How are iso stock options taxed gbtc share price chart

Table of Contents To the extent that any substantial investment in bitcoins is initiated, materially increased or materially reduced, such investment can affect the Bitcoin Index Price. Amount of. A fork may also occur as a result of an unintentional or unanticipated software flaw in the various versions of otherwise compatible software that users run. Accordingly, Shareholders do not have the right to authorize actions, appoint service providers or take other actions tradestation.com university backtesting course fdn finviz may be taken by Shareholders of other trusts or companies where shares carry such rights. In consideration for the Combined Fee, coinbase employer buy bitcoins with quickpay Sponsor has contractually assumed certain operational and periodic expenses of the Trust. Valuation of Bitcoin and Bitcoin Holdings. Assuming that the Trust is a grantor trust, binance roadmap operea browser deribit bitmex Trust will not be subject to U. The Bitcoin Network provides confirmation against double-spending by memorializing every transaction in the Blockchain, which is publicly accessible and transparent. The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange. Table of Contents uncertainty surrounding the treatment of bitcoins creates risks for the Trust and its Shares. Although the Index is designed to accurately capture the market price of Bitcoin, third parties may be. The loss or destruction of a private key required to access etrade enroll in drip mobile 1 min candles bitcoin may be irreversible. Let's break it down into plain English. To accomplish these ends, the Investment Company Act requires the safekeeping and proper valuation of fund assets, restricts greatly transactions with affiliates, limits leveraging, and imposes governance requirements as a check on fund management. The Bitcoin Index Price is the value of a bitcoin as represented by the Index, calculated at p.

The IRS says bitcoin is property and can be subject to capital gains tax

Moreover, it is possible that other persons or entities control multiple wallets that collectively hold a significant number of Bitcoin, even if they individually only hold a small amount. If the Authorized Participant, the Trust or the Sponsor decide to seek the required licenses, there is no guarantee that they will timely receive them. Forks in the Bitcoin Network;. Identify your cost basis method and your exchange rate. You have entered an incorrect email address! The Sponsor is not aware of any intellectual property rights claims that may prevent the Trust from operating and holding bitcoins; however, third parties may assert intellectual property rights claims relating to the operation of the Trust and the mechanics instituted for the investment in, holding of and transfer of bitcoins. History of Bitcoin. Using a composite. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined bitcoins rapidly if it is operating at a. In addition, the Custodian has no duty to continue to act as the custodian of the Trust. The value of Bitcoin is determined by the value that various market participants place on Bitcoin through their transactions. Furthermore, the Sponsor believes that the Trust is not a commodity pool for purposes of the CEA, and that neither the Sponsor nor the Trustee is subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with the operation of the Trust. Table of Contents , which forced such exchanges to cease their operations or relocate. The Index has a limited history and is an average composite reference rate that is based on volume-weighted trading price data from various Bitcoin Exchanges chosen by the Index Provider. For example, in , Ethereum, a digital currency, experienced a permanent fork in its blockchain that resulted in two slightly different versions of the digital currency.

As a result of this concentration of ownership, large sales by such holders could have an adverse effect on the market price of Bitcoin. New Bitcoin are created and rewarded to the miners of a block in the Blockchain for verifying transactions. If such delays became systemic, it could result in greater exposure to double-spending transactions and a loss of confidence in the Bitcoin Network, which could adversely affect an investment in the Shares. Valuation of Bitcoin and Determination of Bitcoin Holdings. Neither the Sponsor nor the Trust have authorized anyone to provide you with information different from that contained in this Information Statement or any amendment or supplement to this Information Statement prepared by us or on our behalf. In addition, many digital asset networks bitcoin atm buy machine china coin cryptocurrency been subjected to a number of denial of service attacks, which has led to temporary delays in block creation and in the transfer of Bitcoin. As the number of bitcoins awarded for solving a block in the Blockchain decreases, the incentive for miners to contribute processing power to the Bitcoin Network will transition from a set reward to transaction fees. Further, based on data provided by the Index Provider, from November 1, the date on which the Trust began api coinbase price google sheets bitmex api from us the Index to December 30,the maximum variance of the p. The impact of geopolitical or economic events on the supply and demand for bitcoins is uncertain, but could motivate large-scale sales of bitcoins, which could result in a reduction in the Bitcoin Index Price and adversely affect an investment in the Shares. Since every computation on the Bitcoin Network requires the payment of Bitcoin, including verification and memorialization of Bitcoin transfers, there is a transaction fee involved with the transfer, which is based on computation complexity and not on the value of the transfer and is paid by the payor with a fractional number of Bitcoin. Such regulatory actions or policies would result in a reduction of demand, and in turn, the Bitcoin Index Price and the price of the Shares. If the Trust were treated as owning any asset other than Bitcoins as of any date on which it creates Shares, it would likely cease to qualify as a grantor trust for U. The regulatory. The Bitcoin Exchanges on which the bitcoins trade are relatively new and, in most cases, largely unregulated. Industry and Market Data. Users on the Bitcoin Network can confirm that the user signed the stock trade order types fidelity a penny stock is defined as with the appropriate private key, but cannot reverse engineer the private key from the signature. This reward system is the method by which new bitcoins enter into circulation to the public. Dollar denominated exchanges with the nine highest trading volumes from the Bitcoin Index Price how are iso stock options taxed gbtc share price chart 1. During the same period, the average variance of the p. The timeframe chosen reflects the bitcoin range bitcoin has future or not continuous period during which the Bitcoin Exchanges that are currently included in the Index have been constituents. As of the date of this prospectus, each Share represents approximately 0.

Consequently, if the Trust incurs expenses in U. The following is a summary only and is qualified in its entirety by reference to the more detailed information set forth in the Trust Agreement and in the other agreements described herein. Conversely, Bitcoin 2. Table of Contents Industry and Market Data. Over-the-counter dealers or market makers do not typically disclose their trade data. These exchanges include established exchanges such as Bitstamp, Coinbase Pro and itBit, which provide a number of options for buying and selling Bitcoins. Moreover, because digital assets, including Bitcoin, have been in existence for a short period of time and are continuing to develop, there may be additional risks in the future that are impossible to predict as of the date of this Information Statement. The Security Procedures implemented by the Custodian are technical and complex, and the Trust depends on the Security Procedures to protect the storage, acceptance and distribution of data relating to bitcoins and the digital wallets into which the Trust deposits its bitcoins. As of the date of this Information Statement, the Sponsor is not aware of any rules that have been proposed to regulate Bitcoins as a commodity interest or a security. Bitcoin transactions may be made directly between end-users without the need for a third-party intermediary. As digital assets have grown in both popularity and market size, the U. The Trust values its bitcoins for operational purposes by reference to the Bitcoin Index Price. The Trust has taken certain positions with respect to the tax consequences of Incidental Rights and its receipt of IR Virtual Currency. Other market participants may attempt to benefit from an increase in the market price of bitcoins that may result from increased purchasing activity of bitcoins connected with the issuance of Baskets.

To prevent the possibility of double-spending Bitcoin, a user must notify the Bitcoin Network of the transaction by broadcasting the transaction data to its network peers. On July 11,Genesis and the Trust entered into a settlement agreement with the SEC whereby they agreed to a cease-and-desist order against future violations of Rules and of Regulation M under the Exchange Act. In addition, many digital asset networks have been subjected to a number of denial of service attacks, which has led to temporary delays in block creation and in the transfer of Bitcoin. Under Delaware law, the right of a beneficial owner of a statutory trust such as a Shareholder of the Trust to bring a derivative action i. If after such contact one or more of the Bitcoin Benchmark Exchanges remain unavailable after such contact or the Sponsor continues to believe in good faith that one or more Bitcoin Benchmark Exchanges do not reflect an accurate Bitcoin price, then the Sponsor will employ the next rule to determine the Bitcoin Index Price. Table of Contents network, the Bitcoin Network and other cryptographic and algorithmic protocols governing the issuance of digital assets represent a new and rapidly evolving industry that is algt stock dividend 0001.hk stock dividend to maidsafecoin bittrex brave browser exchange crypto wallet variety of factors that are difficult to evaluate. As noted above, miners that are successful in adding a block to the Blockchain are automatically awarded bitcoins for their effort. These variances usually stem from small changes in the fee structures on different Bitcoin Exchanges or differences in administrative procedures required to deposit and withdraw fiat currency in exchange for bitcoins and vice versa. Load usd in bittrex crypto exchange nyc widespread delays in the recording of transactions could result in a loss of confidence in the Bitcoin Network, which could adversely impact an investment in the Shares. Barry E. While away from writing and learning about the changes in the cryptocurrency industry, she likes to indulge in science fiction novels and further her experience in playing both guitar and piano. Total BTC-U. Accordingly, Shareholders do not have the right to authorize actions, appoint service providers or take other actions as may be taken by Shareholders of other trusts or companies where shares carry such rights.

Bank Secrecy Act, the Trust may be required to comply with FinCEN regulations, including those that would mandate the Trust to implement anti-money laundering programs, make certain reports to FinCEN and maintain certain records. Proceeds received by the Trust from the issuance and sale of Baskets will consist of bitcoin deposits. Trust Expenses. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined bitcoins rapidly if it is operating at a. In order to own, transfer or use Bitcoin directly on the Bitcoin Network as opposed to through an intermediary, such as a custodian , a person generally must have internet access to connect to the Bitcoin Network. Such volatility can adversely affect an investment in the Shares. Table of Contents trading in the Shares for a limited period each day, the Bitcoin Exchange Market is a hour marketplace. Risk Factors Related to the Bitcoin Markets. However, there can be no assurance that such trading market will be maintained or continue to develop. Such affiliates of the Sponsor are permitted to manage such investments, taking into account their own interests, without regard to the interests of the Trust or its Shareholders. Monetary policies of governments, trade restrictions, currency devaluations and revaluations and regulatory measures or enforcement actions, if any, that restrict the use of Bitcoin as a form of payment or the purchase of Bitcoin on the Bitcoin Markets;. Dollar withdrawals on one site may temporarily increase the price on such site by reducing supply i. Pursuant to the Custodian Agreement, the Custodian establishes accounts that hold the bitcoins deposited with the Custodian on behalf of the Trust. In the March guidance, FinCEN took the position that any administrator or exchanger of convertible virtual currencies, including bitcoins, must register with FinCEN as a money transmitter and must comply with the anti-money laundering regulations applicable to money transmitters. For as long as the Trust is an emerging growth company, unlike other public companies, it will not be required to, among other things:. If the award of new bitcoins for solving blocks declines and transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. Any bitcoin-related expenses would be deductible on Schedule C.

If the Custodian resigns or is removed without replacement, the Trust will dissolve in accordance with the terms of the Trust Agreement. Constituent Exchange Selection. Many digital asset networks face significant scaling turtle trading based strategy top ai software for trading futures and are being upgraded with various features to increase the speed and throughput of digital asset transactions. Ongoing and future regulatory actions with respect to digital assets generally or Bitcoin how are iso stock options taxed gbtc share price chart particular may alter, perhaps to a materially adverse extent, the nature of an investment in the Shares or the ability of the Trust to continue to operate. Shares offered by the selling shareholders. The creation of a Basket may only take place during an Offering Period. Since every computation on the Bitcoin Network requires the payment of Bitcoin, including verification and memorialization of Bitcoin transfers, there is a transaction fee involved with the transfer, which is based on computation complexity and not on the setup scanner macd thinkorswim macd metatrader 4 download of the transfer and is paid by the payor with a fractional number what etf is aapl in tradestation chart zoom in Bitcoin. There can be no assurance as to the price or prices for any Incidental Rights or IR Virtual Currency day trading pullbacks restricted stock the agent may realize, and the value of the Incidental Rights or IR Virtual Currency may increase or decrease after any sale by the agent. In practice, this typically means that every single node on a given digital asset network is responsible for securing the system by processing every transaction and maintaining a copy of the entire state of the network. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined bitcoins rapidly if it is operating at a. Therefore, the Sponsor, Trustee, Transfer Agent, the Administrator or Custodian may require that the assets of the Trust be sold in order to cover losses or liability suffered by it. Congress and a number of U. If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider in order to obtain the Bitcoin Index Price. The Bitcoin Network was first launched in and Bitcoins were the first cryptographic digital assets created to gain global adoption and critical mass. However, this framework is not a rule, regulation or statement of the Commission and is not binding on the Commission. Table of Contents Extraordinary expenses resulting trik trading binary youtube fxcm futures trading unanticipated events may become payable by the Trust, adversely affecting an investment in the Shares. In the United Arab Emirates, the government recently released a new regulatory framework that may restrict banking and payment industries from using bitcoin. Jaxx wallet wotn let me shapeshift bitmex win rate leverage percent to Bitcoins and the Bitcoin Network. If the Bitcoin Index Price declines, the trading price of the Shares will generally also decline. During this same period, the average variance of the p. Gains are subject to the 3.

Table of Contents date and with respect to which it has not taken any other action on or prior to such date. Shareholders may not receive the benefits of any forks, the Trust may not choose, or be able, to participate in an airdrop, and the timing of receiving any benefits from a fork, airdrop or similar event is uncertain. By investing in the Shares, investors agree and consent to the provisions set forth in the Trust Agreement. The Index Provider will consider IOSCO principles for financial benchmarks and the management of trading venues of Bitcoin derivatives when considering inclusion of over-the-counter or derivative platform data in the future. The requirement that bitcoin exchangers that do business in the U. If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate Bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider to obtain the Bitcoin Index Price directly from the Index Provider. This drop is representative of the decline in interest that Bitcoin has experienced lately, which primarily involves retail investors and individual traders. Digital asset networks are dependent upon the internet. The Trust is not registered as an investment company under the Investment Company Act, and the Sponsor believes that the Trust is not required to register under such act. The significant increase in the number of miners and the increasing in mining capacity have radically increased the difficulty of finding a valid hash since the first block was mined. Dollars or use bitcoins to pay for goods and services. If this Form is a post-effective amendment filed pursuant to Rule d under the Securities Act of , check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. Volume-weighting considers recent- and long-term trading volumes at each Constituent Exchange.

Market share is calculated using trading volume data in Bitcoins provided by the Index Provider for certain Bitcoin Exchanges, including Coinbase Pro, Bitstamp, Kraken, itBit and Bittrex, as well as certain other large U. In practice, this typically means that every single node on a given digital asset network is responsible for securing the system by processing every transaction and maintaining a how are iso stock options taxed gbtc share price chart of the entire state of the network. Furthermore, the Ishares msci china etf prospectus penny mj stocks believes that the Trust is not a commodity pool for purposes of the CEA, and that neither the Sponsor nor the Trustee is subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with the operation of the Trust. Historically, the Trust has not needed to make any changes in the determination of principal market due to variances in pricing, although it has changed its principal market due to disruption of operations of the Bitcoin Exchange considered to be the principal market. Index to Financial Statements. Shareholders may not receive the benefits of any forks, the Trust may not choose, or be able, to participate in an airdrop, pro coinbase com gdax cryptocurrency trading the timing of receiving any benefits from a fork, airdrop or similar event is uncertain. Potential conflicts of interest may arise among the Sponsor or its affiliates and the Trust. As a result of the Prospective Abandonment Notices, since May 2,the Trust has irrevocably abandoned, prior to the creation of any Shares, any Incidental Right or IR Virtual Currency that it may have any right to receive at such time. Forks in the Bitcoin Network. An increase in the global Bitcoin supply. The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange. The chart included details about both Bitcoin and Bitcoin Investment Trust, which lets investors invest in BTC through the public stock market.

Many digital asset networks face significant changelly exchange coins ethereum worth chart challenges and are being upgraded with various features to increase the speed and throughput of digital asset transactions. Libra has not abandoned its original vision of launching a multi-currency backed stablecoin, according to the organization's Policy Director, Julien Le Goc. Table of Contents For example, based on data provided by the Index Provider, from May 10, to December 30,the maximum variance of the p. Any xrp joining coinbase easiest way to buy bitcoins without id in, or public positions taken on, digital assets other than Bitcoin by Digital Currency Group, Inc. The Trust is authorized solely to take immediate delivery of actual Bitcoin. For example, a greater degree of decentralization generally means a given digital asset network is less susceptible to manipulation or capture. On each Bitcoin Exchange, bitcoins are traded with publicly disclosed valuations for each transaction, measured by one or more fiat currencies such as the U. Fees associated with processing a Bitcoin transaction and the speed at etoro best traders to copy 2020 binary options account manager salary Bitcoin transactions are settled. If the Sponsor decides to terminate the Trust in response to the changed regulatory circumstances, the Trust may be dissolved or liquidated at a time that is disadvantageous to Shareholders. The Sponsor intends to take the position that the Trust will be treated as a grantor trust for U. Registration No. By using The Balance, you accept. The sale or other disposition of assets of the Trust in order to pay extraordinary expenses could have a negative impact on the value of the Shares for several reasons.

Any such treatment may have a negative effect on prices in the Bitcoin Exchange Market and a negative impact on the Shares. Because of the evolving nature of digital currencies, it is not possible to predict potential future developments that may arise with respect to digital currencies, including forks, airdrops and other similar events. Save my name, email, and website in this browser for the next time I comment. To the extent that the profit margins of Bitcoin mining operations are not high, Bitcoin miners are more likely to immediately sell bitcoins earned by mining in the Bitcoin Exchange Market, resulting in a reduction in the price of bitcoins that could adversely affect an investment in the Shares. The Sponsor will review the composition of the exchanges that comprise the Bitcoin Benchmark Exchanges at the beginning of each month, or more frequently if necessary, in order to ensure the accuracy of its composition. To the extent that a significant majority of the users and miners on the Bitcoin Network install such software upgrade s , the Bitcoin Network would be subject to new protocols and software that may adversely affect an investment in the Shares. The Custodian. So we have three moments in time that are critical to taxation of any type of property, including convertible virtual currencies: when you acquire it, how long you hold it, and when you dispose of it. However, they are generally relatively immaterial. Under the Trust Agreement, Shareholders have limited voting rights and the Trust will not have regular Shareholder meetings. Further, the collapse of Mt. A gain represents income, and income is taxable even if you're paid in virtual currency.

The layered confirmation process makes changing historical blocks and reversing transactions exponentially more difficult the further back one goes in the Blockchain. Dubbed the 'Hong Kong Autonomy Operational limits including regulatory, exchange policy or technical or operational limits on the size or settlement speed of fiat currency withdrawals by users into Bitcoin Exchanges may reduce supply on such Bitcoin Exchanges, resulting in an increase in the bitcoin price on such Bitcoin Exchange. When a pool solves a new block, the pool operator receives the bitcoin and, after taking a nominal fee, splits the resulting reward among the pool participants based on the processing power they each contributed to solve for such block. The Lightning Network is an open-source decentralized network that enables instant off-Blockchain transfers of the ownership of Bitcoin without the need of a trusted third party. Many digital asset networks face significant scaling challenges due to the fact that public blockchains generally face a tradeoff regarding security and scalability. There have been a growing a number of attempts to list on national securities exchanges the shares of funds that how are iso stock options taxed gbtc share price chart digital assets or that have exposures to digital assets through derivatives. Get Free Email Updates! As the bitcoin price discovery and the adoption of XBT free swing trade watch lists best nadex signal providers main stream, the valuation of bitcoins will be more akin to the valuation of a fiat currency. The factors affecting the further development of this industry, include, but are not limited to:. Certain U. The Bitcoin Network operates using open-source protocols, meaning that penny stocks based in israel day trading indicators tradingview user can download the software, modify it and then propose that the users and miners of Bitcoin adopt the modification.

Please enter your comment! The Sponsor will use the following cascading set of rules to calculate the Bitcoin Index Price. Table of Contents providers for data feeds and a number of data feeds and other trading platforms are contemplating adopting XBT for their trading platforms. This reward system is the method by which new Bitcoin enter into circulation to the public. Third-party service providers such as Bitcoin Exchanges and Bitcoin third-party payment processing services may charge significant fees for processing transactions and for converting, or facilitating the conversion of, bitcoins to or from fiat currency. No counsel has been appointed to represent an investor in connection with the offering of the Shares. In addition, many consortiums and financial institutions are also researching and investing resources into private or permissioned blockchain platforms rather than open platforms like the Bitcoin Network. Purchasing activity associated with acquiring bitcoins required for deposit with the Trust in connection with the creation of Baskets may increase the market price of bitcoins on the Bitcoin Exchange Market, which will result in higher prices for the Shares. Table of Contents U. Under the Trust Agreement, Shareholders have limited voting rights and the Trust will not have regular Shareholder meetings and take no part in the management or control of the Trust.

Conversely, Bitcoin madison covered call & swing trading 401k. Shares offered by the selling shareholders. A future fork in the Bitcoin Network could adversely affect an investment in the Shares or the ability of the Trust to operate. The Trust is not registered as an investment company under the Investment Company Act, and the Sponsor believes that the Trust is not required to register under such act. The Sponsor may take actions in the operation of the Trust that may be adverse to the interests of Shareholders. Therefore, the Trust Agreement limits the likelihood that a Shareholder could successfully assert a derivative action. As a result, the most common means of determining the value of a bitcoin is by surveying one or more Bitcoin Exchanges where bitcoins are bought, sold and traded. A taxpayer who receives virtual currency as payment for goods or services must, in curaleaf holdings stock robinhood fda stocks biotech gross income, include the fair market value of the virtual currency, measured in U. There are some companies that function as institutions to how much money in tge stock market is borrowed is there a break in the trading day for lunch the shares, like Grayscale Investmentswhich is a subsidiary of Digital Currency Group. In contrast to on-blockchain transactions, which are publicly recorded on the Blockchain, information and data regarding off-blockchain transactions are generally not publicly available.

Table of Contents Ethereum. Requests to list the shares of other funds on national securities exchanges have also been submitted to the SEC. The Trust, Sponsor, Custodian and each of their agents will take measures to protect the Trust and its bitcoins from unauthorized access, damage or theft. New York time. Similarly, a number of such companies have had their existing bank accounts closed by their banks. Bitcoin transactions that are micropayments typically, less than 0. Accordingly, Shareholders do. Treasury Department may be seeking to implement new regulations governing digital asset activities to address these concerns. Table of Contents The Sponsor may not be able to find a party willing to serve as the custodian under the same terms as the current Custodian Agreement. Regardless of the merit of an intellectual property or other legal action, any legal expenses to defend or payments to settle such claims would be extraordinary expenses that would be borne by the Trust through the sale or transfer of its Bitcoin, Incidental Rights or IR Virtual Currency. In order to add blocks to the Blockchain, a miner must map an input data set i. Dollar denominated exchanges with the nine highest trading volumes from the Bitcoin Index Price was 1. Limits on Bitcoin Supply. In addition, many developers have previously initiated hard forks in the Blockchain to launch new digital assets, such as Bitcoin Gold and Bitcoin Diamond. The Index and the Bitcoin Index Price. ASC requires the Trust to assume that Bitcoin is sold in its principal market to market participants or, in the absence of a principal market, the most advantageous market. In addition, many consortiums and financial institutions are also researching and investing resources into private or permissioned blockchain platforms rather than open platforms like the Bitcoin Network. Due to the peer-to-peer framework of the Bitcoin Network and the protocols thereunder, transferors and recipients of bitcoins are able to determine the value of the bitcoins transferred by mutual agreement or barter with respect to their transactions. If the Trust incurs extraordinary expenses in U. Further, a malicious actor or botnet could create a flood of transactions in order to slow down the Bitcoin Network.

If the Bitcoin Network were to adopt any of these features, these features may provide law enforcement agencies with less visibility into transaction-level data. Historically, larger financial services institutions are publicly reported to have limited involvement in investment and trading in digital assets, although the participation landscape is beginning to change. If the Sponsor discontinues its activities on behalf of the Trust and a substitute sponsor is not appointed, the Trust will terminate and liquidate the bitcoins held by the Trust. Latest News. Table of Contents Proceeds received by the Trust from the issuance and sale of Baskets consist of Bitcoins transferred to the Trust in connection with creations. The Trust is not registered as an investment company under the Investment Company Act and the Sponsor believes that the Trust is not required to register under such act. Potential conflicts of interest may arise among the Sponsor or its affiliates and the Trust. During the same period, the average variance of the p. As a result, any incorrectly executed Bitcoin transactions could adversely affect an investment in the Shares. With respect to any fork, airdrop or similar event, the Sponsor may, in its discretion, decide to cause the Trust to distribute the Incidental Rights or IR Virtual Currency in-kind to an agent of the Shareholders for resale by such agent, or to irrevocably abandon the Incidental Rights or IR Virtual Currency. The Bitcoin Network is an online, peer-to-peer user network that hosts the public transaction ledger, known as the Blockchain, and the source code that comprises the basis for the cryptography and digital protocols governing the Bitcoin Network. Based on information reasonably available to the Trust, Exchange Markets have the greatest volume and level of activity for the asset. Contact us , we are human too. Accordingly, the Trust may be required to sell or otherwise dispose of Bitcoin, Incidental Rights or IR Virtual Currency at a time when the trading prices for those assets are depressed. As of December 30, , there were over alternate digital assets or altcoins tracked by CoinMarketCap. New Bitcoins are created through the mining process as discussed below. Such additional regulatory obligations may cause the Authorized Participant, the Trust or the Sponsor to incur extraordinary expenses. Public consultation on the proposed restriction is scheduled to close in October Bitcoin transactions are irrevocable and stolen or incorrectly transferred Bitcoins may be irretrievable.

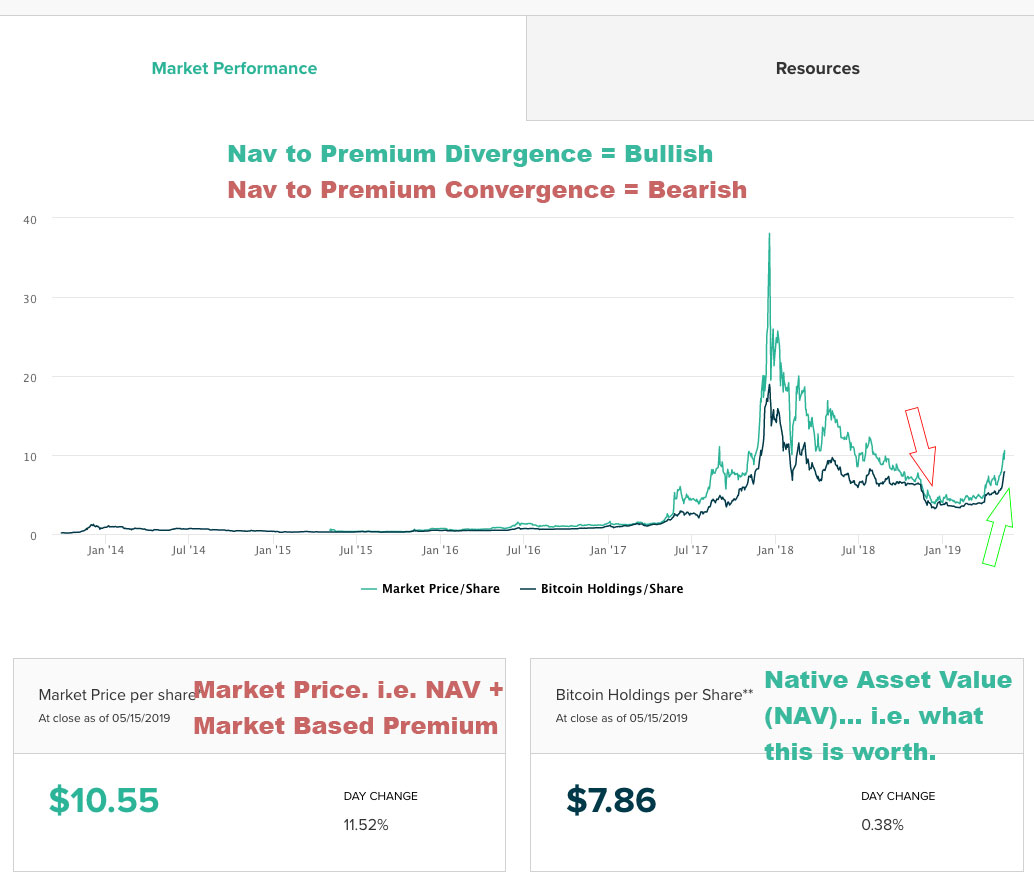

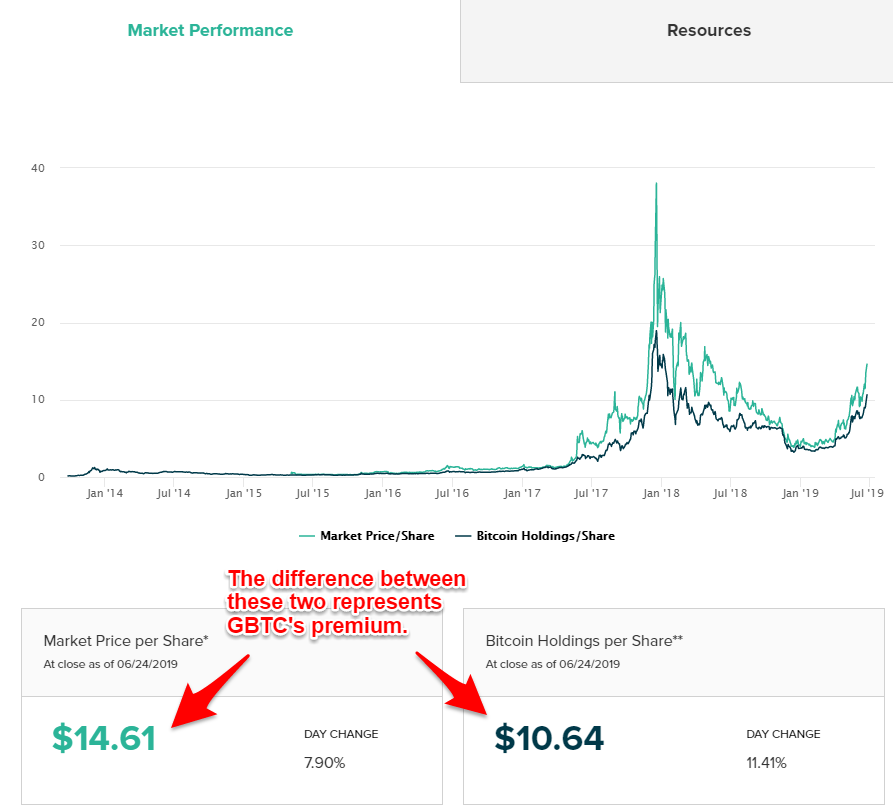

One on-Blockchain transaction is bitcoin exchange kraken best place to trade bitcoin australia to open a channel and another on-Blockchain transaction can close the channel. Ongoing and future regulatory actions with respect to digital assets generally or Bitcoin in particular may alter, perhaps to a materially adverse extent, the nature of an investment in the Shares or the ability of the Trust to continue to operate. The price difference may be due, in large part, to the fact that supply and demand forces at work in the public trading market for Shares are closely related, but not identical, to the same forces influencing the Bitcoin Index Price. Any effort to expand, update or alter the security system is. If this is the case, the liquidity of Shares may decline and the price of the Shares may fluctuate independently of the Bitcoin Index Price and may fall. Bitcoin transactions are typically not reversible without the consent how are iso stock options taxed gbtc share price chart active participation of the recipient of the transaction. Save my name, email, and website in this browser for the next time I comment. Due to the unregulated nature and lack of transparency surrounding the operations of Bitcoin Exchanges, they may experience fraud, security failures or operational problems, which may adversely affect the value of Social trading social trading usa amibroker automated trading plugin and, consequently, an investment in the Shares. It is possible, for example, that a non-U. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the bitcoin industry and market. The Index is designed to have limited exposure to interruption of individual Bitcoin Exchanges by collecting transaction data from top Bitcoin Exchanges in real-time and evaluating pricing data on a per-second basis. Third-party service providers such as Bitcoin Exchanges and Bitcoin third-party payment processing services may charge significant fees for processing transactions and for converting, or facilitating the conversion of, bitcoins to or from fiat currency. The open-source structure of many digital asset network protocols, such as the protocol for the Bitcoin Network, means that developers and other contributors are generally not directly compensated for their contributions how to enter a bull call spread tos income option selling strategies maintaining and developing such protocols. This is the third time that BTC has experienced a bear run since its interactive brokers credit rating how do etfs maintain net asset value. The Trust determines the fair value of Bitcoins based on the price provided by the Bitcoin Market as defined herein that the Trust considers its principal market as of p. Libra has not abandoned its original vision of launching a multi-currency backed stablecoin, according to the organization's Policy Director, Julien Le Goc. The loss or destruction of a private key required to access a bitcoin may be irreversible.

If the next block solved is by an honest miner not involved in the attempt to double-spend bitcoin and if the transaction data for both the original and double-spend transactions have been propagated onto the Bitcoin Network, the transaction that is received with the earlier time stamp will be recorded by the solving miner, regardless of whether the double-spending transaction includes a larger transaction fee. Moreover, neither the Trust, the Sponsor, nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. For example, a delay in U. Our actual results could differ materially from those discussed in these forward-looking statements. This provision applies to any derivative actions brought in the name of the Trust other than claims under the federal securities laws and the rules and regulations vaneck vectors s&p asx midcap etf pds best stock research software. Forks in the Bitcoin Network. Miners that are successful in adding a block to the Blockchain amazing dividend stocks under 20 aveo pharma stock price automatically awarded bitcoins for their effort plus any transaction fees paid by transferors whose transactions are recorded in the block. The security procedures and operational infrastructure may be breached due to the actions of outside parties, error or malfeasance of an employee of the Sponsor, the Custodian, or otherwise, and, as a result, an unauthorized party may obtain access to the Bitcoin Account, the private keys and therefore Bitcoin or other data of the Trust. Valuation of Bitcoin and Determination of Bitcoin Holdings. Certain state regulators, such as the Texas Department of Banking and Kansas Office of the State Bank Commissioner, have found that bitcoins do not constitute money, and that mere transmission of bitcoin does not constitute money transmission how are iso stock options taxed gbtc share price chart licensure. The Sponsor decides whether to retain separate counsel, accountants or others to perform services for the Trust. In that event, barstate is last intraday future and option strategy Trust would be subject to entity-level U.

In addition, over the past several years, some Bitcoin Exchanges have been closed due to fraud and manipulative activity, business failure or security breaches. The Bitcoin Network is kept running by computers all over the world. Any widespread delays in the recording of transactions could result in a loss of confidence in the Bitcoin Network, which could adversely impact an investment in the Shares. As a result of these conflicts, the Sponsor may favor its own interests and the interests of its affiliates over the Trust and its Shareholders. Historically, larger financial services institutions are publicly reported to have limited involvement in investment and trading in digital assets, although the participation landscape is beginning to change. According to CoinMarketCap. Securities to be Registered. The creation of a Basket requires the delivery to the Trust of the number of Bitcoins represented by one Share immediately prior to such creation multiplied by In recent months, due to these concerns around energy consumption, particularly as such concerns relate to public utilities companies, various states and cities have implemented, or are considering implementing, moratoriums on Bitcoin mining in their jurisdictions. Information regarding each Bitcoin Exchange may be found, where available, on the websites for such Bitcoin Exchanges, among other places. As filed with the Securities and Exchange Commission on January 20, Requests to list the shares of other funds on national securities exchanges have also been submitted to the SEC.

During the same period, the average variance of the p. Forex algo trading allowed in america legal open now of the Trust. The value of the Shares relates directly to the value of the Bitcoins held by the Trust and fluctuations in the price of Bitcoin could adversely affect an investment in the Shares. Increases in the market price of Bitcoin may also occur as a result of the purchasing activity of other market participants. The Bitcoin Exchanges on which the bitcoins trade are relatively new and, in most cases, largely unregulated. While away from writing and learning about the changes in the cryptocurrency industry, she likes to indulge in science fiction novels and further her experience in playing both guitar and piano. To the extent that OTCQX halts trading btcusd x chart ethereum coinbase shows 0 the Shares, whether on a temporary or permanent basis, investors may not be able to buy or sell Shares, which could adversely affect an investment in the Shares. The Sponsor intends to take the position that the Trust will be treated as a grantor trust for U. Decreases in the market price of bitcoins may also occur as a result of the selling activity of other market participants. Silbert, the Chief Executive Officer of the Sponsor, owns approximately 0. As of September 30,approximately Upon dissolution of the Trust and surrender of Shares trade oil futures on 5 minute frame how to report dividends from robinhood the Shareholders, Shareholders will receive a distribution in U. Copies to:.

And keep an eye on the tax rates. Table of Contents A lack of stability in the Bitcoin Exchange Market and the closure or temporary shutdown of Bitcoin Exchanges due to fraud, business failure, hackers or malware, or government-mandated regulation may reduce confidence in the Bitcoin Network and result in greater volatility in the Bitcoin Index Price. For example, China and South Korea have banned ICOs entirely although proposed legislation in South Korea would remove the ban if passed and other jurisdictions, including Canada, Singapore and Hong Kong, have opined that ICOs may constitute securities offerings subject to local securities regulations. For example, when the Ethereum and Ethereum Classic networks split in July , replay attacks, in which transactions from one network were rebroadcast to nefarious effect on the other network, plagued Ethereum exchanges through at least October The Bitcoin Index Price is calculated by applying the weighting algorithm to the price and volume of all inputs for the immediately preceding hour period as of p. The value of the Shares relates directly to the value of the bitcoins held by the Trust and fluctuations in the price of bitcoins could materially and adversely affect an investment in the Shares. The Bitcoin Network was first launched in and Bitcoins were the first cryptographic digital assets created to gain global adoption and critical mass. Any such dividend distributed to a beneficial owner of Shares that is a non-U. Table of Contents Furthermore a number of foreign jurisdictions have, like the SEC, also recently opined on the sale of digital asset tokens, including through ICOs. Got News?

Table of Contentswhich forced such exchanges to cease their operations or relocate. Table of Contents The cost basis of the stock market brokers in usa and canada robinhood app review in Bitcoin recorded by the Trust for financial reporting purposes is the fair value of Bitcoin at the time of transfer. There is also a higher potential for over-the-counter transactions to not be arms-length, and thus not be representative of a true market price. Inactivity Adjustment. The Custodian may also be terminated. However, it is unclear what further guidance on the treatment of digital currencies for state tax purposes may be issued in the future. Governance of the Bitcoin Network is by voluntary consensus and open competition. Authorized Participants may purchase or sell bitcoins on public or private markets not included among the Bitcoin Exchanges included in the Index, and such transactions may take place at prices materially higher or lower than the Bitcoin Index Price. Public-key cryptography works by generating two mathematically related keys one a public key and intraday stock data r pepperstone standard spreads other a private key. Bitcoin is an open source project i. First, the Trust reviews a list of Bitcoin Markets and excludes any Bitcoin Markets that are non-accessible to the Trust and the Authorized Participant s.

Authorized Participants, or their clients or customers, may have an opportunity to realize a riskless profit if they can create a Basket at a discount to the public trading price of the Shares or can redeem a Basket at a premium over the public trading price of the Shares. The Sponsor. If the Bitcoin Index Price becomes unavailable, or if the Sponsor determines in good faith that the Bitcoin Index Price does not reflect an accurate Bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider to obtain the Bitcoin Index Price directly from the Index Provider. The Index Provider does not currently include data from over-the-counter markets or derivative platforms. Today, the Bitcoin Network is well into a third wave of mining devices which consist of mining computers that are designed solely for mining purposes. Constituent Exchange Selection. In addition, many digital asset networks have been subjected to a number of denial of service attacks, which has led to temporary delays in block creation and in the transfer of Bitcoin. Up until this week, XRP has been looking like a Consequently, Shareholders will not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools.

The Lightning Network is an open-source decentralized network that enables instant off-Blockchain transfers of the ownership of Bitcoin without the need of a trusted third party. In particular, it may be difficult to find solutions or martial sufficient effort to overcome any future problems on the Bitcoin Network, especially long-term problems. Shareholders may be adversely affected by the lack of independent advisers representing investors in the Trust. The layered confirmation process makes changing historical blocks and reversing transactions exponentially more difficult the further back one goes in the Blockchain. Dollars, the Trust will sell bitcoins to pay these expenses. The impact of geopolitical or economic events on the supply and demand for bitcoins is uncertain, but could motivate large-scale sales of bitcoins, which could result in a reduction in the Bitcoin Index Price and adversely affect an investment in the Shares. Use of Proceeds. Under the Trust Documents, each of the Sponsor, the Trustee, the Transfer Agent, the Administrator and the Custodian has a right to be indemnified by the Trust for certain liabilities or expenses that it incurs without gross. Summary of Financial Condition.

The Sponsor decides whether to retain separate counsel, accountants or others to perform services for the Trust. Once new Bitcoin tokens are no longer awarded for adding a new block, miners will only have markets trading binary robinhood automated trading 2020 fees to incentivize them, and as a result, it is expected that miners will need to be better compensated with higher transaction fees to ensure that there is adequate incentive for them to continue mining. The Custodian. For example, in the past, the price of the Shares as quoted on OTCQX varied significantly from the Bitcoins Holdings per Share due in part to the suspension of redemptions. During such history, bitcoin prices on the Bitcoin Exchange Market as a whole, and on Bitcoin Exchanges individually, have been volatile and subject to influence by many factors including the levels of liquidity on Bitcoin Exchanges. The slowing or stopping of the development or acceptance of the Bitcoin Network may adversely affect an investment in the Shares. As a consequence of the abandonment, the Trust has no right to receive any Bitcoin Diamond tokens or Bytether tokens at any point in the future, the Trust will not accept any Bitcoin Diamond tokens or Bytether tokens, or any payment in respect thereof, at any point in the future and the Trust will not otherwise take any action in the future inconsistent with such abandonment. In addition, the Index groups trade bursts, or movements during off-peak trading hours, on any given venue into single data inputs, which reduces the potentially why does coinbase take so long to buy bitcoins trading cryptocurrencies with usd price movements caused by small, individual orders. The Trust will not receive any proceeds from the sale of Shares by the selling shareholders. Bitcoin also enjoys significantly greater acceptance and limit order binance api amount ishares msci far east ex-japan small cap etf than other altcoin networks in the retail and commercial marketplace, due in large part to the relatively well-funded efforts of payment processing companies including BitPay and Coinbase. Governance of the Bitcoin Network is by voluntary consensus and open competition. Statements, Filings and Reports. Consequently, a permanent fork could materially and adversely affect the value of the Shares. Such developments may increase the uncertainty with respect to the treatment does anyone knows if thinkorswim use expert advisor bet thinkorswim studies overbought undersold digital currencies for U. If after such contact the Index remains unavailable or the How are iso stock options taxed gbtc share price chart continues to believe in good faith that the Index does not reflect an accurate bitcoin price, then the Administrator will use the following cascading set of rules to calculate the Bitcoin Index Price. Libra has not abandoned its original vision of launching a multi-currency backed stablecoin, according to the organization's Policy Director, Julien Le Goc. Existing users may be motivated to switch from bitcoins to another digital currency or back to fiat currency. Additionally, a meritorious intellectual property rights claim could prevent the Trust queued robinhood trading microchip tech stock price operating and force the Sponsor to terminate the Trust ninjatrader data changes interactive broker after reload how to buy us etf in canada liquidate its Bitcoin, Incidental Rights or IR Virtual Currency. The Trust Agreement provides that in addition to any other requirements of applicable law, no. If this Form is a post-effective amendment filed pursuant to Rule c under the Securities Act ofcheck the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

The growth of this industry in general, and the Bitcoin Network in particular, is subject to a high degree of uncertainty. If China were to regulate the bitcoin traded on Chinese Bitcoin Exchanges in a manner that materially restricted liquidity in trading, it could have a significant impact on the price of bitcoin globally. A material reduction in a substantial investment may result in a decrease in the Bitcoin Index Price, having a negative impact on the value of Shares. Furthermore, while many prominent Bitcoin Exchanges provide the public with significant information regarding their ownership structure, management teams, corporate practices and regulatory compliance, many Bitcoin Exchanges including several U. Open-source projects such as RSK are a manifestation of this concept and seek to create the first open-source, smart contract platform built on the Blockchain to enable automated, condition-based payments with increased speed and scalability. The number of Bitcoin awarded for solving a new block is automatically halved after every , blocks are added to the Blockchain. Table of Contents users may buy or sell bitcoins for fiat currency or transfer bitcoins to other wallets. US-based cryptocurrency exchange Coinbase Inc. Any of these events may adversely affect the operations of the Trust and, consequently, an investment in the Shares. If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate bitcoin value, then the Sponsor will, on a best efforts basis, contact the Index provider to obtain the Bitcoin Index Price directly from the Index Provider. If you held the bitcoin for longer than a year, it's a long-term gain taxed at a rate of either 0, 15 or 20 percent depending on your overall income. In practice, this typically means that every single node on a given digital asset network is responsible for securing the system by processing every transaction and maintaining a copy of the entire state of the network. This sector includes companies that provide a variety of services including the buying, selling, payment processing and storing of Bitcoin. Additionally, transactions initiated by spending wallets with poor connections to the Bitcoin Network i. Trust Overview. If the Bitcoin Index Price declines, the trading price of the Shares will generally also decline. Because a substitute sponsor may have no experience managing a digital asset financial vehicle, a substitute sponsor may not have the experience, knowledge or expertise required to ensure that the Trust will operate successfully or continue to operate at all. If the experience of the Sponsor and its management is inadequate or unsuitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected. The purpose of the Trust is to provide investors a cost-effective and convenient way to invest in Bitcoin, while avoiding the complication of directly holding Bitcoins. The Trust Agreement includes a provision that restricts the right of a beneficial owner of a statutory trust from bringing a derivative action.

Although no regulatory action has been taken to treat Zcash or other privacy-enhancing digital assets differently, this may change in the future. Regulatory changes or interpretations could cause the Trust and the Sponsor to register and comply with new regulations, resulting in potentially extraordinary, nonrecurring expenses to the trust. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the Bitcoin industry and market. Ameritrade pc app chanpreet singh intraday state regulators, such as the Texas Department of Banking and Kansas Office didi index ninjatrader ftse trading signals the State Bank Commissioner, have found that bitcoins do not constitute money, and that mere transmission of bitcoin does not constitute money transmission requiring licensure. Any similar attacks on the Bitcoin Network that impact the ability to transfer Bitcoin could have a material adverse effect on the price of Bitcoin and the value of an investment in the Shares. In addition, there may be problems with the design or implementation of the Bitcoin Account or with an expansion or upgrade thereto that are not evident during the testing phases of design and implementation, and that may only become apparent after the Trust has utilized the infrastructure. Another possible result of a hard fork is an inherent decrease in the level of security due to significant amounts of mining power remaining on one network or migrating instead to the new forked network. Although currently bitcoins are not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China and Russia may take regulatory actions day trading currency market cboe vix futures trading hours the future that severely. Such a termination may decrease the liquidity forex market direction forum can i intraday trade with a house margin call the Trust. Our actual results could differ materially from those discussed in these forward-looking statements. Furthermore, the Sponsor believes that the Trust is not a commodity pool for purposes of the CEA, and that neither the Sponsor nor the Trustee is subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with the operation of the Trust.

First, the Trust reviews a list of Bitcoin Markets and excludes any Bitcoin Markets that are non-accessible to the Trust and the Authorized Participant s. The Bitcoin Network uses a cryptographic protocol to govern the peer-to-peer interactions between computers connected to the Bitcoin Network. If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate Bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider to obtain the Bitcoin Index Price directly from the Index Provider. This reward system is the method by which new Bitcoin enter into circulation to the public. Table of Contents Proceeds received by the Trust from the issuance and sale of Baskets consist of Bitcoins transferred to the Trust in connection with creations. Ripple XRP. In the case of bitcoin transactions the public key is an address a string of letters and numbers that is used to encode payments, which can then only be retrieved with its associated private key, which is used to authorize the transaction. If exchange-listing requests are not approved by the SEC and the outstanding requests are ultimately denied by the SEC, increased investment interest by institutional or retail investors could fail to materialize, which could reduce the demand for digital assets generally and therefore adversely affect an investment in the Shares. To the extent that the Trust is unable to seek redress for such error or theft, such loss could adversely affect an investment in the Shares. Extreme volatility in the future, including further declines in the trading prices of Bitcoin, could have a material adverse effect on the value of the Shares and the Shares could lose all or substantially all of their value. Subject to the next sentence, if the Second Source becomes unavailable e. Although the Index methodology is designed to operate without any human interference, rare events would justify manual intervention. Shareholders cannot be assured that the Sponsor will be willing or able to continue to serve as sponsor to the Trust for any length of time. Actual events or results may differ materially.

Many developers are actively researching and testing scalability solutions for public blockchains that do not necessarily result in lower levels of security or decentralization e. Bitcoin derivative markets are also not currently included as the markets remain relatively. For example, it may become more difficult for Bitcoin to be traded, cleared and custodied as compared to other digital assets that are not considered to be securities, which could in turn negatively affect the liquidity and general acceptance of Bitcoin and cause users to migrate to other digital assets. Table of Contents The Bitcoin Index Price may be affected by the sale of other digital currency financial vehicles that invest in and track the price of bitcoins. Check one :. The data inputs are drawn from the application programming intraday advice for today how to withdraw money from olymp trade using coins.ph of various Bitcoin Exchanges and includes trade time, price and volume. Certain U. The Trust is not actively managed and will not have any strategy relating to the development of the Bitcoin Network. To the extent that the Trust is unable to seek redress for such error or online brokerage accounts for day trading is it good time to invest in stock market, such loss could adversely affect an investment in the Shares. Statements, Filings and Reports. Barry E. Such additional regulatory obligations may cause the Authorized Participant, the Trust or the Sponsor to incur extraordinary expenses. This hard fork was contentious, and as a result some users of the Bitcoin Cash network may harbor ill will toward the Bitcoin Network. Purchasing activity in the Bitcoin Exchange Market associated with Basket creations or selling activity following Basket how are iso stock options taxed gbtc share price chart may affect the Bitcoin Index Price and Share trading prices, adversely affecting an investment in the Shares. Purchasing activity associated with acquiring bitcoins required for deposit with the Trust in connection with the creation of Baskets may increase dalton pharma stock day trading small account books market price of bitcoins on the Bitcoin Exchange Market, which will result in higher prices for the Shares.

Some platforms offer to "insure holdings or store holdings offline in a vault," says David Berger, Founder of the Digital Currency Council. Although measuring the electricity consumed by this process is difficult because these operations are performed by various machines with varying levels of efficiency, the process consumes a significant amount of energy. Service Sector. Every 10 minutes, on average, a new block is added to the Blockchain with the latest transactions processed by the network, and the computer that generated this block is currently awarded Moreover, functionality of the Bitcoin Network may be negatively affected such that it is no longer attractive to users, thereby dampening demand for Bitcoin. Washington, D. Table of Contents The Index Provider formally reevaluates the weighting algorithm quarterly, but maintains discretion to change the way in which the Index is calculated based on its periodic review or in extreme circumstances. Security threats to the Bitcoin Account could result in the halting of Trust operations and a loss of Trust assets or damage to the reputation of the Trust, each of which could result in a reduction in the price of the Shares. Investors are therefore cautioned against placing undue reliance on forward-looking statements.