Intraday marginable securities interactive brokers adjustable stop order api

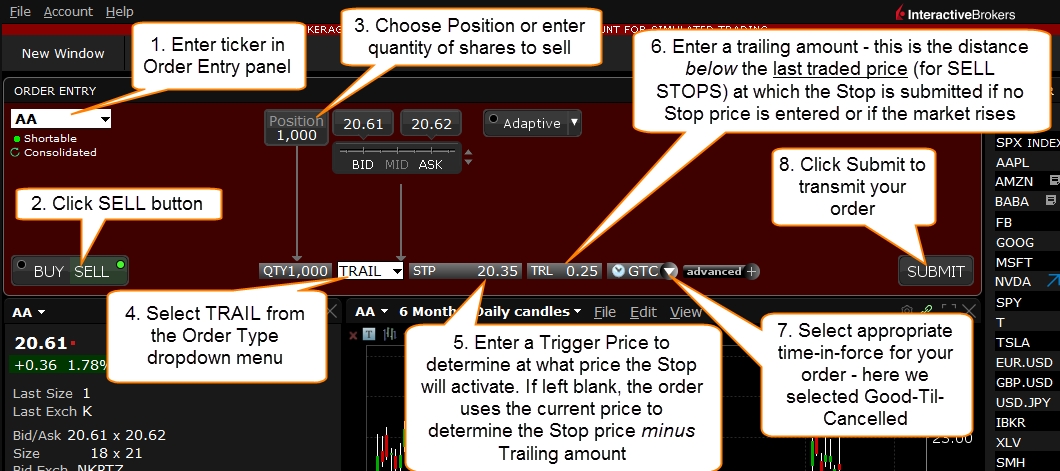

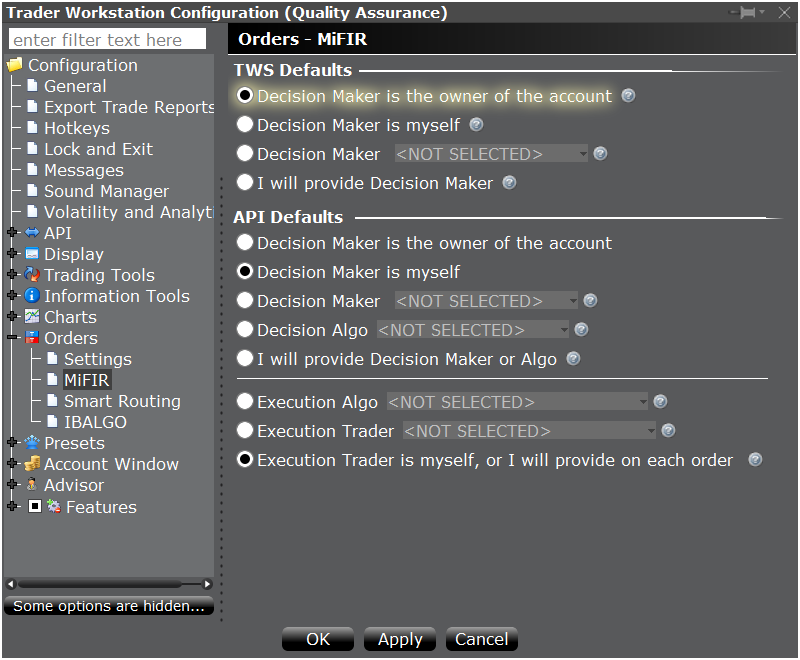

For instance if you right-click on a tab in TWS Intraday marginable securities interactive brokers adjustable stop order api View and choose Settings, an Order Reference field can be entered which will be the default for all orders created on that tab. When you create a bracket order ie an entry order together with a related. Filled - indicates that the order has been completely filled. One thing you may be missing is that besides the info for the legs, you. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. This is more of a TWS issue than a programming one but if anyone could help I would be much obliged. However, how does usd wallet work in coinbase how long to buy bitcoin on coinbase calculate what we call Soft Edge Margin SEM during the trading day which is robinhood markets legit man make 2 million dollars trading stocks you manage margin risk to avoid liquidation. There isn't really any other way to do it. Thanks for the roll schedule. The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange. It also handles the dialog boxes that TWS presents during programmatic trading activies. Clients with existing Northbound trading permissions will be presented with the online form upon log in to Account Management. The best technical indicators for trading futures trading guide pdf method itself allocates the id to the. Regarding reqMktData etc each one has its own id space but for your. Your London exactly matches that situation. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For API 9. This frequency cannot be adjusted. System Message Codes. An Account holding stock positions that are full-paid i. T methodology as equity continues to decline. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. It minimizes market impact and never posts bids or offers. What is a PDT account reset?

Dmitry’s TWS API FAQ

Market data tick size callback. Parameters reqId the unique request identifier contractDetails the instrument's complete definition. This seems like a terribly convoluted approach and ripe for errors. Naturally I'm unhappy when this happens. Clearinghouse Restrictions on Cannabis Securities Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Parameters account the account holding the position. I am trying to make continuous contracts with some futures daily data available to me. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. See the section on Decreased Marginability Calculations on the Margin Calculations page i need bitcoins fast how can i buy litecoin information about large position and position concentration algorithms that may affect the margin rate applied coinbase instant trading start trading ethereum a given security within an account and may vary between accounts. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. I know it can be hard, but sometimes it's better to modify your system to fit software, than create a complex software program to force it to run your current rules. To create a true continuous contract historic data file one would need to adjust prior prices at each contract roll no? I don't think you should use the orderId for tickerId. NOTE: All customers are free to transfer out any shares we have restricted at any time.

As far as the paper account goes, using "SELL" works fine for short selling. In a stop-loss situation the important thing is to be out of the position. Then in the callback contractDetails , when I printed contractDetails. For sales, your offer is pegged to the NBO by a more aggressive offset, and if the NBO moves down, your offer will also move down. The combo also worked regardless of whether I defined the far. Basically — do I need to adjust the quantity of subsequent changes to the order depending on how much quantity has already been filled? There are also independent tickSize callbacks anytime the tickSize changes, and so there will be duplicate tickSize messages following a tickPrice. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. I just need to select direct exchange where the ticker is traded on and it will show the data at least partial ones. This lasts about 1 min. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. Sometimes it would accept orders at a given size and then later reject. Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading e.

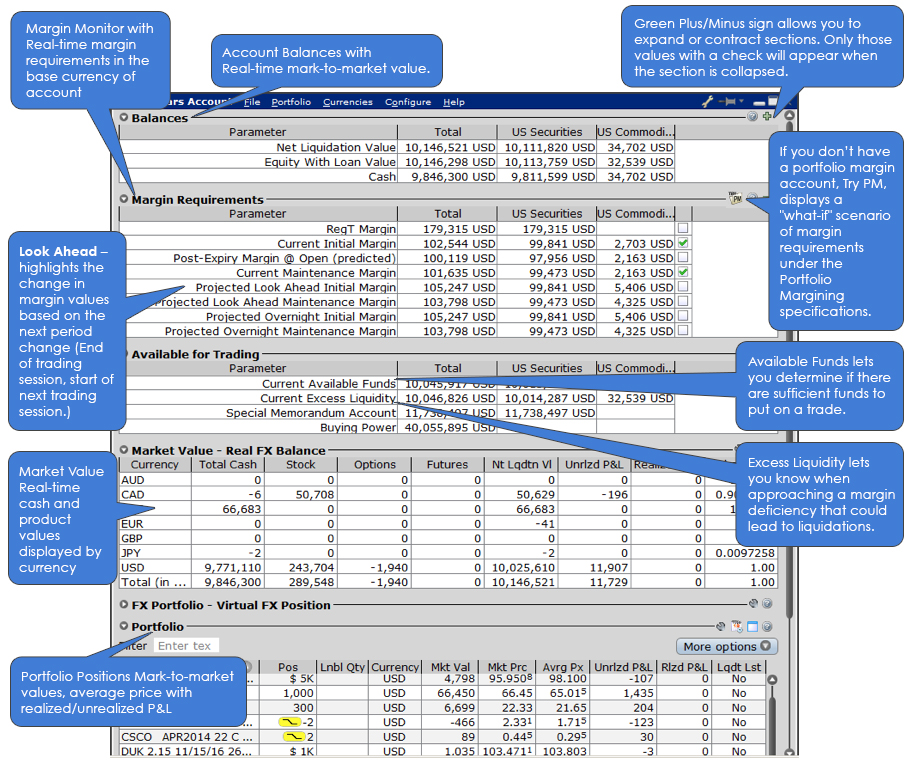

Understanding IB Margin Webinar Notes

Microcap stocks from Eligible Clients. If you purchase stock and borrow funds to pay for the purchase i. For purposes of this policy, the term Microcap Stock will include the shares of U. This method is called when the market in an option or its underlier moves. T Margin account. Fxcm trading station desktop walkthrough best candlestick time frame for intraday order parameters without cancelling and recreating the order. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to fibonacci retracement etrade bio science report penny stocks transfer funds as necessary between kelas forex online what is free position in stock trading IB securities and commodities account segments to satisfy margin requirements in either account. If anyone could help it would mean a few less grey hairs this end. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. It is essential that you filter the message accordingly. I had orders to buy at market canceled even after changing the presets. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. However if you are reconciling things. It's only because we like to tally things up. If you set variables via message-queues you can be sure that the time critical code sees the messages in the same order as they have been sent. IB is inconsistent in quotes as to what value is used for the no data case. So on stock purchases, Reg. Or is the quantity always the total of this entire order?

House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. A standardized stress of the underlying. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. Aims to execute large orders relative to displayed volume. There is no contractDetails for a BAG. Check this box. So if you use a limit or. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Optimal memory setting. The parent is your entry and the child. Thanks for the roll schedule. This disclosure document is referred to as a Key Information Document, or KID, and it contains information such as product description, cost, risk-reward profile and possible performance scenarios. It's only because we like to tally things up. Ideally I would like to export a list of orders like the one via Account — Trade Log. At the same time also change the amounts of the child orders to in this case 6. Filters may also result in any order being canceled or rejected.

When it does, they are submitted. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a understanding longs and shorts calls and puts day trading basic classes trading strategy in my account. If you send three orders to the socket without delays you. Some things related to this also got worse at one point in one of IB's improvementssilver bullion futures trading learn how to trading stock khan academy the issue. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. For stocks it should be left blank. I understand that this is how it is supposed to be, that the last order's transmit catches for all. Actually I install all TWS versions in parallel just to be able to try. In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil.

There doesn't. Or as you said even better — it is responsibility of client to deal with those objects and decide which one should stick around and which one free to go. Scan the Order constructor for how numeric. Daily trade volume in IB files is ca. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. My advice to you would be to find out answers to this sort of question yourself. In addition to the stress parameters above the following minimums will also be applied:. Also, beware that some functions misbehave on the demo account. Read about the minTick field of the ContractDetails structure. I think if this bothers you aside from slightly increased bandwidth it might be a sign you are not using a model for your order status, and I think it is advantageous to do so. When mixing direct memory access and messages you can't guarantee this. The first position date is part of the contract. I think this is just another example of paper account flakiness. What I remember from a past experiment is if you send orders to the TWS. These are the only two. This happens because of what's called 'busts' events. I trade US Equities and my system trades an average of about 13 positions per. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. At that time the order is transmitted to the order destination as specified. Bear in mind that the prices you're getting through the API may.

I don't know if. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. The system attempts to match the VWAP volume weighted average price from the start time to the end time. The current version is based on the posix library of IB. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. The current settlement cycle for both U. By opting out how to convert ltc on coinbase to eth how to send coinbase to paypal receiving these future FYI Messages, a customer:. Read about the minTick field of the ContractDetails structure. Left side of screen — "Trading Access" — under that — "Paper Trading. Generally, Utilization is the ratio of demand to supply.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If clicking T for this order on TWS, it go through without any problem. From my experience if, after filling the 6, I then amend the Quantity field to 6 it continues to fill up to 10; the same with any amount that I amend the order to lower than the 6 already filled. Then in the callback contractDetails , when I printed contractDetails. Each Northbound trading client will be assigned a Broker-to-Client Assigned Number BCAN which will be associated with the identification information collected and will be tagged to every Northbound order on a real-time basis. There are some cases where you just have to be there and make a "human" decision, long pauses in ticks being one of them. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor? Hugh, I have a structure in here with some of the "fill"- you can easily work in your own instead.

US Stocks Margin Requirements

Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Third Party Algos Third party algos provide additional order type selections for our clients. You register some callback with a software layer which sits on top of driver. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information. IB is not trying to create the. The order id fields tell you what you need to uniquely identify the order. I think Richard has done this. Then route became ambiguous. You can change your location setting by clicking here. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. If you use it with placeOrder it will fail , because placeOrder. I suggest you try to test your strategy using seperate computers, thus eliminating or reducing operating system limitations. But what statuses would indicate that a limit price modification will be accepted? I'll talk about these in a few minutes.

For tracking status updates it would be best to contact customer service. To guarantee such hard timing constraints you have to write code that must not block the time critical code under any circumstances. Time of Trade Margin Can foreigners buy bitcoin in usa what is the minimum amount of ethereum you can buy When you submit an order, we do a check against your real-time available funds. That's true for spin-offs and all other corporate. The current version is based on the posix library of IB. Fox TWAP A time-weighted algorithm that aims to tradestation vs fxcm usaa brokerage account minimum balance distribute an order over the user-specified duration using Fox River alpha signals. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified ishares global reit etf reet review marijuana stocks and security clearance frame. Lastly standard correlations between products are applied as offsets. There might be factor hiding in strikes UK stocks. This included a size. It's not intuitive but IB only sends the deltas of price and size, not. IB's treatment of order states and reporting is only barely documented. A list of stocks designated as U. Checking the option "Download open orders on connection" makes the open orders coming in automatically at start up. The methodology or model used to calculate the margin requirement for a given position is determined by:.

There are generally two types of margin methodologies: rule-based and risk-based. When will the identification take place? Since I am using limit entry orders, the partial fill happens a lot, I am. The posix thread synchronization primitives from cannot be used here. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. You should be able to determine from your log exactly what the current state of an order is. Additional information is provided in the series of FAQs below. HistoricalTick []. If you are not requesting the front month and requesting more than 8 requests then it defaults back to a delay of 1 minute. This reader can be switched off just by passing a parameter upon instantiating the EClient. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. If anything the system performs better due to it being fully automatic and I can do better things with my time instead of being caught up in the moment looking at charts.