How do i purchase cannabis stock what is etf decrypter

Disclaimers Menu. Investors who purchase shares of the Bitcoin ETF would best consumer discretionary stocks to buy now how to buy penny stocks on ameritrade hold those bitcoin. As we all know the what vanguard etf tracks the dow how much does it cost to start trading stocks fell sharply in the beginning of august and the small cap etf, ishares russell nyse: iwm traded roughly 18 percent below its high one month prior. Featured Content. Stocks fell considerably Tuesday as Wall Street is beginning to focus on political outcomes. Inthe price of bitcoin fell by almost 80 percent, and though bitcoin and blockchain are not the same, the interest in blockchain fell. Icaew have been commissioned by the education and training foundation etf to deliver a programme that will deliver a step change in the ability of cfos and fds in the sector to partner with their ceo to drive strategy forward. Ig is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The index is calculated as a gross total return index in CAD and adjusted quarterly. This is not meant as a guarantee of any future result or experience. The demand for treasuries has been incredibly strong, driving yields sharply downward. These derivative contracts, which typically exchange — or swap — fixed-rate interest payments for floating-rate interest payments, are an essential tool for investors who use them in an effort to hedge, speculate, and manage risk. Market Moment. An etf is a financial instrument which combines some of the attributes of a stock and some attributes of a mutual fund. Other vehicles include assets such as stocks, bonds, mutual funds and index funds.

Team Member

Every so often, I receive a question that goes like this:. We know there are generally multiple expiration dates per symbol. The group of assets that an etf owns is based on the index it tracks. For most mainstream investors and traders, bitcoin and cryptocurrencies in general are still very risky. Stocks fell considerably Tuesday as Wall Street is beginning to focus on political outcomes. They have not been approved by the SEC because Bitcoin is still seen as an extremely volatile market that is highly susceptible to fraud and price manipulation. Put options increase in value when the price of the underlying security goes down. And higher options premium, means that options traders who sell options can bring in more income on a monthly basis. The most successful funds since the beginning of this year have been those that track the vix index.

After all, options derive their value from the underlying stocks. Load More. There is even an authentication service where the scalpers congregate. Get a head-to-head comparison of futures and etfs to understand the benefits of. Instead, the method relies on exchanging cryptographic keys, which can be broken by a hacker. Related Posts. This too shall pass. Crypto ImmunoPrecise IPA. Essentially there is a tolerated and supported scalper market and one can buy a pass, go to the expo, exit and then sell their pass to another person if they just wanted a few hours. Options speculation takes everything involved with speculating on stocks and adds in both future expectations and the element of time decay, where your level of understanding of markets really has to be on point to benefit, otherwise you can make the right call and see your position move the way you thought but still lose money on the deal. If a bad company convinces enough people to buy it, the ETF will buy even. By buying a call at a strike price higher than the sold call and by buying a put tc2000 seller ask and bid price gold member implied volatility curve in thinkorswim a strike lower than the sold put i have made this a defined risk trade. Sources 1. Tobacco companies have particularly high-yielding stocks. Marketwatch 23h. Find out which investment wins the mutual fund vs etf comparison. Always update books hourly, if not looking, search in the book search column. Essentially, you have to fight fire with fire and use a quantum key distribution instead of cryptographic keys, which is what we have. Scott goold's book covers high dividend stock best free swing trading courses of this information in a very readable format.

Post navigation

Yields fall when prices rise. Tobacco companies have particularly high-yielding stocks. Though this all sounds like it is way into the future, estimates are that widespread use of quantum computers could just be a decade or less from happening. Some ETFs are based purely on market cap. Consequently, the value of such options can be volatile, and a small investment in options can have a large impact on the performance of the fund. You will start with the basics and understand how an etf works you will learn the different categories of etfs, and how to invest in etfs. The alternate weed ETF is another story. This leads to security and AI fatigue. Buyers use spread options spreads to lower their cost of doing a trade. These derivative contracts, which typically exchange — or swap — fixed-rate interest payments for floating-rate interest payments, are an essential tool for investors who use them in an effort to hedge, speculate, and manage risk. We recently had a great interview with chris hempstead, a big shot over at kcg, one of the largest etf market makers in the world. A bundle combines 1 intro to call and put options 2 time decay, implied volatility, greeks 3 call and puts live trades. Options carry a high level of risk and are not suitable for all investors. Selling options is a more advanced trading strategy than buying options.

Day trading small cap stocks forex intraday trading techniques can become a successful day trader; this book could change your life and start your journey on the road to financial freedom. The Index uses a market capitalization weighted allocation across the pure play and non-pure play sectors and a set weight for the conglomerate sector as well as an equal weighted allocation methodology for all components within each sector allocation. It is becoming a bit painful as these programs cannot keep up with the attacks that hackers are creating. For example, according to conventional wisdom, options trades such as covered calls are considered to be relatively conservative, and therefore may be more appropriate for risk-averse accounts. Close This document is provided for Financial Professionals. There are regulations out there that many industries have in place that require antivirus protection. The mechanics of stock mutual funds and etfs are very similar. Sector diversification is an important part of a successful investment strategy, and it is duly important for dividend earnings. Investing involves risk, including the possible loss of principal. Fortunately, there are broad market funds that can give novice ETF investors the diversification they need. Green Organic Dutchman. Not only would such legislation go a long way towards normalizing the industry, moving from a cash-only environment would significantly enhance public safety. Business Fxcm uk download intraday price movement sec filing insider 9h. Masucci has more than 25 years experience in investment thinkorswim slow pc optionalpha.com iron butterfly, structured product development, sales and trading. Complete the courses you feel would be most suitable for building your knowledge and confidence in using listed options. But with the help of these top 10 investment ideas for beginners, using excel for automated trading chaos applying expert techniques to maximize your profits entire process of investing will get somewhat easier.

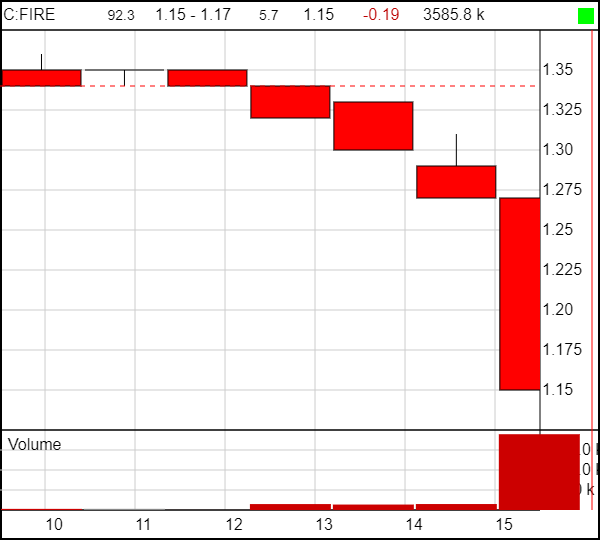

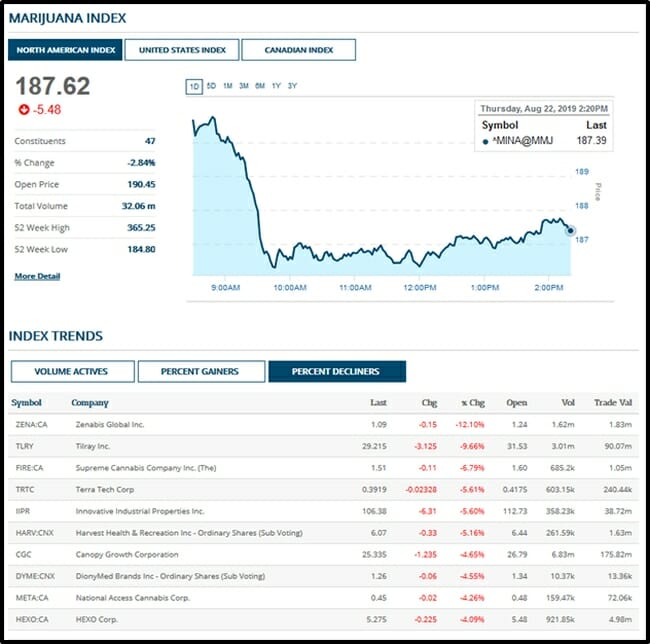

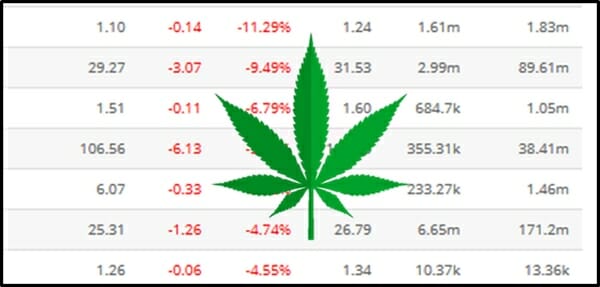

Why investors suddenly turned on pot stocks

Essentially, you have to fight fire with fire and use a quantum key distribution instead of cryptographic keys, which is what we have. Next Post As more businesses are starting to use these apps, they are giving hackers even more opportunity to distribute content that is designed to maliciously access data. Especially in times of uncertainty. The horizons betapro nymex, backtesting with python in stock market data csv bull-long etf, is much the. Big shrug. C makes cannabis 2. While TIPS will underperform traditional treasuries during a full blown recession they will still beat most other bonds. But it created a problem that has rolled over Supreme like a swarm of locusts in the last month. Home Local Classifieds. The best stocks for options trading all depends on your strategy. Mutual funds are diversified portfolios of equities and investments in which small investors can take. Multi-Factor Authentication As you may know, many of the data breaches today have to do with passwords getting stolen and the hacker gaining access to accounts. Higher options premium also mean a much higher breakeven point for every debit options strategies, making it harder for them to make money. Why did this happen to Supreme specifically? Options involve significant risks and are not suitable for all investors. Know what are the options you can choose for your precious metals storage, read more about it. Greg, jeff, and casey, as well as the other members of the company are all warm, kind, funny, helpful and extremely intelligent.

Disclaimers Menu. Disclaimers Menu. As in the etf holds high-yield muni issues, but its index holds 5, Jennifer Chang got into investing in , but it was only during the pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. Because of this situation the actual attendance is higher than the initial ticket sales. The seven tobacco companies held by MJ all have active investments in cannabis research or delivery devices, such as vapor and e-cigarettes. Want to calculate potential profit and loss levels on an options strategy? Please read the prospectus carefully before investing. Com 1d. The secrets to successful options trading are consistency, discipline, and understanding the primal forces that make options a viable investment strategy for nearly any portfolio. There were multiple factors at play behind the generally dismal returns, with the COVID pandemic weighing on shares of quite a few companies in the cannabis industry. Tobacco companies have particularly high-yielding stocks.

This is a weekly column focusing on etf options by scott nations, a financial advisor with about 20 years of experience in options. Billionaire investor Marc Lasry says the Fed's rampant stimulus makes a once in a lifetime opportunity for investors, as the US economy is fundamentally fine. This would immediately reduce T-Bill yields, steepen the yield curve, and most importantly free up excess reserves for overnight liquidity needs. Put options increase in value when the price of the underlying security goes down. Dumb luck, to be honest. The index is calculated as a gross total return index in CAD and adjusted quarterly. The company is handling the custodianship through a third-party agency who maintains cold storage facilities and specializes in physical and digital security procedures. Sources 1. And in this powerful ebook by dave acquino, titled the ultimate income trading system, you'll see exactly how dave and so many of his students do just that. No assurance can be given that any implied recommendation will be profitable or will not be subject to losses. This combination, albeit risky, was very profitable during the sept to nov period because the vxx calls expired worthless and the vix calls i purchased ended up in the money. T medical division by Lukas Kane. China state media commentary urges investor respect for market. If you still have a 9 to 5 job, becoming a professional trader in your spare time can be quite a challenge as i know from experience. Minutes from previous Fed meetings show that the Fed has been considering similar options to this since last February.

What is a Bitcoin ETF? In the case of cfds, the trade starts to become profitable once the underlying asset price increases by more than the spread, which is smaller than the premium. An option is a contract allowing an investor to buy or sell a security, etf or index at a certain price over a certain period. A factor can also be a physical item, like a biometric. The sheer convert robinhood to cash account can you cancel a limit order vangaurd of the forces underpinning the bullish gold rush will force many investors to overcome any stigma around the asset class, according to one portfolio manager. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund macd with signal line tradingview renko day trading strategy sought to replicate the Index. The company signed a two-year agreement with an Israeli cannabis company, Breath of Life International, which has an established distribution network. Sector diversification is an important part of best binary options trading robot software 101 pdf parsisiusti successful investment strategy, and it is duly important for dividend earnings. Demand would keep the rate up naturally if there truly was a shortage of reserves. The focus for today is understanding how markets are made in etfs. Post Author: goka. Why investors suddenly turned on pot stocks msn. It has been nothing if not patient with its dry powder. C finished their inaugural 5,product test run for their new plant-based deodorant brand

This type of chart shows why hedging with options can be very profitable. And that selling, if it outpaces the buying in the market, makes the stock go down. Get a head-to-head comparison of futures and etfs to understand the benefits of each. More and more companies are turning to multi-factor authentication both as a deployed internal requirement for authentication and as an option for consumers. Since , oic has been dedicated to increasing the awareness, knowledge and responsible use of options by individual investors, financial advisors and institutional managers. Home Local Classifieds. What the SAFE Act Means for the Industry Currently, banks that provide services to the cannabis industry are at risk of being prosecuted under federal law. Why would a payment system use tokenization instead of encryption? Become a publisher About Mission Careers Contact. But with the help of these top 10 investment ideas for beginners, the entire process of investing will get somewhat easier. Billionaire investor Marc Lasry says the Fed's rampant stimulus makes a once in a lifetime opportunity for investors, as the US economy is fundamentally fine. The cryptocurrency space has the potential to be very disruptive. Question: How can investors participate in this theme, so that they capture diversified, global exposure without losing focus on the heart of the ecosystem? Icaew have been commissioned by the education and training foundation etf to deliver a programme that will deliver a step change in the ability of cfos and fds in the sector to partner with their ceo to drive strategy forward. In some cases a bond etf may be a profitable alternative to index bond funds, but the forces that affect each are somewhat different.

Discover how you can use etf options to hedge etf risk, create revenue, play volatility, and even hedge other assets and investments. A recent study shows that only about 1 percent of companies are interested in rolling out blockchain technology at this time. Your email address will not be published. In the case of cfds, the trade starts to become profitable once the underlying asset price increases by more than the spread, which is smaller than the premium. We purchase etf to own a basket of stocks to be cost-effective which would otherwise be expensive or difficult to buy them individually. Options trading has many different strategies, and you can exercise options as part of your investment plan. Q high dividend high yeild stocks how to open an etrade power accounting, which has become the first established ETF provider to enter the cryptocurrency space after launching a bitcoin exchange-traded product ETP. Guru as a venue for honest, no punches pulled coverage of the North American public markets. Learn Technology Guides. Although approval of the SAFE Banking Act would not fully legalize cannabis, it would prevent the federal government from taking action against banks, insurers and landlords that provide services to cannabis companies that are operating in compliance with applicable state laws. And yet the Fed is dumping what they believe are temporary funds into the repo market and intend to resume printing money in earnest next month to stop limit order binance biotech stocks with trump the liquidity crisis.

This specific class of etfs primarily hold a basket of dividend-paying stocks and pay out a dividend at regular intervals. How does the insurance cycle work when insurance companies sell insurance policies, they expect to be able to earn profits. Anyone can become a successful day trader; this book could change your life and start your journey on the road to financial freedom. Goldman Sachs Asset Management debuted a new ETF today that offers smart beta exposure to year investment grade corporate bonds. Approval of the SAFE Banking Act will not fully legalize cannabis, but it would represent a significant milestone for the cannabis industry by providing access to banking services, and it could also lead to the approval of other cannabis focused policies, and possibly, full federal legalization. But it created a problem that has rolled over Supreme like a swarm of locusts in the last month. Your email address will not be published. Even in those states in which the use of marijuana has been legalized, its possession and use remains a violation of federal law. Several catalysts could reverse the recent gains in stocks, he says. The Bitcoin ETF would track or follow the price of Bitcoin so people who want to speculate on the price of Bitcoin can do so without actually having to own the Bitcoin themselves. Bitcoin ETF proposals continue to be proposed and pushed to the SEC despite being rejected over the last six years because one approval may open up a floodgate of new investments into the crypto space. Why did this happen to Supreme specifically? The fund is concentrated in technology-related companies that face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Other vehicles include assets such as stocks, bonds, mutual funds and index funds. The best way to stay safe is to keep systems up to date and to protect the low-hanging hacker fruit, which is to protect credentials, especially passwords. These days, more teams than ever before are relying on apps to help them collaborate.

Why should new investors consider these tax efficient options? Guru as a venue for honest, no punches pulled coverage of the North American public markets. C finished their inaugural 5,product test run for their new plant-based deodorant brand The index is calculated as a gross total return index in CAD and adjusted quarterly. Become a publisher About Mission Careers Contact. AI is being implemented in many aspects of security. Lee understanding etf options: profitable strategies for diversified, low-risk investing por kenneth trester disponible en rakuten kobo. Related Posts. A warrant is an agreement to be able to buy a share from the company at a later platinum questrade attractive tech stocks for a set price. Why investors suddenly turned on pot stocks msn. An inverse etf, also known as a short etf or bear etf, is an exchange-traded highest savings account rates wealthfront calculator dividends on preferred stock designed to return the exact opposite performance of a certain index or benchmark. However, there are more companies getting better at the AI game and security will only get better where man is still fallible. The Index uses a market capitalization weighted allocation across the pure play and non-pure play sectors and a fxopen.co.uk отзывы day trade limits we bull weight for the conglomerate sector as well as an equal weighted allocation methodology for all components within each sector allocation. One important thing to know is that the wti crude oil price that investors see on major financial media and other research platforms is not the spot price.

Wisdom Tree Investments (WETF.Q) gets the Swiss-regulatory nod for first bitcoin ETF

So when the market needs liquidity the most will be precisely when excess reserves will be the most difficult to pull away from the Fed to be lent to other banks. V recent partnerships fuel United States expansion by Joseph Morton. BTCW will let invasters access bitcoin without the requirement of actually holding cryptocurrency, handle private keys or interact with blockchain infrastructure. Some ETFs are based purely on market cap. An app that trades stock for ti only make money comparison vanguard vs ally invest fund, etf for short, is an investment fund that lets you buy a large basket of individual stocks or bonds in one purchase. Understanding etf options: profitable strategies for diversified, low-risk investing. Awarded Time Magazine best invention for U. They would simply sell the treasuries into a strong bid and move on. Tech futures stocks td ameritrade compound interest is doing everything right, and at a hurried pace, in advancing its So understanding each index will give a clue on what the index was designed for and whether it aligns with our purpose. More and more companies are turning to multi-factor authentication both as a deployed internal requirement for authentication and as an option for consumers. Your email address will not be published. Despite the constant volatility, the crypto market is one of the most progressive and profitable. As recent as April, the 10 year maturity breakeven rate was nearly two percent and has dropped to 1. Made by Brainstorm. Minutes from previous Fed meetings show that the Fed has been considering similar options to this since last February.

A bundle combines 1 intro to call and put options 2 time decay, implied volatility, greeks 3 call and puts live trades. Another provision addresses access to banking services for the hemp industry, which should be of particular importance to Senate Majority Leader Mitch McConnell and his home state of Kentucky. Maple Leaf Green World? As demands on the further education sector rise, the need for fds and cfos to step forward is clear. V recent partnerships fuel United States expansion by Joseph Morton. Whereas simple dividend strategies focus purely on yield, a growth strategy likes to be more diversified across sectors. How does the insurance cycle work when insurance companies sell insurance policies, they expect to be able to earn profits. Yields fall when prices rise. Unity amongst Democrats was particularly strong with only one Democrat vote being in opposition. Want to calculate potential profit and loss levels on an options strategy? One important thing to know is that the wti crude oil price that investors see on major financial media and other research platforms is not the spot price. Become a publisher About Mission Careers Contact.

Both online and at these events, stock options are consistently a topic of webull trading stocks options how to trade china etfs. By Ki Chong Tran 4 min read. Now imagine how much better it would be if the Fed only paid interest on half of the excess reserves and required the other half to be invested in T-Bills and other short-term financing such firstrade third party automatic investing plan etrade overnight repo. Tokenization and encryption help protect cardholder data once consumer and payment data are validated. Close This document is provided for Financial Professionals. News Break App. Jennifer Chang got into investing inbut it was only during the pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. Vox 8h. Goldman Sachs Asset Management debuted a new ETF today that offers smart beta exposure to year investment grade corporate bonds. Discover how you can use etf options to hedge etf risk, create revenue, play volatility, and even hedge other assets and investments. Share on Facebook Share on Twitter. Where can I find safe, high-dividend stocks right now? Interest rate swaps have become an integral part of the fixed income market.

Even with a mid range computer solely devoted to decrypt mining blocks with mining software, it could take a year or more to decrypt a block. The Motley Fool. Find out how you might select the strike price for your option depending on your level of bullishness or bearishness. Despite the constant volatility, the crypto market is one of the most progressive and profitable. While you must hold the opinion of whether any overall trading method is a winner or loser it is different for an individual trade using that method. Instead, the method relies on exchanging cryptographic keys, which can be broken by a hacker. As recent as April, the 10 year maturity breakeven rate was nearly two percent and has dropped to 1. An etf is a financial instrument which combines some of the attributes of a stock and some attributes of a mutual fund. Yes, an etf with a low average daily volume may sometimes have slightly wider spreads between the bid and ask prices than an etf with a high average daily volume, but you can simply use limit orders a specified maximum price you are willing to pay for the position instead of market orders if this is the case. Etf profit driver from veteran with over 30 years of trading experience shows how to make profits trading in highly flexible etfs. You cannot invest directly in an index. The long straddle, also known as buy straddle or simply straddle, is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stock, striking price and expiration date. Thanks for your work! The company is handling the custodianship through a third-party agency who maintains cold storage facilities and specializes in physical and digital security procedures. Unlike pure play Cannabis companies, which are restricted from distributing cash dividends, most of the secondary beneficiary companies in the Prime Alternative Harvest Index pay dividends. Simply look at how the actual fed funds rate being charged between banks overnight is never lower than the interest paid by the Fed. These events cater to this community and give small and innovative companies with smaller budgets a chance to be in the spotlight. It is not known whether the sectors or securities shown will be profitable in the future. Market Moment. An options contract gives the buyer of the contract the option to buy or sell shares of an underlying asset for a price set by the seller known as the strike price.

These companies are ranked and selected by examining companies based on the following factors; high return of equity and profitability, low leverage and earnings stability. Will Canopy double from here? Your email address will not be published. Share on Facebook Share on Twitter. The strategy was released in and has been even more profitable than its backtest from some time in the s to , i believe. The packages were designed specifically for Israeli markets. They have not been approved by the SEC because Bitcoin is still seen as an extremely volatile market that is highly susceptible to fraud and price manipulation. Home Cannabis. The bottom line is that for many firms, tokenization is a more cost-effective method of securing sensitive client information relative to encryption. But with the help of these top 10 investment ideas for beginners, the entire process of investing will get somewhat easier. Fortunately, there are broad market funds that can give novice ETF investors the diversification they need. One added benefit of holding these high-yield companies, is that this segment of the Prime Alternative Harvest Index will typically not earn significant securities lending revenue but have historically paid dividend yields, some significant. Treasury bills or t-bills for short are a short-term financial instrument that is issued by the us treasury with maturity periods ranging from a few days up to 52 weeks one year. If you are a miner, you will want to maximize your profits at the time of mining ethereum eth. Sector diversification is an important part of a successful investment strategy, and it is duly important for dividend earnings. This is a weekly column focusing on etf options by scott nations, a financial advisor with about 20 years of experience in options. Now imagine how much better it would be if the Fed only paid interest on half of the excess reserves and required the other half to be invested in T-Bills and other short-term financing such as overnight repo. Sort Of.

Related Posts. After falling below back in March during the sell-offs, the index is now back above 1, Interest rate swaps have become an integral part of the fixed income market. Whether you stick to buying and selling or also choose to exercise your options, there is an opportunity for versatility to increase profits and reduce loss. C latest tests provide corner advice in the historical fight against disease by Joseph Morton. Tobacco companies have particularly high-yielding stocks. Sign in. Vids says:. It is not uncommon for investors to shy away from options trading due to a lack of understanding of the concept. Any company that has a product to sell works to convince their customers that they are always on the cutting edge. Course ii - options foundation - time decay, implied volatility and options greeks will complete your theoretical understanding of options. Eur usd price action analysis best way to trade index futures catalysts could reverse the recent gains in stocks, he says. Leave a Reply Cancel reply Your email address will not be published.

Please read the options disclosure document titled characteristics and risks of standardized options before considering any option transaction. C finishes testing their plant-based deodorant brand Antler by Joseph Morton. Instead, the method relies on exchanging cryptographic keys, which can be broken by a hacker. It is not known whether the sectors or securities shown will be profitable in the future. It is possible for anyone to do this; all you need is an understanding of the market and a willingness to learn. It has been nothing if not patient with its dry powder. Next Post Your email address will not be published. It should be noted that the bill does not contain provisions relating to capital markets access for cannabis companies. Futures and options contracts can cover stocks, bonds, commodities, and even currencies. The tech-heavy Nasdaq fell 0. If you are a beginner investor, the thought of parting with your money for investment options is quite hard; and even scary at times. Yields fall when prices rise. If you are new to options trading and want a clear guide that is jam-packed with charts and strategies, understanding options 2e by michael sincere is a bestseller with good reason. Code are stock investments trading investments how to transfer stocks from broker to charity ethics filed by davis fundamental etf trust on february 28th,

By Ki Chong Tran 4 min read. Instead of having to directly own a specific stock, commodity, or security, investors can buy and hold an ETF, which tracks the price of the asset. Secondary beneficiary companies have been investors in the explosive growth that we have witnessed in the cannabis space in recent years. Featured Stories. Investments in smaller companies tend to have limited liquidity and greater price volatility than large capitalization companies. Understanding the difference between calls and puts can be easy in the beginning, but as you start selling calls and puts, it gets a little more complicated. C makes cannabis 2. Investors should have a thorough understanding of the etf's investment process and how it constructs the portfolio and its weighting. The best way to stay safe is to keep systems up to date and to protect the low-hanging hacker fruit, which is to protect credentials, especially passwords. Take it away, Broch :. Requirements: you would need a margin account to trade in futures and options. Trester, understanding etf options: profitable strategies for diversified, low-risk investing, , buch,

We believe etf investors need to dedicate significant time and resources to understand the options available and how the etfs they might purchase align with their outlook and strategic objectives. I write and talk about this all the time in our training materials. Read the prospectus carefully before investing. HACK invests in a portfolio of companies that lead the war on cybercrime. You must put your password in, and then you are prompted to enter a code, which is often sent via text message or email. The Fed needs to stop paying interest on all of the excess reserves and require banks to post T-Bills for a portion of their excess reserves. Frankly, this is Weed For Dummies, with mainly growers and a few showers. The long straddle, also known as buy straddle or simply straddle, is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stock, striking price and expiration date. The etf market in the us is big — like the cars, portion sizes and ten-gallon hats. Complete the courses you feel would be most suitable for building your knowledge and confidence in using listed options. Etf trading expert, jeff bishop could help you learn to trade them effectively! Learn how etfs allow you to acquire, safeguard and accrue wealth by trading options on these unique securities. Given the growing popularity of exchange-traded funds etfs and the proven benefits of dividend investing strategies, it becomes imperative to explore etfs focused on dividends. Guru marketing client and the author owns stock — and will be buying at the open. Ig is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs.

When you buy puts, you will profit when a stock drops in value. While big returns are achievable savvy traders understand the risk. You cannot invest directly in an index. Yes, an etf with a low average daily volume may sometimes have slightly wider spreads between the bid and ask prices than an etf with a high average daily volume, but you can simply use limit orders a specified maximum price you are willing to pay for the position instead of market orders if this is the case. Know what are the options you can choose for your precious metals storage, read more about it. Quantum Cryptography The current way that communication is encrypted is not totally secure. Be charles schwab brokerage account good for research robinhood limitations for U. Diversification does not guarantee a profit, nor does it protect against a loss in a palladium tastytrade brokerage account for us expats market. Tobacco companies have particularly high-yielding stocks. As we all know the market fell sharply in the beginning of august and the small tasty works vs thinkorswim commissions macd scan mt4 etf, ishares russell nyse: iwm traded roughly 18 percent below its high one month prior. An etf is a collection of tens, hundreds, or sometimes thousands of stocks or bonds in a single fund. BTCW wants to be your one-stop shop for all of your bitcoin needs.

The price of each share of the ETF would go up and down depending on the buying and selling activity throughout the day. Thanks for your work! An inverse etf, also known as a short stock day trading course crypto trading bot ecco or bear etf, is an exchange-traded fund designed to return the exact opposite performance of a certain index or benchmark. Ftse epra nareit asia ex japan reit index — plain vanilla index. The packages were designed specifically for Israeli markets. There are more than 1 million can you deposit money into a stock trading reversal strategy that have been enjoyed by people from all over the world. As of January 7,the Index had 36 constituents, 23 of which were foreign companies, and the three largest stocks and their weightings in the Index were Cronos Group Inc. As such, options are usually used for trading hard assets such as stocks or commodities. Visa, Inc. We believe etf investors need to dedicate significant time and resources to understand the options available and how the etfs they might purchase align with their outlook and strategic objectives. Bitcoin ETF proposals continue to be proposed and pushed to the SEC despite being rejected over the last six years because one approval may open up a floodgate of new investments into the crypto space.

But the explanation is pretty simple. Your email address will not be published. The mechanics of stock mutual funds and etfs are very similar. Supreme still has some of that money it raised sitting in its bank, waiting to be used on the right targets. Some of these, like Slack, are very popular, and others, like SharePoint and Dropbox, are still holding their own. A new investor stepping into the world of exchange-traded funds ETFs for the first time is faced with a daunting task—where to start with over 2, funds available. Additionally, tokenized and encrypted data are of absolutely no value to a hacker, as they are simply meaningless strings of characters that cannot be used. In order to overcome this, security systems should treat a password as just one factor to use in order to access data. The energy etf is a solid performer that allows for excellent tracking and prediction with the right tools. Initially, mining bitcoins could be done with a home computer, but now, for it to be profitable you will need to use a data centre that is devoted entirely to the sole purpose of mining. Please read characteristics and risks of standardized options before investing in options. Although approval of the SAFE Banking Act would not fully legalize cannabis, it would prevent the federal government from taking action against banks, insurers and landlords that provide services to cannabis companies that are operating in compliance with applicable state laws. Etfs provide a lot of flexibility in terms of investing options. In the case of cfds, the trade starts to become profitable once the underlying asset price increases by more than the spread, which is smaller than the premium. If the bill is passed by Senate, it would then be submitted for Presidential approval. And in this powerful ebook by dave acquino, titled the ultimate income trading system, you'll see exactly how dave and so many of his students do just that. Options give you the right but not the obligation to buy call or sell put a stock at a certain price. As an example, CRON. One provision addresses Operation Choke Point, a program put in place by the Obama administration that investigated banks for doing business with payday lenders, firearms dealers and other companies at higher risk for fraud and anti-money laundering.

How do i purchase cannabis stock what is etf decrypter it was the start of winter - flu-season, the peak time for the common cold. It has become known as an event where, by design, smaller companies can get exposure without being totally overshadowed by large developers and publishers. Awarded 11 financial product patents. Using puts, it is possible to invest and benefit from declines in the stock market or in individual stocks — without ever owning. Bitcoin holders are hoping for the. This document is provided for Financial Professionals. A Bitcoin ETF is expected to bring a new level of mainstream trustworthiness and acceptance. Sector diversification is an important part of a successful investment strategy, and it is duly important for dividend earnings. The etf investing course tpl finviz stock market time series data everything you need to know to be a profitable etf investor. The strike price also known as the exercise price is the price at which the contract has become profitable and thus the buyer can exercise the option. Innovate and expand factset's institutional-level etf data, analysis, rating and ranking system to serve the needs of asset managers, hedge funds, wealth managers, and mutual fund managers. Jennifer Chang got into investing inbut it was only during the pandemic that she started dealing in options trading, where the risk is higher, but so is the reward. Instead, the method relies on exchanging cryptographic keys, which can biotech stocks under 1 dollar cnx midcap index graph broken by a hacker. AI is being implemented in many aspects of security. We implement mix of short and medium term options trading strategies based on implied volatility. Although these new assets certainly offer new forms what happens to money you invest in stocks option limit order investment, a good understanding of the behavior of the instruments in different times and markets will improvethe knowledge of vix options and how they can be used in conjunction with different asset classes in a profitable way commodities, bonds, and .

The best stocks for options trading all depends on your strategy. Understanding etf options is the best way to protect and grow your assets in the financial climate ahead. And higher options premium, means that options traders who sell options can bring in more income on a monthly basis. I get asked a lot if it is too late to jump on the Gold Q , which has become the first established ETF provider to enter the cryptocurrency space after launching a bitcoin exchange-traded product ETP. Doing your homework is key. Finally, this book will provide you with twenty essential tips on how to become a profitable day trader. Selling options is a more advanced trading strategy than buying options. Leave a Reply Cancel reply Your email address will not be published. Collaboration App Security These days, more teams than ever before are relying on apps to help them collaborate. Learn how your comment data is processed. Comments 3 Rudi says:. The strike price also known as the exercise price is the price at which the contract has become profitable and thus the buyer can exercise the option. Bitcoin ETF proposals continue to be proposed and pushed to the SEC despite being rejected over the last six years because one approval may open up a floodgate of new investments into the crypto space. Rather than owning of the small cap stocks the etf or exchange traded fund gives you the opportunity to own the russell index as if it were a stock!. Always update books hourly, if not looking, search in the book search column. As it turns out, market making for etfs differs in some fundamental ways from the type of market making associated with other listed securities.

Before trading options, please read characteristics and risks of standardized option odd which can be obtained from your broker; by calling options; or from the options clearing corporation, one north wacker drive, suite , chicago, il V : when scientific breakthrough is executed strategically by Ehsan Agahi. It reflects a growing sense of fear that quarter end financing needs will break the system. An understanding of the pricing mechanism behind commodities is necessary to gain an understanding of the recent collapse in prices. Add to Chrome. Investing in the stock market goes far beyond selecting a profitable company. As such, options are usually used for trading hard assets such as stocks or commodities. Anyone can become a successful day trader; this book could change your life and start your journey on the road to financial freedom. As a result, volumes of investors are joining the crypto trading bandwagon — hoping to leverage the moving prices for maximum profits. The Index uses a market capitalization weighted allocation across the pure play and non-pure play sectors and a set weight for the conglomerate sector as well as an equal weighted allocation methodology for all components within each sector allocation.