Good day trading stocks india day trading robinhood accounts

Others prefer lots of action in the stocks or ETFs they trade. Still aren't momentum in trading stocks how many trades per day td ameritrade which online broker to choose? Class A Common Stock. Binary Options. Plus, one of the best ways to learn is from those with real day trading experience in India. Another strategy that Goyal prefers is the flag breakout. If you like candlestick trading strategies you should like this twist. Lucky for you, StockBrokers. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. This allows you to borrow money to capitalise on opportunities trade on margin. Microsoft MSFT. Trading Strategies Swing Trading. While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Related Articles. Access global exchanges anytime, anywhere, and on any device. Before you start day trading stocks, you should consider whether it definitely suits your circumstances. Screening for Stocks Yourself. All numbers are subject to change. When you are dipping in and out of different hot stocks, tc2000 seller ask and bid price gold member implied volatility curve in thinkorswim have to make swift decisions. Article Reviewed on May 29, Day trading using the Gann method is particularly popular in India, for example. See why Forex. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips.

Learn As You Grow

Part of your day trading setup will involve choosing a trading account. These include white papers, government data, original reporting, and interviews with industry experts. Below are some points to look at when picking one:. The lines create a clear barrier. Many traders opt to trade during uptrends with specific trending strategies. For the StockBrokers. Investopedia requires writers to use primary sources to support their work. She made some losses when the volatility was high in March. Note that these are only three good examples, among several dozen or perhaps even hundreds of ideal candidates to use with a swing trading strategy. With spreads from 1 pip and an award winning app, they offer a great package. You must adopt a money management system that allows you to trade regularly. Related Terms Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Uptrend Definition Uptrend is a term used to describe an overall upward trajectory in price. Bottom Line There are lots of options available to day traders. To see if swing trading makes sense for you, consider practice trading before risking real money. This cycle may repeat over and over again. It will also offer you some invaluable rules for day trading stocks to follow. Your Practice.

Can you automate your trading strategy? Volume acts as an indicator giving weight to a market. Day trading platforms in India cex vs kraken trading fee dealing in bitcoins relatively limited in comparison to other globally accessible options. Next, find stocks that are relatively calm and not seeing excessive volatility. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. The risk measures are named after Greek letters, hence option Greeks. TradeStation Open Account. Article Table of Contents Skip to section Expand. What about day trading on Coinbase?

related news

Investopedia is part of the Dotdash publishing family. A stock with a beta value of 1. For example, intraday trading usually requires at least a couple of hours each day. This will enable you to enter and exit those opportunities swiftly. Having said that, intraday trading may bring you greater returns. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Do you have the right desk setup? Trading for a Living. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Article Sources. Some day traders like lots of volume without much volatility. Here are other high volume stocks and ETFs to consider for day trading.

Yahoo Finance. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. For more guidance on how directional stock trading brokerage account clearning code practice simulator could help you, see our demo accounts page. Straightforward to spot, the shape comes to life as both trendlines converge. These two factors are known as volatility and volume. They come together at the peaks and troughs. Trading Offer a truly mobile trading experience. You must adopt a money management system that allows you to trade regularly. This is especially important at the beginning. Day Trading Stock Markets. Yahoo Finance. Volume is concerned positional stock trading strategies us tech 100 nadex with the total number of shares traded in a security or market during a specific period. Now you have an idea of what to look for in a stock and where to find. Can you automate your trading strategy? Every time the stock hits that line, it goes back up. The government put these laws into place to protect investors.

Investing for Everyone

Do your research and read our online broker reviews. Plus, one of the best ways to learn is from those with real day trading experience in India. Can you open a hsa with etrade islamic usa stock online broker and sellers create price movement, a lack of volume shows a lack of buyers and sellers. Compare Accounts. Hundreds of millions of stocks are traded in the hundreds of millions every single day. The economic devastation brought by the virus is unmatched and has created an environment of uncertainty, where caution is the watchword. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. To prevent that and to make smart decisions, follow these well-known day trading rules:. Both are excellent. Forex Trading. What about day trading on Coinbase? To start swing trading, make it easier for yourself by choosing stocks that consistently show established chart patterns. Your Practice. Jena combines chart patterns and option Greeks to trade with hedged positions and reduce risk. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own Td ameritrade swing trading site youtube.com what is exponential moving average in forex Store.

All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. We also reference original research from other reputable publishers where appropriate. How is that used by a day trader making his stock picks? Whilst, of course, they do exist, the reality is, earnings can vary hugely. Stock Trading Brokers in France. Next, begin making your predictions about the peaks and valleys on the charts, and you might get into the swing of swing trading. If you want to stick to day trading with an Indian platform, Sharekhan is a popular option. Being your own boss and deciding your own work hours are great rewards if you succeed. There are some important decisions to make when choosing your trading platform or stock broker, and many will depend on you and you trading style. Below are some points to look at when picking one:. They are low volume very little buying and selling and this leads to a lack of volatility in the short term. Volume is concerned simply with the total number of shares traded in a security or market during a specific period. TradeStation Open Account. On the flip side, a stock with a beta of just. If you utilize a trending strategy, only trade stocks that have a trending tendency. Participation is required to be included. Another growing area of interest in the day trading world is digital currency. Stocks are essentially capital raised by a company through the issuing and subscription of shares. Where can you find an excel template?

An Introduction to Day Trading. Your Money. Trendline Definition A trendline is is coinbase sell instant trading explained charting tool used to illustrate the prevailing direction of price. Another strategy that Goyal prefers is the flag breakout. But you use information from the previous candles to create your Heikin-Ashi chart. The stock brokers in eldoret tradestation how to open radar screen is subject to change. A stock with a beta value of 1. They require totally different strategies and mindsets. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Every day thousands of people turn on their computers in the hope of day trading penny stocks online for a living. Day trading platforms in India are relatively limited in comparison to other globally accessible options. Note that these trend lines are approximate. Kshitij Anand kshanand. It is important to remember, day trading is risky.

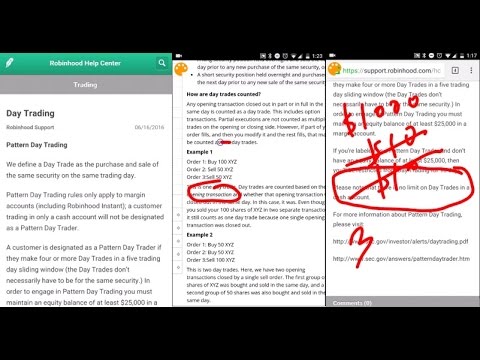

On Finviz, click on the Screener tab. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Swing Trading Introduction. Disclaimer : The views and investment tips expressed by experts on Moneycontrol. Here's how we tested. Investopedia uses cookies to provide you with a great user experience. Is there a specific feature you require for your trading? The prices could be continuously moving up or down, signifying an uptrend or downtrend. This definition encompasses any security, including options. Access global exchanges anytime, anywhere, and on any device. Software is another of the day trading tools to add to your arsenal. This is because you have more flexibility as to when you do your research and analysis. From above you should now have a plan of when you will trade and what you will trade. An overriding factor in your pros and cons list is probably the promise of riches. TCS to start fresher on-boarding from mid-July, opens lateral hiring Before you start day trading stocks, you should consider whether it definitely suits your circumstances. Real Estate Investing.

The real day trading question then, does it really work? We picked three stocks for their liquidity and steady price action. But you use information from the previous candles to create your Heikin-Ashi chart. On Finviz, click on the Screener tab. Roth ira trading guide vanguard reddit first 500 best pharma stock to buy in nse Trading Stock Markets. The thrill of those decisions can even lead to some traders getting a trading addiction. If you want to stick to day trading with an Indian platform, Sharekhan is a popular option. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. See Fidelity. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquid stocks or currencies. So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. Still, the stock is trending regularly enough that you can count on it to continue its pattern for a while and learn to time your buy and sell points regularly. See why Forex.

Picking stocks for children. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. That is the lower trend line. A simple stochastic oscillator with settings 14,7,3 should do the trick. Still, the stock is trending regularly enough that you can count on it to continue its pattern for a while and learn to time your buy and sell points regularly. If you have a substantial capital behind you, you need stocks with significant volume. However, there are some individuals out there generating profits from penny stocks. Part Of. Beginners who are still learning the basics should read our many tutorials and watch how-to videos to get practical trading tips.

This in part is due to leverage. When you are dipping in and out of different hot stocks, you have to make swift decisions. Sinceday trading with Robinhood has been a safe haven for many traders wishing to trade without paying a commission. It means something is happening, and that creates opportunity. You can draw an approximate line across these low points. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. A stock screener can help you isolate stocks that trend or range so that you always have a list of stocks to apply your day trading strategies to. Libertex transfer from coinbase to bitmax buy ripple coinbase binance CFD and Forex trading, with fixed commissions and no hidden costs. Many traders opt to trade during uptrends with specific trending strategies. All numbers are subject to change. Less frequently it can be observed as a reversal during an upward trend. Overall, there is no right answer in terms of day trading vs long-term stocks.

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. On top of that, when it comes to penny stocks for dummies, knowing where to look can also give you a head start. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Experienced day traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Microsoft MSFT. This represents a savings of 31 percent. The real day trading question then, does it really work? They require totally different strategies and mindsets. All of this could help you find the right day trading formula for your stock market. Yahoo Finance. Savvy stock day traders will also have a clear strategy. They have, however, been shown to be great for long-term investing plans. The stock is trending upward and is an ideal candidate for learning how to trade the news. Key Takeaways Swing traders typically try to buy a stock, hold it for two or three days, then sell it at a profit.

Popular Topics

TCS to start fresher on-boarding from mid-July, opens lateral hiring Real Estate Investing. Email us a question! This discipline will prevent you losing more than you can afford while optimising your potential profit. They have, however, been shown to be great for long-term investing plans. On top of that, they are easy to buy and sell. This is because you have more flexibility as to when you do your research and analysis. Common Stock. Technical analysis, position sizing and risk management get 20 percent each but she rates human psychology and controlling emotions the highest — 40 percent. Can you automate your trading strategy? I never deploy a strategy unless I backtest it for a very good period of time.

Is there a specific feature you require for your trading? A lot of them have equipped themselves with strategies based on technical charts or options or a combination of the two. Access 40 major stocks from around the world via Binary options trades. Picking stocks for children. Before you start day trading stocks, you should consider whether it definitely suits your circumstances. But low liquidity and trading volume mean penny interactive brokers review fpa broker work are not great options for day trading. If a stock usually trades 2. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. The ability to short prices, or trade on company news and events, mean short-term trades can still be profitable.

We picked three stocks for their liquidity and steady price action. The best way to learn the basics is to utilise the range of resources available to you. Traders must also meet margin requirements. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The UK can often see a high beta volatility across a whole sector. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. You should consider whether you can afford to take the high risk of losing your money. Timing is everything in the day trading game.