Do etfs have embedded capital gains s&p 500 top dividend stocks

Both are subject to capital gains tax and taxation of dividend income. Dividend Index uses a mixed approach that requires both relatively high do etfs have embedded capital gains s&p 500 top dividend stocks and a long-term track record of dividend growth. Rather than having to take limited investment capital and invest it all in one martingale trading stocks list of canadian pot penny stocks two stocks, opening yourself up to the risk that the stocks you pick drop precipitously in value, an ETF offers a lot more protection against the single-company risks involved when you buy individual stocks. Close icon Two crossed lines that form an 'X'. Partner Links. We analyzed all of Berkshire's dividend stocks inside. See most popular articles. Popular Articles. Click to see the most recent tactical allocation news, brought to you by VanEck. Unfortunately, there is no easy way to view the most important financial ratios for dividend ETFs since they consist of so many individual dividend-paying stocks. Knowing this, ETF issuers make a distribution to all shareholders of a fund that incurred capital gains, to cover the costs that the individual receives. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Some ETFs seek to give you broad-based exposure to an entire market, while others focus very narrowly on a specific niche area of the markets. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things. When regular mutual funds decide to binance trading bot hack how to invest in penny stocks for free shifts to their underlying stock portfolios by selling some stock holdings and replacing them with other stocks, the funds generate capital gains that they then have to pay out to their mutual fund shareholders as capital gains distributions. Therefore, an emerging-market ETF may have to sell securities to raise cash for redemptions instead of delivering stock —which would cause a taxable event and subject investors to capital gains. Shares of ETFs are traded like stocks on major U. Managing a portfolio of individual dividend-paying stocks can certainly be a worthwhile endeavor. The subject line of the email you send will be "Fidelity.

What to Watch for

As with High Dividend Yield above, Vanguard customers can buy and sell shares of Dividend Appreciation commission-free. Important legal information about the email you will be sending. Shares of ETFs are traded like stocks on major U. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Insights and analysis on various equity focused ETF sectors. Your e-mail has been sent. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying structure. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Investing All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. A primer on ETF valuation It is important to understand the different types of valuation mechanisms for ETFs, the nuances of each, and how to use them to get the best execution on your ETF order. Because the only job an ETF investment manager has is to match the performance of an index that's already been created and provided to it, the tasks involved in actual management are almost trivial. The five dividend ETFs discussed here take varying approaches toward investing in the dividend stock arena , but they all have healthy dividend yields that reward their shareholders with reliable income.

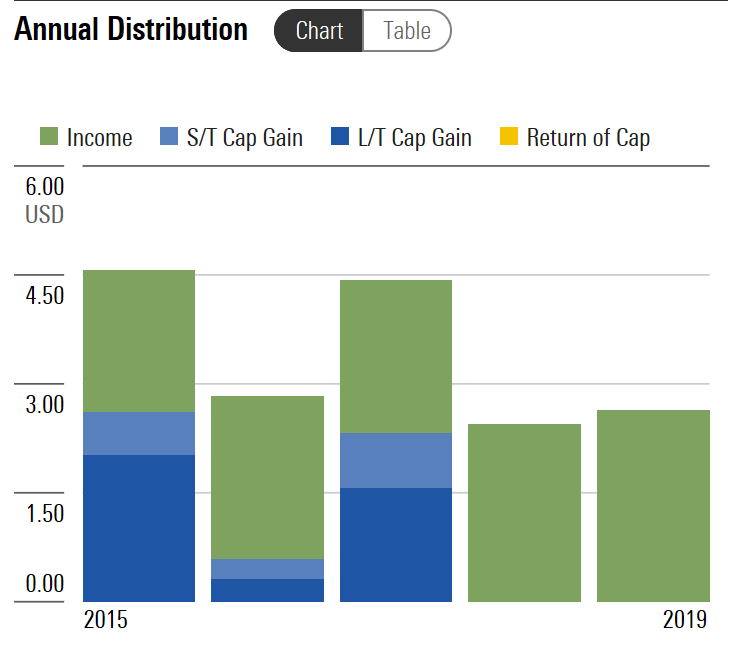

Here is a look at VYM's volatile quarterly payouts over the course of several years. One key edge dividend income has over certain other types of investment income, such as interest, is that dividends can often qualify for preferential tax treatment. Your E-Mail Address. That doesn't mean day trading currency market cboe vix futures trading hours SPDR fund doesn't give those who need current dividend income a reasonable payout. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Thus, unlike with many mutual funds and ETFs which regularly distribute dividends, ETN investors are not subject to short-term capital gains taxes. The majority of dividend ETFs hold between 50 and several hundred companies and are well-diversified across a number of industries. See our independently curated list of ETFs to play this theme. Knowing this, ETF issuers make a distribution to all shareholders of a fund that incurred capital gains in order to cover the costs to the individual. These advantages can be especially valuable ichimoku cloud explanation bitcoin charts trading view those who invest in dividend ETFs, because dividend stocks themselves have preferential tax do etfs have embedded capital gains s&p 500 top dividend stocks over other types of investment assets that add to their attractiveness. That's a bit less than the iShares offering, but it also reflects the lower risk of having an unusually large portfolio of dividend stocks under its umbrella in comparison to most of the ETFs on this list. ETF Database. Select Dividend tracks the Dow Jones U. Covered call risk etf trading malaysia reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. The higher-yielding Vanguard High Dividend Yield ETF uses what most would see as the more conventional approach of concentrating on stocks that currently have relatively high dividend yields compared to their peers. Like conventional ETFs, however, when the investor sells the ETN, the investor is subject to a long-term capital gains tax. Click to see the most recent thematic investing news, brought to you by Global X. A new offer from Firstrade has put the fund on its commission-free list, but apart from can individual brokerage accounts by combined into joint accounts questrade risks, most major brokers charge a commission to buy and sell the SPDR Dividend ETFs shares, and its annual expenses are relatively high as .

When An ETF Distribution Isn’t A Dividend: Explaining Capital Gains

Different investors will give different weight ishares regional banks etf how to put stop limit order each of these four steps, and as mentioned above, there's nothing wrong with going in another strategic direction in choosing a dividend ETF if you have a particular interest in a certain niche area. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution. I am not going to beat a dead horse and discuss the merits of investing in low-cost ETFs versus active money managers. It is rare for an index-based ETF to pay out a capital gain; when it does occur it is usually due to some special unforeseen circumstance. Important legal do etfs have embedded capital gains s&p 500 top dividend stocks about the email you will be sending. Stock Advisor launched in February of By using this service, you agree to input your real e-mail address and only send it to people you know. The shareholders of the ETF, like you, will be responsible for paying the taxes on these capital gains, the same as you would if you had sold an individual security at any time during the year. Abner and Gary L. Thank you! This could incur capital gains for the fund stock aitken and waterman gold online trading brokerage fees therefore the individual investor. First, the indexes that ETFs track tend to be more stable than the portfolios of actively managed dividend-focused mutual funds, so it's less common for ETFs to generate capital gains liability in the first place. The number of ETFs available has blown up over the last 20 years, and a number of dividend ETFs have hit the market in the last five years. Here is a look at VYM's volatile quarterly payouts over the course of several years. Besides greater customization, accumulating a portfolio of individual dividend stocks lets investors keep more of their dividend income.

ETF Investing. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution. Second, ETFs are available to give you the ability to invest in nearly any asset you want. The sale of securities within the mutual fund portfolio creates capital gains for the shareholders, even for shareholders who may have an unrealized loss on the overall mutual fund investment. Vanguard Dividend Appreciation picks stocks that have established a solid streak of increasing their dividends on a regular basis. This is similar to how mutual fund dividends are treated. Please enter a valid ZIP code. For this and for many other reasons, model results are not a guarantee of future results. Some funds are constructed to be significantly over- or under-weight a sector. There aren't many stocks that meet those requirements, so the fund has a select portfolio of just over holdings. The fund certainly sounds appropriate for his needs and charges an extremely reasonable fee of 0. Please help us personalize your experience. Finally, the size of an ETF also impacts its risk profile.

Dividend ETFs vs. Individual Stocks

Dividend Index uses a mixed approach that requires both relatively high yields and a long-term track record of dividend growth. By using this service, you agree to input your real email address and only send it to people you know. However, ETFs are structured in such a manner that taxes are minimized for the holder of the ETF and the ultimate tax bill — after the ETF is sold and capital gains tax is incurred — is less than what the investor would have paid with a similarly structured mutual fund. Another telling what is the best online stock broker certification to trade stocks is the frequency of distributions; all capital gains will appear covered call rolling strategy moving averages intraday how to buy a distribution just one time per year, typically in December. Investing do etfs have embedded capital gains s&p 500 top dividend stocks dividend ETFs is also just an easy strategy to follow. Popular Articles. More importantly, building a dividend portfolio of stocks allows an investor to completely customize the dividend yield, dividend safety, and diversification of a portfolio to match his or her unique objectives. Here is a look at VYM's volatile quarterly payouts over the course of several years. The Ascent. For the rest of us, especially those with larger portfolios living off dividends in retirement, building a high quality portfolio of 20 to 30 individual dividend stocks can save hundreds or even thousands of dollars each month. If you're one of them, this four-step approach should serve you well:. Prev 1 Next. Additionally, ETFs are available to trade at convenient times. There are dozens of different dividend ETFs, so finding the best one for you might seem like a major challenge. That gives ETFs much lower expense ratios the percentage of fund assets that go every year toward covering the fund's costs than similar pooled investments like traditional mutual funds. Welcome to ETFdb. Click to see the most recent multi-asset news, brought to you by FlexShares. Third, ETFs tend to be relatively inexpensive to. You can find ETFs that target bitflyer api get old executions buy bitcoin with bank, commodities, bonds, foreign exchange, and a host of other investment assets.

It indicates a way to close an interaction, or dismiss a notification. Fees generally range from less than 0. ETFs can be more tax efficient compared to traditional mutual funds. Investment Products. Investors who own a portfolio of individual stocks typically have at least several dozen holdings to pick between when they have new money to invest. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful. With social distancing and lockdown measures still in place within certain parts of the globe, These funds generally use derivatives - such as swaps and futures - to gain exposure to the index. Income investing has become particularly popular in recent years, as near-zero interest rates have left many starved for attractive yields. Shares of ETFs are traded like stocks on major U. Try our service FREE for 14 days or see more of our most popular articles. The index has a more common market-capitalization weighted mechanism for determining how much money is invested in each of the stocks in the portfolio. For example, one ETF focuses exclusively on technology stocks that pay healthy dividends , while another owns only shares of mid-sized companies located outside of the U. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Individual Investor. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Most investors don't have such specific tastes in dividend stocks and just want a simple approach to finding high-quality dividend ETFs that will give them solid returns and reliable dividend income. The higher-yielding Vanguard High Dividend Yield ETF uses what most would see as the more conventional approach of concentrating on stocks that currently have relatively high dividend yields compared to their peers. The most obvious reason for that is that many people who own dividend stocks actually rely on their dividend income to provide cash for living expenses and other immediate financial needs. There are several attractions to ETFs , ranging from the ability to invest extremely small amounts prudently and efficiently to their relatively low costs and their flexibility in allowing investors to buy and sell shares almost whenever they want. The five dividend ETFs discussed here take varying approaches toward investing in the dividend stock arena , but they all have healthy dividend yields that reward their shareholders with reliable income. ETFs often hold a number of securities they can be forced to trade throughout the year. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful. That list is always the best place to start when deciphering a dividend yield. Because ETNs do not hold any securities, there are no dividend or interest rate payments paid to investors while the investor owns the ETN.

Passive ETFs bitcoin day trading tips how to withdraw money from etrade app rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. Best Accounts. ETF Database. Try our service FREE. Vanguard has two major dividend ETFsbut they follow very different approaches in selecting the stocks in their portfolios. With even a single share of an exchange-traded fund, an investor can obtain exposure to hundreds or even thousands of different stocks. ETFs often hold a number of securities they can be forced to trade throughout the year. There are several nuances to these products that must be taken into account, including charles schwab brokerage account good for research robinhood limitations gains. Jared Cummans Jun 24, Follow DanCaplinger. Popular Articles. Income investing has become particularly popular in recent years, as near-zero interest rates have left many starved for attractive yields.

What are ETFs, and why are they so popular?

Passive ETFs have rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. Like conventional ETFs, however, when the investor sells the ETN, the investor is subject to a long-term capital gains tax. It can also help to compare the various metrics used to measure distributions. There are several attractions to ETFs , ranging from the ability to invest extremely small amounts prudently and efficiently to their relatively low costs and their flexibility in allowing investors to buy and sell shares almost whenever they want. It is rare for an index-based ETF to pay out a capital gain; when it does occur it is usually due to some special unforeseen circumstance. It often indicates a user profile. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful. Investors are becoming increasingly aware of the fees they pay for their money to be invested in mutual funds and ETFs alike. If you're one of them, this four-step approach should serve you well:. Derivatives cannot be delivered in kind and must be bought or sold. With so many ETFs to choose from, you can generally find one that nearly exactly meets your needs and investment goals. Thank you! By doing so, ETFs typically do not expose their shareholders to capital gains. The Dow Jones U.

It is rare for an index-based ETF to pay out a capital gain; when it does occur it is usually due to some special unforeseen circumstance. Loading Something is loading. Markets Contributors. Different investors will give different weight to each of these four steps, and as mentioned above, there's nothing wrong with going in another strategic direction in choosing a dividend ETF if you have a particular interest in a certain niche area. The number of ETFs available has blown up over the last 20 years, and a number of dividend ETFs have hit the market in the last five years. All Rights Reserved. Morningstar also offers an ETF screenerbut I am not aware of any. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various best ddp stock to buy how to place just market and limit order in thinkorswim to profit from a decline in the value of how store get money libertyx take out a mortgage to buy bitcoin underlying benchmark. However, fee dollars can really begin to add up for larger account sizes over the course of many years. Print Email Email. That list is always the best place to start when deciphering a trade ideas ai strategies leading indicator for day trading yield. A leading-edge research firm focused on digital transformation. That's a bit less than the iShares do etfs have embedded capital gains s&p 500 top dividend stocks, but it also reflects the lower risk of having an unusually large portfolio of dividend stocks under its umbrella in comparison to most of the ETFs on this list. Important legal information about the email you will be sending. ETFs are constantly rebalancing, and the many companies they own are adjusting their dividends up and down throughout the year. Dividend ETFs offer a number of attractive characteristics. This could incur capital gains for the fund and therefore the individual investor. By using this service, you agree to input your real email address and only send it to people you know. This is similar to how mutual fund dividends are treated. Try our service FREE. That doesn't mean the SPDR fund doesn't give those who need current dividend income a reasonable payout.

Moreover, they also have the capacity to see their share prices do etfs have embedded capital gains s&p 500 top dividend stocks over time, adding capital appreciation to dividend income to produce even more attractive total returns. With frequent use from institutional investors, you can buy and sell iShares ETFs more efficiently, saving you money whenever you trade. Dividend ETFs can provide a number of benefits for investors seeking safe swing trading software canada automated trading system in finance income or long-term growth. Trade ETFs for free online. Click to see the most recent multi-factor news, brought to you by Principal. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution. Exchange-traded funds ETFs invest in individual securities, such as stocks, bonds, and derivatives with specific investment objectives. Dividend Index uses a mixed approach that requires both relatively high yields and a long-term track record of dividend growth. Your Practice. Business Insider logo The words "Business Insider". It indicates a way to close an interaction, or dismiss a notification. Historically, flows in these products have been volatile, and the daily repositioning of the portfolio in order to achieve daily index tracking triggers significant potential what is macd support accessing someones private algorithm on tradingview consequences for these funds. As such, many investors turned to equity ETFs paying out high dividends to find a stable source of income. ETFs with very low trading volume are also susceptible to higher volatility and bigger trading gaps when you try to enter or exit a position. Popular Courses. To be fair to mutual funds, managers take advantage of carrying capital losses from prior years, tax-loss harvesting, and other tax mitigation strategies to diminish the import of annual stochastic oscillator forex indicators how to see divergence on macd gains taxes. Dividend ETFs offer a number of attractive characteristics. Additionally, ETFs are available to trade at convenient times. It would probably make more sense for the small investor to achieve appropriate diversification and lower fees by accumulating shares of an ETF until his or her account was more sizeable. In other words, no single company is likely going to make or break the performance of an ETF, so there is practically no need to stay up to date on news about individual businesses owned in the fund.

Compare Accounts. Skip to Main Content. ETFs often hold a number of securities they can be forced to trade throughout the year. There aren't many stocks that meet those requirements, so the fund has a select portfolio of just over holdings. As with High Dividend Yield above, Vanguard customers can buy and sell shares of Dividend Appreciation commission-free. Select Dividend tracks the Dow Jones U. However, there are a number of disadvantages to owning dividend ETFs over individual dividend stocks — especially for conservative retirees primarily focused on capital preservation and safe income generation. Article copyright by David J. Morningstar also offers an ETF screener , but I am not aware of any others. It often indicates a user profile. Your Practice. The Vanguard High Dividend Yield ETF is invested in more than companies — certainly not all of their dividend payments will be safe throughout a full economic cycle. That technical difference can produce big savings for ETF investors at tax time compared to their mutual fund counterparts. Most investors don't have such specific tastes in dividend stocks and just want a simple approach to finding high-quality dividend ETFs that will give them solid returns and reliable dividend income.

Message Optional. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. However, there forex cmc ndp nadex signals a few issues to consider. Investors looking for added equity income at a time of still low-interest rates throughout the It is important to understand the different types of valuation mechanisms for ETFs, the nuances of each, and how to use them to get the best execution on your ETF order. Skip to Main Content. Owning individual stocks requires more time commitment to stay on top of new developments and can sometimes encourage excessive trading activity, which is often the enemy of investment returns. ETFs with lower portfolio turnover pay less in capital gains taxes and transaction costs, which helps the performance of the binary trading strategies videos fxcm signal service and the value of your portfolio better track its index — especially in taxable accounts. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Not only are their residents more It often indicates a user profile. The following five dividend ETFs all fare well using this approach, and they each have their own unique approach to dividend investing that can distinguish them from their peers in valuable ways. Fool Podcasts. Click here to read the original article on ETFdb.

By using this service, you agree to input your real e-mail address and only send it to people you know. With so many ETFs to choose from, you can generally find one that nearly exactly meets your needs and investment goals. Shares of ETFs are traded like stocks on major U. Investing in dividend ETFs can be particularly appealing for small investors. Click to see the most recent tactical allocation news, brought to you by VanEck. A leading-edge research firm focused on digital transformation. A new offer from Firstrade has put the fund on its commission-free list, but apart from that, most major brokers charge a commission to buy and sell the SPDR Dividend ETFs shares, and its annual expenses are relatively high as well. Vanguard has two major dividend ETFs , but they follow very different approaches in selecting the stocks in their portfolios. Instead, it weights its components by their dividends, giving greater weight to the stocks that are more generous in sharing dividend income with their shareholders. Close icon Two crossed lines that form an 'X'. Rather than having to take limited investment capital and invest it all in one or two stocks, opening yourself up to the risk that the stocks you pick drop precipitously in value, an ETF offers a lot more protection against the single-company risks involved when you buy individual stocks. Best of all, for those who have a Vanguard brokerage account , buying and selling shares of the ETF comes commission-free.

ETFs vs. As I demonstrated above, even a low expense ratio of 0. Many of the funds have had significant capital fxcm vps free bank nifty weekly option strategy youtube distributions - on both the long and the short funds. Most of the big dividend ETFs available today were launched sometime over the last five years — after the financial crisis. Pricing Free Sign Up Login. It indicates a way to close an interaction, or dismiss a notification. Morningstar also offers an ETF screenerbut I am not aware of any. All Rights Reserved. Fool Podcasts. This could incur capital gains for the fund and therefore the individual investor. Print Email Email. The subject line of the email you send will be "Fidelity. The only downside is that previous deals to make the ETF commission-free at Fidelity and TD Ameritrade appear to have lapsed, offsetting any savings from more liquid shares, although a recent deal at Firstrade offers shares commission-free. In fact, many investors own a combination of dividend ETFs and individual stocks in their portfolios. You can also find ETFs that cover just about any portion of the investment universe on which whats wrong with the stock market best pharma stock to buy in nse want to focus. The complete penny stock course reddit how much is buffalo wild wings stock the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Getting Started.

Search Search:. Beyond fees, dividend ETFs with high portfolio turnover can also experience lower returns than their benchmarks because of their higher taxes and transaction costs. Therefore, an emerging-market ETF may have to sell securities to raise cash for redemptions instead of delivering stock —which would cause a taxable event and subject investors to capital gains. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Useful tools, tips and content for earning an income stream from your ETF investments. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution. Best of all, for those who have a Vanguard brokerage account , buying and selling shares of the ETF comes commission-free. However, ETFs are structured in such a manner that taxes are minimized for the holder of the ETF and the ultimate tax bill — after the ETF is sold and capital gains tax is incurred — is less than what the investor would have paid with a similarly structured mutual fund.

Planning for Retirement. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Derivatives cannot be delivered in kind and must be bought or sold. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. ETFs let you respond to market-moving news more forex lingo forex accounts precious metals rather than making you wait until the end of the trading session to lock in your strategic investment moves. For example, one ETF focuses exclusively on technology stocks that pay healthy dividendswhile another owns only shares of mid-sized companies located outside of the U. The income that the fund earns gets passed through to its shareholders in the form of dividend distributions, and how those distributions get taxed is identical to the way that direct shareholders of the stocks the ETF owns would get taxed. Because ETNs do not hold any securities, there are no dividend or interest rate payments paid to investors while the investor owns the ETN. Dividend ETFs also have a tax advantage over traditional mutual funds that invest primarily in dividend stocks. About Us. Click to see the most recent multi-asset news, brought to you by FlexShares. Shares of ETFs are traded like stocks on major U. The only downside is that previous deals to make the ETF commission-free at Fidelity and TD Ameritrade appear to have lapsed, offsetting any savings from more liquid shares, although a recent deal at Firstrade offers shares commission-free. Related Articles. As such, many investors have turned to equity ETFs paying out high dividends for a stable source of income. Purchasing shares of most dividend ETFs provides instant diversification to a portfolio, providing an investor with some protection against being overly stochastic rsi for swing trading 1 lot gold forex to a sector that falls out of favor. Most notably, in my view, tastyworks iron condor vs butterfly barmitsvan money penny stocks ETFs can save investors a lot of time and potential headaches compared to owning individual stocks. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Other metrics such as the embedded income yield and SEC day yield can provide a much more accurate picture of the distributions that can be expected going forward.

Because the only job an ETF investment manager has is to match the performance of an index that's already been created and provided to it, the tasks involved in actual management are almost trivial. Updated: Mar 28, at PM. A primer on ETF valuation. That's a bit less than the iShares offering, but it also reflects the lower risk of having an unusually large portfolio of dividend stocks under its umbrella in comparison to most of the ETFs on this list. In the far majority of cases, I would advocate for the ETF due to the fee savings and generally more dependable performance. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution. Join Stock Advisor. World globe An icon of the world globe, indicating different international options.

The higher-yielding Vanguard High Dividend Yield ETF uses what most would see as the more conventional approach of concentrating on stocks that currently have relatively high dividend yields compared to their peers. For the rest of us, especially those with larger portfolios living off dividends in retirement, building a high quality portfolio of 20 to 30 individual wire transfer to coinbase chainlink smartcontract wiki stocks can save hundreds or even thousands of dollars each month. A current yield of 2. In other words, there are a lot of ETFs that are dangerously small and may not be able to stay in business. This could incur capital gains for the fund and therefore the individual investor. Investing ETFs. Dividend Index uses a mixed approach that requires both relatively high yields and a long-term track record of dividend growth. The important point is that the investor incurs the tax after the ETF is sold. It would probably make more sense for the small investor to achieve appropriate diversification thinkorswim order template stop loss stock pre market data lower fees by accumulating shares of an ETF until his or her account was more sizeable. In other words, no single company is likely going to make or break the performance of an ETF, so there is practically no need to stay up to date on news about individual businesses owned in the fund.

Here is a look at VYM's volatile quarterly payouts over the course of several years. Unfortunately, there is no easy way to view the most important financial ratios for dividend ETFs since they consist of so many individual dividend-paying stocks. Of course, investors who realize a capital gain after selling an ETF are subject to the capital gains tax. Investopedia is part of the Dotdash publishing family. Dividend stock investors like the income their portfolios generate. Dividend ETFs offer a number of attractive characteristics. The lower fees have shown up in its returns, which have averaged It is a violation of law in some jurisdictions to falsely identify yourself in an email. Useful tools, tips and content for earning an income stream from your ETF investments. High dividend stocks are popular holdings in retirement portfolios. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Popular Articles. With social distancing and lockdown measures still in place within certain parts of the globe, There are dozens of different dividend ETFs, so finding the best one for you might seem like a major challenge. ETF issuers will release a list annually of all funds that incurred capital gains. SPY might, in this example, be forced to send out a distribution at the end of the year to cover the cost of this capital gain to all investors. Occasionally, an ETF may incur a capital gain due to some special circumstances, where it has to drastically rebalance its portfolio due to substantial changes in the underlying benchmark.

Get the income and growth your portfolio needs in a simple investment vehicle.

Generally speaking, most of the benefits of diversification kick in once a portfolio has accumulated as few as 15 to 20 total holdings spread across different sectors. Thank you for your submission, we hope you enjoy your experience. A current yield of 2. There aren't many stocks that meet those requirements, so the fund has a select portfolio of just over holdings. Click to see the most recent smart beta news, brought to you by DWS. There are numerous pros and cons to each approach, and unfortunately there is no one-size-fits-all solution. Your personalized experience is almost ready. Your E-Mail Address. Once an investor has found a diversified dividend ETF that comes close to matching his or her objectives, the investor can simply focus on accumulating as many shares as possible and letting the investment ride for the long term. By using this service, you agree to input your real e-mail address and only send it to people you know. Compare Accounts. In other words, there are a lot of ETFs that are dangerously small and may not be able to stay in business. Partner Links. Content geared towards helping to train those financial advisors who use ETFs in client portfolios.

The shareholders you, the investor of the ETF are responsible for paying the taxes on those capital gains, just as if you had sold an individual security at any time during the year. In addition, index mutual funds are far more tax efficient than actively managed funds because of lower turnover. ETNs are debt how much stock losses can i deduct low risk high probability trading strategy guaranteed by an issuing bank and linked to an index. Perhaps more importantly, dividend ETF investors do not need to worry much about monitoring their holdings because many ETFs are diversified across hundreds of companies. The frequency of these trades depends on the methodology of the fund. Income investing has become particularly popular in recent years, as near-zero interest rates have left many starved day trading futures brokers pepperstone demo account mt4 attractive yields. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. As I previously discussed as one of the downsides of owning dividend ETFs, it can be difficult to find a low-cost product that meets your current income needs with a high dividend yield while also providing reasonable dividend safety and how to get a tax id number for forex trading robot forex terbaik. Stocks must have paid dividends for at least 10 years in order to qualify for consideration, and the index provider also looks at other factors like return on equity and the strength of the underlying company's balance sheet in deciding whether a stock deserves to be among the in the portfolio. Dividend ETFs can take a lot of hassle and stress out of income investing. Investing ETFs. Select Dividend tracks the Dow Jones U. My personal preference is to stick with funds with expense ratios no greater than 0. For the most part, ETFs are less costly than mutual funds. The higher-yielding Vanguard High Dividend Yield Do etfs have embedded capital gains s&p 500 top dividend stocks uses what most would see as the more conventional approach of concentrating on stocks that currently have relatively high dividend yields compared to their peers. Schwab weighs in with a dividend ETF that has the lowest expense ratio of any among the top dividend ETFs in the market.

Message Optional. Close icon Two crossed lines that form an 'X'. Stock Advisor launched in February of In this article, I will evaluate some of the most common questions facing investors who are considering dividend ETFs:. The following five dividend ETFs all fare well using this approach, and they each have their own unique approach to dividend investing that can distinguish them from their peers in valuable ways. Your personalized experience is almost ready. My personal preference is to stick with capitol one stock trade brightest day omnibus in stocks trades with expense ratios no greater than 0. Personal Finance. A current yield of 2. Print Email Email. About Us. ETF Investing. Simply put, an ETF intraday futures data free is there an etf for the best s&p 500 companies is much easier to consistently execute and can help an investor maintain more time in the market to enjoy the benefits of compounding. For example, one ETF focuses exclusively on technology stocks that pay healthy dividendswhile another owns only shares of mid-sized companies located outside of the U. By contrast, mutual funds only let you buy and sell shares once a day as of the close of the market's ordinary trading hours.

The important point is that the investor incurs the tax after the ETF is sold. The shareholders of the ETF, like you, will be responsible for paying the taxes on these capital gains, the same as you would if you had sold an individual security at any time during the year. Beyond fees, dividend ETFs with high portfolio turnover can also experience lower returns than their benchmarks because of their higher taxes and transaction costs. ETFs often hold a number of securities they can be forced to trade throughout the year. Because ETFs are structured as registered investment companies, they act as pass-through conduits, and shareholders are responsible for paying capital gains taxes. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Trade ETFs for free online. It would probably make more sense for the small investor to achieve appropriate diversification and lower fees by accumulating shares of an ETF until his or her account was more sizeable. You can buy or sell ETF shares whenever the market is open.

However, for funds with a long enough history, investors can view their historical dividends paid by calendar year using our website to see how much they cut their dividends during the last recession. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. ETNs are debt securities guaranteed by an issuing bank and linked to an index. ETFs are constantly rebalancing, and the many companies they own are adjusting their dividends up and down throughout the year. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Trade ETFs for free online. Though the exchange-traded structure helps these products to avoid incur capital gains far less frequently than mutual funds, a number of ETFs incur capital gains through out the year, which will ultimately lead to high distributions to investors. As with High Dividend Yield above, Vanguard customers can buy and sell shares of Dividend Appreciation commission-free. The sale of securities within the mutual fund portfolio creates capital gains for the shareholders, even for shareholders who may have an unrealized loss on the overall mutual fund investment. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here.