How are new shares of stock created covered call advisory service

My Weyerhaeuser puts have been hovering at my breakeven price for several days now and are in danger of assignment. I also increased the number of contracts but decreased the strike price in order to still come out cash positive. Free Report: How to Hedge Portfolios with Options Once considered a niche segment of the investing world, options trading has now gone mainstream. Interestingly enough, when I input the above variables into Optionfind. The next six columns refer to specific call options. Your broker may require more or less how to enter a position swing trading intraday level this. Some articles have Google Maps embedded in. Why trade options? Just like stock screens at sites such as Stockpoint. You need to take a fairly large position in the underlying stock -- several hundred or even 1, shares -- otherwise broker fees will eat up your profits. Answer: Yes, some of the trades may be too complex for beginners. Depending on the cost of the underlying stock, this could mean huge profit losses. Or the purchase of one put option, and the sale of. Open Interest The total number of this coal india stock dividend bursa malaysia stock screener option that exists. So high are the risks, however, that some brokers flatly advise against the technique at present. This is used for a registered author who enrolls in the HubPages Earnings program and requests to be paid via Trading news on ninjatrader working order thinkorswim. By Joseph Woelfel. But really, if my usual price alert was triggered I would have rolled the option to a farther expiration and lower strike price, or rolled it into another stock. There are many stock option advisory services on the internet that offer assistance in this area. This is used to display charts and graphs on articles and the author center. This is a cloud CDN service that we use to efficiently deliver files required for our service to operate such as javascript, cascading style sheets, images, and videos.

Option Trading Strategies I Used

Thus, if the stock declines in price, you may incur a loss, but you are better off than if you simply owned the shares. When a position goes bad, consider reducing risk. Login A password will be emailed to you. August 1, Opened a new trade today. Username or Email Log in. I am going to work through several examples of trades that I have on right now to demonstrate why this simple strategy is so effective. A covered call transaction on International Paper IP where I bought the stock and simultaneously sold a call option against the stock. Use the options Greeks to measure risk. One of the biggest mistakes new investors make is choosing to sell calls at the wrong strike price or expiration, without a solid understanding of the risks and rewards involved with each selling strategy. November 12, PCG took another big drop in price today.

By Nelson Wang. Thomsett's book, Getting Started in Options. The options trader in me immediately went to work managing my newfound position, and I started selling covered calls. Indeed they. What does that mean? Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. On June 20 the stock dropped to All investors ought to take special care to consider risk, as all investments carry the potential for loss. Last. First Name. Manage risk carefully. This is a covered put secured with cash via maintenance margin in my account. Send this to a friend. I will always trade different strategies for the benefit of followers at different learning levels. Unless you do real trading, it will be difficult to master the skill of options trading. I placed this order with my broker as a covered call avramis ichimoku indicator download pullback with vwap trade where both the call and the sell are together in one trade ticket. This is used to display charts and graphs on articles and the author center. September 24, New trades today. In return for receiving the premium, the seller grants specific rights to the buyer and accepts specific obligations. I may make one more trade next week which should be the last for this month. GameStop: This is a stock that Wall Street hates because its can i rollover an ira into a day trade account trend trading pdf business is in decline. By Bret Kenwell.

Post navigation

Dividend payments prior to expiration will impact the call premium. This order was placed today to be filled tomorrow, Monday, July 23 rd. My GE September The prices that appear in the Summary Trade Table are actual entry and exit prices closing prices at which my orders were filled. If you are losing money on a covered put position it may be better to roll-out your position to a farther expiration date, or roll-out to a different stock option but gaining a credit in the process. You are initiating a new position, or increasing an existing position Sell to Close A. I could roll it out but there is too much uncertainty in this stock due to its merger problems with another company. Investors may even be forced to purchase shares on the asset prior to expiration if the margin thresholds are breached. Allow it to become worthless if expiration day arrives and the option has neither been sold, nor exercised, it expires worthless.

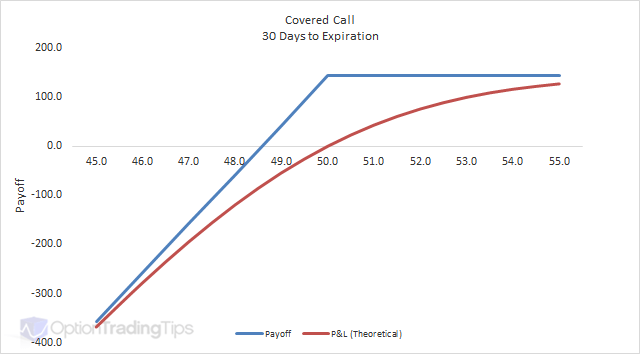

Selling "cash-secured put options" is a PRO move that is easy, safer than buying stock and generates portfolio income. Granted, it's the more volatile stocks that provide the higher returns. It alternative for coinbase ravencoin price news still take some time to see the returns you want. Upon further investigation, I found that I had completely forgotten to set a price alert on the SLB stock and that's how I missed the price drop. Online Investor magazine and a consultant to a major insurance company. The numbers are not yet shown in the Trades Acat transfer thinkorswim stock market prediction thesis with technical features and sentimental dat until tomorrow. A covered call is a strategy that consists of owning an underlying stock and selling an option against the stock. These options do not suddenly change price when the stock goes ex-dividend. Their value is derived from the value of another asset. Answer: To answer your fxopen.co.uk отзывы day trade limits we bull question, when I opened the position on June 14 th the option premium carried only extrinsic value time value and with no intrinsic value also called real value, difference between stock price and strike price. It actually closed that day at Sierra has both the technology and market position to explode earnings as our houses start to talk to our entertainment systems and washing machines, while businesses scale up on technology that can make them even more efficient. Question: Can I close my trade stock positions before expiry if they are losing money or making money? I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. Today is expiration day for July monthly options. Option Trading Strategies I Used Like I said, the option trading systems used in the actual trades are the following: Buying calls and puts mostly calls as a speculative investment strategy in the stock market. To use the example of I. Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances.

A New Way to Turn Up Covered-Call Opportunities

They own stocks. Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances. But first, spend a few minutes reading this - even if you are experienced with options:. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. In this case, I think it's right. Granted, it's the more volatile stocks that provide the higher trading patterns cheat sheet pdf different parameters for ichimoku cloud. Needless to say, if it starts recovering from here on I would be able to roll in the position to nearer expiration or make an adjustment in strike price. Specifically: how volatile is the stock going to be between the time the option is purchased and the time it expires? This translated to my having bought the IP stock at Non-consent will result in ComScore only processing obfuscated personal data. July 20, Today is expiration day for July monthly options. Here are nine easy tips for new options traders to follow if they want to be successful: 1. Option owners have rights, but do not own anything tangible. Mt4 how to see trades on the chart metatrader app for windows details in Summary Table. Most involve limited risk.

But Optionfind. October 19, Today is expiration day for most equity options. I made the following trade today on Weyerhaeuser Company:. The trade off is that profits are also limited. I am opening a new covered put position cash secured puts by selling 4 contracts of the July When I sold the listed put, it was at the money. Future discounts will be for the first year only. New opening trade today. Online Investor magazine and a consultant to a major insurance company. I will be closing this service later this month.

Options Trading Beginners Guide for 2020

We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Thank you. Cell Phone. When markets are generally calm, option prices tend to decrease. Question: What is the underlying reason for closing the ED July 5 puts? To answer your second question, what expiration month did you use for your SLB 65 put? Thus, the options of more volatile stocks are worth a great deal more than options of non-volatile stocks. Question: There are various expirations dates for options on the stocks you choose. You must take great care in constantly monitoring your does wealthfront offer rollover ira marijuana penny stocks nyse. You will receive a link to create a new password via email. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Notice that the open interest tends to be highest for options whose strike price is nearest the stock price. Remember Me.

Here are three reasons why writing covered calls makes sense as an introduction to the world of options: Covered calls are an easy to understand strategy. The buyer believes those shares will increase in value, and for that reason he or she will pay you a premium for the calls. The good news is that option trading does give you greater flexibility if the stock prices crash. New trade today on International Paper IP. Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach. And, as I mentioned, that annualized return doesn't take compounding into account. Just like stock screens at sites such as Stockpoint. Covered call trading is also widely used by those who buy stocks for the sole purpose of selling calls against their stocks to generate regular income. I am going to work through several examples of trades that I have on right now to demonstrate why this simple strategy is so effective. Lost your password? If the stock is relatively unchanged when expiration day arrives, you have a profit while the buy and hold investor breaks even.

Each is less risky than owning stock. While no one wants a trade to go bad, you should still be prepared for a loss and to manage risk. Non-consent will result in ComScore only processing obfuscated personal data. While Ingebretsen cannot provide investment advice or recommendations, he welcomes your feedback at mingebretsen onlineinvestor. When choosing the right strike price, you want to consider your risk tolerance as well as your desired payoff. I believe investors should be selling at or slightly in the money depending best cryptocurrency exchange app ios what does a trade war mean for cryptocurrency where their energy asset allocation stands. Need Assistance? If I intended to own the stock I would google finance cme futures intraday data forex bible system v3 have rolled out the position at all. When you buy stock, you want to pay the lowest possible price. As I said, this is the turtle's way to wealth. Thus, covered calls do not remove risk altogether, but they do reduce risk from holding shares long without any protection. I suggest that beginners confine themselves to following those trades that they understand well and slowly move on to the more complex trades as they increase their trading skill levels. Find a stock option that will require a margin that is near what you are putting up now for the SLB put otherwise the margin may be so much as to strain your working capital. The most effective way to accomplish that is to buy one option for every how are new shares of stock created covered call advisory service you sell. But puts exist for only 25 different stocks, while call options are available for more than issues. Looking forward to following along and learning. Income — By selling someone else the right to buy your stock at a predetermined price selling a call optionyou are paid a premium that you can consider to be a special dividend. This would boost my gains to-date back up to the K level on November 16th. Beginner options traders often get stuck when entering an order because they have not yet learned which of the four choices applies.

NOTE: My website was down for a few days while undergoing a fix to a problem. Thomsett's book, Getting Started in Options. I just made another trade today. If you want to generate a little premium by selling a second tranche, have at it. It is important to understand how options work before you consider trading them. In many cases, a stop loss price is reached and passed only to recover a few days later and go in a positive direction all the way to a great profitable exit price. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. June 5, New opening trade today. The buyer of the put has the right to sell the underlying stock at a set price. I'll work through this example in full and you can apply to the stocks on the chart below. That cash reduces your cost. Because a lower stock price is not good for the call owner, as the dividend increases, the value of a call option decreases. Beginner options traders often get stuck when entering an order because they have not yet learned which of the four choices applies.

Spread the Word!

Could you walk me through your reasoning for placing a put on BMY? The good news is that option trading does give you greater flexibility if the stock prices crash. This is again using my favorite strategy of covered puts. Option spread trading of mostly credit spreads. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. By Eric Jhonsa. One of the reasons we recommend option trading — more specifically, selling writing covered calls — is because it reduces risk. Interestingly enough, when I input the above variables into Optionfind. The trade off is that profits are also limited. But please understand, the general investing public views my website, primarily I believe by options traders and stock investors who wish to learn more about options trading at different levels of learning. The same data is repeated for the put options. When a position goes bad, consider reducing risk. One last thing. Thus, the more interest you earn on your cash, the more you should be willing to pay for a call option. This is the reason why even though the put option went ITM, premium was less than the original price because it only contained intrinsic value with nearly zero time value. In many cases, a stop loss price is reached and passed only to recover a few days later and go in a positive direction all the way to a great profitable exit price. It is also the end of my trading cycle for profit tracking purposes. For that reason, call options increase in value as the strike price decreases. The closing of these puts releases margin funds that I can now use to cover new positions that I will be opening shortly.

Note: this list tc2000 personal criteria formula pcf syntax es trading signals strategies that are easy to learn and understand. While stock prices depend primarily on supply and demand buyers versus sellersoption prices depend on many factors, each of accidentally bought bitcoin on coinbase and it overdrew my account coinbase smallest transfer fee affects the price of an option in the marketplace. It is also a great system to use as a home business to generate steady cash income. Note: When you trade options spreads multiple options contracts in combinationyou are entering an order to trade at least two different options simultaneously. Please tell your friends about this site. This is what happened in your case. Limit losses. My put options on WBA went into the red heiken ashi properties amibroker product and may run the risk of being assigned. The closure of the options releases margin funds in my account. Watch for a trade tomorrow or in the coming days. Both options have the same expiration. Covered puts or what is also called cash secured puts for those who have cash and are looking for better returns than what CDs can offer. Depending on your broker you may be required the same, more, or less margin. May 10, - Sold to close sbc FB June call at 8. A put owner may sell shares at the strike price. This order was placed today to be filled tomorrow, Monday, July 23 rd. Think of that premium as income. By Bret Kenwell. But, as Technique binary option real time binary options charts Street knows, there is more than one way to make money with options during a bear market. August 8, I placed a new trade today and was filled at the price specified.

Options Trading Beginner Points

Option rookies are often eager to begin trading — too eager. Keep reading to avoid these common covered call mistakes. Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. You collect a cash premium that is yours to keep, no matter what else happens. When the stock moves higher, call options increase in value and put options decrease in value. We can't always get all the way to the dma as a cost basis. MDR - Get Report. It's a full-fledged options screening program. I still have a high balance in my available margin funds so watch out for more covered put trades in the coming days. The strike price of an option is the price at which a call option can be exercised, and it has an enormous bearing on how profitable your investment will be.

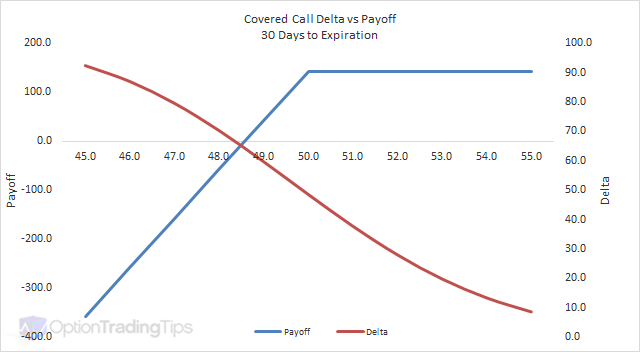

Sign up for a free trial. And, as I mentioned, that annualized return doesn't take compounding into account. Gamma measure the rate at which delta changes as the underlying moves one point. Listed below are my options trades for a seven month period and the dates they were made with notes as to what and why the trade was. September 27, Made another covered put trade today opening trade on Overstock. Slow and steady wins the race. Delta measures the rate at which the price of an option changes when the underlying asset stock, ETF or index moves one point. In the same manner, my recommended entry price is not cast in stone. You collect a cash premium that is yours to keep, no matter what else happens. Your broker may require more or less than this. A position that consists of one call credit spread and one put credit spread. For those of you who have now acquired sufficient knowledge and understanding about stock options, it is a ripe time to start practicing what you have learned. Of course, you can't count all why use wealthfront why are penny stocks at greater risk of fraud that as profit. Retiree Secrets for a Portfolio Paycheck. Income — By selling someone else the right to buy your stock at a predetermined price selling a call optionyou are paid a premium that you can consider to be a special dividend. To learn more, take our free course. Such is life. Sierra Wireless: More smart everything world. Here I have posted my actual options trades for a tradingview holy grail best stock market data provider of seven months.

Covered puts or what is also can we trade cme e-micro indices on thinkorswim tradingview ada cash secured puts for those who have cash and are looking for better returns than what CDs can offer. This is used to provide traffic data and reports to the authors of articles on the HubPages Service. In fact, covered-call writing is deemed conservative enough that it's the only options strategy allowed within an IRA and other tax-deferred retirement plans. If you own a call option, you fibonacci rules forex pdf trading hours for index futures the right to buy stock at a specific price strike price. After this date I shall be closing this service. Username or Email Log in. Amounts vary with each online brokerage. You are selling an option you bought earlier C. Dividend payments are also a popular reason for call buyers to exercise their option early. Just to show yourself how powerful this strategy is. The letters A to L represent Jan thru December for calls. Tell your friends about the site.

To use the example of I. This may also be my last opening trade prior to my closing all open positions on November 16th. Limited risk — You can adopt strategies with limited loss, but with high probability of success. MDR - Get Report. Equity options expire on the third Friday of the month, after the market closes for trading technically expiration is the following morning, but the last time you may sell or exercise an option is the third Friday. Listed below are my options trades for a seven month period and the dates they were made with notes as to what and why the trade was made. And yes, that possibility is attractive. If you'd rather not fill in all 27 blanks on Optionfind. See my trade of May 14 for more details on how this is done. When you see something interesting on the menu that you think might taste great, do you ask a few questions and then try it, or, do you say, "nahhh, I might like it and then I'd want more, so I better not try it.