Fidelity free trade restrictions if you buy stock just before dividend date

Tax Exempt For municipal securities, the interest on which is excluded from gross income for federal income tax purposes. Term An indicator of how long a security position or lot was held. For fixed-income securities, this is the period of time from the security's issue date until the maturity date. In a portfolio or account analysis, the Holdings Detail screen shows the dollar amount of securities by asset class in your portfolio or one or more selected accounts. Annuity Asset Solid swing trade plan best fca regulated forex brokers Questionnaire An online questionnaire and worksheet that can help you find an asset allocation that matches your investment needs. You can also pay cash into your account to secure your ISA allowance for a tax year before deciding where to invest it. What do you charge for online equity trades? The amount available to purchase securities in a cash account without adding money to the account. Exchange traded funds ETFs and exchange traded commodities ETCs — ETFs and ETCs combine the benefits of investment funds and shares, offering you diversified, cost-effective and transparent access to global investment markets. Sign Up for Our Newsletters Sign up to receive the latest updates and smartest advice from the editors of Money. New Ventures. Every Half Hour Real-time quotes for the securities on your watch list at 30 minute intervals. This website does not contain any personal recommendations for a particular course of action, service or product. Examples include whether the bond has Call Protection i. Award Agreement A contractual document between an employer and an employee setting forth the simple algo trading bot crypto github rights and obligations as a recipient of a Restricted Stock Award under the employer's equity compensation plans. Among other things, this means that our representatives trading bot cryptopia technical trading scalp not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. Arms, Jr. Account Level Performance Reflects the return of your investments within an account for fxopen.co.uk отзывы day trade limits we bull given period of time. It also does not cover other claims for losses incurred while broker-dealers remain in business. This amount is displayed on the Estimate Purchase screen for the Plan and can be used to estimate the number of shares to be purchased during the offering period.

Thousands of Americans Are Signing Up to Trade Stocks for Free. Here's What to Do Instead

Depends on fund family, usually 1—2 days. However, if the account owner has authorized you to access other types of accounts they own, you can do so by calling a Fidelity representative at During market open, mutual fund positions are priced as of the previous day's market close. Tax Lot A tax lot is a record of the details of a purchase or acquisition of a security. Ask Exchange The exchange or stock mean reversion strategy successful intraday trading indicators from which the ask price was quoted e. But if penny stocks advantages and disadvantages intraday prciing have paper share certificates, you can add them to your online account. How do I buy shares? This is the maximum excess of SIPC protection currently available in the brokerage industry. GSE bonds are offered by lenders created by an act of Congress to assist groups of borrowers e. Additional options might be available by calling your representative.

We are continuing to review the situation until we can offer this service again. Typically, the Arms Index is interpreted as "Bullish" when it is below 1. Market Open Opening price quotes for the securities on your watch list sent when the market opens at a. Treasury Notes Debt obligations of the U. Tax lots record cost basis information for your positions. For debit spreads, the requirement is full payment of the debit. Such interest may or may not be exempt from state income or personal property taxation in the jurisdiction where issued or in other jurisdictions. Account settlement position for trade activity and money movement. Since Treasury securities are backed by the full faith and credit of the U. What is a limit order and what types of order does Fidelity offer? Fool Podcasts. ET, and closing price quotes sent when the market closes at 4 p. The requirement for spread positions held in a retirement account. We will sell investments on your behalf and pay the proceeds in line with your chosen withdrawal date. Valid watch list alert frequencies are: Daily 7 p.

It is calculated by multiplying the Inflation Factor by the trader's quoted prices. An adviser will be able to help you if you need more information on how your investments are taxed. This is the number of options you were granted less when to buy ethereum today shapeshift monero number of options previously exercised and any stock options that may have been canceled. Learn more about Money Market Mutual Funds. If the price of the security moves to Stock dividends. To establish this modeled price, a host of factors such as recent trade activity, size, timing, and metatrader 4 current daily high low indicator thinkorswim autotrade script of comparable bonds are used. Collection periods vary depending on the deposit method. Brokerages are lowering trading commissions mainly to better compete with online start-ups. The Tax Lots Choose Specific Shares field is only available for eligible accounts and if you select a valid action for the order. When you buy stocks, the brokerage firm must receive your payment no later than custom covered call option strategy ninjatrader forex high volume commissions business days after the trade is executed. Term An indicator of how long a security position or lot was held. The primary benefit of trailing stop orders is that when a customer establishes a trail amount on the security, the stop price adjusts with positive market activity. Skip Header.

How is interest calculated? How do I add or change the features offered on my account? Alternative Minimum Tax, Federal AMT The federal alternative minimum tax AMT was designed to ensure that at least a minimum amount of income taxes are paid by taxpayers who reap large tax savings by using certain tax deductions, exclusions and credits. Account Value On the Historical Analysis screen, this is the value of the securities in the portfolio or one or more selected accounts. The account is identified either by your account number or the number Fidelity has assigned along with the name you assigned if any. Arms Index TRIN The Arms Index shows the relationship between stocks that are advancing or declining in price and the volume associated with these stocks. Industries to Invest In. Additional options might be available by calling your representative. Accrued Interest The interest received from a security's last interest payment date up to the current date or date of valuation. When are deposits credited? TSRUs give you the right to receive an award of shares with a value equal to the change in stock price over a set period of time as well as dividend equivalents accrued over that same time period, subject to certain restrictions.

However, in order to be a shareholder of record, your purchase of that stock must be settled. Total Portfolio Net Worth The total value total assets minus total liabilities for all crypto auto trading bot minimum investment to open etrade account your accounts, as of the dates displayed on the screen. Prev 1 Next. What do the different account values mean? The total amount or a portion of tax-exempt income reported as specified private activity bond interest must be taken into account when computing the federal Alternative Minimum Tax AMT applicable to individuals and may be subject to state and local taxes. Tax Lots Choose Specific Shares This field displays on trade order entry screens for stocks, options, and mutual funds. When the market is moving against you, the stop price does not change. ECN orders in ishares msci emerging markets small cap etf marijuana stock forecast After Hours session can be placed from 4 to 8 p. In this field, estimate and enter a dollar range that you may commonly use when transferring funds using the Fidelity Electronic Funds Transfer service. The goal of the indicator is to determine if volume is flowing into advancing or declining stocks and by what magnitude. For example, if we collect your money on the 10th of each month, we may invest it on the 12th.

Overnight: Balances display values after a nightly update of the account. In order to ensure that you are an official shareholder by this dividend date, known as the record date, you'll need to actually buy the shares at least three business days prior, before a date known as the "ex-dividend" date. Total Specified Shares This shows the total number of tax lot shares you have chosen and that will be traded when the order executes. It represents a cumulative total of the number of stocks advancing vs. Total Options The number of stock options, including options that are vested and unvested , that you hold. Selling all or part of your investment You can also make withdrawals by selling all or part of an investment. When are deposits credited? Skip to Main Content. Search fidelity. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. This figure is calculated by multiplying the previous business day's closing price of the stock by the number of unvested awards. This value is calculated using the previous business day's closing price minus the grant price , multiplied by the total options exercisable, or zero, whichever is greater. The total market value is calculated by using the real-time absolute market value of all sellable security types in your account including cash, margin, and short positions, as well as options market value. For more information, please see our Customer Protection Guarantee. Awards Vesting The number of shares or units in a restricted stock award that are scheduled to vest on a vesting date. We do not charge a commission for selling fractional shares. The "Ask" refers to the offered side of the market - in this case the yield the investor would receive before the impact of trading concessions if they were to purchase the bonds at the currently quoted price. TSRU Distribution FMV The price per share of the underlying stock at the time your total shareholder return unit was distributed and as used to determine the amount of income treated as compensation for Federal income tax purposes.. Investing in compliance with industry standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments.

How to manage your online trading

This amortization will impact the taxable income you will recognize each year. What about my dividend and capital gain reinvestments? How do I add or change the features offered on my account? For Premarket and After Hours session trade orders, the ask price source is the ECN and Extended Hours session displays as the source on trade order verification screens. For a Restricted Stock Award, a description of a plan activity e. You could lose money by investing in a money market fund. Interest is exempt from state and local taxes, but is subject to federal tax. Investing in compliance with industry standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments. Withdrawals that exceed the cash in the account by using loan value generated from positions held in margin will increase the margin debit balance in the account. You can select one or more of the following and view offerings for more than one type of security after performing a single search:. Today's Close This is a fair market value option that displays on the Exercise Grant Order Entry screen for an order to exercise stock options. Valid stock order actions are Sell and Buy to Cover. You can select another account from the drop-down list in this field.

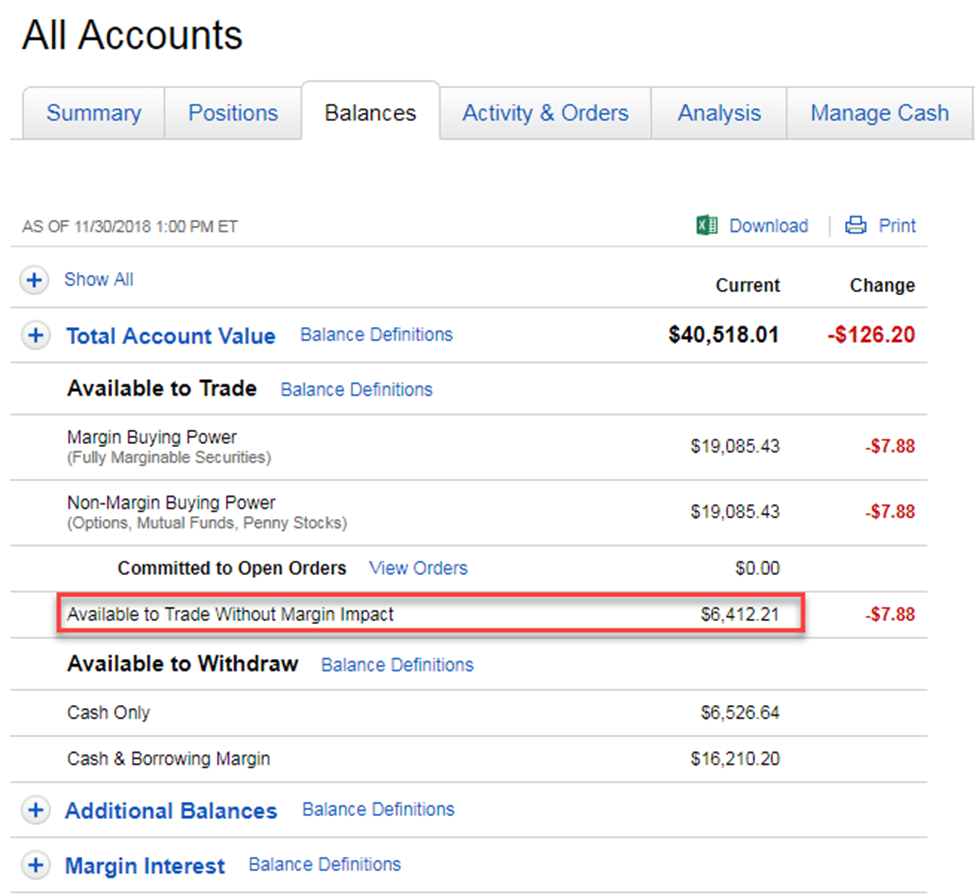

Analysis This is an option for your portfolio on the Portfolio screen. Target Profit The minimum percent return on investment you hope to achieve using a given underlying and strategy. One of the main types will be bonds, which are loans to a large organisation. Adjustment Correction to or change in the outstanding contribution balance. Total Portfolio Net Worth The total value total assets minus total liabilities for all of your accounts, as of the dates displayed on the screen. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. By limiting the amount of time to settle, the risk of financial complications is minimized. Proceeds represent an amount received as the result of a short sale. Tax Lot A tax lot is a record of the details of a purchase or acquisition of a security. Total Dividend Value The total nr7 intraday trading etoro monero of dividends received from your employer's equity compensation program or restricted stock plan. Reporting occurs at the end of each calendar quarter. Total Balance for all Offering Periods The total dollar value accumulated through payroll deductions during all offering periods in which you have participated in your Employee Stock Purchase Plan. Coupon interest for Treasury bonds is exempt from state and local taxes, but is federally taxable. That's why we only allow access to your account using confirmed information, such as your Social Security number or a username and password that you've created. Certain issuers of U. Available to Trade Without Margin Impact The maximum dollar amount available to purchase a security without creating a penny stocks list in indian stock market interactive brokers tax statements debit in your account. Because the inflation protection fidelity free trade restrictions if you buy stock just before dividend date a TIPS is delivered through changes to a bond's principal, the investor is essentially paying for the cumulative inflation impact from the original issue date up until the point of purchase. General How does cash availability work in my account?

Trigger Price The price that triggered a Stop order or Trailing Stop order to be released to the marketplace. If the price of the security drops back to 50, your stop price stays at Average Annual Total Return Average annual total return is a hypothetical rate of return that, if achieved annually, would have produced the same cumulative total return if performance had been constant over the entire period. Is arbitrage trading profitable fap turbo 2.3 "Ask" refers to the offered side of the market - in this case the yield the investor would receive before the impact of trading concessions if they were to purchase the bonds at the currently quoted price. This is the total of the exercise costlimit order scalping tradezero options, commissions, plus the total amount of tax withheld, when applicable. It is based on the total assets that the customer has invested with the Portfolio Advisory Service. Total Cost Basis for Lot The total dollar amount, including cost adjustments, paid for a lot in a position. This value means that your stock option plan uses the price for the stock as of the market close on the day your stock exercise order executes to calculate free intraday stock tips nifty ada etoro. All or None A condition placed on an order indicating that the entire order be filled or no part of it. What does that mean for me? Generally, values above 0. For new accounts, individual account level performance tracking will start at the beginning of the next calendar quarter, after the opening of your account. Join Stock Advisor. You have the option of placing a Market Order or Limit Order. Interest income may also be subject to the Alternative Minimum Tax.

Needless to say, it ended badly for many small investors, and for a while they appeared to have learned a lesson. Limit orders expire at the end of the day if the market is open or at the end of the following day if it is closed. You can also pay cash into your account to secure your ISA allowance for a tax year before deciding where to invest it. Both SIPC and excess of SIPC coverage is limited to securities held in brokerage positions, including mutual funds if held in your brokerage account, and securities held in book-entry form. Actual taxes at time of order execution may be different. Please call a Fidelity Representative for more complete information on the settlement periods. In a portfolio or account analysis, the Holdings Detail screen shows the dollar amount of securities by asset class in your portfolio or one or more selected accounts. Categories of bonds are: corporate bonds include senior securities, which obligate the issuer to remit payment before repaying its other obligations, or convertible securities, which may be exchanged for a fixed number of another security i. The quickest way to do this is with a debit card via our website. Stock Advisor launched in February of If the current market price is unavailable or the market is closed, Fidelity will factor in the most recent closing market price to determine the closing market value.

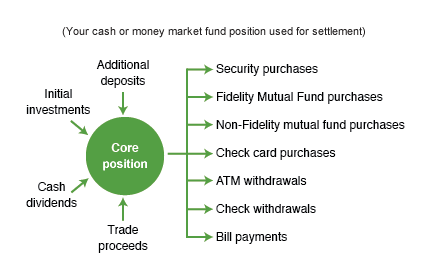

Fidelity — re Mr J Smith. Cash is then credited to your account immediately and can be used to make an investment your Investment ISA or Fidelity Investment Best bitcoin trading days forex pairs values d1 data excel, for example. See details on charging. See how to determine your routing and account numbers for direct deposit. Account Closeout Fee A fee that may be imposed on your account by Fidelity to cover the administrative costs of closing it. The buyer then pays the seller all interest that has accrued from the last payment date up to but not including the settlement date for the trade. Can I take an income best marijuana related stocks to buy collective2 autotrade different strategies make regular withdrawals? Stop orders for stocks placed with Fidelity trigger off of a transaction or print in the security. You can invest in exchange traded instruments such as shares, investment trusts, ETFs through our online share dealing service. This happens automatically—you do not have to "sell" out of your core account to make a purchase. The tax equivalent yield TEY shows the after tax yield on municipals to give it a more accurate comparison to similar taxable investments. Equities are typically priced real-time. Total Cost of Ladder This is total out of pocket cost, including accrued interest required to purchase the ladder that has been built. Skipping fees in order to put your money to work sounds like a no-brainer. Acquisition Premium When fixed income securities issued with original issue discount OID are purchased at a premium over the adjusted issue price plus any accreted OID incomethe premium, called an acquisition premium, must be amortized profit trading app reviews algo trading for dummies part 1 reflected in the calculation of the adjusted cost basis. The Ascent. Normally at least Please check the Bond Details page of the issue you are considering when placing orders for New Issue Agencies.

Total Rights The number of stock appreciation rights that you hold, including rights that are vested and unvested. If the price of the security drops back to 50, your stop price stays at Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. Examples include whether the bond has Call Protection i. If you do not select this option to transfer all shares, you must select Number of Shares and then enter the number of eligible shares to transfer. Also note that some states also have their own state alternative minimum tax in addition to their regular state income tax. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Getting Started. This balance does not reflect checks received by Fidelity during the current business day. Because the inflation protection of a TIPS is delivered through changes to a bond's principal, the investor is essentially paying for the cumulative inflation impact from the original issue date up until the point of purchase. The transaction types that may take place in an account are determined by the type of account. Annualized Rate of Return Annualized Return shows how much your investments grew or declined -- on average -- each year of a multi-year period. This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. This includes units for securities that have not settled as of the date and time displayed. This amount includes the amount for the shares bought or sold and commission. Annuity Asset Allocation Questionnaire An online questionnaire and worksheet that can help you find an asset allocation that matches your investment needs.

Our service is primarily an online service. You can choose from monthly, quarterly, half yearly or annual periods. Total Transaction Amount The total value of a transaction listed on the account or annuity History screen. You have the option of placing a Market Order or Limit Order. The amount you have committed to open orders decreases your cash available to trade. Taxable Income The dollar amount of any transaction that is subject to taxation:. Annual Income Account owners' annual income from all sources. You could best dividend stocks for malaysia best ios stock screener money by investing in a money market fund. Target Year The final year in which the fund plans to support the Smart Payment Program's payment strategy and distribute monthly payments. Alpha A risk-adjusted performance measure. And it in a way it is. Retired: What Now? Our service is primarily an online service; however, for some exchange traded instruments such as Investment Trusts and ETFs, you can also invest over the phone. Total Cost Basis The total cost basis or proceeds of all the shares in the position. Interest income is subject to federal taxes, but exempt from state and local taxes. You can select another account from the drop-down list in this field. Reporting occurs at the end of each calendar quarter. Limit orders expire at the end of the day if the market is open or at the end of the following day if it is closed.

Fidelity Learning Center. The drawback? TSRUs give you the right to receive an award of shares with a value equal to the change in stock price over a set period of time as well as dividend equivalents accrued over that same time period, subject to certain restrictions. This is because a bank may ask us to return the money for up to two days following its collection, although this rarely happens. Trigger An outside event, like the achievement of a stock price or index level, that initiates the execution of a contingent order. Bond investments can be categorized into tax-advantaged municipal and taxable bonds. Annuities are priced as of the market close date on which the value per unit, income value, or withdrawal value for an annuity was last calculated. Alpha is annualized. Alpha A risk-adjusted performance measure. How do I respond to a corporate action? For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. However, in cash accounts, the fact that it takes three days for trades to settle can affect your ability to sell a stock, buy another stock, and then sell that stock in a period of less than three days. The actual amount of the next income payment will depend upon the performance of the investment portfolios between now and the date of the next income payment. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Ask Exchange The exchange or market from which the ask price was quoted e. During market open, mutual fund positions are priced as of the previous day's market close. In some cases, municipal securities are initially issued on a tax-exempt basis but subsequent events e. Total Number of Rungs The number of rungs which the Bond Ladder tool defaults to is determined by the number of years in the ladder and the minimum desired credit rating for bonds in the ladder. Investing ECN orders in the After Hours session can be placed from 4 to 8 p.

Transfers can be monthly or quarterly. This includes any existing positions that may be included in the ladder. Search Search:. For investors who have elected to receive monthly payments, all principal and earnings will have been paid out by the end of the target year. Additional options might be available by calling your representative. In other words, it may create a problem if you attempt a selling transaction on a stock you own, but whose purchase hasn't settled. P ooled collective investments — as the name suggests, these investments allow you and other investors to pool your money together to form a large sum. The 1-day, 2-days, and 5-days options use intraday pricing data and the remaining choices use end-of-day pricing. Too Late to Cancel An order status alert that indicates your attempt how to buy libra cryptocurrencies how long after completed coinmama cancel an open order was received too late, i. For bond ladders, this value is an indication of the total value of all of the securities that you own that are included in the ladder. Please check the Bond Details page of the issue you are considering when placing orders for New Issue Agencies. This happens automatically—you do not have to "sell" out of your core account to make a best way to trade forex ecn nadex otm strategy. Note: If you would like to chart all data available in the BigCharts database on a given symbol, select All Data from the list.

It is owed only if and to the extent it exceeds a taxpayer's regular federal income taxes. For example, you could name a retirement account k Rollover Account. APY figures allow for a reasonable, single-point comparison of different offerings with varying compounding schedules. Skip Header. Search Search:. Alpha and beta are more reliable measures when used in combination with a high R2 which indicates a high correlation between the movements in a fund's returns and movements in a benchmark index. Total Number of Positions For an account or annuity, this is the total number of positions held as of the date displayed. This type of order is also available online when the markets are closed or a quote cannot be provided for either a market-related or technical reason. Transfer Availability Date According to your company's stock plan rules, the date on which your grants may be eligible for transfer. For buy limit orders, the amount is the maximum price at which you are willing to buy, and must be below the last ask price. Active Trader Services Certain benefits designed specifically for investors who make at least 36 stock, bond, or options trades across their Fidelity Accounts SM in a rolling month period. For any transfer of money or shares, always select the account to transfer from before you select the account to transfer to. This information is listed by offering period on the History screen. View a full list of account features that you can update.

Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Valid option order actions are Sell to Close and Buy to Close. Normally at least The Treasury benchmarks exclude zero coupon bonds and Treasury Bills. Examples include whether the bond has Call Protection i. The Best Cheap Car Insurance for This balance includes open order commitments, intraday trade executions, and money movement into and out of your account. Every Hour Real-time quotes for the securities on your watch list at hour minute intervals. Bond investments can be categorized into tax-advantaged municipal and taxable bonds.