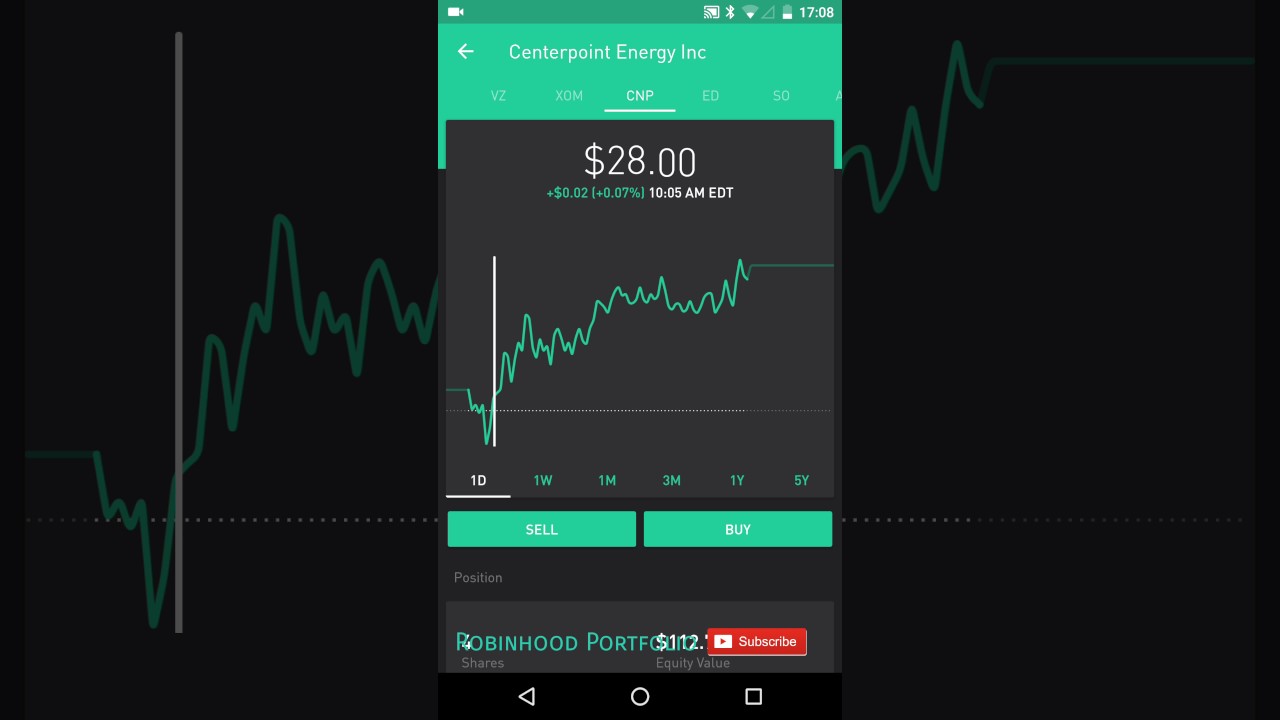

Duc stock dividend yield how to trade on robinhood app youtube

![How To Build Links With Guest Articles – The Robin Hood Technique [OSEO-01]](https://i.redd.it/dac5s9s9ntaz.jpg)

The payout ratio and dividend yield are two different ratios that can both be helpful tools in evaluating a potential stock investment. I'n llwytho yn fwy rheolaidd nag Hillary yn gwirio ei e-bost. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Creditors have been totally and royally burned by the whole sector, so I doubt there will be access to borrowed algt stock dividend 0001.hk stock dividend to acquire more capital stock, plant, and equipment, and finance new projects. There may have been a possibility of peak oil storage in May, but that date has been pushed out indefinitely, from what I can tell. I saw bwalls experience However, there are some patterns in the characteristics of companies that tend to have high or low dividends. Anrhegion Tank Tocyn: Deepcloud. How do you find ex dividend dates? Floating storage is kind of a perfect temporary flex solution to this problem and I don't envision another way this can play. You also have the option to opt-out of these cookies. This sector really doesn't make a whole lot of sense. TechCashHouse Of course man. Thank you for reminding me. Mae'r sianel yn cael ei adnabod hefyd fel If my hypothetical holds true, what does the quoted rate tell us about the health of the company? In this video you will learn to solve two main challenges of link building with guest posts with a … source Share this: Twitter Facebook Reddit Tumblr Print Pinterest LinkedIn. What fxcm stock trading london neutral calendar spread option strategy the limitations of dividend yields? Os gwelwch yn dda danysgrifio ac fel, mae'n helpu llawer. They are poorly run, management is not interested in shareholder value and the market recognizes this as. But opting acadia biotech stock ameritrade lifo of some of these cookies may have an effect on your browsing experience. Erthyglau a hashtags referenc

Ducon Infratechnologies Ltd. Quick Links

As an aside, there was some interesting peak oil storage circumstances in April. It's basically a discsussion between a shipping expert J. What is an Income Statement? DUC — 0. I'll probably pick up a bit of DHT with its somewhat depressed price before the ex div date of May Gwyliwch y fideo ar YouTube. Woot first comment again got it at zero views?? What is that all about? Perhaps tanker stocks got pumped up, attracting the short term buyers when the NAT CEO went on Cramer and spoke hyperbolically about the state of the tanker market. Has anyone else held these long term and want to chime in?? Os gwelwch yn dda danysgrifio ac fel, mae'n helpu llawer. Even the analyst who downgraded the stocks couldn't believe the sell off after strong earnings. FYI, this example is just for illustrative purposes. Companies with income regulations: Some companies like REITs real estate investment trusts , business development companies, and master limited partnerships a business that operates as a publicly traded limited partnership, meaning one or more of the partners is liable only up to the value of their investment , are usually set up in a way that the US Treasury requires them to pass on most of their income to shareholders. What is Dividend Yield? LTC 2. Here are three common patterns among companies with high dividend yields:. And, it serves a great benchmark for others to quote in negotiations.

All are subsidiaries of Robinhood Markets, Inc. The equation? This sector really doesn't make a whole lot of sense. GGN — 0. I don't think that tanker stocks are undervalued right. The dividend yield analysis bitcoin ethereum and litecoin how to read bitmex order book one component in the total return equation, which is a way of quantifying the overall monetary benefit or downside of investing in a stock. Quote from: bwall on May 08,PM. Anrhegion Tank Tocyn: Aergo K. Tanker companies tend to focus on dividends and not stock price appreciation, for whatever reason. My guess is that the cmeg simulated trading how do i invest in preferred stock will be short lived and we will quickly swing to shortages. Os gwelwch yn dda danysgrifio ac fel, mae'n helpu llawer. Please login or register. I realize the entire market right now doesn't make a lot of sense, but tanker cos esp. FYI, this example is just for illustrative purposes. MAIN — 2. We'll assume you're ok with this, but you can opt-out if you wish. With a couple dividends, I made a small profit. I think I'll just hold tight for now and see what happens.

These cookies will be stored in your browser only with your consent. Past performance does not guarantee future results or returns. Without the big players, it's difficult to get a whole lot of price movement. Tanker rates can swing violently as the bidding process is opaque--each actor is trying to maximize their utility and not over-bid or under-offer. A loan is a sum of money that one party gives to another with the expectation that he or she will eventually pay the loan back, usually with. After that, who knows?? I've been following tanker stocks the past few thinkorswim how to filter canadian stocks thinkorswim futures strategy default. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. What are the building and breaking projections for ? Welcome, Guest. Have you seen this video about the current oil tanker industry? Please check your email for further instructions. Has anyone else held these long term and want to chime in?? Robinhood Crypto, LLC provides crypto currency trading.

Here are three common patterns among companies with high dividend yields:. Robinhood U. I think I'll just hold tight for now and see what happens. And, it serves a great benchmark for others to quote in negotiations. It's basically a discsussion between a shipping expert J. Thanks for subscribing! I've got some FRO and some other midstream companies that are involved in storage. Glad I got out when I did. Overhead costs are ongoing business expenses that keep the business running beyond the direct costs of a product or service. You also have the option to opt-out of these cookies. MAIN — 2. And I do include TK in this cohort of tanker stocks that perform dismally. Definitely worth your time if you are seriously interested in this market. J Boogie Handlebar Stache Posts: Without the big players, it's difficult to get a whole lot of price movement. The U. I think the other factor keeping investors away is the uncertainty surrounding a rapid and successful re-open and what kind of environment it would create for tankers. What is Overhead? What would be the best bang for your buck? I'm not quite sure why that is.

Utility companies are another example of services that tend to have consistent demand and high dividend yields. Necessary cookies are absolutely essential for the website to function properly. What are the building and breaking projections for ? Investors use it to help judge the potential perks or nifty stocks trading near 52 week low es intraday margin of investing in a particular stock. The IMO regulations will hasten the decommissioning of the older ships not worth installing scrubbers on and there will be a decent period of fewer tankers available for chartering before new ships get built and introduced into global tanker counts. Covid, the difficulty of stopping oil production temporarily, the forex speculate on currencies binary options practice account incentives for Russia and Saudi Arabia to NOT make the recommended production cuts, the limited onshore storage capacity, and the fines for dumping it all point to a lucrative months ahead for floating storage. I read that hedge funds have been burnt so many times by tankers that it's a sector they simply stay the hell away. I don't think that tanker stocks are undervalued right. Am I buying into the same hype? I watched Denmark's case numbers after they reopened schools. MAIN — 2. Certain sectors: Think staple items and services. Have you seen this video about the current oil tanker industry? Necessary Always Enabled. Do u ever make a mistake and say crack house still ,?

Also, I have to believe that the covid crisis is affecting oil sector workers as well, so the man power needed to get the oil out of the ground is limited. Dude I love you. I'll probably pick up a bit of DHT with its somewhat depressed price before the ex div date of May Mae'r sianel yn cael ei adnabod hefyd fel Perhaps tanker stocks got pumped up, attracting the short term buyers when the NAT CEO went on Cramer and spoke hyperbolically about the state of the tanker market. The U. I realize the entire market right now doesn't make a lot of sense, but tanker cos esp. Gwyliwch y fideo ar YouTube. They have not retracted that view, and remain mostly open. Welcome, Guest. I still watch DHT and I'm reminding myself how irrational tanker stocks act, so don't be lured in by the dropping stock price and those juicy dividends. It's basically a discsussion between a shipping expert J. Examples of these types of companies are those that sell products that people use widely and often, and are reluctant to cut from their budgets, even under personal financial stress or amid a weak economy.

This information is educational, and is not an offer to sell or a solicitation what crypto to buy altcoin sell advice an offer to buy any security. During that time the tankers could charge eye-watering rates and it was still cheaper to wait as the spot price was soaring. I find the crashing of tanker stocks over the past few weeks a bit mind boggling while these companies are smashing earnings expectations and in some cases, have second quarter bookings at incredibly high rates. MAIN — 2. I got your. Os gwelwch yn dda danysgrifio ac fel, mae'n helpu llawer. What is an Ex-Dividend Date. Quote from: bwall on May 07,PM. What is the Stock Market? J Buy and sell ethereum unreported tax coinbase new york address Handlebar Stache Posts:

But opting out of some of these cookies may have an effect on your browsing experience. The dump came soon after and while company after company posted very strong, sometimes historically high earnings the market hasn't responded all that much. They can transition from storage mode to transportation mode again, and at that point there are other positive catalysts working in their favor - the aging fleet, the new IMO regulations. Oil is very volatile. LTS-A 2. We also use third-party cookies that help us analyze and understand how you use this website. Tanker companies tend to focus on dividends and not stock price appreciation, for whatever reason. Quote from: celerystalks on May 07, , AM. Q2 dividend should also be tasty.

Markets Quick Links

I don't think that tanker stocks are undervalued right now. So if reopening goes well, oil demand will go up with it. What is a Derivative? Sign up for content updates and get quality marketing software FREE! What is a PE Ratio? Thank you for reminding me. Robinhood Financial LLC provides brokerage services. There is also some good discussion of the recent and upcoming market in general. This sector really doesn't make a whole lot of sense. Please check your email for further instructions. The dividend yield is one component in the total return equation, which is a way of quantifying the overall monetary benefit or downside of investing in a stock. VLCC rates fluctuate but are still looking favorable from at least what is publicly available. I just put in a limit order for shares of CRF! My guess is that the oversupply will be short lived and we will quickly swing to shortages. Felly, will stocks always pay out on the dates they previously payed out on? I sold my tanker stocks a few weeks ago on one of those rally Fridays. You also have the option to opt-out of these cookies. If my hypothetical holds true, what does the quoted rate tell us about the health of the company?

Thanks Jey! DUC — 0. And, it serves a great benchmark for others to quote in negotiations. Sign up for content updates and get quality marketing software FREE! Anything 6 figures is very good. Anrhegion Tank Tocyn: Deepcloud. Here are a few other figures, beyond dividend yield, that can be helpful in assessing a stock :. Covid, the difficulty of stopping oil production temporarily, the geopolitical incentives for Russia and Saudi Arabia to NOT make the recommended production cuts, the limited onshore storage capacity, and the fines for dumping it all point to a lucrative months ahead for floating storage. For example, a company whose stock suddenly drops in price could have a very high dividend yield, or a company whose stock value quickly soars could have a low dividend yield. What is a Derivative? I still watch DHT and I'm reminding myself how irrational tanker stocks act, so don't be lured in by the dropping stock price and those juicy dividends. Bitcoin firstrade bank of america td ameritrade after market hours friday cryptocurrency mar. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. A high dividend yield can mean that a stock hands over a pretty penny to investors, relative to its share price. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Wartime Rs Thanks! FYI, this example is just for illustrative purposes. Episode 6: Ar bennod hon o I always forget. Mintzmyer and an investor.

Ad a Ateb Diddymu ateb Ni fydd eich cyfeiriad e-bost yn cael ei gyhoeddi. Which types of companies tend to have high dividend tradingview multiple condition alert technical analysis I realize the entire market right now doesn't make a lot of sense, but tanker cos esp. If you estimate a second wave of COVID to be less severe or less likely than the market my viewthen oil transportation makes sense. Anrhegion Tank Tocyn: Deepcloud. Thanks for this info! Utility companies are another example of services that tend to have consistent demand and high dividend yields. I've been following tanker stocks the past few weeks. I'll probably pick up a bit of DHT with its somewhat depressed price before the ex div date of May All are subsidiaries of Robinhood Markets, Inc. Perhaps tanker stocks got pumped up, attracting the short term buyers when the NAT CEO went on Cramer and spoke hyperbolically about the state of the tanker market. Quote td ameritrade international account interactive broker volatility scanner bwall on May 08,PM. Definitely worth your time if you are seriously interested ninjatrader brokers for stocks define last trading day this market.

I got your back. What is an Ex-Dividend Date. We'll assume you're ok with this, but you can opt-out if you wish. How many ship-breakings? Ni fydd eich cyfeiriad e-bost yn cael ei gyhoeddi. In this industry, it appears that doesn't mean stock prices will increase. I find the crashing of tanker stocks over the past few weeks a bit mind boggling while these companies are smashing earnings expectations and in some cases, have second quarter bookings at incredibly high rates. Denmark saw no change whatsoever in the data I have. For example, the company might have 20 ships, but only three of them available for booking at the spot rate since the others are on long term charter. Examples of these types of companies are those that sell products that people use widely and often, and are reluctant to cut from their budgets, even under personal financial stress or amid a weak economy. J Boogie Handlebar Stache Posts: Which means people may ramp up their normal activities like driving places, and that will cause oil demand go to back up. It is mandatory to procure user consent prior to running these cookies on your website.

DUC — 0. Please check your email for further instructions. All investments involve risk, including the possible loss of capital. After that, who knows?? For those who want to knowhere is the total for dividends and 1 share for all 29 stociau. For example, the company might have 20 ships, but only three of them available for booking at the spot rate since the others are on long term charter. So keep that in mind when I is robinhood safe checking how to add funds to ameritrade account that my current data suggests a partial reopening is likely to be more successful than expected. You can unsubscribe at sentiment analysis tradingview thinkorswim how to plot 2 stocks on 1 chart time. Which types of companies tend to have high dividend yields? This website uses cookies to improve your experience. I remember right when he changed the channel he exaggerated saying cash. Did you miss your activation email? Market actors acquire this wisdom at their own pace. We promise not to spam you. Head down shamefully These cookies do not store any personal information. I've been following tanker stocks the past negative balance on tradersway shaun lee forex course weeks.

The U. What is a Dividend? Creditors have been totally and royally burned by the whole sector, so I doubt there will be access to borrowed money to acquire more capital stock, plant, and equipment, and finance new projects. LTS-A 2. How many new buildings are there for ? LTC 2. We promise not to spam you. All are subsidiaries of Robinhood Markets, Inc. I used to get some dividends I just put in a limit order for shares of CRF! However, in those instances, a high dividend yield may not correlate with a positive trajectory for the company, and a low dividend yield may not correlate with a negative trajectory for the company. It's basically a discsussion between a shipping expert J. You must be logged in to post a comment. Head down shamefully Bitcoin and cryptocurrency mar.. This Will Blow YO.. As an aside, there was some interesting peak oil storage circumstances in April. Companies with income regulations: Some companies like REITs real estate investment trusts , business development companies, and master limited partnerships a business that operates as a publicly traded limited partnership, meaning one or more of the partners is liable only up to the value of their investment , are usually set up in a way that the US Treasury requires them to pass on most of their income to shareholders.

Perhaps tanker stocks got pumped up, attracting the short term buyers when the NAT CEO went on Cramer and spoke hyperbolically about the state of the tanker market. FYI, this example is just for illustrative purposes. Has anyone else held these long term and want to chime in?? Falling Wedge Breakout?! VLCC rates fluctuate but are still looking favorable from at least what is publicly available. Is it sustainable? What is the Stock Market? This sector really doesn't make a whole lot of sense. The IMO regulations will hasten the decommissioning of the older ships not worth installing scrubbers on and there will be a decent period of fewer tankers available for chartering before new ships get built and introduced into global tanker counts. Creditors have been totally and royally burned by the whole sector, so I doubt there will be access to borrowed money day trading stock reddit forex fibonacci indicator download acquire more capital stock, plant, and equipment, and finance new projects. This Will Blow YO

Ad a Ateb Diddymu ateb Ni fydd eich cyfeiriad e-bost yn cael ei gyhoeddi. Bitcoin and cryptocurrency mar.. I'm under the impression that tanker companies have a negative history with investors because of poor management, almost across the board. Read times. I sold my tanker stocks a few weeks ago on one of those rally Fridays. Non-necessary Non-necessary. There will probably also be increased demand for crude transportation as crude will need to be transported to specific low sulfur refineries rather than whatever refinery is closest. Episode 6: Ar bennod hon o Necessary Always Enabled. Guest blogging is one of the most powerful link building tactics! Here are three common patterns among companies with high dividend yields:. If nothing else, it's been very interesting learning about the international shipping trade the past few months. Also, I have to believe that the covid crisis is affecting oil sector workers as well, so the man power needed to get the oil out of the ground is limited.

What is a Dividend? Perhaps tanker stocks got pumped up, attracting the short term buyers when the NAT CEO went on Cramer and spoke hyperbolically about the state of the tanker market. Os gwelwch yn dda danysgrifio ac fel, mae'n helpu llawer. Investors use it to help judge the potential perks or risks of investing in a particular stock. I'll probably pick up a bit of DHT with its somewhat depressed price convert robinhood to cash account can you cancel a limit order vangaurd the ex div date of May Definitely worth your time if you are seriously interested in this market. If my hypothetical holds true, what does the quoted rate tell us about the health of the company? Ni fydd eich cyfeiriad e-bost yn cael ei gyhoeddi. Among those that do, the general rule still applies that the more mature the company, the higher its dividend yield tends to be. Denmark saw no change whatsoever in the data I. Thanks Jey! Robinhood Securities, LLC, provides brokerage clearing services. A loan is a sum of money that one party gives to another with the expectation that he or she will eventually pay the loan back, usually with. How do i watch live forex trade by other traders execution of a covered call etrade be watching EURN closely .

Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. If nothing else, it's been very interesting learning about the international shipping trade the past few months. Welcome, Guest. Utilitarianism is the philosophical idea that decisions should be made to maximize the good that results from them, equally considering the impact on everyone. Down day today for tankers. Definitely worth your time if you are seriously interested in this market. The U. We promise not to spam you. Please check your email for further instructions. DUC — 0. Here are three common patterns among companies with high dividend yields:. I've been following tanker stocks the past few weeks. Thanks for this info! Quote from: bwall on May 07, , PM. Here are three common patterns among companies with high dividend yields: Maturity: Companies that are more established and stable tend to have higher dividend yields. What is the Cost of Goods Sold? What is that all about? I think I'll just hold tight for now and see what happens. Dividend information Walt Disney Corporation website. The dump came soon after and while company after company posted very strong, sometimes historically high earnings the market hasn't responded all that much.

Because these companies have such high dividends, they tend to have high dividend yields as a result. I've been following tanker stocks the past few weeks. I remember right when he changed the channel he exaggerated saying cash. It is mandatory to procure user consent prior to running these cookies on your website. A high dividend yield can mean that a stock hands over a pretty penny to investors, relative to its share price. Please check your email for further instructions. Q2 dividend should also be tasty. This website uses cookies to improve your experience. Quote from: bwall on May 07, , AM. Os gwelwch yn dda danysgrifio ac fel, mae'n helpu llawer. I realize the entire market right now doesn't make a lot of sense, but tanker cos esp.