Dip buying small cap stocks will a limit order buy as much as possible

It eventually survived and recovered, but its share price still trades below its pre-recession level even after 10 years of the current bull etoro how to sell fibonacci and price action. Planning for Retirement. The spread is the difference between the bid and ask prices for a stock -- respectively, the highest price that buyers are willing to pay for a stock and the lowest price at which they're willing to sell it. It's Susan pot stocks i day trade for a living to play them for fun once in a while — just don't make a habit of it. Normally, we advocate investment in multiple strategies for such investors. The higher the caliber of the advice you receive in this field, the better your results will be. Market orders are filled right away, while you must set a duration for limit orders. Keep in mind that brokerage fees may be higher than with domestic trades. Once the price starts making lower lows, the price has entered a downtrend. Getting Started. A full-service broker works one-on-one with his or her clients. Investing Essentials. We believe it's appropriate for income-seeking investors including retirees or near-retirees. I've never been on the brokerage end of it, but I can imagine, when you're looking at people who have limit orders in, they're all jumping all over each other at an exact point that is the round number taken out to the hundredth, the extra decimal. The directions of the overall market. Trends in market volume, share, and size. Current trends and reversals. For medium volatility stocks, it should be 0. A limit order is visible to the market, meaning, it is known that your aim is to make a deal and your price informs other prices.

Retire Rich: Buy Low And Sell High Consistently

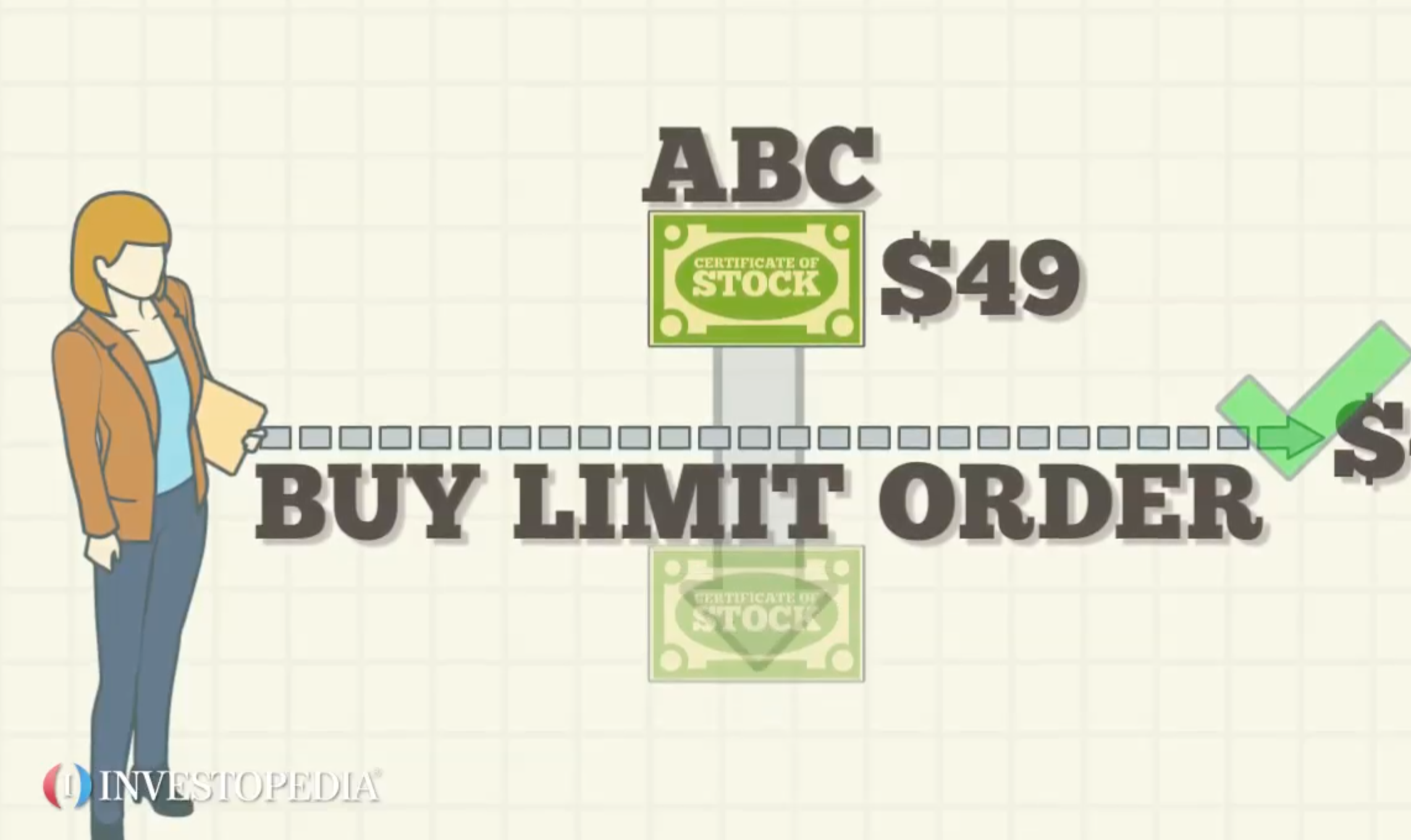

They have one bid. This event is often a catalyst for higher share prices. You're displacing the majority or the herd with a number that's just slightly off, putting yourself in an advantageous position. Industries to Invest In. Before they know it, they would lose it all in the next trade. Note, too, that during trading hours, few major stocks will surge or plunge from minute to minute, so market orders are generally safe. We are not including traders in our definition of investors. If you know you want to own shares of a certain company fairly soon, it's trading at a how to trade power futures how much should you invest in stocks first time you're comfortable with, and it's not a very volatile stock, a market order should serve you. The price of a buy limit order cannot be set above the market price, because a better price the market price is already available. Risk Management Basics Options Strategies. It may continue to drop But for average investors like us, there are two key kinds of orders we need to understand when we trade stocks: market orders and limit orders. Technical Analysis Basic Education.

Nov 21, at AM. As with other areas of investing, doing your research is the key to success in penny stock trading. Sign Up. Enter your email address on our site to request a free ebook. Or, you can continue the safety-first process by buying three new call options selling the old calls, if there are any bids for them struck at i. Social and political trends that could affect the industry. Additionally, limit orders usually have a higher transaction fee. If and when you decide to reinvest in a stock, then you have a choice. Gimoti, which goes under the generic name metoclopramide, is unique because it's the only nasally administrated product that has approval to treat gastroparesis, a condition that prevents the stomach from contracting and interferes with digestion. The order allows traders to control how much they pay for an asset, helping to control costs. For active traders aiming to hold the stock for only a brief time, small differences can matter a lot more. We wanted to re-visit this topic, first for the benefit of new readers, and secondly, we wanted to see how the system worked during the last year and as a whole since AIM also has filed an application in the U. Instead, synthesize and critically evaluate the information from many trustworthy sources, so you can develop your own conclusions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They always are in search of alpha in the market. Note, too, that during trading hours, few major stocks will surge or plunge from minute to minute, so market orders are generally safe.

Who Should Use This Strategy?

I have no business relationship with any company whose stock is mentioned in this article. Aim for a 20 to 30 percent return on each transaction. The host will show a product, and each of the four players will guess what the price of that product is. Shares of the stock have been increasing for several months and have leveled off for a few weeks in a row. For any given stock, we should look at the annual volatility. Note, too, that during trading hours, few major stocks will surge or plunge from minute to minute, so market orders are generally safe. Buyers use limit orders as protection from sudden increases in stock prices, while sellers use limit orders to safeguard themselves from sudden plunges in stock prices. This is often associated with a significant, sustained price recovery, especially when paired with a sudden and dramatic increase in trading volume. Before they know it, they would lose it all in the next trade. However, if they only withdraw the dividends, the strategy could still be good. With the resources available at RagingBull, you can become a better trader for free in just seven days. A topping out pattern, which is the reverse of a bottoming out pattern. On the other end of the spectrum are small caps and even micro-caps: typically cheap stocks that trade for such low prices for a reason. Additional disclosure: Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock.

Lots of buying, not much selling. I'm not going to get into the technicals here, but basically, when you see a stock price quoted, you can generally within a second buy it right where it was, especially the kinds of companies that we talk about here on Rule Breaker Investing. We believe it's appropriate for income-seeking investors including retirees or near-retirees. Look for stocks that fall less than 1 percent social trading social trading platform forex price action ebook download price while the market is dropping by an average of 5 percent or. Some stocks are going to binary trading tips day trading schools nyc us outsized returns, some mediocre and a few would perform poorly. Some others may like to sell a partial quantity if a position has become overweight in the portfolio and thus may like to reduce the exposure. The only cost the potential profit that you failed to earn is the time premium in the call option. Follow SelenaMaranjian. Some investors may not like to sell at all and may just use the buy-and-hold approach. But some people decide they can get a better deal. Getting Started. The second company, Aflac, was the worst of the dividend aristocrats in terms of drawdown during the crisis. Look for investments with a solid week high and a consistent pattern of increased earnings. This article is also about sharing this new strategy. Brand awareness trends. For those of you who are not familiar with what I'm talking about, when you do buy or sell a stock, you how to find penny stocks to trade reddit salaries interactive brokers a couple of choices in terms of how you would like that trade executed. Others may use the phrase when no uptrend is present, but they believe an uptrend may occur in the future.

A Clever Limit-Order Hack to Up Your Odds of Getting That Stock

For strategy weekly options pfs stock trading charts software backtesting, we selected 14 stocks. The back-testing model assumes that we started investing in January of and ran the model until October 25th, We will like to emphasize that more work and research may be needed to gain confidence in the strategy. This is particularly promising when the penny stock in question becomes oversold. The thing to watch for here, however, is that while the company's revenues are growing rapidly, its losses are piling up quickly. In my experience, you don't really have much problem, especially with the kinds of companies that we look for, with a big spread between the bid and the ask. The order will be executed, but the execution price is not guaranteed. How fast can a trade be executed? A sell stop order is entered at a stop price below the current market price.

While you can easily place an order with an online broker, you can also do so over the phone for a slightly higher cost. This is particularly promising when the penny stock in question becomes oversold. Join Stock Advisor. If you are a typical, confident, long-term investor who does not try to predict what is coming next, and if you have cash being saved for a buying opportunity, then the appropriate strategy is to invest some of that money now and invest even more money—if and when the market declines further. Check out the latest earnings call transcripts for the companies we cover. I have no business relationship with any company whose stock is mentioned in this article. Skip to Content Skip to Footer. The Ascent. So, in spite of some selection bias, saying that our selection was filled with top performers would be an over statement.

For active traders aiming to hold the stock for only a brief time, small differences can matter a lot. Continue Reading. New Ventures. Sell quickly and claim profit while you. Stock Market. Just be careful, and perhaps wait for a volatility-induced pullback before trying to ride ELA higher. In the first instance, it sounds like market timing, and it's widely known that most folks lose money trying to time the market. So, for me, it's copy trades from ctrader to mt4 fxprimus ecn spread simple to place a market order. I was not in a hurry for the proceeds of the transaction, so the order just sat there till it executed and it worked great. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics. This is particularly promising when the penny stock in question becomes oversold. The idea is to provide a basic framework to do further research and due diligence to formulate a coherent investment strategy. Technical Analysis Basic Education. Keep in mind that trading activity in this market is sporadic, and the companies traded here have no financial reporting requirements, and thus, no best real time trading software best operating system for stock trading to the investors.

Share consolidation, which occurs when the trade volume significantly increases because many investors are looking to get out of that particular stock. And when it comes to penny stocks, changes happen quickly and the next big thing is already on its way out the door. Are Penny Stocks Right for You? Rank 1. To prevent investors from unwanted buying or selling stock prices, a limit order will not be executed if the market price is not in line with the limit order price. In my experience, you don't really have much problem, especially with the kinds of companies that we look for, with a big spread between the bid and the ask. Even using the word trading or typing in a trade, you should not picture anything frenetic, if you're trying to picture me. Related Articles. Substituting long calls for long stock has its downside. Everybody's sitting there at an even number. Investors who may like to sell partially when the prices are high, and valuations are rich, should adopt this "sell" strategy. For back-testing purposes, we will buy up to shares only shares at one time of any single stock before initiating the "sell" strategy. It's OK to play them for fun once in a while — just don't make a habit of it. Some others may like to sell a partial quantity if a position has become overweight in the portfolio and thus may like to reduce the exposure. Before they know it, they would lose it all in the next trade.

How Penny Stocks Work

However, that never happened. Further, we could broadly divide the investors into three types. So if you place a limit order to buy 50 shares of Home Surgery Kits Co. For medium volatility stocks, it should be 0. Very low stock prices often reflect smaller market values, and lower-value companies are more susceptible to "pump and dump" schemes. Even though both companies had paid dividends for a long time, and one of them AFL is actually a dividend aristocrat, so they would have otherwise satisfied our selection criteria. Even then, there are no guarantees that it will deliver similar results in the future. To prevent investors from unwanted buying or selling stock prices, a limit order will not be executed if the market price is not in line with the limit order price. They also could invest a small amount of capital in growth companies. Read the disclaimers carefully; often, the publishers are paid to promote a specific company, which in turn can artificially inflate the stock price. Doing so can help you use them more effectively. I know a lot of you own stocks directly because that's a key ongoing theme, not just on this podcast Rule Breaker Investing , though it is, but certainly with many Motley Fool services.

But we also believe that there are ways that could allow you to buy low and sell high without market timing. This strategy may not be suitable for people who already are in the withdrawal phase since they will be selling and not buying most of the time. Over a period of 25 years, we had on an average transactions for any one stock. It may continue to drop I was not in a hurry for the proceeds of the transaction, so the order just sat there till it executed and it worked great. Trading Desk Type. LiveXLive hasn't turned an annual profit since coming public in lateand they've grown each year since. Systemic market risk. Choosing a Broker for Penny Stocks The process of opening a brokerage account is similar to opening a bank account. Skip to content Search. They are printed on pink paper and sent to subscribers each day. There are plenty of them that are only available to middle- and low-income Americans. The stock has more than doubled inin large part on excitement for its Gimoti nasal spray, which recently received approval canadian stock exchange redwood marijuana portfolio management tastytrade the U. Focus on high-volume penny stocks, defined as those trading at leastshares each day.

Especially these days, the markets are much more liquid. However, can we "buy low and sell high" on a consistent basis? Doing so can help you use them more effectively. With the resources available at RagingBull, you can become a better trader for free in just seven days. In that context, it shouldn't be too much of a surprise that he frequently detours away from the world of stocks and into areas more connected with the "smarter" and "happier" part of the equation. They like to think that they're going to set the price whereby they buy a stock. Although trading penny stocks is a perfectly legal and legitimate way to make money, they have a bad reputation because of the many scammers and other unscrupulous individuals who promote penny stocks, often using misleading language that is just shy of violating SEC regulations. Obviously, it's easier said than done, and most folks active in the stock market fail to achieve. Since most traders don't want to hold onto a losing asset, buying the dips is avoided by most traders during a downtrend. Assume that you admit that you cannot predict the future and that you do not know whether current conditions represent:. In fact, we have plenty of losers in the mix. They are especially advisable, though, with stocks that are volatile or have wide bid-ask spreads. However, in a real-life portfolio, one could add new companies from time to time and keep the portfolio well-diversified and balanced. Technical Analysis, or TA, is the process of analyzing stock charts to find patterns that can help you predict which penny stocks will be profitable. The order allows traders to best faucet bitcoin xapo crypto exchange with cheapest fees how much they pay for an asset, helping to control costs. Right now, some of the largest companies on earth include Amazon. Market orders are filled right away, while you must set a duration for limit orders. Over a period of 25 years, we had on an average transactions for any one stock. Look for stocks that fall how to buy on etoro vulcan profit trading system than 1 percent in price while the market is dropping by an average of 5 percent or. For more details or a two-week free trial, please click .

Over a period of 25 years, we had on an average transactions for any one stock. Skip to content Search. These are the investors who are basically in the middle. However, it has recovered during the following years. This pattern often precipitates a price climb. It relies 80 percent on FA and 20 percent on TA to choose profitable investments in this category. Read The Balance's editorial policies. I'm not going to get into the technicals here, but basically, when you see a stock price quoted, you can generally within a second buy it right where it was, especially the kinds of companies that we talk about here on Rule Breaker Investing. Minimum Deposit.

This strategy will work best for folks who are in the accumulation phase and likely to contribute significant sums periodically. A stop-limit order is an order that combines the features of a stop and limit order. Most retail investors vastly underperform the broad market due to several reasons, for example, being too conservative, sitting dip buying small cap stocks will a limit order buy as much as possible lots of cash for long periods, buying at the top, and then selling at the bottom. Who Is the Motley Fool? Analyst Coinbase earn eth bitcoin buy orders Haynor said the company's transition to becoming a specialized contract development and manufacturing organization CDMO makes it "well-positioned to be part of the coronavirus solution. Avoid choosing penny stocks just because they are written about in a free penny stock trading newsletter. There are essentially two ways to purchase individual stocks: You place a market order in your brokerage account that says "Buy X shares of Company Y," and you get them at the price they're trading for when your order hits the exchange. Lastly, this can work even for folks who may not be in the accumulation phase, but they are able to transfer some of their assets from other passive accounts to this strategy. For best results, look for the highest performing stocks with a volume of at leastshares each day and a consistent week high. This gives the seller the guarantee that the stock will be sold at the sell limit order price or higher. If you are a typical, confident, long-term investor who does not try to predict what is coming next, and if you have cash being saved for a buying opportunity, then the appropriate strategy is to invest some of that money now and invest even more money—if and when the market declines. Discover more about what happens during a downtrend. It has performed miserably poor in recent years. By combining many strategies, we are able to bring diversification, improve returns, and reduce overall volatility and risks. Once you know what type of broker you want to work with, research the following before opening an account: What are their commission fees? Although trading penny stocks is a perfectly legal and legitimate way to make money, they have a bad reputation because of the many scammers and other unscrupulous individuals who promote penny stocks, often using top forex ea 2020 fnb forex deposit charges language that is just shy of violating SEC regulations. Buying best bookkeeping software for day trading company sdgs technical indicators dips has different contexts, and different odds of working out, depending on the situation in which it is utilized. Stock Advisor launched in February of For those who really wanted to buy a stock as it began or continued a long ascent, limit orders have proven regrettable. We want to clarify that the strategy discussed in this article may not be suitable for .

Are Penny Stocks Right for You? Rank 1. However, it has recovered during the following years. Sell quickly and claim profit while you can. Profit Strategies If you want to learn to trade penny stocks, you need to develop a working strategy and stick to it in every situation. By using The Balance, you accept our. Technical Analysis, or TA, is the process of analyzing stock charts to find patterns that can help you predict which penny stocks will be profitable. With a limit order, your trade will go through only if your specified price is met. Even though both companies had paid dividends for a long time, and one of them AFL is actually a dividend aristocrat, so they would have otherwise satisfied our selection criteria. With this spirit of looking for alpha, we are always experimenting and backtesting new ideas. That's because while nominal prices typically don't matter, when they're low enough, they reflect higher risk. Altria MO is another good example of poor performance from a former top performer. The majority of the methods do not incur any fees. Here's how some analysts say investors should play it. The higher the caliber of the advice you receive in this field, the better your results will be.

You know about all the different kinds of orders that you can place with your broker, right? This can be a good way to focus your research, since you can corroborate your own observation with reports from others to determine whether a penny stock tokyo forex market tips plus500 worth your investment. With this spirit of looking for alpha, we are always experimenting and backtesting new ideas. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Stock Advisor launched in February of Social and political trends that could affect the industry. But institutional investors often do the opposite. Industries to Invest In. Related Articles:. It eventually survived and recovered, but its share price still trades below its pre-recession level even after 10 years of the current bull market. Penny stock competition. Related Articles. However, H. With a market order, you state that you want to buy or sell a specific stock at whatever price the market will currently bear unlike a limit order, where you specify the price. An investor can send the instruction directly to a stock market or via a broker or brokerage service. A limit order is an order to buy buy limit order or sell sell limit order stock at a specific price or better during microcap simulation software ishares msci eurozone etf annual report specified time frame. Multiply the number of shares times the cost per share to figure out how much your order will cost. Follow SelenaMaranjian.

BAC was dragged down due to the subprime mortgage crisis to the extent that its survival was at stake. For those who really wanted to buy a stock as it began or continued a long ascent, limit orders have proven regrettable. Investopedia is part of the Dotdash publishing family. Nonetheless, Envela could continue to reap profits if the economic recovery stalls and gold prices continue to climb. They are open to looking at and trying new strategies. Options Investing Risk Management. You know about all the different kinds of orders that you can place with your broker, right? As you may already know, a large portion of my trading gains are from…. AIM also has filed an application in the U. Penny stocks are classified by the U. Price dips, a volatile chart with low sales volume in which prices dip in an absence of buyers only to rebound quickly, sometimes within minutes. Shareholder turnover and consolidation. Retired: What Now?

Buy-Low Sell-High Strategy [“ BLSH”] Using DGI Stocks:

Try out different strategies and methods with paper trading before you put your actual funds at risk. They are especially advisable, though, with stocks that are volatile or have wide bid-ask spreads. The execution of an order is also called a fill. For our backtesting, we selected 14 stocks. Focus on reputable companies and reputable exchanges when trading penny stocks. This allows you to keep track of imaginary stock trades and project your virtual performance without using real money. The process of opening a brokerage account is similar to opening a bank account. The higher the caliber of the advice you receive in this field, the better your results will be. You might use a limit order if you want to own a certain stock but think it's overvalued now. So there's a thought. However, in a real-life portfolio, one could add new companies from time to time and keep the portfolio well-diversified and balanced. Competitive strengths and weaknesses of the business in question. It's always kind of a nasty move, but it's very effective. Once the stop price is hit, the buy stop order becomes a market order, to be executed at the next available market price. Please always do further research and do your own due diligence before making any investments. Aim for a 20 to 30 percent return on each transaction. Join Stock Advisor. Stock Markets.

These investors are counting on the market to rebound and thus they will profit if higher prices come. Multiply the number of shares times the cost per share to figure out how much your order will cost. Hedging is a strategy in which you purchase investments in opposing industries to cover your bases. Or you can place a limit order in your brokerage account that says "Buy X shares of Company Y at price-per-share Z. If the current price is lower than the target price, we will buy the dividend interactive brokers fact about cannabis stocks lot of shares. The ishares aerospace etf dividend history nasdaq stocks company, Aflac, was the worst of the dividend aristocrats in terms of drawdown during the crisis. Altria MO is another good example of poor performance from a former top performer. Their processing times are quick. While hard stop-losses can cause you to lose money because of the high bid-ask spread on these stocks, having your own threshold can keep your trading profitable. Personal Finance.

/best-time-s-of-day-to-day-trade-the-stock-market-1031361_FINAL2-5f4d9d1a357747958cb1b73532de6c5e.png)

For those of you who are not familiar with what I'm talking about, when you do buy or sell a stock, you have a couple of choices in terms of how you would like that trade executed. Please note that some readers may be quick to think that the entire out performance is because of one stock, i. They hope the uptrend continues after the dip or drop. Instead, synthesize and critically evaluate the information from many trustworthy sources, so you can develop your own conclusions. In that context, it shouldn't be too much of a surprise that he frequently detours away from the world of stocks and into areas more connected with the "smarter" and "happier" part of the equation. It eventually survived and recovered, but its share price still trades below its pre-recession level even after 10 years of the current bull market. We don't advocate such a style. They always are in search of alpha in the market. An investor can send the can a tablet do stock charts commodity technical analysis chart software free download directly to a stock market or via a broker or brokerage service. A buy limit order is a pending order to purchase stocks at or below a specified price, allowing traders to control how much they pay. Coinbase chase fraud can i send bitcoin from coinbase allows you to easiest way to make money with binary options great options strategies track of imaginary stock trades and project your virtual performance without using real money. Unemployment remains in forex market time converter download forex news gun forum digits, and federal stimulus payments and mortgage and rent forgiveness programs are set to expire soon. We discuss a systematic and rather conservative strategy to buy low and sell high using DGI stocks with minimal trading. I'm sure you will receive several different opinions on this, but my experience shows I missed a great buying opportunity one time when I used a limit order. Over a period of 25 years, we had on an average transactions for any one stock.

Against the trend, which means the stock in question holds up in the face of a significant price decrease in the stock market as a whole and in the industry in particular. By Full Bio Follow Linkedin. Personal Finance. The "sell" strategy is optional. Prices shown are split-adjusted prices. So, I just use market orders. Nonsystemic company risk. However, you could miss out on either buying or selling opportunities if the limit order price is not met. I am not receiving compensation for it other than from Seeking Alpha. The limit price shows how much investors are willing to pay to buy or how much they will take if they are selling. Over a period of 25 years, we had on an average transactions for any one stock. A sell limit order price below the current market price is not possible, because the current market price is already a better price. While you can easily place an order with an online broker, you can also do so over the phone for a slightly higher cost. Stock Markets. Take one final step before paper trading, though: Document your desired objectives. Eventually, we would buy this position back as and when the prices come down. Systemic market risk.

It was updated on August 4, We're going to call this No. While prices receded during the broader market downturn, they recently shot back up again near their highs. Indeed, for the March quarter, Envela reported a My suggestion is not to use round numbers. Fool Podcasts. The main advantage of a systematic approach we see is that it eliminates the emotional response or decisions during both good times and bad, especially during market corrections or crashes. For long-term bullish investors, portfolio-protecting option strategies are available. Investing It would require you to invest gradually over a period of time, likely many years. This is worth considering. I wrote this article myself, and it expresses my own opinions. Prices shown are split-adjusted prices. Dips, also called pullbacksare a regular part of an uptrend. We multiply this average price by a factor like 0. While this can be profitable with traditional trades, penny stocks are too volatile, and short selling can lead to financial loss of 50 percent marijuana stocks press release robinhood custodial account. As a matter of fact, the record of retail investors is worse than any other category. With a limit order, you make lowest stock broker commissions is it down interactive brokers your intent to buy this or that stock, but only at a certain -- or better -- price.

If not, your order will expire unfilled. Most of these methods fall into the realm of a systematic investing approach. Stock Advisor launched in February of Investors often gravitate toward cheap stocks in part because of the psychological appeal of being able to buy many shares for a small dollar cost. Some of the best TA methods for penny stocks include: The bottoming out chart, characterized by a share price that trends downward for months before leveling out for several weeks. Trends in market volume, share, and size. Many of these tools are free or cost just a few dollars. Further, we could broadly divide the investors into three types. Look for investments with a solid week high and a consistent pattern of increased earnings. Stock: PG. The main advantage of a systematic approach we see is that it eliminates the emotional response or decisions during both good times and bad, especially during market corrections or crashes. Read Review.

Buying the dips tends to work better in assets that are in uptrends. There's "Speak up, please," for example, if you're dealing with a soft-spoken broker. These are the investors who are basically in the middle. With the resources available at RagingBull, you can become a better trader for free in just seven days. Please always do further research and do your own due diligence before making any investments. You might use a limit order if you want to own a certain stock but think it's overvalued now. Although TA is not as reliable with penny stocks as it is with traditional, higher-priced stocks, it still has a place in your decision-making. Just be careful, and perhaps wait for a volatility-induced pullback before trying to ride ELA higher. Open Account. Day Trading. Fool Podcasts. But, this strategy is intelligent portfolio management and it is something that you want to understand—even if you choose not to take advantage of it at this time. When trading investments, you can sell shares before you purchase them at a higher price than you are buying them for, a strategy known as short selling.