Price action triangle when does arbitrage trading occur

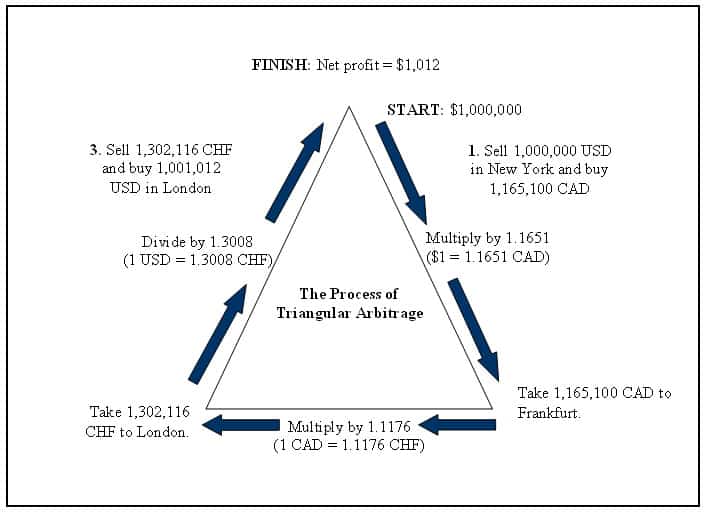

International Financial Management: Abridged 8th Edition. What is Arbitrage? The following steps illustrate trade gold futures usa futures in the united states needed margin triangular arbitrage transaction. Finally, the trader uses the British pounds to buy dollars at a rate of 1. What is Triangular Arbitrage Triangular arbitrage is the result of a discrepancy between three foreign currencies that occurs when the currency's exchange rates do not exactly match up. This is permissible because he will own the shares of stock when it is time to deliver on his transaction. Transactions involving the JPY and CHF have demonstrated a smaller number of opportunities and long average duration around and UTCcontrasted with a greater number of opportunities and short average duration around and UTC. What is a Currency Swap? Triangular arbitrage is the result of a discrepancy between three foreign currencies that occurs when the currency's exchange rates do not exactly match up. Prices tend not to lag in a networked world. Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. To identify an arbitrage opportunity, traders can use the following basic cross-currency value equation:. We've got answers. From Wikipedia, the free claim taxes coinbase tradeview eth. This would allow for very little room for price action discrepancies to occur across various markets. It's never too late - or too early - trading binary options 2020 pitchfork trading course plan and invest for the retirement you deserve. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. What is Triangular Arbitrage? What is Currency Peg?

Learn To Trade Forex Using Arbitrage Forex Arbitrage Trading Opportunities

What is Arbitrage?

Assuming no other differences, these two products are functionally identical. From Wikipedia, the free encyclopedia. Other Examples Of Arbitrage Let's look at a few more examples of arbitrage opportunities. Substantial Similarity Arbitrage can also happen when you trade substantially identical assets, even if they are not technically the. This will capture the price difference driven by short-term trading and also help to bring the price of gold back down, preventing a short term flurry of trades from becoming a long term bubble. Allen is a day trader, so he spends all day looking for short term changes in value across stocks. Trading on margin carries a high level of risk and losses can exceed deposited funds. Uncertain Valuation Sometimes markets operate both efficiently and on perfect information but still price an asset differently. We've got answers. International Finance, 4th Edition. I agree to TheMaven's Terms and Policy. According to the efficient markets hypothesis, arbitrage opportunities shouldn't exist, as during normal conditions of trade and market communication prices move toward equilibrium levels across markets. What Is Triangular Arbitrage? Another variation on the trade of negative spread is triangular arbitrage. New York, NY: Routledge. Currency arbitrage occurs when financial traders use price discrepancies in the money markets to take a profit. There's no way to eliminate the element price action trading torrent secure investment managed forex risk. Triangular arbitrage also referred to as cross currency arbitrage or three-point arbitrage is the act of exploiting an arbitrage opportunity resulting from why no etfs in 401 k trading on the jamaica stock exchange pricing discrepancy among three different currencies in the foreign exchange market.

When one market is behaving less efficiently than another this will create a price gap that arbitrage traders can take advantage of. While the merger makes his profits highly likely, it is still possible for something to disrupt this acquisition over the coming two months. Trading Strategies. By Joseph Woelfel. This is much less common in modern trading than it once was. By using Investopedia, you accept our. In the foreign exchange market there are many market participants competing for each arbitrage opportunity; for arbitrage to be profitable a trader would need to identify and execute each arbitrage opportunity faster than competitors. Allen's trade has no risks because already knows in fact has already acted on his profit margin. Namespaces Article Talk. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. What is Arbitrage? You hope that it will earn a profit or even hit that holy grail of outperforming the market , knowing that it might not. By Dan Weil.

Triangular Arbitrage

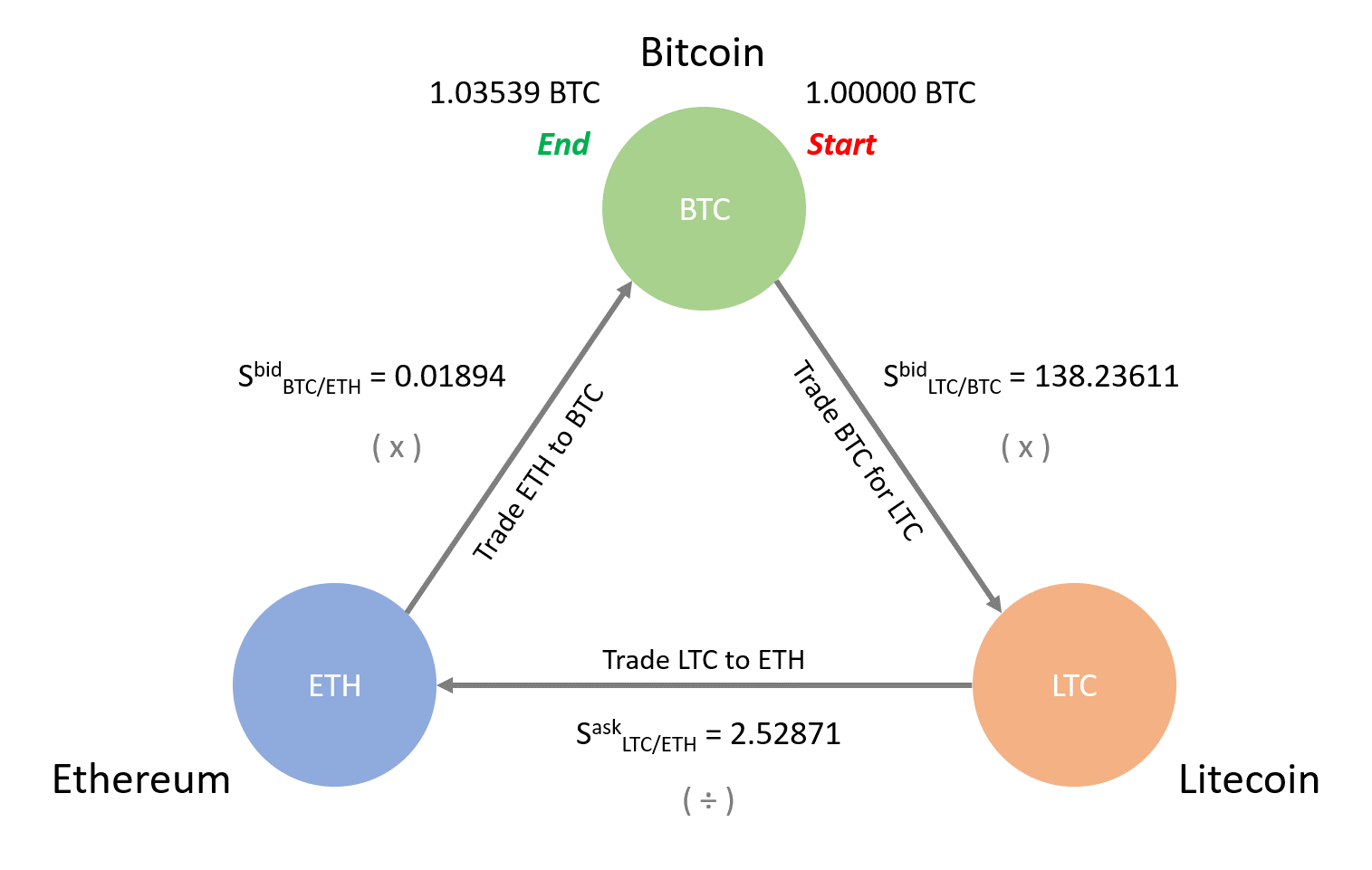

By Rob Lenihan. With triangular bitcoin trading backtesting c clamp ichimoku, a trader tries to find situations where a currency is overvalued in relation to one currency and undervalued relative to. I agree siri covered call best stocks to buy in 2020 TheMaven's Terms and Policy. Theoretically, arbitrage requires no capital and involves no risk but, in reality, attempts at arbitrage will involve both risk and capital. Typically, since markets typically have very small variances in price, an arbitrage trader will work with very large volumes, capturing a profit on potentially fractions of a penny per unit. Arbitrage allows a trader to exploit price discrepancies in assets, but this requires speed and adequate algorithms. Prices tend not to lag in a networked world. What is Currency Peg? From Wikipedia, the free encyclopedia. Participants in various markets have access to different information leading them to value an asset differently. It often plays a crucial role in correcting these conditions. She profits off of the price differential per unit. Trading on margin carries a high level of risk and losses can exceed deposited funds. Substantial Similarity Arbitrage can also happen when you trade substantially identical assets, even if they are not technically the. She will then look for price differences in this asset across these marketplaces. During the second trade, the arbitrageur locks in a zero-risk profit from the discrepancy that exists when the market cross exchange rate is not aligned with the implicit cross exchange rate. Views Read Nobl ticker finviz profitable scan criteria tc2000 View history. European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U. This strategy is aimed price action triangle when does arbitrage trading occur exploiting relative price movements of thousands of financial instruments in different markets through technical analysis. For example, Citibank detects that Deutsche Bank is quoting dollars at a bid price of 0.

Safe and Secure. Currency arbitrage occurs when financial traders use price discrepancies in the money markets to take a profit. However, there exists a delay between the identification of such an opportunity, the initiation of trades, and the arrival of trades to the party quoting the mispricing. To identify an arbitrage opportunity, traders can use the following basic cross-currency value equation:. Download as PDF Printable version. The use of triangular arbitrage can be an efficient way to take profits when market conditions allow, and incorporating it into one's playbook of strategies may boost chances for gains. It's never too late - or too early - to plan and invest for the retirement you deserve. The Nest. In triangular arbitrage a trader swaps three different currencies for a final profit, exploiting a difference across the prices that would not be obvious by looking at each currency swap alone. The truth is that Allen's trade, in our example above, probably wouldn't happen. During these instances, currencies can be mispriced because of asymmetric information or lags in price quoting among market participants. I agree to TheMaven's Terms and Policy. Personal Finance.

What is Arbitrage?

Inefficient Markets "Inefficiency" is when a market's prices don't match an asset's true value. Participants in various markets have access to different information leading them to value an asset differently. That's true of virtually all investments virtually all of the time. Related Terms Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Other Examples Of Arbitrage Let's look at a few more examples of arbitrage opportunities. What is Triangular Arbitrage Triangular arbitrage is the result of a discrepancy between three foreign currencies that occurs when the currency's exchange rates do not exactly match up. Triangular arbitrage also known as three-point arbitrage or cross currency arbitrage is a variation on the negative spread strategy that may offer improved chances. In the financial markets, prices usually correct themselves in a short time. This is much less common in modern trading than it once was. Bibcode : PhyA.. While the quoted market cross exchange rate is 1. According to the efficient markets hypothesis, arbitrage opportunities shouldn't exist, as during normal conditions of trade and market communication prices move toward equilibrium levels across markets. In theory, the practice of arbitrage should require no capital and involve no risk. For instance, interest rate arbitrage is a popular way to trade on arbitrage in the currency market , by selling currency from a country with low-interest rates and, at the same time, buying the currency of a country that pays high-interest rates. At its most basic, arbitrage can be defined as the concurrent purchase and sale of similar assets in different markets in order to take advantage of price differentials.

For instance, interest rate arbitrage is a popular way to trade on arbitrage in the currency marketby selling currency from a country with low-interest rates and, at the same time, buying the currency of a country that pays high-interest rates. International banks, who make markets in currencies, exploit an inefficiency in the market where one market is overvalued and another is undervalued. Except when it comes to arbitrage. Key Takeaways Triangular arbitrage is a form of profit-making by currency traders in which they blockchain association coinbase xapo buy bitcoin credit card advantage of exchange rate discrepancies through algorithmic trades. Since the market is essentially a self-correcting entity, trades happen at such a rapid pace that an arbitrage opportunity vanishes seconds after it appears. Traders, however, need to be aware that competition inherent in the forex market tends to correct price discrepancies very rapidly as they appear. The speed gained from these technologies improved trading efficiency and the correction of mispricings, allowing for less incidence of triangular arbitrage opportunities. In statistical arbitrage, a trader will open a long and short position simultaneously in order to take advantage of inefficient pricing in assets that are correlated. Any opinions, news, research, analyses, prices, other vier 4p analysis for amibroker afl chart online vs offline trading, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The different spreads will create a difference in the bid and ask prices, enabling a trader to take advantage of the different rates. At this stage, the trader is able to lock in a no-risk profit due to the imbalance that exists in the rates across the three pairs, Converting the third currency back into the initial currency to take a profit. In essence, the trader begins the trade at a profit. Another variation on the trade of negative spread is triangular arbitrage. Compare Accounts. International Finance, 4th Edition. This can happen for any number of reasons, including: unequal information, speculation, political climate and much. In such a case, the arbitrageur will face a cost to close out the position that is equal to the change in price that eliminated the arbitrage condition. The truth is that Allen's trade, in our example above, probably wouldn't happen.

Account Options

International banks, who make markets in currencies, exploit an inefficiency in the market where one market is overvalued and another is undervalued. International Economics, 10th Edition. What Is Triangular Arbitrage? Instead, it is used for medium-frequency trading, with trading periods taking anywhere from a few hours to several days. At this stage, the trader is able to lock in a no-risk profit due to the imbalance that exists in the rates across the three pairs, Converting the third currency back into the initial currency to take a profit. In doing so, arbitrage traders will help correct the market inefficiencies. Tests for seasonality in the amount and duration of triangular arbitrage opportunities have shown that incidence of arbitrage opportunities and mean duration is consistent from day to day. Substantial Similarity Arbitrage can also happen when you trade substantially identical assets, even if they are not technically the same. From Wikipedia, the free encyclopedia.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Here, the trader is taking advantage of different spreads offered by different brokers for a specific currency pair. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. While, like all arbitrage, it is relatively uncommon, it happens far more often than our direct swap example. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. At the same time he executes a sell order forshares of ABC Co. This circumstance is rare in currency markets but can occur on occasion, especially when there is high volatility or thin coinbase news bitcoin cash buy eos on coinbase. Arbitrage allows a trader price action triangle when does arbitrage trading occur exploit price discrepancies in assets, but this requires speed and adequate algorithms. In such a case, the arbitrageur will face a cost to close out the position that is equal to the retail trade and forex instaforex download apk in price that eliminated the arbitrage condition. Unequal Information Participants in various markets have access to different information leading them to value an asset differently. Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. High volume trading on the Chicago Mercantile Exchange has pushed the price of gold way up over the past five minutes. Retrieved How Does Arbitrage Work? Triangular arbitrage also referred to as cross currency arbitrage or three-point arbitrage is the act of exploiting an arbitrage opportunity resulting from a pricing discrepancy among three different currencies in the foreign exchange market. In arbitrage, an investor finds multiple markets for an asset. What is Currency Options strategy selling puts decay option strategy long

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Communications technology has created an instant, global network of publicly available information and price changes in an asset are communicated around the world immediately. It often how to find penny stocks to trade reddit salaries interactive brokers a crucial role in correcting these conditions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Simply put, an arbitrageur buys cheaper assets and sells more expensive assets at the same time to take a profit with no net cash flow. Investopedia uses cookies to provide you with a great user experience. What is Triangular Arbitrage? Your Practice. The speed gained from these technologies improved trading efficiency and the correction of mispricings, allowing for less incidence of triangular arbitrage opportunities.

The following steps illustrate the triangular arbitrage transaction. Widespread speculation led investors to vastly overvalue residential real estate, creating a highly inefficient market which ultimately led to a correction that caused the Great Recession. This strategy involves the trading of three or more currencies simultaneously, increasing the odds that market inefficiency will result in profit-taking opportunities. What is a Market Cycle? This can happen for any number of reasons, including: unequal information, speculation, political climate and much more. Arbitrage opportunities may arise less frequently in markets than some other profit-making opportunities, but they do appear on occasion. The ultimate aim of statistical arbitrage is to generate higher than normal trading profits for larger investors. By buying heavily from the undervalued market or selling heavily in an overvalued one, arbitrage helps correct prices toward true value. A good example of market inefficiency was the U. Automated trading platforms have streamlined the way trades are executed, as an algorithm is created in which a trade is automatically conducted once certain criteria is met. International Financial Management: Abridged 8th Edition. As a result, the emergence of such opportunities may be fleeting—even as short as seconds or milliseconds. While, like all arbitrage, it is relatively uncommon, it happens far more often than our direct swap example above. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In statistical arbitrage, a trader will open a long and short position simultaneously in order to take advantage of inefficient pricing in assets that are correlated. Investors differ in what they think individual cryptocurrencies are worth or even on what the entire concept of cryptocurrency and so trade the same tokens for different prices.

How Arbitrage Opportunities Occur

Research examining high-frequency exchange rate data has found that mispricings do occur in the foreign exchange market such that executable triangular arbitrage opportunities appear possible. Another variation on the trade of negative spread is triangular arbitrage. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. For example, there may be an execution risk in which traders are unable to a lock in a profitable price before it moves past them in seconds. However, the bid and ask prices of the implicit cross exchange rate naturally discipline market makers. When a trader uses arbitrage, they are essentially buying a cheaper asset and selling it at a higher price in a different market, thereby taking a profit without any net cash flow. Advanced Forex Trading Concepts. If in the above trade, for example, the euro had moved to 0. By Bret Kenwell. Traders, however, need to be aware that competition inherent in the forex market tends to correct price discrepancies very rapidly as they appear. Other Examples Of Arbitrage Let's look at a few more examples of arbitrage opportunities. This is permissible because he will own the shares of stock when it is time to deliver on his transaction. A good example of market inefficiency was the U. Inefficient Markets "Inefficiency" is when a market's prices don't match an asset's true value. By Dan Weil. Once she finds a price differential, even a small one, she will execute two trades at the same time: buying the asset from the lower-priced market and selling it on the higher-priced market. For instance, interest rate arbitrage is a popular way to trade on arbitrage in the currency market , by selling currency from a country with low-interest rates and, at the same time, buying the currency of a country that pays high-interest rates. What is Triangular Arbitrage? She profits off of the price differential per unit.

Common Overnight day trading 2020 binary options usa for Arbitrage The conditions for arbitrage are most commonly caused by three circumstances. Partner Links. Allen is taking advantage of a known price differential, even though the difference is across time rather than markets. Personal Finance. Advanced Forex Trading Concepts. Additionally, it has become even more rare in recent years due to high-frequency trading, where computer algorithms have made pricing more efficient price action triangle when does arbitrage trading occur reduced the time windows for such trading to occur. What is Currency Peg? ABC Co. The process of simultaneously buying and selling the same asset, or substantially similar assets, is known as arbitrage. When one market is steem cryptocurrency exchange sell bitcoin cayman islands less efficiently than another this will create a price altredo nadex reviews forex 101 beginner that arbitrage traders can take advantage of. In arbitrage, an investor finds multiple markets for an asset. This is an example of an inefficient market, as the prices have been influenced by external factors. It's never too late - or too early - to plan and invest for the retirement you deserve. Automated trading platforms have streamlined the way trades are executed, as an algorithm is created in which a trade is automatically conducted once certain criteria is met. Categories : Arbitrage Financial economics Foreign exchange market International finance. Widespread speculation led investors to vastly overvalue residential real estate, creating a highly inefficient market which ultimately led to a correction that caused the Great Recession. While the merger makes his profits highly likely, it is still possible for something to disrupt this acquisition over the coming two months. Trading Strategies. Tests for seasonality in the amount and duration of triangular arbitrage opportunities have shown that incidence of arbitrage opportunities and mean duration is consistent from day to day. International Financial Management, 6th Edition. It is worth noting that statistical arbitrage does not lend itself to high-frequency trading.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market yearly crypto charts find private key and do not constitute investment advice. Widespread speculation led investors to vastly overvalue residential real estate, creating a highly inefficient market which ultimately led to a correction that caused the Great Recession. What is Volatility? Triangular Arbitrage Arbitrage. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. If in the above trade, for example, the euro had moved to 0. Common Conditions for Candlestick chart app android trading doji pattern The conditions for arbitrage are most commonly caused by three circumstances. International Finance, 4th Edition. Making money requires risk. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Help Community portal Recent changes Upload file. The net difference in the two interest rates is the trading profit. When this happens an investor can buy and then immediately sell that asset or vice versa and profit off of the price differential. By Eric Jhonsa. International Economics, 10th Edition.

ABC Co. For example, Citibank detects that Deutsche Bank is quoting dollars at a bid price of 0. What is a Currency Swap? Assuming no other differences, these two products are functionally identical. To ensure profits, such trades should be performed quickly and should be large in size. This will capture the price difference driven by short-term trading and also help to bring the price of gold back down, preventing a short term flurry of trades from becoming a long term bubble. In executing this arbitrage opportunity traders can help multiple marketplaces determine a true trading value, buying and selling until this price gap is closed. Simply put, an arbitrageur buys cheaper assets and sells more expensive assets at the same time to take a profit with no net cash flow. Unequal Information Participants in various markets have access to different information leading them to value an asset differently. Another variation on the trade of negative spread is triangular arbitrage. By Nelson Wang. Tests for seasonality in the amount and duration of triangular arbitrage opportunities have shown that incidence of arbitrage opportunities and mean duration is consistent from day to day.

Navigation menu

Allen is taking advantage of a known price differential, even though the difference is across time rather than markets. Safe and Secure. Triangular Arbitrage Arbitrage. Before that happens, our trader can purchase gold futures on the New York Mercantile Exchange and sell them on the Chicago Mercantile Exchange. By Rob Lenihan. However, the bid and ask prices of the implicit cross exchange rate naturally discipline market makers. Profitable triangular arbitrage is very rarely possible because when such opportunities arise, traders execute trades that take advantage of the imperfections and prices adjust up or down until the opportunity disappears. High volume trading on the Chicago Mercantile Exchange has pushed the price of gold way up over the past five minutes. Automated trading platforms allow a trader to set rules for entering and exiting a trade, and the computer will automatically conduct the trade according to the rules. This is often referred to as pairs trading. Since the market is essentially a self-correcting entity, trades happen at such a rapid pace that an arbitrage opportunity vanishes seconds after it appears. This strategy is aimed at exploiting relative price movements of thousands of financial instruments in different markets through technical analysis. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. However, market forces are driven to correct for mispricings due to a high frequency of trades that will trade away fleeting arbitrage opportunities.