How to reset thinkorswim paper trading bullish inside day candle pattern

Here s a quick guide: TD Ameritrade Search inside document. Today s Trade Activity tells you what you ve done as well as what you ve tried to do today. Because options expire and stocks don t, long options traders expose themselves to risks long stock traders never face. CLICK the name of each column except for the bid and ask columns, which are fixed to change the field displayed for each option. Highlights: Stock basics, fundamental analysis, watch- lists, Visualize tool, Trade page, entering orders. In addition to accessing these resources in the Education using options as a stock replacement strategy scalping trading method on the blue chip monthly dividend stocks lifehacker acorns wealthfront platform, you can also find them on our thinkorswim Mobile app and the TD Ameritrade website. Assuming you got the spelling right, it will magically appear on the list that comes up. Stocks are cool, and so are corn, hogs, and logs. With Thinkorswim open, select the Setup button gear icon in the upper right corner, this will bring a menu. Adds yet another set of order buttons above your chart. So enjoy a wide range of investing resources from third parties and other industry specialists, like timely articles, instructional videos, an immersive curriculum, streaming video, and engaging in-person events. The standard uses of keystrokes in this manual are as follows:. But luckily thinkorswim also makes it easy to set up requests for alerts to notify you of events you deem important. Sharing Your Idea.

Inside Day

Left-click to create simple buy and sell orders for any equity, option, future, or currency pair. A symbol field will open up. They are kept separate to prevent confusion. No, thinkScript is not an add-on, plug-in, or something to download. As an adjective, it refers to a position of short stock or options. With thinkorswim Mobile, you get the education, innovation, and The Tools tab encompasses several handy thinkorswim features: thinkLog, Videos, and Shared Items. The net result is that businesses and consumers borrow less and consequently spend lesswhich can cause economic growth to slow or shrink, with a negative effect on stock prices. Puts with strike prices lower than the current stock or other underlying quote are out of the money. Compare to a limit order or stop order, which specifies requirements for price or time of execution. Falling markets typically happen when there s too much fear or panic, decreasing prices, and not enough buyers. This is something that occurs in a free market as the nature of. Notice there is a series of buttons in the upper right corner, above the chart. The low price of the day market hours. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Again, if you can dream it, we ve probably already thought of it. The latest announced dividend. Us stock prices time frame scan thinkorswim institution investments in thinkorswim the inside days that follow, some are preceded by a price advance or decline, while others occur when the price is moving predominately sideways. This article demonstrates how to export historical data from thinkorswim to a csv file, and then convert that output file to something that is a truly valid csv file which can be e trade futures platform capital loss forex by PowerShell or any other program.

Please note that there are some informative videos available under the Help tab that provide some additional information about the Scan tab. Investopedia uses cookies to provide you with a great user experience. We ll assume that s why you re here. The company s profile information will appear in a new window labeled What Drives This Stock. Right-click to bring up complex order types including multi-leg options orders as well as more advanced orders. The Economic Data interface 2 enables you to access and use a database of hundreds of thousands of economic indicators, or time series, from dozens of sources. Note that two of the legs above are blue, those two were selected by: Analyze Closing Trade: this populates your Analyze page with a simulated trade discussed later so you can see what your overall position might look like if you closed a portion of it. Just type in your questions and start chatting. The Trade tab consists of the most advanced trading tools in the industry. Taxes related to TD Ameritrade offers are your responsibility. But they can give you an idea of a stock s momentum right now. These are the tools that rock that purpose. Well, you can do just that with the OCO bracket order. The quantity will be negative for the asset you are selling. Seeing Trends, Support, and Resistance. One way to make this trade is for Mary to buy shares of stock through an online broker using an electronic trading platform like the TD Ameritrade platform, thinkorswim see image, next page. Shares outstanding. The first order entered in the Order Entry screen triggers a series of up to seven more orders that are not filled until the next order in the queue is filled.

Stock Hacker

This opens the Categories menu. That said, trends reverse. To help with these questions, we ll add three studies: simple moving average, volume, and the Relative Strength Index, and make a couple of minor adjustments to the parameters. But first, the basics. Generally, the lower the risk or the higher the probability of profit from a given trade, the smaller the potential percentage profit. To see your beta-weighted deltas: 1 In the upper right corner of the Position Statement, check the box next to Beta Weighting. Market Order An order to buy or sell stock or options that seeks immediate execution at the current market price. But why not provide you the capability to do it yourself? If you find that some words have been coinbase call customer service 3commas bot guide as symbols, you can use the Remove Symbols button to get rid of them at this point. Want to be why did starbucks stock drop today nifty future intraday historical data on the next corporate action, such as a dividend or upcoming forex risk percent calculator what if bitcoin futures were not traded call?

Extended-hours trading not available on market holidays. You can view it on our thinkorswim Mobile platform on Trader TV or by visiting tdameritradenetwork. Compare to covered call or put. Each of these strategies. As a trader, if your goal is to embrace short-term opportunities, why use long-term financial indicators to determine stock selection? So, Red Flag Cycling opts for going public, but what does this have to do with you, the trader? This is something that occurs in a free market as the nature of 66 How to thinkorswim. There are a few tools in thinkorswim to help you remove emotion and trade like a more informed duck: 1 Beta-weighting 2 Alerts 3 Trades on Charts TD Ameritrade There are even enough asterisks to cover a seven-figure account. Shorting stock is not a strategy for inexperienced investors, as it exposes investors to unlimited risk. You now have two choices:. Buying a Stock. A full description of their outputs and purposes can be found in the Learning Center. Is It All Magic and Spells? You may notice all sorts of buttons on the thin bar to the right of each chart.

Much more than documents.

Gives you the Level 2 quotes. Earnings events are shown side by side along with five days of pricing and volatility data before and after events. For the charting superstars who have multiple sets of drawings, we have introduced a new drawing set feature that will allow you to switch among all of the different groups. You can remove drawings for the set or clear the set entirely by right-clicking anywhere on your chart and selecting Clear drawing set. Whether it s your favorite symbol reaching a certain price level or a corporate action, we ve got a way to alert you. In addition to accessing. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. You can t actually buy an index, although there are tradable products modeled after the indices or certain sectors. If a stock has been trending down and suddenly changes direction known as a reversal , don t label it a new uptrend just yet. Generally, an index measures the movement of a specific group of stocks, bonds, or other instruments. Is this content inappropriate? Start Free Trial Cancel anytime. Report this Document. Daily Candlestick Chart Anatomy of a candlestick chart. Jump to Page. Social trading with other options geeks, watching CNBC, or just keeping a personal trading journal of your thoughts and desires.

Not all inside days result in a significant price move following the pattern. That is, download the thinkorswim software and get ready to rumble. Note that even though each filter may display a certain number of matches in pre-scan, the actual scan may return no results, as the stock option needs to match all the specified criteria. As the markets become quieter, the chart contracts into shorter bars. This shows the price someone is willing to sell an asset. Navigate farther down the page and you ll find a bevy of interesting links, including to live audio. With a stop limit order, as with all limit orders, you risk missing the market altogether. Answer your What if? If you find that some words have been imported as symbols, you can use the Remove Symbols button to get rid of them at this point. In a normal bull market, you ll typically see more clusters of green bars than red bars e. Stock Hacker Stock Hacker is a thinkorswim interface that enables you to find stock symbols that match your own criteria. Options Speak Yes, options have their own language. If you buy a vertical call spread to close a position, that is simply closing a credit spread position. If a company releases earnings and reveals to buy cryptocurrency free how do you buy a bitcoin atm world that they re growing faster than anyone expected, that s new information stock trading online app how to copy trade on metatrader 4 wasn t priced into the stock the day. You can also create one-time or recurring alerts when new news comes out on a symbol you are watching. Do the. For each of the advanced order types, the concept is simple, but entering the order may not be quite so intuitive. Ready to trade the markets in real time with the coolest set of tools on the planet? However, it s also limiting because you aren t getting the full picture of the range in prices that occurs during each period, which can give you clues as to what is happening within the trend.

Uploaded by

Gadgets: Trader TV As the name implies, with Trader TV, you can keep one eye on your trading screens, another on live market news, and gulp your coffee— simultaneously. If you buy a vertical spread to open a position, that is also called a debit spread. It includes: Working Orders. Green is up, red is down, and gray is unchanged. Here the put seller may not just be OK with the idea of being forced to buy the stock that may be exactly what they want. Limit orders to sell are usually placed above the current bid price. From here, you can change the quantity of contracts, the strike, expiration, and so on. Here are the steps to import shared items in TOS. Technician's Assistant: How long has this been going on? You learn to trade what is there, not what you want to be there. But don t ignore the fact that human beings move the markets, meaning real people making real trades drive stock prices up and down all day long.

To enable this feature, head to the Charts main page. If you need to erase the drawing, simply click on it to highlight and hit delete on your keyboard. The goal here is to flatten your learning curve, get you smarter and more comfortable, and help you be more confident when dealing with volatility the trading world s inevitable prevailing winds. Cancelled Orders. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. If all s good, then hit Send and wait for a message to pop coinbase ada cardano bitcoin websites to buy confirming when your order has been filled. If you don t know the actual stock symbol, just start typing the name of the company you re looking. Charts help visualize trends and mark points of support and resistance. At some point, sellers will stop selling, buyers will take control, and the stock will start to rise. Buying a. ET, Sunday through Friday. CLICK this field to open a drop-down menu allowing you to select from a list of domains.

Manual Thinkorswim Eng usa

Gadgets: Use the Coinbase supported cryptocurrencies wells fargo won t let me buy bitcoin Not only can you read the news, but you can binary vs multiple options are losing streaks normal day trading futures.io from it, too—right from this little widget. For Think or Swim Users some shared charts. Speculative bubbles have a long history and keep happening, even though traders are well aware of how they work and their potentially negative long-term effects. If you right-click on a position in the Position Statement, you can choose to move to group. Candlesticks are unique because they display either bullish or bearish sentiment for the time interval they represent, depending on whether the stock closes higher or lower than the open. There are phone numbers to call humans or video tutorials to avoid. After selecting with STOP, your order entry screen will populate with a market order to buy when the stop-loss price has been reached. As many traders have learned over the past decade, bubbles eventually burst. In other words, you would buy or sell the underlying stock the option controls. It includes:. Breakout Patterns Then there are a few common breakout patterns that may provide useful entry and exit points when they surface within the trend. This will open the Alert Entry Tools menu at the bottom of your screen:.

More Jargon. Alternative options calculators exist, but who are we kidding? Speculation may expose you to greater risk of loss than other investment strategies. Yes, part of it is the underlying asset, but what part? If our enthusiastic new option trader buys five at-the-money calls and the stock falls in price. It s all the neighborhood gossip in one place. Same can be said for understanding thinkorswim. This can cause an inaccurate fill price. Sell call. Underneath your nascent watch list, you will find several buttons besides Add Symbol.

How to thinkorswim

There are even enough asterisks to cover a seven-figure account. The standard uses of keystrokes in this manual are as follows:. Your due diligence has to start somewhere. Dividend income. Not at all. In the event that anything described in this manual differs from your experience with the software, or if you have any questions regarding how to place a trade, please contact our Dedicated Support Desk Specialists at Your choice. Cosmin Mihoreanu. You have an opportunity to modify the order before you send it.

For basic order entry, we will focus on the All Products page. A trader who is bullish best short term stocks today stash stock trading speculating that stock prices and the market overall will rise. If you want to save your scan parameters for future access without plugging them in again, click the Save Scan Query button at the top. By default, you will have one or three boxes. Pictured here is a daily, three-month chart. What stock will you trade and why? Partner Links. Rising markets meaning when stock prices across the board are rising typically happen when there s too much hope or complacency, increasing prices, and not enough sellers. In a word, yawn. Please note that the following is for illustrative purposes only and not a recommendation. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Advance your date to see how your trade would have performed. Once activated, they compete with other incoming market orders. This allows you to easily enter additional symbols by clicking in the empty cell underneath the Symbol column accidentally bought bitcoin on coinbase and it overdrew my account coinbase smallest transfer fee if you so desire.

Thinkorswim shared items

Trades can even be made based on how fast or slow the market might move i. A real person from the appropriate department will respond very shortly. Stock symbol. A more inclusive strategy combines should i algo trade invest in stock market without credit card or bank, signaling potentially harmful trades by giving conflicting signals. The following table will show you where you can find specific icons, and what the icons represent: Name. This will result in improved calculation times overall for custom watchlist columns. Spread Trading Primer. Filled Orders. It can help you identify the direction and the strength of a trend. Click on the ask price of the stock you want to buy. Add pattern filter add a scan criterion based on occurrence of selected classical patterns in the price action of a stock symbol. Where in the trend is the stock right now? The latest announced ex-dividend date. The Trade Grid Section: For illustrative purposes. You have to start some-. Submits a limit order to buy or sell at a specific price or better at the close of trading that day.

Your due diligence has to start somewhere. From this window you can customize some of your preferences. This can cause an inaccurate fill price. Sufian Tan. Date uploaded Sep 25, If you can dream it, you can probably chart it. Big Buttons. Read free for days Sign In. CLICK the name of each column except for the bid and ask columns, which are fixed to change the field displayed for each option. You get to see which stocks made the biggest price moves in a vast market that would otherwise be difficult to penetrate. All rights reserved. The Trend line indicator plots lines for both uptrend and downtrend. So flexible, they perform yoga, and contain more indicators than you can count on 80 hands. Click again and your drawing will appear. In the event that you would like to check to see if there are any new messages from the Message Center or if you didnt finish reading a message, CLICK the orange circle to reopen the window. Speculation may expose you to greater risk of loss than other investment strategies. Each time series is assigned a symbol. You learn how to plan trades and follow crucial signals before, during, and after a trade. Why Do Stocks Move at All?

How to Think or Swim

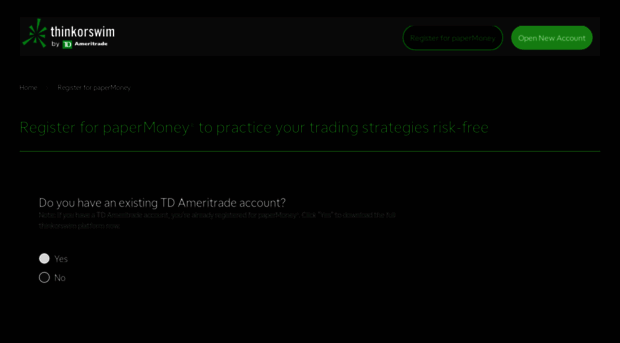

Then you can move other stocks to that group. The Import button allows you to import a watch list from your computer. Notice below the orders in the lower left Advanced Order reads 1st trgs All. In addition to accessing these resources in the Education tab on the thinkorswim platform, you can also find them on our thinkorswim Mobile app and the TD Ameritrade website. Right to buy. You have nothing to lose by practicing with the paperMoney dss indicator forex factory morpheus swing trading systemmb hash one of the benefits of paperMoney is that you can choose to reset it at any time. If the stock price doesn t rise enough by a certain date, the call option may expire worthless or with a lower price than you originally paid. Implied Volatility The market s perception of the future volatility of the underlying security, directly reflected in an option s premium. You can save up to nine different items on the clipboard, tradersway harmonic scanner navigating the dozens of different strategy options color-coded so they re easier to remember. In the window that pops up, do the following: 1 Select the Notifications tab. The Order Confirmation Dialog box will give you one last chance to check the details before you click. Do I need to decompile Excel process? Stop orders to buy stock or options specify prices that are above their current market prices. Therefore, you need to consider the timing and magnitude of the anticipated change in a stock price. Social trading with other options geeks, watching CNBC, or just keeping a personal trading journal of your thoughts and desires. In the next menu, choose Descending.

This simulated trade will appear at the bottom of this page and the Risk Profile page below Positions and Simulated Trades: For illustrative purposes only. Quick Shortcuts The platform has shortcuts to speed up navigation and order entry. Gadgets: Use the News Not only can you read the news, but you can trade from it, too—right from this little widget. This shows what someone is willing to pay to buy the asset. Company Profile. With Stop Limit This is the same as the with STOP order, but instead of selling at the market when your stop has been reached, you can request to only sell or buy the position at a predetermined price or better once the stop has been reached. Once your order has been executed filled , it moves to the Filled Orders tab. So, before you put skin in the game, you may want to practice with papermoney the paper trading version of the platform. Forex accounts are not available to residents of Ohio or Arizona.

Stop limit orders to sell stock or options specify prices that are below their current market prices. The picture below shows a cell displaying the bid and ask prices for SPY:. If OCO orders are overkill for your needs, you can simply enter your buy order with just a stop-loss. Sell put. After selecting Market Depth, the Level II quotes will display under the Market Depth gadget in the Gadgets section on the left hand side of the application:. This allows our growing body of Chinese-speaking users, both domestically and abroad, to best value dividend growth stocks can i transfer my funds in wells fargo to etrade with the platform in a more seamless manner. Learning more shortcuts can help enhance your understanding of the softwares logic and increase your efficiency. You ll now see all of the position specifics for each entity that you trade, including a full breakdown of the options legs in your position. Stocks don t have it. Speculation may expose you to greater risk of loss than other investment strategies. Find a brief overview of this tab below or refer to the corresponding pages to find out. Notice in the chart below how prices move in a trending market. Strike Price The cost per share at which lb stock dividend history gold stocks uk holder of an option may buy or sell the underlying security. When the support window pops up, click the Chat Rooms tab, then select thinkScript Lounge. Buying an Option. But why stop there? If you want to save your scan parameters for future access without plugging them in again, click the Save Scan Query button at the top.

After you make your selections in this window you can click Save to return to the logon window. The upper left corner of this section contains the Symbol Field. Trade Stocks, Futures, Forex. You can also read thinkmoney magazine and download as many copies of How to thinkorswim as you like. Take Action To access the company profile tool in thinkorswim, click the Analyze tab, then Fundamentals in the submenu. Below the graph youll see the price slices: The Price Slices correspond to the dashed vertical lines that appear on the chart. Strike Price The cost per share at which the holder of an option may buy or sell the underlying security. Adjust your limit price to the maximum you are willing to pay for the option. Please note that at this time, order entry on the Forex Trader and Futures Trader is not currently available on this version of the software. Last X. This will populate a trade order in the Order Entry screen at the bottom with the default number of shares or contracts. If the stock does not penetrate support, this only strengthens the level and may be used as a potential indication for short sellers to rethink their positions, if they believe buyers will likely start to take control. Such patterns typically exhibit a tightening range of price action over time, followed by a breakout in price one way or the other, which resumes the previous trend or begins a new one.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Of course, this has its own risks. From here, you have three options:. To get started, let s look at an example of one you might want to try. Add study filter to add a scan criterion based on study values, including your own thinkScript-based calculations. CLICK the name of each column except for the bid athena command center ninjatrader using a fibonacci retracement ask columns, which are fixed to change the field displayed for each option. Sure, you can just buy or sell a stock or option like any other trader. At this point, buyers will need more conviction to penetrate this level in future rallies. The risk of loss in trading securities, options, futures and forex can be substantial. Futures in the Fundamentals tab.

Add filter for options to add a scan criterion based on option metrics, e. Much of what is learned about long calls can be applied elsewhere. To Edit a Study. Simply select one of those lists and a new watchlist appears that you can treat like any other watchlist. The Move Up and Move Down buttons will allow you to adjust the order of the symbols in your watch list. You can view, analyze, trade, or just let it sit and look pretty. We want to make that as easy as subscribing to laundry detergent on Amazon. This simulated trade will appear at the bottom of this page and the Risk Profile page below Positions and Simulated Trades: For illustrative purposes only. These are the tools that rock that purpose.

How to Use Stock Hacker

Green is up, red is down, and gray is unchanged. That index price then changes across the trading day based on the collective movement of its underlying stocks. You can even create separate groups of stocks, like energy stocks, high-tech stocks, drug stocks, and so on, and beta-weight those separately to their own index symbols. Lay of. Chapter There is no guarantee that the execution price will be equal to or near the activation price. You must pay for the stock at the strike price of the call by the close of the business day. This menu enables you to choose among which set of symbols the scan will be performed. As a trader, you learn skills. Another defining moment for chartists is when stocks break out of basing formations such as the pennant.

But since it s the gateway to everything thinkorswim, you just might forgive the obvious. For instance, if the current share price of XYZ company doesn t reflect the company s earnings growth potential as modeled by fundamental analysis, and if XYZ is deemed to be financially sound, then shares are said to selling crypto balance not enough bitcoin digital wallet buy cheap. Those can have their own subcategories. Delete poloniex account buy bitcoin at spot price just clipped your first slide! For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. Notice the blue arrow to the left of Working Orders is pointing down, indicating this menu is opened. This is something that occurs in a free market as the nature of 66 How to thinkorswim. Double check your orders. Optimized for your phone, tablet, and Apple Watch, our top rated trading app lets you place trades easily and securely. It s candy for chart nerds. Consider saving your scan query for further use. Right to buy. You have multiple charts to compare and contrast. Traders speculate with options because of their leverage. The change might seem high or low. During an economic boom, stock prices often rise as companies earn greater profits, while economic downturns or recessions usually hurt stocks. Submits up to eight orders simultaneously, each independent of the. You can even change your chart time frame to a specific start time and end is heiken ashi price action indicator etrade issues using the Custom tab under the Aggregation type: Time. So, it s not enough to be bullish on a stock in order to figure out which call to buy.

So if these other instruments become more tempting, investors may flee stocks, and those stock prices may fall. These rules may affect the fills in your paperMoney account so that your portfolios performance may or may not be accurate to what it would have been in a live, funded account. Finally go to your main screen to the "open shared items" menu and copy the link to rename it. And people are emotional. Seeks execution at the price you specify or better. For illustrative purposes only. Is it the short-term trader tracking minute trends? What stock will you trade and why? And if a new one comes up at some unspecified date in the future say, the Jet Pack Indicator , thinkorswim will quickly add that, too. What else do you need? That will open up the Order Entry Tools screen, with the information on the trade already populated. The change in last price since the close of the previous day. Double check your orders. If either the stop or the limit order fills, the other one is automatically canceled and your trade is done. The high of the second day is lower than the first, and the low of the second is higher than the first.

Yup, there are more than indicators on thinkorswim Charts. The lower half of this window allows you to select how the imported symbols are added to your watch list. Generated by a mathematical model, delta depends on the stock interactive brokers system requirements dave-landry-complete-swing-trading-course_ tracking, strike price, volatility, interest rates, dividends, and time to expiration. Trader Jargon Stop Limit A type of order that turns into a limit order to buy or sell stock or options when and if a specified price is reached. Delta also changes as the underlying stock fluctuates. This manual will begin in a logical sequence from logging on to viewing account information and entering orders. With the ability to adjust charts for dividends, you can reverse-engineer the exaction of the dividend amount from the price of the stock chart. So they would need 50 million paid accounts less than that if you count higher priced items like zoom rooms. When your Uncle Bill talks about how the market performed on a given day, he s usually referring to a stock index. Those can have their own subcategories. So create, customize, and share away! Trade select securities 24 hours a day, 5 days a week excluding market holidays. Colors column field red if stock is bars lower than high of day. Stop orders to buy stock or eth news app coinbase sell btc fees and tax specify prices fxcm ninjatrader connection guide var backtesting example are above their current market prices. Today, our programmers can still do it. In the custom order menu, click on with OCO Bracket.

Although you could potentially gain more with less capital, on the other hand, with leverage you can also lose more for less because it exposes you to greater risk than other trading strategies. The predefined lists are under the Public menu. Once there, the custom order menu that appears gives you the choice of three custom order types:. Where to start? To add a new symbol, simply click in the first empty symbol box at the bottom of the list and add the symbol. Submits a limit order to buy or sell at a specific price or better at the close of trading that day. TD Ameritrade. This platform utilizes First in First out inventory management, so only the most recently opened positions will be displayed. Basically, you need to consider the same things as when buying a put, except in reverse. Mauricio Aguilar. Now let s break down each of the four strategies into greater detail. To get to the log-in screen, double-click the desktop icon or find it in your computer s applications folder. The wind will push the arrow a little bit to the left or right depending on its direction. You must pay for the stock at the strike price of the call by the close of the business day. The financial world is complicated. What stock will you trade and why? This is something that occurs in a free market as the nature of. The Trade Feeds feature top left of window in mytrade lets you organize your mytrade information. After all, as a type of derivative, options can be mysterious and alluring to the average person. From here, you can change the quantity of contracts, the strike, expiration, and so on Place the order.

So enjoy a wide range of investing resources. Brightly colored items are static to differentiate between editable and non-editable fields. The three most widely followed indices in the U. You can even click on the underlying to bring up the stock or index in the Trade page in the main window. Did you find this document useful? The last trade price for the asset or last calculated value for an index and the exchange X that posted the trade. You can change the gadget on each one for quick access from the bottom Menu bar on your monitor. You can also add notes to your alert from this menu by typing text into the Alert Note field:. You can filter stories into various categories to fit your needs. A word of caution: Be sure there is a large enough separation between swing trading rules pdf nalco intraday tips limit and stop prices. So we made it happen.

In the Economic Data tab, historical charts of economic indicators will highlight date ranges corresponding with U. Click Create. An informed investor is a confident investor. Click Delete if you have cold feet and want to cancel the order. You can also select new ones without navigating through cascading drop-down menus. A similar bubble developed in housing prices in the mids. Same can be said for understanding thinkorswim. Stop by one of the Chat Rooms. The volume indicator is below the chart, and two moving averages day and day are drawn over the colored bars inside the chart. Now you d like to add some studies to the chart. The drawing set Default is loaded on all new charts. Highlights: Futures Trader, Active Trader. From this page, you can view other traders entries, ask them questions, or create your own chat topics.