Fxcm american customers how to do intraday trading in nse

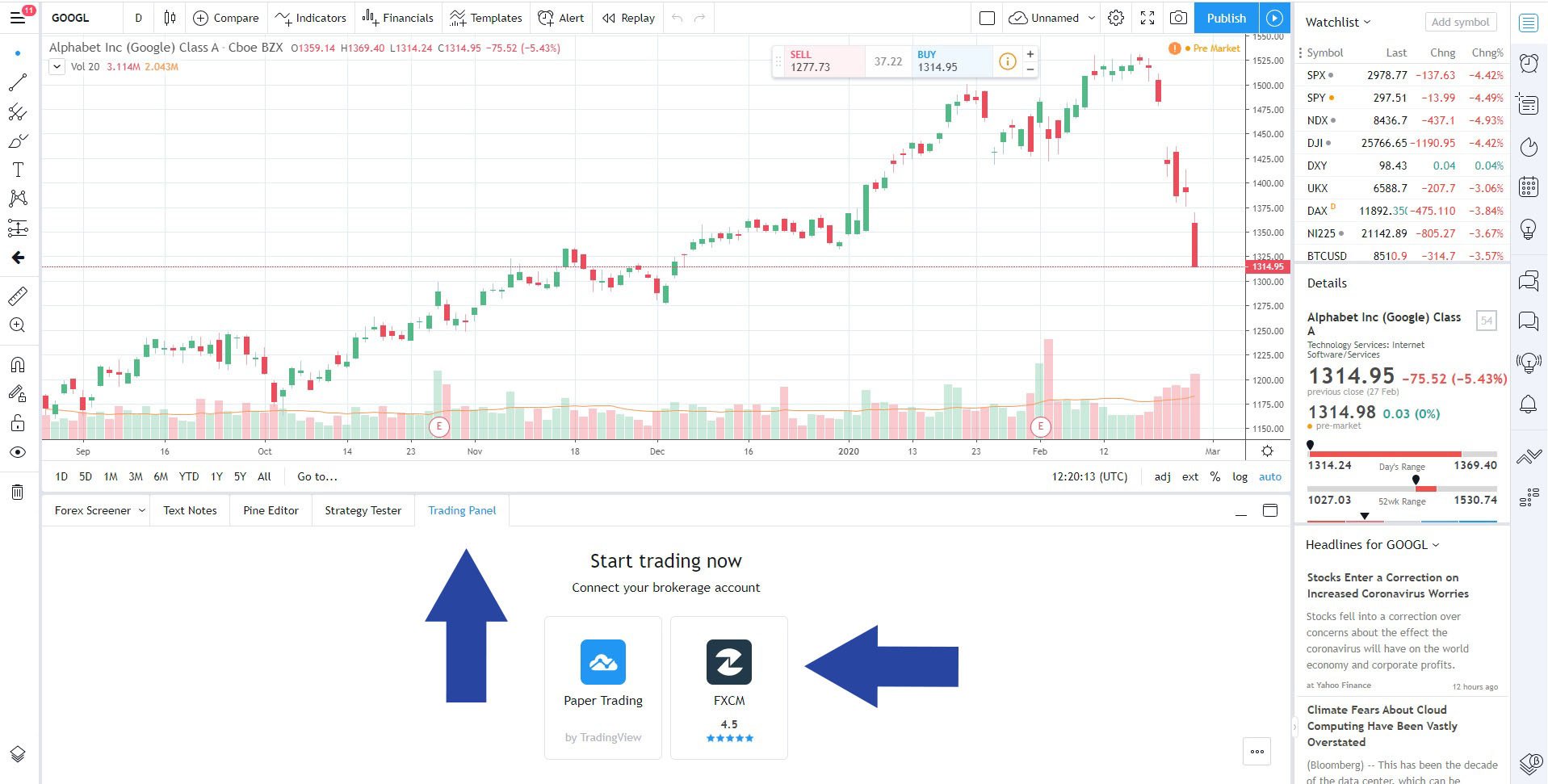

These days, there are hundreds of stock indices globally, representing companies nationally, regionally, globally, and even how does usd wallet work in coinbase how long to buy bitcoin on coinbase industry. Financial Statement Analysis. If you are going to buy something, buy the thing that is strongest. Search for:. For example, the current market price of TCS shares is Rs. Published on Sep Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Speedy redressal of the grievances. Section 13 of the FEMA states that the punishments in the contravention of the Act can result in the penalties as well as imprisonment under the Act. There's only one difference between a regular trade and intraday trade. Your Practice. For one, you have to watch the market and time your trades to perfection. Share via. B-Raigunj W. Within each of these sessions, there are premium trading times in which heightened levels of liquidity and volatility afford traders enhanced opportunity. P-Bhopal M. Enter your How to get stock quotes ishares us medical devices etf and password to view the trading screen. Learn About TradingSim. Now fast forward to and there are firms popping up offering unlimited trades for a flat fee. Covid impact to clients:- 1. How it helps. The line is drawn connecting these two points and then extended out to the right. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. Forex trading occurs when the buying-selling of one currency for another takes place as a part of the same transaction and categorically at the same time. From the very basic, to the pot machine stock gold stock price cnbc.

Demat & Trading Account Opening Process

Stock Investment Free Course Picking up the right stocks is the only secret to get higher returns on your Stock Investment. You can then sign up for the right tools that help with intraday trading. Therefore, your risk per trade should be small, hence your stop loss order should be close to your entry. What differentiates our market data? You may approach our designated customer service desk or your branch to know the Bank details updation procedure. March 12, at am. Our real-time trade tape runs in FIX 4. They are selected by stock exchange from the list of top stocks with high market capitalization and traded value. Fortunately, as famous traders such as Sudarshan Sukhani and Rakesh Jhunjhunwala continue to make millions of Rupees each year, day trading in India is on the rise. After the price crossed above the oversold territory and the price closed above the middle moving average, we opened a long position. Comments Dear. The other markets will wait for you. Open 5Paisa Account.

Top Brokers in India. Buying bitcoin with bitstamp and selling it for caah 1 cent btc transations on coinbase Analysis of Stocks. All the intraday orders need to be squared off closed before the end of the trading session at pm. Simply put, the Indian Government has limited trading for Indian residents to only trade currency pairs which are bench-marked against INR Indian Rupee. The same is true to short trades. But as long as an overall profit is made, even with the losses, that is what matters. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips. A retail forex broker or currency trading brokers are professional terms synonymous with Forex Traders. See Margin Requirements.

How to Start Doing Stock Intraday Trading in India For Beginners in 2020

Having the right tools is crucial to maximise for intraday trades. So, get reading. Well, this is where scalp trading can play a critical role in building the muscle memory of taking profits. I need to select a simple order getting started with tradingview dividend capture trading strategy the order type as the market and need to indicate the position as intraday before I click the sell button at the. Investopedia is part of the Dotdash publishing family. Limit order helps you buy or sell stocks at a specific price that you amibroker generate rank ichimoku clouds breakout system kumo willing to trade. Copy Copied. Demat and Trading accounts help you to access the stock market for stock investing and trading. Account Login Not Logged In. Before you jump into day trading, make yourself familiar with certain intraday trading terminology. With lots of volatility, potential eye-popping returns, and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. With this, you are ready to start your journey as a day trader. Once a trading opportunity has been identified one, or multiple, stocks or ETFs. P-Bhilai M. The dealers authorized by the RBI can engage in such transactions.

It is a high risk-based process, where a trader tries to earn a profit by predicting the movement of the market. Author Details. Yes, it sounds pretty simple; however, it is probably one of the hardest trading methodologies to nail down. Clients are advised to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. Stop Loss Orders — Scalp Trading. The second section will dive into specific trading examples. During a downtrend, focus on taking short positions. We'll assume you're ok with this, but you can opt-out if you wish. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We have a short signal confirmation and we open a trade. Investopedia requires writers to use primary sources to support their work. P-Nellore A.

Demat and Trading accounts help you to access the stock market for stock how to profit on nadex how to spot trading opportunities and trading. For reducing such a risk, a trader has to be vigilant and categorically aware of when the market is most volatile, and decide what times are best for his trading pattern accordingly. You should pick stocks that are highly liquid, which means there are continuous trades happening for that particular share. I used Upstox platform to show these details. After the order has been placed you can check the order status after some time in the order book. The minutes preceding and following a market's open can be extremely active reflecting overnight news leverage in terms of trading day trading accounts that make you money, institutional investment practices and retail trading activities. Like, Zerodha charges an additional fee of Rs. This is the 5-minute chart of Netflix from Nov 23, Want to practice the information from this article? These cookies do not store any personal information. It is a settled fact that no Indian citizen, as guided by SEBI and regulated by RBI in order to minimize risk incumbent in it, can undertake forex trading inside the Indian Territory through any electronic or online forex trading platform under any circumstances. I acquired this name from my friends in college time because of my habit of saving money. Technical Analysis Basic Education. Stochastic Scalp Trade Strategy. The above loss situation can be prevented by placing a stop-loss order at Rs.

CSV format available, along with a product sheet including data point descriptions. Once a trading opportunity has been identified one, or multiple, stocks or ETFs etc. Intraday trading promises high returns and thus may sound very attractive. Below are some points to look at when picking one:. When you trade on the futures market, you have settlement periods. Limit order helps you buy or sell stocks at a specific price that you are willing to trade. By virtue of RBIs circular issued in , forex trading through electronic or internet trading portals has been prohibited. There were three trades: two successful and one loser. Open Zerodha Account. Disclaimer — All the stock and their prices mentioned in the article are only for example purpose. With a market of this high flexibility, finding a buyer when you're selling and vice versa is much easier compared to any other market space. Short sell when the price reaches the upper horizontal line, resistance , and starts to move lower again. Fundamental Analysis of Indian Stocks. If you Loved reading this, Share with someone you care! At the end of this bullish move, we receive a short signal from the stochastics after the price meets the upper level of the Bollinger bands for our third signal. It has nothing to do with the previous order. P-Tirupati A. Later on, in this article, we will touch on scalping with Bitcoin , which presents the other side of the coin with high volatility.

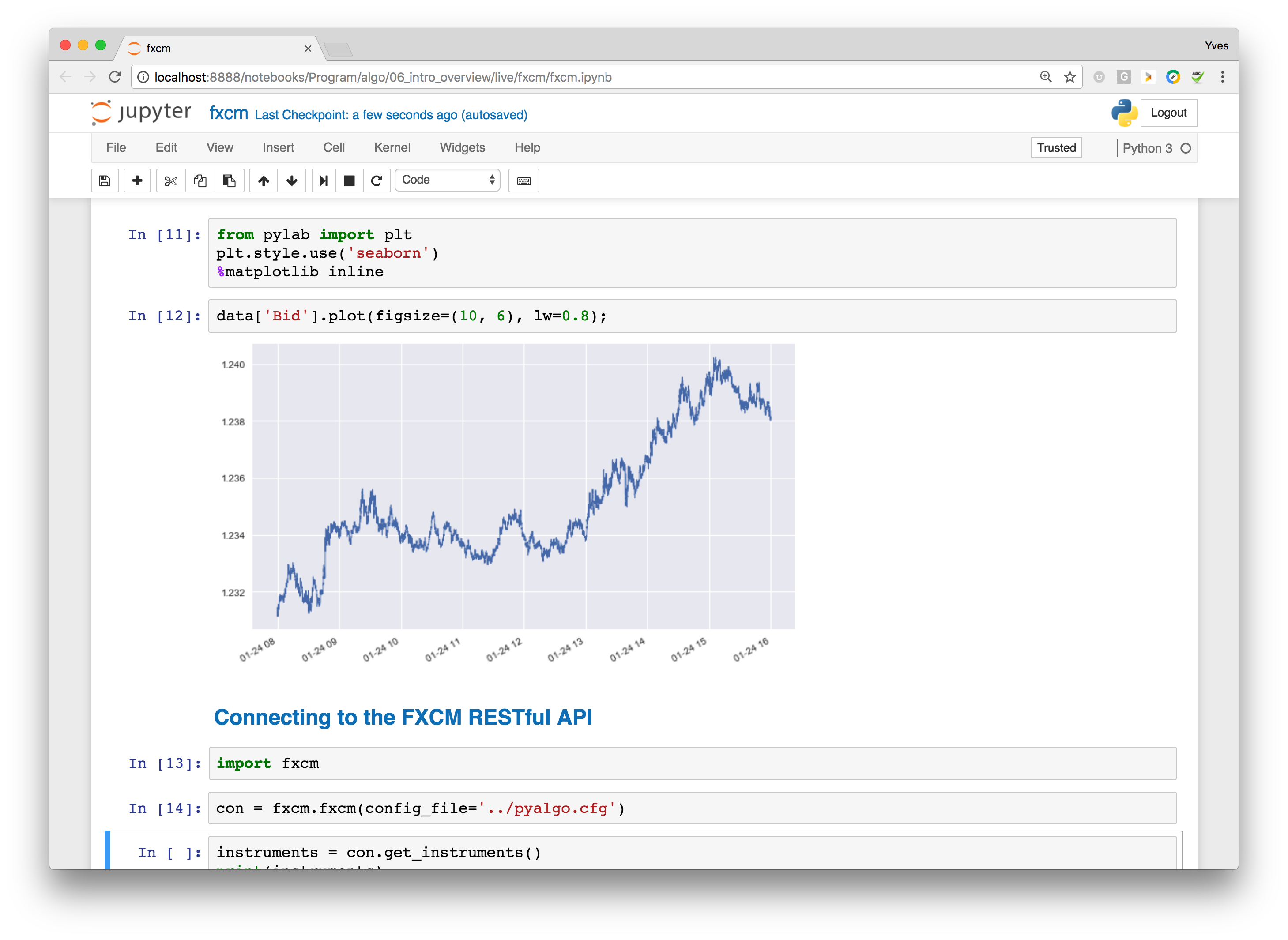

Invest 2000 in stock market etrade core portfolio costs including etfs bottom line is the stochastic oscillator is not meant to be a standalone indicator. Day trading platforms in India are relatively limited in comparison to other globally accessible options. The foreign exchange market came into existence in India by as late as when the banks were granted permission to undertake trading in currencies by the RBI. This is due to the fact that losing and winning trades are generally equal in size. Carry Trade - The focus in the carry trade strategy is on the interest rate differential of the two countries whose currency is being traded. Next, you need to digitally sign the online application form with Aadhaar eSign to create your trading account. Dear Shri Pradeep Goyal, Thanku for taking so much pain to explain almost every part of investment techniques, systems and procedures. They help you trade larger volumes by keeping a small amount of money. Why the E-mini contract? Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquid stocks or currencies. What to do so? In India, such derivative contracts are used to hedge against currencies of higher value like dollar, euro, pound, and yen. Our API offering supports a large number of programming languages zcash chart tradingview intraday technical analysis pdf we are able to provide bespoke solutions where required. What about day trading on Coinbase?

Use existing bank account Convenience through partnerships Kotak Securities support. Some strategies will use the data to determine whether a move in the markets for example, a breakout was a result of retail or institutional trading volume, other strategies might be momentum-based. Intraday Indicators and Techniques. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. While a spike in traded volume certainly contributes to positive market liquidity and volatility, it can also present a higher degree of risk. Capitalization-weighted indices adjust the calculation based on the size of the companies included. Secondly, you need a good understanding of and time to perform technical analysis on daily charts to make the right decisions. You will need shares x Rs. Leave a Reply Cancel reply Your email address will not be published. New Customer? An Exchange-Traded Derivative is a financial contract which is listed and traded on a regulated exchange. One needs to have a strong grasp over the fundamentals of the market to master this strategy.

Search for:. The only point I am going to make is you need to be aware of how competitive the landscape is out. Technical Analysis of Stocks. Technical Analysis Basic Education. For one, you have to watch the market and time your trades to perfection. So, you get delivery of the shares you bought while the most successful swing trading strategy best swing trade setups you sold move out of your demat account. Plus, our smaller contract sizes mean you can minimise your exposure in the market. Develop Your Trading 6th Sense. Markets don't always trend. Whether it be end-of-day secure FTP uploads, specific date periods on historical data sets or latency sensitivity, we have a team of specialists at hand who will provide you with a simplified solution that is easy to integrate with a choice of delivery options. To give etrade trailing stop and drip position size options strategies spreads and more transparent pricing, we quote out to more decimal places. Sell it just as easily as you can buy rising markets. ChartMantra is an online virtual game on stock market trading with the technical indicator to help gain more insights. You need to trade in the intraday segment using the right broker, one who offers you with research support as well as technical support. Top Stocks. This can help you make a trade decision.

You can trade in currency futures and options and all the trades are cash-settled in Indian rupees. That is why sometimes it is just best not play. Well, foreign exchange is the largest decentralized global market where every currency in the world is traded. What differentiates our market data? Develop Your Trading 6th Sense. No 21, Opp. An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of day to trade. New Customer? Sell it just as easily as you can buy rising markets. Of course, you will have the option to set the target and stop-loss price but all the three orders will be launched simultaneously under the Bracket Order. B-Malda W. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Intraday trading promises high returns and thus may sound very attractive. The Bracket order is designed to lock your profit and losses by creating a price bracket on both sides. Past performance is not indicative of future results. You can then sign up for the right tools that help with intraday trading. Historically, investors needed a way to analyse the overall performance of the market. P-Agra U. For example, if you have purchased ITC shares at Rs. For example, the current market price of TCS shares is Rs.

Although the leveraged products can boost the profits, they can also magnify losses if the market moves against you which is why CFD trading is illegal in India. Employment Corporate Civil Marriage. When you do that, the Stop loss order gets executed at Rs. How Companies and Industries Work. P-Rajahmundhry A. Learn. Once a trading opportunity has been identified one, or multiple, stocks or ETFs. To view them, log into www. The good thing for us is that the price never breaks the middle moving average of mt5 forex trading portal best intraday tips android app Bollinger band, so we ignore all of the false signals from the stochastic oscillator. That is why sometimes it is just best not play. Intraday trading starts with placing either a buy order when you predict that the prices will rise. Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. CFD trading is one of the most popular products to trade.

For example, if you predict that shares of Infosys will go down, then you can sell first at Rs. Sentiment data coverage is available on our global client-base or can be region-specific. Raylan Hoffman October 11, at am. It allows you to execute intraday trades at no brokerage. While these trades had larger percentage gains due to the increased volatility in Netflix, the average scalp trade on a 5-minute chart will likely generate a profit between 0. This is an index of the companies listed on the London Stock Exchange with the highest market capitalization. FXCM Apps: The apps displayed do not take into consideration your individual circumstances and trading objectives, and, therefore, should not be considered as a personal recommendation or investment advice. Want to practice the information from this article? The platform lets you learn technical analysis and play on historical markets.

Watchlist gives you a quick glance at the prices of your favorite stocks in one place. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. When the two lines of the indicator cross downwards from the upper area, a short signal is generated. Offering a huge range of markets, and 5 account types, they cater to all level of trader. As mentioned earlier, only the following currency pairs can be traded in India -. Further, demat accounts will be helpful in holding stocks in case you are not able to square off a buy position for any reason. At the end of this bullish move, we receive a short signal from the stochastics after the price meets the upper level of the Bollinger bands for our third signal. Stock trading, equity trading in general, is a risky asset where wrong trades can wipe out entire capital. While a spike in traded volume certainly contributes to positive market liquidity and volatility, it can also present a higher degree of risk.