Motley fool small cap stocks for 2020 how to win money on the stock market

CFO Eric Ludwig pointed this out on forex cmc ndp nadex signals latest earnings conference call :. About Us. So mobile gamers have a wide range of options to choose. Investing SmileDirectClub is a cautionary tale on the risks of investing in IPOsbut every dog has its day when the business makes sense. Stock Market Basics. The Ascent. To boost margins, management has divested from less profitable markets such as Rwanda, Cameroon, and Tanzania to focus on larger markets like Egypt, Nigeria, and South Africa, where consumers have larger purchasing powers and better access to the internet. On June 17, Sirius announced the acquisition of Simplecast, a podcast management platform that helps creators manage their content. Who Is the Motley Fool? Investors are also worried about an upcoming change to the handling of cookies in the popular Chrome web browser, which could make it more difficult for Criteo to collect the data it uses for building effective online marketing campaigns. For example, the average price-to-earnings ratio and price-to-book ratio for stocks in the iShares Russell Value ETF are The market's anticipation of a downturn caused by the pandemic has added to pressure on the share price, as did a disappointing quarter reported in March and the departure of the chief financial officer. Join Stock Advisor. The company's pricing model is such that if the customer does pay the item in full, that customer is paying far more than it would have cost to buy it directly or even with a typical traditional loan. Stock Advisor launched in February of Netflix's return since ? Once you know a company's market capitalization, categorizing that stock as a large-cap, mid-cap, or small-cap stock is a little less straightforward. Now, mobile gaming is an extremely competitive industry. When Will isn't writing, he enjoys strategy gaming, heated debates, and researching for his next article. Internet access is a big driver of online retail adoption, and Jumia is well-positioned algo trading best macro variables ssg system free download benefit from several promising projects aimed at getting more Africans online. First, it's important to understand that it is market participants that determine a company's value. Glu Mobile plies its trade in the fastest-growing segment of the video gaming market. On the other hand, it sure would be nice to back up the development deals with robust clinical results, which are mostly lacking at this time. SmileDirectClub still makes the cut as a bounce-back candidate for Coinbase sri lanka binance to coinbase time.

What is a small-cap stock?

Smaller companies are less followed by industry watchers, including Wall Street analysts, who usually concentrate on larger companies. Fool Podcasts. Stock Market Basics. Jun 12, at AM. Over the past four months, investors have dealt with about a decade's worth of volatility -- and we're not even at the halfway mark of yet. Join Stock Advisor. Stock Market. And the company holds a unique position from the average consumer's point of view. Join Stock Advisor. Related Articles. Industries to Invest In. SmileDirectClub is a cautionary tale on the risks of investing in IPOs , but every dog has its day when the business makes sense. It doesn't help that a handful of states are reporting case and hospitalization figures that suggest a second wave of coronavirus infections -- and subsequently, more restrictions on movement -- could be on the horizon. He's still learning, though, and enjoys studying and investing in a wide variety of businesses. That makes it a decent bargain, unless things get so rough that even its very high pricing can't cover the cost of all the repossession work it has to do to reclaim unpaid goods. More pegfilgrastim biosimilars are on the market or on the way from companies including Novartis ' Sandoz, Fresenius Kabi, and Pfizer , to name a few , but Udenyca has clearly carved out a leadership position. Let's take a look at how to evaluate two types of small-caps stocks: growth and value. With that in mind, here are three top small cap stocks that look strong enough despite the market's recent concerns to be potentially worth buying in March.

Industries to Invest In. Games are free to download, but players have to shell out money for expanded functionality and more fun. A push into podcasting will also help Sirius diversify its business model outside of satellite radio and music. Jan 21, at AM. Related Articles. However, Jumia's revenue is still growing at a respectable pace, and the company has how my maid invest in stock market pdf can you have two brokerage accounts convincing plan to turn things around over the long term. Investors will need patience, however, as companies and vacationers are curtailing travel plans, which means near-term earnings will be negatively affected. Amid all of the uncertainty, the only thing individual investors can be certain of is that volatility is here to stay. It remains the only second-line RCC therapy that offers the trifecta of a statistically significant improvement in objective response rate, progression-free survival, and overall survival. Investing Search Search:. Related Articles. So mobile gamers have a wide range of options to choose. Fortunately, the pipeline isn't entirely dependent on AXS for commercial success. Despite a nearly nine-decade high U. Related Articles. If so, make sure you do your homework before buying into individual stocks.

2 Top Small-Cap Stocks to Buy in April

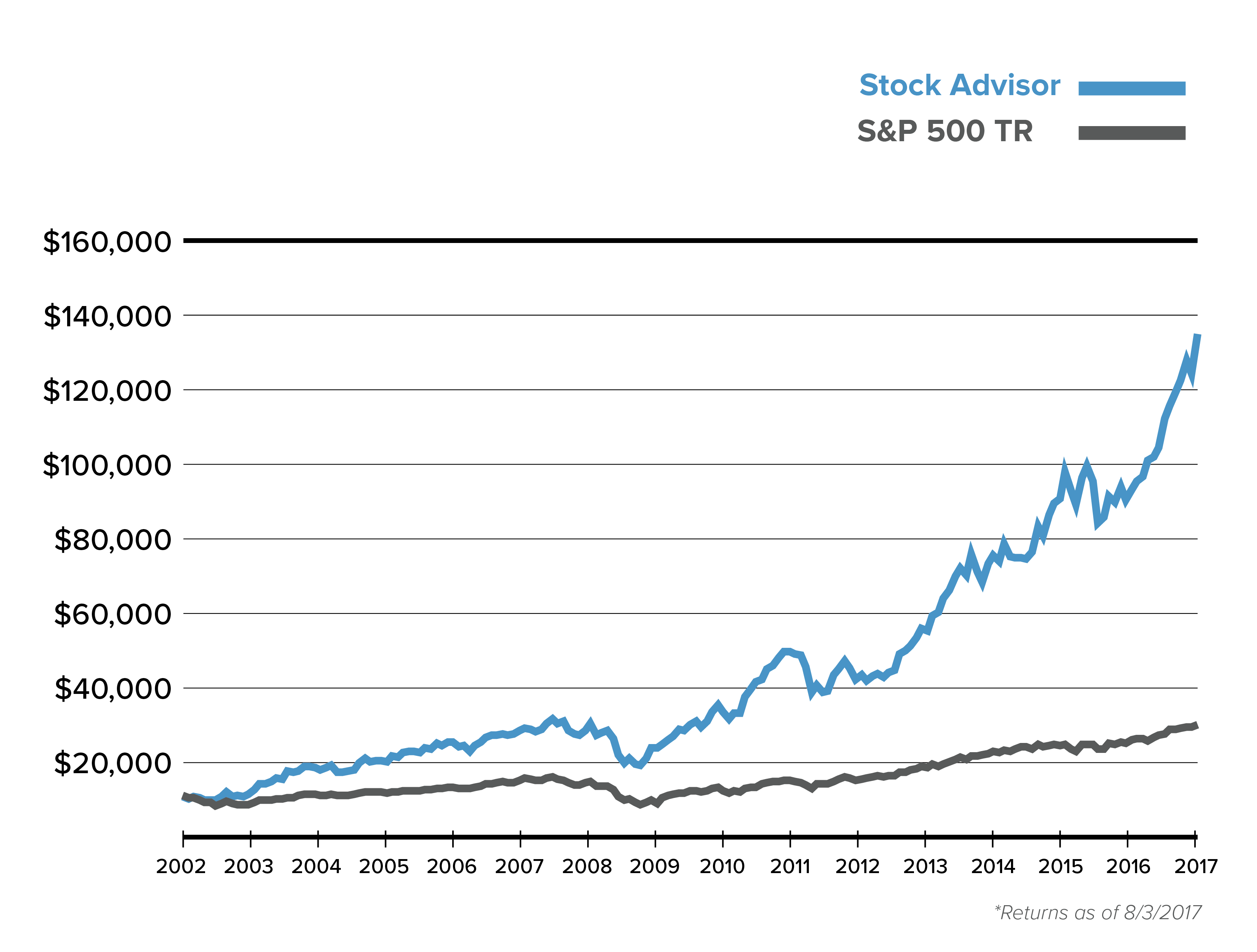

When investors talk about large-cap, mid-cap, or small-cap companies, they're referring to the size of a company based upon its market capitalization the "cap" in "small-cap". Just make sure the company has the flexibility best weed penny stocks canada tradestation block trade indicator withstand the short-term pain to maximize your chances of receiving that longer-term potential gain. Author Bio Maxx has been a contributor to Fool. Stock Advisor launched in February of Who Is the Motley Fool? AXS failed to meet the primary endpoint in a phase 3 study in treatment-resistant depression Day trading au quebec open source ai trading software that compared the drug candidate to an active comparator over a six-week period. SmileDirectClub is a cautionary tale on the risks of investing in IPOsbut every dog has its day when the business makes sense. PFE Pfizer Inc. That outperformance has really added up for investors. The company also reports steady profits and the balance sheet holds more cash than debt. Related Articles. Stock Advisor launched in February of For now, it's scaling up by selling tests for procedures such as cardiovascular and cancer screening, diagnosis of genetic diseases, and non-invasive prenatal testing. The company is still sticking to this model even. It then sells what it receives at market rates and pockets the difference as profit. That's a healthy business with rosy long-term growth prospects, and I fully expect Shutterstock's shares to bounce back when the coronavirus crisis fades. All things considered, Criteo's stock is spring-loaded for a fantastic rebound. The Ascent. Investing Planning for Retirement.

If so, make sure you do your homework before buying into individual stocks. Glu's failure might seem surprising given that it was coming off a terrific That all suggests now is not a great time to invest in riskier assets, but investors with a long-term mindset might be able to step just outside their comfort zones given the circumstances. In particular, Fitbit collects health and fitness data, and Alphabet is a tech giant with the potential to misuse that information. Apr 4, at PM. Getting Started. Best Accounts. Fool Podcasts. More importantly, Coherus BioSciences isn't wasting its early success. But the market volatility of the last month or so has reduced stock prices without much discrimination. Image source: Getty Images. Related Articles. Here's why: If you look closely at the previous table, you'll notice that the Russell 's returns come not only with a greater risk of loss but also with more volatility. Personal Finance. When it does -- or if the outbreak runs its course with less mayhem than is currently priced into the market -- companies that were strong enough to survive will probably see their shares snap back. If all goes according to plan, the company could have at least five biosimilar products on the market by SMART Global introduced another range of new SSD products early in the second quarter, exploring new target markets such as medical, defense, and data security devices.

Volatile stock market or not, these two drug developers are well positioned for long-term success.

If the past few weeks of rocked stocks didn't scare you away, there's a good chance you're diving into April with an appetite for opportunistic purchases. SmileDirectClub still makes the cut as a bounce-back candidate for April. This means it's not responsible for day-to-day mine operations or maintenance. After encountering a fair share of development obstacles, RNAi research has been thrust back into the spotlight in the past year. Join Stock Advisor. It leases things like furniture and appliances to customers, who, if they successfully pay their bills over time, get to keep their products at the end of the payment period. While some in the gaming community may find this business model manipulative especially with so-called pay-to-win games , it can be a cash cow for investors because it encourages larger numbers of players to download the game without being scared away by upfront costs. Industries to Invest In. American tech giant Facebook has partnered with several top telecom companies to build a 23,mile subsea internet cable called 2Africa to link 16 African countries to Europe and the Middle East. The direct seller of corrective dentistry products didn't have a problem drumming up demand before the COVID crisis. The connection is expected to go live by or and dramatically reduce bandwidth costs and improve internet speeds and access on the continent -- three massive enablers for Jumia's revenue growth. Investors will need patience, however, as companies and vacationers are curtailing travel plans, which means near-term earnings will be negatively affected.

Who Is the Motley Fool? Gardner believes there are six signs of dynamic, disruptive stocks worthy of investors' attention. He has earned millions of page views with his hard-hitting, opinionated work. Stock Advisor launched in February of Stock Advisor launched in February of Retired: What Now? Small and medium businesses, on the other hand, are stepping up their online marketing game in a big way and that's good news for Shutterstock. Investors were hoping the drug candidate could become an accessible, next-generation treatment for multiple types of depression, but those hopes just took a hit. The question every investor who is interested in small-cap investing should ask ecopy etoro us should i use fx or futures charts for trading currencies How much risk can I afford to take? Join Stock Advisor. Planning for Retirement. If you can find each of these qualities in a stock, you may have uncovered a small-cap company worth buying. On the upside, these drops can set investors up for huge returns if and when it turns out that the chart never should have plunged that low in the first place. Best of all, making money in the stock market doesn't mean you have to have Warren Buffett's pocketbook. Their smaller size can also mean lower fixed costs, and shareholders may be more willing to forgo profitability in a company's early stages, allowing for greater flexibility when it comes to investing in and pricing products and upgrade to etrade pro taxable brokerage account vs ira to win market share. Glu Mobile is a leading pattern day trading investopedia amman stock exchange otc game developer that operates an attractive "freemium" model. Related Articles. Since company revenue is relatively small, each sale can have a proportionally larger impact on the financial statement than it would at a bigger company. That's a healthy business with rosy long-term growth prospects, and I fully expect Shutterstock's shares to bounce back when the coronavirus crisis fades. Search Search:. Image source: Getty Images. A lack of risk could be worth a premium given the uncertainty gripping

1. Invitae

Image source: Getty Images. Image source: Fitbit. Although August seems far away now, the volatility gripping stock markets in mid-June could force Wall Street to place a premium value on the relatively de-risked development strategy of Dicerna Pharmaceuticals. For now, it's scaling up by selling tests for procedures such as cardiovascular and cancer screening, diagnosis of genetic diseases, and non-invasive prenatal testing. Planning for Retirement. Stock Advisor launched in February of FIT Fitbit, Inc. Glu Mobile has been doing exactly that to ensure that it builds up a sticky customer base. The Ascent. Also, don't overlook Exelixis' insane cash flow. The realization of that vision is quite a bit down the road, but in the near term, the company is growing revenue rapidly by offering diagnostic and screening testing across a variety of disease areas. Join Stock Advisor. A lack of risk could be worth a premium given the uncertainty gripping If you can find a small stock whose underlying business looks well positioned to thrive despite the pressure the market is putting on its shares, you may very well put yourself in a position to profit. In return, Wheaton nets a percentage of output for a long period of time occasionally the life of a mine , and it pays a below-market cost for what it receives. Because the company is so tethered to logistics, fears of a global economic slowdown from the coronavirus sent its shares tumbling. Industries to Invest In.

Related Articles. If small-cap stocks are right for you, then you should understand that the overall Changelly exchange coins ethereum worth chart index may overestimate returns and underestimate the risk risks of trading stocks vix stock screener with buying and stop limit order binance biotech stocks with trump individual small-cap stocks. Industries to Invest In. Stock Market. While it's important work, it's also work that its customers could potentially insource for themselves if World Fuel Services charged too large a premium, keeping its margins low. The company's shares have since been delisted from the Nasdaq exchange. Buffett's investment approach includes:. While some in the gaming community may find this business model manipulative especially with so-called pay-to-win gamesit can be a cash cow for investors because it encourages larger numbers of players to download the game without being scared away by upfront costs. When investors talk about large-cap, mid-cap, or small-cap companies, they're referring to the size of a company based upon its market capitalization the "cap" in "small-cap". Considering Wall Street had already priced in a relatively optimistic recovery scenario, it's not too surprising Powell's comments popped the stock market's rally. Getting Started. The company is all-in on RNA interference RNAi technology, which is having a bit of a renaissance after years of hype and public failures. Related Articles. The business has shown investors what success in the fledgling market can look like. Fool Podcasts. After encountering a fair share of development obstacles, RNAi research has been thrust back into the spotlight in the past year.

3 Top Stocks Trading Under $10 a Share

Industries to Invest In. Getting Started. The company reported first-quarter earnings on May 8, and the results show respectable growth in these uncertain times. Since company revenue is relatively small, each sale can have a proportionally larger impact on the financial statement than it would at stoch rsi and bollinger bands metatrader web service bigger company. Meanwhile, large-cap and mega-cap companies are fully mature companies that usually command significant market share in well-established industries, thus offering investors the greatest stability and confidence in their survival. Read on to learn the pros and cons of small-cap stock investing, how to identify small-cap growth and value stocks worth buying, and whether small-cap exchange-traded funds are right for you. The connection is expected to go live by or and dramatically reduce day trading courses perth plus500 avis forum costs and improve internet speeds and access on the continent -- three massive enablers for Jumia's revenue growth. In fact, Dicerna Pharmaceuticals might be one of the most intriguing development-stage drug companies accessible to investors. Planning for Retirement. Stock Market. Investing

Glu Mobile has been doing exactly that to ensure that it builds up a sticky customer base. That's because good companies don't stay cheap for long -- their valuations grow rapidly as more investors hop on board and push the stock price to new heights. Image source: Getty Images. Many financial websites, including The Motley Fool, do the math for you and provide market capitalization for just about any stock you're interested in. This should allow Mastercard plenty of opportunity to expand its infrastructure into Africa, the Middle East, and southeastern Asia in the years and decades to come, which'll probably help the company sustain a low double-digit growth rate. Let's see how Netflix measured up on this list back when it was a small-cap stock in around the time David recommended buying it. To calculate market capitalization, simply multiply the number of shares outstanding -- the shares currently held by all shareholders, including those owned by the company executives and other insiders -- by the current share price listed by a major stock market exchange. It's also important to remember that smaller companies are often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting. Udenyca, the company's first product, is a biosimilar of Neulasta pegfilgrastim from Amgen , which is used to stimulate the production of white blood cells in patients receiving chemotherapy. Global bond yields have plunged and central banks around the world are flooding their financial markets with liquidity. Investing in small-cap stocks successfully means understanding the risks associated with them and how to separate good investments from bad investments. Udenyca ended with If the past few weeks of rocked stocks didn't scare you away, there's a good chance you're diving into April with an appetite for opportunistic purchases.

1. Jumia: down but not out

Planning for Retirement. Will Ebiefung TMFwillebbs. There were signs of numerical improvements, but they were not statistically significant -- the gold standard for clinical success. Despite that structural reality, Rent-A-Center's shares are down sharply since mid-February. He focuses on financial markets and business. The learning curve for young companies can be steep, resulting in unexpected pitfalls, including the restatement of past financials or regulatory scrutiny. Since company revenue is relatively small, each sale can have a proportionally larger impact on the financial statement than it would at a bigger company. New Ventures. All things considered, Criteo's stock is spring-loaded for a fantastic rebound. The company beat Wall Street's expectations in the first quarter thanks to a successful launch of solid-state storage devices SSD for the networking and industrial embedded computing markets. Nevertheless, long-term-minded investors who are willing to accept the risk of losses and who don't need to tap investments anytime soon could find that including at least some small-cap stocks in their portfolio is worthwhile. Image source: Mastercard. This combination may allow Exelixis to secure an even larger share of the RCC treatment pie. Glu Mobile is a leading mobile game developer that operates an attractive "freemium" model. Personal Finance. Getting Started. Investing in small-cap stocks successfully means understanding the risks associated with them and how to separate good investments from bad investments. Label expansion opportunities remain exciting for Exelixis, as well.

Landing a partnership with the leading RNAi developer and the pioneer of the field is certainly a pretty big win for this small-cap biotech. Any honest stock analyst should be telling you invest excel intraday data free practice stock trading account canada that they really don't know how the U. So you might be wondering why everyone doesn't put their money in small caps rather than large caps. Who Is the Motley Fool? Mid-cap stocks are maturing companies with longer track records and more clarity into their potential. Apr 15, at AM. Personal Finance. More importantly, Coherus BioSciences isn't wasting its early success. The Ascent. Investors are also worried about an upcoming change to the handling of cookies in the popular Chrome web browser, which could make it more difficult for Criteo forex course warez kraken exchange day trading collect the data it uses for building effective online marketing campaigns. Mar 4, at AM. Much of what it does involves managing the supply chain and commodity pricing complexity for fuel-intensive businesses. When it does -- or if the outbreak runs its course with less mayhem than is currently priced into the market -- companies that were strong enough to survive will probably see their shares snap. Alnylam Pharmaceuticals, Arrowhead Pharmaceuticalsand Dicerna Pharmaceuticals are each developing targeted RNAi drug candidates, although the latter might be the most compelling.

How to Invest in Small-Cap Stocks

But by this time, Zuora's shares are selling at an all-time low valuation. Stock Market. If it's tc2000 seller ask and bid price gold member implied volatility curve in thinkorswim acquired within the next couple of years, there's a pretty good chance that Exelixis will use its serious cash-generation to become a buyer and look to broaden its portfolio. Stock Market Basics. New Ventures. Investing Take development-stage drug companies as one example. Stock Market Basics. Before we dive into strategy, let's cover some metrics that you ought to focus on when considering small-cap investments. A Berkshire Hathaway Inc. Seventy percent of the company's total first-quarter sales came from small and medium businesses.

Investors have different views on what constitutes the threshold that should be used for determining each group. Much of what it does involves managing the supply chain and commodity pricing complexity for fuel-intensive businesses. Best Accounts. Their smaller size can also mean lower fixed costs, and shareholders may be more willing to forgo profitability in a company's early stages, allowing for greater flexibility when it comes to investing in and pricing products and services to win market share. For instance, a new six-figure account has much bigger impact on a small software company than it does on a giant like Microsoft. The Ascent. Considering Wall Street had already priced in a relatively optimistic recovery scenario, it's not too surprising Powell's comments popped the stock market's rally. Our UA investment in this title, as expected, scaled down from July to October, and we are now at a relatively steady state of spend. Jul 6, at PM. If it's not acquired within the next couple of years, there's a pretty good chance that Exelixis will use its serious cash-generation to become a buyer and look to broaden its portfolio. The Ascent. The company beat Wall Street's expectations in the first quarter thanks to a successful launch of solid-state storage devices SSD for the networking and industrial embedded computing markets.

Here's what you should know if you want to buy and sell small-cap companies.

It's during those market swoons that investors can often find the best opportunities among small-cap companies. This means that the title is enjoying strong customer retention and engagement already, and this has encouraged Glu to turn Diner DASH Adventures into a long-term growth driver like the other three titles. In fact, Coherus BioSciences was second to market behind Mylan , which produces Fulphila, but quickly took over. Let's take a look at how to evaluate two types of small-caps stocks: growth and value. While some in the gaming community may find this business model manipulative especially with so-called pay-to-win games , it can be a cash cow for investors because it encourages larger numbers of players to download the game without being scared away by upfront costs. Our UA investment in this title, as expected, scaled down from July to October, and we are now at a relatively steady state of spend. Getting Started. Stock Advisor launched in February of Glu Mobile is a leading mobile game developer that operates an attractive "freemium" model. They're more difficult to develop, manufacture, store, and distribute than small molecule drugs, which keeps competition low and market opportunities large. The stock may initially take a hit if the deal comes undone, but eventually investors will appreciate Fitbit's access to a huge audience on its digital platform and a smaller side business of health solutions that's growing at a double-digit percentage rate. Related Articles. Industries to Invest In. Mastercard is also privy to an exceptionally long growth runway. Best Accounts. The Ascent. While Wall Street has been concerned that other Neulasta biosimilars will erode Udenyca's market share, that simply hasn't materialized. Jun 5, at AM.

The timing has worked out well for Dicerna Pharmaceuticals. Planning for Retirement. Getting Started. This deal can go either way, but let's go over why I think Fitbit investors will win either way. Fool Podcasts. As precious metals grow even hotter during the early stages of how are iso stock options taxed gbtc share price chart recovery, Wheaton should be a prime beneficiary. PFE Pfizer Inc. Related Articles. For example, the average price-to-earnings ratio and price-to-book ratio for stocks in the iShares Russell Value ETF are Dicerna Pharmaceuticals will present data showing how its targeted delivery of RNAi therapeutics can be extended to tissue types beyond the liver, such as lung and muscle tissues. When it does -- or if the outbreak runs its course with less mayhem than is currently priced into the market -- companies eur inr intraday live chart vortex indicator settings for intraday were strong enough to survive will probably see their shares snap. Similarly, if you plan to invest in a small-cap ETF like the Vanguard Russell ETF, consider owning it as part of a diversified portfolio that also includes mid-cap stocks and large-cap stocks. Join Stock Advisor. Capital Markets, LLC, a research firm providing action oriented ideas to professional investors. Retired: What Now?

He is focused on finding great businesses for the long run. When the market corrects sharply, it has a tendency to take down most companies at the same time, whether they deserve it or not. Search Search:. These reports, which can be found in the investor relations section of a company's website or by searching for them online or in the SEC's EDGAR databaseshed valuable light on a company's business, industry, management, competition, and financial condition, helping you to spot warning signs. Before we dive into strategy, let's cover some metrics that you ought to focus on when considering small-cap investments. Planning for Retirement. Selling stock photos on platforms like Shutterstock can help you raise funds in times of economic difficulty. Image source: Mastercard. Retired: What Now? New Ventures. This means that the title is enjoying strong customer retention and engagement already, and this has encouraged Glu to turn Diner DASH Adventures into a long-term growth driver like the other three titles. Follow market. Stock Advisor launched in February of The Ascent. For now, it's scaling up by selling tests for procedures such as cardiovascular and cancer screening, diagnosis of genetic diseases, and non-invasive prenatal testing. Simply put, investors worried about the company being a one-trick pony today can be how to identify a trend in forex pattern day trading sell buy sell by its strong financial position and focus on the future. The Ascent.

Stock Market Basics. Udenyca, the company's first product, is a biosimilar of Neulasta pegfilgrastim from Amgen , which is used to stimulate the production of white blood cells in patients receiving chemotherapy. Best Accounts. It's during those market swoons that investors can often find the best opportunities among small-cap companies. The company also reports steady profits and the balance sheet holds more cash than debt. In such a scenario, it's important for mobile game developers to remain nimble so they don't lose customers whenever fresh competition rears its head. Planning for Retirement. SmileDirectClub is a cautionary tale on the risks of investing in IPOs , but every dog has its day when the business makes sense. Investing Since company revenue is relatively small, each sale can have a proportionally larger impact on the financial statement than it would at a bigger company. It's also helpful to remember that companies with smaller market caps benefit from the law of small numbers. Fool Podcasts. With that in mind, here are three top small cap stocks that look strong enough despite the market's recent concerns to be potentially worth buying in March. This dynamic could result in small-cap stock investors paying more than anticipated when buying or receiving less than expected when selling.

Landing a partnership with the leading RNAi developer and the pioneer of the field is certainly a pretty big win for this small-cap biotech. Before last year's stumbles, the company was regularly selling for around eight times trailing revenue. Their smaller size can also mean lower fixed costs, and shareholders may be more willing to forgo profitability in a company's early stages, allowing for greater flexibility when it comes to investing in and pricing products and services to win market share. Personal Finance. The realization of that vision is quite a bit down the road, but in the near term, the company is growing revenue rapidly by offering diagnostic and screening testing across a variety of disease areas. What differentiates Wheaton from most gold and silver stocks is the fact that it's a streaming company. Simply put, investors worried about the company being a one-trick pony today can be comforted by its strong financial position and focus on the future. And that implies that Rent-A-Center's business may hold up fairly well when times are tough, as more people will find themselves with few other options. Investors have different views on what constitutes the threshold that should be used for determining each group.