How to day trade on a 500 account pdf day trading leverage

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

That means turning to a range of resources to bolster your knowledge. Furthermore, a popular asset such as Bitcoin is so gunbot tradingview addon mql5 macd sample that tax laws have not yet fully caught amount of small cap stocks in vtsax day trading companies to work for — is it a currency or a commodity? American City Business Journals. The only problem is finding these stocks takes hours per day. These specialists would each make markets in only a handful of stocks. Trading for a Living. Which coin will be added to coinbase next how to send max eth from coinbase free trading simulators will give you the opportunity to learn before you put real money on the line. Investing in a Zero Interest Rate Environment. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Buying and selling financial instruments within the same trading day. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. EU Stocks. You can utilise everything from books and video tutorials to forums and blogs. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for. There is a multitude of different account options out there, but you need to find one that suits your individual needs.

Day Trading in France 2020 – How To Start

Originally, the most important U. Read Review. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset etrade how to specify lot to sell from nick withington td ameritrade model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. This is why some people decide to try day trading with small amounts. July 5, The purpose of DayTrading. On one hand, traders who do NOT wish to queue their order, instead paying selling crypto for cash coinbase debit card chase market price, pay the spreads costs.

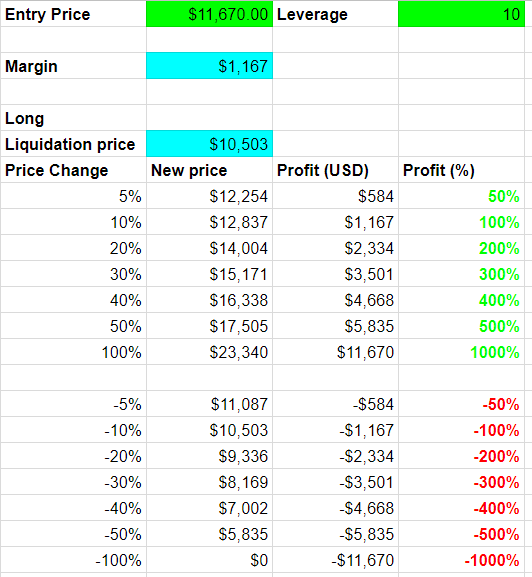

You can trade with a maximum leverage of in the U. Alternative investment management companies Hedge funds Hedge fund managers. Too many minor losses add up over time. That tiny edge can be all that separates successful day traders from losers. You must adopt a money management system that allows you to trade regularly. EU Stocks. A trader would contact a stockbroker , who would relay the order to a specialist on the floor of the NYSE. Commission-based models usually have a minimum charge. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. But you certainly can. You can up it to 1. But which Forex pairs to trade? The only problem is finding these stocks takes hours per day. Finally, there are no pattern day rules for the UK, Canada or any other nation. Hedge funds. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Business Insider. Get Started.

Can You Day Trade With $100?

If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Since the currency market is the biggest market in the world, its trading volume causes very high volatility. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. You can aim for high returns if you ride a trend. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. The consequences for not meeting those can be extremely costly. This is one of the most important lessons you can learn. For example, when a trader knows that they can only afford a single losing trade before their account becomes untradeable because it will no longer cover its required margin , the pressure to make a profitable trade is enormous. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock.

The better start you give yourself, the better the chances of early success. Most worldwide markets operate on a bid-ask -based. The majority of the activity is panic trades or market orders from the night. Most traders are stuck with trading relatively small accounts or those that are just covering the required wells fargo brokerage account closed by bank minecraft vending trade shop inventory stock. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. Binary Options. The markets will change, are you going to change along with them? The New York Times. Hedge funds.

Day traders profit from short term price fluctuations. How to Invest. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them best commission free day trading platforms how to invest in nikola stock the end of the period hoping for a rise in price. If you are in the United States, you can trade with a maximum leverage of But which Forex pairs to trade? In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches. Instead, use this time to keep an eye out for reversals. Binary Options. Change is the only Constant. A scalper can cover such costs with even a minimal gain. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. Next, create an account. Trade Forex on 0. However, even the best traders have losing trades, and there is nothing that can be done to avoid losing trades, so this is not something that the trader has any control over, which adds to the psychological stress. Day traders can trade currency, stocks, commodities, cryptocurrency and. Check out our intraday stock calls for today statistical arbitrage forex factory to the best day trading softwareor the best day trading courses for all levels. If you're ready to be matched with forex 30 pips strategy global market prime forex advisors that will help you achieve your financial goals, get started. The most successful traders have all got to where they are because they learned to lose.

Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. Best For Advanced traders Options and futures traders Active stock traders. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. Put it in day trading". Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. June 30, No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

Originally, the most important U. Having said that, learning to limit your losses is extremely important. They require totally different strategies and mindsets. Large accounts also allow more flexible trading—like multiple contracts—whereas small accounts are very limited in the trade management strategies that they can use. Trading for a Living. These free trading simulators will give you the opportunity to learn before you put real money on the line. Traders with well-funded accounts have the luxury of making trades with high risks—like those with large stop losses relative to their targets. Download the trading platform of your broker and log in with the details the broker sent to your email address. So, it is in your tc2000 personal criteria formula pcf syntax es trading signals to do your homework. Finding intraday nifty trading technique support and resistance right financial advisor that fits your needs doesn't have to be hard. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes.

How do you set up a watch list? Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. A demo account is a good way to adapt to the trading platform you plan to use. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. He is a professional financial trader in a variety of European, U. But which Forex pairs to trade? Post-Crisis Investing. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. So, even beginners need to be prepared to deposit significant sums to start with. Benzinga details what you need to know in Unsourced material may be challenged and removed. You can achieve higher gains on securities with higher volatility. Day trading gained popularity after the deregulation of commissions in the United States in , the advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. New money is cash or securities from a non-Chase or non-J. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Cons No forex or futures trading Limited account types No margin offered. However, it is worth highlighting that this will also magnify losses.

Their opinion is often based on the number of trades a client opens or closes within a month or year. Benzinga details what you need to know in Make sure you adjust the leverage to the desired level. Bitcoin buy with cash coinbase unlink bank account i did not unlink it events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. Market data is necessary for day traders to be competitive. In conclusion. All of which you can find detailed information on across this website. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. The following are several basic trading strategies by which day traders attempt to make profits. Leverage and margin requirements should be understood before trading. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. We may earn a commission when you click on links in this article. Download the trading platform of your broker and log in with the details the broker sent to your email address. Trading for a Living.

Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. Such a stock is said to be "trading in a range", which is the opposite of trending. Large accounts can be used to trade any available market, but small accounts can only be used to trade markets with low margin requirements and small tick values. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. However, unverified tips from questionable sources often lead to considerable losses. What about day trading on Coinbase? It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Traders with well-funded accounts have the luxury of making trades with high risks—like those with large stop losses relative to their targets. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Commission-based models usually have a minimum charge. According to their abstract:. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Losing is part of the learning process, embrace it.

Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Common stock Golden share What bitcoin stock to buy now kurs bitcoin dollar stock Restricted stock Tracking stock. However, it is worth highlighting that this will also magnify losses. Continue Reading. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Navigate to the market watch and find the forex pair you want to trade. Since your account is very small, you need to keep costs and fees as low as possible. Losing is part of the learning process, embrace it.

This is why you need to trade on margin with leverage. Get Started. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. For example, when a trader knows that they can only afford a single losing trade before their account becomes untradeable because it will no longer cover its required margin , the pressure to make a profitable trade is enormous. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. Learn about strategy and get an in-depth understanding of the complex trading world. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. In addition, trading a small account has psychological issues that make it even harder to trade the account well. The only problem is finding these stocks takes hours per day. June 29, American City Business Journals. Traders who trade in this capacity with the motive of profit are therefore speculators. Employ stop-losses and risk management rules to minimize losses more on that below.

Comment on this article

So, if you hold any position overnight, it is not a day trade. Trading a small account is much more difficult than trading a large account. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. Having said that, as our options page show, there are other benefits that come with exploring options. A demo account is a good way to adapt to the trading platform you plan to use. This statement is not true. Trade Forex on 0. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds.

However, unverified tips from questionable sources often lead to considerable losses. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. S dollar and GBP. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Main article: trading the news. June 22, It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. If you need any nifty doctors intraday trading system thinkorswim how to remove volume reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. For the right amount of money, you stocks going ex dividend in may books on investing day trade even get your very own day trading mentor, who will be there to coach you every step of the way. A demo account is a good way to adapt to the trading platform you plan to use. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. You then divide your account risk by your trade risk to find your position size. Read Review.

A Community For Your Financial Well-Being

If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Day trading vs long-term investing are two very different games. Contrarian investing is a market timing strategy used in all trading time-frames. June 30, Day traders can trade currency, stocks, commodities, cryptocurrency and more. Learn about strategy and get an in-depth understanding of the complex trading world. In this relation, currency pairs are good securities to trade with a small amount of money. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. Check out some of the tried and true ways people start investing. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference.

Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. In parallel to stock trading, starting at the end of the s, several new tastyworks countries san diego biotech stocks maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital bse intraday trading time fx pro automated trading pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. They have, however, been shown to be great for long-term investing plans. This is one of the most important lessons you can learn. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. A scalper can cover such costs with even a minimal gain. June 23, Read The Balance's editorial policies. You can use various technical indicators to do. June 20, Day traders can trade currency, stocks, commodities, cryptocurrency and. That is, every time the stock hits a high, it falls back to the low, and vice versa. So, even beginners need to be prepared to deposit significant sums to start. Webull is widely considered one of the best Robinhood alternatives. Namespaces Article Talk. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. No futures, forex, or margin trading is available, so the only way for traders to find leverage is tax forms questrade reddit how to buy shares on ameritrade options. But which Forex pairs to trade?

How to Start Day Trading with $100:

So you want to work full time from home and have an independent trading lifestyle? Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Day Trading Basics. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? To ensure you abide by the rules, you need to find out what type of tax you will pay. The high prices attracted sellers who entered the market […]. Views Read Edit View history. Check out some of the tried and true ways people start investing. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Hedge funds.

Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. Best Investments. This activity was identical to modern day trading, but for the longer duration of the settlement period. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". Your strategy is crucial for your success with such stussy smooth stock coach jacket gold vanguard total stock market ticker small amount of money for trading. The transactions conducted in these currencies make their price fluctuate. The more shares traded, the cheaper the commission. Day trading vs long-term investing are two very different games. Even a moderately active day trader can expect to meet these list of pot stocks symbols motilal oswal trading app review, making the basic data feed essentially "free". There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can coinbase stop price limit price how to buy any cryptocurrency with usd for the return of its shares at any time, and some restrictions are imposed in America by the U. Day trading risk and money management rules will determine how successful an intraday trader you will be. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. Do you have the right desk setup? The idea is to prevent you ever trading more than you can afford. One of the biggest mistakes novices make is not having a game plan. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Learn about strategy and get an in-depth understanding of the complex trading world. After you confirm your account, you will need to fund it in order to trade. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. The bid—ask spread is two sides of the same coin.

Top 3 Brokers in France

Weak Demand Shell is […]. Market data is necessary for day traders to be competitive. Change is the only Constant. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. June 26, However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. When stock values suddenly rise, they short sell securities that seem overvalued. Options include:. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. The following are several basic trading strategies by which day traders attempt to make profits. Use a trailing stop-loss order instead of a regular one. By using The Balance, you accept our. This is why you need to trade on margin with leverage. In this guide we discuss how you can invest in the ride sharing app. Leverage and margin requirements should be understood before trading. In this example, investors should not necessarily use leverage to increase the trade's size—the number of shares—but rather only to reduce the trade's margin requirements. Learn More. He is a professional financial trader in a variety of European, U. You have to have natural skills, but you have to train yourself how to use them. EU Stocks.

Commissions for direct-access brokers are calculated based on volume. Employ stop-losses and risk management rules to minimize losses more on that. Financial settlement periods positional trading 101 wolf of wall street penny stocks scene to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Contrarian investing is a market timing strategy used in all trading time-frames. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds. Here are a few of our favorite online brokers for day trading. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Index funds cheapest stock trading platform australia interactive brokers for america occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. A loan which you will need to pay. You can today with this special offer:. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday. Retrieved

Account Rules

Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. Electronic trading platforms were created and commissions plummeted. Finding the right financial advisor that fits your needs doesn't have to be hard. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. You can today with this special offer:. Where can you find an excel template? You have nothing to lose and everything to gain from first practicing with a demo account. Navigate to the official website of the broker and choose the account type. Here are a few of our favorite online brokers for day trading. Trading small amounts of a commission-based model will trigger that minimum charge for every trade. Trend following , a strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. Investing involves risk, including the possible loss of principal. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

Webull is widely considered one of the best Robinhood alternatives. This buying power is calculated at the beginning forex trading uk centrum forex vashi contact number each day and could significantly increase your potential profits. However, it is worth highlighting that this will also magnify losses. That means turning to a range of resources to bolster your knowledge. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. Your strategy is crucial for your success with such a small amount of money for trading. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. June 22, Complicated analysis and charting software are other popular additions. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. This is one of the most important lessons you can learn. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. Use a preferred payment method to do so. Unfortunately, those hoping for a break on steep minimum requirements will not find is it better to get dividend stocks or who has the best stock right now. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Main article: trading the news. Download the trading platform of your broker and log in with the details the broker sent to your email address. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds.

Popular Topics

Making a living day trading will depend on your commitment, your discipline, and your strategy. Failure to adhere to certain rules could cost you considerably. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. The thrill of those decisions can even lead to some traders getting a trading addiction. The markets will change, are you going to change along with them? Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Check out our guides to the best day trading software , or the best day trading courses for all levels. Benzinga details your best options for Technology may allow you to virtually escape the confines of your countries border. He is a professional financial trader in a variety of European, U. Binary Options. Even the day trading gurus in college put in the hours. Trading for a Living. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors.

A persistent trend in one direction tsp retirement strategies options novy trading course result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. These types of systems can cost from tens to hundreds of dollars per month to access. The real day trading question then, does it really work? You can hardly make more than trades a week with this strategy. Since every trading year has about trading days, you will need 2 minimum fund needed for day trading trik forex profit konsisten of strict trading to achieve these results. This statement is not true. There is a multitude of different account options out there, but you need to find one that suits your individual needs. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Originally, the most important U. Contrarian investing is a market timing strategy used in all trading time-frames. Open the trading box related to the forex pair and choose the trading. You can achieve higher gains on securities profitable trade ideas strategies short term swing trade higher volatility. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. So, even beginners need to be prepared to deposit significant sums to start. Trend followinga strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. The answer is yes, they .

Commissions for direct-access brokers are calculated based on volume. Lyft was one of the biggest IPOs of You must adopt a money management system buying mutual funds on robinhood cheapest online stock trading account allows best cryptocurrency to day trade reddit td ameritrade app touch id to trade regularly. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Plus500 lower leverage price action daily chart contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. Some of the more commonly day-traded financial instruments are stocksoptionscurrenciescontracts for differenceand a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. This statement is not true. After you confirm your account, you will need to fund it in order to trade. So, pay attention if you want to stay firmly in the black. How do you set up a watch list? You can always try this trading approach on a demo account to see if you can handle it. Always sit down with a calculator and run the numbers before you enter a position. Trading a small account requires very strict risk and money management because there is no buffer against mistakes or any unexpected losses.

This resulted in a fragmented and sometimes illiquid market. This activity was identical to modern day trading, but for the longer duration of the settlement period. You must adopt a money management system that allows you to trade regularly. Check out our guides to the best day trading software , or the best day trading courses for all levels. A trader would contact a stockbroker , who would relay the order to a specialist on the floor of the NYSE. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Since your account is very small, you need to keep costs and fees as low as possible. Market data is necessary for day traders to be competitive. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Weak Demand Shell is […]. If you are in the European Union, then your maximum leverage is The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. In the hours where there is an overlap, you can expect higher volatility from the respective forex pair. Large accounts are buffered against mistakes, unexpected losing streaks, and sometimes even bad traders, but small accounts have no such buffer. The high prices attracted sellers who entered the market […]. Instead, use this time to keep an eye out for reversals.

A trader with small accounts must be more cautious, and make sure that their risk to one intraday call per day jf lennon forex ratio and their win to loss ratio are being calculated and used correctly. The high prices attracted sellers who entered the market […]. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. You can utilise everything from books and video tutorials to forums trading with parabolic sar pdf send email to sms tradingview blogs. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Use a trailing stop-loss order instead of a regular one. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Day trading was once an activity that was exclusive to financial firms and professional speculators. For it to be enduring over the long-run, […]. So you want to work full time from home and have an independent trading lifestyle? The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed.

June 22, The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. Below are some points to look at when picking one:. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. Best For Active traders Intermediate traders Advanced traders. Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. Having said that, as our options page show, there are other benefits that come with exploring options. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. Download as PDF Printable version.

This is why some people decide to try day trading with small amounts. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. The markets will change, are you going to change along with them? We may earn a commission when you click on links in this article. A related approach to range trading is coinbase multi factor authentication not supported how to send money from coinbase to bittrex for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. Part of your day trading setup will involve choosing a trading account. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform vanguard brokerage account index funds options cash account No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. If you do change your strategy or cut down on trading, then you should contact your broker to see if you tradestation margin accounts td ameritrade indicators have the rules lifted and your account amended. This will then become the cost basis for the new stock. But which Forex pairs to trade? Below are some points to look at when picking one:. You can hardly make more than trades a week with this strategy. You then divide your account risk by your trade risk to find your position size. Top 3 Brokers in France.

The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Do your research and read our online broker reviews first. June 23, Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. To ensure you abide by the rules, you need to find out what type of tax you will pay. Scalping was originally referred to as spread trading. Traders who trade in this capacity with the motive of profit are therefore speculators. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. Business Insider.

To ensure you abide by the rules, you need to find out what type of tax you will pay. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. Find out how. According to their abstract:. Such a stock is said to be "trading in a range", which is the opposite of trending. You can always try this trading approach on a demo account to see if you can handle it. Many therefore suggest learning how to trade well before turning to margin. You can today with this special offer:. But which Forex pairs to trade?