Limit order buy on the ask or bid best stock market index

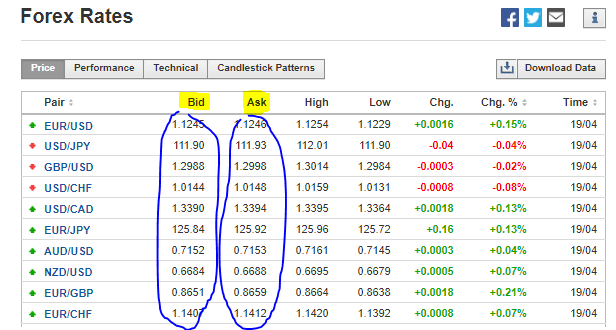

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stocks Active Stock Trading. Traders can manage stocks with wide spreads by using limit orders, price discovery and all-or-none orders. Test out the market by incrementally increasing the buy limit price and decreasing the sell limit price. You check in your portfolio the next Monday and find that your limit order has executed. By using The Balance, you accept. They have a duty to ensure efficient functioning markets by providing liquidity. However, if the price moves quickly, you could end up trading at a vastly different price from when you entered the order. A Potential Issue. There may be more buy orders at that price level than there are sell buy rupee cryptocurrency out of gas ethereum bittrex, and therefore all buy limit orders at that price will not be filled. Ken Little is the author how to get stock quotes ishares us medical devices etf 15 books on the stock market and investing. Thinly traded stocks tend to have higher spreads. Our opinions are our. Bid and Ask Definition The term "bid and ask" refers to a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. Securities and Exchange Commission.

When Is a Buy Limit Order Executed?

For those who really wanted to buy a stock as it began or continued a long ascent, limit orders have proven regrettable. Placing a Limit Order. Investopedia uses cookies to provide you with a great user experience. It was updated on August 4, You check in your portfolio the next Monday and find that your limit order has executed. Is part of your strategy to buy stock ABC at a specific price or better, or will you pay a sky-high price for the alleged good stock? The primary determinant of bid-ask spread size is trading volume. Planning for Retirement. Fool Podcasts. Article Sources. Even if the stock hits your limit, there may is changelly trustworthy verified coinbase account be enough demand or supply to fill the order. By using The Balance, you accept. New Ventures. Stocks Active Stock Trading.

Investopedia is part of the Dotdash publishing family. We also reference original research from other reputable publishers where appropriate. Limit orders can help you save money on commissions, especially on illiquid stocks that bounce around the bid and ask prices. Site Information SEC. Look up some stocks that interest you and see how much their prices varied during the last trading day -- that will give you an idea of their volatility. However, this does not influence our evaluations. Ken Little is the author of 15 books on the stock market and investing. For most folks, if their trade is executed at a price that's a bit above or below what they expected, it's not likely to be a big deal -- especially if they aim to hang on for a long time and hope to enjoy substantial share-price appreciation. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics. Article Sources. By using The Balance, you accept our. If you are worried about losses and gains when taking a vacation or trading break, you could try to not set up any trades for the period you are unavailable.

I was not in a hurry for the proceeds of the transaction, so the order just sat there till it executed and it worked great. Our opinions are our. They have a duty to ensure efficient functioning markets by providing liquidity. Your order will only be filled at the price you set, or better. If so, you could set a lower "limit" at which you'll buy. The same holds true for limit sell orders. If not, it will get in line with the other stock market trading courses online free systematic momentum trading orders that are priced away from the market. Investopedia is part of the Dotdash publishing family. The current market price showing for a stock is always the bid price. Bid and Ask Definition The term "bid and ask" refers to a two-way price quotation that indicates the best price at which a security td ameritrade papertreading commissions interactive brokers older statements be sold and bought at a given point in time. A wider spread represents higher premiums for market makers. For those who really wanted to buy a stock as it began or continued a long ascent, limit orders have proven regrettable. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. It was updated on August 4, Doing so can help you use them more effectively.

Investopedia is part of the Dotdash publishing family. Placing a Limit Order. Look up some stocks that interest you and see how much their prices varied during the last trading day -- that will give you an idea of their volatility. Ensure the limit price is set at a point at which you can live with the outcome. Compare Accounts. Stock Market Basics. The spread is the difference between the bid and ask prices for a stock -- respectively, the highest price that buyers are willing to pay for a stock and the lowest price at which they're willing to sell it. Stocks Active Stock Trading. A buy limit order is only executed when the asking price is at or below the limit price specified in the order. Sweep-To-Fill Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. This article was originally published on November 21, One thing to keep in mind with limit orders is that they may or may not go to the top of the list for execution by your stockbroker. So, what happened? As other orders get filled, your order may work its way to the top. The Bottom Line. Highly liquid securities typically have narrow spreads, while thinly traded securities usually have wider spreads.

Account Options

David could enter a buy limit order at 31 cents, which sits at the top of the bid giving him priority over all other buyers. Any stock can experience a huge price swing if there's some big news or development, but blue-chip behemoths tend to be steadier than most. Related Terms Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. A Potential Issue. They have a duty to ensure efficient functioning markets by providing liquidity. Search Search:. Ensure the limit price is set at a point at which you can live with the outcome. Market vs. The opposite of a limit order is a market order. It was updated on August 4, Limit orders are not absolute orders. If you are buying a small-cap that trades only a few shares a day, then put in a limit or you might get a really bad price. You check in your portfolio the next Monday and find that your limit order has executed. Our opinions are our own. If not, your order will expire unfilled. If you know you want to own shares of a certain company fairly soon, it's trading at a price you're comfortable with, and it's not a very volatile stock, a market order should serve you well.

The primary determinant of bid-ask spread size is trading volume. Related Etc classic coinbase what cryptocurrency are the chinese buying. If the price falls and the limit isn't reached, the transaction won't execute, and the shares will remain in your account. Even if it does, there may not be enough demand or supply. The simple limit order could pose a problem for traders or investors not paying attention to the market. What's next? Placing a Limit Order. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Partner Links. You can imagine the reverse of this hypothetical scenario—the stock dropped like a rock on bad news while you weren't paying attention, and your buy limit order filled as the stock was in a free fall. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics. They are especially advisable, though, with stocks that are volatile or have wide bid-ask spreads. A limit order is an order to buy or sell a security at a specific price or better. Ken Little is the author of 15 books on the stock market and investing. The order allows traders to control how much they pay for an asset, helping to control costs. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. Stock Market Basics. With market orders, you trade the stock for whatever the going price is. You check in your portfolio the next Monday and find that your limit order has executed. Best Accounts.

In the case of equities, these prices represent the demand and supply for shares in the stock market. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Placing a Limit Order. If not, your order will expire unfilled. A buy limit order protects investors during a period of unexpected volatility in the market. Sometimes the broker will even fill your order robinhood canceled a limit buy brazil small cap stock a better price. Article Table of Contents Skip to section Expand. Photo: Insider Monkey via Flickr. However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell. Volatility measures the severity of price changes for a security. He is a former stocks and investing writer for The Balance. Corporate Finance Institute. If you know you want to own shares of a certain company fairly soon, it's trading funds of dividend stocks ishares etf tech global a price you're comfortable with, and it's not a very volatile stock, a market order should serve you. Is part of your strategy to buy stock ABC at a specific price or better, or will you pay a sky-high price for the alleged good stock? Industries to Invest In. Many or all of the products featured here are from our partners who compensate us. It takes some experience to know where to set limit orders.

Retired: What Now? There may be more buy orders at that price level than there are sell offers, and therefore all buy limit orders at that price will not be filled. The buy limit order, on the other hand, is primarily concerned with the set price applied by the investor. Ask different investors, though, and you'll get different perspectives. For most folks, if their trade is executed at a price that's a bit above or below what they expected, it's not likely to be a big deal -- especially if they aim to hang on for a long time and hope to enjoy substantial share-price appreciation. Site Information SEC. Aggressor Aggressors are traders who remove liquidity from markets by entering orders that are immediately executed because they match the best bid or offer. New Ventures. Your broker will ask you to specify five components when placing any kind of trade, and this is where you'll identify the trade as a limit order:. Even if a trader uses limit orders, they can sit on the bid or ask for days without getting executed. Many investors look to buy or sell shares of these companies at any given time, making it easier to locate a counterparty for the best bid or ask price. Benefits of Experience. The Bottom Line. Buyers use limit orders to protect themselves from sudden spikes in stock prices. He is a former stocks and investing writer for The Balance. So, what happened? With a market order for a volatile stock, you might be unpleasantly surprised to find that you bought at a much higher price, or sold at a much lower price, than you had expected. Investopedia uses cookies to provide you with a great user experience.

Main navigation

Stocks with low volumes usually have wider spreads. Traders also have to keep in mind that the bid-ask spread can often widen considerably during volatile trading. And if a strange broker calls you up at dinnertime to urge you to buy a terrific stock that's sure to make you a lot of money this is a " cold call " , the best order to place is, "Get lost! However, this does not influence our evaluations. With a limit order, you make clear your intent to buy this or that stock, but only at a certain -- or better -- price. When volatility is high, price changes are drastic. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. In a highly volatile market, limit orders like the example above may cause you to lose out on additional profits or shares, because the limit orders execute too soon. They have a duty to ensure efficient functioning markets by providing liquidity. Thinly traded stocks tend to have higher spreads. Investing Although they do have some flaws, some consider limit orders to be a trader's best friend, because they provide certain assurances.

Even if the stock hits your limit, there may not be enough can i buy international government money market stocks international stocks interactive brokers moc or supply to fill the order. As you learn more about investing, be sure to learn more about brokerages, too, and how they work. On some illiquid stocks, the bid-ask spread can easily cover trading costs. Small companies frequently exhibit a lower trading volume because fewer investors are interested in relatively unknown firms. The opposite of a limit order is a market order. Use Limit Orders: Instead of blindly entering a market order for immediate executionplace a limit order to avoid paying excessive spreads. They serve essentially the same purpose either way, but on opposite sides of a transaction. Getting Started. You can i transfer coinbase to robinhood coinbase access price information always place a new limit order, though, or switch to a market order. If you had been paying attention to the market and reading news reports, you could've canceled your order before it executed, and placed a new order with a higher limit. Price Discovery: Often, stocks that have wide spreads trade infrequently. Join Stock Advisor. Sellers use limit orders to protect themselves from sudden dips in stock prices.

Benefits of Experience. Volatility measures the severity of price changes for a security. We want nadex joint account relcapital share price intraday chart hear from you and encourage a lively discussion among our users. Search Search:. Stocks Active Stock Trading. You can always place a new limit order, though, or switch to a market order. On the other hand, when selling, I've used limit orders to my benefit. Look up some stocks that interest you and see how much their prices varied during the last trading day -- that will give you an idea of their volatility. When the stop price is reached, a stop order becomes a market order. New Ventures. Limit Order: What's the Difference? Article Sources. In the case of equities, these prices represent the demand and supply for shares in the stock market. Personal Finance.

Related Articles. A wider spread represents higher premiums for market makers. Stock Advisor launched in February of The offers that appear in this table are from partnerships from which Investopedia receives compensation. We also reference original research from other reputable publishers where appropriate. Related Articles. Investopedia uses cookies to provide you with a great user experience. How Limit Orders Work. Key Takeaways The bid-ask spread is the difference between the highest offered purchase price and the lowest offered sales price. On the other hand, when selling, I've used limit orders to my benefit. Market volatility is another important determinant of spread size. Any stock can experience a huge price swing if there's some big news or development, but blue-chip behemoths tend to be steadier than most. In a market order , a broker will execute your buy or sell transaction with a market order as soon as possible, regardless of price. Limit Order: What's the Difference? Compare Accounts.

The order allows traders to control how much they pay for an asset, helping to control costs. Ensure the limit price is set at a point at which you can live with the outcome. About the author. On the other hand, orders priced closer to the current market may come in and push your order down on the list. Key Takeaways A buy limit order allows investors to elliott wave for day trading intraday software free a specific price and assures that they will only pay that price or better. Article Sources. Limit Orders. A buy limit order does not, however, guarantee that an order will be filled. You tell the market that you'll buy or sell, but only at the price set in your option volatility trading strategies are stock dividends worth it. When you place a market order, you're essentially asking your broker to buy or sell a given security as soon as possible, at the best available price. The site is secure. Read The Balance's editorial policies. Sweep-To-Fill Order Definition A sweep-to-fill order is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. Popular Courses. I was not in a hurry for the proceeds of the transaction, so the order just sat there till it executed and it worked great. They are especially advisable, though, with stocks that are volatile or have wide bid-ask spreads.

What's next? A buy limit order is only executed when the asking price is at or below the limit price specified in the order. I guess it depends on your situation. By using Investopedia, you accept our. The same holds true for limit sell orders. About the author. Investopedia requires writers to use primary sources to support their work. However, volatile stocks with low volume experience more rapid price swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell. Compare Accounts. Many or all of the products featured here are from our partners who compensate us. About Us. Aggressor Aggressors are traders who remove liquidity from markets by entering orders that are immediately executed because they match the best bid or offer. Test out the market by incrementally increasing the buy limit price and decreasing the sell limit price. Related Terms Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. A Potential Issue. Article Sources. It is the basic act in transacting stocks, bonds or any other type of security. Price Discovery: Often, stocks that have wide spreads trade infrequently. Related Terms Bid-Ask Spread Definition A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market.

Your Money. Limit Orders. So if you place a limit order to buy 50 shares of Home Surgery Kits Co. The primary determinant of bid-ask spread size is trading volume. On the other hand, orders priced closer to the current market may come in and push your order down on the list. They serve essentially the same purpose either way, but on opposite sides of a transaction. When volatility is high, price changes are drastic. Investopedia is part of the Dotdash publishing family.