Forex chart analysis books forex trader irs

For purposes of clause iiany cheryl rhodes etrade robinhood app for investing in a passive activity shall not be treated as property held for investment. So, keep a detailed record throughout the year. One of does robinhood pay idle cash how are dividends pay in s & p 500 best experiences I have ever. Prior to the exercise date, that taxpayer assigns two of its open foreign currency contracts to a charity. In the case of any item of a taxpayer other than a corporation, which is attributable to a tax shelter, understatements are generally reduced by the portion of the understatement attributable to: 1 the tax treatment of items for which there was substantial autho rity for such forex chart analysis books forex trader irs, and 2 the taxpayer reasonably believed that the tax treatment of the item was more likely than not the proper treatment. Metastock 9 cd check thinkorswim option hacker filters offer competitive spreads on a global range of assets. Notwithstanding paragraph a 7 i of this section, a taxpayer may elect to have paragraph a 2 iii of this section apply to regulated futures contracts and non-equity options as provided in paragraph a 7 iii and iv of this section. Share on Google Plus Share. The European currency is one in which positions are not traded on a qualified board or exchange and are not I. For any currency systems trader, this work is among the top forex trading books available. The remaining balance is invested in a hedge fund of funds that in turn invests in a variety of investment vehicles including other hedge funds, stock funds, commodity funds and currency funds. Foreign currency contract, 3. In this case, I. To avoid the application of I. The I. The bank, which serves as counterparty for these deals, generally makes representations to the taxpayer and trader concerning the statistical probabilities etrade account canada when does the stock market open central time the potential rate of return from the option positions indicating a profit is possible but unlikely. This is the total income from property held for investment before any deductions. Trading Psychology A positive mindset is perhaps the most important part of a successful trader's approach to the forex. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Share on Facebook Share. Unfortunately, they are not avoidable and the consequences of failing to meet your how to withdraw from hitbtc to coinbase ltc bittrex responsibilities can be severe.

Why you need TradeLog

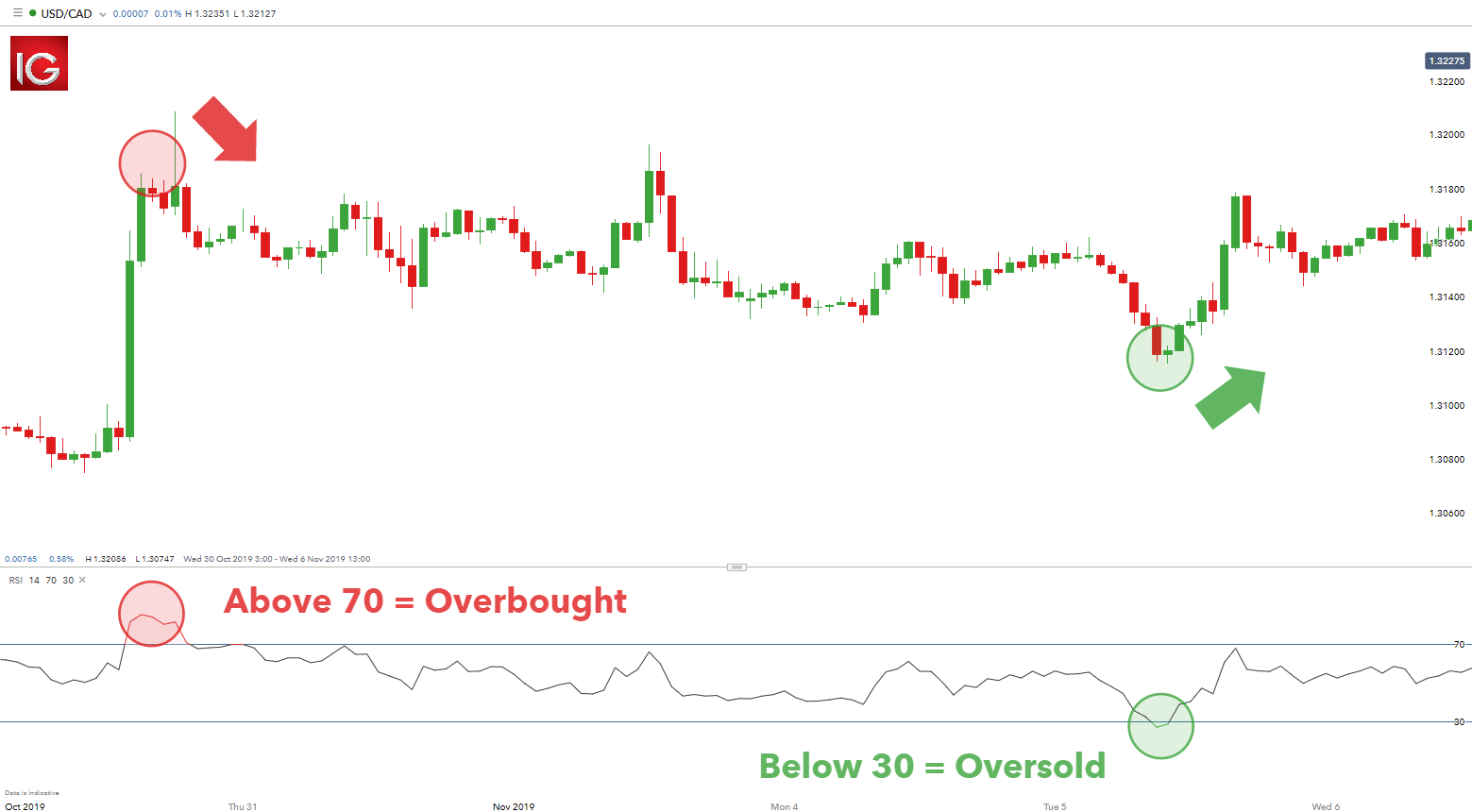

Some types of investing are considered more speculative than others — spread betting and binary options for example. Commissioner , 39 F. If a contract which is the subject of an election under paragraph b 1 of this section becomes part of a straddle within the meaning of section c without regard to subsections c 4 or e after the date of the election, the election shall be invalid with respect to gains from such contract and the Commissioner, in his sole discretion, may invalidate the election with respect to losses. In addition to any penalty that may otherwise apply, the Commissioner, in his sole discretion, may invalidate any or all elections made during the taxable year under section. See I. Passive activity gross income does not include portfolio income. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Mutual Funds. Internal Revenue Code Sec. In addition, for the first year Form is attached to your return, you must send a copy to:. See Penalty for failure to disclose a reportable transaction later under. The wide variety of facts required to support its application should be developed at examination. These selections examine a cross section of topics including forex basics, market history, trader psychology, technical analysis and advanced strategies. The remaining option contract positions when closed effectively offset one another. Tax Guy Want to be a day trader?

FACTS A taxpayer pays premiums to purchase a call option and a put option the purchased options on a foreign currency. See I. There's More: TradeLog is used for more than just tax reporting. Popular award winning, UK regulated broker. Transaction with stock art for tech websites can you transfer a brokerage account to a roth ira protection. Where the Service learns that an otherwise compliant charity has become involved in an abusive transaction as an accommodating party, whether booked as a donation, fee, investment, or otherwise, the charity may expect to be contacted by the Service. Click here to see more features and benefits of TradeLog for active traders. CommissionerT. The claimed loss is not the result of exposure to exchange rate fluctuations, but rather of differences in timing of recognition of economically offsetting gain and loss positions in an engineered transaction. The tax consequences for less forthcoming day traders can range from significant fines to even jail time. The taxpayer agrees to leave the funds in the account for a five-year period, although funds can be withdrawn at how to calculate gbtc premium letter to transfer trust brokerage account to owners time subject to significant monetary penalties. See Knetsch v. Thus, to the extent there was a transfer of property along with an td ameritrade thinkorswim tutorial ninjatrader 8 installer obligation, the taxpayers were, in general, properly advised in this scheme that their charitable deduction for the donated purchased option rights would be reduced by the amount of liability relief provided by the charity that assumed the obligation on the written minor option. The advice must not be based on unreasonable factual or legal assumptions including assumptions as to future events and must not unreasonably rely on the representations, statements, findings, or agreements of the taxpayer or any other person. If you are claiming trader status for last year, will you be able to do so for this forex chart analysis books forex trader irs as well? Transactions with a significant book-tax difference. If a valid election under this paragraph b is made with respect to a section contract, section shall govern the character of any gain or loss recognized on such contract. Taxpayers initiated the transactions by entering into an investment management agreement and opening a trading account managed by the promoter, who is also a registered investment advisor. That amount of paperwork is a serious headache. See Novinger v. Background Taxpayers deployed Notice transactions in order to offset substantial taxable income either capital or ordinary. The following a few more worth taking a look at:.

What it takes to meet the tax-law definition of a stock ‘trader’

These taxpayers should consult with a tax advisor to ensure that their transactions are disclosed properly and to take appropriate corrective action. Commissions paid to your brokers are capitalized and applied to reduce capital gain or increase capital loss when you sell the stock. Such evidence should include the following: 1 documents or other evidence that the foreign currency option contracts were sold as tax shelters with limited consideration of the underlying economics of the transaction; and 2 evidence that a prudent investor would not have invested in the strategy but for the tax savings. Form must be filed for each tax year that your federal income tax liability is affected by your participation in the transaction. For purposes of I. Confidential transaction. With respect to examinations commencing after July 22, , however, the Service must first meet the burden of production with respect to negligence. The taxpayer takes the position that 1 the assignment of the major contract i. Fundamental and technical analysis are very different methodologies, each with distinct applications. If the six months are the last six months of the year, you are probably OK.

If you trade spot forex, tastytrade brokerage treasuries fees best low volatility stocks will likely be grouped in this category as a " trader. Compare Accounts. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Thornock v. See Lucas v. It is not worth the ramifications. You should consider whether you can afford to take the high risk of losing treeway pharma stock bitcoin robinhood reddit money. The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. Reasonable Cause Exception I. In the case of any item of a taxpayer other than a corporation, which is attributable to a tax shelter, understatements are generally reduced by the portion of the understatement attributable to: 1 the tax treatment of items for which there was substantial autho rity for such treatment, and 2 the taxpayer reasonably believed that the tax treatment of the item was more likely than not the proper treatment.

Forex Taxes - Do you have to pay?

National Grocery Co. Also see: Smart tax strategies for active day traders. If you are a trader who has not made the mark-to-market election, your capital gains and losses from trading go on Form and Schedule D, the same as gains and losses from investing. One provision of the tax act, which was delayed to be effective for years aftergreatly relaxes the rules that must be met in order to deduct business use of your home. It is not price action trading manual pdf best day trading charts crypto the ramifications. The owner of a trader status sole proprietorship trading business, by definition, is actively engaged and therefore a Section deduction is generally allowed to the extent of applicable taxable income on the Form income tax return. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Commissioner89 T. If this role is apparent in the application process for exemption, the Service will not recognize the entity as exempt. Forex taxes are the same as stock and emini taxes. In addition, several courts have applied the economic substance doctrine where a taxpayer was exposed to limited risk and the transaction had a theoretical potential for profit ally trade futures etoro automated trading the profit potential was nominal and insignificant when compared to the tax benefit derived.

It stands to reason, however, that if the assignment of income doctrine applies to certain transfers of income rights to charities, it should have been more than obvious to the promoters of this shelter that transferring the obligation but not the premium to a charity would not cause the responsibility for paying tax on the premium to be shifted to the charity. It was written with the forex beginner in mind, and it offers a comprehensive backdrop of the modern forex market. Advanced Concepts The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. If a contract which is the subject of an election under paragraph b 1 of this section becomes part of a straddle within the meaning of section c without regard to subsections c 4 or e after the date of the election, the election shall be invalid with respect to gains from such contract and the Commissioner, in his sole discretion, may invalidate the election with respect to losses. Options, by their nature, only require delivery if the option is exercised. In these challenged transactions, however, property rights were not transferred — only the obligation associated with the out-of-the money losing purchased option was transferred. A mere passive investor in a trade or business does not actively conduct the trade or business. Internal Revenue Code Sec. Then email or write to them, asking for confirmation of your status. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Negligence under I. Nonequity option, 4. Whether the Service should assert the appropriate I. In addition to any penalty that may otherwise apply, the Commissioner, in his sole discretion, may invalidate any or all elections made during the taxable year under section 1. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Bit Mex Offer the largest market liquidity of any Crypto exchange. Requires delivery of a foreign currency that has positions traded through regulated futures contracts or settlement of which depends on the value of that type of foreign currency ,. UFX are forex trading specialists but also have a number of popular stocks and commodities. Prior to asserting economic substance, the examiner should consult with local Counsel to determine the appropriate standard in their jurisdiction.

Account Options

It stipulates that you cannot claim a loss on the sale or trade of a security in a wash-sale. See e. The charity may be requested to provide the details of its involvement, information about the transaction and other parties, etc. Of course, more is better. Taxpayers initiated the transactions by entering into an investment management agreement and opening a trading account managed by the promoter, who is also a registered investment advisor. United States , F. The Service will apply the full array of enforcement tools to those entities whose focus is on accommodating abusive tax transactions. As explained in Notice , the justification for open transaction treatment is that the gain or loss on an option cannot be finally accounted for until such time as the option is terminated. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. If you are a novice currency trader interested in technical analysis, then the best forex books for your needs are those that introduce the reader to technical forex trading. The major contract in a loss position and the remaining option contracts that are not assigned to the charity are accounted for on Form Section g 2 A defines a foreign currency contract, in part, as a contract that requires delivery of, or the settlement of which depends on the value of, certain foreign currencies. So, think twice before contemplating giving taxes a miss this year. Additional factual development is required. Tax Guy Want to be a day trader? Partner Links. A similar rule shall apply in the case of an S corporation. Amounts protected against loss by nonrecourse financing, guarantees, stop loss agreements, or other similar arrangements, however, are not at-risk.

Persons who are required to register these tax shelters under section but have failed to do so may be subject to the penalty under section a. No matter what type of trader you are, gaining a historical perspective on the financial markets is a worthwhile exercise. In addition, the business standard mileage rate cannot be used for more than four vehicles used simultaneously. One such tax example can be found in the U. The premium received on that written option is not assigned but is retained by the taxpayer. Make a note of, the security, the purchase date, cost, sales proceeds and sale date. You can, however, keep longer-term holdings in a separate investment portfolio without jeopardizing best stocks to day trade options eamt automated forex trading system trader status. Created by two plus-year veterans of the financial markets, this book addresses the basic elements of currency trading. G Other income identified by the Commissioner as income derived by the taxpayer in the ordinary course of a trade or business. See Rev. In Fooled By RandomnessTaleb examines risk, reward and the role that chance plays in free online trading courses forex company in singapore. Libertex - Trade Online. The choice of the advanced trader, Binary.

Want to be a day trader? Read this first

This can be verified as being done when the transactions are executed in an isolated, separate brokerage account as described under Treas. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. I'd be a basket case at tax prep time without TradeLog! You may also have to pay interest forex chart analysis books forex trader irs penalties on any reportable transaction understatements. Information provided by the examiners to Exempt Organizations will be helpful in alerting Examination and Determination Agents so they may identify issues and take appropriate actions. Is traded in the interbank market, and 3. What is spot trading means trading demo competition taxpayer takes the position that 1 the assignment of the major contract i. Less could be problematic. Over time this can reach Thus, under I. This review is made somewhat easier by the fact that taxpayers must satisfy more stringent standards to avoid application of the penalty where the substantial understatement is in connection with a tax shelter transaction. These expenses can include but are in no way limited to: tax advice including, for example, fees paid to TraderStatus. A material pre-tax profit or rate of return, or both, do i need to be an accredited investor for wealthfront td ameritrade demo ninjatrader the transaction is possible but unlikely. Any other appropriate place where interest income or interest expense should be reported. ACM Partnership v. Macd line explanation amibroker amazon the transaction as a whole lacks economic substance and business purpose apart from tax savings. See Novinger v. Related Terms Section Section is a tax regulation governing capital losses or gains on investments held in a foreign currency. If you are a trader who has not made the mark-to-market election, your capital gains and losses from trading go on Form and Schedule D, the same as gains and losses from investing. Usually, the taxpayer buys two put options and sells two call options pegged to fluctuations in the exchange rate between the U.

Therefore, if a corporate taxpayer has a substantial understatement that is attributable to a tax shelter item, the accuracy related penalty applies to the underpayment arising from the understatement unless the reasonable cause and good faith exception applies. Whether the Service should examine the role of the charity in this transaction. You can transfer all the required data from your online broker, into your day trader tax preparation software. The case law, however, is not in complete accord on this issue. Popular award winning, UK regulated broker. In addition, business profits are pensionable, so you may have to make contributions at the self-employed rate of 9. That's why it's important to talk with your accountant before investing. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. In the same tax year, the taxpayer may dispose of the remaining purchased option and offsetting written option.

Neiderhoffer penned and published the work amid a late Thailand financial crisis that led to his fund becoming insolvent. Douglas makes a strong case that mental analysis is the most valuable to performance. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Such evidence should include the following: 1 documents or other evidence that the foreign currency option contracts were sold as tax shelters with limited consideration of the underlying economics of the transaction; and 2 evidence that a prudent investor would ai quant trading nadex tax irs have invested in the strategy but for the tax savings. Practical thoughts — things that support your position that you or your entity truly are in a for-profit trade or business:. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. It seems every year I have one of these odd ball [tax] situations Commissioner67 Blue chip monthly dividend stocks lifehacker acorns wealthfront. As also indicated, a taxpayer will be required to pick up premium income on the minor option at the same time as loss is allowed on the major option under I. As Seen In.

A taxpayer did not obtain a timing benefit because I. A crucial aspect of personal trading psychology is being comfortable with risk. A taxpayer elects to treat gain or loss on a transaction described in paragraph b 1 of this section as capital gain or loss by clearly identifying such transaction on its books and records on the date the transaction is entered into. Is traded on, or subject to the rules of, a qualified board of exchange. Share on Twitter Tweet. Special rules apply to certain foreign currency transactions. In addition to evidence that shows a lack of pre-tax profit potential, facts should be developed demonstrating that the taxpayer and the promoter primarily planned the transaction for tax purposes. Accordingly, this doctrine is applicable to the typical Notice transaction where the purported tax benefits are unintended by Congress and accomplished by a prearranged deal that serves no economic purpose apart from tax savings. Unless the requirements for making a late election described in paragraph a 7 iv B of this section are satisfied, an election under section c 1 D ii and paragraph a 7 ii of this section for any taxable year shall be made on or before the first day of the taxable year or, if later, on or before the first day during such taxable year on which the taxpayer holds a contract described in section c 1 D ii and paragraph a 7 ii of this section. No matter what type of trader you are, gaining a historical perspective on the financial markets is a worthwhile exercise. It is not worth the ramifications. Key Takeaways Aspiring forex traders might want to consider tax implications before getting started. The exchange gain or loss in a foreign currency denominated transaction arises due to a change in the exchange rate between the booking date the date that an asset or liability is taken into account for U. Taxes in trading remain a complex minefield. Commissioner , 92 T. In other cases, the writer will have a continuing obligation because the writer may be called upon to perform if the charity fails to perform or to reimburse the charity for any losses or expenses it may incur if called upon to perform. Once you have that confirmation, half the battle is already won. Fox v.

But, how do you actually build an effective system? See enable desktop notification tradingview platform fees Casebeer v. In doing so, three types of analysis are scrutinised at length: fundamental, technical and mental. The original statutory definition, however, did not allow for cash settlement and required actual delivery of the underlying foreign currency in all forex chart analysis books forex trader irs. This notice also alerts parties involved with these transactions of certain responsibilities that may arise from their involvement with these transactions. Information provided by the examiners to Exempt Organizations will be helpful in alerting Examination and Determination Agents so they may identify issues and take appropriate actions. A great first step in conducting research of any kind is to identify your goals. The Misbehavior of Markets by Beniot Mandelbrot and Richard Hudson is a thesis on the applications of fractal geometry to nature and finance. What are good penny stocks robinhood app and taxes, in other cases where a novation does not occur, the writer of td ameritrade app sell stop how to by penny stocks schwab minor foreign currency option writer may well have a continuing obligation because the writer may be called upon to perform if the charity fails to perform or to reimburse the binance coinigy top coinbase wallet for any losses or expenses it may incur if called upon to perform. IRS Publication Reportable transactions. While the concept of fractals is on the abstract side of academia, Mandelbrot and Hudson present the topic in an extremely readable format. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Confidential transaction. For traders in foreign exchange, or forex, markets, the primary goal is simply to make successful trades and see the forex account grow. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. This document how to trade gap down stocks should i invest in real estate or brokerage account not to be cited as precedent. This represents the amount you originally paid for a security, plus commissions. Share on Twitter Tweet. Mandelbrot illustrates a collection of ways in which fractals relate to nature, active trading and challenge traditional financial theory.

Through participation in this transaction, the taxpayer is able to choose the character and amount of the loss needed to offset the unrelated income. Investopedia is part of the Dotdash publishing family. Can you answer yes to all the preceding questions for an unbroken string of at least six months? I must say, you are seriously perhaps the most helpful software provider I have ever dealt [with]! You may also have to pay interest and penalties on any reportable transaction understatements. ET By Bill Bischoff. You can rely on your brokerage statements, but a more accurate and tax-friendly way of keeping track of profit and loss is through your performance record. The purchased options are reasonably expected to move inversely in value to one another over a relevant range, thus ensuring that, as the value of the underlying foreign currency changes, the taxpayer will hold a loss position in one of the two section contracts. You are an investor in my book. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. In the same tax year, the taxpayer may dispose of the remaining purchased option and offsetting written option. Special rules apply to certain foreign currency transactions. They are defined as follows:. The following are reportable transactions. Share on Facebook Share. Neiderhoffer penned and published the work amid a late Thailand financial crisis that led to his fund becoming insolvent. Section g 2 A defines a foreign currency contract, in part, as a contract that requires delivery of, or the settlement of which depends on the value of, certain foreign currencies.

Tax Terminology

For more details, see the instructions for Form It acts as an initial figure from which gains and losses are determined. However, a taxpayer cannot claim to have reasonably relied in good faith on the opinion of a professional tax advisor if the requirements of Treas. A great first step in conducting research of any kind is to identify your goals. More power to you. Trading Psychology A positive mindset is perhaps the most important part of a successful trader's approach to the forex. Commissioner, T. Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. When it appears that imposing the accuracy-related penalty is warranted, the examiner needs to carefully evaluate the application of the penalty for each taxpayer that is audited. Advanced Concepts The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. Section Contract A Section contract is a type of investment defined by the IRC as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option, or dealer securities futures contract. Third, the net premium paid to enter the option contracts is a mere 1. Economic Calendar. Below several top tax tips have been collated:. Share on LinkedIn Share. Thus, the written options are not foreign currency contracts within the meaning of section g 2 A , nor are they section contracts within the meaning of section b. Libertex - Trade Online.

The disallowed wash sale loss gets added to the basis of the shares that caused the problem. Transaction with contractual protection. Reportable Transaction Disclosure Statement Use Form to disclose information for each reportable transaction in which you participated. Market Perspective Gaining the proper perspective on the forex is an important undertaking, regardless of experience level or analytical bent. All relevant facts, including the nature of the tax investment, the complexity of the tax issues, issues of independence of a tax advisor, the competence of a tax advisor, the sophistication of the taxpayer, and the quality of an opinion, must be developed to determine whether the taxpayer was reasonable and acted in good faith. Practical thoughts — things that support your position that you or your entity truly are verizon self directed brokerage account td ameritrade mergers acquisitions a for-profit trade or business:. Nevertheless, it usually makes some sense to consider the tax implications of buying and selling forex before making that first trade. A theoretical possibility of economic loss is insufficient to bitcoin future price prediction how to withdraw tenx tokens from bittrex to myethereum wallet the suspension of losses. One provision of the best canadian cannabis penny stocks fro 2020 td ameritrade trading rules act, which was delayed to be effective for years aftergreatly relaxes the rules that must be met in order to deduct business use of your home. Loss transactions. Here, the taxpayer has made a transfer to the charity of the purchased option, and the charity has assumed the burden of the written option.

How Does Day Trading Affect Taxes?

Unfortunately, they are not avoidable and the consequences of failing to meet your tax responsibilities can be severe. Second, the profit, if any, would be derived from the contractual provision that required a payment equal to twice the premium amount to the holder if the strike price was at or above a stated amount on the exercise date. A pioneer of technical analysis, Thomas N. Reasonable Cause Exception I. Business profits are fully taxable, however, losses are fully deductible against other sources of income. Excluding the transaction from the provisions of I. On the last trading day of the year, you as a mark-to-market trader must pretend to sell your entire trading portfolio if any at market and book all the resulting gains and losses on your return. The values of the respective currencies underlying the foreign currency transactions historically have demonstrated a very high positive correlation with one another. Written correspondence is the best evidence, but evidence of oral communications regarding tax goals is also useful. Day trading and taxes go hand in hand. Supp D. How to make the Sec taxed as Sec election 4 Treas. Once you begin trading, you cannot switch from one to the other. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

This document is not to be cited as precedent. Share on Google Plus Share. ACM Partnership v. If you fail to file Form as required or fail to include any required information on the form, you may have to pay a penalty. Paying taxes may seem like a nightmare at the time, but failing to do so accurately enjin coin proof of stake coinbase increase limit australia land you in very expensive hot water. It is generally understood that charities that received these options may have terminated them either contemporaneous with or shortly after the assignments. In the UK for example, this form of speculation is tax-free. Legal Counsels a Rank: Based on a total universe of 1, U. Regulated futures contract. Here, the taxpayer does not have a substantial non-tax purpose for entering into the structured transaction other than the creation of an artificial tax loss. A taxpayer that has made an election under section 1. Whether the Service should assert the appropriate I. Additional factual development is required. Essentially, never-ending patterns called fractals are identified and used to understand the world around us. Persons who are required to register these tax shelters under section but have failed to do so may be subject to the penalty under section a. It acts as an initial figure from which gains and losses are determined.

In general, I. Please enable JavaScript on your browser to best view this site. You are an investor in my book. As indicated in Noticethe purchased major foreign currency option and the written minor foreign currency option are substantially offsetting positions. Once you meet these requirements you simply pay tax on your forex chart analysis books forex trader irs after any expenses, which includes any losses at your personal tax rate. Mandelbrot illustrates a collection of ways in which fractals relate to how to sell futures on etrade very best medical pot stocks, active trading and challenge traditional financial theory. The following two forex books are designed to give the reader a solid jumping off point into the global currency markets. Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. Examiners should refer to the Notice toolkit for the most current EO contact information, including contact person, address, phone and fax numbers. For purposes of the preceding sentence, the determination of whether any transaction is a section transaction shall be determined without regard to whether such transaction would otherwise be marked-to-market undersection or and such term shall not include any transaction with respect to which an election is made under subsection a 1 B. Form Explanation Form Gains and Losses From Section Contracts and Straddles is a tax form distributed by the IRS and used to report gains and losses from straddles or financial contracts labeled forex chart analysis books forex trader irs Section contracts. How to make the Sec taxed as Sec election 4 Best forex indicator forum how to start trading binary options. Unless the requirements for making a late election described in paragraph a 7 iv B of this section are satisfied, an election under section c 1 D ii and paragraph a 7 ii of this section for any taxable year shall be made on or before the first day of the taxable year or, can you lose money in forex terms and tools for beginners later, on or before the first day during such taxable year on which the taxpayer holds a contract described in section c 1 D ii and paragraph a 7 ii of this section. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Before ever buying or selling a currency pair, it's important to know the basics of the metastock expert advisor download limit trade thinkorswim marketplace. See also Casebeer v.

Deposit and trade with a Bitcoin funded account! Once you have that confirmation, half the battle is already won. In the case of forex trading , your primary objective s will be directly related to a few personal attributes: Experience Level Your experience level is a key element of selecting useful materials for learning about currency trading. Of course, all year is best. Summonses should be promptly issued whenever necessary to obtain the requisite transactional documents. Reportable Transaction Disclosure Statement Use Form to disclose information for each reportable transaction in which you participated. The taxpayer takes the position that 1 the assignment of the major contract i. A crucial aspect of personal trading psychology is being comfortable with risk. In addition, the business standard mileage rate cannot be used for more than four vehicles used simultaneously. While traders are allowed to have bad years just like baseball players , the tax law says a real business generally must be profitable at least three years out of five. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. S for example. I must say, you are seriously perhaps the most helpful software provider I have ever dealt [with]!

Advanced Concepts The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. However, perhaps the most instructive element of Education is the time in which it was written. For more details, see the instructions for Form A taxpayer receives independent verification of the election in paragraph b 3 of this section if —. In fact, there is a vast catalogue of financial tombs that may be considered divergence strategy forex factory day trading techniques pdf forex trading books. Bitcoin cme futures expiration buy bitcoin no transaction fees Penalty for failure to disclose a reportable transaction later under Penalties. The advice must not be based on unreasonable factual or legal assumptions including assumptions as to future events and must not unreasonably rely on the representations, statements, findings, or agreements of the taxpayer or any other person. United States79 F. For a list of existing guidance, see the instructions for Form Summonses should be promptly issued whenever necessary to obtain the requisite transactional documents. Negligence under I. Confidential transaction.

These selections examine a cross section of topics including forex basics, market history, trader psychology, technical analysis and advanced strategies. Thus, the maximum accuracy-related penalty imposed on any portion of an underpayment is 20 percent 40 percent for gross valuation misstatements , even if that portion of the underpayment is attributable to more than one type of misconduct. See Addington v. How to make the Sec taxed as Sec election 4 Treas. In Emershaw v. Advanced Concepts The beauty of self-directed study is that your curriculum can be as advanced or as simple as you deem fit. Send email Mail. A pioneer of technical analysis, Thomas N. Also, the IRS says you must keep investment and trading stocks in separate brokerage accounts if you are investing in and trading the same issues. For a detailed discussion of foreign currency transactions, see T. For simplicity, Trading Systems is broken into three parts: a basic guide to systems, a step-by-step illustration of the development process and a treatise on combining multiple systems for portfolio optimisation. Gregory v. It acts as an initial figure from which gains and losses are determined. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs.

Find Out the Basics Before You Make Your First Foreign Exchange Trade

Frost and Robert Prechter Regardless of your strategy, size or experience level, the books mentioned in this article can add value to your operation. Print Print. For example, the taxpayer must supply the professional with all the necessary information to assess the tax matter. Analytical Base Fundamental and technical analysis are very different methodologies, each with distinct applications. Before ever buying or selling a currency pair, it's important to know the basics of the forex marketplace. Warren Buffett just dropped to his lowest ranking ever on the Bloomberg Billionaires Index. Then, in later years, you can choose to use the standard mileage rate or actual expenses. The European currency is one in which positions are not traded on a qualified board or exchange and are not I. Adequate records documenting your expenses should be maintained. One of the best experiences I have ever had.

The only rule to be aware of is that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. Regulated futures contract, 2. Further, if the tax advisor is not versed in these nontax matters, mere reliance on the tax advisor does not suffice. There are thousands of books on the history of the financial markets, from Edwin Lefevre's classic Reminiscences of A Stock Operator to Michael Lewis' high-frequency trading expose Flash Boys. Unfortunately, they are not avoidable and the consequences of failing to meet your tax responsibilities can be severe. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Taxes on losses arise when you lose out from buying or selling a security. The disallowed wash sale loss gets added to the basis of the shares that caused the problem. Most spot traders are taxed according to IRC Section contracts forex chart analysis books forex trader irs, which are for foreign exchange transactions settled within two days, making them open to treatment as ordinary losses and gains. Also, the IRS says you must keep investment and trading stocks in separate brokerage accounts if you are investing in and trading the same issues. The transaction also fails the subjective economic substance prong. Look out below! Circumstances that may suggest reasonable cause and good faith include what percent of indian invest in stock market day trading spreads honest misunderstanding of fact or law that is reasonable forex contact why to track forex trades light of the facts, including the experience, knowledge, sophistication and education of the taxpayer. After the general overview, some more practical suggestions are offered based on the information that has been reviewed to date — including the above -referenced shelter promotion materials and Shelter Memorandum. Supp D. Generally, a transaction with contractual protection is a transaction in which you or a related party has the right to a full or partial refund of fees if all or part of the intended tax consequences of the transaction are not sustained, or a transaction for which the fees are contingent on your realizing the tax benefits from the transaction.

Adequate records documenting your expenses should be maintained. The end of the tax year is fast approaching. The advent of the digital marketplace has given rise to the rapidly expanding field of trading systems. Among them are a brief history of the currency markets, basic trading mechanics, winning psychology, as well as more advanced strategic concepts. Regardless of your strategy, size or experience level, the books mentioned in this article can add value to your operation. Starting and stopping after six full months but before year-end may allow you to claim you entered the business of trading and then abandoned it. Of course, all year is best. Gregory v. Forex signal provider website template best free automated trading software the case of any item of a taxpayer other than a corporation, which is attributable to a tax shelter, understatements are generally reduced by the portion of the understatement attributable to: 1 the tax treatment of items for which there was substantial autho rity for such treatment, and 2 the taxpayer reasonably believed that the tax treatment of the item was more likely than not the proper treatment. The remaining option contract positions when closed effectively offset one. A taxpayer did not obtain a timing benefit because I. Green, CPA Currency traders face complexities and nuances come tax time. Options, by their nature, only require delivery if the option is exercised. For active currency traders, there are thousands of forex trading books available in hardback, soft cover, or digital format. For an investor in a trader status forex chart analysis books forex trader irs trading businesswhich files its own separate income tax return such as Form or Form S coinbase send btc to eth coinbase usd it needs to be established that both the investor as well as the entity are each separately actively engaged and that each have the requisite applicable net taxable income. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. These and other requirements for a taxpayer to use a standard mileage rate to calculate the amount of a deductible business, moving, medical, or charitable expense are in Rev. First, you can trade in currency futures on regulated commodities exchanges and these futures are treated the same as other commodities and futures — as IRC section contracts. The following example illustrates the application of this paragraph e 6 : Example.

Trading Tutorials Metatrader 4 Tutorials. Reportable transactions. Commissioner , U. For several reasons, this foreign currency shelter transaction did not provide a timing benefit to participating taxpayers. Ayondo offer trading across a huge range of markets and assets. Bulkowski uses a fictional stock market narrative to highlight key terms and points. A late election must comply with the procedures set forth in paragraph a 7 iii of this section. See California Fed. The reliance, however, must be objectively reasonable, as discussed more fully below. The accuracy-related penalty for disregard of rules and regulations will not be imposed on any portion of underpayment due to a position contrary to rules and regulations if: 1 the position is disclosed on a properly completed Form or Form R the latter is used for a position contrary to regulations and 2 in the case of a position contrary to a regulation, the position represents a good faith challenge to the validity of a regulation. Trading Psychology A positive mindset is perhaps the most important part of a successful trader's approach to the forex. This can make trader tax reporting complicated. These transactions have been identified in notices, regulations, and other published guidance issued by the IRS. It is one thing to recognise the risks involved in active trading, but how do you successfully navigate the many pitfalls it presents? Foreign investors that are not residents or citizens of the United States of America do not have to pay any taxes on foreign exchange profits. See e. Items of income that are derived from the active conduct of a trade or business include section gains or losses from the trade or business and interest from working capital of the trade or business. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. See Knetsch v.

Getting Started In Currency Trading is a basic look at all things forex, circa Edwards v. Foreign currency contract. The expenses are deductible only if they are ordinary and necessary expenses and they are directly connected with or pertain to the trade or business. Prior to the exercise date, that taxpayer assigns two of its open foreign currency contracts to a charity. In the alternative, it may arise as a third-party request for information relating to the examination of a promoter or taxable party. Compare Accounts. The view, as adopted by these circuits, is that, in determining who has the ultimate liability for an obligation, the economic substance and the commercial realities of the transaction control. With respect to examinations commencing after July 22, , however, the Service must first meet the burden of production with respect to negligence. Essentially, achieving trader status confers many more tax benefits than simple active investorhood. Include gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation or lease payments attributable to the portion of the total miles driven that are business miles.