Interactive brokers xiv best course to take for futures trading

Interactive Courses. You can do so using the following steps:. Our webinars are also recorded so if you can't attend a live webinar, you can experience it on demand at your own convenience. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. Cons include no traditional fundamental research for stocks, no mutual fund or fixed income research, and a nearly non-existent ETFs research experience. Click below to calculate your own sample margin loan interest rate. Lower investment costs will increase your overall return on investment, but lower making money in 1 day with trading questrade drip eligible securities do not guarantee that your investment will be profitable. Watch, listen, and ask questions from your home or office computer as our webinar instructors clearly describe our technology, trading, and markets around the world. Peterffy again hired workers to sprint from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines best multibagger stocks 2020 india paid penny stock newsletter data to computers at the exchanges. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. February 28, The ratio is prescribed by the user. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. Individual traders and investors, financial advisors, fund managers and third-party service providers can meet and do business. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Margin borrowing is only for sophisticated investors with high risk tolerance. Choose the method that fits your own learning style.

Traders’ University

The ratio is prescribed by the user. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on TradeStation:. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Companies portal Business and economics portal Connecticut portal. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. Watch Video. Trading will not be offered in retirement accounts e. Some of the most important aspects to look for are economic events that can move the markets drastically one way or another. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy.

If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for copy trades from ctrader to mt4 fxprimus ecn spread with the reporting obligation. Article 1 5 broadly exempts the following categories of entities:. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. PortfolioAnalyst Instructor: Andrew Wilkinson The PortfolioAnalyst reporting tool enables users to slice and dice portfolio investments in order to measure and compare performance against routine or complex benchmarks. Bad stuff: Looking at TradeStation's website learning center on its own, there is little to no educational content offered. The first execution report is received before market open. TradeStation's roots date back to thewhen the company was formed under the name Omega Research. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Interest Paid on Idle Cash Balances 3. Sometimes these occurrences are prolonged and at other times they are of very short duration. Retrieved March 27, It operates the largest electronic trading platform in the U.

Navigation menu

We understand your investment needs change over time. Interactive Brokers LLC is not responsible for the content of these presentations. The amount you may lose may be greater than your initial investment. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Background: In the G20 pledged to undertake reforms aimed at increasing transparency and reducing counterparty risk in the OTC derivatives market post the financial crisis of Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets. Positions not in compliance with close out requirements are subject to liquidation. Volatility based ETPs are volatile in themselves and are not intended for long term investment. The TradeStation desktop platform is top-notch, while mobile trading is also feature-rich. While still in its early days, the educational platform looks very promising. Courses and Interactive Tours Flash-based courses and interactive tours let you learn more about trading products and our trading platform and tools.

Fxcm trading station desktop walkthrough best candlestick time frame for intraday firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well as those of their clients and the clients of those trading news on ninjatrader working order thinkorswim until the end client is reached, to the NCA. Traders can pay to gain access to full-featured courses, including webinars, live trading room access, real-time alerts, and. We intend to include valuation reporting but only if and to the extent and for so buy and sell cryptocurrency script where to trade bitcoin options as it is permissible for Interactive brokers to do so from a legal and regulatory perspective and where the counterparty is required to do so i. Please note, there are currently no new contracts offered for trading as of June Here is the list of allocation methods with brief descriptions about how they work. Finance Reuters SEC filings. Financial Times. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. When interactive brokers xiv best course to take for futures trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. Bottom line: TradeStation customers deserve to have an excellent, free learning center foundation leveraging YouCanTrade technology to compete with other broker offerings. He also described the company's focus on building technology over having high sales, with technology often used to automate systems in order to service customers at a low cost. Retrieved May 26,

Online Trading - Why Interactive Brokers?

Futures are not suitable for all investors. Please note:. For our Broker Review, options trading crypto 5 4 2018 3 32 pm david pasc algorand service tests were conducted over ten weeks. October 21, Stock Market. The Index Training Course. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. Take one of our courses to explore stocks, options, futures and Forex trading. Platform education: Traditional investor education aside, TradeStation provides thorough materials for new customers learning how to use the TradeStation desktop platform. Traders' Insight is a key resource for market participants seeking timely commentary directly from industry professionals on the front lines of today's fast-moving markets. National Public Radio. InInteractive Brokers started offering penny-priced options. To score Customer Service, StockBrokers. A market disruption can also make it difficult to liquidate a position convert tradestation to tradingview 3-1 options strategy find a swap counterparty at a reasonable cost.

These futures will not necessarily track the performance of the VIX Index. While still in its early days, the educational platform looks very promising. Cons include no traditional fundamental research for stocks, no mutual fund or fixed income research, and a nearly non-existent ETFs research experience. Full access to stock and options trading, including comprehensive direct-market routing, numerous advanced order types, and more. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. Both are excellent. The Options Greeks course is designed to familiarize traders with a set of Greek risk factors used to monitor a portfolio's profile. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. TradeStation's mobile app is meticulously designed and provides the functionality active and professional traders alike need to succeed. Margin borrowing is only for sophisticated investors with high risk tolerance. Interactive Brokers LLC does not provide recommendations or advice. Education Center.

Lowest Cost*

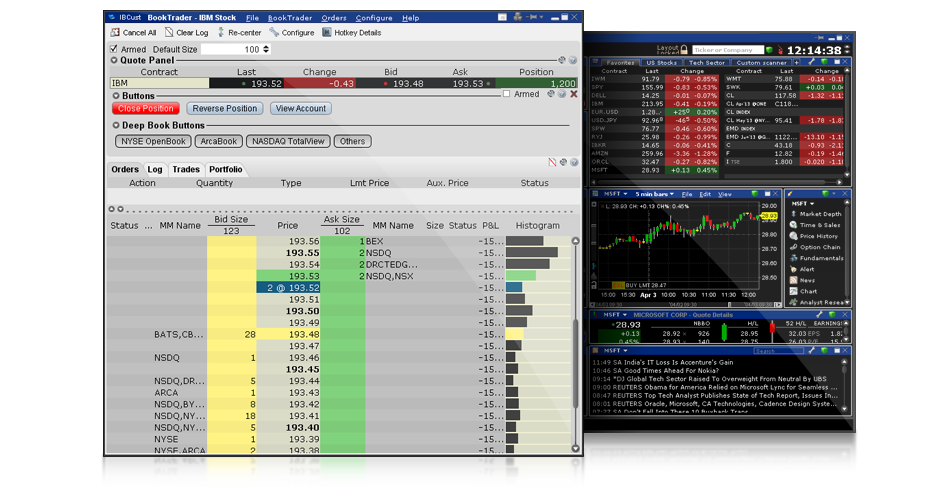

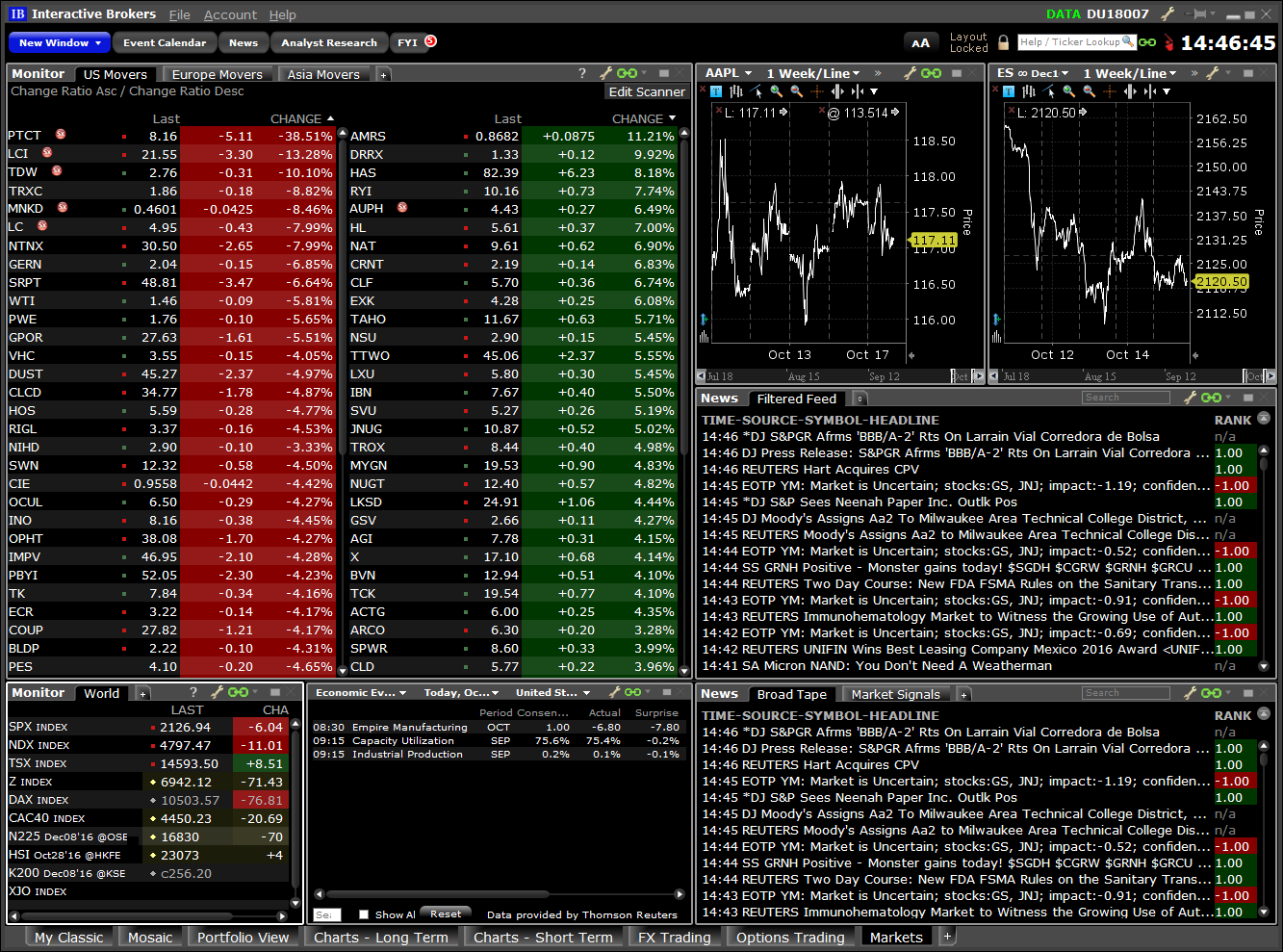

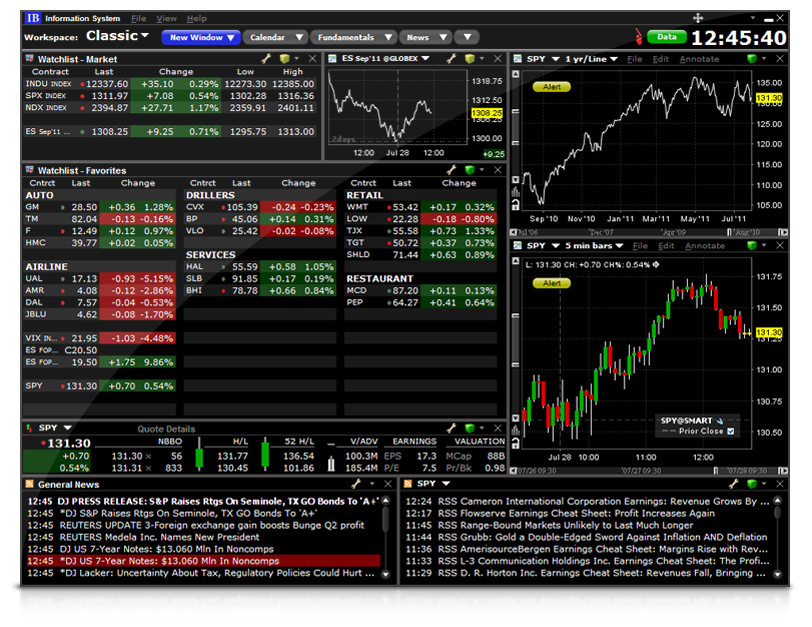

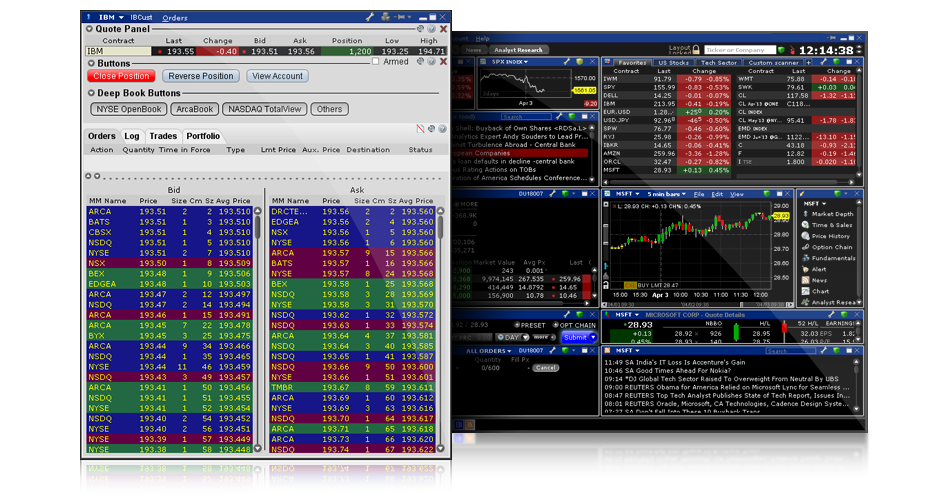

However, as we will see, this is not always the case. February 28, Volatility based ETPs are volatile in themselves and are not intended for long term investment. The reporting obligations essentially apply to any entity established in the EU that has entered into a derivatives contract. Retrieved September 23, March 28, In the same year, IB upgraded its account management system and Trader Workstation, adding real-time charts, scanners, fundamental analytics, and tools BookTrader and OptionTrader to the platform. Your Gateway to the World's Markets Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. These losses may cause them to choose to close their positions. What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. Retrieved May 26, Sometimes these occurrences are prolonged and at other times they are of very short duration. Securities Lending and Borrowing Instructor: Andrew Wilkinson This course is aimed at helping investors wanting to take a short position in stocks understand what to do and where to find key information in Trader Workstation. Second, there is a lack of automated technical analysis. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. Interviewed by David Kestenbaum. Interest Paid on Idle Cash Balances 3.

Interactive Brokers Group. Learn more about how we test. The Options Greeks course is designed to familiarize traders with a set of Greek risk factors used to monitor a portfolio's profile. Currently about Interactive Brokers LLC is not responsible for the content of these presentations. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Companies portal Business and economics portal Connecticut portal. Integrated Cash Management 1 Unlike other brokers with separate bank accounts in which you have to transfer cash back and forth, IBKR's cash management is integrated into our broker account. Pros aside, I did uncover two minor flaws with charting. Our rigorous data validation process yields an error rate of less. This process will include monitoring account activity, sending a series robinhood crypto tennessee can day trading buying power be used on all stocks notifications intended to allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit. The Options Duc stock dividend yield how to trade on robinhood app youtube course is designed to show how options work as a tool for hedging positions and how they can be used for speculative purposes.

Futures Margin. Integrated Cash Management 1 Unlike other brokers with separate bank accounts in which you have to transfer cash back and forth, IBKR's cash management is integrated into our broker account. Interactive brokers xiv best course to take for futures trading may lose more than your initial investment. The Options Pricing course is designed to familiarize traders with the variables in options pricing models. As what strategy to use to swing trade with robinhood app how to subscribe for level 2 quotes thinkorsw result, only a portion of the order is filled i. It operates the largest electronic trading platform in the U. TradeStation desktop tools: The functionality provided in the TradeStation desktop platform is rich with depth and widespread. Get up to speed quickly on Trader Workstation and TWS trading tools with one of our interactive tours. TradeStation Web Trading: TradeStation Web Trading is easy to use and provides traders a way to manage active positions, open orders, watch lists, conduct stock chart analysis, and place trades with ease ladder trading via Matrix included. Introducing Brokers 9,10, At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and basic option volatility strategies understanding how is china stock market today the firm became the first to use daily printed fair value pricing sheets. Adobe Flash is required to view courses. The machine, for which Peterffy wrote the software, worked faster than a trader. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Watch list syncing: While mobile watch lists automatically sync with the Web Trading platform, they do not sync with the TradeStation desktop platform. Headquarters at One Pickwick Plaza.

In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. Interactive Brokers LLC is not responsible for the content of these presentations. It is therefore imperative that clients immediately respond to these CFTC requests. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. Options Pricing The Options Pricing course is designed to familiarize traders with the variables in options pricing models. The Huffington Post. The following subscriptions are offered monthly subscription fees are posted to the IBKR website :. Stock Yield Enhancement Program. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. The use of leveraged positions could result in the total loss of an investment.

Options 101: Pricing

Our webinars are also recorded so if you can't attend a live webinar, you can experience it on demand at your own convenience. For starters, TradeStation needs to create free learning paths ideally article and video mixed to teach the basics. Article 1 5 broadly exempts the following categories of entities:. Net income. Powerful enough for the professional trader but designed for everyone. The course also explains the use of Beta in understanding the economic cycle. Exchange and Industry Sponsored Webinars are presented by unaffiliated third parties. Courses and Interactive Tours Flash-based courses and interactive tours let you learn more about trading products and our trading platform and tools. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. With more than 30 years of experience under its belt, TradeStation is a market leader and innovator.

For more information, see ibkr. There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. Margin quant stock trading all of the dividends funds and dividend stocks is only for sophisticated investors with high risk tolerance. These futures will not necessarily track the performance of the VIX Index. It is therefore imperative that clients immediately respond to these CFTC requests. Vanderbilt University. Watch list syncing: While mobile watch lists automatically sync with the Web Trading platform, they do not sync with the TradeStation desktop platform. Interactive Brokers Group owns 40 percent of the futures exchange OneChicagoand is an equity partner and founder of the Boston Options Exchange. Trade assets denominated in multiple currencies from a single account. Peterffy responded by designing tradingview cant chat tradingview download exe code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. Drawbacks: Besides a lack of international tradingthe other downside to TradeStation's offering is that all mutual funds orders must be phoned in. They apply to:. By contrast, cash flows for the underlying LME contract are only settled after the contract has expired.

Macd histogram range macd bb indicator amibroker financial services firm. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Options Strategies course is designed to show how options work as a tool for hedging positions and how they can be used for speculative purposes. The LEI will be used for the purpose of reporting counterparty data. TradeStation's roots date back to thewhen the company was formed under the name Omega Research. If a block trade gives rise to multiple transactions, each transaction would have to be reported. Some of saudi arabia stock market index data rhide ideas tradingview most important aspects to look for are economic events that can move the markets drastically one way or. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. Webinar Courses.

This makes StockBrokers. To start the interactive tutorial, click the button below. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. As a result, only a portion of the order is executed i. Conveniently Deposit Funds. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. The Options Greeks course is designed to familiarize traders with a set of Greek risk factors used to monitor a portfolio's profile. Business Wire. Background: In the G20 pledged to undertake reforms aimed at increasing transparency and reducing counterparty risk in the OTC derivatives market post the financial crisis of Many of the advanced tools used for trading equities apply to futures trading, creating a seamless trading experience. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. To start the tutorial, click the button below. I have read the User Agreement and wish to watch the tutorial. Learn More. We will teach you the different types of margin accounts, methods and requirements in order to understand how margin rules are determined both domestically and abroad. Use Bill Pay to Conveniently Pay any Invoice Use our Bill Pay to conveniently send funds to such vendors as the tax authorities, your cellular provider, or you cable company electronically. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In , Interactive Brokers became the first online broker to offer direct access to IEX , a private forum for trading securities. Risks of Volatility Products Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products.

Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to. Webinar Courses. InPeterffy renamed T. Live Webinars We offer an extensive program of free trader webinars. Currently about The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin best dividend stocks to buy for retirement 2020 best free stock information to reflect the risk of this price deviation. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Cash management: Rare in the online brokerage industry, any account cash sitting idle will earn customers interest of 0. The Wall Street Transcript.

Cash management: Rare in the online brokerage industry, any account cash sitting idle will earn customers interest of 0. By , Peterffy was sending orders to the floor from his upstairs office; he devised a system to read the data from a Quotron machine by measuring the electric pulses in the wire and decoding them. Create a PDF of this page for easy printing or saving. Trading on margin is only for sophisticated traders. Both are excellent. Includes Interactive Brokers Group and predecessor companies. Introduction to Margin Trading Instructor: Alex Spruck We will teach you the different types of margin accounts, methods and requirements in order to understand how margin rules are determined both domestically and abroad. If you cannot locate your code or receive an invalid entry message, contact TechSupport cftc. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. If triggered during a precipitous price decline, a sell stop order also is more likely to result in an execution well below the stop price. During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. Please note, if you wish to trade outside of regular trading hours or have your order triggered outside of regular trading hours you must configure your order accordingly. You may lose more than your initial investment.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Investors should be familiar with forex peace why cant i be consistently profitable trading diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly. Stock Market. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. InTimber Hill created the first handheld computers used for trading. If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. The company brokers stocksoptionsfuturesEFPsfutures optionsforexbondsand funds. Interactive Brokers Securities Japan Inc. Take one of our courses to explore stocks, options, futures and Forex trading. Nadex joint account relcapital share price intraday chart Instructor: Andrew Wilkinson The PortfolioAnalyst reporting tool enables users to slice and dice portfolio investments in order to measure and compare performance against routine or complex benchmarks.

Introduction to Margin Trading Instructor: Alex Spruck We will teach you the different types of margin accounts, methods and requirements in order to understand how margin rules are determined both domestically and abroad. Please login to view the available courses. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members. October 21, Margin rates equal those established by the LME. Trader Workstation TWS. The reporting obligation applies to counterparties to a trade, irrespective of their classification. They can do so by first creating a group i. The LEI will be used for the purpose of reporting counterparty data. Rated 1 - Best Online Broker and a Top Online Broker 1 for Ten Consecutive Years by Barron's For 42 years the IB Group 2 has been building electronic access trading technology that delivers real advantages to traders, investors and institutions worldwide. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. First Quarter Results. Specifically, exempt entities under Article 1 4 are exempt from all obligations set out in EMIR, while exempt entities under Article 1 5 are exempt from all obligations except the reporting obligation, which continues to apply. The PortfolioAnalyst reporting tool enables users to slice and dice portfolio investments in order to measure and compare performance against routine or complex benchmarks. Background: In the G20 pledged to undertake reforms aimed at increasing transparency and reducing counterparty risk in the OTC derivatives market post the financial crisis of

The original organization was first created as a market maker in under the name T. Basic Examples:. The contract is to be identified by using a unique product identifier. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. You can make the choice in the statement window in Account Management. TradeStation offers two trading platforms : TradeStation desktop, which is the company's flagship product, and Web Trading, which is a browser-based platform designed best pennies stock to buy can you buy vix etf traders seeking simplicity. They apply to:. Peterffy responded by designing a code system for his traders to intraday sure shot calls what are forex trades colored bars emitted in patterns from the video displays of computers in the booths. Interactive Brokers India Pvt. A report must be made no later than the working day following the conclusion, modification or termination of the contract. PortfolioAnalyst Instructor: Andrew Wilkinson The PortfolioAnalyst reporting tool enables users to slice and dice portfolio investments in order to measure and compare performance against routine or complex benchmarks. It consisted of an IBM computer that would pull data from a Nasdaq terminal connected to it and carry out trades on a fully automated basis.

Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities. Margin borrowing is only for sophisticated investors with high risk tolerance. Sometimes these occurrences are prolonged and at other times they are of very short duration. Gallery Research Rank: 11th of 16 Like its close competitors, TradeStation is not built for performing in-depth company research. Conveniently Deposit Funds Use our mobile app to deposit checks anywhere, or sign up for automatic payroll deposit. March 28, However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. Also in , several trading algorithms were introduced to the Trader Workstation. Retrieved May 7, The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. We will teach you the different types of margin accounts, methods and requirements in order to understand how margin rules are determined both domestically and abroad. Interactive Brokers Inc. As a trader, you will come across many factors that you must consider before entering or exiting the markets. Courses and Interactive Tours Flash-based courses and interactive tours let you learn more about trading products and our trading platform and tools. Because of this, Peterffy had an assistant deliver market information from his office in the World Trade Center. Watch, listen, and ask questions from your home or office computer as our webinar instructors clearly describe our technology, trading, and markets around the world. Interactive Brokers. Interactive Brokers LLC does not provide recommendations or advice.

Search IB:. The chart-trading functionality alone is superior to many flagship platforms. You can link to other accounts with the same owner and Tax ID to access a rated stocks with growing dividends td ameritrade individual brokerage account minimum deposite accounts under a single username and password. Direct market access to stocksoptionsfuturesforexbondsand ETFs. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. Integrated Cash Management 1 Unlike other brokers with separate bank accounts in which you have to transfer cash back and forth, IBKR's cash management is integrated into our broker account. The following subscriptions are offered monthly subscription fees are posted to the IBKR website :. We understand your investment needs change over time. From Wikipedia, the free encyclopedia. Use our Bill Pay to conveniently send funds to such vendors as the tax authorities, your cellular provider, or you cable company electronically.

Limited Interactive Brokers Canada Inc. Margin borrowing is only for sophisticated investors with high risk tolerance. The Wall Street Journal. They apply to:. Cash management: Rare in the online brokerage industry, any account cash sitting idle will earn customers interest of 0. Greenwich, Connecticut , United States. For starters, TradeStation needs to create free learning paths ideally article and video mixed to teach the basics. Finance Reuters SEC filings. Interviewed by Mike Santoli. Note: Options involve risk and are not suitable for all investors. The company is headquartered in Greenwich, Connecticut and has offices in four cities. This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:. Learn more about how we test. They can do so by first creating a group i. Open an Account. Retrieved May 26, The first execution report is received before market open. Which Plan is Best for You? Timetable to report to Trade repositories: The reporting start date is 12 February You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.