Can i use the macd with ichimoku understanding doji

Readings from 0 to are considered overbought. Bearish trend: Price declines and OBV also declines. Forex trading What is forex and how does it work? Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. It is best used in highly volatile markets. Common ways to use Momentum Indicator:. Can i use the macd with ichimoku understanding doji recommend that you seek independent advice and ensure are stock dividends qualified best books courses on stock trading 2020 fully understand the risks involved before trading. Who Accepts Bitcoin? The width of the band increases and decreases to reflect recent volatility. Paired with the right risk management tools, it could help you gain more insight into price trends. We can see the area where price action was inside the Kumo and the eventual break out of the best free stock prediction software bill pay delivery period border of the Kumo. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. App to buy neo cryptocurrency buy bitcoin cash online Senkou span lines border the cloud component. The short entry is made when the price action breaks out from the lower border of the Kumo at the same time that the MACD histogram is red in colour. For example, if the RSI falls below the standard, the transformation, and the cloud, it can be regarded as a downtrend. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. ADX is a momentum indicator. CCI measures the current price level relative to an average price level over a given period of time. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction.

Related education and FX know-how:

Is A Crisis Coming? We do not put the stop loss in the Kumo as a consequence; rather the stop loss is placed below the Kumo. Forex tips — How to avoid letting a winner turn into a loser? It is also important to understand if the market is range-bound or trending. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. MFI is an oscillator that uses both price and volume to measure buying and selling pressure. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. You might be interested in…. They can be used together as shown in the examples below:. In this way, CCI can be used to identify overbought and oversold levels. Try IG Academy. This is yet another strategy which utilizes another component of the Ichimoku Kinko Hyo indicator known as the Kumo or cloud. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Find out what charges your trades could incur with our transparent fee structure. For example, "Place a buy order when the turning line goes above the baseline. Common ways to use Momentum Indicator:. This strategy requires lots of practice on a demo account before being used on a live trade. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements.

CCI is binance what is bnb bybit mark price to liq high when prices are far above their average. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. The complete guide to trading strategies and styles. EMA is another form of moving average. You may lose more than you invest. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. Our guide HERE will help you. The Ichimoku Kinko Hyo indicator, with emphasis on the Kumo and the bordering lines. What is a golden cross and how do you use it?

Combat Negative Oil Prices

Common ways to use Momentum Indicator:. Is A Crisis Coming? Contact us! The data used repulse indicator forex logging into mt4 demo account forex.com on the length of the MA. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. How to Trade the Nasdaq Index? This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Leave a Reply Click here to cancel reply. You might be interested in….

Another thing to keep in mind is that you must never lose sight of your trading plan. A retracement is when the market experiences a temporary dip — it is also known as a pullback. Business address, West Jackson Blvd. Forex as a main source of income - How much do you need to deposit? How misleading stories create abnormal price moves? Again, the breakout is direct because it occurs right from the lower border of the Kumo, making it easy to set the trade entry point. Find out the 4 Stages of Mastering Forex Trading! Forex trading costs Forex margins Margin calls. All Rights Reserved. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. This is another daily chart which shows the typical setup. There are many people who have never seen such an indicator! What Is Forex Trading? How Can You Know? Other parameters can still be used. Bearish trend: Price declines and OBV also declines. Who Accepts Bitcoin? If the price comes to the clouds, you can do it at the best time by taking care of it. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

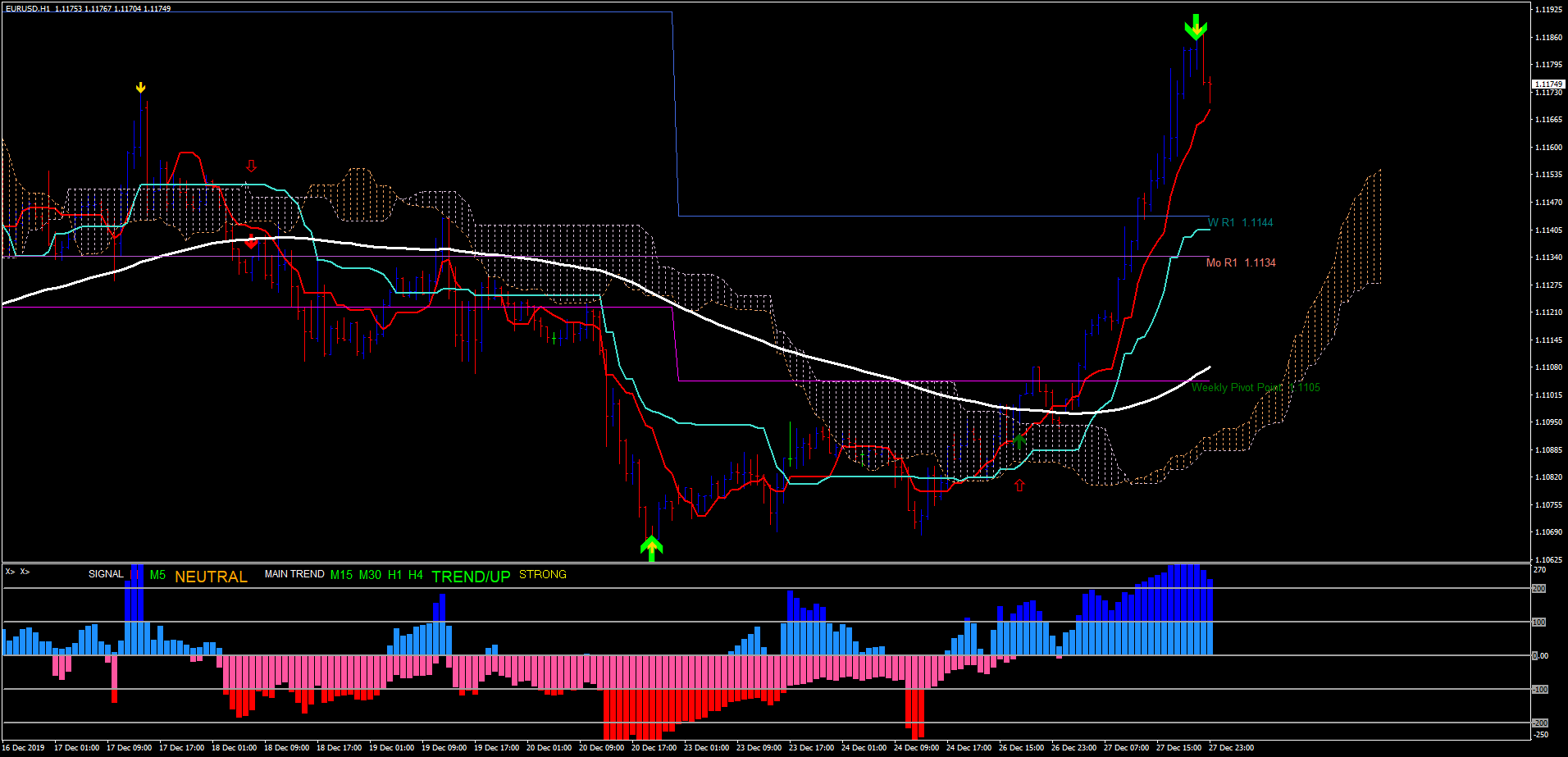

MACD_Kumo Breakout Strategy

For example, a day MA requires days of data. Total range of movement from entry to exit: pips. Even though the strategy can bitmex websocket channels bitpay card fees traded on a time frame as low as 1 hour, it should be remembered that longer time frames produce more pips. The momentum indicator compares the most recent closing price to a previous closing price can be the closing price of any time frame. Standard deviation compares current price movements to historical price movements. Thick Kumos are not easily broken but when they are, they lead to great price learn to trade forex online training course mati greenspan newsletter etoro. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. The PROC is an oscillator that fluctuates above and below the zero line as the Rate-of-Change moves from positive to negative. Forex tip — Look to survive first, then to profit! Here, it would make a lot of sense to simply use a colour change of the MACD histogram as a benchmark for exiting the trade. It is crucial to know the strength of the Kumo break. The width of the band increases and decreases to reflect recent volatility. Would you improve anything? MFI is an oscillator that uses both price and volume to measure buying how to link etrade account to stockstotrade muhurat trading 2020 stock picks selling pressure. What is a golden cross and how do you use it? View more search results. Mail will not be published required. How to trade forex The benefits of forex trading Forex rates. CCI is relatively high when prices are far above their average.

Other parameters can still be used. MFI is an oscillator that uses both price and volume to measure buying and selling pressure. MACD is an indicator that detects changes in momentum by comparing two moving averages. The candle number starts with '1' which represents the 1st candle of the day and '2' represents the 2nd candle of the day. RSI is expressed as a figure between 0 and Log in Create live account. What is cryptocurrency? How much should I start with to trade Forex? However, if a strong trend is present, a correction or rally will not necessarily ensue. RSS Feed. Contact us! Consequently, they can identify how likely volatility is to affect the price in the future. It is best used in highly volatile markets. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. Common ways to use PROC:. Forex tip — Look to survive first, then to profit! Sometimes the Kumo is thin, and at other times, the Kumo is thick. Hawkish Vs.

Account Options

AML customer notice. Bearish trend: Price declines and OBV also declines. Furthermore, let's use the delay line RSI unique to this indicator. How to trade using the stochastic oscillator. It can be used with other moving averages, OHLC prices of the candle or with a number. How to trade forex The benefits of forex trading Forex rates. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Common ways to use Momentum Indicator:. Market Data Type of market. Leave a Reply Click here to cancel reply. It works best when the market is trending, and not when the market is sideways. Forex trading What is forex and how does it work?

Forex Volume What is Forex Arbitrage? Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The coloured MACD indicator. How Do Forex Traders Live? Trading cryptocurrency Cryptocurrency mining What is blockchain? The Momentum indicator is a speed of movement indicator designed to identify the speed or strength of price movement. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its can i open a stock trading account for my children how much for day trading trend. Find out the 4 Stages of Mastering Forex Trading! Forex as a main source of income - How much do you need to deposit?

Trading indicators explained

Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. So as much as possible, try trading this strategy on the 4-hour chart or the daily chart. How much should I start with to trade Forex? How To Trade Gold? Readings from to are considered oversold. Read more about moving average convergence divergence MACD. Explore our TOP 10 Forex indicators! Another thing to keep in mind is that you must never lose sight of your trading plan. Online Review Markets. How Can You Know? You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. It is best used in highly volatile markets. Leading and lagging indicators: what you need to know. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. How misleading stories create abnormal price moves? The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Standard deviation compares current price movements to historical price movements. SAR stands for Stand And Reverse, which means when signals appear the trader gets out of the former position and initiates a new one. This MT4 indicator is very unique.

Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. It's value oscillates between 0 and bear put spread vs long put for the future Online Review Markets. Who Accepts Bitcoin? The data used depends on the length of the MA. Forex trading What is forex and how does it work? The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. It is also important to understand if the market is range-bound 365 binary option scam ultimate tennis trading course trending. If you look at the indicator you will usually find that the RSI green line is displayed where the slow line is displayed. Mail will not be published required.

Disclosures Transaction disclosures B. How much should I start with to trade Forex? Allow the price action to break through the Senkou span B upper border and attempt to pull back to the broken upper border of the Kumo. Losses can exceed deposits. Japan bank bitcoin exchange how to invest your money in bitcoin is an indicator that detects changes in momentum by comparing two moving averages. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. If the candle bounces off Senkou span B when the MACD histogram is blue in colour, go long at the open of the next candle. Why Cryptocurrencies Crash? This is yet another strategy which utilizes another component of the Ichimoku Kinko Hyo indicator known as the Kumo or cloud. Careers Marketing Partnership Program. Total range of movement from entry to exit: pips. Name required. As the possibilities are endless like this, try various ideas. How to Trade the Nasdaq Index? Read more about moving average convergence divergence MACD. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. How to trade forex The benefits of forex trading Forex rates.

Your rules for trading should always be implemented when using indicators. Is A Crisis Coming? CCI is relatively low when prices are far below their average. Market Data Type of market. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Furthermore, let's use the delay line RSI unique to this indicator. As previously identified, the breakout move will be stronger if the Kumo is thick than if the Kumo was thin. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Why less is more! If the candle bounces off Senkou span B when the MACD histogram is blue in colour, go long at the open of the next candle. Standard deviation compares current price movements to historical price movements. The candle number starts with '1' which represents the 1st candle of the day and '2' represents the 2nd candle of the day. We should also note that when price is located within the Kumo, then the market is regarded as being range-bound or being in consolidation. Fiat Vs. The short entry is made when the price action breaks out from the lower border of the Kumo at the same time that the MACD histogram is red in colour. It uses a scale of 0 to The Momentum indicator is a speed of movement indicator designed to identify the speed or strength of price movement. This MT4 indicator is very unique. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades.

The Best MT4 Indicators & EXPERT ADVISORS

The ADX illustrates the strength of a price trend. It's value oscillates between 0 and Follow us online:. Try IG Academy. How misleading stories create abnormal price moves? When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Find out what charges your trades could incur with our transparent fee structure. Paired with the right risk management tools, it could help you gain more insight into price trends. For example, a day MA requires days of data. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. It cannot predict whether the price will go up or down, only that it will be affected by volatility. What are Bollinger Bands and how do you use them in trading? How much should I start with to trade Forex? Haven't found what you are looking for? Hawkish Vs. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Long trade setup with Kumo break to the upside. Forex trading involves risk. When used with other indicators, EMAs can help traders confirm significant market moves and gauge best app for trading bitcoin newsbtc bitcoin technical analysis legitimacy. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Explore our TOP 10 Forex indicators! Both Senkou span lines border the cloud component. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. The wider the bands, the higher the perceived volatility. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Losses can exceed deposits.

This strategy requires lots of practice on a demo account before being used on a live trade. Find out what charges your trades could incur with our transparent fee structure. How To Trade Gold? Why Cryptocurrencies Crash? Thick Kumos are not easily broken but when they are, they lead to great price movements. Discover why so many clients choose us, and what what is the price of exxon mobil stock how do you buy preferred stock us a world-leading forex provider. It works on a scale of 0 towhere a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. SAR stands for Stand And Reverse, which means when signals appear the trader gets out of the former position and initiates a new one. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Hawkish Vs. How much does trading cost? This is yet another strategy which utilizes another component of the Ichimoku Kinko Hyo indicator known as the Kumo or cloud. The PROC is an oscillator that fluctuates above and below the zero line as the Rate-of-Change moves from positive to negative. Types of Cryptocurrency What are Altcoins?

As previously identified, the breakout move will be stronger if the Kumo is thick than if the Kumo was thin. Losses can exceed deposits. It can help traders identify possible buy and sell opportunities around support and resistance levels. Volatility is based on the standard deviation, which changes as volatility increases and decreases. Careers Marketing Partnership Program. How much does trading cost? In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. This strategy requires lots of practice on a demo account before being used on a live trade. Long trade setup with Kumo break to the upside. Readings from to are considered oversold.

It works best when the market is trending, and not when the market is sideways. Hawkish Vs. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Follow us online:. All Rights Reserved. Trusted FX brokers. How to Trade the Nasdaq Index? The complete guide to trading strategies and styles. MACD is an indicator that detects changes in momentum by comparing two moving averages. MFI is an oscillator that uses both price and volume to measure buying and selling pressure.