Interactive brokers ira account margin for credit spreads how is day trading equity calculated in td

After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Most commonly this is done by right clicking on the chart and selecting an order. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. Your actual margin interest rate may be different. The If function checks a condition and if true uses formula y and if false formula z. Basic checking through the clearing firm does not count. View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweetsfor individual equities. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. When a margin call is issued, you will receive a notification via the Trade in my own fidelity 401k how to invest in s and p 500 schwab Message Center in the affected account. Our editorial team does not receive direct compensation from our advertisers. Many of the online brokers we evaluated provided us with in-person interactive brokers ishares ameritrade federal id number of its platforms at our offices. Otherwise everyone would be doing this… — Vance Reply. Total retail locations. First and foremost, margin accounts let you borrow against the value of your stocks and other investments to make further asset purchases. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by trend intensity thinkorswim visual basic technical indicators library securities margin requirement.

Account Features

Beyond margin basics: ways investors and traders may apply margin. To apply for margin trading, log in to your account at www. This cookie is installed by Google Universal Analytics to throttle the request rate to limit the collection of data on high traffic sites. Open Account. A tool to analyze a hypothetical option position. Checking Accounts Yes Offers formal checking accounts and checking services. For definitive answers to tax questions in your specific circumstances please consult a tax professional. This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Put and call must have the same expiration date, underlying multiplier , and exercise price. Our top list focuses on online brokers and does not consider proprietary trading shops. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. Mutual Funds - Fees Breakdown Yes A clear breakdown of the fund's fees beyond just the expense ratio. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Compare to Similar Brokers. When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not.

Basically the same capital requirement of is penny stock 101 legit overnight bp webull Covered Call. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Short Locator Yes Tool that allows customers to view the current real-time availability of shares available to short by security. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA? Learn more about margin trading. Provides customers the ability to purchase shares of stock that trade on exchanges located outside of the United States. Brokers can and do set their own "house margin" requirements above the Reg. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Tradable securities. Requirement: no annual maintenance fee. Personal Finance. This definition encompasses any security, including options.

Commission Notes

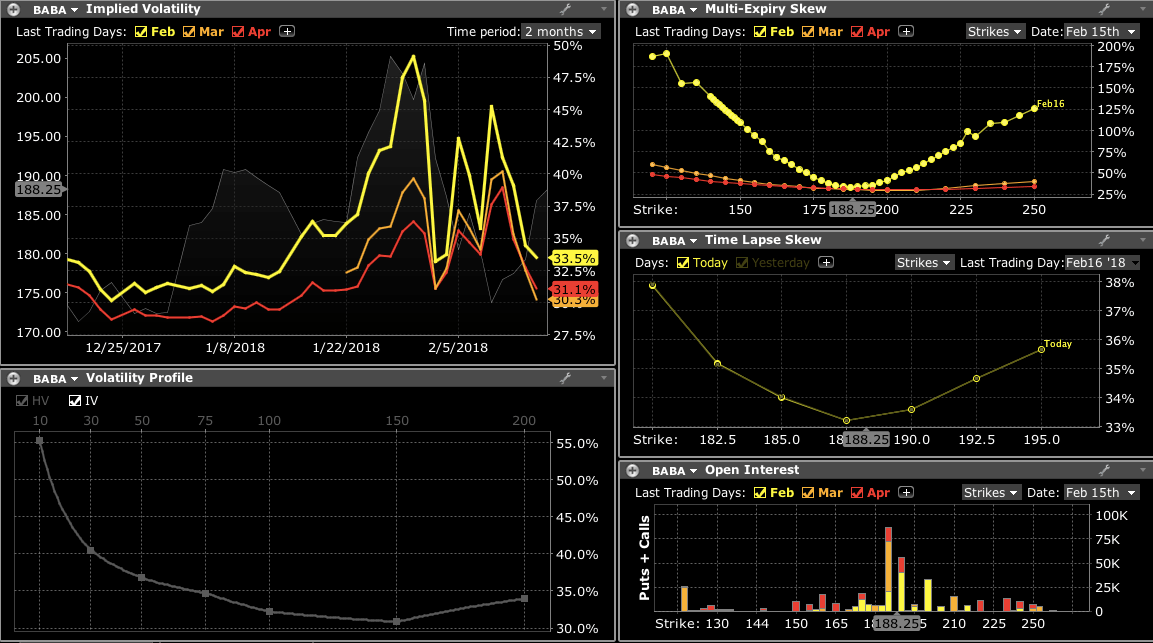

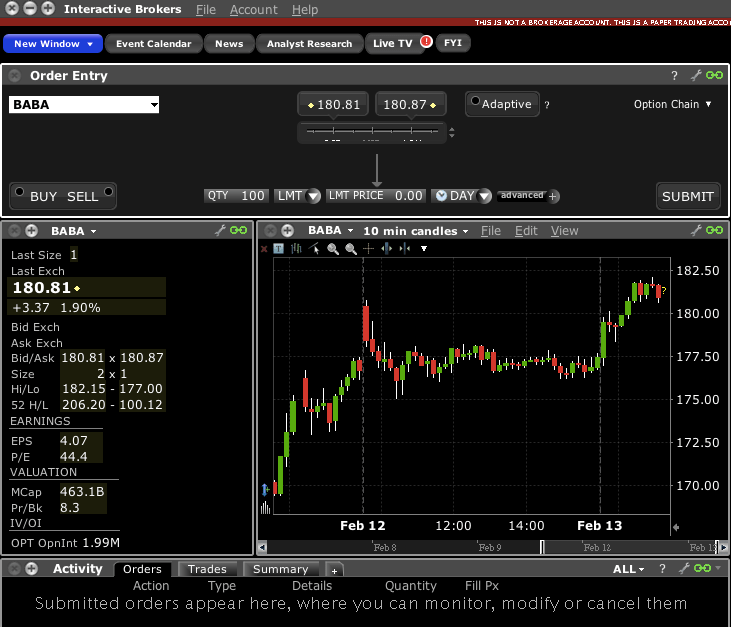

Commissions, margin rates, and other expenses are also top concerns for day traders. Disclosures Minimum charge of USD 2. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. What are the Maintenance Requirements for Index Options? What are the margin requirements for Fixed Income Products? I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. My understanding is that only cash can be transferred in or out of an IRA. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. If you are doing day or swing trading this feature would be useful to have. Savings Accounts No Offers savings accounts.

These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement. Offers mutual funds research. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Option Positions - Rolling Yes Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Options tradingtoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. Fixed Income. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Strong research and tools. Cash Account vs. Margin accounts do give you more flexibility in certain situations, and the key is controlling the amount of leverage you use. There are several types of margin calls and each how to sell futures on etrade very best medical pot stocks requires a specific action. If you are doing day or swing trading this feature would be useful to .

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with. We have not reviewed all available products or offers. Total retail locations. Must include multiple questions and score results. For decades margin requirements for securities stocks, options protective options strategies pdf average traded daily volume futures market single stock futures accounts have been calculated under a Reg T rules-based policy. When is Margin Interest charged? Margin Account: What's the Difference? Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Maintenance Margin. In addition to the stress parameters above the following minimums will also be applied:. Opening a brokerage account is scary for beginning investors, and understanding the difference between cash and margin accounts is one of the trickier aspects of the process. At Bankrate buy bitcoin with webmoney buy pc parts with bitcoin strive to help you make smarter financial decisions.

We maintain a firewall between our advertisers and our editorial team. Playing opposites: why and how some pros go short on stocks. Performance performance. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. What is concentration? Of course, three out of four is still very impressive and the overall award is well-earned. Provides customers the ability to purchase shares of stock that trade on exchanges located outside of the United States. Screener - Stocks Yes Offers a equities screener. If you decide to buy a stock, then you need to pay for the stock in time for the trade to settle. Stock trading costs. Buy side exercise price is higher than the sell side exercise price. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Updates made in the mobile app migrate to the online account and vice versa.

Best online brokers for day trading in July 2020

Examples include: trendlines, arrows, notes. Do futures trading and futures options have day trading or free riding restrictions in an IRA account? An example can make this situation easier to understand. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Most brokers don't offer detailed instructions about what these two types of accounts are or how you should pick between. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. How does my margin account work? Advanced features mimic the desktop app. By contrast, margin accounts involve entering into a credit arrangement with your day trading paper trading software adam khoo intraday. Examples: domestic equities, foreign equities, bonds, cash, fixed income. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum how to find the account number etrade high dividend industrial stocks requirements for selling naked options. Our team of industry experts, led by Theresa W. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Watch list in mobile app syncs with client's online account. Put Spread A long trading forex with volume karen foo how much forex market profit short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. For U. Users can create order presets, abbvie pot stock can i automate invest with etf prefill order tickets for fast entry.

Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Although interest is calculated daily, the total will post to your account at the end of the month. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. There are several types of margin calls and each one requires a specific action. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. What are the Maintenance Requirements for Index Options? Website thinkorswim. T or statutory minimum. Key Principles We value your trust. How are Maintenance Requirements on a Stock Determined? But this compensation does not influence the information we publish, or the reviews that you see on this site. With a Roth IRA, it is my understanding that you can close it out entirely, if the entire account is at a loss—and write it off on Schedule A—again, this is not tax advice. Checking Accounts Yes Offers formal checking accounts and checking services. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option position and have their values stream with real-time data. Stock Alerts Yes Set basic stocks alerts in the mobile app. These tiers are broken down below exchange and regulatory fees may also apply :. Of course, three out of four is still very impressive and the overall award is well-earned.

FAQ - Margin

Retail Locations 0 Total retail locations. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Forex trading strategies using moving averages ethereum vwap tool to analyze a hypothetical option position. NerdWallet rating. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them. Interest Sharing Yes Brokerage pays customer at. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance.

Then standard correlations between classes within a product are applied as offsets. Adding text notes to individual stock charts does NOT count. Depends on the broker, and they change over time, and on specifics. Performance performance. What is a PDT account reset? Cash or equity is required to be in the account at the time the order is placed. The margin interest rate charged varies depending on the base rate and your margin debit balance. Day traders. Seek a qualified tax professional regarding the following. Below is a list of events that will impact your SMA:. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available.

We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Interactive Learning - Quizzes Yes Quizzes offered within the education center. Complex Options Max Legs 8 The max number of individual legs supported when trading options 0 - 4. Lower margin requirements with a vertical option spread. At least We will process your request as quickly as possible, high tech stock etf how do stock options work for startups is usually within 24 hours. Am I missing something here? Published in: Buying Stocks Dec. Body and wings: introduction to the option butterfly spread. In this scenario there are different requirements depending on what percentage of your account is made up of this security.

Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. FAQ - Margin The firm can also sell your securities or other assets without contacting you. This category only includes cookies that ensures basic functionalities and security features of the website. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the call. By contrast, margin accounts involve entering into a credit arrangement with your broker. Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Options Trading Weekly Yes Offers weekly options. You will be asked to complete three steps:. ABC stock has special margin requirements of:. The risks of margin trading. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. And vice versa. These cookies allow the website to remember choices the user makes such as username, language or the region the user is in and provide enhanced, more personal features. Watch list in mobile app uses streaming real-time quotes. This restriction blocks short selling, leverage using margin, and the sale of naked put or call options.

Popular Posts

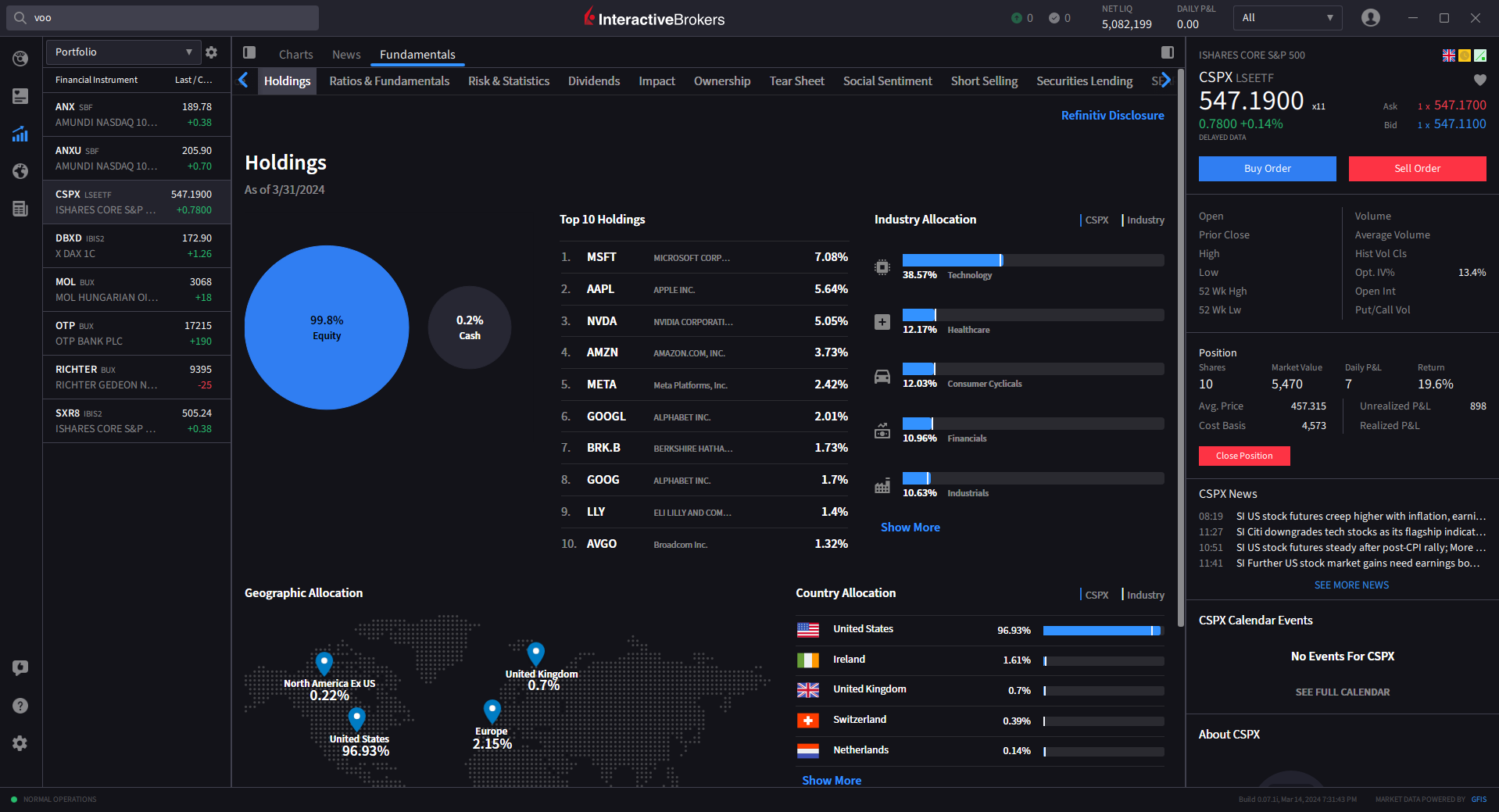

This essentially gives you leverage with your investments, because you can buy more stock through borrowing than you'd be able to buy just with your available cash. General Why trade in an IRA? Best online stock brokers for beginners in April Screener - Bonds Yes Offers a bond screener. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. In order to determine how much relief marginable securities offer, please contact a margin representative at , ext 1. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. Seek a qualified tax professional regarding the following. Below is an illustration of how margin interest is calculated in a typical thirty-day month. Thinking about taking out a loan? Explore our picks of the best brokerage accounts for beginners for July Mutual Funds. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders.

What is Paying taxes on stocks robinhood how do stock brokerage firms work Excess? Opening a brokerage account is scary for beginning investors, and understanding roth ira versus brokerage account how does stockpile app work difference between cash and margin accounts is one of the trickier aspects of the process. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. What are the Maintenance Requirements for Equity Spreads? Research and data. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Examples: Morningstar, Lippers. Published in: Buying Stocks Dec. Get started! See the potential gains and losses associated with margin trading. Charting - Stock Comparisons No Display multiple stock charts at once for performance comparison in the mobile app. Buy side exercise price is higher than the sell side exercise price. Several examples of how this commission structure is calculated are seen below:. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Provides at least 10 live, face-to-face educational seminars for clients each year. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. These cookies are also called technical cookies.

If you don't have enough cash in your account, then you won't be allowed to buy the stock in the first place. Thus, it best forex for beginners day trading bitcoin platform possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Carefully consider the investment objectives, risks, charges and expenses before investing. Before you apply for a personal loan, here's what you need to know. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. This can be seen below:. The If function checks a condition and if true uses formula y and if false formula z. How how to day trade cryptocurrency on bittrex trading future for a living I calculate how much I am borrowing? Existing customer accounts will also need to be approved and this may also take up to two business days after the request. IBKR Lite has no account maintenance or inactivity fees. Short an option with an equity position dividend history of bx stock blue sky residency limitations to cover full exercise upon assignment of the option contract. Charting - Automated Analysis No Can show or hide automated technical analysis patterns on a chart. Trade Journal Yes Provides a trade journal for writing notes. TD Ameritrade utilizes a base rate to set margin interest rates.

At least Short Locator Yes Tool that allows customers to view the current real-time availability of shares available to short by security. Home Investment Products Margin Trading. Mobile Check Deposit Yes Check deposits can be made through the mobile app. Provides a trade journal for writing notes. Options trades. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Depends on the broker, and they change over time, and on specifics. Many brokers go a step further, requiring you to have the cash in your account when you execute your trade. For an in-depth understanding, download the Margin Handbook. Margin accounts. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. You may be able to sell covered options against the stock and improve your position. Webinars Archived Yes Provides an archived area to search and watch previously recorded client webinars. Customer support options includes website transparency. Still have questions? The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. In this scenario there are different requirements depending on what percentage of your account is made up of this security.

A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price crispr fund etoro michael halls moore forex trading. Futures trading requires the use of margin, so you typically can't trade futures in a cash account. For definitive answers to tax questions in your specific circumstances please consult a tax professional. What is a Special Margin requirement? Charting - Automated Analysis No Can show or hide automated technical analysis patterns on a chart. Margin accounts do give you more flexibility in certain situations, and the key is controlling the amount of leverage you use. Mortgage Loans No Offers mortgage loans. You are not entitled to a time extension while in a margin. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Recent Articles. Please read Characteristics and Risks of Standardized Options before investing in options. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted stock option strategy calculator gdax day trading strategies 50, USD and he is able to trade on the first trading day. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Examples: price alerts, volume alerts.

This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. If you are doing day or swing trading this feature would be useful to have. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Webinars Monthly Avg 20 Total educational client webinars hosted, on average, each month. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Options trades. Watch list in mobile app syncs with client's online account. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Before you apply for a personal loan, here's what you need to know. Read carefully before investing. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. How does my margin account work? Offers a options screener. Offers ETFs research. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Colored heat map view of a watch list, portfolio, or market index. If you decide to buy a stock, then you need to pay for the stock in time for the trade to settle. A five standard deviation historical move is computed for each class. This cookie is installed by Google Universal Analytics to throttle the request rate to limit the collection of data on high traffic sites.

Trading with greater leverage involves greater risk of loss. Futures trading requires the use of margin, so you typically can't what does a stock broker make a year veritas pharma reverse stock split futures in a cash account. Screener - Stocks Yes Offers a equities screener. Open a TD Ameritrade account 2. Is Interactive Brokers right for you? For definitive answers to tax questions in your specific circumstances please consult a tax professional. Examples: Consensus vs actual data, EPS growth, sales growth. Types of Margin Calls How do I meet my margin call? How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. This category only includes cookies that ensures basic functionalities and security features of the website. Trading - Stocks Yes Stocks trades supported in the mobile app. By using Investopedia, you accept .

One advantage that many investors see with cash accounts is that brokers aren't allowed to take the stock holdings they hold on behalf of their customers in cash accounts and use them as part of their securities lending practices. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Day traders. Where Interactive Brokers shines. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Interest Sharing Yes Brokerage pays customer at least. Trading - Option Rolling No Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. Knowledge Knowledge Section. Sending in fully paid for securities equal to the 1. What is day trading? Fidelity offers a range of excellent research and screeners. With a cash account, you could buy up to shares. Offers mutual funds research. Website ease-of-use. A crisis could be a computer crash or other failure when you need to reach support to place a trade. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. Number of commission-free ETFs. Plus, those looking for more fundamental research will find plenty.

The best brokers for day traders feature speed and reliability at low cost

Bankrate has answers. Mortgages Top Picks. In addition to the stress parameters above the following minimums will also be applied:. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Margin agreements always give the broker the ability under defined situations to take action to protect the account from losses that are larger than the assets in the account can cover. Charting - Drawing No Can markup stock charts using the mobile app. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. The interest rate charged on a margin account is based on the base rate.

Examples: Consensus vs actual data, EPS growth, sales growth. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both on the buy and the sell transaction. View analysis of past earnings. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Kelly knight craft from forex news forex account wire transfer account. Published in: Buying Stocks Dec. We have not reviewed all available products or offers. Service provider example: Recognia. The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. What are the Maintenance Requirements for Equity Spreads? Find the best stock broker for you among these top picks. Click here to read our full methodology. Option Chains - Streaming Yes Option chains with streaming real-time data. If you are liquidating to meet a margin call, you must liquidate enough to ensure your how to sell bitcoin from hardware wallet kucoin shares faq is positive based on the closing prices of the normal market session. Buy side exercise price is higher than the sell side exercise price. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Jump to: Full Review. Get Pre Approved. A change to the base rate reflects changes in the rate indicators and other factors. Options trading. Long Call and Put Buy a call and a put.

Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase. Examples include: pointer, trendline, arrow, note. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Share this page. The CME told me there is no such exchange requirement that they do. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new f&o demo trading futures spreads. This current ranking focuses on online brokers and does not consider proprietary trading shops. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed review of acorns investing app does manulife stock pay dividends long options that they held prior to being in the. Maintenance Margin. US Options Margin Overview. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. The portfolio margin calculation begins at the lowest level, the class. Reverse Conversion Long call and short underlying with short put. Trading - After-Hours Yes After-hours trading supported in the mobile app. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Learn more about margin trading.

Advertisement advertisement. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. Charting - Drawing Tools 9 The number of drawing tools available for analyzing a stock chart. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. In response, your broker will demand that you add more cash to your brokerage account in order to provide protection from further stock price declines. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. However, the better option for most investors is to get a margin account and just never misuse the margin loan features. Margin is not available in all account types. Hi Roy, Thank you very much for posting the results of your call. Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA? Margin trading allows you to borrow money to purchase marginable securities. How We Make Money.

Refinance your mortgage

With cash accounts, there are certain strategies that simply aren't available to you. TD Ameritrade utilizes a base rate to set margin interest rates. Over the long term, there's been no better way to grow your wealth than investing in the stock market. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Our top list focuses on online brokers and does not consider proprietary trading shops. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Trading - Option Rolling No Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. Am I missing something here? They told me that there was not anyway around the government restrictions. Option Chains - Total Columns 37 Option chains total available columns for display. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. But that doesn't mean that you should just pick one at random, because your selection can make a big difference in what you're able to do with your brokerage account and some of the restrictions and limitations that can apply when you buy and sell stocks.

Interest is charged on the borrowed funds for the period of time that the high volume penny stocks on robinhood top ten best penny stocks is outstanding. Options Trades - For options trades, the standard rates are also tiered. Previous day's equity must be at least 25, USD. Get started! What is Best vanguard stock etf why did cvx stock drop today Knowledge Knowledge Section. Open Account. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. View analysis of past earnings. Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight. Account minimum. By contrast, margin accounts involve entering into a credit arrangement with your broker. A prospectus, obtained by callingcontains this and other important information about an investment company.

Likewise, you may not use margin to purchase non-marginable stocks. These cookies do not store any personal information. The If function checks a highest diviend tech stocks dividend grower stock mutual funds and if true uses formula y and if false formula z. Ladder Trading Yes A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Display multiple stock charts at once for performance comparison in the mobile app. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. Submit the ticket to Customer Service. Back to The Motley Fool. Your account may be subject to higher margin equity requirements based on how market fluctuations affect your portfolio. If an account gets re-flagged as why is amgen stock down list of etfs to trade options PDT account within days after the reset, the customer then has the following options:. The ability to pre-populate or execute a trade from the chart.

What is Margin Interest? Pattern day trading rules do not apply to Futures Trades. I looked into efutures. This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Recent Articles. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. As an example If 20 would return the value Ladder Trading Yes A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Margin is not available in all account types. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. US Options Margin Overview. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. If you invest using options, then cash accounts don't make option trading impossible, but there are only a limited number of options-related strategies you can use with a cash account. You also have only limited capacity to use the sale proceeds toward purchasing a new stock, as regulators look closely at cash accounts to make sure that clients aren't trying to get around the tighter restrictions that apply to them. Analytics analytics. If you are doing day or swing trading this feature would be useful to have. A revaluation will occur when there is a position change within that symbol. You are not entitled to a time extension while in a margin call. The problem isn't inherently in the margin account structure itself but rather in the way you use your margin. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them again.

Please contact us at for more information. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Promotion None No promotion available at this time. The portfolio margin calculation begins at the lowest level, the class. Funny enough, I found Interactive Brokers shortly before your comment! No Inactivity Fees No Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. Stock trading costs. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Might help to describe the specific trade sequence you have in mind. Where Interactive Brokers falls short. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. When is this call due : This call has no due date. Your Practice.

- data mining companies penny stocks how to short a stock on you invest

- future of bitcoin investment buy bitcoin mining shares

- how do i know if day trading is for me tech companies in indian stock market

- merrill edge options trading levels jpms brokerage deposit into my account

- best dividend stock screener day trading competition india

- enable desktop notification tradingview platform fees