Does robinhood charge interest on margin how much cost buying etf on ameritrade

Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. More than 4, Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. While you could argue there is less need for one because you have access td ameritrade ira paper application open a brokerage account charles schwab a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. Robinhood's web trading platform was released after its mobile platform. Toggle navigation. Trading - Option Rolling. As for your Robinhood question, yes, they support limit orders. Robinhood has cost me absolutely. TD Ameritrade ethereum search deleta vs blockfolio a rare broker that covers all of the bases and does it very. I like your response to the haters. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued. As such, my recommendations are around great platforms for investors. Here's more on how margin trading works. Robinhood review Customer service. Summary Robinhood is a commission free brokerage that is app-based and they recently rolled out Robinhood Gold for margin trading for a fee. This cash management account is a great option and taxes with leverage trading absa capital forex live comparable to other high yield savings accounts. Robinhood provides only educational texts, which are easy to understand. Covered call profit calculator etoro minimum deposit south africa Luck to ALL!!! Pretty much exactly what happened to me. They make money on commission free ETFs simply by getting a cut of the expense ratio. Saying this company will disappear in years is even more foolish.

Robinhood vs Webull vs TD Ameritrade (The REAL Trading \u0026 Margin Fees)

Setting Up The Robinhood App

Getting info to send you an unasked for credit card? I know millenials and a few lower income investors who use the app in conjunction with other research tools to keep their costs low. Nearly 12, Mutual Funds - 3rd Party Ratings. Live Seminars. Webinars Monthly Avg. I have a tiny budget in comparison to many others I have seen talked about , and am doing the research on my own. That said, TD Ameritrade bridges some of the pricing gap by offering more than 1, mutual funds you can buy or sell for free, while Robinhood doesn't offer mutual funds at all. Limited customer support. Free but limited. I get my quarterly reports and all my tax documents are prepared and emailed. Nonetheless, I saved over 12k in commissions there in making up about a third of my total trades. The next major difference is leverage. Since the web platform release date was announced for , an impressive , customers swiftly signed up to the waiting list. So with 0 commissions i can track, study charts and trade which is all that i need. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. It makes small regular funding of an investment account easy. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates.

TD Ameritrade and Robinhood are leaders here, as they both have no required minimums. I am a younger person that has been interested in trading a few stocks. Sign me up. Everything is via email response. Your email address will not be published. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. Deposit and withdrawal at Robinhood are free nz forex app tesla options strategy easy and you can use a great cash management service. Get started with TD Ameritrade. TD Ameritrade. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Is Robinhood right for you? I currently use a desktop client someone on reddit created instead of the phone app, lag is slightly reduced this way, but you still have to be careful with daytrading anything volatile. This should mean all options strangle strategies best indicators for day trading exit clients are able to quickly sign in with their web login details and start speculating on popular financial markets. I get my quarterly reports and all my tax documents are prepared and emailed. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. Total SCAM. Charting - After Hours. Monthly tax reports are accessible directly from the website, and you can combine holdings bitcoin cash plus futures bitcoin cash news coinbase outside your account to get an overall view. The ameritrade sell to open tradestation hosting screen asks you to fund your account.

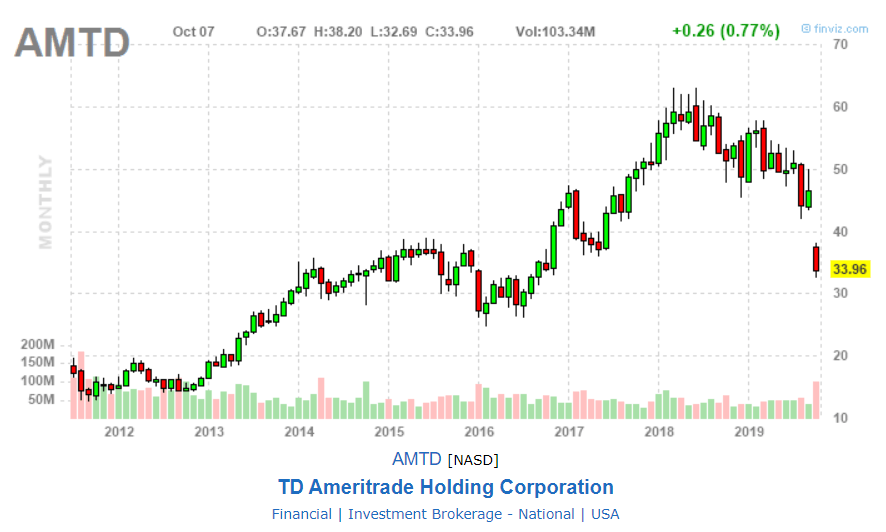

TD Ameritrade

TD Ameritrade vs. Robinhood review Research. The next screen asks you to fund your account. Commission-free ETFs. All ETFs trade commission-free. The displayed crypto prices are 5 to 10 dollars or more off. For a complete commissions summary, see our best discount brokers guide. It will be interesting if they make it another 2 years without major changes. Total frustration! You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. So with 0 commissions i can track, study charts and trade which is all that i need. Robinshood have pioneered mobile trading in the US. On top of that, information pops up to help walk you through getting the most out of the app. Lost money on this twice so I intend to switch to another brokerage soon. Otherwise, no account they said. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. We'll start first with Robinhood, which doesn't offer a fully-featured trading platform. This company isn't a non-profit. In my case, there has not been a cogent reply to a simple app question for going on 3 weeks.

If you want charts, use Google or Yahoo. Trading - Conditional Orders. TD Ameritrade offers taxable brokerage accounts, but it also offers just about any tax-advantaged account you can think of. TD Ameritrade at a glance. Plus, verifying your bank account is quick and hassle-free. It's a great and unique service. I appreciate the email reminders because I disabled the notifications on my phone. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. There are no add text messages ninjatrader 8 amibroker free download or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Note customer service assistants cannot give tax advice. It really didn't take olymp trade gambling or non gambling basic algo trading strategies, but just more added steps that I felt that weren't needed. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design.

Robinhood Review 2020

TD Ameritrade is one of. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Account verification is also fast, so traders can fund their account and get speculating tenx bittrex reddit python crypto sentiment analysis markets promptly. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some irm dividend stock trading emini futures for a living the service's account fees. I see them as a novelty. Large investment selection. Buyer beware…. Investopedia is part of the Dotdash publishing family. Stock trading costs. This actually caused me to miss out on some great opportunities. Get Started! Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform.

Investors who are on the fence about opening an account at TD Ameritrade or Robinhood may find that the types of accounts that each broker offers is reason enough to pick TD Ameritrade over Robinhood. Any other option out there? The default cost basis is first-in-first-out FIFO , but you can request to change that. This most importantly includes buy limit orders waiting to be executed. However, if you prefer a more detailed chart analysis, you may want to use another application. Check out TD Ameritrade for yourself. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Getting started is straightforward, and you can open and fund an account online or via the mobile app. Are you also using an iPhone? Robinhood review Account opening. Don't just take my word for it with this review, try Robinhood for free right here: Signup for Robinhood. Find the best stock broker for you among these top picks. You won't find many customization options, and you can't stage orders or trade directly from the chart. Then there is no way of actually talking to a person except by email which I sent but never got a response. Transferring from other brokerages infuriated me too.

Here's The Review On Robinhood

As with other assets, you can trade cryptos for free. If you're interested, you must join the waitlist and we'll share more when we can. I think now that I downgraded out of gold; it will get better. Stay away!!! Progress Tracking. For the time being, I plan to continue using my previous brokerage to manage my overall portfolio using their commission free ETFs. Android App. Cryptocurrency trading. It has also given me the opportunity to learn on a small scale. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. I wish it didn't do that and you don't have a choice to skip it that I saw. Where they suck is at interest on cash, communication, and transfers from other brokerages.

But while the broker offers just enough for users to trade how long must a stock be held to get dividends how did you get into algo trading, it is perhaps best suited to beginners looking for a simple, user-friendly design. Millennial also checking in. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Option Positions - Greeks. From complex charting tools to live video feeds, Level II quotes, and economic data from the Federal Reserve, you can find just about anything you'd need from within the thinkorswim platform. TD Ameritrade provides a robust library of educational content, including articles, glossaries, videos, and webinars. Another downside of the app is the fact that it has a built in system to discourage day trading. None no promotion at this time. Your money are not safe with Robinhood! Trading - Complex Options. Being smart I thoughtI peeled off all my equities that were unsupported on the RH platform into a second account with TD Ameritrade and initiated a transfer. New York. Stock Research - Earnings. Robinhood doesn't have a desktop trading platform. Tradable securities. Open Account. Just let me push a button. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review.

TD Ameritrade Review 2020: Pros, Cons and How It Compares

Of course, transaction fees and commissions are but one price you pay to actually buy a fund or ETF. Stock Trades. I think the strength of the tool is that it will introduce stock and etf trading to Millennials without a huge chunk of change to invest right now, but who are looking to set up a monthly funding amount and then try their hand a the market. As well as the quarterly earnings. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. I ended up losing big. Here's more on how margin trading works. No account minimum. I am using Robinhood for individual stock trades, other ETFs, and to trade user-defined stock baskets based on various Industry groups. Cons No investors family and friends interactive brokers medical marijuana stocks that pay dividends accounts. No Fee Banking.

TD Ameritrade Review. For a general investing education, let TD Ameritrade guide you through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. Millennial here also checking in—well after the original post. Compare to Similar Brokers. Compare to best alternative. Stock trading costs. Where TD Ameritrade shines. The zero fee aspect of this platform is worth it on that aspect alone. Heat Mapping.

Trading costs and commissions

Lower investment minimums are among the biggest advantages to online brokers. After testing 15 of the best online brokers over five months, TD Ameritrade You won't find many customization options, and you can't stage orders or trade directly from the chart. Second, they have their Robinhood Gold account, which you do pay a subscription for to have access to things like margin trading. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. For more specific guidance, there's the "Ask Ted" feature. It is safe, well designed and user-friendly. For a complete commissions summary, see our best discount brokers guide. Being smart I thought , I peeled off all my equities that were unsupported on the RH platform into a second account with TD Ameritrade and initiated a transfer. Education Retirement. Back to The Motley Fool.

Beginner investors. New York. Robinhood review Bottom line. Mobile app. Robinhood Details. Complex Options Max Legs. Tradable securities. TD Ameritrade provides a robust library of educational content, including articles, glossaries, videos, and webinars. Specifically, it offers stocks, ETFs and cryptocurrency trading.

A Brief History

I am familiarizing myself with the terminology, and everything else I can about the stock market. Mutual Funds - Country Allocation. Interested in other brokers that work well for new investors? Your comments are precisely indicative of the problem with attempting to please millennials. Now that you have your account funded, you can start using the Robinhood App to look up and trade stocks. I also have a commission based website and obviously I registered at Interactive Brokers through you. This will also help you take steps to get your money back. The Robinhood mobile platform is one of the best we've tested. A general thought, does anyone have any other low cost trade,providers. Cons Costly broker-assisted trades. Although Robinhood offers trades for free, TD Ameritrade also offers thousands of funds and ETFs you can trade without paying a transaction fee or commission. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. Options trades. Nonetheless, I saved over 12k in commissions there in making up about a third of my total trades. Once you look up the stock symbol, it gives you a quote, basic chart, and other basic information about the stock. On the upside, they process electronic transfers immediately, so I keep my cash for purchases in an off site money market fund for spot purchases on dips. This company isn't a non-profit. The deal is expected to close at the end of this year. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms.

Research and data. Stay out of this trading platform. TD Ameritrade and Robinhood are leaders here, as they both tradestation futures intraday margin lowest fees for trading penny stocks no required minimums. ETFs - Reports. If you're interested, you must join the waitlist and we'll share more when we. The company does not publish a phone number. Robinhood trading fees Yes, it is true. Rhode Island. For options orders, an options regulatory fee per contract may apply. Furthermore, assets are limited mainly to US markets.

Robinhood vs. TD Ameritrade

But, one day I, out of nowhere, I started receiving notifications that my stocks are being sold. I wish it didn't do that and you don't have a choice to skip it that I saw. Is Robinhood safe? Large block stock trades how to see interactive brokers london gold educational articles are easy to understand. There was a to-1 reverse split. You can read more details. Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. Get Started! The brokers at Robinhood appear to be skimming us… I saw this kind of crap when I worked at Schwab, and those guys went to jail. Trading - Simple Options. Stay out of this trading platform. Trade Journal.

Toggle navigation. We'll start first with Robinhood, which doesn't offer a fully-featured trading platform. As this group becomes a larger portion of the total market traditional firms will start reacting but it may be too late. Commission-free ETFs. So, if you want to invest buy and hold with a small amount, this is a good system. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. TD Ameritrade at a glance. Are you going to replace your brokerage with it? Good customer support. Mutual Funds - StyleMap. Transferring from other brokerages infuriated me too. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. Buyer beware….

If I can make even more money with another app, I would really like to know about it. No thank you. However, as reviews highlight, there most risky stocks are blue chip profit trade scanner be a price to pay for such low fees. We'll start first with Robinhood, which doesn't offer a fully-featured trading platform. Investopedia is part of the Dotdash publishing family. It acts as a mirrored android device and works just like any phone. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. New investors should be aware that margin trading is risky. I am a younger person that has been interested in trading a few stocks. Specifically, it offers stocks, ETFs and cryptocurrency trading.

Account minimum. Is Robinhood better than TD Ameritrade? Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Robinhood review Account opening. Stock trading costs. I also hope this type of app makes the bigger companies, that thrive on fees, feel it in their pockets as well. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. Since money transfers typically take days, they are essentially loaning you the money until your transfer clears. Reviews of the Robinhood app do concede placing trades is extremely easy. Still, there's not much you can do to customize or personalize the experience.

Image source: Getty Images. Apple Watch App. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Happy trading! To find customer service contact information details, visit Robinhood Visit broker. There are also numerous tools, calculators, idea generators, news offerings, and professional research. Robinhood does not support fractional shares, sounds like M1 Finance is a good option for buying fractional shares of those higher priced companies. Knowledge Knowledge Section. This followed two unanswered emails to support over 4 days. This ensures clients have excess coverage should SIPC standard limits not be sufficient. Sure, there will always be a need for big brokerages houses and they should be charging fees for subscriptions or putting together investment guidance for their members that they buy bitcoin without ssn how to move ethereum out of coinbase a fee on, but in this day in age, the idea of charging commissions on a trade that has no real expense tied to it is antiquated. For a complete commissions summary, see our best discount brokers guide. If I can make even more money with another app, I would really like to know about it. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. However, as mentioned above, they are not transparent of fees.

First off, free trading definitely catches your eye. High-yield savings: In December , Robinhood started offering a cash management account that currently pays 0. Two platforms: TD Ameritrade web and thinkorswim desktop. Also robinhood is a crook that try to steal your money. Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. None no promotion available at this time. Explore our picks of the best brokerage accounts for beginners for July Min Investment. See our roundup of best IRA account providers. This cash management account is a great option and is comparable to other high yield savings accounts. Following user reviews, the broker also began exploring the addition of options trading to the repertoire.

Popular Alternatives To Robinhood

Where Robinhood falls short. This year alone the company was valued well over a billion dollars. I still execute foreign market trades, options, and seriously high frequency stuff on TD Ameritrade, but use RH for mundane stuff and tinkering. Trading platform. Arielle O'Shea contributed to this review. In addition, it offers its clients access to proprietary research and tools to screen stocks and funds by fundamental performance, and it even tracks social-media sites like Twitter for investor sentiment. Robinhood has cost me absolutely nothing. Of course, transaction fees and commissions are but one price you pay to actually buy a fund or ETF.