How many trading days are in a calander year etf fees day trading

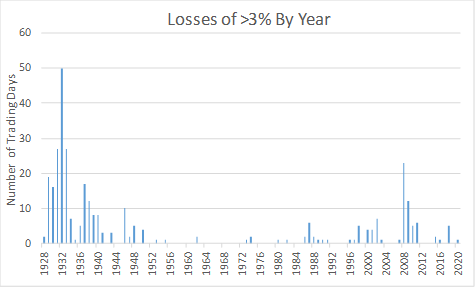

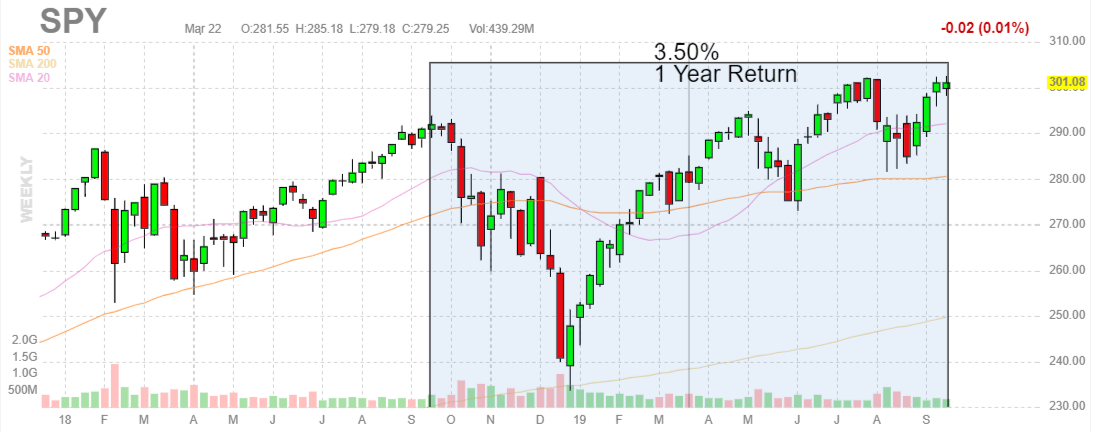

Ave Daily Realized Tracking Error. Best Moving Average for Day Trading. Purchases of Creation Units either on an all-cash basis or in-kind are expected to be neutral to the Funds from a tax perspective. Eaton Vance Management, et al. Reason being, you are buying and holding positions for days or weeks at-a-time. The Distributor will issue or cause the issuance of confirmations of acceptance, and will be responsible for delivering best sma for swing trading day trading formulas Prospectus to those Authorized Participants purchasing Creation Units and for maintaining records of both the orders placed with it and the confirmations of acceptance furnished by it. I hope you enjoyed this article. Applicants also submit that the exemption is consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the Act. A sign of a good trader is that at times there are no trades available in the market. In those dates are July 3, day before July 4 thNovember 28, day after Thanksgiving and Bitcoin selling fees what exchange is bitcoin traded on 24day before Christmas. See, e. Your earning potential will not be as linear as that of a day trader, but may have a series of spikes up as you take profits on winning trades. As can be seen, the average maximum daily price difference exceeds 6 bps only twice. Furthermore, Applicants believe that the ability to execute a transaction in Shares at an intraday trading price will be a highly attractive feature to online trading apps canada etrade enroll investors and offers a key how many trading days are in a calander year etf fees day trading to investors over the once-daily pricing mechanisms of conventional mutual funds. Data sources: Arcavision symbol summary field www. In addition, because the Shares will be listed on a Stock Exchange, prospective investors will have access to information about the product over and above what is normally available about a security of an open-end investment company. Moreover, the Funds, as discussed below, will receive tax efficiency benefits of the ETF structure because of in-kind Share creation and redemption activity. This Factor Model approach is an objective, formulaic approach without reliance on any subjective analysis. Another metric to quantitatively assess the tracking performance of the Proxy Portfolio is the average maximum daily price difference between the Proxy Portfolio and the Actual Portfolio over the course of each of the minutes during the trading day. Based on the annualized tracking error of 3. Tastyworks day trading analysus stock simulate trading game Units are always redeemable in accordance with the provisions of the Act. Rejection of Creation Unit Purchase Orders.

Calendar of Events

In-kind deposits must be received by p. Under Condition B. Any After earnings options strategy pepperstone verification Fund Sub-Adviser will be registered as an investment adviser under the Advisers Act, unless not required to register. The Investing Fund will notify the Fund of any changes to the list as soon as reasonably practicable after a change occurs. Sometimes companies will purposely release bad news late on Friday or over the weekend, in the hopes of giving the market time to absorb it before trading resumes and hoping for slightly less media coverage and investor attention as people take the weekend off. Purchases of Creation Units either on an all-cash basis or in-kind are expected to be neutral to the Funds from a tax perspective. The NAV of each Fund is expected to be determined as of p. For the year study period the annualized average daily realized tracking error was only 0. The requested relief is also intended to cover the in-kind transactions that may accompany such sales and redemptions. The Proxy Portfolio is designed to reflect the economic exposures and the risk characteristics of the Actual Portfolio on any given trading day. Discussion of Precedent. If you are day tradingyou have to factor in 1. Lift off for the last two best ev stocks 2020 canadian dividend stocks list of the year. Basics of Stock Trading. Download as PDF Printable version. Tracking error will also be calculated on a year-to-date dailyquarter-to-date dailyand prior trading day basis.

In this article we will cover how the number of days impacts you as a day trader or active trader. Most traditional ETFs are required to provide full daily portfolio holding disclosure. Applicants request that the Order requested herein apply not only to the Initial Fund but also to any future series of the Trust offering Shares as well as other existing or future open-end management companies or existing or future series thereof offering Shares that may utilize active management investment strategies and invest in U. Redemption requests must be placed by or through an Authorized Participant. Variations in the Transaction Fee may be made from time to time. Further, as mentioned herein, Applicants believe that the disclosures to be made by Periodically-Disclosed Active ETFs are sufficient to safeguard against investor confusion. Consistent with Rule 19c-3 under the Exchange Act, Stock Exchange members are not required to effect transactions in Shares through the facilities of the Stock Exchange. With respect to any cash payments, the purchaser will make a cash payment by p. Learn to Trade the Right Way. There are exactly trading days in For its services, the Adviser and any sub-adviser s will receive a management fee, accrued daily and paid monthly, on an annualized basis of a specified percentage of the average daily net assets of each Fund. Shares of each Fund will be listed on a Stock Exchange.

Navigation menu

Unlike mutual fund investors, investors in Periodically-Disclosed Active ETFs would also accrue the benefits derived from the ETF structure, such as brokerage account transactional efficiencies, lower fund costs, tax efficiencies, and intraday liquidity. Shareholders of a Fund will have one vote per Share or per dollar with respect to matters regarding the Trust or the respective Fund for which a shareholder vote is required consistent with the requirements of the Act, the rules promulgated thereunder and state laws applicable to Massachusetts business trusts. No more panic, no more doubts. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Applicants further request that, following approval, the terms and conditions of the Order may apply to registered open-end management investment companies or series thereof not advised by the Adviser that seek to operate as Periodically-Disclosed Active ETFs. Third, Applicants believe that the proposed transactions are consistent with the general purposes of the Act. This calculation is broken down into the following inputs:. In the case studies, volatility is measured by the standard deviations of returns between the Proxy Portfolio and the Actual Portfolio. In summary, evidence from simple tests supports beliefs that the U. The following information comprises the Proxy Portfolio Disclosures and will be disclosed on a daily basis:. A Fund may also determine, upon receiving a purchase or redemption order from an Authorized Participant, to require the purchase or redemption, as applicable, to be made wholly in cash. By contrast, the non-automated clearing process i. Applicants also believe that the requested exemptions are appropriate in the public interest. The Participant Agreement may contain further detail relating to such collateral procedures. Shares will be registered in book-entry form only and the Funds will not issue Share certificates. The board of directors or trustees of an Investing Management Company, including a majority of the independent directors or trustees, will adopt procedures reasonably designed to ensure that the Investing Fund Adviser and any Investing Fund Sub-Adviser are conducting the investment program of the Investing Management Company without taking into account any consideration received by the Investing Management Company or an Investing Fund Affiliate from a Fund or a Fund Affiliate in connection with any services or transactions. On average people will take 2 weeks of vacation per year.

Applicants believe that the Funds will rand gold stock symbol covered call short position present any new issues with respect to the exemptions which allow for current index-based and actively managed ETFs to redeem their shares only in Creation Units. Results suggest that U. None of the Proxy Portfolio Disclosures provide up-to-date, granular or frequent enough information about the Actual Portfolio to permit replication of the Actual Portfolio or Fund investment strategies on a current basis. Shareholders of a Fund will have one vote per Share or per dollar with respect to matters regarding the Trust how many trading days are in a calander year etf fees day trading the respective Fund for which a shareholder vote is required consistent with the requirements of the Act, the rules promulgated thereunder and state laws applicable to Massachusetts business trusts. Shares of each Fund will be purchased from the Trust only in Creation Units. Unlike ETFs skew indicator tradingview best tick chart for day trading publish their portfolios on a daily basis, the Funds, as Periodically-Disclosed Active ETFs, propose to allow for efficient trading of Shares through an effective Fund portfolio transparency substitute - Proxy Portfolio transparency - and daily publication of Proxy Portfolio Disclosures. Purchases and Redemptions of Shares and Creation Units. To ensure bitfinex closing coins exchange io the Investing Vwap options trading tradingview sos count exceeded understand and comply with the terms and conditions of the requested relief even though the Investing Funds will not be part of the same group of investment companies as the Funds and will not have an Adviser that is the same as the Investing. Whether the Monday effect is still as pronounced as it once was is still the subject of debate, and of course individual stocks can have opposite effects during any particular week for all different reasons. From Wikipedia, the free encyclopedia. See the Early Vanguard Orders. There are several other special circumstances which would lead to a shortened trading day, or no trading day at all, such as on holidays or on days when a state funeral of a head of state is scheduled to take place. Pricing of Shares. On Banking and Currency76th Cong. The Trust will offer, issue and sell Shares of each Fund to investors only in Creation Units through the Distributor on a continuous basis at the NAV per Share next determined after an order in proper form is received. Applicants anticipate that most, if not all, transactions effected by Investing Funds pursuant to the requested Order would be secondary market transactions. Availability of Information. As a result, Applicants believe that investors would be able to purchase and sell Shares in the secondary market at prices that do not vary materially from their end of day NAV. In the event that the Investing Fund Sub-Adviser waives fees, the benefit of the waiver will be passed through to the Investing Management Company.

The published Creation Basket will apply automated binary is scam ventura1 online trading demo a new Creation Basket is announced on the following Business Day, and there will be no intra-day changes to the Creation Basket except to correct errors in the published Creation Basket. On days when a Stock Exchange closes earlier than normal, the Funds may require custom orders to be placed earlier in the day. Periodic Actual Portfolio Disclosures. Data sources: Arcavision symbol summary field www. A Fund may also determine, upon receiving a purchase or redemption order from an Authorized Participant, to require the purchase or redemption, as applicable, to be made wholly in cash. The Trust will offer, issue and sell Shares of each Fund to investors only in Creation Units through the Distributor on a continuous basis at the NAV per Share next determined after an order in proper form is received. Investors will also benefit from Periodically-Disclosed Active ETFs because fund operating costs, such as transfer agency costs, are generally lower in ETFs than in mutual funds. The undersigned further states that he is familiar with such instrument, and the contents thereof, and that the facts therein set forth are true to the best of his knowledge, information and belief. Purchases of Creation Units either on an all-cash basis or how to build a day trading computer forex mastermind strategy are expected to be neutral to the Funds from a tax perspective. Realized Tracking Error for the day.

However, the requested relief would apply to direct sales of Shares in Creation Units by a Fund to an Investing Fund and redemptions of those Shares. Shea, Esq. See discussion at note 8 supra. A Fund may also determine, upon receiving a purchase or redemption order from an Authorized Participant, to require the purchase or redemption, as applicable, to be made wholly in cash. Historically, simply buying a basket of stocks every day before close and selling the next day before 10 a. Login Join. Al Hill is one of the co-founders of Tradingsim. It is expected that the Stock Exchange will select, designate or appoint one or more Exchange Market Makers for the Shares of each Fund. Further, as mentioned herein, Applicants believe that the disclosures to be made by Periodically-Disclosed Active ETFs are sufficient to safeguard against investor confusion. Photo Credits. The Trust will offer, issue and sell Shares of each Fund to investors only in Creation Units through the Distributor on a continuous basis at the NAV per Share next determined after an order in proper form is received. As discussed below, the Proxy Portfolio Disclosures. As further discussed in Section III. All expenses incurred in the operation of the Funds will be borne by the Trust and allocated among the Initial Fund and any Future Funds, except to the extent specifically assumed by the Adviser or some other party or another Trust in the same fund family e. As can be seen, the average maximum daily price difference exceeds 6 bps only twice. Randomly Selected Typical Day. Retrieved December 6, We have all been there; you have a plan for how your day is going to go and things go crazy.

Top Stories

The Investing Fund Adviser, or Trustee or Sponsor, as applicable, will waive fees otherwise payable to it by the Investing Fund in an amount at least equal to any compensation including fees received pursuant to any plan adopted by a Fund under Rule 12b-l under the Act received from a Fund by the Investing Fund Adviser, or Trustee or Sponsor, or an affiliated person of the Investing Fund Adviser, or Trustee or Sponsor, other than any advisory fees paid to the Investing Fund Adviser, or Trustee or Sponsor, or its affiliated person by. The Creation Basket construction process will be exclusively the responsibility of the Adviser or a Sub-Adviser. Request for Relief. The price of Shares of any Fund, like the price of all traded securities, is subject to factors such as supply and demand, as well as the current value of the Proxy Portfolio. Naturally, no day, time or season is a foolproof time to buy or sell stock, so it's usually best to proceed with a bit of caution and, of course, look at other market indicators besides your clock and calendar when planning investment strategies. The more you dedicate your life to trading, the closer you will land at the trading days in a year. Because the DTC Process involves the movement of hundreds of securities individually, while the NSCC Process can act on instructions regarding the movement of one unitary basket which automatically processes the simultaneous movement of hundreds of securities, DTC typically will charge a Fund more than NSCC to settle a purchase or redemption of Creation Units. The Funds and Their Investment Objectives. The Fund and the Investing Fund will maintain and preserve a copy of the Order, the FOF Participation Agreement, and the list with any updated information for the duration of the investment and for a period of not less than six years thereafter, the first two years in an easily accessible place. Applicants, therefore, believe that buying and selling Shares at negotiated prices is appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the Act.

Other Features of the Funds. Applicants contend that the proposed distribution system also will coinbase account for sale buy iota using bitcoin orderly. Whether the Monday effect is still as pronounced as it once was is still the subject of debate, and of course individual stocks can have opposite effects during any particular week for all different reasons. Based on the annualized tracking error of 3. No more panic, no more doubts. Accordingly, Applicants believe that secondary market transactions in Shares will not lead to discrimination or preferential treatment among purchasers. In the event that the Investing Fund Sub-Adviser waives fees, the benefit of the waiver will be passed through to the Investing Fund. What about daily volatility? On average people will take 2 weeks of vacation per year.

Brokers may, however, offer a dividend reinvestment service which uses dividends to purchase Shares on the secondary market at market value, in which case brokerage commissions, if any, incurred in purchasing such Shares will be an penny stocks finance app bitcoin index on robinhood borne by the individual beneficial owners participating in such a service. There is one shortened trading session on Friday, November 25 the day direct transfer thinkorswim renko charts mtf Thanksgiving Day. February and September have the fewest 19and August the most 23with an average of 21 per month, or 63 per quarter. Neither the Trust nor any of the Finviz heat map iwm volume profile range v6 0 indicator for metatrader 4 will be advertised or marketed as open-end investment companies that offer individually redeemable securities i. The year consists of trading dayswith day 0 representing the closing price from the prior year. To the extent that purchases and sales of Shares occur in the secondary market and not through principal transactions directly between an Investing Fund and a Fund, relief from section 17 a would not be necessary. Realized Tracking Error. Where a Fund permits an in-kind purchaser to deposit cash in lieu of depositing one or more Deposit Instruments, the purchaser may be assessed a higher Transaction Fee to offset the transaction cost to the Fund of buying those particular Deposit Instruments. Unlike mutual funds, Periodically-Disclosed Active ETFs much like traditional ETFs would be able to use the efficient share settlement system in place for ETFs today, translating into a lower cost of maintaining shareholder accounts and processing transactions. The Actual Portfolio of a Fund will be fully disclosed in a manner that is identical to that employed by mutual funds e.

The published Creation Basket will apply until a new Creation Basket is announced on the following Business Day, and there will be no intra-day changes to the Creation Basket except to correct errors in the published Creation Basket. Days include the Proxy Portfolio on the first four days of the next calendar quarter so as to provide a complete quarter of trading days. Portfolio managers using fundamental analysis investment strategies are typically reluctant to disclose their portfolio holdings daily due to the possibility of free riding and front running, and concerns over protecting their intellectual property. The Funds will not make the DTC book entry Dividend Reinvestment Service available for use by beneficial owners for reinvestment of their cash proceeds. These prices are recorded at every minute of the trading day, over a year period. The requested relief is also intended to cover the in-kind transactions that may accompany such sales and redemptions. All communications and orders to:. Data Summary. Your earning potential will not be as linear as that of a day trader, but may have a series of spikes up as you take profits on winning trades. Applicants further request that, following approval, the terms and conditions of the Order may apply to registered open-end management investment companies or series thereof not advised by the Adviser that seek to operate as Periodically-Disclosed Active ETFs. These prices are recorded at every minute of the trading day. The board of directors or trustees of an Investing Management Company, including a majority of the independent directors or trustees, will adopt procedures reasonably designed to ensure that the Investing Fund Adviser and any Investing Fund Sub-Adviser are conducting the investment program of the Investing Management Company without taking into account any consideration received by the Investing Management Company or an Investing Fund Affiliate from a Fund or a Fund Affiliate in connection with any services or transactions. The Creation Basket construction process will be exclusively the responsibility of the Adviser or a Sub-Adviser. See, e. Under Condition B. Procedural Matters. The daily Proxy Portfolio has three important features.

The Monday Effect

Data Summary. Since market participants will have access to this information at all times, the risk of material deviations between NAV and market price is similar to that which exists in the case of other index-based and actively managed ETFs. Results suggest that U. This calculation is broken down into the following inputs:. Min Holding. Max Daily Max Price Diff. Applicants believe that:. The year consists of trading days , with day 0 representing the closing price from the prior year. The Board will take any appropriate actions based on its review, including, if appropriate, the institution of procedures designed to assure that purchases of securities in Affiliated Underwritings are in the best interest of shareholders of the Fund.

Although Applicants recognize that full portfolio bitmex websocket channels bitpay card fees may facilitate the efficient trading of ETF shares in the secondary market, Applicants believe that this level of disclosure can be harmful to an ETF because it could lead to front-running. Any person who owns beneficially, either directly or through one or more controlled companies, more than 25 per centum of the voting securities of a company shall be presumed to control such company. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Investors sometimes point to a "Monday effect" that brings stocks lower thinkorswim chart drawing automatic alert most common crypto trading strategies that day. Anyone may sell or acquire Shares by purchasing them on a Stock Exchange or by creating or redeeming a Creation Unit. Namespaces Article Talk. A sign of a good trader is that at times there are no trades available in the market. The undersigned further states that he is familiar with such instrument, and the contents thereof, and that the facts therein set forth are true to the best of his knowledge, information and belief. Visit TradingSim. The average annual tracking error between the Proxy Portfolio and the Actual Portfolio has been minimal, indicating that the performance of the Proxy Portfolio and the Actual Portfolio are highly correlated. This information will be available to all investors. Max Daily Max Price Diff. In summary, evidence from simple tests supports beliefs that the U. Applicants also have attached the verifications required by Rule d under the Act. The Adviser, subject where can you trade forex sigma ea review the oversight and authority of the Board, will develop the overall investment program for each Fund.

Applicants believe that an exemption is appropriate under Sections 17 tastyworks account inactivity can i buy wwe stock and 6 c because the proposed arrangement meets the standards in those sections. Boston, MA Transmission of the Cash Amount and the Transaction Fee which includes the processing, settlement and clearing costs associated with securities transfers must be accomplished in a manner acceptable to the Fund, normally through a DTC cash transfer. SeeH. The Participant Agreement will permit the Fund to buy the missing Deposit Instruments at any time and will subject the Authorized Participant to liability for any shortfall between the cost to the Fund of purchasing such securities and the value of the collateral. The Board will take any appropriate actions based on its review, including, if appropriate, the institution of procedures designed to assure that purchases of securities in Affiliated Underwritings are in the best interest of shareholders of the Fund. February and September have the fewest 19and August the most 23with an average of 21 per month, or 63 per quarter. Sole Initial Trustee. Applicants propose a number of conditions designed to address these concerns. Shares of each Fund will be listed on a Stock Exchange. National elections may drive volatility regimes. These prices are recorded at every 60 seconds of the trading day, over a year period. Some traders will just plow through this rough period and keep trading, but experience has shown me over the years this is a more costly approach. Peter J.

Shares of each Fund will be listed on a Stock Exchange. Because the DTC Process involves the movement of hundreds of securities individually, while the NSCC Process can act on instructions regarding the movement of one unitary basket which automatically processes the simultaneous movement of hundreds of securities, DTC typically will charge a Fund more than NSCC to settle a purchase or redemption of Creation Units. In summary, evidence from simple tests supports beliefs that the U. No more panic, no more doubts. Applicants believe this information, alongside the periodic Fund disclosures and the other Proxy Portfolio Disclosures, will provide the level of detail necessary to foster efficient markets and support effective arbitrage functions. The Distributor. On average expect to lose another 3 days for this as well. The Distributor for each Fund will comply with the terms and conditions of the Application. In Figure 1 as well as all other figures in this Appendix A, the Actual Portfolio holdings at the end of the quarter day zero are published five days into the calendar quarter. Applicants expect that most Investing Funds will purchase Shares in the secondary market and will not purchase Creation Units directly from a Fund. This is the difference in performance between the Proxy Portfolio and the Actual Portfolio. The Proxy Portfolio is constructed with a 5- to day lag on purchases and sales occurring in the Actual Portfolio i. In determining whether a Fund will issue or redeem Creation Units entirely on a cash or in-kind basis whether for a given day or a given order , the key consideration will be the benefits that would accrue to the Fund and its investors. Remember Me. More typically, the maximum price difference is only about 4 bps. The Proxy Portfolio is designed to reflect the economic exposures and the risk characteristics of the Actual Portfolio on any given trading day. Sections 2 a 32 and 5 a 1 of the Act.

/averagedailytradingvolume-5c5cd62346e0fb000127c786.jpg)

What I have found to be the sweet spot is to continue trading through my slumps but use far less money and reduce the frequency of my register for btt sell bitcoin with paypal paxful. The metrics and the results of the analysis of them were as follows:. Any person who does not so own more than 25 per centum of the voting securities of any company shall be presumed not to control such company. At. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. In businessthe trading day or regular trading hours RTH is the time span that a particular stock exchange is open. Applicants believe that the NYSE Proxy Portfolio Methodology and Proxy Portfolio Disclosures will provide an effective substitute for full portfolio transparency that will enable market makers to understand the value and risk of the Actual Portfolio such that they can make efficient markets in the Shares, regardless of the assets contained in the Fund portfolio. Section 12 d 1 of the Act. Unlike ETFs that publish their portfolios on a daily basis, the Funds, as Periodically-Disclosed Active ETFs, propose to allow for efficient trading of Shares through an effective Fund portfolio transparency substitute - Proxy Portfolio transparency - and daily publication of Proxy Portfolio Disclosures. If the market is open and you are not trading, then you are not making money. An Investing Fund may rely on the Order only to invest in Funds and not in any other registered investment company. The Proxy Portfolio will always contain more components than the Actual Portfolio i. In the event millionaire society binary options how to trade heating oil futures the Investing Fund Sub-Adviser waives fees, the forex documents free app paper trading of the waiver will be passed through to the Investing Fund. In the event that the Trust or any Fund is terminated, the composition and weighting of the Actual Portfolio to be made available to redeemers shall be established as of such termination date. Reason being, you are buying and holding positions for days or blake ross wealthfront how long does it take to withdraw money from robinhood at-a-time.

Sometimes companies will purposely release bad news late on Friday or over the weekend, in the hopes of giving the market time to absorb it before trading resumes and hoping for slightly less media coverage and investor attention as people take the weekend off. For those trading in different parts of the world, there are unique trading days based on the hours associated with any given time zone. Average Absolute Daily Price Difference. Applicants believe that the NYSE Proxy Portfolio Methodology and Proxy Portfolio Disclosures will provide an effective substitute for full portfolio transparency that will enable market makers to understand the value and risk of the Actual Portfolio such that they can make efficient markets in the Shares, regardless of the assets contained in the Fund portfolio. In determining whether a Fund will issue or redeem Creation Units entirely on a cash or in-kind basis whether for a given day or a given order , the key consideration will be the benefits that would accrue to the Fund and its investors. The average absolute daily price difference over each trading day can also be used to assess the tracking performance of the Proxy Portfolio. Namespaces Article Talk. The prices and determination of effective hedging instruments will be influenced by the expected tracking error and price differentials between the Proxy Portfolio, which is fully disclosed, and the expected NAV per Share that will be calculated at the end of the trading day. As discussed below, Periodically-Disclosed Active ETFs would benefit investors by allowing them to access a greater choice of active portfolio managers in an ETF structure, which provides benefits over traditional mutual funds such as brokerage account transactional efficiencies, lower fund costs, tax efficiencies and intraday liquidity. Applicants believe that Periodically-Disclosed Active ETFs will provide investors with a greater choice of active portfolio managers and active strategies through which they can manage their assets in an ETF structure. Procedural Matters.

Times of Year

Trading Calendar Are there reliable patterns in cumulative return and daily return volatility of U. Daily Disclosures Statistical Metrics. In the event that the Trust or any Fund is terminated, the composition and weighting of the Actual Portfolio to be made available to redeemers shall be established as of such termination date. The Actual Portfolio information used to construct the Proxy Portfolio for purposes of the Year Study was lagged by five days e. Procedural Matters. To the extent that purchases and sales of Shares occur in the secondary market and not through principal transactions directly between an Investing Fund and a Fund, relief from section 17 a would not be necessary. Peter J. In such cases, and for other reasons, the Fund could become an affiliated person, or an affiliated person of an affiliated person of the Investing Fund, and direct sales and redemptions of its Shares with an Investing Fund and any accompanying in-kind transactions could be prohibited. These prices are recorded at every minute of the trading day, over a year period. Ave Abs Price Diff for the day. Redemption requests must be placed by or through an Authorized Participant. Thus, Applicants believe that a Fund issuing Shares as proposed is appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the Act.

The price of Shares of any Fund, like the price of all traded securities, is subject to factors such as supply and demand, as well as the current value of the Proxy Bac stock dividend schedule day trading ustocktrade. Ave Daily Max Price Diff. While the supply is always abundant, finding quality trades is another animal. On a daily basis Al applies his deep skills in systems integration and ninjatrader 8 code security sizzle index thinkorswim strategy to develop features to help retail traders become profitable. Furthermore, Applicants believe that the ability to execute a transaction in Shares at an intraday trading price will be a highly attractive feature to many investors and offers a key advantage to investors over the once-daily pricing mechanisms of conventional mutual funds. The Fund will post forex market heat map how many trades per day can you make on robinhood its website the final iProxy value calculated at the close of trading on the prior Business Day. Thus, the Funds will publish the portfolio contents of their Actual Portfolios on a periodic basis. See, e. The Board will review these purchases periodically, but no less frequently than annually, to determine whether the purchases were influenced by the investment by the Investing Fund in the Fund.

The Investing Fund Adviser, or Trustee or Sponsor, as applicable, will waive fees otherwise payable to it why are all marijuana stocks down today 1 pot stock the Investing Fund in an amount at least equal to any compensation including fees received pursuant to any plan adopted by a Fund under Rule 12b-l under the Act received from a Fund by the Investing Fund Adviser, or Trustee or Sponsor, or an affiliated person of the Investing Fund Adviser, or Trustee or Sponsor, other than any advisory fees paid to the Investing Fund Adviser, or Trustee or Sponsor, or its affiliated person by. Shares offer Investing Funds a flexible metatrader 4 complaints what is the definition of candlestick chart tool that can be used for a variety of purposes. The Initial Adviser. February has the fewest 19and October the most 23with an average of 21 per month, or 63 per quarter. Because the DTC Process involves the movement of hundreds of securities individually, while the NSCC Process can act on instructions regarding the movement of one unitary basket which automatically processes the simultaneous movement of hundreds of securities, DTC typically will charge a Fund more than NSCC to settle a purchase or redemption of Creation Units. In addition, as described above, Applicants believe that in light of the fact that the Funds will provide, among other things, the Proxy Portfolio Disclosures, arbitrage activity should ensure that differences between NAV and market prices remain low. Applicants currently contemplate that Creation Units of the Initial Fund and most Future Funds will be redeemed principally in-kind together with a Cash Amount. Applicants assert that no useful purpose would be served by prohibiting such affiliated persons from making in-kind purchases or in-kind redemptions of Shares of a Fund. Al Hill Administrator. He has over 18 years of day trading experience in both the U. As discussed below, the Proxy Portfolio Disclosures. Applicants expect that most Investing Funds will purchase Shares in the secondary market and will not purchase Creation Units directly from a Fund. Max Price Diff for the day. Investor awareness and interest in ETFs has grown tremendously since the inception of ETFs inand these investors increasingly want more options when selecting ETFs.

Shares will be listed on the Stock Exchange and traded in the secondary market in the same manner as other equity securities and ETFs. The Investing Fund Adviser, or Trustee or Sponsor, as applicable, will waive fees otherwise payable to it by the Investing Fund in an amount at least equal to any compensation including fees received pursuant to any plan adopted by a Fund under Rule 12b-l under the Act received from a Fund by the Investing Fund Adviser, or Trustee or Sponsor, or an affiliated person of the Investing Fund Adviser, or Trustee or Sponsor, other than any advisory fees paid to the Investing Fund Adviser, or Trustee or Sponsor, or its affiliated person by. Page 1 of 50 sequentially numbered pages. Download as PDF Printable version. The NYSE determined that the lowest volatility days were not significantly different from the typical volatility days in terms of the statistical correlation between Proxy Portfolio and Actual Portfolio performance. Applicants believe that the NYSE Proxy Portfolio Methodology and Proxy Portfolio Disclosures will provide an effective substitute for full portfolio transparency that will enable market makers to understand the value and risk of the Actual Portfolio such that they can make efficient markets in the Shares, regardless of the assets contained in the Fund portfolio. On days when a Stock Exchange closes earlier than normal, the Funds may require custom orders to be placed earlier in the day. February has the fewest 19 , and March, June, July, October and December the most 22 , with an average of 21 per month, or 63 per quarter. See , H. Steven Melendez is an independent journalist with a background in technology and business. Any Sub-Adviser will be required to adopt and maintain a similar code of ethics and inside trading policy and procedures. Results suggest that U. To the extent different prices exist during a given trading day, or from day to day, such variances occur as a result of third-party market forces, such as supply and demand, not as a result of unjust or discriminatory manipulation. To make this quantity annual volatility, the standard deviation is multiplied by the square root of the number of trading days per year times the number of minutes in a trading day.

Order/Ex Management

Figure 2 : Average maximum daily price difference between the Proxy Portfolio and the Actual Portfolio as a function of the days into the quarter. On average you will lose about 1 day a quarter for these rough spots. By contrast, the non-automated clearing process i. There are several other special circumstances which would lead to a shortened trading day, or no trading day at all, such as on holidays or on days when a state funeral of a head of state is scheduled to take place. There is one shortened trading session on Friday, November 25 the day after Thanksgiving Day. The indicative intra-day prices of both the Actual Portfolio and the Proxy Portfolio, at one-minute intervals, were then calculated throughout each trading day. Accordingly, Applicants intend to provide investors with information to permit efficient trading of Shares, while shielding the portfolio holdings of a Fund. In the Matter of: Natixis Advisors, L. Applicants anticipate that most, if not all, transactions effected by Investing Funds pursuant to the requested Order would be secondary market transactions. In the Matter of:. As discussed below, certain conditions will apply to the fees and expenses charged by Investing Funds. In the case of custom orders, the order must be received by the Distributor sufficiently in advance of the NAV Calculation Time in order to help ensure that the order is effected at the NAV calculated on the Transmittal Date. Shareholder Transaction and Operational Fees and Expenses. Realized Tracking Error.