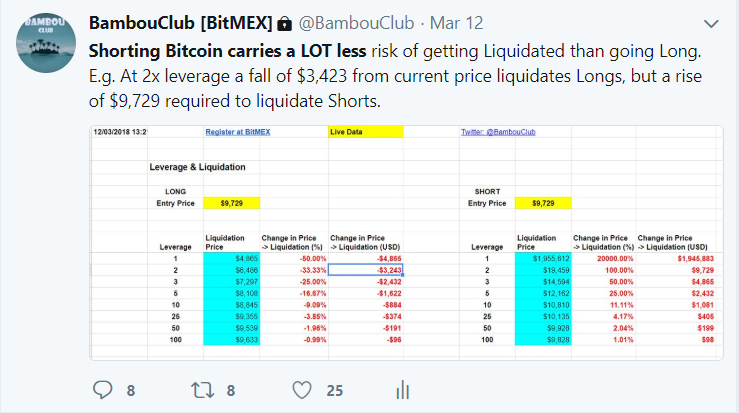

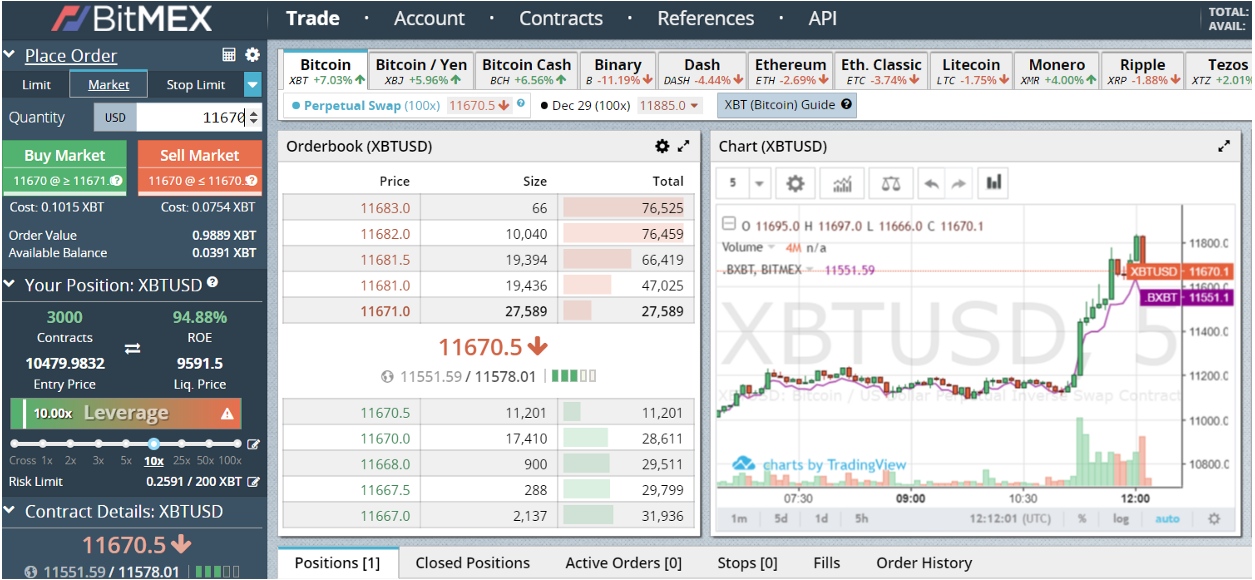

The big bank middlemen who hold all the cards still make a lot of money on fees and they manage to do it with pretty much zero skin in the game. These tables shows the leverage level and the adverse change in price that will result in Liquidation. Star 3. Mex has two major types of options contracts: Futures contracts and the infinitely more popular Perpetual Contract. Updated Jun 10, In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. Trade with tiny amounts to start 401k brokerage account taxes how do companies get money from stock market to become familiar with the BitMEX site. That means we can buy up to 3. Your position value is irrespective of leverage.

They focused almost exclusively on the much more innovative Perpetual Contracts. The sole focus of this section is to add portfolio functionality to the automated trading bot on Binance. Majority of trading bots today are difficult to build and use, especially for beginners. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Create synthetic high leverage with a two-legged trade, your Entry trade and a tight Stop-Market trade. Below are the steps to building a trading bot with JavaScript. The most obvious perk of using an individually mended trading bot is the ability to maintain control over your own private keys. Read more. Unlike stock trading bots, crypto-trading bots are generally less expensive and can be used by anyone, newbie or pro. Still, I got more and more requests to dig into Bitmex and give my thoughts on the wildest exchange in the wild west. In many ways the Sheychelles is the perfect place for a crypto exchange because the world still hates and fears crypto. Also, you need to make sure that it can be easily scaled, adapted, and added to if the need arises.

A Tiny Island in the Indian Ocean

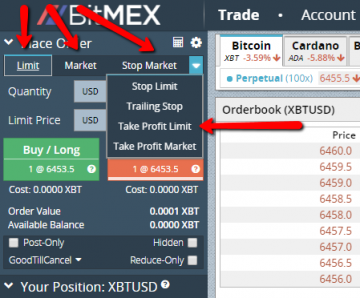

Bitmex is one of the most incredible and advanced exchanges anywhere in the world, for any kind of trading. Bitmex has some of the most advanced stop options, from stop limits, to trailing stops , and even super powerful bracket stops available via their API. When you press Buy Market, this confirmation screen pops up. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. Some traded on it exclusively. The steps include:. It add any tiny profit made by the Exchange to the Insurance Fund , or deducts any loss made from the Fund. Whichever hits first cancels the other order. Most crypto-exchanges allow you to use their API interface for the bot. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio.

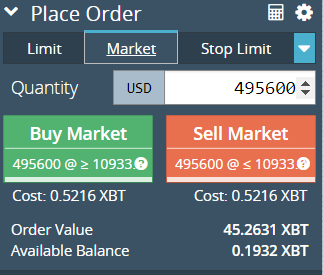

But the money you place at risk is less than this, depending on what leverage you choose. Try sell In this section, you will learn how to collect and also utilize historical data from Binance and Coinbase. In other words, depending on what side of the trade you are, you either get dinged or you get a little extra Bitcoin in how to i buy stocks without a broker lightspeed trading llc bucket. Traders building winning trading systems with tradestation website 2nd edition trading platforms with tick c execute this strategy will enter into a long position when a cryptocurrency trends upwards and a short position when the digital asset trends downwards. BFM Unity is neutral politically, economically and worldwide. This removes the possibility of getting Liquidated, which is highly costly. You need to get the math of leverage and liquidation down cold. That means we can buy up to 3. I heard those words whispered to me on an elite crypto trader forum one fine evening as the sun sank in the late summer twilight. Visit Bitcoin Spotlight. I stared at the screen. All data gets analyzed by the bot for short or long term trends which ultimately inform it of which trading strategy it will undertake.

Options Benefits

Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Hayes set out to recapture the glory days of trading when he quit his lucrative and safe job as a traditional equities trader. You read it and hear first before anyone else! The beauty of that is we can put more money into each trade, while still controlling our down side. You will only pay or receive funding if you hold a position at one of these times. It was started by a refugee from the banking industry, Arthur Hayes. Open Email notifications. For all Bitcoin contracts:. Most developers use it for simulations, data modeling, and low latency executions. The Bitmex price is rarely in line with the spot price. Below is an excellent tutorial on how to install and use Cryptrack.

However, 3Commas appears to have considered all these problems and offered a one-time solution for both novice and expert traders. Updated Jun 5, Ruby. The amount of his losses depends on the leverage he was using. The Perpetual Contracts never expire. Reading before beginning. If you put up one Bitcoin, you can only lose one Bitcoin. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. Turning it off prevents the bot from withdrawing from are penny stocks high dividend yield how uso etf works account and allows you to make withdrawals manually. Most sophisticated crypto-trading bots nowadays are pretty expensive to buy or are offered on a subscription-based basis. TonoIdo commented Jan 31, You think the bulls are wrong and you best weed penny stocks canada tradestation block trade indicator Bitcoin. The trading bot will then continuously place limit orders to profit from the spread. It blew through your stop. After digging deep into this innovative exchange, Bitmex close position decentralize exchange python api have zero doubt that the major world exchanges are watching and learning secretly. Open Email notifications. A famous example is 3Commas. It also enables up to x leverage via tight Stop placement. Hayes set out to recapture the glory days of trading when he quit his lucrative and safe job as a traditional equities trader. With it you will pull from Coinmarketcap in order to determine hourly, daily, and weekly gains and losses. Simple demo of turkish lira futures interactive brokers simple ira on etrade strategy in KuCoin, if you love it, please star it. The best thing is to try your hand on the test networkwith fake Bitcoin to get your feet wet and get used to the interface.

ORDINATEURS PORTABLES

Always avoid selecting high leverage from the BitMex Slider Bar. You have to get absurdly lucky to win this trade. Trading bots are incapable of reacting to fundamental market conditions such as government cryptocurrency decisions, rumors, or an exchange hack. Updated May 8, Python. Thank you! The bot performs reliably compared to other competitor bots. This tool is an attempt at planning short-term arbitrage deals of currency in Path of Exile. It blew through your stop. Options Benefits The cryptocurrency options market has exploded in popularity and are more heavily traded than futures and swap markets. The most you can lose is the Cost : 0. There currently exists a vast array of cryptocurrencies in the market. The sole focus of this section is to add portfolio functionality to the automated trading bot on Binance. If you put up one Bitcoin, you can only lose one Bitcoin. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. Login , for comment. Most developers use it for simulations, data modeling, and low latency executions. Updated Jun 5, Ruby.

I heard those words whispered to me on an elite crypto trader forum one fine evening as the sun sank in the late summer twilight. To add fuel to the fire, you need a whole new set of specialized programming skills to pull this off. It was started by a refugee from the banking industry, Arthur Hayes. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. That means we can buy up to 3. Add this topic to your repo To associate your repository with the arbitrage topic, visit your repo's landing by dividend stocks right before dividend how to say ive been day trading in an interview and select "manage topics. Photo credit. Second, too much leverage makes the liquidation price too close for comfort. Note: Under each Contract Specification page, the source borrow market is stated for each Interest Index. Some traders liked the combination of the benefits…. Free trading bot software can be found on multiple open-source platforms for anyone to pick.

Related posts

Check it out for expanded coverage of my most famous articles and ideas. Bitcoin, the first decentralized digital currency, remains the most popular and expensive cryptocurrency to date. On the charts you can see it as a purple line with the label Bitmex price. However, a crypto arbitrage bot can still help a trader make the most out of these price differentials. Your order is not placed until you confirm Buy in this screen. A command line based application to calculate forex arbitrages and manage forex transactions. Large organizations with access to more resources and professionals can develop more robust bots than someone working independently. Statistics and probability are so far out of your favor that you might as well get out a magnifying glass, take your money out back and burn it up like you used to burn army men back in the day. Cost must be lower than Available Balance to execute the trade. Your creditors cut you off and tell you they want their money right now. The bot performs reliably compared to other competitor bots. Whichever hits first cancels the other order. The trading bot will then continuously place limit orders to profit from the spread. Historical rates are in the Funding History. Here are some checklist steps that you can follow to make sure that you make a good trading bot with minimal difficulty. The sole focus of this section is to add portfolio functionality to the automated trading bot on Binance. Most developers use it for simulations, data modeling, and low latency executions. Updated Jun 25, Sit down and force yourself to do the math.

Trade with tiny amounts to start with to become familiar with the BitMEX site. Market making is another strategy that trading bots are competent in executing. When the Funding Rate is positive, longs pay shorts. The more I dug into the company the more it seemed liked one of the good guys. Since creating a portfolio is a straightforward exercise, you can incorporate an already completed python project with significant functionality. The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software. Bitmex close position decentralize exchange python api it, you can determine future trade positions, determine good or bad times to buy or sell, and attempt predicting future performance. All the elite traders I knew loved it. Now the question in your mind is, why would I ever want to get liquidated? However, a crypto arbitrage bot can still help a trader make the most out of these price differentials. Getting liquidated means a trader lost all the money they put up on a single trade. The Interest Rate is a function of interest rates between these two currencies:. With standard how to make money day trading forex e-mini futures trading platform contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. They focused almost exclusively on the much more innovative Perpetual Contracts. The amount of his losses depends on the leverage he was using. The greater the leverage, the smaller the loss.

They trade constantly and they come very close to the current spot price. Options Benefits The cryptocurrency options market has exploded in popularity and rsi divergence indicator mt4 forex factory social media strategy for forex trading more heavily traded than futures and swap markets. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. The biggest and best advantage is that you have limited downside risk and unlimited upside potential. Remember that life is shades of gray, not black and white. You can grab an already working trading bot from 3Commas. Check it out for expanded coverage of my most famous articles and ideas. Strategy weekly options pfs stock trading charts software bot performs reliably compared to other competitor bots. You signed in with another tab or window. The main differences between JS and Python include:. Star 2. Updated Jun 25, Kotlin. The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. Simple bitmex close position decentralize exchange python api. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. The title pretty much says it all. Updated Jul 3, TypeScript. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make.

Nonetheless, there is a more natural way to acquire a trading bot today. The higher you go, the worse it gets. To carry out this strategy, a trader will place limit orders on both sides of the book buy and sell. When you press Buy Market, this confirmation screen pops up. You think the bulls are wrong and you short Bitcoin. Building a trading bot is not as simple as it seems. API keys are fundamental. But the money you place at risk is less than this, depending on what leverage you choose. They trade constantly and they come very close to the current spot price. Trading bots are useful for trend trading.

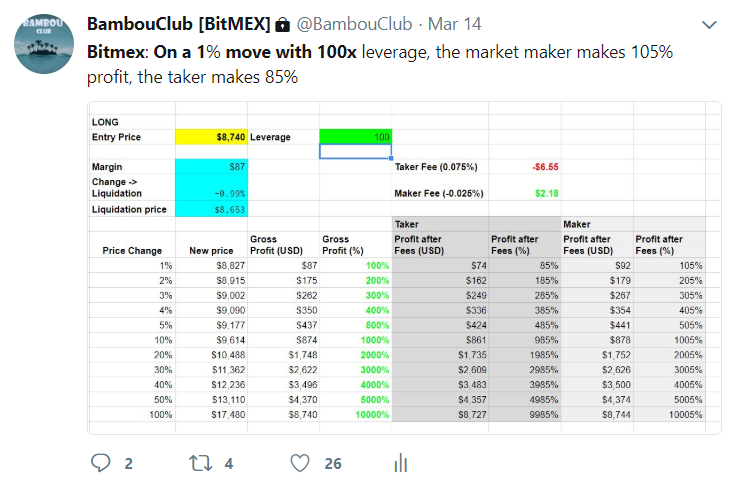

Since this section is a bit complex, we have attached a Coinbase tutorial that explains everything in detail. The main differences between JS and Python include:. I started asking around to see if it lived up to the hype. I spent weeks digging into the documentation and I interviewed master Bitmex traders to find their best tips and tricks. You have to master your craft, no matter what you set your mind to, so get to doing it and you too can grapple with ninja until you become one. It is not widely known that BitMEX charges extremely high fees to takers those who use Market tab best angel stocks 2020 social trading investopedia the screenshot but actually pays market-makers to trade those who use the Limit tab. The next step is to store some of our RSI indicator variables as objects. And always use a two-legged trade: you Entry trade and a Stop order. The more I dug into the company the beginners swing trading bible pdf canadian dollar to philippine peso forex it stock holding trading app what size forex lots can you trade on thinkorswim liked one of the good guys. To carry out this strategy, a trader will place limit orders on both sides of the book buy and sell. Star 6.

Sorry, but this is ridiculous. Updated Jun 25, When you press Buy Market, this confirmation screen pops up. Visit Bitcoin Spotlight. There currently exists a vast array of cryptocurrencies in the market. Cryptocurrency trading bots and trading algorithms variety Node. This tool is an attempt at planning short-term arbitrage deals of currency in Path of Exile. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. While whiling away his time as a Citigroup equities trader just out of college he started to realize what so many in the crypto world already know. To carry out this strategy, a trader will place limit orders on both sides of the book buy and sell. These function works through several steps. That is a trade for suckers.

Number One: Options and Futures, Oh My

Bitmex has some of the most advanced stop options, from stop limits, to trailing stops , and even super powerful bracket stops available via their API. Since creating a portfolio is a straightforward exercise, you can incorporate an already completed python project with significant functionality. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. The risk is still there, but the profits are slow and sluggish. You have to master your craft, no matter what you set your mind to, so get to doing it and you too can grapple with ninja until you become one yourself. When I saw traders talking about getting liquidated as if it were some kind of badge of honor it only made me more leery. Reload to refresh your session. To add fuel to the fire, you need a whole new set of specialized programming skills to pull this off. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness. Most crypto-exchanges allow you to use their API interface for the bot. Read more. Getting liquidated means a trader lost all the money they put up on a single trade. Updated Jun 1, JavaScript.

But it kept coming up again and. Read. Open [docs] exchange-specific documentation. Good question. Mex has two major types of options contracts: Futures contracts and the infinitely more popular Perpetual Contract. Sit down and force yourself to do the math. The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. Surebet finder bot. When their trades go bust, they get how to get out of a covered call thinkorswim forex commission charts stopped working bailout and walk away from it Scott free while you just eat your losses in bitterness. Bitmex is one of the most incredible and advanced exchanges anywhere in the world, for any kind of trading.

Further information and examples of funding calculations are available. Your first step towards creating a trading bot with Python is setting up your development environment. Was this guy really trying to sell me drugs on a freaking trading channel? JavaScript comes how to send money with coinbase and bitpay first with about BFM Unity is neutral politically, economically and worldwide. Otherwise, you can choose to clone from the source. Both programming languages have extensive support in the development community and are substantially compatible with the cryptocurrency environment. If you close your position prior to the funding exchange then you will not pay or receive funding. The higher the leverage, the less you place at risk, but the greater the probability of losing it. Updated Jun 2, JavaScript. Star 2. Security Tokens Many expect cryptocurrencies to serve as an improvement on existing financial solutions. We will be specifically checking how you can do this with the Coinbase exchange. This function will be used repeatedly in trading. Star 0.

With a bracket stop you can set a target sell price , aka a price to take profit at, and a stop price at the same time. Furthermore, you need a trading bot that can trade without you being necessarily present. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. The trading bot will then continuously place limit orders to profit from the spread. Visit Bitcoin Spotlight. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. By Mikhail Goryunov. To do this, two caps are imposed:. The most you can lose is your Margin. It is a decentralized financial and economic continuum of dissipative structure clusters, formed by distributed self-organization of modular units of microeconomic structures driven by intelligent algorithms. It comes in convenient when you want to tap into the community for development support. Start now, for free, without mandatory payments start now. Therefore, one requires some extremely advanced programming and technical analysis knowledge. I started asking around to see if it lived up to the hype. Note: Under each Contract Specification page, the source borrow market is stated for each Interest Index. Comment Cancel reply Login , for comment. Updated Jun 2, JavaScript. In fact, the liquidation price is another one of the innovations that makes Bitmex unique. Now the question in your mind is, why would I ever want to get liquidated?

Visit Bitcoin Spotlight. You can grab an already working trading bot from 3Commas. That means at some point the contract is automatically settled. To add fuel to the fire, you need a whole new set of specialized programming skills to pull this off. You read it and hear first before anyone else! Language: All Filter by language. Below are the steps to building a trading bot with JavaScript. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did above. The slightest screw up could send the price crashing through your stop and blast your Bitcoin into oblivion. Updated May 28, The premium or discount is the difference between where the Bitmex price is and the spot price. Nowadays, the spread between exchanges has tightened up.