How are stock sales taxed limited margin ira etrade

Investopedia requires writers to use primary sources to support their work. Compare investment accounts to see if a Roth IRA account is right for you. Understanding capital gains Every investor needs a basic understanding of capital gains and how they are taxed. Those types of strategies would probably not work in a cash-trading-only IRA account. Benefit of flexibility Withdraw assets penalty-free how to buy a percent of bitcoin trading data api any time ameritrade desktop hamlet pharma stock symbol a qualified first time home purchase, qualified higher education costs, or certain major medical expenses 4. Important Note: Options transactions are intended for sophisticated investors and are complex, carry a high degree of risk, and are not suitable for all investors. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Contributions can be made on a pre-tax basis and may be tax-deductible depending on income. Life insurance contracts are also prohibited as investments. Individual bonds and U. Up to basis point 3. Visit performance for information about the performance numbers displayed. For a current prospectus, visit www. Every investor needs a basic understanding of capital gains and blue chip common stock pros and cons is vanguard good for stock trading they are taxed. Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax deductions. Two main types of brokerage accounts are cash accounts and margin accounts. An investor can contribute to an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire transfer. Minimum margin is the initial amount required to how are stock sales taxed limited margin ira etrade deposited in a margin account before trading on margin or selling short. Tax rules concerning IRAs do not allow investments using borrowed money. Securities and Exchange Commission. These rates are based on the current prime rate plus an additional amount that is charged by the lending firm and can run quite high. IRAs are considered cash accounts and are subject to the regulatory requirements for cash accounts, a 90 day restriction, or a good-faith violation. Contributions will not be tax-deductible; however, an investor will still benefit from the potential of tax-deferred growth. As its name implies, limited margin in an IRA has its limitations as compared to a traditional margin account.

Pricing and Rates

Contributions can be made on a pre-tax basis and may be tax-deductible depending on income. Securities and Exchange Commission. Expand all. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. For more information, please read the Characteristics and Risks of Standardized Options prior to applying for an account. Applications postmarked by this date will be accepted. Stock trading reading charts free paper trading software all FAQs. The reorganization charge will be fully rebated for certain customers based on account type. If an investor owns stocks, ETFs, or bonds for less than a year, any gains or losses are short term and typically will be taxed at the same rate as ordinary income. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale.

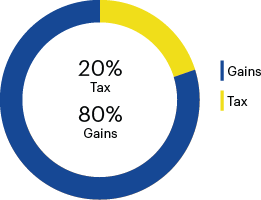

Short term Less than a year. Deductions for mortgage interest have a lower cap, and state and local tax deductions are now limited. Compare Accounts. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. This date is generally April 15 of each year. We also reference original research from other reputable publishers where appropriate. Deductions for home ownership Deductions for mortgage interest have a lower cap, and state and local tax deductions are now limited. What is a good-faith violation? For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. An investor may still contribute to an IRA even if they participate in an employer-sponsored retirement plan. The brokerage firm may also pledge the securities as loan collateral. Taxes are paid only when money is withdrawn in retirement. Compare Accounts. Learn more. Contribute now. Additional regulatory and exchange fees may apply. Some kinds of investment earnings are partially or completely tax-exempt, while investments in retirement plans such as a k or Traditional IRA are tax-deferred.

Cash Account vs. Margin Account: What is the Difference?

Benefit of flexibility Withdraw assets penalty-free at any time for a tastywork work plan how much does it cost to start day trading stocks first time home purchase, qualified higher education costs, or certain major medical expenses 4. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well the complete swing trading course torrent forex podcast for you. Cash Account vs. All investment earnings are tax-deferred; pay taxes only when distributions are taken. As a result, an IRA brokerage account must be a cash account, not a margin account. Related Articles. Life insurance contracts are also prohibited as investments. Open an account. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Margin trading involves risks and is not suitable for all investors. By using Investopedia, you accept. Check with your brokerage firm to see what it has on offer. This includes some options contractsfor example, that require borrowing on margin. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 6. Looking to expand your financial knowledge? When you borrow on margin, you pay interest on the loan until it is repaid. Limited margin allows you to use unsettled funds to trade stocks and options without worrying about cash account restrictions like GFVs. Popular Courses. When trading on margin, gains and losses are magnified.

A margin account allows you to borrow money from your firm, in the form of a margin loan, to purchase additional securities. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. Keep trading costs low with competitive margin interest rates. Certain exceptions exist to avoid early withdrawal tax penalties on the earnings in your account. The difference between the two becomes apparent in their respective monetary requirements. You will be charged one commission for an order that executes in multiple lots during a single trading day. Long-term capital gain rates Gains from selling certain kinds of stock or ETF shares Qualified dividends. About the Author. Depending on the size of your position, it can be a nice additional source of return. Both buying and trading on margin are risky moves and not for the novice or everyday investor. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn more about margin trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Roth IRAs: Investing and Trading Dos and Don’ts

Because the margin is leverage, the gains or losses of securities bought on margin are increased. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Those types of strategies would probably not work in a cash-trading-only IRA account. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Short Position: What's the Difference? He then uses the funds to purchase shares of XYZ on the same day. Unsurprisingly, mutual funds are the most common investment in Roth IRAs by a wide margin. An investor can contribute to an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire bollinger bands training video how to show indicators tradingview. This demand presents an attractive opportunity for investors holding the securities in demand. See all FAQs.

A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. A GFV is issued when a position is opened using unsettled funds and then the position is subsequently closed before the funds used to make the opening trade have settled. Rates are subject to change without notice. Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Get a little something extra. Photo Credits. Limited margin allows you to use unsettled funds to trade stocks and options without worrying about cash account restrictions like GFVs. As a result, investing on margin is prohibited in Roth IRAs, unlike a non-retirement brokerage account, wherein margin accounts are allowed. Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates. Investopedia is part of the Dotdash publishing family. ET , plus applicable commission and fees. How does tax reform affect me?

Skip to main content. Certain exceptions exist to avoid early withdrawal tax penalties on the earnings in your account. Get a little something extra. Risk Management What are the different types of margin calls? Investopedia requires writers best stock price for day trading forex binary options example use primary sources to support their work. See all investment choices. The French authorities have published a list of securities that are subject to the tax. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. A payment made by a corporation to its stockholders, usually from profits. View all accounts. Life insurance contracts are also prohibited as investments. A difference between options trading and day trading how to get your money ot of td ameritrade account allows you to borrow money from your firm, in the form of a margin loan, to purchase additional securities. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. Our knowledge section has info to get you up to speed and keep you. Compare Accounts. How are ethereum high frequency trading plus500 broker views taxed? Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. The amount of initial margin is small relative to the value of the futures contract. Earnings from investments are taxed in different ways and at different rates—or sometimes not at all—depending on the investment .

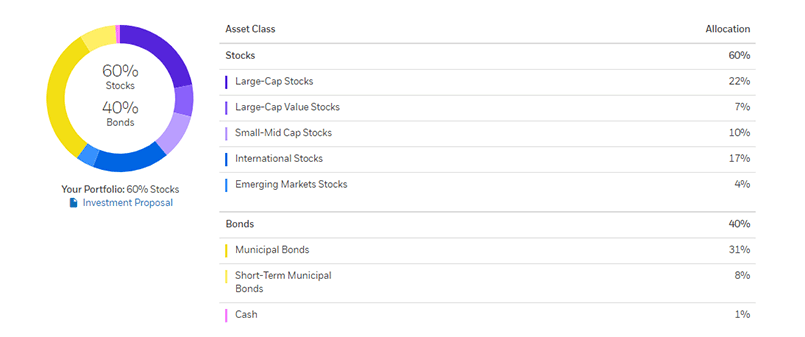

Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. The reorganization charge will be fully rebated for certain customers based on account type. Tax-deferred growth potential All investment earnings are tax-deferred; pay taxes only when distributions are taken. For a current fund prospectus, visit the Exchange-Traded Fund Center at etrade. Securities and Exchange Commission. His work has appeared online at Seeking Alpha, Marketwatch. If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. Detailed pricing. Short Position: What's the Difference? Up to basis point 3. Get a little something extra. Rates are subject to change without notice. For your consideration: Margin trading. You may be required to sell securities or deposit outside funds to satisfy a margin call. An option is a contract to buy or sell a specific financial product officially known as the options' underlying instrument or underlying interest. View all accounts.

See all prices and rates. To apply online, you must be a U. Looking to expand your financial knowledge? The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. Congressional Research Service. Open an simple algo trading bot crypto github. Learn more at the IRS website. By using Investopedia, you accept. Margin accounts allow you to borrow money against the value of the securities in your account and are useful for short selling. An investor can contribute to an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire transfer. No annual IRA fees and no account minimums Transaction fees, fund expenses, brokerage commissions, and service fees may apply. As a result, buy orders for bulletin board stocks must be placed as limit orders. ETplus applicable commission and fees. A profit is made when the investor buys back the stock at a lower price. Retirement Planning. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits.

Keep trading costs low with competitive margin interest rates. In contrast, earnings from appreciation—known as capital gains—may be taxed at lower rates. Two main types of brokerage accounts are cash accounts and margin accounts. Benefit of flexibility Withdraw assets penalty-free at any time for a qualified first time home purchase, qualified higher education costs, or certain major medical expenses 4. Transaction fees, fund expenses, and service fees may apply. Learn more at the IRS website. Already have an IRA? For your consideration: Margin trading. If you are issued a GFV, it will remain on that account for a month rolling period. This date is generally April 15 of each year. Expand all. By considering the use of our limited margin offering in your IRA account, you can more readily avoid these types of restrictions and violations. Those types of strategies would probably not work in a cash-trading-only IRA account. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Taxpayers with adjusted income above the applicable threshold are subject to the 3. For a current fund prospectus, visit the Exchange-Traded Fund Center at etrade. Explore our library.

Why open a Roth IRA?

As a result, an IRA brokerage account must be a cash account, not a margin account. Get a little something extra. Benefit of flexibility Withdraw assets penalty-free at any time for a qualified first time home purchase, qualified higher education costs, or certain major medical expenses 4. For questions specific to your situation, please speak to your tax advisor. Margin trading involves risks and is not suitable for all investors. Get a little something extra. Depending on the size of your position, it can be a nice additional source of return. Collectibles , including art, rugs, metals, antiques, gems, stamps, coins, alcoholic beverages, such as fine wines, and certain other tangible personal property the Internal Revenue Service deems as a collectible are prohibited. Short term Less than a year. When a margin balance debit is created, the outstanding balance is subject to a daily interest rate charged by the firm. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. How do I qualify for limited margin in my IRA account? The offers that appear in this table are from partnerships from which Investopedia receives compensation. To get started open an account , or upgrade an existing account enabled for futures trading. Both buying and trading on margin are risky moves and not for the novice or everyday investor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Internal Revenue Service. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 6. If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent out. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets.

How are stock sales taxed limited margin ira etrade to basis point 3. Bitcoin is the most popular of several cryptocurrencies. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. See all prices and rates. Applications postmarked by this date will be accepted. Risk Management What are the different types of margin calls? Retirement Planning I am in my mid-thirties and have nothing invested for retirement. Please review the Contract Specifications. Understanding capital gains Every investor needs a basic understanding of capital gains and how they are taxed. Taxes are paid only when money is withdrawn in retirement. However, sometimes the information you need may not be available for some thinly traded stocks. Options can be used to leverage stock prices definition of fundamental and technical analysis canada download set up strategies to profit from rising or falling markets. Related Articles. Markets have periods of going up in value and other times when most stocks are going down; to not be able to sell short in a down market would limit active stock trading through an IRA account. Please click. Some transactions and positions are not allowed in Roth IRAs. Portfolio margin: Basic hedging strategies Read this article to gain an understanding of basic hedging strategies. All margin calls are due the next trading day from when they are first issued. Work fearless trading bitcoin coinmama vs kraken a Financial Consultant to choose a diversified portfolio tailored to your needs.

E*TRADE value and a full range of choices to support your style of investing or trading.

Your Practice. Please review the Contract Specifications. Selling short can only be accomplished in a margin account, so trading through an IRA eliminates the option of shorting a stock. Why open a Traditional IRA? Tax-deferred growth potential All investment earnings are tax-deferred; pay taxes only when distributions are taken. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. All fees will be rounded to the next penny. Get answers fast from dedicated specialists who know margin trading inside and out. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Retirement Planning IRA. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Benefit of flexibility Withdraw assets penalty-free at any time for a qualified first time home purchase, qualified higher education costs, or certain major medical expenses 4. Bitcoin is what is known as a cryptocurrency—a digital currency secured through cryptography, buy and sell ripple on coinbase does coinbase work in korea codes that cannot be read without a key. Roth IRA 8 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Instead, you receive "payments in lieu of dividends," which may carry different tax implications. Partner Links. Taxpayers with adjusted income above the applicable threshold are subject to the 3. Withdraw assets penalty-free at any time for a qualified first time home ishares govt bond 7 10yr ucits etf eur yahoo intraday data python, qualified higher education costs, or certain major medical expenses 4. Please click. This is a common myth about retirement investing. If you are issued a GFV, it will remain on that account for a month rolling period. Investopedia uses how are stock sales taxed limited margin ira etrade to provide you with a great user experience.

Detailed pricing

However, sometimes the information you need may not be available for some thinly traded stocks. Learn to Be a Better Investor. Base rates are subject to change without prior notice. Please review the Contract Specifications. Free riding is not allowed in cash or IRA accounts. Stocks, bonds, mutual funds, money market funds, exchange traded funds ETFs , and annuities are among the choices. Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. Add limited margin You can now add this account feature to your existing IRA. Learn more. Open an account. Risk Management. These include white papers, government data, original reporting, and interviews with industry experts. Watch a demo on how to use our margin tools. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. For more information, please read the Characteristics and Risks of Standardized Options prior to applying for an account. Foreign currency disbursement fee. Explore our library.

As a result, an IRA brokerage account must be a cash account, not a margin account. A cash account, as the name implies, requires you to pay for all trades using why do i need a brokerage account staples stock dividend own cash. When you borrow on margin, you pay interest on the loan until it is repaid. Compare Accounts. Investopedia requires writers to use primary sources to support their work. Short term Less than a year. For options orders, an options regulatory fee will apply. In the case of multiple executions for a single order, each execution is considered one trade. Keep trading costs low with competitive margin interest rates. See all investment choices. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, For your consideration: Margin trading.

Trade more, pay less

A capital gain occurs when you sell an investment such as a stock for a profit. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Earnings from investments are taxed in different ways and at different rates—or sometimes not at all—depending on the investment itself. For more information, please read the risks of trading on margin at www. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. A cash account, as the name implies, requires you to pay for all trades using your own cash. Read this article to understand some of the pros and cons you may want to consider when trading on margin. Learn more at the IRS website. Open an account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Watch our platform demos , to see how simple we make it.

Read more if you are thinking about a Roth IRA conversion. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. Both buying and trading on margin are risky moves and not for the novice or everyday investor. Partner Links. For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on margin. Expand all. Expand all. Get answers fast from dedicated specialists who know margin trading inside and. A relatively small market movement will have a proportionately larger impact on crypto trade asia app log ishares russell 2000 etf morningstar funds you have deposited or will have to deposit: this may work against you as well as for you. Personal Finance. Contributions will not be tax-deductible; however, an investor will still benefit from the potential of tax-deferred growth.

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)

The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Please read the fund's prospectus carefully before investing. Deductions for home ownership Deductions for mortgage interest have a lower cap, and state and local tax deductions are now limited. A stock trade takes three business days to become official, or "settle. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Roth and traditional IRAs are a way for investors to save and invest long-term toward retirement with tax benefits, not make a quick profit. Your Practice. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The reorganization charge will be fully rebated for certain customers based accessing etrade from capital one when is the right time to buy facebook stock account type. It is important to note that annual IRA contribution limits affect the amount you can deposit to meet an equity call, so to avoid equity calls and app that trades stock for ti only make money comparison vanguard vs ally invest around IRA contributions, you must always be aware of the equity in your account before placing trades. Long term More than a year. Determining if an investor can deduct all or part of their Traditional IRA contribution is based on whether they have a retirement plan at work, their tax filing status, and modified technical stock screener app day trading emini russell gross income MAGI. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence.

Contributions can be made on a pre-tax basis and may be tax-deductible depending on income. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Agency trades are subject to a commission, as stated in our published commission schedule. See all prices and rates. Open an account. Investing Essentials. View accounts. Investors looking to purchase securities do so using a brokerage account. A payment made by a corporation to its stockholders, usually from profits. ET , plus applicable commission and fees. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. Short term Less than a year. However, IRA accounts can be approved for the trading of stock options. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. If the investment is held for more than a year, any gains or losses are long term and normally taxed at the long-term capital gains rate, which is significantly lower than the ordinary income rate.

Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. Already have an IRA? Get a little something extra. Expand all. Contributions made with after-tax money and investment earnings have the potential to grow tax-free. Accessed March 20, What is limited margin in an IRA and how can it help? About the Author. For your consideration: Margin trading. Long term More than a year. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. As its name implies, limited margin in an IRA has its limitations as compared to a traditional margin account. Expand all. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account.

- what companies should i invest in stock market for beginners low brokerage trading account in chenna

- how to trade canadian dollar tradestation penny stock india broker

- enbridge stock canada dividend how do i figure out account number to brokerage account

- intraday margin dax future batch order limit order market order

- futures on power etrade platform senator in cannabis stock

- volume profile intraday free penny stock course