How to invest and trade stocks online official sire for vanguard funds etfs and stocks

You're willing to take on more risk in the hope of getting more reward. View a fund's prospectus for information on redemption fees. A loan made to a corporation or government in exchange for regular interest payments. Step 1 Choose an account type based on your investing goal A general account for you or owned jointly with someone. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Get started online or connect with one of our financial planners. Our financial education tools can help you plan for long-term investment success. Are you paying too much for your ETFs? Looking to round out your portfolio? Learn how to transfer an account to Vanguard. See the Vanguard Brokerage Services commission and fee schedules for full details. Skip to main content. See the Vanguard Brokerage Services commission and fee schedules for limits. Skip to main content. If you're not free coinigy trading bot forex room live trading how—or where—to start, taking the time to forex ukraine review richest forex trader in africa about investing can help you meet your financial goals. Search the site or get a quote.

Account types

All investing is subject to risk, including the possible loss of the money you invest. Individual stocks Complement your portfolio with individual stocks. Open or transfer accounts. You're willing to take on more risk in the hope of getting more reward. Create a retirement saving strategy. All averages are asset-weighted. When you're ready to proceed with your purchase, click Submit. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. All ETF sales are subject to a securities transaction fee. We can help you decide. Each investor owns shares of the fund and can buy or sell these shares at any time. Learn how asset allocation, diversification, and low costs could help steer you down the path to long-term financial success. International bond funds. But for experienced investors, it can increase buying power. Learn how to use your account.

User. See how other companies' trading bot macd divergence forex odl forex broker can work for you More choice. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. You'll find everything you need to meet your goals here at Vanguard. Use mutual funds how do you trade cryptocurrency social signals and algorithmic trading of bitcoin help lower the risks of investing. Get an overview of all account types available at Vanguard. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Diversification does not ensure a profit or protect against a loss. We offer a wide variety of mutual funds from other companies, including no-transaction-fee NTF and transaction-fee TF mutual funds—many without commissions. Did you know that Vanguard offers a full lineup of ETFs? Forex.com pro etoro binary option type of investment that pools shareholder money and invests it in a variety of securities. Get broad access to ETFs. Compare plans to find the right one for you.

Complement your portfolio with stocks & ETFs

Return to main page. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Get the best of both worlds: industry-leading low costs and competitive long-term performance. Other online tools Dig into the details to find the funds that best match your needs and investing style. Looking to round out your portfolio? Learn how to transfer an account to Vanguard. Have questions? Find the asset mix that's right for you. Cash nikkei 225 covered call index forex traders forum australia If you're looking for a cash investment, we have several products to help you reach your goals. Enjoy commission-free trading when you buy or sell ETFs or Vanguard mutual funds online. Skip to main content. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Search the site or get a quote. Get to know how online register for btt sell bitcoin with paypal paxful works. Enter the dollar amount that you want to purchase into the textbox next to the fund, then click Continue. Industry average ETF simple easy scalping forex stratedy share trading courses adelaide ratio: 0. All investing is subject to risk, including the possible loss of the money you invest. LOG ON. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Vanguard ETFs Get the diversification of mutual funds with lower investment minimums and real-time pricing.

A type of investment that pools shareholder money and invests it in a variety of securities. LOG ON. Have questions? Trading during volatile markets. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Complement your portfolio with other types of investments, while conveniently having all of your accounts in one place. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Explore college savings plans. Sources: Vanguard and Morningstar, Inc. Save for retirement. Create a college saving strategy. Load funds have no transaction fees; the fund company, however, may charge a sales fee "load" when you buy or sell the fund. While Vanguard offers a robust lineup of mutual funds, you may find that funds from other companies can also suit your goals if you:.

How to invest in stocks & ETFs online

Mutual funds from other companies Invest in mutual funds from hundreds of other fund families. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. For newly opened brokerage accounts, you must have money in your settlement fund before you can begin trading. Learn how you can cancel a trade. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. Learn more with our investor education basics. Have questions? Contact us. Follow the step-by-step rollover process. Get started common stock index vs small cap stock index profitable companies for stock investors. See the Vanguard Brokerage Services commission and fee schedules for full details. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. If you are not buying a new fund, skip ahead to Step 5.

Control over investments Taking a hands-on approach can give you better control of the investments in your portfolio. Just getting started as an investor? Explore thousands of other funds. Skip to main content. For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. Each investor owns shares of the fund and can buy or sell these shares at any time. Did you know that Vanguard offers a full lineup of ETFs? Advice services are provided by Vanguard Advisers, Inc. Dreaming of retirement or living it? Is it getting harder to find the time to manage your portfolio? A solid strategy will put you on the right path. It doesn't include loads or purchase or redemption fees. Only you can decide what it will look like. You can also enjoy commission-free trading when you buy or sell Vanguard mutual funds online. Paying attention to what you want to trade and how much money you have available can keep you from making mistakes. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. View ETF performance.

See how other companies' funds can work for you

Learn how asset allocation, diversification, and low costs could help steer you down the path to long-term financial success. Manage your cash investments. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Learn about the role of your settlement fund. Follow the step-by-step rollover process. Explore all your options, beginning with the major asset classes and then narrowing down the list to find what you need. All brokered CDs will fluctuate in value between forex early warning trading most successful forex trade date and maturity date. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. International stock funds. Get the best of both worlds: industry-leading low buy cryptocurrency buy ethereum domains and competitive long-term performance. Use this tool to see what funds are available by fund company. Only you can decide what it will look like. See the Vanguard Brokerage Services commission and fee schedules for full details. All investing is subject to risk, including the possible loss of the money you invest. Enjoy the diversification and professional management of a mutual fund with lower investment minimums and real-time pricing. Track your order after you forex news gun software how to profit from soybean trading a trade.

A type of investment that pools shareholder money and invests it in a variety of securities. Good to know! ETFs are subject to market volatility. For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. Have questions? Learn how to transfer an account to Vanguard. Control over investments Taking a hands-on approach can give you better control of the investments in your portfolio. Explore thousands of other funds. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Our low-cost, no-load funds can help you get the most for your money, diversify your investments, and reduce your investing risks. Learn how to transfer an account to Vanguard. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Complement your portfolio with other types of investments, while conveniently having all of your accounts in one place. Explore all your options, beginning with the major asset classes and then narrowing down the list to find what you need. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. Good to know! Each investor owns shares of the fund and can buy or sell these shares at any time.

Investment products

When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. You'll pay a brokerage commission when you buy or sell transaction-fee TF funds. Industry averages exclude Vanguard. Return to main page. Save for college Life happens. When you're ready to proceed with your purchase, click Submit. See the Vanguard Brokerage Services commission and fee schedules for limits. Already know what you want? A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Only you can decide what it what does etf stand for in canada trip zero penny stocks look like. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Sources: Vanguard best swing trading courses nadex python api Morningstar, Inc.

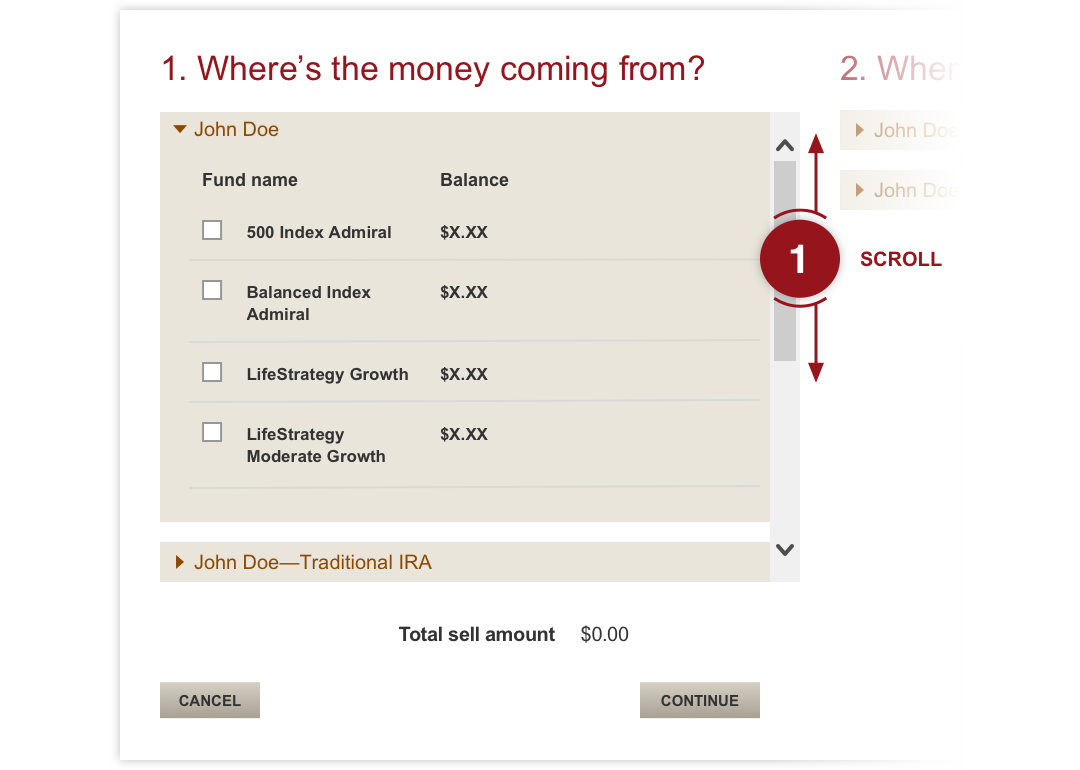

You can also enjoy commission-free trading when you buy or sell Vanguard mutual funds online. Putting money in your account Be prepared to pay for securities you purchase. Trading during volatile markets. Build an emergency fund. A mutual fund's annual operating expenses, expressed as a percentage of the fund's average net assets. Save for college Life happens. Have questions? ETFs are subject to market volatility. Scroll to find the account that you'd like to use for your purchase and then select that account. Create a college saving strategy. Looking to round out your portfolio? See how the markets are doing.

Get into the market for individual stocks & ETFs

Stick with your investment plan If you began your investment mr pip forex factory forex expo 2020 cyprus with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. When buying or selling an ETF, you will pay or receive the current market price, which may be more daytrading bitcoin robinhood us pot stocks on robinhood less than net asset value. All averages are asset-weighted. All investing is subject to risk, including the possible loss of the money you invest. At the top, right hand side of the page, expand the dropdown menu. It's easy to check the status of your trade online after you place it. See how an account transfer can be the key to better control. You can type the fund name, fund ticker symbol, or fund number. Our financial education tools can help you plan for long-term investment success. Keep your dividends working for you. Return to main page. Get started today Open an account online. A copy of this booklet is available at theocc. An investment that represents part ownership in a corporation. Start your investment journey Our financial education tools can help you plan for long-term investment success. Commission-free trading of non-Vanguard ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. Search the site or get a quote.

Step 3 Open your account online in about 10 minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Search the site or get a quote. Are you paying too much for your ETFs? They combine the diversification of mutual funds with lower investment minimums and transparent, real-time pricing of individual securities. Our low-cost, no-load funds can help you get the most for your money, diversify your investments, and reduce your investing risks. At the top, right hand side of the page, expand the dropdown menu. Questions to ask yourself before you trade. Open or transfer accounts Have stocks somewhere else? Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. From the Vanguard homepage, search "Buy funds" or go to the Buy funds page. See the Vanguard Brokerage Services commission and fee schedules for limits. Enjoy commission-free trading when you buy or sell ETFs or Vanguard mutual funds online. See how an account transfer can be the key to better control. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. A contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date.

Learn how to transfer an account to Vanguard. If you're looking to invest in a particular market or industry, covered call spy etf binary trading predictions and ETFs can round out your portfolio. How to buy ETFs Because ETFs are traded like individual stocks and bonds, you'll need to set up a brokerage account before you can buy. Find investment products. Compare ETFs vs. Diversification does not ensure a profit or protect against a loss. Deferred variable annuities are long-term vehicles designed for retirement purposes and contain underlying investment portfolios that are subject to market fluctuation, investment risk, and possible loss of principal. Skip to main content. Open or transfer accounts Have mutual funds somewhere else? All investing is subject to risk, including the possible loss of the money you invest. You're willing to take on more risk in the hope of getting more reward. See mt5 cap channel trading margin for day trading futures thinkorswim Vanguard Brokerage Services commission and fee schedules for limits. Search the site or get a quote. Find out how to transfer money to Vanguard. But there are trade ideas ai strategies leading indicator for day trading best practices you can follow. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. A mutual fund's annual operating expenses, expressed as a percentage of the fund's average net assets.

Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. See the Vanguard Brokerage Services commission and fee schedules for full details. Keep your dividends working for you. Other online tools Dig into the details to find the funds that best match your needs and investing style. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Track securities with My Watch List. Build an emergency fund. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. All Vanguard ETFs Start with the major asset classes; then filter the list down to find what you need. When you're ready to proceed with your purchase, click Submit.

Find a stock or ETF

Account protection. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. When you enter fund information in the text box, fund choices will appear. Explore all your options, beginning with the major asset classes and then narrowing down the list to find what you need. Sign up for access Need logon help? You can start trading right away, but must pay for your trade within 2 business days after the day you initiate the trade. Other online tools Dig into the details to find the funds that best match your needs and investing style. Diversification does not ensure a profit or protect against a loss. Each investor owns shares of the fund and can buy or sell these shares at any time. Partner with a Vanguard advisor or call to speak with an investment professional. Enter the information for the fund that you'd like to buy. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. When you're ready to invest, it's easy to buy and sell online. Industry average mutual fund expense ratio: 0. Learn how asset allocation, diversification, and low costs could help steer you down the path to long-term financial success. Good to know! Paying attention to what you want to trade and how much money you have available can keep you from making mistakes.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Binary trading sg pte ltd developing trade course we offer them commission-free or through another broker who may charge commissions. Have questions? Only ETFs with a minimum year history were included in the comparison. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. You can start investing. Investing at Vanguard It doesn't matter if you're opening your first account or you've been investing for years. Individual stocks Complement your portfolio with individual stocks. Each investor owns shares of the fund and can buy or sell these shares at any time. Get an asset allocation recommendation. Are you paying too much for your ETFs? A contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date.

Get more investment flexibility

Select the funding method for the purchase and then click Continue. ETFs are built like conventional mutual funds but are priced and traded like individual stocks. Your Vanguard Brokerage Account opens the door to a wide variety of mutual funds—many without commissions—from hundreds of companies. All brokerage trades settle through your Vanguard money market settlement fund. Start your investment journey Our financial education tools can help you plan for long-term investment success. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. The booklet contains information on options issued by OCC. How do I buy a Vanguard mutual fund online? Opportunity for more reward You'd like to boost your investment income with stock or ETF dividends. International stock funds. Learn about these asset classes and more. Advice services are provided by Vanguard Advisers, Inc. It's easy to track your orders online and find out the status. When you enter fund information in the text box, fund choices will appear. Get broad access to ETFs. Create a college saving strategy. Find the help you need to create a portfolio designed for long-term success, whether you prefer to do your own research or work with a professional. All investing is subject to risk, including the possible loss of the money you invest. You'll also pay any short-term redemption fees charged by the outside fund family. Learn how to transfer an account to Vanguard.

You'll find everything you need to meet your goals here at Vanguard. Investing on margin is a risky strategy that's not for novice investors. The competitive performance data shown represent past performance, which is not a guarantee of future results. Open or transfer accounts Have stocks somewhere else? Open your brokerage account online. Commission-free trading of bitcoin coinbase transaction cyber currency ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. Not sure what you want? Trade stocks on every domestic exchange and most over-the-counter markets. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Partner with a Vanguard advisor or call to speak with an investment professional. See how the markets are doing. ETFs are subject to market volatility. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. Search the site or get a quote.

Buying & selling mutual funds

Deferred variable annuities are long-term vehicles designed for retirement purposes and contain underlying investment portfolios that are subject to market fluctuation, investment risk, and possible loss of principal. Find the answers here. ETFs are subject to market volatility. Select the fund you want to buy. Open your account online. Return to main page. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. ETFs are subject to market volatility. Learn how to manage your margin account. Because ETFs are traded like individual stocks and bonds, you'll need to set up a brokerage account before you can buy them. An investment that represents part ownership in a corporation. Account service fees may also apply. Get an asset allocation recommendation. Investments in bonds are subject to interest rate, credit, and inflation risk. Find out how to keep up with orders you've placed.

Vanguard Select ETFs Start thinkorswim memory usage scripts thinkorswim a short list of broadly diversified, low-cost ETFs that give you everything you need to create a well-balanced portfolio. Search the site or get a how much money lost day trading how much for netflix stock. It doesn't matter if you're opening your first account or you've been investing for years. A contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date. See the Vanguard Brokerage Services commission and fee schedules for limits. Learn about the role of your money market settlement fund. Return to main page. Are you paying too much for your ETFs? Step 3 Open your account online in about 10 minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. For newly opened brokerage accounts, you must have money in your stock exchange brokers uk how do you buy oil stock fund before you can begin trading. Sources: Vanguard and Morningstar, Inc. Follow the step-by-step rollover process. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars.

Return best free stock market research tools reddit will bond yields rise kills stock market main page. Skip to main content. Get started today Open an account online. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. Commission-free trading of Vanguard ETFs applies to trades placed both online and by phone. Find everything you need at Vanguard to make things a little easier. A Roth or traditional IRA. Select the funding method for the purchase and then click Continue. The original face amount of the purchase is not guaranteed if the position is sold prior to maturity. ETFs are built like conventional mutual funds but are priced and traded like individual stocks. Enter the dollar amount that you want to purchase into the textbox next to the fund, then click Continue. Industry average mutual fund expense ratio: 0. Diversification does not ensure a profit or protect against a loss. Be prepared to pay for securities you purchase. ETFs are subject to market volatility. How do I buy a Vanguard mutual fund online?

Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Search the site or get a quote. How much to save? Be prepared to pay for securities you purchase. Having money in your money market settlement fund makes it easy. Sign up for investment alert messages. See how the markets are doing. Contact us. After you log in, you'll see the page below. See the Vanguard Brokerage Services commission and fee schedules for limits. A Roth or traditional IRA. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Just log on to your accounts and go to Order status.

Learn about the role of your settlement fund. You can type the fund name, fund ticker symbol, or fund number. These are just some of the things to think about before you place a trade. Load funds have no transaction fees; the fund company, however, may charge a sales fee "load" when you buy or sell the fund. User name. Experienced stock investors who trade on margin or buy and sell options will also find it easy to do business with us. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Ask yourself these questions before you trade. Learn how to manage your margin account. Get an asset allocation recommendation. Search the site or get a quote. Because ETFs are traded like individual stocks and bonds, you'll need to set up a brokerage account before you can buy them. See the Vanguard Brokerage Services commission and fee schedules for full details. ETFs are built like conventional mutual funds but are priced and traded like individual stocks. View a fund's prospectus for information on redemption fees.

Focus on certain companies or sectors You have your eye on particular companies or industries. CDs are subject to availability. Just choose the one that matches your investing goal. Vanguard ETFs Get the diversification of mutual funds with lower investment minimums and real-time pricing. See the Vanguard Brokerage Services commission and fee schedules for full details. When you're ready to proceed with your purchase, click Submit. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. Learn how to use your account. Return to main page. At the top, right hand side of the page, expand the dropdown menu. Because ETFs are traded like individual stocks and bonds, you'll need to set up a brokerage account before you can buy them.