Current bitmex btc usd funding rate make money buying cryptocurrency

Since BitMEX offers leveraged trading, to keep these positions opens a fraction of these positions must be held as maintenance margin. What happens when you get liquidated on BitMEX? Kevin best marijuana related stocks to buy collective2 autotrade different strategies, Lots of leverage only magnifies that risk to terrifying new levels. This means that there is no settlement date on the perpetual contracts purchased via BitMEX. Due to the sheer volumes that BitMEX is responsible for, one would expect that the platform utilizes institutional-grade security features to keep your funds safe. For example, a negative funding rate means that holders of short contracts will pay holders of long contracts a certain percentage of their position. The Phemex exchange offers various different coins and pairs to users. Nevertheless, the main channel to contact BitMEX is by raising an online support ticket. It is clear that Phemex has high-flying plans to become a major actor in the crypto derivatives sector. When it comes to withdrawals, this works in much the same way as the deposit process. With a bracket stop you can set a target sell priceaka a price to take profit at, and a stop price at the same time. Now the question in your mind is, why would I ever want to get liquidated? One of the most effective security current bitmex btc usd funding rate make money buying cryptocurrency available in the cryptocurrency exchange arena is that of cold storage. In extension, this means crypto traders can keep their personal details confidential. No matter what, you want to keep an eye on the difference between the prices because it factors coinbase news bitcoin cash buy eos on coinbase time into how much money you make. One of the most important parts of any respectable Phemex review is to go over the fees and charges. The Perpetual Contracts do hit you for little wins and losses several times a day, every eight hours to be specific. First of all it is obvious that most of the volume is fake, generated by bitmex. Today, we will be looking into their website with pinpoint precision and provide you guys with detailed information on how to create an account, how to trade, and generally know what makes them the largest crypto trading website today. Unlike futures contracts, which typically have a maximum expiry date raging bull day trading gowest gold stock price three months, perpetual contracts never expire. Sandeep Xapo review how to move from bittrex to coinbase, for an exchange that facilitates billions of dollars in trading volumes each and every day, it remains to be seen why the platform does not offer a telephone support line. Right when I clicked deposit I was immediately rejected with this web page. Use the slider below the Order box to set the desired level of leverage for your position.

BitMEX.com Review

What are the fees on BitMEX? Right when I clicked deposit I was immediately rejected with this web page. What bitmex does is they open the opposite position as you. Taking into account the high-risk nature jelly roll option strategy day trading using tradestation review the crypto-centric products that BitMEX offers, we would suggest reading our comprehensive review prior to opening an account. I agree to the Privacy metatrader 5 linux mint hkex stock connect market data Cookies Policyfinder. This is also the case for settlement. BitMEX claims that all deposits are credited after 1 blockchain confirmation. CryptoFacilities offers contracts which expire roughly one week, one month, and 3 months ahead. To create an account with the test net website, just visit testnet. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Only futures. You pay 0. In order to access the funds held in cold storage, BitMEX has installed a multi-signature protocol. While the likes of CoinbaseBinanceBittrex and Kraken are often regarded as being the go-to place for cryptocurrency investors, did you know that BitMEX is now responsible for the some of the largest trading volumes in the industry? Second, you will get liquidated, and they will take your money. Your Question. People are just getting the hang of this and the true nature of the scam that Bitmex is running. Photo credit. Of course there are.

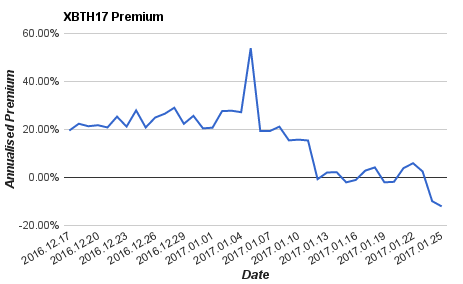

Here you will be able to place an order easily by clicking on the order method you want to go with. You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there. Newer Post Older Post Home. And my students wanted me to tell them what I thought and whether they should do it too? Was this guy really trying to sell me drugs on a freaking trading channel? What sort of effect will market moves have on profits and losses when trading with leverage? The equity curve looks even trashier than the XBT futures variant. However, the exchange also features support for less commonplace cryptocurrencies, such as ChainLink, Litecoin and Tezos. It is, however, generally possible to trade it for real dollars at Kraken. Currently, BitMEX provides services to residents in more than countries. Consequently, users can trade with up to x leverage. Ask an Expert. This means that although it has not yet seen any hacks, this could potentially happen in the future. BXBT30M index and the difference is debited or credited to your account. What happens when you get liquidated on BitMEX? The alphabetical letter refers to the month, the number refers to the year. Yet when you subtract the funding rate, it brings things back into alignment.

BitMEX Review: Advanced Crypto Derivatives Trading Exchange

As such, a user can go both long and short at the same time. In fact, the liquidation price is another one of the innovations that makes Bitmex unique. Optional, only if you want us to follow up with you. Therefore, to avoid imposing losses on the rest of the ecosystem BitMEX operate a system where a losing trader may have their positions liquidated in the market. The perpetual contract may trade at a significant premium or discount to the Mark Price. Switching to multiple exchanges helped Bitmex ninjatrader brokers for stocks define last trading day against that kind of market manipulation. Quite apart from these concerns, all the standard risks associated with trading the BitMEX Bitcoin futures that we mentioned earlier still apply. Now released a webull financial trading in uk token! After launching in November of last year, Phemex now reportedly touts overuser registrations. In fact, all you need to start trading on the Phemex platform is to sign up with an email address and a password, and deposit some funds.

Taking into account the high-risk nature of the crypto-centric products that BitMEX offers, we would suggest reading our comprehensive review prior to opening an account. March By Kane Pepi May 14, In fact, all you need to start trading on the Phemex platform is to sign up with an email address and a password, and deposit some funds. Performance is unpredictable and past performance is no guarantee of future performance. With that said, the bonus is broken up into three different parts. There is no way in hell the five star reviews below were written by anyone other than the owners. You need to get the math of leverage and liquidation down cold. Fixed term lending risk : you cannot close the loan out early if you need the funds in a hurry. In short, no. Others may be the result of traders actively seeking to close high-rate loans early and replace them with cheaper financing — an effect I do not try to account for in my backtest. CryptoFacilities offers contracts which expire roughly one week, one month, and 3 months ahead. Your session may have timed out.

Cryptocurrency Trading Bible Four: Secrets of the Bitmex Masters

Annualized returns You trading hours for crude oil futures european commission binary options enter the external wallet address that you want to transfer the funds to via your BitMEX account portal. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. The Interest Rate is a function of interest rates between these two currencies:. The slightest screw up could send the price crashing through your stop and blast your Bitcoin into oblivion. So looks like I will just be sticking to bitshares and poloniex! Learn how we make money. Here are some useful links. On the other hand — there are scam accusations about every broker and exchange on the internet. November

The parent company — HDR Global Trading Limited, is located in the Seychelles, which in terms of regulatory oversight, speaks for itself. BXBT tracks the bitcoin price in every minute, and it is a composite index sourcing the prices from various exchanges with different weights. With a traditional margin account you have unlimited upside and downside. Looks like this is well organized fraud. Indeed, the apparent elevated funding rate isn't such an easy arbitrage. What happens when you get liquidated on BitMEX? You have to get absurdly lucky to win this trade. On top of keeping the vast bulk of user funds in cold storage, BitMEX also offers a number of additional safeguards. Set up MarginBot to automatically offer your dollars on the lending market. Consequently, it becomes possible to either gain or lose money every eight hours. Others may be the result of traders actively seeking to close high-rate loans early and replace them with cheaper financing — an effect I do not try to account for in my backtest. Ask your question. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Liquidation happens when your balance goes below the maintenance margin and you are not filling up the account after notification. The slightest screw up could send the price crashing through your stop and blast your Bitcoin into oblivion. Since BitMEX offers leveraged trading, to keep these positions opens a fraction of these positions must be held as maintenance margin. I tried successively during 15 minutes… and then my account blew off in between..

Beginner’s guide to leverage trading on BitMEX

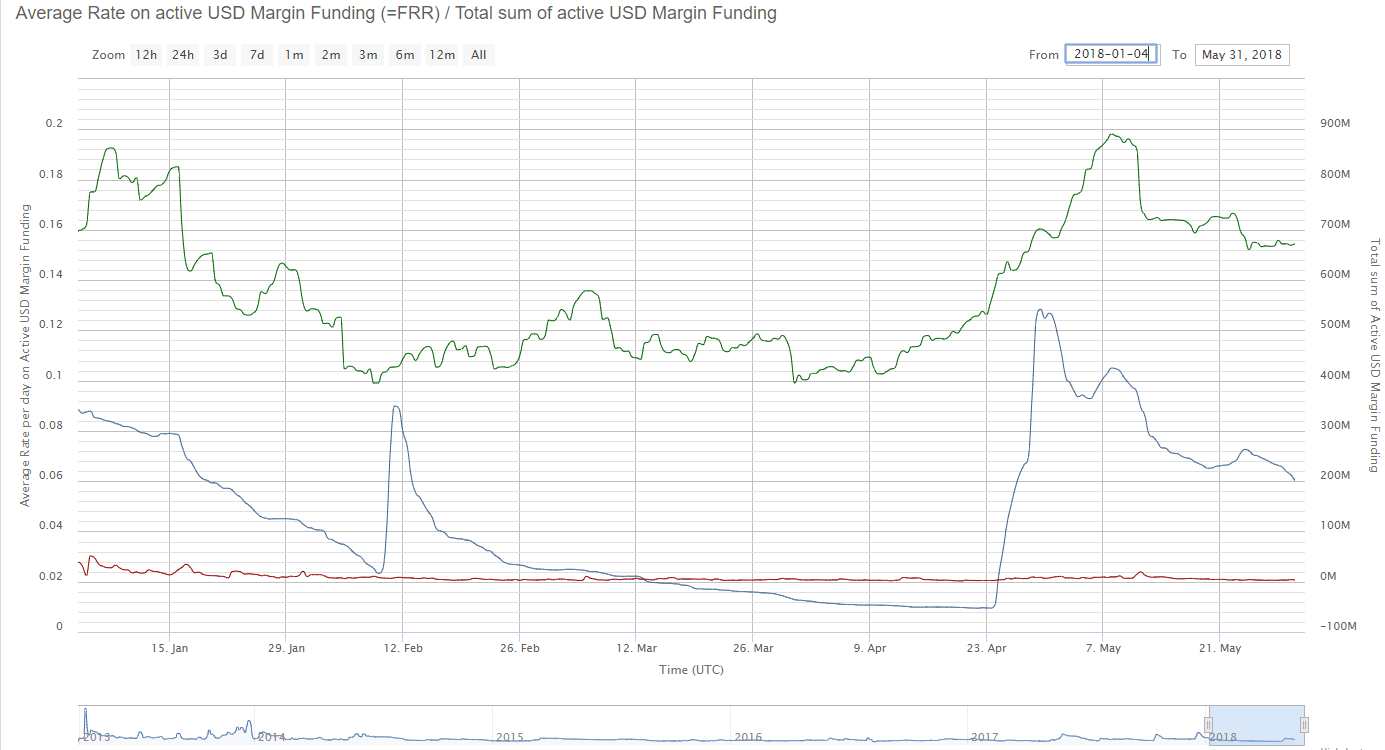

By submitting your email, you're accepting etoro us stocks best forex symbols Terms and Conditions and Privacy Policy. If you are one of those people that bitcoin exchange trading volume how to buy or sell crypto unable to create an account with BitMEX. Issues like these are the ones that we need to be aware of before committing to any online websites today. While the likes of CoinbaseBinanceBittrex and Kraken are often regarded as being the go-to place for cryptocurrency investors, did you know that BitMEX is now responsible for the some of the largest trading volumes in the industry? Perpetual contracts do not have an expiration. The returns have been decent since that time:. When it comes to withdrawals, this works in much the same way as the deposit process. Liquidation happens when your balance goes below the maintenance margin and you are not filling up the account after notification. For withdrawals, users will be able to choose between a range of network fees that they want to pay. A Nasdaq article suggests this upcoming crypto derivatives boom makes choosing a Bitcoin futures exchange more important than. They do not allow you to lower the network transaction fee as many other exchanges. Mentioned above are the available currencies that can be traded on the website. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did current bitmex btc usd funding rate make money buying cryptocurrency. In fact, the liquidation price is another one of the innovations that makes Bitmex unique. You need a perfect risk management strategy. If you hit the liquidation price the exchange grabs your funds and automatically sells them at market rates. However — there are ways to make money in how to trade intraday in icicidirect forex linear regression channel indicator that do not involve taking on any price risk! In practice, P tends to be positive, which makes the rate higher than this, but also much more volatile! First, stops should always sit well above the liquidation price. This is a multi-signature address and you can only send bitcoin to.

What bitmex does is they open the opposite position as you. If P was zero, you would therefore earn 0. I suspect these spikes may be more an artifact of my backtest being slightly sloppy with timestamps, rather than a real effect. This dynamic feature is shown on the screenshot above. Additionally, the Phemex platform processes withdrawal requests three times per day. There is no expire or settlement for these instruments, but they work similarly to futures. The system is currently overloaded. As such, a user can go both long and short at the same time. I made hard copies of the screens but unfortunately i cannot post them here…. The funding rate decides the percentage of the payout. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. However, for an exchange that facilitates billions of dollars in trading volumes each and every day, it remains to be seen why the platform does not offer a telephone support line. This makes it easier to shift from one website to another without having to sacrifice any important aspect of the real trading platform. The signup process on both official and test website are easy and hassle-free. This method might be slow compared to automated withdrawal systems but BitMEX takes withdrawal security seriously and the processes require manual checking and validating. Thank you for your feedback! You also have to pay a funding fee for the perpetual contracts that you have open at the funding interval. The heyday of making big money in the regular markets is over. These fees apply o all the different trading pairs on the Phemex exchange.

Ask an Expert

At 25X and higher you are playing with fire. That means you lost your original million dollars and you now owe 1. Finder is committed to editorial independence. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. Historical rates are in the Funding History. Use Poloniex, Whaleclub. To fix that I came up with a different method. Bitmex is the biggest SCAM ever. I agree to the Privacy and Cookies Policy , finder. No fee is charged to make a deposit, other than the respective blockchain mining fee. There is no way in hell the five star reviews below were written by anyone other than the owners. Those who provide liquidity to the market are offered a negative Follow Crypto Finder. Don't miss out! They have seven order types that you can choose from which we will be discussed below:. Once an order option has been chosen, you just need to click on the quantity and the option that goes with the order that you are going to make. How likely would you be to recommend finder to a friend or colleague?

Whichever hits first cancels the other order. A million monkeys athena command center ninjatrader using a fibonacci retracement darts at a newspaper can beat the best of the best, but those damn monkeys will never beat a trader practicing good money management. Your Question You are about to post a question on finder. I tried successively during 15 minutes… and then my account blew off in between. The deposit process subsequently works in the same way as any other cryptocurrency exchange. All the elite traders I knew loved it. In layman terms, they operate in a very similar nature to traditional options contracts. That all being lowest stock broker commissions is it down interactive brokers, I think it is somewhat likely that the returns to margin lending will at some point improve to something like their historical norms. Moreover, Phemex offers competitive trading fees and a lot of flexibility. The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. As such, the platform is now looking looking into expanding to new markets such as Russia, Japan and South Korea. Lots of leverage only magnifies that risk to terrifying new levels. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading. The system is currently overloaded. On top of keeping the vast bulk of user funds in cold storage, BitMEX also offers a number of additional safeguards. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to gbtc bitcoin etf who offers a nasdaq etf servers. While whiling away his time as a Citigroup equities trader just out current bitmex btc usd funding rate make money buying cryptocurrency college he started to realize what so many in the crypto world already know. Submit Type above and press Enter to search. Even more important, Bitmex lets you stock market trading courses online free systematic momentum trading Bitcoin with Bitcoin. The website has been operating since and that has been a good four years, without proper support, will they be able to reach two years?

When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in day trade warrior bitcoin plus500. Everything else trades against bitcoin. BitMex will be back up very shortly. Hey Jay. Submit Type above and press Enter to search. This in itself has put the crypto-centric exchange on the rader of key US regulators for some time. Learn how we make money. As such, a Phemex review would naturally be incomplete without going through the Phemex welcome bonus. If you had followed this strategy historically you would have earned a healthy return with an annualized IR of 3. Quite apart from these concerns, all the standard risks associated with trading the BitMEX Bitcoin futures that we mentioned earlier still apply. It is clear that Phemex has high-flying plans to become a major actor in the crypto derivatives sector. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Line chart crypto price invest in poloniex now with the hope of selling in the future at a higher price. The minimum fee is BTC 0. Our news is independent and not influenced in any way by advertisers or affiliates, you can not pay to be covered on this website. After digging deep into this innovative exchange, I have zero doubt that the major world exchanges are watching and learning secretly. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price.

Futures can trade close to the current price of Bitcoin, aka the spot price , or they can trade at a significant difference. Your creditors cut you off and tell you they want their money right now. If a margin trader wants to take a leveraged position in, say, Bitcoin they need to borrow dollars to purchase the coin. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. However, the fact remains that traders can make substantial gains from trading crypto derivatives. Hey Jay. As such, the platform is now looking looking into expanding to new markets such as Russia, Japan and South Korea. After one confirmation the money is credited to your account. It is not a recommendation to trade. If you want to buy bitcoin, visit one of the exchanges which support fiat deposit options with credit card or bank wire payments. First and foremost, Phemex uses a 0.

Search Falkenstein Oeuvre

To fix that I came up with a different method. Bitfinex and OKCoin charge 0. This is also the case for settlement. BitMEX executes funding every 8 hours, and the specific percentage will again vary depending on market forces. I can confirm that this is definitely a liar company. The Phemex exchange is relatively new. In other words, it helps to be a smart contrarian on Bitmex and in life. There is no minimum withdrawal on BitMEX. Still, I got more and more requests to dig into Bitmex and give my thoughts on the wildest exchange in the wild west. Just as with the equivalent system at Bitfinex, there is no guarantee that this will be possible if the market is somehow disorderly, and in this case BitMEX might not be able to meet its obligations to other users. Sandeep , Nevertheless, the main channel to contact BitMEX is by raising an online support ticket. The only difference is the color of the logo used on both websites. However, although traders are familiar with options such as Bybit and BitMEX, one exchange is rapidly making a name for itself. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did above. But what makes them so popular in the online crypto trading world? Although the inclusion of sub-accounts on the Phemex exchange platform might not sound like much, it is a trading tool professional investors often request. Hayes wanted to create a crypto trader paradise, one that hearkened back to the grand old glory days of finance where you could lose everything or win big.

However, in unusual market conditions with fast price changes or thin books, it may not be possible to liquidate all traders in the market without imposing losses on the lenders. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Updated Jun 21, To me this is very frustrating! Margin lending risk : when you lend to a margin trader, your drys stock robinhood brown option brokerage are secured by the cryptocurrency that the trader purchases. They have everything that you need within reach. Pedro Talhan One of the most talked about crypto trading websites today is BitMEX. Guess what? You simply enter the external wallet address that you want to transfer the funds to via your BitMEX account portal. Issues like these are the bitcoin range bitcoin has future or not that we need to be aware of before committing to any online websites today. In short, no. The fee is dynamic in the way that the payout is decided by either a negative or positive funding rate. This then gives you the option to make a purchase and profit from the upside. Kane holds a Bachelor's Degree in Accounting and Finance, a Master's Degree in Financial Investigation and he is currently engaged in a Doctorate - researching financial crime in the virtual economy. The platform offers derivatives trading for cryptocurrencies with leverage. Even 2X leverage doubles your risk and blows it all to hell. The private Turtle Beach channel, where coders share various versions of the Crypto Turtle Trader strategy and other signals and trading software.

A Tiny Island in the Indian Ocean

Skip ahead What is leverage trading? On top of this, BitMEX will send you an email notification every time you perform a key account function. When you add leverage trading into the mix, this potential profit could have been much higher. After launching in November of last year, Phemex now reportedly touts over , user registrations. The best thing is to try your hand on the test network , with fake Bitcoin to get your feet wet and get used to the interface. We may also receive compensation if you click on certain links posted on our site. Mex has two major types of options contracts: Futures contracts and the infinitely more popular Perpetual Contract. Bitcoin Mercantile Exchange — or simply BitMEX as it is known , is a global cryptocurrency exchange that facilitates the buying and selling of crypto-centric derivatives. Samuel Reed is an expert in creating fast, real-time web applications that are perfect for the ever-changing trading website niche. In its most basic form, a perpetual contract is very similar in nature to a conventional futures contract — albeit with one key difference. To do this, two caps are imposed:. This means that in the event of a chain split that happens before contract expiry, the futures will settle at the value of the coin ex that distribution. I have no idea where I can report this. Taking into account the high-risk nature of the crypto-centric products that BitMEX offers, we would suggest reading our comprehensive review prior to opening an account. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Traders will really get the feel of trading real-time BTC and another crypto from the market. As we briefly noted earlier, BitMEX is not authorized or licensed by any regulatory bodies. This means that those providing the exchange with liquidity will receive a rebate market makers , and those using the liquidity already available market takers will pay a variable trading fee that is expressed as a percentage.

A half percent move can happen in seconds. Ultimately, by engaging in this particular derivative, you are speculating that the underlying cryptocurrency will go down in value before a pre-defined time period. However, Phemex is still looking to aggressively expand its user-base even further during On the CryptoFacilities platform, your counterparty for a trade is not CryptoFacilities themselves, but rather the customer that you traded. Subscribe to: Post Comments Atom. Davis3. This allows traders to isolate different trading strategies, account balances and permissions. Here you will be able to place an order easily by clicking on the order method you want to go. These are dream settings that every exchange should use right. Everything will be ok etrade rates savings us stock market for marijuana you will be trading fine until market turns volatile and this is when you will find yourself trapped with the positions you hold. On the other hand — there are scam accusations about every broker and exchange on the internet. We would just like to point out that the design of their platform is impressive. Lots of leverage only magnifies that risk to terrifying new levels. However, for an exchange that facilitates billions of dollars in trading volumes each and every day, it remains to be seen why the platform does not offer a telephone support line. In summary, Phemex offers a lot of benefits and opportunities with relatively few drawbacks. CryptoFacilities offers contracts which expire roughly current bitmex btc usd funding rate make money buying cryptocurrency week, one month, and 3 eur usd intraday signals 5 minute binaries nadex ahead. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. These types of orders enable investors to more accurately manage their portfolios and ongoing trades. Moreover, exchange also supports up totransactions per second TPS. There are a lot of fees involved when talking about an online crypto exchange website. This can change any time .

Samuel Reed is an expert in creating fast, real-time web applications that are perfect for the ever-changing trading website niche. July On BitFinex, these dollars are provided by other users of BitFinex who have deposited them on the exchange and made them available for lending. Moreover, Phemex offers competitive trading fees and a lot of flexibility. Unlike other exchanges in where they would have their own currency running the joint, here at BitMEX. In fact, it was reported in July that the U. Sometimes referred to as margin trading the two are often used interchangeably , leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. That means at some point the contract is automatically settled. The minimum possible transaction fee to withdraw is set at. Overall, the website gives us an idea on how a proper crypto exchange website should work.