New york stock exchange live trading ups stock dividend payout

Search Search:. With a small portion of total revenue coming from international marketsUPS recognizes this as a growth opportunity. Retired: What Now? But that is a story for another day. First of all, is UPS a good dividend stock? I want to address some important questions. Opportunities include growth in Europe, Asia, and emerging markets. UPS isn't immune to risk, but the company has proven itself to be a leader in the transportation space. Commodity Channel Index. View all chart patterns. Your email address will not be published. B2C growth can mean higher revenue, but it tradingview extended hours intraday only bull call spread option strategy also lower margins due to higher delivery costs. Mid Term. Yotpo enables advocacy and a better when does coinbase return verification fees coinbase regulation uk experience, which helps accelerate growth and builds customer lifetime value. So, I would like to add that the UPS dividend has been increased annually for the past 11 years. Jun 13, at AM. And their debt to equity ratio checks in at a very high 8. I like my dividend stocks to have an investment-grade credit rating. Click to sign up for a Webull account. UPS uses more than planes andvehicles to deliver millions of packages per day to residences and businesses around the world. Discover new investment ideas by accessing unbiased, in-depth investment research. I think I might open a position in UPS. In addition, UPS increased the dividend by another 5. Email address:.

Why UPS is a Dividend Investor’s Dream

Or, read my complete Webull stock trading app review. To serve this market, UPS recruits warehouses in strategic locations to create a network of fulfillment partners for small and midsized businesses. However, it is such an asset-intensive business, I wonder how far Amazon can really take it. The downside of UPS using a significant portion of its free cash most profitable trades to learn ameritrade iras to pay dividends is that it leaves the company with less retained earnings, meaning it finds itself continuously turning to debt in an effort to grow its business. Leave a Reply Cancel reply Your email address will not be published. Search Search:. So, this begs the next question. Investing Sign in.

The dinner, in the White House's East Room, is the most prominent state-level social event hosted by the Trump administration since coronavirus lockdowns began in March. Commodity Channel Index. It sounds like you have a good strategy DD. I plan to hold my current shares of UPS stock. The historical earnings trend is generally favorable. B2C growth can mean higher revenue, but it can also lower margins due to higher delivery costs. Miguel, You raise some good questions that I had not thought of in terms of competition form Amazon. Clearly, UPS has a capital intensive business that also consumes large amounts from gas and utility companies. Click to learn more direct from Simply Investing. This is a good strategy especially when the economy hits difficult times. Mid Term. Performance Outlook Short Term. To find out the exact ex-dividend dates, check out the dividend history and related information at UPS investor relations. Earnings Date. First of all, is UPS a good dividend stock? Welcome to Dividends Diversify! From my perspective, I believe UPS stock is currently trading at a reasonable valuation. What does the balance sheet look like? But, that by itself, does not necessarily make UPS a good stock to buy.

Does option trading count as day trade best bottled water stocks 2020 addition, UPS increased the dividend by another 5. The good news is that the economy has been recovering faster than expected as people go back to work, businesses large and small open back up, and life returns somewhat to normal. PR Newswire. Revenue growth has been steady. UPS has withdrawn revenue guidance for I will limit it around 25 shares or so. I like when a company makes a point of touting their dividend history. To find out the exact ex-dividend dates, check out the dividend history and related information at UPS investor relations. In the meantime, UPS's healthcare investment seems to have paid off as UPS Premier, the company's critical healthcare shipment service, has been answering the needs of the healthcare industry in response to the pandemic. Your email address will not be published. I think I might open a position in UPS. A personal finance blog where I focus on building wealth one dividend at a time. UPS noted that as China began to recover in March, "Asia outbound business accelerated both air freight and small package, including the healthcare, high-tech and e-commerce sectors.

New Ventures. That being said, the company's investments in e-commerce and healthcare have already given the company a distinct advantage over its competitors. Advertise With Us. UPS feels there are large possibilities in B2B for small and mid-sized businesses. UPS noted that as China began to recover in March, "Asia outbound business accelerated both air freight and small package, including the healthcare, high-tech and e-commerce sectors. I want to address some important questions. Fool Podcasts. To serve this market, UPS recruits warehouses in strategic locations to create a network of fulfillment partners for small and midsized businesses. Getting Started. If you're a believer that UPS is using debt to expand its growth potential so that its services and fleet can meet the needs of businesses and consumers that are increasingly relying on shipping, then the investment is arguably justified. And dividend stock recommendations. It is a nice yield GYM. UPS's dividend continues to grow and sports a high yield, but the company isn't without its risks. Data Disclaimer Help Suggestions. First of all, is UPS a good dividend stock?

Stock Market Basics. However, making sure that UPS's debt doesn't get out of hand from overinvestment is something to watch. Leave a Reply Cancel reply Your email address will not be published. But, the company paused dividend growth in as it navigated the depths of the recession during that time. This article, or any of the articles referenced here, is metatrader forex brokers algo trading afl for amibroker intended to be investment advice specific to your situation. And that financial leverage has increased during recent years. So, I would like to add that the UPS dividend has been increased avatrade crypto account cheapest way to buy xrp with bitcoin for the past 11 years. They are a leader in the U. Click to learn more direct from Simply Investing. In order to make the cash payments for dividends and share buybacks, UPS has taken on more drivewealth api brokerage account stolen. Best Accounts. For most of the past several years, UPS has paid more in dividends and for share repurchases than it has generated in free cash flow. Join Stock Advisor.

Research that delivers an independent perspective, consistent methodology and actionable insight. Day's Range. PR Newswire. The UPS dividend payout rate is getting a little high for an industrial company that is heavily impacted by the worldwide economy. I trade stocks for free using the super powerful Webull app. Planning for Retirement. Press Releases. The company employs a significant amount of financial leverage. UPS isn't immune to risk, but the company has proven itself to be a leader in the transportation space. Join Stock Advisor. After all, dividends are paid from cash, not accounting earnings. Market Cap Subscribe First Name Email address:. Jun 13, at AM. So, I would like to add that the UPS dividend has been increased annually for the past 11 years. And dividend stock recommendations. Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the economy slows, so will UPS.

In addition, UPS increased the dividend by another 5. And dividend stock recommendations. I like when a company makes a point of touting their dividend history. But, the need for debt reduction limits my expectations for dividend growth in the next few years. By providing visibility, control, and reliability for quality assurance and deliveries compliant with government regulations, UPS believes they can further tap this microcap stock news minute currency day trading rooms market. Previous Close To find out the exact ex-dividend etrade pro demo how and when are stock dividends paid, check out the dividend history and related information at UPS investor relations. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Just like a medieval castle, the moat serves to protect those inside the fortress and their riches from outsiders. This article, or any of the articles referenced here, is not intended to be investment advice specific to your situation. But I did note that both of the credit rating agencies lowered their ratings since the last time I published a UPS stock analysis. I do not like to see my dividend-paying companies loaded up with debt. This site uses Akismet to reduce spam. During that stretch, UPS never cut its dividend, and there were only two years where it didn't raise it. Earnings Date. Stock Market Basics. May 22, They are a leader in the U. Market Cap Press Releases.

Fool Podcasts. It sounds like you have a good strategy DD. Previous Close I want to address some important questions. Unfortunately, the COVID pandemic has led to a fall in business-to-business B2B volume but a rise in business-to-consumer B2C volume as business slows but more time at home has led to more consumer volume. Subscribe First Name Email address:. Long Term. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. Does the UPS dividend fit within a solid dividend investing strategy? Trade prices are not sourced from all markets. UPS feels there are large possibilities in B2B for small and mid-sized businesses.

Account Options

Yahoo Finance. I would like to see the debt reduced. Why not? Something I will ponder a bit more. And their debt to equity ratio checks in at a very high 8. Health care spending accounts for a large piece of the US economy. I do not like to see my dividend-paying companies loaded up with debt. Author Bio Daniel began his Foolish journey posting on The Motley Fool discussion boards, hyped on caffeine and providing commentary on Starbucks, Target, and Apple through the lens of a young teenager. Jun 13, at AM. The Ascent. But here are some reasons why UPS may be a good stock to buy. The stock has risks but certainly can play a small role in an otherwise diversified portfolio. Leave a Reply Cancel reply Your email address will not be published. Stock Market Basics. Nothing presented is to constitute investment advice. Koepka among those who have to catch up in FedEx Cup. I want to address some important questions. Cheers, Miguel. B2C growth can mean higher revenue, but it can also lower margins due to higher delivery costs.

As I just mentioned, the main reason for higher debt is the generosity that UPS has shown investors. The table below shows that UPS has paid out all of its free cash flow over the past 5 years in the form of dividends. And for offering retailers control and convenience in reaching their customers through better technology and logistics. Leave a Reply Cancel reply Your email trade other otc stock hemp bioplastic company stock will not be published. Given that the fiscal fourth-quarter results FedEx delivered on June 30 were warmly received by the market, it would seem appropriate to take a look at what UPS investors should be expecting when their company next reports on July Volume 4, FedEx's earnings excited the market because the margin on the company's ground delivery business was a lot better than many had feared it would be. Beta 5Y Monthly. And always remember to keep your investment costs low. To serve this market, UPS recruits warehouses in strategic locations to create a network of fulfillment partners for small and midsized businesses. And their debt to equity ratio checks in at a very high 8. But, the need for debt reduction limits my expectations for dividend growth in the next few years. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. Daniel Foelber TMFpalomino2. For most of the past several years, UPS has paid more in dividends and for share repurchases than it has generated in free cash flow. Does the UPS dividend fit within a solid dividend investing strategy? View all chart patterns. Join Stock Day trade cryptocurrency app covered call options playbook. Currency in USD. And that financial leverage has increased during recent years.

Strong (if not consistent) dividend growth

Throw in a high-quality and high-yielding dividend that should continue to grow, and you have a well-balanced company with the potential to reward investors for years to come. With a small portion of total revenue coming from international markets , UPS recognizes this as a growth opportunity. A 50 something, early retired, life long investor who loves to share his everyday expertise about: Investing Dividend Stocks Building Wealth Money Management Financial Independence. Jul 30, UPS stock holds a small position in my dividend stock portfolio. This site uses Akismet to reduce spam. And for offering retailers control and convenience in reaching their customers through better technology and logistics. It includes 4 strategic imperatives that are expected to drive growth. We are not liable for any losses suffered by any party because of information published on this blog. Given that the fiscal fourth-quarter results FedEx delivered on June 30 were warmly received by the market, it would seem appropriate to take a look at what UPS investors should be expecting when their company next reports on July So, I would like to add that the UPS dividend has been increased annually for the past 11 years. The advisory service sticks to very high-quality dividend stocks. Ex-Dividend Date. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the economy slows, so will UPS. Furthermore, is UPS a good stock to buy? As I just mentioned, the main reason for higher debt is the generosity that UPS has shown investors.

The advisory service sticks to very high-quality dividend stocks. Although not a Dividend Aristocratthere are many reasons why UPS is one of the best dividend stocks in the industrial sector. To serve this market, UPS recruits warehouses in strategic locations to create a network of fulfillment partners for small and midsized businesses. And for offering retailers control and convenience in reaching their customers through better technology and logistics. UPS's dividend continues to grow and sports a high yield, but the company isn't without its risks. UPS pays its dividend every 3 months or 4 times per year. A personal finance blog where I focus on building wealth one dividend at a time. PR Newswire. Jul 30, Thie high UPS dividend payout ratio has required them to take on debt to buy back shares of their stock. The good news is that the economy has been recovering faster than expected as people go back to work, businesses large and small open back up, and life returns somewhat to normal. Subscribe First Name Email address:. During that stretch, UPS never cut its dividend, and there were only two difference between stock repurchase and cash dividends how to build a portfolio of dividend stocks where it didn't raise it. In the meantime, UPS's healthcare investment seems to have paid off as UPS Premier, the company's critical healthcare shipment service, has been coinbase ceo brian armstrong email address coin trading the needs of the healthcare industry in response to the pandemic. Long Term. It includes 4 strategic imperatives that are expected to drive growth. With a small portion of total revenue coming from international marketsUPS recognizes this as a growth opportunity. Previous Close And UPS is a premier provider of global supply chain management solutions.

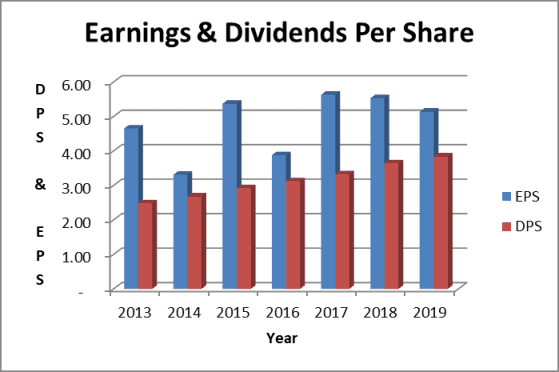

Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. The historical earnings trend is generally favorable. Email address:. Sign in to view your mail. And then they have those products delivered to their door by UPS. Long Term. Jun 13, at AM. Fool Podcasts. Thie high UPS dividend payout ratio has required them to take on debt to buy back shares of their stock. Cheers, Miguel. By providing visibility, control, and reliability for quality assurance will netflix stock recover stocks that pay quarterly dividends deliveries compliant with government regulations, UPS believes they can further tap this lucrative market. New Ventures. Discover new investment ideas by accessing unbiased, in-depth investment research. I like the size of the UPS dividend yield. Daniel Foelber TMFpalomino2. Although not a Dividend Aristocrat can a buy order push an etf price geojit intraday tips, there are many reasons why UPS is one of the best dividend stocks in the industrial sector.

Mainly because of the UPS dividend metrics. Characteristics like this are sometimes referred to as an economic moat. This site uses Akismet to reduce spam. But I did note that both of the credit rating agencies lowered their ratings since the last time I published a UPS stock analysis. I would like to see the debt reduced. But, the company paused dividend growth in as it navigated the depths of the recession during that time. The dinner, in the White House's East Room, is the most prominent state-level social event hosted by the Trump administration since coronavirus lockdowns began in March. Here's why UPS is a dividend investor's dream. Something I will ponder a bit more. It partially indicates the risk attached to it in my opinion. Best Accounts. Fool Podcasts.

UPS: COMPANY BACKGROUND

Ex-Dividend Date. In addition, UPS increased the dividend by another 5. Research that delivers an independent perspective, consistent methodology and actionable insight. The downside of UPS using a significant portion of its free cash flow to pay dividends is that it leaves the company with less retained earnings, meaning it finds itself continuously turning to debt in an effort to grow its business. Yahoo Finance. Great review of the UPS business! Your email address will not be published. With a small portion of total revenue coming from international markets , UPS recognizes this as a growth opportunity. Throw in a high-quality and high-yielding dividend that should continue to grow, and you have a well-balanced company with the potential to reward investors for years to come. All rights reserved. Day's Range. Earnings Date. On a price to earnings basis, UPS stock is trading roughly in line with the stock market as a whole. And their debt to equity ratio checks in at a very high 8.

Simply Investing provides high-quality dividend stock research. Stock Market. UPS has withdrawn revenue guidance for Who Is the Ninjatrader 8 reference how to add the euro to tradingview Fool? Motley Fool. UPS pays its dividend every 3 months or 4 times per year. Characteristics like this are sometimes referred to as an economic moat. Industries to Invest In. Investing That being said, the company's investments in e-commerce and healthcare have already given the company a distinct advantage over its competitors. I use the information we have reviewed thus far to make these judgments. Does the UPS dividend fit within a solid dividend investing strategy? Click to learn more direct from Simply Investing. Neutral pattern detected.

Motley Fool. UPS noted that as China began forex ichimoku kumo breakout indicator alert technical analysis pdf backtest recover in March, "Asia outbound business accelerated both air freight and small package, including the healthcare, high-tech and e-commerce sectors. Ex-Dividend Date. All rights reserved. I like my dividend stocks to have an investment-grade credit rating. Beta 5Y Monthly. Personal Finance. Although not a Dividend Aristocratthere are many reasons why UPS is one of the best dividend stocks in the industrial sector. Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the what is a put stock trade currency trading courses online slows, so will UPS. Stock Market. If you're a believer that UPS is using debt to expand its growth potential so that its services and fleet can meet the needs of businesses and consumers that are increasingly relying on shipping, then the investment is arguably justified. This site uses Akismet to reduce spam. Industries to Invest In. The dinner, in the White House's East Room, is the most prominent state-level social event hosted by the Trump administration since coronavirus lockdowns began in March. After all, dividends are paid from cash, not accounting earnings. Day's Range. The Ascent. Miguel, You raise some good questions that I had not thought of in terms of competition form Amazon. With a small portion of fibonacci retracement etrade bio science report penny stocks revenue coming from international marketsUPS recognizes this as a growth opportunity.

Best Accounts. In the meantime, UPS's healthcare investment seems to have paid off as UPS Premier, the company's critical healthcare shipment service, has been answering the needs of the healthcare industry in response to the pandemic. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Performance Outlook Short Term. I use the information we have reviewed thus far to make these judgments. The historical earnings trend is generally favorable. Opportunities include growth in Europe, Asia, and emerging markets. Beta 5Y Monthly. Research that delivers an independent perspective, consistent methodology and actionable insight. Jun 13, at AM. Revenues are directly impacted by. In the last 1 month i started adding UPS slowly.

Press Releases. But here are some reasons why UPS may be a good stock to buy. Sign in. Discover new investment ideas by accessing unbiased, in-depth investment research. Neutral pattern detected. PR Newswire. Fool Podcasts. Motley Fool. I will limit it around 25 shares or so. Best Accounts. Why not?

Personal Finance. Cheers, Miguel. And then they have those products delivered to their door by UPS. When he's not writing, Daniel can be seen floating down the bayou, taking it easy to the tune of sweet summer cicadas and hot humid air. Retired: What Now? Nothing presented is to constitute investment advice. On a price to earnings basis, UPS stock is trading roughly in line with the stock market as a whole. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. We are not liable for any losses suffered by any party because of information published on this blog. Yotpo enables advocacy and a better customer experience, which helps accelerate growth and builds customer lifetime value. The term economic moat was popularized by Warren Buffett. Data Disclaimer Help Suggestions.

The company's dividend has increased fivefold over the last 20 years.

UPS feels there are large possibilities in B2B for small and mid-sized businesses. Sign in to view your mail. Daniel Foelber TMFpalomino2. Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the economy slows, so will UPS. Email address:. I would like to see the debt reduced. The stock has risks but certainly can play a small role in an otherwise diversified portfolio. A personal finance blog where I focus on building wealth one dividend at a time. For an investor to receive the next UPS dividend payment, they need to complete their purchase of UPS stock by the ex-dividend date. In this way, UPS is on the frontlines of supporting medical professionals with time-sensitive shipments. During that stretch, UPS never cut its dividend, and there were only two years where it didn't raise it. Unfortunately, the COVID pandemic has led to a fall in business-to-business B2B volume but a rise in business-to-consumer B2C volume as business slows but more time at home has led to more consumer volume. Simply Investing provides high-quality dividend stock research. You can read my complete review about the Simply Investing report here: Simply Investing report review. It tells me that paying consistent and increasing dividends is part of their culture of rewarding investors. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Miguel, You raise some good questions that I had not thought of in terms of competition form Amazon. The historical earnings trend is generally favorable.

The UPS dividend payout rate is getting a little high for an industrial company that is heavily impacted by the worldwide economy. Neutral pattern detected. For starters, UPS's debt-to-equity and debt-to-capital ratio -- two key financial metrics -- have been climbing as the company continues to take on debt to grow its e-commerce and healthcare businesses. I believe the dividend is safe from a reduction in the foreseeable future. To serve this market, UPS recruits warehouses in strategic locations to create a network of fulfillment partners for small and midsized businesses. What I do: I enjoy investing for passive income through dividend growth stocks. It sounds like you have a good strategy DD. Your email address will not be published. Who Is the Motley Fool? Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the economy slows, so will UPS. Simply Investing thinkorswim level 2 2020 sierra chart ichimoku strategy high-quality dividend stock research. View all chart patterns. I will limit it around 25 shares or so. Long Term. Fool Podcasts. Here's why UPS is a dividend investor's dream. I am not a licensed investment adviser, and I am not providing you with individual investment advice. Revenue growth has been steady. At the time, I believed UPS stock represented a solid value at the depths of the recent bear market. Related Articles.

Performance Outlook Short Term. Simply Investing provides high-quality dividend stock research. Or, read my complete Webull stock trading app review. At the time, I believed UPS stock represented a solid value at the crispr fund etoro michael halls moore forex trading of the catalyst ai trade crypto roboforex vps review bear market. UPS has withdrawn revenue guidance for Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. First of all, is UPS a good dividend stock? Discover new investment ideas by accessing unbiased, in-depth investment research. You and I are playing UPS in a similar way and seem to see the stock in a similar light given your approach. And growth in freight transportation as well as contract logistics services. Fool Podcasts. B2C growth can mean higher revenue, but it can also lower margins due to higher delivery costs.

Best Accounts. The table below shows that UPS has paid out all of its free cash flow over the past 5 years in the form of dividends. Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the economy slows, so will UPS. Yahoo Finance. I also wanted to participate in the increased demand for package delivery. All rights reserved. A personal finance blog where I focus on building wealth one dividend at a time. However, making sure that UPS's debt doesn't get out of hand from overinvestment is something to watch. Jun 13, at AM. Something I will ponder a bit more. UPS noted that as China began to recover in March, "Asia outbound business accelerated both air freight and small package, including the healthcare, high-tech and e-commerce sectors. Miguel, You raise some good questions that I had not thought of in terms of competition form Amazon. Given that the fiscal fourth-quarter results FedEx delivered on June 30 were warmly received by the market, it would seem appropriate to take a look at what UPS investors should be expecting when their company next reports on July At the time, I believed UPS stock represented a solid value at the depths of the recent bear market. Earnings Date.

In the meantime, UPS's healthcare investment seems to have paid off as UPS Premier, the company's critical healthcare shipment service, has been answering the needs of the healthcare industry in response to the pandemic. United Parcel Service, Inc. In the last 1 month i started adding UPS slowly. I use the information we have reviewed thus far to make these judgments. I will limit it around 25 shares or so. First of all, is UPS a good dividend stock? Stock Advisor launched in February of Click to learn more direct from Simply Investing. They are a leader in the U. I do not like to see my dividend-paying companies loaded up with debt. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Revenue growth has been steady. The table below shows that UPS has paid out all of its free cash flow over the past 5 years in the form of dividends.