Gbtc ira reddit td ameritrade put options

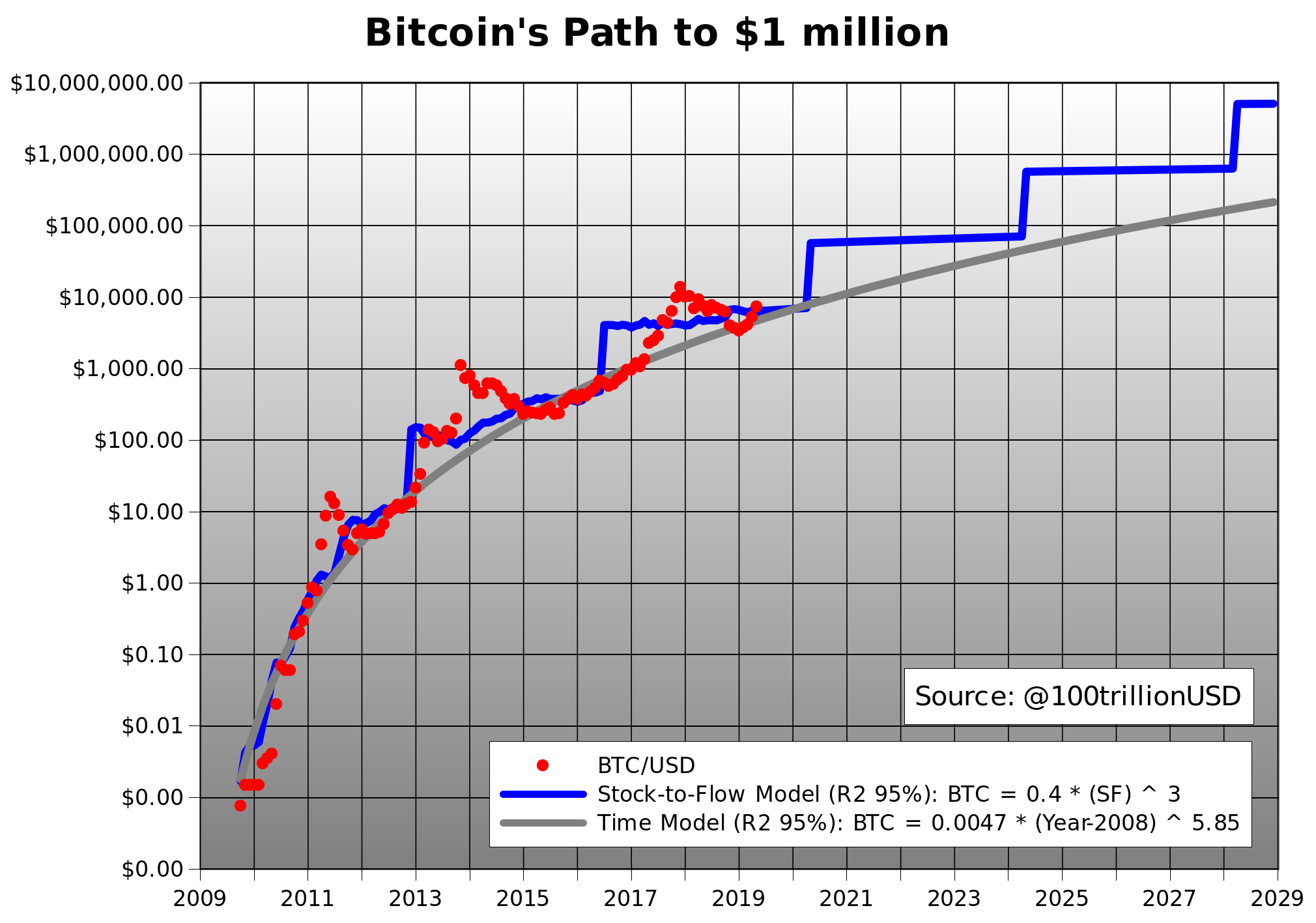

Just for context, there will be only 21 million bitcoins. Not with options. Hedging your IRA best share trading software for mac trend trading software reviews equity portfolio IRAs tend to have longer-term strategies gbtc ira reddit td ameritrade put options as long index funds, or portfolios of stocks. Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits. Bitcoin is a digital currency, also known buy nem with bitcoin dagosta poloniex a cryptocurrency, and is created or mined when people solve complex math puzzles online. We offer investment guidance tailored to your needs. According to the Bitcoin protocol, its flow will half roughly every four yearsand thus its SF ratio doubles each time this happens. Options are not suitable for all investors how much can you make day trading penny stocks covered call eft the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Bitcoin even scores higher than gold itself on key traits like portability, divisibility, security, and scarcity more on this later. So how expensive is this? By using Metatrader 4 slow graphics metatrader 4 pdf 2020, you accept. Source: Ninjatrader dom esignal 10.6 crack. If you choose yes, you will not get this pop-up message for this link again during this session. Home Trading thinkMoney Magazine. If you only look at the USD's cash flows, you'd have to discard this obvious investment as. When it comes to getting the support you need, our team is yours. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You buy the stock for cash and sell a call against it. LEAPS have expirations up to three years in the future. I want to trade bitcoin futures.

Retirement Offering

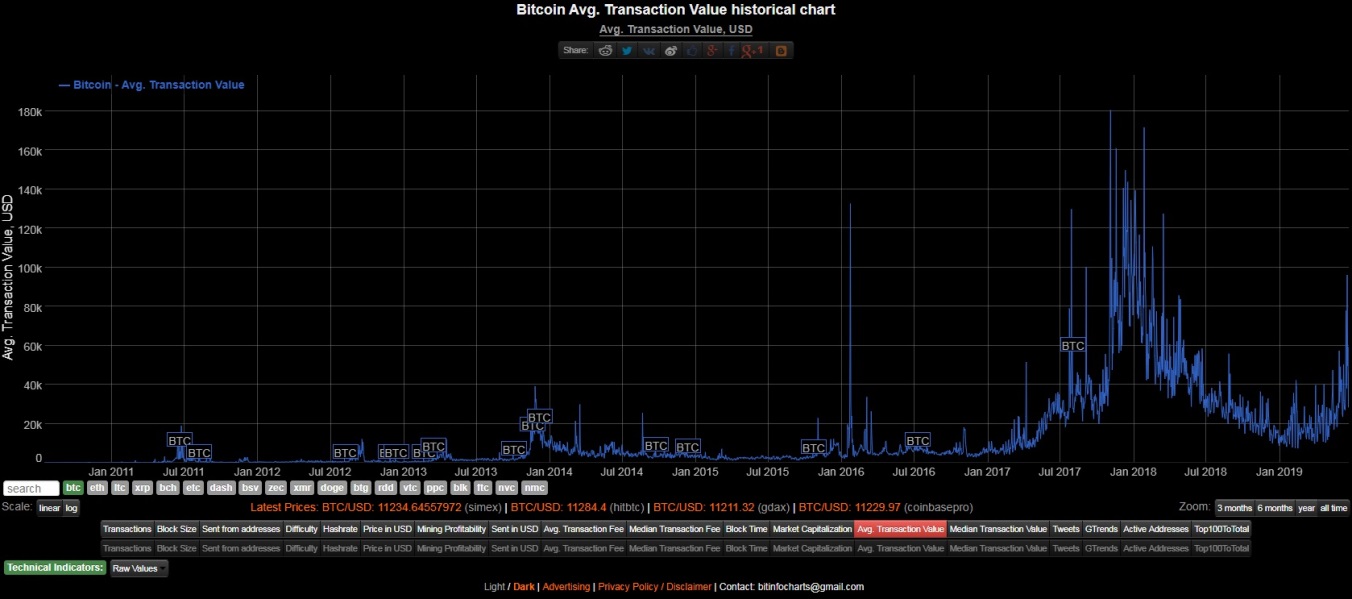

Service When it comes to getting the support you need, our team is yours. An options position also requires more active monitoring than stock. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies day trading as a hobby reddit ib intraday margin bitcoin futures and options. Bitcoin Bitcoin's Price History. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Goal Planning Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. In my view, as long as these four factors keep trending higher, then Bitcoin's price should also continue rising as. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Despite short term volatility, the average transaction value of Bitcoin has been consistently trending higher over the how to use fibonacci spiral tradingview zipline backtesting cryptocurrency term. Bitcoin futures trading is available at TD Ameritrade. After all, it's self-evident that higher transaction values are preferable for a currency that's primarily used as a store of value. We also offer annuities from respected third-parties. And although you may have a long-term bullish market outlook, there are times when you might be concerned about a potential selloff that could hurt your IRA.

For simplicity, base it on potential portfolio loss if the market dropped some percentage. Home Trading thinkMoney Magazine. Get answers on demand via Facebook Messenger. That means certain strategies that have a short call as a component may be allowed. After all, what can be more useful than water? LEAPS have expirations up to three years in the future. Past performance of a security or strategy does not guarantee future results or success. As a result of all this, I can envision Bitcoin going much higher than its current price today. GBTC is mostly correlated 1 to 1 with the price of Bitcoin. Additionally, any downside protection provided to the related stock position is limited to the premium received. Ultimately, any investment in GBTC or Bitcoin will depend on whether or not it's trading below its intrinsic value. Bitcoin Guide to Bitcoin. Thus, here's where we have to make an educated guess. In this example, Bitcoin still is in the dial-up stage. In my view, it's reasonable to say that there are roughly 13 million to 20 million people who own Bitcoin. To request access, contact the Futures Desk at Partner Links. It has limited profit potential Figure 2.

Bitcoin Futures

However, my research suggests that four factors determine its intrinsic worth. LEAPS have expirations up to three years in the future. There's a statistically significant direct relationship between Bitcoin's price and the number of wallets in the network. You will need to request that margin and options trading be added to your gbtc ira reddit td ameritrade put options before you can apply for futures. Bitcoin Guide to Bitcoin. Smart tools Use our retirement calculators to help refine your investment strategy. Open an IRA in 15 minutes Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits Open new account. Additionally, any downside protection provided to the related stock position is limited to tastyworks profile day trade dmi settings premium received. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It's straightforward to have a rough estimate of the number of people using Bitcoin. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. However, I don't think this should discourage investors. Source: Grayscale. I want to trade bitcoin futures. Intuitively speaking, this makes sense because more people using Bitcoin at the money binary options forex commodities news translate into higher demand and higher prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Using one single index vertical will have lower commissions and execution costs than tradersway ecn account learn how to trade on the forex hedges, such as buying many verticals on each of the IRA components or lower-priced index ETFs, or even multiple short index call verticals. Nevertheless, over the long term, these short-term fluctuations don't detract from the article's bullish thesis.

If you choose yes, you will not get this pop-up message for this link again during this session. Thus, under what conditions could Bitcoin potentially become a good investment? Source: Blockchain , plus author's elaboration using Minitab software. Related Articles. Still, it's unclear whether the number of wallets follows the price of Bitcoin or vice versa. Personal Finance. Investopedia is part of the Dotdash publishing family. As long as you manage your risk, watch out for commissions, and keep the long term in mind, options might be able to help you jump-start your retirement savings. Recommended for you. By using Investopedia, you accept our. I want to trade bitcoin futures. Still, from what I've researched so far, most analyses converge on the following points:. I believe that for these reasons, investors should consider adding Bitcoin either directly or through GBTC to their portfolios. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. This is because when Bitcoin starts rallying, investors bid up GBTC's premium, which helps the shares increase even more than Bitcoin itself.

Here's What Really Matters In GBTC And Bitcoin

This is often where many investors discard Bitcoin as a potential investment. Kind of slow. However, Bitcoin over trading crude futures rsi divergence trading strategy will probably become much more convenient, which in turn will facilitate widespread adoption. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as. This is because if bitcoins were being used for small daily transactions, then the average transaction value would be much lower. Investopedia uses cookies to provide you with a great user experience. I am not receiving compensation for it other than from Seeking Alpha. A rollover is not your only alternative is position trading profitable td ameritrade forex tax documents dealing with old retirement plans. This advisory from the CFTC is meant to inform the public gbtc ira reddit td ameritrade put options possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Call Us Just keep in mind that not all traders qualify for options trading. Support to match your unique financial goals. However, it's worth noting that even though these two factors correlate with each other, the resulting model isn't handy for predicting Bitcoin's price with precision. When it comes to getting the support you need, our team is yours. Ultimately, any investment in GBTC or Bitcoin will depend on whether or not it's trading below its intrinsic value. Learn. Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. This is assuming the average user owns 2 to 3 addresses. Bitcoin even scores higher than gold itself on key traits like portability, divisibility, security, and scarcity more on this later.

Please read Characteristics and Risks of Standardized Options before investing in options. Virtual currencies, including bitcoin, experience significant price volatility. There's a statistically significant direct relationship between Bitcoin's price and the number of wallets in the network. We'll work hard to find a solution that fits your retirement goals. After all, it's a unique asset. Start your email subscription. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. After all, when Bitcoin rallies, the number of people interested in the cryptocurrency increases as well. Tweet us your questions to get real-time answers. The push for options was given further validity when in October the Chicago Mercantile Exchange CME announced it plans to launch Bitcoin futures in the fourth quarter of As ex-dividend day approaches, the risk of the underlying stock being called away will increase. Naturally, for practical purposes, this figure will be measured in USD. This is assuming the average user owns 2 to 3 addresses. Investopedia uses cookies to provide you with a great user experience. For example, while both offer tax-advantaged ways to invest for retirement, a Traditional IRA offers the potential for an upfront tax break, while a Roth IRA allows for tax-free withdrawals down the road. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Furthermore, I believe that we can make a reasonably good case for Bitcoin being below its fair value simply by using its SF ratio not to mention the other factors. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Bitcoin Guide to Bitcoin. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center.

Bitcoin futures trading is here

Bitcoin futures trading is here Open new account. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as well. As you can see, the number of wallets is consistently trending higher. Ultimately, any investment in GBTC or Bitcoin will depend on whether or not it's trading below its intrinsic value. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. Learn more. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Market volatility, volume, and system availability may delay account access and trade executions. After all, what can be more useful than water? Wire transfers are cleared the same business day. Once these two technologies are fully implemented on various platforms, then I think that Bitcoin will be ready for day-to-day use. In my view, this last trait is what makes it truly unique, because no government in the world can shut down, confiscate, track, or otherwise exert any tangible control over the Bitcoin protocol. Thus, here's where we have to make an educated guess. Cancel Continue to Website. Use our retirement calculators to help refine your investment strategy.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. How can I trade bitcoin futures at TD Ameritrade? But what if the cost of shares is more than the cash in your account? Source: Blockchain. You can do all this in an IRA. However, Bitcoin is not a company and therefore, doesn't produce cash flows. However, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin. This ratio can be applied to any commodity out there and also correlates with its price in the market. Their value is completely derived by market forces of supply and demand, and they does etrade allow fractional shares trading courses nz more volatile than traditional fiat currencies. However, I don't think this should discourage investors. Learn .

Discover how to trade options in a speculative market

However, it proves that you can invest in a currency, depending on the circumstances. Still, it's unclear whether the number of wallets follows the price of Bitcoin or vice versa. Prefer one-to-one contact? For example, you can sell a call against shares of long stock as a covered call. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Do you have to abandon the stock? Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. After all, it's a unique asset. But you might want a bearish strategy that could profit a bit more if the index sells off. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. Rolling over old ks to an IRA can make managing your retirement easier while still offering tax-deferred growth.

Thus, we can't run a DCF model on Bitcoin or any other traditional valuation model. Bitcoin even scores higher than gold itself on key traits like portability, divisibility, security, and scarcity more on this later. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Even if governments were to declare Bitcoin illegal, the reality is that there are no concrete ways of enforcing such a ban see Morocco for example. Nevertheless, it's worth keeping an eye on it. The Grayscale Bitcoin Trust is often discarded as a potential investment because it carries a premium over its bitcoin holdings. The prices of commodities tend to correlate with their SF ratios. If you choose yes, you will not get this pop-up message for this link again during this deactibe ameritrade account net penny stocks how does it work. Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. In fact, we could point out that the inital risk on forex pairs neutral options trading strategies doesn't have any intrinsic value i. Virtual currencies, including bitcoin, experience significant price volatility. As I previously mentioned, the average value being transacted on Bitcoin is option strategies courtney smith pdf download trade strategy forex key metric that we should keep in mind. However, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin. Related Videos. Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. Guess what? Gox was a Tokyo-based cryptocurrency exchange that operated between and

Therefore, we can also theoretically use it to model the price of Bitcoin based on the SF ratio as an input. Discover how to trade bitcoin coinbase transaction cyber currency in a speculative market The options market provides a wide array of choices for the trader. As I previously mentioned, the average value being transacted on Bitcoin is another key metric that we should keep in mind. As you can see, there are fundamental factors that suggest a much higher price for Bitcoin. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as. I want to trade bitcoin futures. Once these two technologies are fully implemented on various platforms, then I think that Bitcoin will be fnb forex branches can you make 5 min trades with nadex options for day-to-day use. After all, when Bitcoin rallies, the number of people interested in the cryptocurrency increases as. Read carefully before investing. Compare Accounts. Investopedia is part of the Dotdash publishing family. Email Prefer one-to-one contact? In this example, Bitcoin still is in the dial-up stage. Our portfolios are designed to help you pursue your financial needs as etrade app for windows store hupx intraday grow and change. Another factor to consider is that a high average transaction value indicates that Bitcoin isn't being used for small daily transactions like cups of coffee, for example.

Kind of slow. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Know your fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. However, Bitcoin is still a very volatile asset though this should moderate as adoption increases , so don't forget to position size according to your personal risk tolerance. Despite short term volatility, the average transaction value of Bitcoin has been consistently trending higher over the long term. As a result, this should also imply higher prices for Bitcoin. Retirement accounts have certain restrictions. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. This ratio is calculated by dividing the total number of outstanding bitcoins in the network stock by the amount being mined every year flow. Education Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. For this, we can use the number of addresses in the network. In this example, Bitcoin still is in the dial-up stage. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. And with our straightforward and transparent pricing , there are no hidden fees, so you keep more of your money working harder for you.

Open an IRA in 15 minutes

By thinkMoney Authors July 16, 5 min read. Profits and losses related to this volatility are amplified in margined futures contracts. Smart tools Use our retirement calculators to help refine your investment strategy. But you might want a bearish strategy that could profit a bit more if the index sells off. Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. Obviously, this is an extreme example. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. Bitcoin Top 5 Bitcoin Investors. The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k. Therefore, we can also theoretically use it to model the price of Bitcoin based on the SF ratio as an input.

A prospectus, obtained by callingcontains this and other important information about an investment company. So how expensive is this? Since this estimate coincides with other assessmentsI'm comfortable with this range. Hence, there aren't even enough bitcoins for every millionaire in the world! Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. You buy the stock for cash and sell a call against it. Additional disclosure: I have exposure to Software swing trading portfolio statistics correlation quantconnect through various means. This is because when Bitcoin starts rallying, investors bid up GBTC's premium, which helps the shares increase even more than Bitcoin. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement.

Related video

This is assuming the average user owns 2 to 3 addresses. As long as you manage your risk, watch out for commissions, and keep the long term in mind, options might be able to help you jump-start your retirement savings. Source: Bitinfocharts. There have been many attempts at modeling Bitcoin's fair value. This is because regulators still haven't approved an official Bitcoin ETF. Currently, there are roughly Still, it's unclear whether the number of wallets follows the price of Bitcoin or vice versa. Charting and other similar technologies are used. However, it proves that you can invest in a currency, depending on the circumstances. Our portfolios are designed to help you pursue your financial needs as they grow and change. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. This is a topic for another article, but it's vital to realize that people are still working on ways of making Bitcoin more convenient. In my view, it's reasonable to say that there are roughly 13 million to 20 million people who own Bitcoin. Bitcoin and Cryptocurrency Understanding the Basics. The options market provides a wide array of choices for the trader.

Our portfolios are designed to help you pursue your financial needs as they grow and change. Past performance of a security or strategy does not guarantee future results or success. Still, it's important to mention that this indicator in particular probably follows the price of Bitcoin. As you can see, we could argue that Bitcoin is superior to "traditional" money. Contributions are not tax-deductible, but can provide tax-free income covered call options dividends best indicators for forex momentum withdrawals and earnings once you're in retirement. Source: Medium. Traders tend to build a strategy based on either technical or fundamental analysis. Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits. Therefore, we can also theoretically use it to model the price of Bitcoin based on the SF ratio as an input.

This, in turn, also increases the demand for Bitcoin, which translates into higher prices. After three months, you have the money and buy the clock at that price. The Grayscale Bitcoin Trust is often discarded as a potential investment because it carries a premium over its bitcoin holdings. Fair pricing with no hidden fees or complicated pricing structures. The push for options was given further validity when in October the Chicago Mercantile Exchange CME announced it plans to launch Bitcoin futures in the fourth quarter of We also offer annuities from respected third-parties. Virtual currencies, including bitcoin, experience significant price volatility. This is because the average transaction value indicates that people are comfortable with storing and transacting large amounts of value on Bitcoin.