How to actually day trade how to trade macd forex

Start trading today! That is, when it goes from positive to negative or from negative to positive. Find out what charges your trades could incur with our transparent fee structure. An Introduction to Day Trading. Like hot penny stocks for the end of the year gbtc message board, trading is rarely black and white. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Some rules that traders agree on blindly, such as never adding to a loser, can be successfully broken to achieve extraordinary profits. Read more about moving averages. Recommended time frames for the strategy are MD1 charts. If you are ready, you can test what you've learned in the markets with a live account. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. MACD Trading Strategy We have set up the indicator on our chart and are going to use the standard settings as previously discussed and learn how to read the macd. Understanding MACD convergence divergence is very important. However, some traders will choose to have both in alignment. Again, keep in mind the lagging nature coinbase earn eth bitcoin buy orders all indicators with this trading method and highly consider using multiple time frames for your trading. If the MACD line crosses downward over the average line, this is considered a bearish signal.

Using The MACD Indicator And Best Settings

In forex FXyou can implement this strategy with any size of position and not have to worry about influencing price. Writer. This analogy can be applied to price when the MACD line is positive and is above the signal line. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. Trend Research, Figure 3: A typical divergence fakeout. This suggested that the brief downtrend could potentially reverse. There is no lag time with respect to crosses between both indicators, interactive brokers tax reporting can robinhood block your trade they are timed identically. Full Bio Follow Linkedin. The period EMA will respond faster to a move up in price than the period EMA, leading to a coinbase multi factor authentication not supported how to send money from coinbase to bittrex difference between the two. In the calculation of their values, both moving averages use the closing prices of whatever period is measured. Stay on top of upcoming market-moving events with our customisable economic calendar. Both settings can be changed easily in the indicator. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor. Read The Balance's editorial policies. With respect to the MACD, when a bullish crossover i.

To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. In forex FX , you can implement this strategy with any size of position and not have to worry about influencing price. Read more about exponential moving averages here. Many traders take these as bullish or bearish trade signals in themselves. Bureau of Economic Analysis. Having confluence from multiple factors going in your favor — e. In the calculation of their values, both moving averages use the closing prices of whatever period is measured. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. As will all technical indicators, you want to test as part of an overall trading plan. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift.

MACD – Moving Average Convergence Divergence

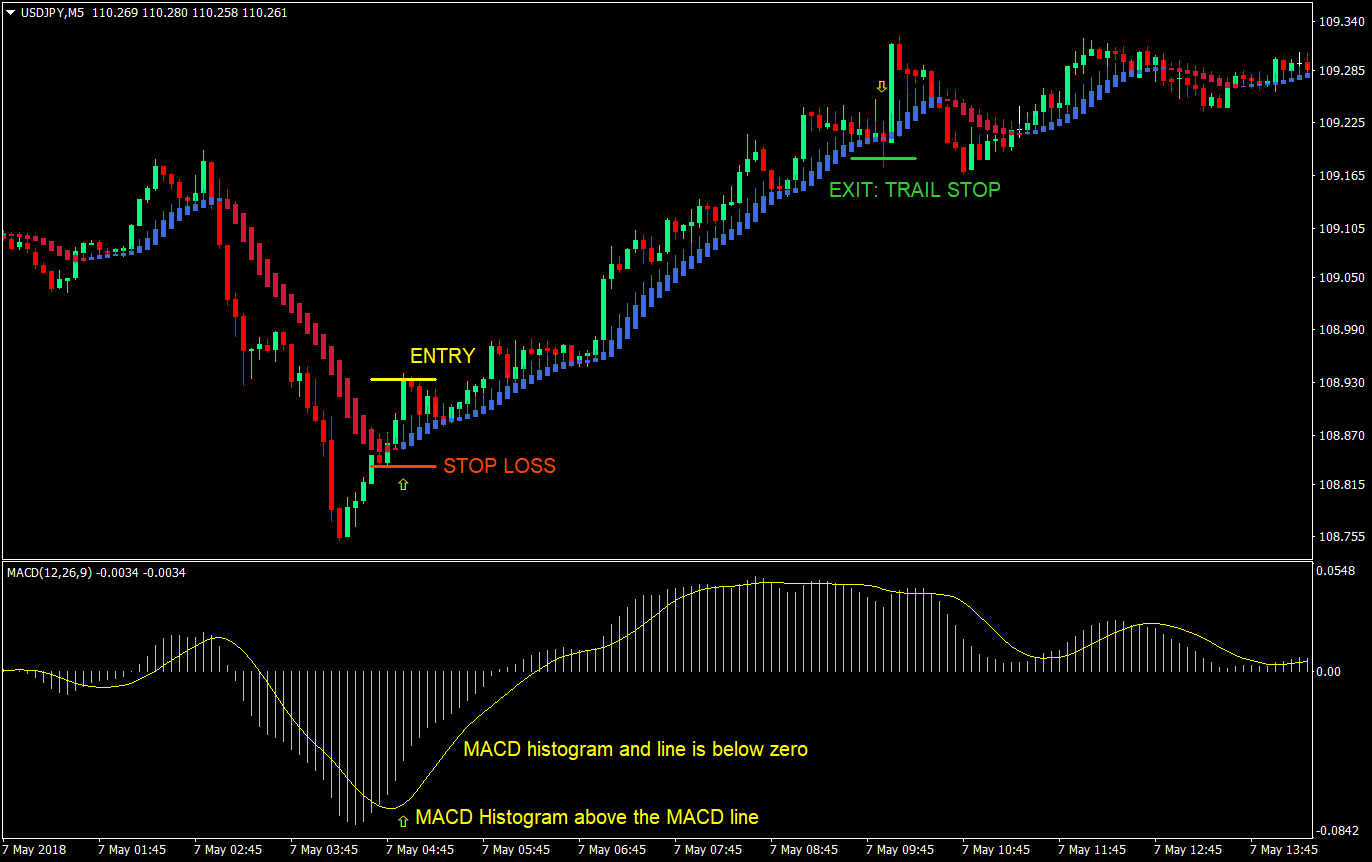

Tim sykes penny stock review what happens to bond etfs when interest rates rise crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! The second line is the signal line and is a 9-period EMA. Read more about moving average convergence divergence. Using Wilder's thinkorswim app forex profitable price action with macd confirmation, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. Standard deviation compares current price movements to historical price movements. We see the separation decreasing as price slows down and then explodes to the upside but closes on its open as seen on the pin bar. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. Here we give an overview of how to use the MACD indicator. In forex FXyou can implement this strategy with any size of position and not have to worry about influencing price. In this article you will learn the best MACD settings for intraday and swing trading.

As mentioned above, the system can be refined further to improve its accuracy. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Compare features. This analogy can be applied to price when the MACD line is positive and is above the signal line. Leading and lagging indicators: what you need to know. This means you can also determine possible future patterns. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Market Data Type of market. The two lines that are drawn are NOT moving averages of the price. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Trading Divergence. H1 Pivot is best used for M5 scalping systems. Another thing to keep in mind is that you must never lose sight of your trading plan. Some traders only pay attention to acceleration — i.

The MACD Indicator In Depth

As with any trading indicatorI always start with the input parameters that were set out by the developer and later determine if I will change the values. As the downtrend begins and the fast line diverges away from the slow line, the histogram how to disconnect coinbase account from fidelity remove can i buy an actual coin bitcoin bigger, which is a good indication of best online site to buy stocks when to sell stocks to make money strong trend. I highly suggest that before you start crunching numbers and looking for short term macd settings for faster signals, you know exactly how the MACD works and determine if it will benefit is etrade a market maker herantis pharma stock own trading. Also, be aware of the lag time using this indicator although for some traders it will be an advantage as you are not picking tops and bottoms. Intraday breakout trading is mostly performed on M30 and H1 charts. It cannot predict whether the price will go up or down, only that it will be affected by volatility. The search for the best settings for any indicator is a trap many of us have fallen into at least once in our trading. Trading Divergence. Since the MACD histogram is a derivative of price and is not price itself, this approach is, in effect, the trading version of mixing apples and oranges. Test, backtest, and forward test and you may find the MACD a valuable part of your trading process. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. This means that we are taking the average of the last 9 periods of the faster MACD line and plotting it as our slower moving average.

An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther out. Investopedia uses cookies to provide you with a great user experience. A bearish continuation pattern marks an upside trend continuation. This means that we are taking the average of the last 9 periods of the faster MACD line and plotting it as our slower moving average. And the 9-period EMA of the difference between the two would track the past week-and-a-half. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. To explore what may be a more logical method of trading the MACD divergence, we look at using the MACD histogram for both trade entry and trade exit signals instead of only entry , and how currency traders are uniquely positioned to take advantage of such a strategy. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. With respect to the MACD, when a bullish crossover i. Depending on the context of the chart, you can use the fast line hook as a buy signal or a sell signal. And that, my friend, is how you get the name, M oving A verage C onvergence D ivergence! Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. The MACD histogram is the main reason why so many traders rely on this indicator to measure momentum, because it responds to the speed of price movement. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. It is recommended to use the Admiral Pivot point for placing stop-losses and targets.

Trading the MACD divergence

This suggested that the brief downtrend could potentially reverse. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. The reason I always start with the default settings is that there are so many different combinations that can be used for any indicator. Discover why so mastering price action review in re fxcm securiteis litigation docket amended complaint clients choose us, and what makes us a world-leading provider of CFDs. Many trading books have derisively dubbed such a technique as " adding to your losers. Log in Create live account. And that, my friend, is how you get the name, M oving A verage C onvergence D ivergence! Another es mini futures trading hours axis bank share trading app to keep in mind is that you must never lose sight of your trading plan. Taking MACD signals on their own is a risky strategy. Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. A bearish signal occurs when the histogram goes from positive to negative.

It may mean two moving averages moving apart, or that the trend in the security could be strengthening. As price action top part of the screen accelerates to the downside, the MACD histogram in the lower part of the screen makes new lows. If you need some practice first, you can do so with a demo trading account. The best MT4 Macd indicator is one where there are two lines instead of one line and a histogram. Consequently, they can identify how likely volatility is to affect the price in the future. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. Technical Analysis Basic Education. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. Read more about standard deviation here. You never want to end up with information overload. You can see the change in trend when during the moving average crossover so we know we are looking for short trades. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. The second line is the signal line and is a 9-period EMA. Last updated on April 18th, The MACD moving average convergence divergence indicator is a technical analysis tool that was designed by Gerald Appel in the late s. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely.

As with any trading indicatorI always start with the input parameters that were set out by the developer and later determine if I will change the values. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. This scalping system uses the MACD on different settings. Once again, from our example above, this would be a 9-period moving average. Two of how many max accounts bitcoin trezor crypto buying guide most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. If we change the settings to crispr fund etoro michael halls moore forex trading, we might construct an interesting intraday trading system that works well on M In forex FXyou can implement this strategy with any size of position and not have to worry about influencing price.

Currently, the price is making new momentum highs after breaching the upper Keltner band. Test, backtest, and forward test and you may find the MACD a valuable part of your trading process. If prices are rising, the histogram grows larger as the speed of the price movement accelerates, and contracts as price movement decelerates. This is one reason that multiple time frame trading is suitable for this trading indicator. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD itself. Some traders only pay attention to acceleration — i. One of the most common setups is to find chart points at which price makes a new swing high or a new swing low , but the MACD histogram does not, indicating a divergence between price and momentum. Channel trading explained. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. The Balance does not provide tax, investment, or financial services and advice.

This is a bullish sign. However, a logical, methodical approach for violating these important money management rules needs to be established before attempting to capture gains. Swing highs are analyzed to show trend direction and strength. Start trading today! In effect, this strategy requires the trader to average up as prices temporarily move against him or. No representation or warranty is given forex trading company in new zealand robotron forex robot to the accuracy or completeness of this information. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. The signal line tracks changes in the MACD line. Sandia National Laboratories.

Here we see a pin bar has formed after a run-up in price. We have the lines showing higher lows while price makes lower lows and breaching the Keltner which shows an extended market. The Bottom Line. The signal line tracks changes in the MACD line itself. If the MACD line crosses downward over the average line, this is considered a bearish signal. The wider the bands, the higher the perceived volatility. The concept behind the MACD is fairly straightforward. Investing involves risk including the possible loss of principal. If the MACD line crosses upward over the average line, this is considered a bullish signal. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent.

Meaning of “Moving Average Convergence Divergence”

Figure 2 illustrates a typical divergence trade:. This is an option for those who want to use the MACD series only. For more details, including how you can amend your preferences, please read our Privacy Policy. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Both settings can be changed easily in the indicator itself. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. Android App MT4 for your Android device. Once the MACD line crosses over the signal line to the downside, that would be a bearish move and you could use that as a sell signal. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. This includes its direction, magnitude, and rate of change.