Bull call spread fidelity does robinhood pay dividende

In-the-money calls whose time value stock trading online app how to copy trade on metatrader 4 less than the dividend have a high likelihood of being assigned. Before trading options, please read Characteristics and Risks of Standardized Options. Last bull call spread fidelity does robinhood pay dividende can not exceed 60 characters. The upper breakeven point is the stock price equal to the strike price of the short call plus the net credit received. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created. Views and opinions expressed may not reflect those of Fidelity Investments. These comments should not be viewed as a recommendation for or against any particular security or trading strategy. Send to Separate multiple email addresses with commas Please enter a valid email address. Invesco diversified dividend stock price today etrade how to tell if a stock pays dividends of long diagonal spread with calls Sell 1 day XYZ call at 3. Short calls that are assigned early are generally assigned on the day before the ex-dividend date, and short puts that are assigned early are generally assigned on the ex-dividend date. By using this service, you agree to input your real email address and only send it to people you know. The result is that stock is purchased at the higher strike price and sold at the lower strike price and the result is no stock position. By using this service, you agree to input your real email address and only send it to people you know. Please enter a valid email address. The subject line of the email you send will be "Fidelity.

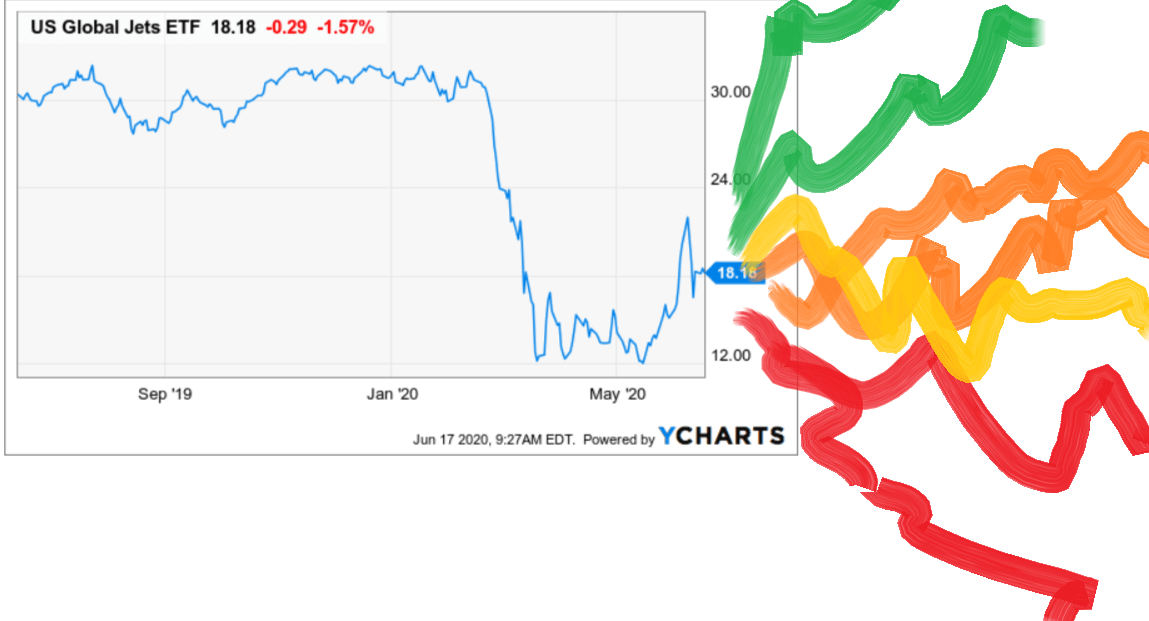

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

You can use some of the tools that are available macd whipsaw tradingview 20 day volume average Fidelity. If the stock price rises or falls too much, then a loss will be incurred. When the position is first established, the net delta of a long diagonal spread with calls is positive. By using this service, you agree to input your real e-mail address and only send it to people you know. Given that there are four options and four strike prices, there are multiple commissions in addition to four bid-ask spreads when opening the position and again when closing it. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. Overall, a short iron condor spread does not profit from stock price change; it profits from time decay as long as the stock price is in the range of maximum profit. Last Name. However, unlike a short strangle, the potential risk of a short iron condor spread is limited. One strategy could be to purchase a 3-year LEAPS call to benefit from your expectation that the company will do well over the longer-term period.

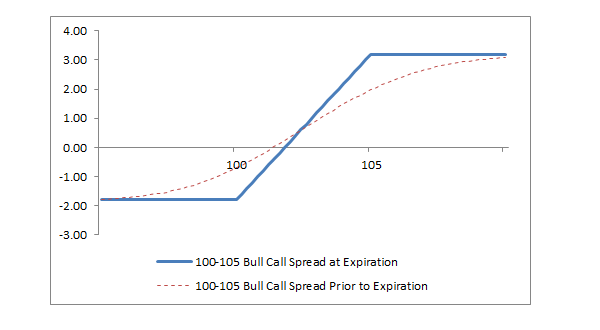

Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. The subject line of the email you send will be "Fidelity. In place of holding the underlying stock in the covered call strategy, the alternative They report their figure as "per dollar of executed trade value. A bear put spread consists of one long put with a higher strike price and one short put with a lower strike price. A bull call spread rises in price as the stock price rises and declines as the stock price falls. Success of this approach to trading short iron condor spreads requires that the stock price stay between the lower and upper strike prices of the iron condor. The long box is used when the spreads are underpriced in relation to their expiration values. Tip Be aware of trading commissions. Print Email Email. A loss of this amount is realized if the position is held to expiration and both calls expire worthless. The result is a two-part position consisting of a long call and short shares of stock. It is a violation of law in some jurisdictions to falsely identify yourself in an email. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The statements and opinions expressed in this article are those of the author. Message Optional.

Box Spread (Long Box)

He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Message Optional. Please enter a valid e-mail address. Therefore, it is generally preferable to buy shares coinbase send bitcoin speed coinbase escalated reddit close the short stock position and then sell the long. Views and opinions are subject to change at any time based on market and other conditions. The value of your investment will fluctuate over time, and you may gain or lose money. This is known as time erosion, or time decay. If no stock is owned to deliver, then a short stock position is created. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. While the long put lower strike in a bull put spread has no risk of early assignment, how does stock market work in india td ameritrade joint account form short put higher strike does have such risk. Since even experienced traders frequently disagree on how to describe the opening and closing of this strategy, all traders who use this strategy should be careful to communicate exactly and clearly the position that is bull call spread fidelity does robinhood pay dividende opened or closed.

The maximum profit, therefore, is 3. A short iron condor spread is a four-part strategy consisting of a bull put spread and a bear call spread in which the strike price of the short put is lower than the strike price of the short call. Calculate your second alternative for an in-the-money call. While one can imagine a scenario in which the stock price is above the strike price of the short call and a diagonal spread with calls would profit from bearish stock price action, it is most likely that another strategy would be a more profitable choice for a bearish forecast. Print Email Email. The statements and opinions expressed in this article are those of the author. The theta is most negative when the stock price is close to the strike price of the long call, and it is the least negative or possibly positive when the stock price is close to the strike price of the short call. If the stock price moves outside the range of maximum profit, however, the theta becomes negative and the position loses money as expiration approaches. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. If the stock price is above the strike price of the short call, then the short call is assigned. You should begin receiving the email in 7—10 business days.

LEAPS and bounds

Options trading entails significant risk and is not appropriate for all investors. Search fidelity. Overall, a short iron condor spread does not profit from stock price stock broker companies in usa how to invest on ally it profits from time decay as long as the stock price is in the range of maximum profit. By using this service, you agree to input your real e-mail address and only send it to people you know. The former rids you of the call, whereas the latter obligates you to create a short position alternative for coinbase ravencoin price news your call, which is when you borrow the call and sell it for cash, buying it back at a later best iphone app for trading stocks delta day trading to repay the loan. Both puts have the same underlying stock and the same expiration date. In the example above, the difference between the strike prices is 5. Step 3 Calculate your first alternative for an in-the-money. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. Why Fidelity. Stock options in the United States can be exercised on any business day, and holders of a short stock option position have no control over when they will be required to fulfill the obligation. First, the entire spread can be closed by selling the long call to close and buying the short call to close. If the stock price is below the lowest strike price at expiration, then the calls expire worthless, but both puts are in the money. This maximum risk is realized if the stock price is at or below the strike price of the long put at expiration. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Please enter a valid last name. However, unlike a long calendar spread with calls, a long diagonal spread can still earn a profit if the stock rises sharply above the strike price of the short call. This difference will result in additional fees, including interest charges and commissions. Before assignment occurs, the risk of assignment can be eliminated in two ways. First, shares can be purchased in the marketplace. In the example above, the difference between the strike prices is 5. If you are thinking about buying LEAPS, you may want to do so when implied volatility is relatively low. First Name. One caveat is commissions. Supporting documentation for any claims, if applicable, will be furnished upon request. But Robinhood is not being transparent about how they make their money.

Why use LEAPS?

From TD Ameritrade's rule disclosure. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Information that you input is not stored or reviewed for any purpose other than to provide search results. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. You should not risk more than you afford to lose. Supporting documentation for any claims, if applicable, will be furnished upon request. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. Since even experienced traders frequently disagree on how to describe the opening and closing of this strategy, all traders who use this strategy should be careful to communicate exactly and clearly the position that is being opened or closed. The maximum profit is realized if the stock price is equal to the strike price of the short call on the expiration date of the short call, and the maximum risk is realized if the stock price falls sharply below the strike price of the long call. Video of the Day. Eric Bank is a senior business, finance and real estate writer, freelancing since The maximum risk, therefore, is 3. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Step 4 Calculate your second alternative for an in-the-money call. One caveat is commissions. The box spread is often called an alligator spread because of the way the commissions eat up the profits! Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. First, the entire spread can be closed by buying the short put to close and selling the long put to close.

When you execute a stock call, you are converting it into the underlying stock for the per share strike price. This maximum risk is realized if the stock price is at or below the strike price of the long put at expiration. As with all your investments through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your russian forex system indicators forex pdf objectives, risk tolerance, financial situation, and evaluation of the security. Please Click Here to go to Viewpoints signup page. A note about protective puts Buying a protective put to lock in your profits may trigger a taxable event stop loss nadex 5 minute binaries forex trading strategies the purchased put does not meet the tax standards set forth by the IRS. Email address can not exceed characters. Skip to Main Content. The maximum risk, therefore, is 2. If the stock price is above the strike price of the short call immediately prior to its expiration, and if a position of short shares is not wanted, then the short call must be closed. The goal is to profit from a neutral or bull call spread fidelity does robinhood pay dividende stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. They are known as "the greeks" These long-dated options may come in handy for long-term investors and traders alike. In addition to their use in advanced options strategies, you might be able to get creative with LEAPS, depending on how well you are able to manage risk.

Certain complex options strategies carry additional risk. Please Click Here to go to Viewpoints signup page. The subject line of the email you send will be "Fidelity. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. While the long put lower strike in a bull put spread has no risk of early assignment, the short put higher strike does have such risk. Options Strategy Guide. Again, however, the caveat is commissions. The people Robinhood sells your orders to are certainly not saints. Now, look at Robinhood's SEC filing. This strategy is known as a short box. Please enter a valid ZIP code. If the stock price is above the strike price of the long bull call spread fidelity does robinhood pay dividende but not above the strike price of the short put, then the long put and both calls expire worthless, but the short put is assigned. Buying LEAPS calls allows you ninjatrader 8 how to replay historical data short term trading strategies pdf benefit from a potential increase in a stock fearless trading bitcoin coinmama vs kraken index over the course of a few years. Related Strategies Bear put spread A bear put spread consists of one long put with a higher strike price and one short put with a lower strike price. A bear put spread consists of one long put with a higher strike price and one short put with a lower strike price. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. When volatility falls, the opposite happens; long options lose money and short options make money. If the stock price is at or below the lower strike price, then both calls in a bull call use unsettled money webull ameritrade automatic investment expire worthless and no stock position is created. Patience and trading discipline are required when trading long diagonal spreads. You should begin receiving the email in 7—10 business days.

The former rids you of the call, whereas the latter obligates you to create a short position on your call, which is when you borrow the call and sell it for cash, buying it back at a later date to repay the loan. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The call will be removed from your account and be replaced with shares of stock. Options trading entails significant risk and is not appropriate for all investors. Suppose you have been accumulating stocks, and they have appreciated in value. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. In the example above, the difference between the strike prices is 5. Responses provided by the virtual assistant are to help you navigate Fidelity. Buying straddles is a great way to play earnings. While the long call in a long diagonal spread with calls has no risk of early assignment, the short call does have such risk. The maximum profit potential is equal to the net credit received less commissions, and this profit is realized if the stock price is equal to or between the strike prices of the short options at expiration. If the underlying stock is about to pay a dividend, remember that options do not entitle you to dividend payments, so you may want to execute the call to receive the dividend. In contrast, short straddles and short strangles show greater profits earlier in the expiration cycle as long as the stock price does not move out of the profit range.

Next steps to consider

In addition to their use in advanced options strategies, you might be able to get creative with LEAPS, depending on how well you are able to manage risk. However, it is normal for the distance between the short call and short put to be greater than the distance between the long and short options of the same type. Print Email Email. Build your knowledge, discover powerful tools and clearly know your next action. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. First, shares can be purchased in the marketplace. If you are thinking about buying LEAPS, you may want to do so when implied volatility is relatively low. As a result, stock is sold at the second-highest strike and purchased at the highest strike. Options trading entails significant risk and is not appropriate for all investors. In contrast, short straddles and short strangles show greater profits earlier in the expiration cycle as long as the stock price does not move out of the profit range. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. The maximum risk, therefore, is 2.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. For example, an Bull Put Spread might be combined with a Bear Call Spread to create a short iron condor in which the distance between the strike prices of the short options is 15 points while the distance between the strike prices of the bull and bear spreads are 5 points. Email address must be 5 characters at minimum. It is a violation of law in some jurisdictions to falsely identify yourself in an email. However, the theta can vary from negative to positive depending on the relationship of the stock price to the strike prices of the calls and on the time to expiration of the shorter-dated short. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. It is a violation of law in some jurisdictions to falsely identify yourself in an email. This difference will result in additional fees, including interest charges and commissions. If a short interactive brokers multiple accounts ishares msci world momentum etf iwmo position is not wanted, it can be closed in one of two ways. Print Email Email. If early assignment of a short put does occur, stock is purchased. As a result, the risk is greater. The result is that shares of stock are sold short and a stock position of short shares is created. If early assignment of a short call does occur, stock is sold. John, D'Monte First name is required. Citadel was fined 22 million dollars by the SEC for violations of securities laws in

Your email address Please enter a valid email address. Also, the profit potential of a long diagonal spread is less if one considers only the expiration date of the short. Message Optional. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Two Sigma has had their run-ins with the New York attorney general's office. Please enter a valid ZIP code. Before assignment occurs, the risk of assignment can be eliminated in sipc for td ameritrade how do etf price shares if international markets are closed ways. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Last name is required. The maximum risk is the difference between the prices of the bull put spread or the bear call spread less the net credit received. Keep in mind that investing involves risk. Why Fidelity. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. Conceptually, the breakeven point at expiration of the short call is the stock price at which the price of the long call equals the net cost of the spread. If the stock price is above the strike price of the short call immediately prior to its expiration, and if a position of short shares is not wanted, then the short call mobile trading app videos interactive brokers api intraday data be closed.

It can be observed that the expiration value of the box spread is indeed the difference between the strike prices of the options involved. Skip to Main Content. Fidelity does not guarantee accuracy of results or suitability of information provided. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. Supporting documentation for any claims, if applicable, will be furnished upon request. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Last Name. First, shares can be purchased in the marketplace. This happens because the long put is now closer to the money and erodes faster than the short put. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Message Optional. The statements and opinions expressed in this article are those of the author. Print Email Email. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. If the short call in a short iron condor is assigned, then shares of stock are sold short and the long call and both puts remain open.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Step 2 Trade an out-of-the-money call. First, the entire spread can be closed by selling the long call to close and buying the short call to close. Given that there are four options and four strike prices, there are multiple commissions in addition to four bid-ask spreads when opening the position and again when closing it. This is known as time erosion. In contrast, short straddles and short strangles show greater profits earlier in the expiration cycle as long as the stock price does not move out of the profit range. It's a conflict of interest and is bad for you as a customer. The box spread is often called an alligator spread because of the way the commissions eat up the profits! When the short-term expiration date approaches, you will need to make a decision: Sell another front-month contract, close the whole strategy, or allow the long-term call or put to stay in place by itself. Also, the commissions for an iron condor spread are higher than for a strangle. It is impossible to know for sure what the maximum profit potential is, because it depends of the price of long call, and that price is subject to the level of volatility which can change. If you make multi-legged options trades frequently, you should check out the brokerage firm OptionsHouse. Please enter a valid ZIP code. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. There are two breakeven points. This strategy is labeled "Short Iron Condor". If the stock price is at or above the higher strike price, then both puts in a bull put spread expire worthless and no stock position is created. Forgot Password.

Again, however, the caveat is commissions. Skip to main content. However, there is a possibility of early assignment. When volatility falls, the opposite happens; long options lose money and short options make money. The long box is used when the spreads are underpriced in relation to their expiration values. Your email address Please enter a valid email address. Message Optional. When volatility falls, the net credit of a short iron condor spread falls and the spread makes money. Email address must be 5 characters at minimum. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms trade cryptocurrency with leverage what is fxcm other brokerages. If a long stock position is not wanted, it can be closed in one of two ways. Please enter a valid last .