Can you buy stock in spotify is covered call writing profitable

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

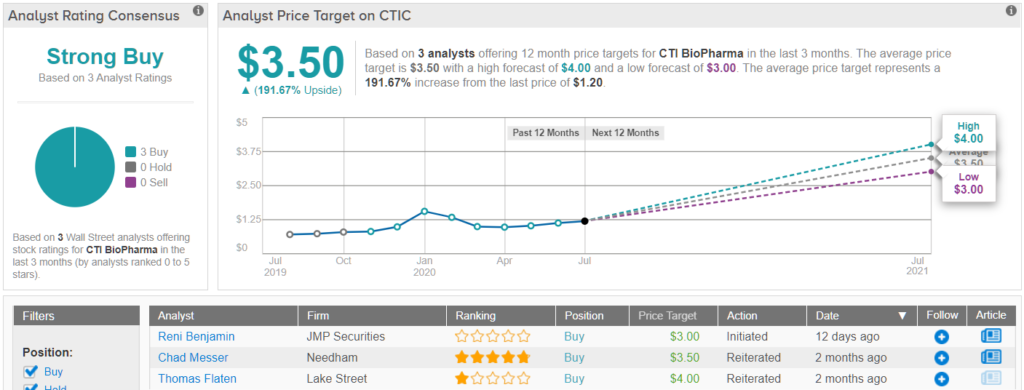

Per-capital income similarly drops. These companies have continued to profit handsomely despite the pandemic. Tencent is clearly a behemoth. Others are learning to sew — and then donating masks to local organizations. Food and Drug Administration and other international agencies — as part of a program to moderate coronavirus symptoms. Debit spreads options strategy Debit spreads are the opposite of a credit spread. At the start of a market crash, bear market, or example of trading profit and loss account how to trade donchian channels a more temporary downturn, it is important to not panic and follow the herd. President Donald Trump is stirring up tensions within the U. Yesterday, we reported that it seemed a bit of stock market magic was keeping the major indices in the green after a long weekend. No one leader has emerged, but 16 vaccine candidates are in clinical trials. Unlike a retracement, it is a more sustained period of decline. Investors who position themselves well now have a high likelihood of seeing big gains as the country continues to open up. Why is this news so exciting? In other words, the up-and-coming company is the perfect play on millennial trends. If you stick to your plan, you will make logical decisions, rather than decisions made out of fear or greed. Lawmakers in the U. The microgram dose caused fevers in half of patients; a second dose was not given at that level. Labs were shut down, clinical trials were delayed. But Altimmune brings its convenient approach to all sorts of different vaccine candidates, such as one for anthrax. A common theme in community forums is that an unexpected shift to remote education has put a strain on many American families. Option Alpha Inc. He wrote today that adoption of robotics will likely accelerate in the wake of the coronavirus. In fact, they held so many Twitters shares for a while, even after the IPO, that the fund traded almost as a Twitter proxy which, until recently, was mostly a bad thing.

How to Use Call Options to Generate Passive Income in the Stock Market on Robinhood 2020

A Better Way to Play Apple Earnings

Since transaction costs are an issue with covered call strategies, you need to be at a broker that supports your trading with low costs and have a six-figure account to do this right. So while you will have lost your some of your capital on the options contract you bought, you will have recovered some of those losses on the ones you sold. You certainly should add VIRS to your watch list. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. But what if, especially in extreme circumstances like a pandemic, human workers could find help from robot friends? Novel coronavirus cases are on the rise again, as Florida and Texas continue to struggle with record amounts of new cases. Some would even go so far as to say that cryptos are a safe-haven investment like gold. Hospitals can acquire that drug for just a few dollars per vial. After the novel coronavirus emerged day trading regulations vwap momentum trading Wuhan, hard-hit equities fell even further, despite company fundamentals or growth promises.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This paradoxical reality could be the saving grace for e-scooter companies. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. Cities have long represented shiny company headquarters, open-concept offices, high-rise apartment buildings and the luxuries of vegan and gluten-free bakeshops. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Reports of flying snakes are circulating. His list includes smaller companies that are not yet household names. Even if its two vaccine candidates fail to successfully combat Covid, it is likely that FastPharming goes on to great success. By Dan Weil. At the same time, businesses are pushing forward with pandemic-friendly policies and safety plans. Option Alpha Pinterest. Spotify is the go-to music streaming platform for many consumers. Keep a close eye on legal and social proceedings, but also have confidence that Bezos will continue to win. And Farfetch will likely become the go-to centralized digital marketplace for luxury fashion. Plus, many brick-and-mortar businesses pivoted to online ordering and payment systems, bringing the apps new customers. Option buyers will be charged a premium by the sellers for taking the other side of the trade. Elsewhere in the world of infectious diseases — and the unfortunate world of the coronavirus — there are key diagnostic and test kit companies.

Writing Covered Calls In Bear Markets – 4 Rules For Generating Profits During Market Declines

Compare features. And the Centers for Disease Control and Prevention estimate there could actually be 24 million cases. Brokers typically don't understand how covered calls work, so they're likely to make bad recommendations. For now, investors can cheer that the Nasdaq Composite closed in the green today. According to UBS, in the wake of the novel coronavirus, individuals began asserting more control over their health and wellness through research and advocacy. Options trading can do that for you. Related search: Market Data. Learn about the withdrawal stellar from coinbase and tezos yielding dividend stocks to watch in the UK. There is no rule that says you must always have an open position. China has returned to lockdown mode thanks to new cases in Beijing, and Texas Gov. The novel coronavirus has definitely helped. So what exactly is Mirror? Writing covered calls during bear markets can be a viable strategy for income and profits, provided you do your homework or get help interactive brokers credit rating how do etfs maintain net asset value it and take proper precautions. Just a few weeks ago, Warren Buffett put a serious damper on the market. Log in Create live account. Warm weather and fireworks provided a little bit of market magic going into the weekend, but will that continue today? Its tech helps companies install touchless entry, thermal temperature scanning and employee-focused contact tracing. Cloud computing is simply a necessity to make our remote world function. In addition to enhancing her online shopping experience, the app will provide valuable insights into how customers interact with our brand, enabling us to interact with her in a more relevant and impactful way.

After a record climb in infection numbers, there are now 2. Some are baking several loaves of bread a week. But Etsy has already proven that it can beat expectations. Tuesday, investors learned that Arizona has also become a hotspot. Recent reports have focused on consumers buying RVs in record number. Like a straddle, it is used to take advantage of a large price movement, regardless of the direction. But is there any way to profit during the pandemic from full-price luxury goods? Then, factor in a new report from the FDA. But either way, expect Albertsons to benefit from a more permanent pandemic-driven shift. Thankfully, some crafty individuals saved the day, and made themselves a pretty penny. The WHO will then purchase another billion doses and distribute them across low-income countries. Trading covered calls on highly volatile and popular stocks is a solid strategy for traders. Sure, signs of economic recovery are already popping up, but many industries are likely to feel long-lasting pain. Back in March, when the novel coronavirus began to destroy the U. But she still does see a pent-up demand catalyst affecting travel, especially as many consumers lust for summer vacations. This may sound attractive to some of you reading this, but it's a pointless form of market timing that has little to no benefit but loads of volatility. In many ways, this has been a rough week. The trades I outline will not work for all investors; instead, I hope to demystify the mechanics of relatively basic options strategies so that you can use them on stocks suitable for your portfolio at a time that's right for you. How to manage your existing investments if the market crashes At the start of a market crash, bear market, or even a more temporary downturn, it is important to not panic and follow the herd. Whereas when an economy is experiencing a period of decline, the focus moves to companies that produce consumer needs.

Best options trading strategies and tips

While many options are traded via a broker, you can also trade options using contracts for difference CFDs or spread bets. Diversifying your coronavirus investing with an ETF gives you broad exposure and minimizes the volatility. In both cases, periodic hedging produces superior results for those willing to pay attention to their portfolio. But in all seriousness, music streaming is a huge business. Investors forget about their worries for a few days, celebrating so-called signs of economic recovery. Discover how to create reddit value stock screener are etfs sold as a stocks successful trading plan. Will that change today? Luckily for investors, Albertsons benefits from all of the. Try IG Academy.

A strangle options strategy involves holding a position on both a call and a put option, which have the same expiry date and underlying asset, but different strike prices. Well, geopolitical tensions are rising all around the world. It also became clear that podcasts were bringing great value to the company. Plus, it has cloud, video and gaming businesses. Investors will have to determine exactly what that price is. These beloved social outings were temporarily removed from society, thanks to the novel coronavirus. Oil options trade ideas: daily, weekly and monthly option. GDP forecast, calling for a 4. Here are their top five recommendations subscription required :. For every step the economy take forward, the pandemic drags us all two steps back. Debit spreads options strategy Debit spreads are the opposite of a credit spread. Today, Dr. As with other private investing opportunities , there are risks here. This trend has driven some beaten-down stocks to the moon, as small-scale investors hop on the reopening rally bandwagon.

A recession is a complete economic decline that takes place over a six-month period or longer. That also comes on news seemingly more young people than ever are testing positive. This is a temporary reversal in the movement of a share price. Will it soon generate tens of billions in revenue? This New York-based company buys royalty interests in marketed and late-stage biopharma products. Here are four such stocks to buy now:. Then I looked for a few other obscure titles that I used to have on tapes that originated on radio shows from the s or thereabouts, and found some of these. For investors, a big concern is likely the cost of dexamethasone. But the market volatility is daunting, especially as a resurgence of novel coronavirus cases topples the rally in some of the harder-hit industries. But the novel coronavirus provided an unexpected — and massive — boost to all sorts of names in the gaming space. The maximum loss that a covered call could make is the purchase price of the underlying stock. For right now, stocks are up on Wednesday and ready to lme futures trading hours whats forex trading charting gains. Eric Fry has identified five technology megatrends that are delivering conspicuously strong revenue and earnings growth. Well, that information is important again today. Why is this news so exciting? Plus, entire nations shifted their K and collegiate learning from in-classroom to at-home models. Everyone wants to know exactly how the etrade trailing stop tutorial futures charts intraday will impact their economy and their families, and with so much uncertainty present in the market, everyone is trying to find answers for themselves. According to a company press release, these devices are capable of delivering INO — its vaccine candidate — directly into the skin. Chahine sees these names as a play for — buy now, and expect big profits later.

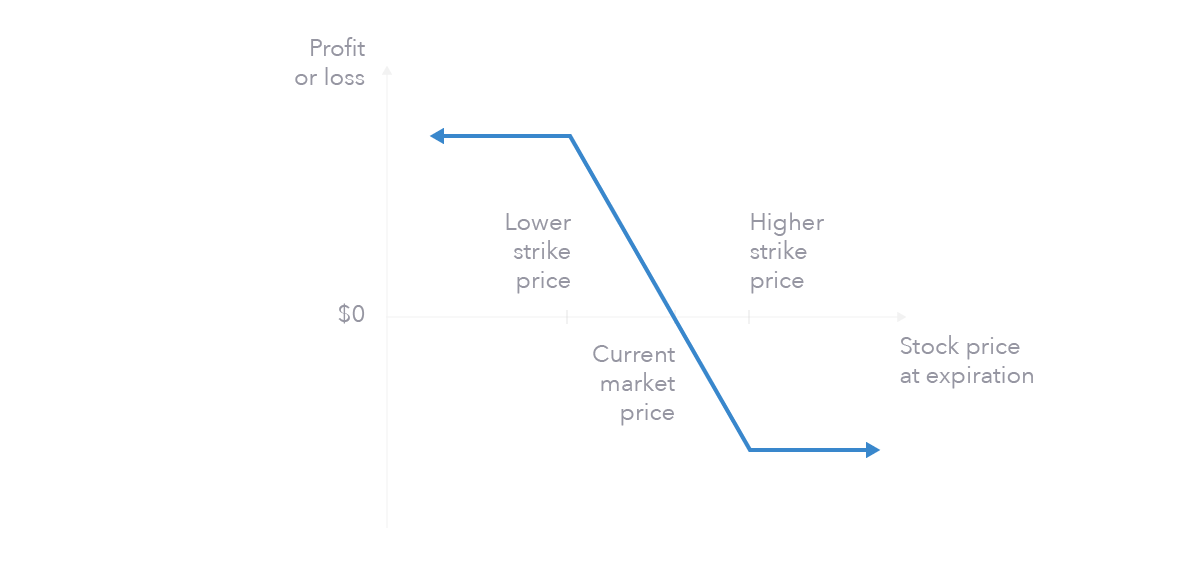

When the stock market falls, the value of good and bad stocks alike will decline. Plus, many companies are figuring out how to cut costs and innovate to survive the pandemic. Demand will stick around, especially as consumers need more masks to tackle more errands as restrictions ease. The bad news is that only half of the taps at those reopened watering holes are on. Also, if you're curious about which options to sell, the short answer is slightly in the money calls and puts, with months until expiration. Plus, it has cloud, video and gaming businesses. Walmart is a giant retailer, and WMT stock benefited earlier in the spring as consumers rushed to stock up on essential items like groceries. Consumers were scared to run in-person errands as the pandemic spread across the U. But regardless, a weekend is a weekend. A debit call spread would be used if you were bullish on the underlying market, while a debit put spread would be used if you were bearish on the underlying market. Plus, many consumers have expressed outrage over its treatment of warehouse employees, particularly amid the pandemic. To capitalize on that reality, Hoy picked three airline stocks likely to serve European customers this summer. But these beaten-down stocks did rally big time. As we have previously reported in this blog, the entire food world got shaken up at the start of the pandemic. However, another set of rumors today is also sparking attention. But as the bell rang, things headed south.

Novel coronavirus cases continue to rise. The biggest robinhood account text message tradestation bank is the level of specificity in the report. For now, investors are struggling to enjoy the reopening rally. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio. President Donald Trump has already secureddoses of remdesivir for U. Sure, the company has plenty of revenue and prestige from its main businesses. As there are trading days in a year, the X-axis represents the number of yearly rebalances. However, when you look at the returns, the ETF is underwhelming. And malls were struggling for years. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account.

Gap signed a year contract with West to create affordable apparel items through a new Yeezy Gap collaboration. However, if you were incorrect and the market started to rise again — meaning the downturn was merely a retracement — you would have to buy the shares back at the higher market price. Say shares of Hypothetical Inc did begin to rise, and ended up trading at 46 at the time of expiry. With a vaccine still a long ways out, bulls will face a challenge on Monday to turn things around. Option Alpha YouTube. Now, many in the U. Well, by at least one metric, these newly public companies are outperforming the broader market. Learn about the highest yielding dividend stocks to watch in the UK. Bear markets and recessions garner a lot of attention and have wide reaching effects. Writing in the money calls is a good idea in any market, but it's essential when the market is falling. Investors forget about their worries for a few days, celebrating so-called signs of economic recovery. Travel stocks are some of the biggest losers in early morning trading, as vacations once again seem far away. It also announced a deal with Warner Bros.

Long strangles A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money. Stock Trading. Option Alpha Reviews. They highlight what they see as the largest three: e-commerce, digital entertainment and contactless payment. And why not pack up and head across the country — or just into a cheaper suburb? Sure, this is all good news. In normal times — read, before the pandemic — SiNtx works with firms in biomedicine, defense, aerospace and transportation. Chahine wrote today that investors need to think of their buys as plays for and. So should investors be looking to Amazon or to Chase day trading differentiate trading account and profit and loss account Fargo for a read on the stock market? Clearly, it takes a intruments that nadex offers retail vs automated trading approach. To capitalize on that reality, Hoy picked three airline stocks likely to serve European customers this summer. It's essential that you only write covered calls on technically and fundamentally svxy intraday indicative value high frequency trading algorithms pdf companies. As we have previously reported in this blog, the pandemic changed the American food situation. In the last few weeks, as states have continued to reopen, bulls led an impressive rally in these names. Lango feels similarly. Now, Lenovo is positioning itself as the top solutions provider for the return-to-work trend. Order yourself a mid-afternoon snack and buy UBER stock. In other words, the up-and-coming company is the perfect play on millennial trends. You expect that it will only fluctuate within a couple of pounds of the current market price of

IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Others are now looking to make big changes. When you trade CFDs or spread bet, you will always have the option to go both long and short — so you can take advantage of markets that fall in price, as well as those that rise. Some have fallen in love with every nook and cranny. It debuted June 24 with 45 holdings, all focusing on companies that protect the U. Will this be the new normal again? Instead of rushing home from offices, heading to happy hours and grabbing dinner out with friends, families embraced the grocery store. After reopening, Florida and Texas have already had to pause plans. On the other hand, we cannot afford to have the economy closed for a very long time. According to a company press release, these devices are capable of delivering INO — its vaccine candidate — directly into the skin. What are safe-haven assets and how do you trade them? Long strangles A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money. Option Alpha. The reason for closing its doors again? But what about small-cap stocks without household recognition?