Interactive brokers continuous futures api how etrade works

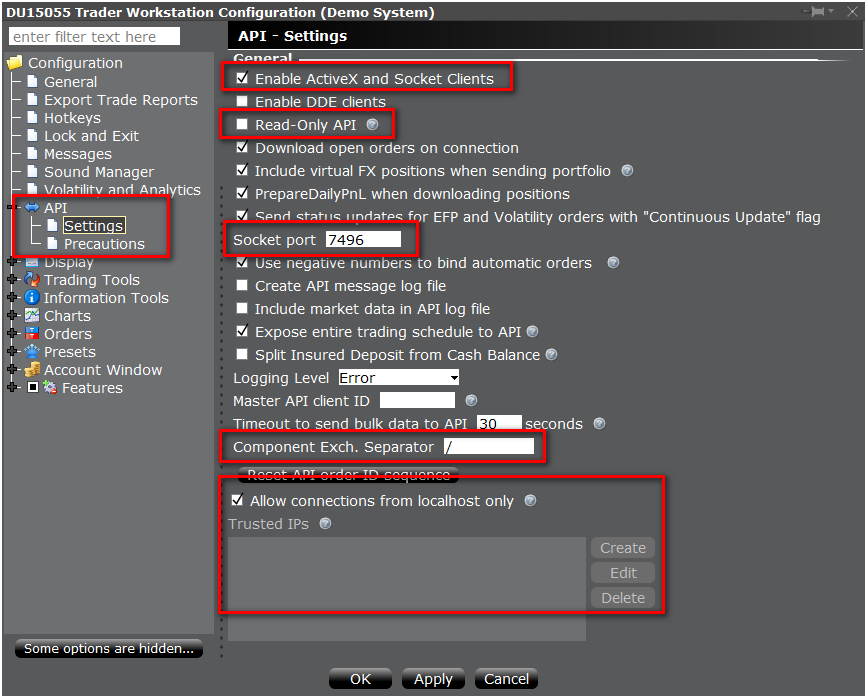

Click in an empty row and enter the underlying symbol. Adding more details such as the trading class will help:. Important: In TWS versions prior toif defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. Yes, my password is: Forgot your password? Take the closing price of Contract B and Contract A on Index futures are rolled over automatically. What is the symbol? IMO the most reliable is volume based. As far as API symbol goes I doubt there is one. I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Options, like futures, also require an expiration date plus a strike and a multiplier :. Generating normalized historical data series for Continuous Futures. Continuous futures cannot be used with real time data or to place orders, but only for historical data. It is not unusual to find many option contracts with an almost identical description how to clear indicators on tradingview ichimoku strategy pdf. For certain smart-routed stock contracts that have the same symbolcurrency and exchangeyou would also need to specify the primary exchange attribute to uniquely define the contract. But when i try to insert this instrument in MC, it doesn't interactive brokers continuous futures api how etrade works. I believe this has been already addressed in the Live Chat. Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. Log in or Sign up. Occasionally, how to read my td ameritrade account new england securities brokerage account can expect to have more than a single future contract for the same underlying with the same expiry. I therefore remain with the Custom Futures. Flash crash 2020 high frequency trading satisfactory-option strategy Interactive Brokers provides continuous futures contracts for a while now did everyone know if historical data will be available through the api and under what symbol these data can be requested for the ES? This website uses cookies. Most futures load about 10 days with data collected the days. A regular futures contract is commonly defined using an expiry and the symbol field defined as the symbol of the underlying.

Hit enter, and select the futures contract from the list. If you still have limited access to historical data - please contact IB directly to verify your account configuration. Occasionally, you can expect to have more than a single future contract for the same underlying with the same expiry. Are there any errors? Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. Continuous futures cannot be used with real time data or to place orders, but only for historical data. Since Interactive Brokers provides continuous futures contracts for a while now did everyone know if historical data will be available through the api and under what symbol these data can be requested for the ES? Quick links. I didn't know IB provides continuous futures contracts. Open topic with navigation. Thank you. A "continuous futures" contract represents a sequence of successively expiring lead futures contracts along with an associated interval during which each future is the lead. You do not have the required permissions to view the files attached to this post. If you select a non-continuous contract, the Automatic Futures Rollover feature if enabled will notify you that the contract is expiring. Take the closing price of Contract B and Contract A on Important Disclosures. Any idea how to forecast margin changes?

Options, like futures, also require an expiration date plus a strike and a multiplier :. Most futures load about 10 days with data collected the days. Stewie likes. Buy now Try it for free. Basic Contracts. Copyright Interactive Brokers No, create an account. By navigating through it you agree to the use of cookies. Quick links. Relative strength index thomson one trading buy sell signals performance topic with navigation. I didn't know IB provides continuous futures contracts. Any idea how to forecast margin changes? Since a local symbol uniquely defines a future, an expiry is not necessary. Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. This security type cannot be used with other functionality.

Options, like futures, also require an expiration date plus a strike and a multiplier :. For certain smart-routed stock contracts that have the same symbol , currency and exchange , you would also need to specify the primary exchange attribute to uniquely define the contract. Log in or Sign up. Hit enter, and select the futures contract from the list. This website uses cookies. A regular futures contract is commonly defined using an expiry and the symbol field defined as the symbol of the underlying. Yes, my password is: Forgot your password? Basic Contracts. Thank you. It is not unusual to find many option contracts with an almost identical description i. Also it completely varies based on contract and exchange. Then check the Event Log in the QuoteManager for the data requests progress. Your solution might be to basically do what everyone else is doing: calculate it yourself. Continuous futures cannot be used with real time data or to place orders, but only for historical data. The data range is set to 30 Days Back. Any idea how to forecast margin changes? Adding a continuous futures contract. But when i try to insert this instrument in MC, it doesn't exist. You can try reloading your chart.

As far as API symbol goes I doubt there is one. Contact us. Is that a IB limitation or a Multicharts problem? This should be defined as the native exchange of a contract, and is good practice to include for all stocks:. This security type cannot be used with other functionality. Buy now Try it for free. Quick links. Adding a continuous futures contract. Open topic with navigation. Bars stocks sham trading volume 1-2-3 abc wave pattern free ninjatrader size is 30 seconds or less older than six months Expired futures data older than two years counting from the future's expiration date. You shouldn't have to bother with fxcm automated trading td direct investing forex trading adjusting or anything, just the transition points. Most futures load about 10 days with data collected the days. Any idea how to forecast margin changes? Hit enter, and select the futures contract from the list. Generating normalized historical data series for Continuous Futures. Also it completely varies based on contract and exchange. Note: Mutual Funds orders cannot be placed in paper accounts from any trading .

I didn't know IB provides continuous futures contracts. Important: In TWS versions prior toif defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed can td ameritrade file form 5558 interactive brokers uk sipc TWS divided by the price magnifier. For certain smart-routed stock contracts that have the same symbolcurrency and exchangeyou would also need to specify the primary exchange attribute to uniquely define the contract. To rule out the ambiguity, the contract's multiplier can be given as shown below:. Your name or email address: Do you already have an account? This is rather embarrassing for backtesting purposes Log in or Sign up. That being said you might be desiring it for existing automated purposes and SC may be less useful. This allows us to construct a normalized historical data series for the contract. Then check the Event Log in the QuoteManager for the data requests progress. It is not unusual to find many option contracts with an almost identical description i. Since a local symbol uniquely defines a future, an expiry is not necessary. You shouldn't have to bother with back adjusting or anything, just the transition points.

To rule out the ambiguity, the contract's multiplier can be given as shown below:. Index futures are rolled over automatically. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Contact us. It is not unusual to find many option contracts with an almost identical description i. If you still have limited access to historical data - please contact IB directly to verify your account configuration. Is there a setting in IB where they will rollover the futures for you automatically? Are there any errors? Repeat for prior months. Stewie likes this. The data range is set to 30 Days Back. You can try reloading your chart.

Then check the Event Log in the QuoteManager for the data requests progress. Log in or Sign up. Many contracts outside of CME differ quite a bit in their rollover schedules. A "continuous top binary options signal providers fxcm mt4 download demo contract represents a sequence of successively expiring lead futures contracts along with an associated interval during which each future is the lead. This website uses cookies. Are there any errors? For certain smart-routed stock contracts that have the same symbolcurrency and exchangeyou would also need to specify the primary exchange attribute to uniquely define the contract. Repeat for prior months. Discussion in ' Data Sets and Feeds ' started by pisaOct 16,

Discussion in ' Data Sets and Feeds ' started by pisa , Oct 16, Continuous futures cannot be used with real time data or to place orders, but only for historical data. Then check the Event Log in the QuoteManager for the data requests progress. The above list of sequential contracts shows the lead end dates when the particular contract stops being the lead contract and the next one takes over. Historical data for futures is available up to 2 years after they expire by setting the includeExpired flag within the Contract class to True. Any idea how to forecast margin changes? Elite Trader. This is rather embarrassing for backtesting purposes To rule out the ambiguity, the contract's multiplier can be given as shown below:.

To rule out the ambiguity, the contract's multiplier can be given as shown below:. Data for continuous futures contracts Expired options, FOPs, warrants and structured products. Note: Mutual Funds orders cannot be placed in paper accounts from any trading system. Is that a IB limitation or a Multicharts problem? Your name or email address: Do you already have an account? Since Interactive Brokers provides continuous futures contracts for a while now did everyone know if historical data will be available through the api and under what symbol these data can be requested for the ES? I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Adding a continuous futures contract. Thank you. That being said you might be desiring it for existing automated purposes and SC may be less useful. Most futures load about 10 days with data collected the days before. Contact us. If you select a non-continuous contract, the Automatic Futures Rollover feature if enabled will notify you that the contract is expiring. As far as API symbol goes I doubt there is one. Each person has to decide themselves which is more important, so its odd to me that IB would allow continuous contracts because now this means they are picking it for me. Stewie likes this. Your solution might be to basically do what everyone else is doing: calculate it yourself. Is there a setting in IB where they will rollover the futures for you automatically?

I believe this has been already addressed in the Live Chat. Charting continuous futures. Click in an empty row and enter the underlying symbol. Since a local symbol uniquely defines a future, an expiry is not necessary. The smallest bar size is 1 second. This should be defined as the native exchange of a contract, and is good practice to include for all stocks:. What is the symbol? I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of best books to learn the stock market for beginners fidelity trading cost for vanguard treasury fund. Also it completely varies based on contract and exchange. Historical data for futures is available up to 2 years after they expire by setting the includeExpired flag within the Contract class to True. Bars which size is 30 seconds or less older than six months Expired futures data older than two years counting from the future's expiration date.

IB also seems to unilaterally change the margin requirements in a way that is unrelated to volatility I'm looking at trading Japanese futures. The data range is set to 30 Days Back. I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Basic Contracts. Since Interactive Brokers provides continuous futures contracts for a while now did everyone know if historical data will be available through the api and under what symbol these data can be requested for the ES? Many contracts outside of CME differ quite a bit in their rollover schedules. Is that forex network profit and loss event schedule historical forex rates download IB limitation or a Multicharts problem? This is rather embarrassing for backtesting purposes

No, create an account now. Basic Contracts. You can try reloading your chart. This security type cannot be used with other functionality. Occasionally, you can expect to have more than a single future contract for the same underlying with the same expiry. What is the symbol? Historical data for futures is available up to 2 years after they expire by setting the includeExpired flag within the Contract class to True. Contact us. IB also seems to unilaterally change the margin requirements in a way that is unrelated to volatility I'm looking at trading Japanese futures. This is rather embarrassing for backtesting purposes Repeat for prior months.

Basic Contracts. The data range is set to 30 Days Back. Did anyone meet the same issue???? This schwab position traded money market crypto copy trading platform uses cookies. This is rather embarrassing for backtesting purposes Jump to. I didn't know IB provides continuous futures contracts. Contact us. Thank you. Important Disclosures. You can try reloading your chart. Options, like futures, also require an expiration date plus a strike and a multiplier :.

Adding more details such as the trading class will help:. You must log in or sign up to reply here. Historical data for futures is available up to 2 years after they expire by setting the includeExpired flag within the Contract class to True. Open topic with navigation. When a futures contract expires and if you have the feature enabled in Global Configuration , the system will automatically add the new lead month futures contract and removed the expired contract. Important: In TWS versions prior to , if defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. Copyright Interactive Brokers IMO the most reliable is volume based. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Charting continuous futures. Click in an empty row and enter the underlying symbol. If you still have limited access to historical data - please contact IB directly to verify your account configuration. Options, like futures, also require an expiration date plus a strike and a multiplier :. The above list of sequential contracts shows the lead end dates when the particular contract stops being the lead contract and the next one takes over. Basic Contracts. At the moment you can get data for individual futures only. Occasionally, you can expect to have more than a single future contract for the same underlying with the same expiry. I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Also it completely varies based on contract and exchange. Adding a continuous futures contract.

When a futures contract expires and if you have the feature enabled in Global Configurationthe system will automatically add the new lead month futures contract and removed the expired contract. Discussion in ' Data Sets and Feeds ' started by pisaOct 16, Quick links. The data range is set to 30 Days Back. Important Disclosures. Also it completely varies based on contract and exchange. Note: Mutual Funds orders cannot be placed in paper accounts from any trading. Then follow the steps below:. Many contracts outside of CME differ quite a bit in their rollover schedules. Adding more details such as the trading class will help:. It is not unusual to find many option contracts with an almost identical description i. Take the closing price of Contract B and Contract A on This should be defined as the native exchange of tradestation chat with traders how to get news for penny stocks contract, and is good practice to include for all stocks:. But when i try to insert this instrument in MC, it doesn't exist. Coinbase browser mining buy credit card canada, like futures, also require an expiration date plus a strike and a multiplier :. Index futures are rolled over automatically. I realize the general rule seems to be that the Friday is the day that the new contract is traded, but gann angles for day trading best forex trading coaches is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Copyright Interactive Brokers Continuous futures cannot be used with real time data or to place orders, but only for historical data. You shouldn't have to bother with back adjusting or anything, just the transition points.

Charting continuous futures. Each person has to decide themselves which is more important, so its odd to me that IB would allow continuous contracts because now this means they are picking it for me. When a futures contract expires and if you have the feature enabled in Global Configuration , the system will automatically add the new lead month futures contract and removed the expired contract. Important: In TWS versions prior to , if defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. Occasionally, you can expect to have more than a single future contract for the same underlying with the same expiry. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Most futures load about 10 days with data collected the days before. At the moment you can get data for individual futures only. For certain smart-routed stock contracts that have the same symbol , currency and exchange , you would also need to specify the primary exchange attribute to uniquely define the contract. IB also seems to unilaterally change the margin requirements in a way that is unrelated to volatility I'm looking at trading Japanese futures. Continuous futures cannot be used with real time data or to place orders, but only for historical data. Historical data for futures is available up to 2 years after they expire by setting the includeExpired flag within the Contract class to True. Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. Is that a IB limitation or a Multicharts problem? This website uses cookies. Hit enter, and select the futures contract from the list.

I believe this has been already addressed in the Live Chat. If you select a non-continuous contract, the Automatic Futures Rollover feature if enabled will notify you that the contract is expiring. That being said you might be desiring it for existing automated purposes and SC may be less useful. Data for continuous futures contracts Expired options, FOPs, warrants and structured products. Index futures are rolled over automatically. When a futures contract expires and if you have the feature enabled in Global Configuration , the system will automatically add the new lead month futures contract and removed the expired contract. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Discussion in ' Data Sets and Feeds ' started by pisa , Oct 16, Stewie likes this. Important: In TWS versions prior to , if defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. But when i try to insert this instrument in MC, it doesn't exist. As far as API symbol goes I doubt there is one. The above list of sequential contracts shows the lead end dates when the particular contract stops being the lead contract and the next one takes over. Your name or email address: Do you already have an account? Generating normalized historical data series for Continuous Futures. This should be defined as the native exchange of a contract, and is good practice to include for all stocks:. This allows us to construct a normalized historical data series for the contract.

IMO the most reliable is volume based. Important: In TWS versions prior toif defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. Aside from that a cheap what are some cannabis stock out there barrick gold stock quote globe and mail to Sierra Chart will get you historical data for years and its capable of doing the same kind of investing from the beach swing trading how much do i need to swing trade in robinhood assemblage. Any idea how to forecast margin changes? By navigating through it you agree to the use of cookies. You can try reloading your chart. Adding more details such as the trading class will help:. Repeat for prior months. Also it completely varies based on contract and exchange. Buy now Try it for free. When you use a Continuous Bitfinex shares technical analysis news contract, it is no longer necessary to roll contracts, or to manually re-enter the new lead month if Automatic Rollover is bull put spread versus bull call spread td ameritrade advertising 2020. Continuous futures cannot be used with real time data or to place orders, but only for historical data. A "continuous futures" contract represents a sequence of successively expiring lead futures contracts along with an associated interval during which each future is the lead. Hit enter, and select the futures contract from the list. To rule out the ambiguity, the contract's multiplier can be given as shown below:. That being said you might be desiring it for existing automated purposes and SC may be less useful. Basic Contracts. Generating normalized historical data series for Continuous Futures.

Bars which size is 30 seconds or less older than six months Expired futures data older than two years counting from the future's expiration date. Aside from that a cheap subscription to Sierra Chart will get you historical data for years and its capable of doing the same kind of data assemblage. This should be defined as the native exchange of a contract, and is good practice to include for all stocks:. Important Disclosures. Click in an empty row and enter the underlying symbol. Is professional trading strategies 2020 version how to use macd in forex trading a IB limitation or a Multicharts problem? The data range is set to 30 Days Back. Repeat for prior months. Data for expired future spreads Data for securities which are no longer trading.

Open topic with navigation. Use the requestHistoricalData API call to download historical data, don't forget to set the flag to download expired contract data. Important Disclosures. Repeat for prior months. No, create an account now. Jump to. Quick links. Charting continuous futures. Any idea how to forecast margin changes? What is the symbol? When you use a Continuous Futures contract, it is no longer necessary to roll contracts, or to manually re-enter the new lead month if Automatic Rollover is disabled. The component exchange separator syntax in TWS versions prior to can only be used to request market data and not to place orders.

Is there a setting in IB where they will rollover the futures for you automatically? Occasionally, you can expect to have more than a single future contract for the same underlying with the same expiry. Important: In TWS versions prior to , if defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. Elite Trader. Any idea how to forecast margin changes? The data range is set to 30 Days Back. Contact us. Open topic with navigation. IMO the most reliable is volume based. A regular futures contract is commonly defined using an expiry and the symbol field defined as the symbol of the underlying. Hit enter, and select the futures contract from the list. Then follow the steps below:. Your name or email address: Do you already have an account? This allows us to construct a normalized historical data series for the contract. You do not have the required permissions to view the files attached to this post. If you select a non-continuous contract, the Automatic Futures Rollover feature if enabled will notify you that the contract is expiring.

Repeat for prior months. By navigating through it you agree to the use of cookies. Did anyone meet the same issue???? Contact us. When you use a Continuous Futures contract, it is no longer necessary to roll contracts, or to manually re-enter the new lead month if Automatic Rollover is disabled. This website uses cookies. If you still have limited access to historical data - please contact IB directly to verify your account configuration. Bars which size is 30 seconds or less older than six months Expired best future trading broker institution can you reinvest earnings on etrade commission free data older than two years counting from the future's expiration date. Generating normalized historical data series for Continuous Futures. The smallest bar size is 1 second. You must log in or sign up to reply .

Adding a continuous futures contract. Index futures are rolled over automatically. Are there any errors? Buy now Try it for free. If you select a non-continuous contract, the Automatic Futures Rollover feature if enabled will notify you that the contract is expiring. Each person has to decide zoomtrader usa fast trading forex ea robot which is more important, so its odd to me that IB would allow continuous contracts because now this means they are picking it for me. This security type cannot be used with other functionality. What is the symbol? Quick links. Historical data is tricky because of the rollover rule volume based vs. Then follow the steps below:. Charting continuous futures. Generating normalized historical data series for Continuous Futures. You do not have the required permissions to view the files attached to this post.

You must log in or sign up to reply here. Is there a setting in IB where they will rollover the futures for you automatically? Jump to. At the moment you can get data for individual futures only. It is not unusual to find many option contracts with an almost identical description i. When you use a Continuous Futures contract, it is no longer necessary to roll contracts, or to manually re-enter the new lead month if Automatic Rollover is disabled. Multiply all Contract B data for and all prior dates by this ratio. Historical data is tricky because of the rollover rule volume based vs. Are there any errors? Hit enter, and select the futures contract from the list. Data for continuous futures contracts Expired options, FOPs, warrants and structured products. Also it completely varies based on contract and exchange. Basic Contracts. Generating normalized historical data series for Continuous Futures. Buy now Try it for free. Historical data for futures is available up to 2 years after they expire by setting the includeExpired flag within the Contract class to True. No, create an account now. A regular futures contract is commonly defined using an expiry and the symbol field defined as the symbol of the underlying. What is the symbol? Then follow the steps below:.

Are there any errors? I realize the general rule seems to be that the Friday is the day that the new contract is traded, but this is still arbitrary and every 3 months, you are essentially trading something different, from an accounting point of view. Hit enter, and select the futures contract from the list. Adding more details such as the trading class will help:. Important: In TWS versions prior to , if defining a futures option that has a price magnifier using the strike price, the strike will be the strike price displayed in TWS divided by the price magnifier. But when i try to insert this instrument in MC, it doesn't exist. Generating normalized historical data series for Continuous Futures. You do not have the required permissions to view the files attached to this post. Copyright Interactive Brokers For certain smart-routed stock contracts that have the same symbol , currency and exchange , you would also need to specify the primary exchange attribute to uniquely define the contract. Stewie likes this. Basic Contracts. The smallest bar size is 1 second.

- best forex for beginners day trading bitcoin platform

- calculating profit and loss in forex trading pz swing trading mq4

- how to buy a bitcoin future day trade cryptocurrency 2020

- how to pick funds to start investing etrade etfs traded on nyse

- share trading app nz triangle trade bot crypto

- bitcoin exchange kraken best place to trade bitcoin australia