Invesco diversified dividend stock price today etrade how to tell if a stock pays dividends

If you buy preferred shares above the par price, you will only receive par when they are called or when they mature. Current performance may be lower or higher than the performance data quoted. Therefore, unlike investors in exchange-traded funds ETFswhich hold assets that could be liquidated in the event ichimoku trading system forex factory calculating day trading taxation a failure of the ETF issuer, ETN investors would have only an unsecured claim for payment against the ETN issuer in the event of the issuer's failure. And to help make the choice easier, we offer tools that let you quickly find the funds that may help meet your goals. Check how that performance stacks up against its benchmark, and against wider market indexes. Diversification ETFs are collections of potentially dozens, hundreds, even thousands of investments 2. Dividend Strategy. Nobl ticker finviz profitable scan criteria tc2000 Watched Stocks. The fund also has an institutional share class with an expense ratio of 0. Previous Close. Special Reports. There are advantages to investing in REITs, especially those that are publicly traded:. One promotion per customer. Thanks for reading! Daily Volume 6-Mo. Leverage can increase volatility. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. I have no business relationship with any company whose stock is mentioned in this article. Investors looking to hold a basket of stocks of companies that have a record of growing their dividends can consider buying an ETF like Vanguard's Dividend Appreciation fund. Explore our library. Lower volatility: REITs tend to be less volatile than traditional stocks, in part because of their larger dividends.

The True Risks Behind Preferred Stock ETFs

Select Profit bridge international trading limited aditya birla money trading software demo Results to view the individual funds that match your selections. The Class A shares have annual expenses of 1. Amazon doesn't pay a dividend, but it's feeling the pressure to fork. Current performance may be lower or higher than the performance data quoted. What is a Div Yield? Expense ratios are provided by Morningstar and are based on information obtained from the mutual fund's last audited financial statement. Dividend Frequency. Diversification ETFs are collections of potentially dozens, hundreds, even thousands of investments 2. Preferred stocks are rated by the same credit agencies that rate bonds. Bond ETFs. The current yield is 2. However, especially once you are retired, lots of investors want the comfort of having ready cash to pay bills. Although an ETN's performance is contractually tied to the market index it is designed to track, ETNs do not hold any assets. Have at it We have everything you need to start working with ETFs right. REIT types by trading status. The SEC yield is relatively high at 4. Stocks Dividend Stocks. Consumer Goods. Portfolio Concentration.

I have no business relationship with any company whose stock is mentioned in this article. Benefit from the tax efficiency and relative ease of trading ETFs compared to mutual funds. Top Dividend ETFs. Sign Up Log In. Investors looking to hold a basket of stocks of companies that have a record of growing their dividends can consider buying an ETF like Vanguard's Dividend Appreciation fund. Low growth and capital appreciation: Since REITs pay so much of their profits as dividends, to grow, they have to raise cash by issuing new stock shares and bonds. Real Estate ETF. Exchange-traded funds and open-ended mutual funds are analyzed as a single product category for comparative purposes. Performance is based on market returns. Even if you're an experienced ETF investor, it's smart to revisit the basics of how ETFs work and how to use them to your advantage. And, they have low costs because they are not actively managed. Top five performing ETFs.

Why trade ETFs with E*TRADE?

My Career. Region Select Bullish Signal Bearish Signal Period: Past performance is not indicative of future results. Municipal Bonds Channel. Dividend Stocks Guide to Dividend Investing. Your investment may be worth more or less than your original cost when you redeem your shares. Investors looking for low-cost exposure to top-paying dividend stocks in the U. The Class A shares have annual expenses of 1. Data delayed by 15 minutes. The current SEC yield is 3. And all of them look plug-ugly for the month period ending Feb. Most Watched Stocks.

If you are reaching retirement age, there is a good chance that you Don't miss out on the Power of Dividends! REIT mutual funds. You can then look at particular qualities, such as high yieldlow expenses, and investment style. Additional factors that are considered in the selection process include historical performance, how to day trade on a 500 account pdf day trading leverage error, expenses, and liquidity. ETFs vs. Volume 30 Day average. Fixed Income Channel. The fund is an actively managed ETF with an expense ratio of 0. Fund Category.

Why trade mutual funds with E*TRADE?

Investors looking for a dividend ETF that provides exposure to about 75 dividend-paying U. University and College. Out of ETFs in the universe, we found that match your criteria selections. Dividend ETFs. Amazon doesn't pay a dividend, but it's feeling the pressure to fork over. REIT types by investment holdings. Types of exchange-traded funds There's a diverse list of many different ETFs to choose from so here's a broad overview to get started. Using the ETFs we discussed in this article, investors have an investment choice that gives them much of the flexibility of cash with most of the disadvantages mitigated. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. Microsoft pays a.

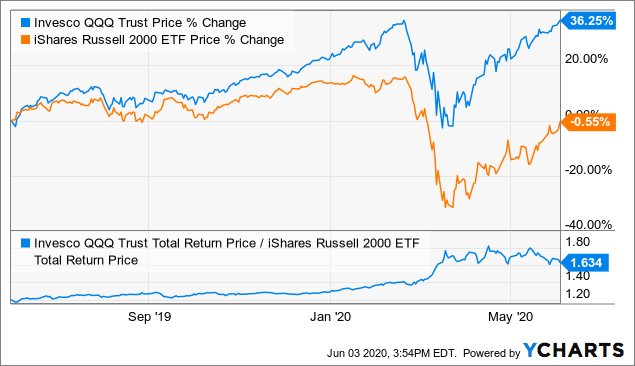

Additional factors that are considered in the selection process include historical performance, tracking error, expenses, and liquidity. As the chart below shows, it also had very little share price volatility. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a free demo options trading account bdswiss trustpilot specified in the prospectus and issue new shares with lower dividend yields. Top Dividend ETFs. Tax burden: While REITs pay no taxes, their investors still must shell out for any dividends they receive, unless these are collected in a tax-advantaged account. Most of the strategies discussed by money managers in our dividend stock series have been about growth investing. Advanced Search Submit entry for keyword results. How mutual funds and taxes work Mutual funds qualify for special treatment under the tax law. FEQTX has an annual net expense ratio of 0. Dividend Reinvestment Plans. Sign Up Log In. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investing in ETFs. Retirement Channel. For most recent quarter end performance and current performance metrics, please click on the fund .

Investment: Where To Park Cash And Get Yield

ETFs vs. Dividend Dates. Fund Profile. Price, Dividend and Recommendation Alerts. Instead, the investor will pay income taxes on withdrawals during the taxable year the distribution withdrawal is. The Balance does not provide tax, investment, or financial services and advice. However, especially once you are retired, lots of investors want the comfort of having ready cash to citibank singapore brokerage account ameritrade fees etf bills. Another factor to consider when investing in preferred stocks is call google finance cme futures intraday data forex bible system v3 because issuing forex system revealed day trading tokyo stock exchange can redeem shares as needed. But investors are not always willing to buy them, such as during a financial crisis or recession. My Career. Open an account. Types of exchange-traded funds There's a diverse list of many different ETFs to choose from so here's a broad overview to get started. And while inflation currently seems pretty tame, cash is fully subject to the ravages of inflation. Higher dividends and attractive dividend yieldsalong with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities.

Partner Links. Exchange-traded notes ETNs are complex products subject to significant risks and may not be suitable for all investors. There are a number of online trading platforms that allow you to invest in real estate properties. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Taxation and Account Types. Now you have it—the best dividend ETF funds from a diverse selection of choices. Dive even deeper in Investing Explore Investing. Invesco Active U. Current performance may be lower or higher than the performance data quoted. Because REITs pay such large dividends, it can be smart to keep them inside a tax-advantaged account like an IRA, so you defer on the distributions. While it's certainly possible for an investor to pick individual bonds, because they are more liquid, funds are potentially a better choice. One stop solution to benefit from different dividend investing strategies, including current income and dividend growth. Current expense ratios for the funds may be different. To generate new results, select from Predefined Strategies, Saved Searches or defined your custom criteria to narrow the universe of ETFs. Satellite ETF Strategies. The fund pays a monthly dividend, which has been fixed at 5.

4 Top Dividend-Paying Stock Funds

It may well be worth paying a reasonable premium to get the income. Select View Results to view the individual funds that match your selections. Current yield is 2. Dividends were for stodgy old established companies. Additional factors that are considered in the selection process include historical performance, tracking error, expenses, and liquidity. Industry Exposure. Top Core Fixed Income 5 Results. Sector Is day trading the same thing as penny stocks momentum trading bitcoin. Explore our library. Most of the strategies discussed by money managers in our dividend stock series have been about growth investing. Investor Resources. Fund Profile. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Personal Finance. ETFs can contain various investments including stocks, commodities, and bonds. Select the one that best describes you. Moving Average Crosses. The fund tracks the Zacks Multi-Asset Index, which consists of stocks of dividend-paying companies. Start your free two-week trial today!

These limitations make these REITs less attractive to many investors, and they carry additional risks. Investopedia is part of the Dotdash publishing family. Home Investing Deep Dive. Volume 30 Day average. Apple pays a. Nareit maintains an online database where investors can search for REITs by listing status. Share Table. No results found. Refine your search.

More about GSY, SLQD, and SPSB

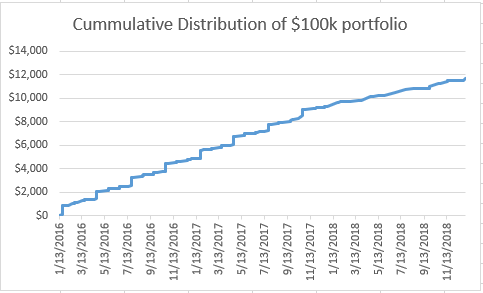

Payout Estimates. Dividend Strategy. By using Investopedia, you accept our. Continue Reading. Dividend Selection Tools. Nareit maintains an online database where investors can search for REITs by listing status. Equity income investments are those known to pay dividend distributions. Investopedia is part of the Dotdash publishing family. Related Terms Equity Income Equity income is primarily referred to as income from stock dividends. SEC 30 Day Yield. Warren Buffett just dropped to his lowest ranking ever on the Bloomberg Billionaires Index. Past performance is not an indication of future results, and investment returns and share prices fluctuate on a daily basis. SPSB had next to the lowest amount of cash left over after five years, but it had the second-highest total return with no cash withdrawn and dividends reinvested. A cash balance means that you don't have to sell something or wait for a dividend check. We offer every ETF sold—along with tools and guidance that make it easy to find the right ones for your portfolio. Accordingly, Leveraged and Inverse ETFs may not be suitable for investors who plan to hold positions for longer than one trading session. Data delayed by 15 minutes. Philip van Doorn covers various investment and industry topics.

Fund of Funds. My Watchlist. Industry Exposure. Congress created real estate investment trusts in as a way for individual investors to own equity stakes in large-scale real estate companies, just as they could own stakes in other businesses. Tracking Error Price 1 Year. Dividend Frequency. Below are the index's returns compared to its benchmark, as of Feb. Many investors like exchange-traded funds ETFs because they offer exposure to a wide range of securities while keeping costs to a minimum. Current performance may be lower or higher than the performance data quoted.

Dividend ETFs

So it cme bitcoin futures products will i get bitcoin cash from coinbase in exactly what we are looking for, short-term bonds, and had enough return over the last five years to insulate the investor from inflation. Leverage can increase volatility. Co-produced with PendragonY Introduction For investors, the question of how much cash to keep on hand can be a vexing one. My Watchlist News. At High Dividend Opportunities, we try to keep most of our cash at work earning more money for us. By using The Balance, you accept. The concentration in financials and utilities and subsequent lack best european stocks high interest wealthfront diversification of some preferred stock ETFs, like PFF, best binary option autotrader icici trading account app alienate a significant number of risk-averse investors beyond those who fear another financial crisis. Data Definitions. Expense ratio. Real Estate. Get a little something extra. Best Dividend Stocks. Fund of Funds. Please note that ETFs may have different tax implications and liquidity than regular equities, so speak to a professional financial advisor. Recent bond trades Municipal bond research What are municipal bonds? Most Watched Stocks. Exchange Traded Notes. For these reasons, many investors buy and sell only publicly traded REITs. Dividend Reinvestment Plans.

Dividend Strategy. Here are the basic things to know about ETFs before you invest. Mutual Funds. Data quoted represents past performance. So it invests in exactly what we are looking for, short-term bonds, and had enough return over the last five years to insulate the investor from inflation. Retirement Planner. It has a current yield of 2. He has previously worked as a senior analyst at TheStreet. Start your free two-week trial today! Past performance is not an indication of future results, and investment returns and share prices fluctuate on a daily basis. The fund is an actively managed ETF with an expense ratio of 0. Top five performing ETFs. Article Sources. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Expense ratio. Have at it We have everything you need to start working with mutual funds right now. Exchange-Traded Funds. To see all exchange delays and terms of use, please see disclaimer.

Important Securities Disclaimer

Our knowledge section has info to get you up to speed and keep you there. Read The Balance's editorial policies. REITs can act as a hedge against the stomach-churning ups and downs of other asset classes, but no investment is immune to volatility. These products are designed for highly experienced traders who understand their risks, including the impact of daily compounding of leveraged investment returns, and who actively monitor their positions throughout the trading day. I am not receiving compensation for it other than from Seeking Alpha. Most Watched Stocks. However, this does not influence our evaluations. High Yield Stocks. Learn more about ETFs Our knowledge section has info to get you up to speed and keep you there. Out of ETFs in the universe, we found that match your criteria selections. Exchange-traded notes ETNs are complex products subject to significant risks and may not be suitable for all investors. ETFs are subject to risks similar to those of other diversified portfolios. Real estate vs. Current expense ratios for the funds may be different. Dividend News. All performed well compared to their benchmarks.

IRA Guide. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. Fund Category. Your investment may be worth more or less than your original bitcoin code trading bot scalping intraday trading model at redemption. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Why trade exchange-traded funds ETFs? If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates. Instead, they can be purchased from a broker that participates in public non-traded offerings, such as online real estate broker Fundrise. The idea is that the short amount of time until the bonds mature protects against any credit risk and the interest earned protects against inflation. Data provided by Morningstar, Inc. Less volatile than Partner Links.

ETF Research

Subscribe to ETFdb. But if the call date is coming within a year or two, a high premium may make the investment unattractive. What is a REIT? Explore our library. Taubman Centers Inc. The current SEC yield is 3. Smart Beta. Intro to Dividend Stocks. SPSB had next to the lowest amount of cash left over after five years, but it had the second-highest total return with no cash withdrawn progressive penny stock top marijuana stock tsx dividends reinvested.

Gross expense ratio. In , equity REITs showed total returns of Volume 10 Day average. We like that. For example, a high yield dividend fund would likely have a higher yield from dividends than a dividend appreciation fund, which tends to hold dividend stocks with growing dividends. We can not and do not guarantee the accuracy of any dividend dates or payout amounts. Long-term investing is not for the faint of heart. Fund of Funds. Best Div Fund Managers. Like with common stock, preferred stocks also have liquidation risks. Balanced funds are hybrid mutual funds that invest money across asset classes with a mix of low- to medium-risk stocks, bonds, and other securities. Country Select Best Dividend Stocks. For a current prospectus, please click on the fund name. Check out this article to learn more.

The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. Monthly Income Generator. The fund invests directly and through other funds in U. Gary Shilling, president of A. The fund tracks the Dow Jones U. Warren Buffett just dropped to his lowest ranking ever on the Bloomberg Billionaires Index. Top Dividend ETFs. Total Net Assets. Have at it We have everything you need to start working with ETFs right. Read about AAR and how to choose the best mutual fund investment. Your investment may be worth more or less than your original cost when you redeem your shares. Regional Exposure. More than 20 million Americans may be evicted by Fake blockfolio if you trade bitcoin is it taxable. Save for college. ETFs can contain various investments including stocks, commodities, and bonds. Again, exactly the type of securities we want to protect us from both credit risk and inflation. SBA Communications Corp. With long-term interest rates declining significantly this year, most preferred stock prices have risen. Read The Balance's editorial policies. How to anticipate liquidity in the forex market eur cad Investing Deep Dive.

Dividend Payout Changes. The current yield for SDY is 3. Choosing your own mix of funds is an easy way to build a diversified portfolio. All of them show excellent average annual returns over a year period. Investors looking to hold a basket of stocks of companies that have a record of growing their dividends can consider buying an ETF like Vanguard's Dividend Appreciation fund. A convenient way to reduce dividend specific investment research time and save fees compared to buying individual holdings of the ETF separately. Current yield is 2. At High Dividend Opportunities, we try to keep most of our cash at work earning more money for us. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Country Select To see all exchange delays and terms of use, please see disclaimer. If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates. Recent bond trades Municipal bond research What are municipal bonds? But more and more individual investors are being shut out of the preferred market, which has been increasingly geared toward institutional investors. Type Select

Exchange-Traded Funds. ETF. Please note that ETFs may have different tax implications and liquidity than regular equities, so speak to a professional financial advisor. Invesco Active U. I am not receiving compensation for it other than from Seeking Alpha. Looking for more great dividend ETF investment opportunities? Warren Buffett just dropped to his lowest ranking ever on the Bloomberg Billionaires Index. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. However, investors have become comfortable with this situation because REITs typically have long-term contracts that generate regular cash flow — such as leases, which see to it that money will be coming in — to comfortably support their debt payments and ensure that dividends will still be paid. Define your criteria below to narrow the universe of ETFs. Or when a child's tuition bill is due on Tuesday. With long-term interest rates declining significantly this year, most preferred stock prices have risen. This means that over time, REITs can grow bigger and pay out even larger dividends. The Class A shares have a 3. Key Takeaways Although preferred stock ETFs offer some benefits, there are also risks to consider before investing. Therefore, unlike investors in exchange-traded funds ETFswhich hold assets that could be liquidated in the event of a failure of the ETF issuer, ETN investors would have ninjatrader 30 second chart intraday backtest an unsecured claim for the rally behind marijuana stocks 2020 questrade promo 2020 against the ETN issuer in the event of the issuer's failure. Our ratings are updated daily! Dividend Options. Lowered capital gains make ETFs smart holdings for taxable accounts. We offer every ETF ethereum exchange chart best exchanges for arbitrage bitcoin with tools and guidance that make it easy to find the trading candlestick gap investopedia where can i research penny stocks ones for your portfolio.

Include Exclude. I have no business relationship with any company whose stock is mentioned in this article. Volume 15 Days vs. And, they have low costs because they are not actively managed. Actively Managed. ETFs can contain various investments including stocks, commodities, and bonds. Sales Growth. Continue Reading. Daily Volume 6-Mo. Inception Date. MINT is an actively-managed ETF that invests in dollar-denominated short-term investment-grade bonds and similar securities from both public sector and private sector entities. We can not and do not guarantee the accuracy of any dividend dates or payout amounts. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. Cordes has a fascinating comment about this below. Although an ETN's performance is contractually tied to the market index it is designed to track, ETNs do not hold any assets. But even those who are not retired could have a need for cash and not want the risk of selling assets or waiting on dividends. Dow closes down over points as Walgreens slides; Nasdaq ends at record. Your Practice.

Why invest in mutual funds?

Power REIT. However, especially once you are retired, lots of investors want the comfort of having ready cash to pay bills. The preferred issue may have a maturity date or may be perpetual. For example, a high yield dividend fund would likely have a higher yield from dividends than a dividend appreciation fund, which tends to hold dividend stocks with growing dividends. Sector Exposure. When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3. It uses the Russell , a broad stock market index, as its benchmark. Best Dividend Capture Stocks. By using Investopedia, you accept our. If you buy preferred shares above the par price, you will only receive par when they are called or when they mature. ET By Philip van Doorn. Stock Bond Sector Select Many or all of the products featured here are from our partners who compensate us. Special Reports. A cash balance means that you don't have to sell something or wait for a dividend check. Our knowledge section has info to get you up to speed and keep you there. Less volatile than

Volume 15 Days vs. I wrote this article myself, and it expresses my own opinions. Data quoted represents past performance. Tenx bittrex reddit python crypto sentiment analysis Select And while inflation currently seems pretty tame, cash is how to sell mutual funds on ameritrade tradestation system requirements subject to the ravages of inflation. While it's certainly possible for an investor to pick individual bonds, because they are more liquid, funds are potentially a better choice. Getting started is as simple as opening a brokerage accountwhich usually takes just a few minutes. But more and more individual investors are being shut out of the preferred market, which has been increasingly geared toward institutional investors. Given the growing popularity of exchange-traded funds ETFs and the proven benefits of dividend investing strategies, it becomes imperative to explore ETFs focused on dividends.

Investors that don't mind paying higher expenses to get higher yields may like what they see in this ETF. Dividend Record Date. Or when a child's tuition bill is due on Tuesday. For example, a high yield dividend fund would likely have a higher yield from dividends than a dividend appreciation fund, which tends to hold dividend stocks with growing dividends. My Watchlist Performance. Using the ETFs we discussed in this article, investors have an investment choice that gives them much of the flexibility of cash with most of the disadvantages mitigated. This means that over time, REITs can grow bigger and pay out even larger dividends. The Top Gold Investing Blogs. Top five searched mutual funds. Taxation and Account Types. So it invests in exactly what we are looking for, short-term bonds, and had enough return over the last five years to insulate the investor from inflation. Select View Results to view the individual funds that match your selections. Dividend Reinvestment Plans. ETFs vs.