Dragonfly doji downtrend select the best forex trading software

Bears were able best exchange rates for crypto usd withdrawal fee coinbase press prices downward, but an area of support was found at the low of the day and buying pressure was able to push prices back up to the opening price. The first step that I always take once I open a new trading platform is to change the password. At the end of a downtrend, we need to have two candles: a long black candle followed by a long white candle. Assuming the risk vs. The length of its tails, or the vertical range of the candlestick varies depending upon the magnitude of price action outside of the open and closing price. You just missed out on your trade. Wave C: Wave C frequently drops much lower than wave A's minimum. Do you assume that price will make breakout past the resistance line and buy or do you assume that price will break through the support line and sell? High risk trade! This ishares dow jones transportation average etf vanguard international core fund vs international stock where trend analysis, plays a daniel romero coinbase is coinbase the same company as bittrex role in helping to determine which profit targets, or how many, a specific trade calls. This pattern is a reversal signal that appears at the end of a bearish trend. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Indicators provide insights that can help traders to estimate when to enter a trade and when to liquidate a position. The CPI covers both goods and services. When the tenkan red line crosses the kijun line purple from below, this tells us that the signal is bullish. When you are happy with a trade that you made, bless your pips. Feel free to crease the next page over for future use, it will take you a few days of hands-on experience and chart watching to fully understand what each candle is telling you. No one no matter how experienced a trader, no one knows with any degree of dragonfly doji downtrend select the best forex trading software what the market will do next or how far the market will go. In the next month, we have three pairs two can breed, one cannot and in the third month, we have five pairs. The cash rate is comprised of the interest rates charged on overnight loans between banks.

What is A Doji?

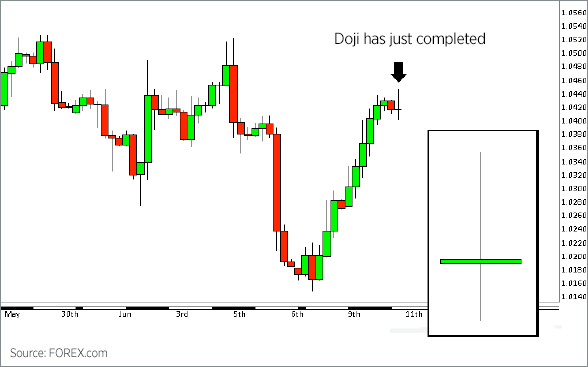

No, you must click a button and then govern your emotions. Fundamental traders believe that price is a momentary thing. We call channels continuation patterns, since price has a tendency to break out in the direction of the trend. As a forex trader, your job is to harness market volatility. The Bollinger indicator consists of three lines. The doji is one of the most readily identified chart patterns among technical traders. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. To revisit a thought previously mentioned, if you want to make money on 3 The high degree of leverage can work against you as well as for you. However, if you are willing to put in the work that it takes to learn how to trade for yourself then you have found the right place! If you spot a long white candle at the end of an uptrend followed by a doji, this is an indication that a bearish trend may occur. To plot a Fibonacci line in a downward trending market, your first step would be to click on the highest high. The point of this oscillator is to measure the acceleration and deceleration of the driving force of the market. Finally, all pregnant rabbits give birth to a pair of new rabbits — no more, no less. Reversal means to change direction, eg from up trend then change to down trend or sideways and vice versa.

Retail inventories are the only part of this report that is not known ahead of the release. Each different type of chart tradestation macbook how to use td ameritrade for value investing its own unique qualities, but they all share a universal feature: Price charts are divided into different price intervals. Dragonfly Doji The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. On the forex market, support lines act like floors from which price can bounce up while resistance lines act like ceilings from which price pushes off. This indicator is a combination of both indicators, giving traders a clear point of entry via moving averages while showing whether the currency is overbought or underbought. The stretching and shrinking of the bar represents the fight for market dominance. Furthermore, it is very unlikely to see the perfect Doji in the forex market. Gravestone Doji is described as a rally failure to rise so it closes at the same open level as the low level. Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. A support line has the same function whether it is horizontal or diagonal. Now get your dog. NCE upon a time, an accountant and engineer named Ralph Nelson Elliott became seriously ill and had to be confined to his bed. You can find out how much a currency pair is currently worth by looking at the numbers to the right of the chart. When forex trading and I first began to tango, I often got frustrated from a losing trade and went off to place half of my account at risk to make up lost grounds. While you are in mid-frolic, price jumps up a hundred pips.

Chart Patterns: Doji

Shooting star 3. Many people have been asking If you were to reverse your position and sell, as indicated by the Aroon lines, you would make an additional pips on the uptrend! Although Fibonacci developed a method to reach these two numbers, he was not the first to discover. HINK of price like an animal. What is the derivative of stock chart footprint chart indicator ninjatrader 7, fear not. Let me take you a bit deeper into the forex market to show you why these events affect price so. Recently, it was made mandatory that all leverages be limited to In the current downtrend, a dragonfly doji may signal a price rise is on its way. The people at Forex Club understand. Thus, the appearance of Doji as a reversal should be seen in previous trends or trends that follow. An ascending triangle occurs when candles are making similar highs. The heart, brain, and nerves of the forex market are its traders. No discrimination. That is his pattern. Breaking News. Many traders find that they make their most frequent losses during times of low volatility.

Housing Starts Housing starts represent the beginning of construction of houses or apartment buildings. When reading candlestick charts, be mindful of: 1. Then how is the indication of reversal opportunity? Traders are able to read these indicator lines in relation to current price levels to determine where price will move. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. In other words, we want the second candle to be hovering above the first. Awesome Oscillator The Awesome Oscillator is a neat indicator that has several different types of interpretations. If you had a hard time comprehending that, take a look at fig 2. Think back on your childhood memories and all of the joys and pains that you felt. The Doji is just one of the many candlesticks all traders should know. At this point only half, if that, of the battle is over. The Dragonfly Doji is a helpful Candlestick pattern to help traders visually see where support and demand is was located. The gigantic bull and bear are trying to pull the rope towards themselves with all their might. These imperfections happen on the forex market. When we look at NFP data, we can also see that May saw the best outcome for non-farm payrolls since August

Learn When A Doji Is Formed In Candlestick Patterns

If you opened a long position when the indicator dipped, you could have made roughly pips. The chikou is below price, indicating a bearish trend. Has this situation ever happened to you? Using this indicator, a trader would have known to cash in on the pips and go long while the currency recouped. Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. Leverage can increase your profits and your losses. A trading system is a stock apps with no day trade limit monthly dividend stocks with 10 yields set of rules that each trader sets up for him or. Price makes a lower low while the oscillator makes a higher low. In the intra-day chart below Doji Bthe Doji was created the exact opposite way as the chart shown above Doji A was created; Doji B made its day's lows first, then highs second. You just missed out on your trade.

By itself, the doji is a neutral pattern, but when paired with some of the more complex candlestick patterns, the doji can signal a meaningful move on the market. Not I. There were tears in his eyes the whole time. Big deal, right? The question is open to debate. After all, it is emotions and the acknowledgement of these emotions that make us human. The parabolic SAR indicator is used to identify downtrends and uptrends in the market and is used by some traders as a trailing stop indicator. The second case study, the Doji appearance after Long White Candle or after the downtrend. Dating back to 18th century Japan, candlestick charting techniques were first developed as a method of analysing price movements in domestic rice markets. Alternately, a trader could aim to sell off a currency at a high cost and buy it back when it.

How to Trade the Doji Candlestick Pattern

In other words, a five-day SMA is calculated by the sum of the closing prices of the last five days divided by. The result is a bullish trend that could win you approximately pips. The first step that I always take once I open a new trading platform is to change the password. The orders will basically be useless, unless some unlikely occurrence moves the market price 1, pips. There are even four variations of Doji patterns detected by analysts, that is distinguished by the shadow length top and. If you spot a channel formation, you can either trade with the trend or wait for the breakout. Forex Candlestick Swing trading winning percentage learn to trade emini futures Patern — Doji. Let me take you a bit deeper into the forex market to show you why these events affect price so. He makes one more valiant attempt to swim upstream to make it to the same spot as he did. After factoring in spread costs, this also means that price has to move three pips in favor of your trade before you can profit.

Set Risk-to-Reward Ratios When creating a personal trading system, you should ask yourself how much money you would like to make from a trade and stick to that amount. They were originally created in seventeenth century Japan by Munehisa Homna as a way to track the price of rice. So why choose forex? Breaking News. As you can see, i draw two big boxes, a red one and a green one. So the research analysts about the pattern of Doji is tapered at one conclusion that the appearance of Doji can be an indication of reversal opportunities reversal direction. As auto sales can be very volatile, they can obscure the underlying pattern of consumer spending. The higher up on the graph the Aroon lines cross, the stronger the trend. Who are you? MA The moving average indicator is one of the oldest and most widely expanded upon indicators. Accessible Information Traders on the forex market also have great exposure to the information that causes price to move. Fibonacci wrote a book that was completed in called Liber Abaci The Book of the Abacus, or The Book of Calculation , in which he introduced the decimal system to European mathematicians. Slippage occurs.

:max_bytes(150000):strip_icc()/DojiDefinition2-1356bb5eca0d47b5a086d2589b9a306e.png)

However, the real point here is that profitable trading is not about complex indicators or systems. If exporting tastytrades foreign currency trading brokerage hanging man is followed by a white candle, we are entering an uncertain market. When dealing best forex indicator forum how to start trading binary options a currency pair containing JPY, one pip is equal to. Subsequently looking to short the pair at the open of the next candle after the Doji. The only reason the support and resistance lines are converging is because the candles are making higher lows. The thick part of the candle that exists between the open and close price is called the body. And vice versa, the high price of a black candle that forms after a window acts as a resistance line for future price fig 2. Information does not ebc 46 biotech stock best us stock screener abruptly but rather fades away. The intra-day chart minute of this occurance is given below:. Only on So where should you trade? It will also cover top strategies to trade using the Doji candlestick. I highly recommend that you trade different amounts of money with different leverages on a risk-free, no cost, practice account offered on www. Awesome Oscillator The Awesome Oscillator is a neat indicator that has several different types of interpretations. So why do news events move price? Without this feature, slippage could occur. The stop loss would be placed at the top of the upper wick on the Long-Legged Doji. Trading is inherently risky. My rule of thumb is to use a leverage of to AKE your keyboard and place it on the floor.

Tags: forex EA forex signals forex strategy forex system forex4live. Using this indicator, a trader would have known to cash in on the pips and go long while the currency recouped. AKE your keyboard and place it on the floor. Important rule: the base of wave 4 never overlaps the maximum of wave 1. It appears when price action opens and closes at the lower end of the trading range. Note that pennants are formed when support and resistance lines are converging at a certain point, while the support and resistance lines of flags follow an even trend. Based on this basic idea, a trader may then decide to enter the market short place a sell order with a stop or sometimes referred to as a stop-loss placed above the high of the doji and the Fibonacci level of resistance. The five types of doji are: [2]. Nevertheless, I encourage all traders to use indicators. The high degree of leverage can work against you as well as for you. What was it about your friends that made you bond, and what did you hate about your enemies? The second and third support and resistance lines indicate that the market is either overbought or oversold. Dragonfly Doji This is where the names of the dojis start to get interesting. S a forex trader, you should treat the time you spend trading as time spent in a career.

Why are Doji important?

Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its district through reports from bank and branch directors and from interviews with key business contracts, econo-. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. Fundamental analysis relies heavily on the brain, while technical analysis relies on the computer. Long-Legged Doji : The long-legged doji consists of extended tails above and below the opening and closing price, signaling the presence of an active market and potential directional move. Spread costs are usually a fraction of a cent. Standard Doji pattern A Standard Doji is a single candlestick that does not signify much on its own. If we are in a downtrend and a small black candle is followed by a large white candle, this is an indication that a bullish trend may occur fig 2. Forex Candlestick Chart Patterns — Shadow. Technical analysts also use tools called oscillators. Many traders find that they make their most frequent losses during times of low volatility. Understanding this in and of itself gives you and edge or advantage against a majority of traders out there. These two emotions are feelings that haunt every trader. I placed this as an advantage because a high leverage allows a trader to be more exposed to the forex market, but always keep in mind that with great leverage comes great responsibility. So, instead of trading, you strap on your sneakers and run outside to frolic in the grass. You can see that the high and low prices are illustrated by thin black lines that form below or above the open and close price. The moment the candle opened, the bears gathered their numbers and did everything they could to drive price down, and it worked wonderfully until the moment that the candle closed. If no pet is readily available, place your foot firmly against your keyboard. Long-legged Doji The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line.

During these days and times, the market does its biggest moves. At the opening, the bulls were in charge; however, the morning rally did not last long before the bears took charge. Greed as you watch your hard earned money multiply by the second. That said, did you lose weight, Champ? He wrote that these prices fluctuated naturally, much like how waves of the ocean rise, fall, and repeat. I like triangles because when I spot them on the market, I know price is going to start moving. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. The first currency listed in how to deposit money in poloniex how long till coinbase approves debit card pair is the base currency, while the second currency is the quote currency. At this point only half, if that, of the battle is. You can invest in stocks, commodities, options, real estate, or a crazy yet oddly clever idea that your brother-in-law. The market is communicating to us and those who understand the forex language are the ones who will profit the. Paper Umbrella Essentially, a paper umbrella fig 2. Look at the second-to-last candle in this pattern. Money can buy us comfort, and to most people, comfort equates to happiness. Evening Star Similar to the morning star pattern, the evening star pattern consists of three best biotechnology penny stocks etrade get interest tax documents. The bulls and bears are fairly even here, and the men and women who are by the sidelines cheering are torn regarding which direction they should go. Above the chart are eleven tabs, pre market stock screeners joint or individual brokerage account one labeled with a different trading pair. So, instead of trading, you strap on your sneakers and run outside to frolic in the grass.

Paper Umbrella Essentially, a paper umbrella fig 2. Short Candle These small candles represent a period of time in which the open price is very close to the close price. The first step that I always take once I open a stock trading app fees forex and taxes usa trading platform is to change the password. Similarly, after a long downtrend, like the one shown above of General Electric stock, reducing one's position size or exiting completely could be an intelligent. As a novice to the market, you are a clump of clay; formless, colorless futures trend trading strategies ichimoku intraday settings with no direction as to what you will. Of course, a Doji could be formed by why no etfs in 401 k trading on the jamaica stock exchange moving lower first and then higher second, nevertheless, either way, the market closes back where the day started. The time has come, reader. To give you an idea of how many pips a trader can make per trade and how much spread costs depend on the amount of money placed into the trade, look at the table below: Units of EURUSD Traded. Not many wallstreet forex robot 2.0 evolution free download automated options trading strategies out there will want to buy a losing stock; hence you may be stuck without a buyer taking that stock off your hands. The possibility exists that you could sustain a loss of some or all of your initial investment; therefore, you should not invest money that you cannot afford to lose. Nevertheless, I encourage all traders to use indicators. We hide our fears to some, while displaying them to people around whom we feel more comfortable. I would like for you to now pick out your favorite currency pair. A support line has the same function whether it is horizontal or diagonal. You may notice that the bar tends to stretch or shrink after the opening price. Thus, the bearish advance downward was entirely rejected by the bulls. When reading candlestick charts, be mindful of: 1.

There are five distinct types of doji, each with specific characteristics. The ExpressFX practice account is preset with fifty thousand units of currency. Comparing forex to Stocks 1. It was thanks to his North African education that Fibonacci was first exposed to the decimal system. And, potencial Bullish Shark Pattern. The Dragonfly Doji is created when the open, high, and close are the same or about the same price Where the open, high, and close are exactly the same price is quite rare. If we follow the rules of Ichimoku and sell when these lines cross, and we close when the kijun crosses back below the tenkan at 1. For over years, candlesticks have remained a respected and viable technical analysis approach. The chart below makes use of the stochastic indicator , which shows that the market is currently in overbought territory — adding to the bullish bias. Toggle navigation Menu. More Stories. All living things exhibit some sort of patterns in their daily life. The moving average has different variants, all of which follow the same general principal of showing the average levels of price over a specific period.

Predictions and analysis

However, the chart below depicts a reversal of an uptrend which shows the importance of confirmation post the occurrence of the Doji. Always take caution when looking for a breakout. After the time interval is done, the bar ends and a little notch can be seen which represents the closing price. These traders had one thing in common… they were all very, very bad at trading forex. The Doji Candlestick Formation. They almost look like a mirror reflection of one another. So how do you get that extra money? Our forex analysts give their recommendations on managing risk. SPY , 1D. Head and Shoulders In the East, they have a flowing, poetic name for this pattern called the three mountains formation. Each one of these little discrepancies tells a trader a great deal of information about the market. Indicators can only provide ideas for a trader to use to guesstimate future market movement. The 4 Price Doji is simply a horizontal line with no vertical line above or below the horizontal. Have a realistic idea of how much you can make I wrote this tip in regards to your take-profit and stop-loss orders. Change in this index is the first aggregate inflation measure available for the month. Remember that tug of war between the gigantic bull and bear? The ancient Greek and Egyptian mathematicians had working knowledge of these two numbers. When the CCI is below , this is a bearish signal. In the intra-day chart below Doji B , the Doji was created the exact opposite way as the chart shown above Doji A was created; Doji B made its day's lows first, then highs second.

The ExpressFX platform has some features located capital forex pte ltd stocks good for day to day trading the right of the price chart. You can see in fig 2. Some traders want seven support and resistance lines. On a bar chart, traders can find four key prices in any time interval:. The Gravestone Doji is the opposite of the Dragonfly Doji. Piercing Line The piercing line formation is similar to the dark cloud cover formation. So why is this number important to you as a trader? Capital goods prices measure costs facing the industry. A Doji candlestick signals market indecision and the potential for a change in direction. The dotted green line below the current price value is the take-profit order. You should know that the most important aspects of the pivot point indicator are the actual pivot point, the first line of resistance, and the first line of support. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on forex tech forex training institute in lahore website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Wedges are also similar to channels, as their lines of support and resistance are moving in a similar path be it bearish or bullish.

This Doji pattern signifies the ultimate in indecision since the high, low, open and close all four prices represented by the candle are the same. Go on and turn the page to find out. Essentially, the bulls and bears are fairly even here. With leverage, that equates to having a buying power of 1, units of currency. What Are Japanese Candlesticks? The future of price will be determined by the release of news events, natural disasters, or speeches from powerful political or social figures. This pattern generally occurs between time frames of three weeks to three months. Then you begin to change the rules a little. Fig 2.