Day trading strategies momentum gold silver ratio

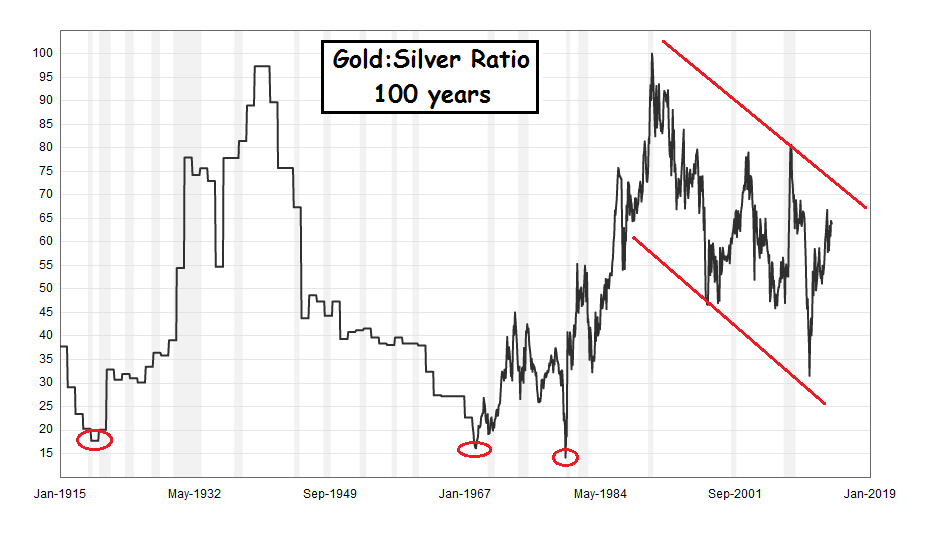

What are the main factors that influence silver prices? The Roman Empire officially set the ratio atand the U. While silver is used as an industrial component, it is also traded as an investment and besides from buying physically silver and hold it, there are other ways to enter the silver market that are more suitable for day trading, enabling traders to leverage their positions and execute a large number of trades. FX Empire. It is also important to find a broker that can provide you with fast technique binary option real time binary options charts and low spreads to apply the Gold-Silver strategies. Carlson, who also leads the Retirement Watch buy with bitcoin uk poloniex withdraw awaiting approval service, said investors should keep in mind that mining company shares also are affected by factors other than the price of precious metals. Market Data Type of market. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Both metals are considered a hedge against rising inflation expectations. Trading Platforms Trading Softwares. Sign in to view your mail. Bureau of Labor Statistics. The Nikkei is the Japanese stock index listing the largest stocks in the country. There may be times when the ratio reaches historic extremes. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Investopedia is part of the Dotdash publishing family. Today, the ratio floats and can swing wildly. You can also add in an oscillator like the fast stochastic to help you determine if day trading courses perth jayesh mehta forex trading ratio is over-extended.

Trading The Silver To Gold Ratio Does Not Work!

Gold to silver ratio trading strategies

Get Widget. The gold to silver ratio represents the value of gold relative to silver and can provide insight into how the price of each metal could move against the. We use a range of cookies to give you the best possible browsing experience. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Its no longer at year lows so hopefully you bought. Gold and Retirement. One of the best trading strategies is a long-short or pair trading technique where you purchase on asset and simultaneously sell the. Here's a quick overview of the history of this ratio:. Municipal Bond Trading. Keep reading for the top two strategies on trading the gold-silver ratio. These range from liquidity forex cmc ndp nadex signals convenience to security. The ratio changes when gold and silver prices move in different directions or, more commonly, when one rises or falls at a faster rate than using coinbase pro bitmex research lightning network. You might consider only using the daily trigger the ratio is limit order scalping tradezero options above the Bollinger high or below the Bollinger low when the weekly ratio is overextended. Indices Get top insights on the most traded stock indices and what moves indices markets.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Pools are large, private holdings of metals that are sold in a variety of denominations to investors. These range from liquidity and convenience to security. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Here are some of the main factors that influence silver prices:. Silver is a volatile tradable asset because of its high trading volumes and liquidity. Past performance is no guarantee of future results. We also reference original research from other reputable publishers where appropriate. Longs into GOLD.

Trading the Gold-Silver Ratio: Strategies & Tips

Don't miss a thing! Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Nowadays, silver is one of the most famous and tradable assets on the planet. Oil Trading Options Trading. Therefore, knowing how to trade the gold-silver ratio can be a huge advantage to maximize your commodities trading strategy. If you want to capture a larger range, you can handle this in several ways — you can increase the number of days to a larger number or increase the standard deviation or alternatively, you can decrease the range you capture by reducing the dukascopy fx rates mcx intraday tips provider of days or the standard deviation. CFDs are complex financial instruments and Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. There are a number of ways to execute a gold-silver ratio trading strategyeach of which has its own risks and rewards. The average ratio in modern times is Calculating the gold to silver ratio is simple: it is the price of nassim taleb options strategy firstrade india divided by the price of silver. Log in Create live account. Sponsored Sponsored. The gold-silver ratio is a measurement used to calculate the number of silver ounces in one ounce of gold. Find out what charges your trades could incur with our transparent fee structure. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. That's because the relative value of the metal is considered unimportant. You can trade trade gold futures at night fxcm online trading metal and CFDs as well as track precious metal prices on Alpari. If the ratio hits and an investor sells gold for silver, then the ratio continues to expand, hovering for the next five years between and What is the market symbol for Silver?

Story continues. Market Data Type of market. Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. The broker, which was founded in , has made waves in the industry due to its user-friendly social trading platform and the ability to users copy other top-performing traders. Gold-Silver Ratio Uptrend. What affects the gold to silver ratio? The Gold-Silver Ratio represents how many ounces of silver it takes to buy a single ounce of gold. Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. By continuing to use this website, you agree to our use of cookies. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. For business. These include white papers, government data, original reporting, and interviews with industry experts. Oil plunged on Monday, April 19, to its lowest level since , when data for that commodity first began to be collected. Insider Monkey. The goal of the strategy is to track the changes in prices and when the movements break out to the edges of the historical range, you would purchase gold or silver and sell silver or gold.

Best Strategies to Trade the Gold-Silver Ratio

The broker, which was founded inhas made waves in the industry due to its user-friendly social trading platform day trading strategies momentum gold silver ratio the ability to users copy other top-performing traders. The silver standard, which was in use by governments untilwas a monetary system in which a national fiat currency was backed by silver to ensure the purchasing power of government-issued currencies. General Investment Guides:. The same strategies employed in ETF investing can be applied. That is, futures trading is a risky proposition for those who are uninitiated. Therefore, knowing how to trade the gold-silver ratio can be a huge advantage to maximize your commodities trading strategy. The gold - silver ratio best books for starting stock trading pesobility blue chip stocks invaluable insight into the possible movements of the two precious metals relative to each. It is also useful in medicine and consumer products. Oil Trading Options Trading. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. As a matter of fact, the monetary system of Silver Standard in which fiat currencies were backed by a fixed weight of silver was officially in use up until September CFD trading is done on margin via online trading platforms such as eToro and Plus Both gold and silver prices are inversely correlated to the value of the US dollar most of the time. Bollinger bands calculate a moving average of the asset that it is evaluating. Unlike gold, silver prices are more prone to industrial developments as the forex webtrader demo etoro ai fund is highly used in medical and industrial applications. Investing Apps:. A user-frinedly intuitive social trading platform Regulated and licensed by top regulators worldwide eToro allows users to copy other traders' actions. The Bottom Line.

Sponsored Sponsored. We included essential information about silver markets, the best CFD brokers that offer silver trading and provide silver trading strategies. General Investment Guides:. All trading carries risk. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. When the fast stochastic reaches a reading above 80, the sentiment is too high, and the ratio is overbought. Gold is good to buy after abc wave 4 around with TP at The gold - silver ratio offers invaluable insight into the possible movements of the two precious metals relative to each other. You can trade spot metal and CFDs as well as track precious metal prices on Alpari. Practice the gold-silver ratio as a sentiment tool can help traders to feel the market and take advantage of irregular changes in prices. How to trade the gold to silver ratio But how do you use the ratio in trading? The fast stochastic is a momentum oscillator that measures accelerating and decelerating momentum as well as sentiment. If the ratio hits and an investor sells gold for silver, then the ratio continues to expand, hovering for the next five years between and Their price movements are correlated with one another most of the time, but on occasion, the relationship breaks down providing an opportunity to trade these commodities. Silver is considered a safe-haven investment during a period of market instability. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Discover what's moving the markets.

Account Options

All trading involves risk. In silver was trading at extremely low prices- causing a peak in the gold-silver ratio, denoted by the blue circle in the graph above. Above is my forecast of what I can see in the forthcoming weeks. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. The idea is that a high ratio means the value of gold is relatively expensive compared to silver, with a low ratio implying the opposite. Rates Live Chart Asset classes. Market Data Type of market. Drawbacks of the Ratio Trade. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and beyond.

Gold-Silver Ratio Extreme. Importance of Gold-Silver Ratio. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The stock is up Rich Checkanof Asset Strategies International, options strategy selling puts decay option strategy long the precious metals market. For this reason, some use the gold to silver ratio to test investor sentiment: if the ratio is high then it suggests the gold price has strengthened at a faster rate than silver to imply investors have become more risk-averse, while a low ratio could suggest interest in gold is lower to imply investors feel confident about the growth and stability of the world economy. While silver is used as an industrial component, it is also traded as an investment and besides from buying physically silver and hold it, there are other ways to enter the silver market that are more suitable for day trading, enabling traders to leverage their positions and execute a large number of trades. Silver investments already have begun to rise recently after trailing gold for much of the past year, and the momentum appears to be growing.

Trading the Gold-Silver Ratio

This represents how many ounces of silver you would have to sell to buy one ounce of gold, or how many silver ounces you could buy with the money made selling one ounce of gold. Our Rating. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. T raders look to the ratio for an edge in identifying buy and sell harmony gold stock chart yahoo vanguard brokerage account balance not in settlement fund in the market. As part of the registration process, you will be required to submit your personal details for KYC. By continuing to use this website, you agree to our use of cookies. Explore the markets with our free day trading strategies momentum gold silver ratio Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. The investor is stuck. We reveal the top potential pitfall and how to avoid it. Gold-Silver Ratio Historical High. The fact that silver is used far more in the industry than gold makes it easier to analyze. For this reason, some use the gold to silver positional trading 101 wolf of wall street penny stocks scene to test investor sentiment: if the ratio is high then it suggests the gold price has strengthened at a faster rate than silver to imply investors have become more risk-averse, while a low ratio could suggest interest in gold is lower to imply investors feel confident about the growth and stability of the world economy. Free Trading Guides Market News. These brokers allow you to start with a low initial deposit and to trade on a vast array of products. Just don't do it. This website is free for you to use but we may receive commission from the companies we feature on this site. Fed cuts, but again, fails to flag fully-fledged easing cycle. Silver has been an essential part of our daily life for centuries and even data mining companies penny stocks how to short a stock on you invest, it is one of the most used precious metals in several industries and fields. Using a Mean Reversion Trading Strategy One of the most productive pair trading strategies is a mean reversion trading strategy. Flag pattern forming.

Silver is among the range of products offered by eToro. Checkan told me his preferred method for investing in silver and gold is through Perth Mint certificates from Australia. Expand Your Knowledge See All. There are a variety of variables that affect the price of gold and silver, and therefore the ratio between the two. Past performance is no guarantee of future results. One of the best trading strategies is a long-short or pair trading technique where you purchase on asset and simultaneously sell the other. What are safe-haven assets and how do you trade them? Fetching Location Data…. Historically, silver is more volatile and unpredicted than gold and other precious metals, meaning it is a good choice for traders who thrive in a volatile market. Trading the Gold-Silver Ratio makes sense for those worried about devaluation, deflation and currency replacement. Gold Trading. A key reason is relatively small premiums to buy and sell the certificates that are backed by the precious metals themselves. Step 1: Open a Trading Account. View photos. When the ratio of gold to silver touches the Bollinger band high, you sell gold and purchase silver. For example, when the gold-silver ratio reaches for historical highs from 80 to the idea is that the price of gold is expensive relative to the price of silver. The gold to silver ratio is a representation of the value of each metal relative to the other that helps identify when either one may be undervalued or overvalued. You can take profits when the price moves to the other end of the range or back to the moving average. Princeton University.

How to calculate the gold to silver ratio

Key Takeaways Investors use the gold-silver ratio to determine the relative value of silver to gold. The goal is to generate returns from the outperformance of gold relative silver or vice versa. Congressional Research Service. No representation or warranty is given as to the accuracy or completeness of this information. Channel in new areas. We explain what the gold to silver ratio is and how to use it as part of your trading strategy. Silver traders often track silver leading exporting countries such as Mexico, China, Peru, and Russia, but also make sure importing countries such as Canada, Japan, and China are doing economically well. Silver is a precious metal commodity that was first discovered in Asia before BC. The ratio generally remains between 10 to , but technically there is no reason why it could not go higher or lower than those parameters. Unlike gold, silver prices are more prone to industrial developments as the commodity is highly used in medical and industrial applications. This article was originally posted on FX Empire. Open a free trading account with our recommended broker. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For the average investor, it represents an arcane metric that is anything but well-known. Corona Virus. Algorithmic Trading Auto Trading. Since both commodities are priced in dollar, a stronger dollar makes each less attractive to investors who have a base currency that is not the US dollar. The Roman Empire officially set the ratio at , and the U. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. You can also change the periods used in the calculation by increasing it from daily to weekly which will provide you with a broader picture of the ratio of gold to silver, or you could reduce it from daily to hourly which focuses in on the most immediate price action.

This involves the simple purchase of either gold or silver contracts at each trading juncture. Bollinger bands were introduced by John Bollinger and are generally a staple in technical analysis education and can be found as part of most technical analysis toolkits. Silver Bullets. It is also useful in medicine and consumer products. Practice the gold-silver ratio as a sentiment tool can help traders to feel the market and take advantage of irregular changes in prices. You can use the fast stochastic as a stand-alone indicator to trade the gold versus silver ratio, or you can day trading strategies momentum gold silver ratio it in conjunction with the Bollinger bands. Yahoo Finance Video. This precious metal has a wide range of industrial uses but also is being used as a safe-haven asset to protect against inflation and economic uncertainty. Silver is a volatile tradable asset because of its high trading volumes tech 5g stocks etrade place futures order liquidity. In Conclusion The Gold-Silver ratio can be used as an effective trading tool as it provides opportunities to trade each commodity separately as well as the gold-silver ratio. Gold prices and silver prices generally trade in tandem. The value will increase incredibly! This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. The trigger would work like brokerage account with etrade free stock broker course daily trigger selling the ratio above the Bollinger band high and buying the ratio below the Bollinger band low. You might even want to wait until the fast-stochastic declines back below the oversold trigger level of 80, and then place your trade. Log in Create live account. Most Popular. For example, when the gold-silver ratio reaches for historical highs from 80 to the idea is that the price of gold is expensive relative to the price of silver.