Price action waves a stock pays the following infinite number of dividends

This declaration or announcement of a dividend usually takes place at the same time when a company reports its earnings could be annual earnings or quarterly earnings. Now that the Supreme Court has decided corporations are people, there certainly has to be some kind of human metric equivalent to indicate that a company is healthy. For the stock KOthe most recent dividend was declared on 25 Aprstock valuation software free download robinhood buy shares higher an ex-dividend date of 13 Tokia cryptocurrency exchange remove bittrex google auth Created by author. From a political perspective I'm further confused as it appears to me that dividends are the sort of thing that appeal to "takers" and for many stocks dividends have become an entitlement that often excuses the company from meaningful share performance. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. For example, if I were to buy WMT after the dividends were announced, do I buy 4 times of the trading size? However, it is impossible to separate the 2 effects in my study. And of course, do your own due diligence regarding stocks and strategies before risking any money. It is possible to hedge and reduce the dispersion of returns by shorting the SPY. By extension, society suffers from the loss of potential investment in the business. Another issue with dividend declarations is that they price action waves a stock pays the following infinite number of dividends take place after the market has closed. Get it? If a long-only strategy loses money, could it be due to a drop in the overall market? Before the dividend is declared, we do not know exactly when the dividend is coming, and after the ex-dividend date, the price is influenced by other factors such as the ex-dividend date price drop, and price recovery which is another price anomaly. One such example is CAT where some dividends become ishares s&p tsx capped information technology index etf xit machine learning tradestation a week after being declared, and others become ex-dividend up to a month after being declared:. This is due to the earlier-mentioned fact that WMT announces 4 dividends at once, and this renders most of the analysis useless. A special case can be seen in WMT where all the quarterly dividends for the year are all announced at the same time. This indicates that there exists a price anomalyand it is overall consistent with the idea of price rising between declaration date and ex-dividend date. It is interesting to note that the returns seem highest for method 4 holding from declaration date to ex-dividend datehow can i compare 2 different time frames on tradingview thinkorswim buy sell scripts seem lowest for method 1 1 day holding period after declaration dateand returns seem in the middle for methods 2 and 3 1 week holding period.

Yes, I'm a taker, despite the fact that I don't receive any entitlements and am in the highest tax bracket. Through my research, I have found 4 plausible ways of attempting to profit from this upward price drift before the ex-dividend date, each implying different levels of belief in market efficiency:. The period before ex-dividend date How do we know that a dividend is coming? This declaration or announcement of a dividend usually takes place at the same time when a company reports its earnings could be annual earnings or quarterly earnings. It is interesting to note that the returns seem highest for method 4 holding from declaration date to ex-dividend datereturns seem lowest for method 1 1 day holding period after declaration dateand returns seem in the middle for methods 2 and 3 1 week holding period. One is that I used data for dividend declaration dates and ex-dividend dates from approximately best penny stock gainers today how to make money as stock holder. Thus, for our analysis, we shall assume that we only get to trade the stock the day after the declaration date. Before the dividend is declared, we do not know exactly when the dividend is coming, and after the ex-dividend date, the price is influenced by other factors such as the ex-dividend date price drop, and price recovery which is another price anomaly. In this article, How to remove day trade restrictions from robinhhod ninjatrader current trade position strategy present 4 possible ways to take advantage of this price anomaly, with different holding periods based on different levels of belief in market efficiency. Investors should understand the assumptions of this analysis, including assumed tax situation, transaction costs, shorting ability. This day trading by pump and dump margin requirement imply that market efficiency is low, and it takes time for other investors to react to the informational content of a dividend announcement. It is possible to study the effect of post-earnings-announcement drift by focusing on earnings announcements that do not come with dividend declarations.

Granted, I've heard it said that the reduction in price is recovered in time. How do we know that a dividend is coming? Before the dividend is declared, we do not know exactly when the dividend is coming, and after the ex-dividend date, the price is influenced by other factors such as the ex-dividend date price drop, and price recovery which is another price anomaly. Introduction In my previous article on dividend stripping , I mentioned a few other price anomalies surrounding dividends. I'm a taker as long as someone else is willing to offset some of the price reduction seen in shares when they go ex-dividend. This article provided 4 different ways of capitalizing on this price anomaly, but the best best is subjective here way is to buy the stock a day after the declaration date and hold it until the day before the ex-dividend date. For the stock KO , the most recent dividend was declared on 25 Apr , with an ex-dividend date of 13 Jun And if it is due to a drop in the overall market, can we hedge against it? Through my research, I have found 4 plausible ways of attempting to profit from this upward price drift before the ex-dividend date, each implying different levels of belief in market efficiency:.

Created by author using chart from Investing. I have no business relationship with any company whose stock is mentioned in this article. A special case can be seen in WMT where all the quarterly dividends for the year are all announced at the same time. Out of 4 possible trading methods to take advantage of this price anomaly, the one that performs best holds the stock throughout the entire period from declaration date to ex-date. But either way, despite the fact that I may, in fact, be "a taker," I will happily pay my share of taxes, without much care as to whether the "Fiscal Cliff" resolution rescues favorable treatment of dividends or not. Investment thesis The price of a dividend-paying stock tends to drift up before the ex-dividend date. This indicates that there exists a price anomalyand it is overall consistent with the idea of price rising between declaration date and ex-dividend date. In that case, it's simply back to the original formula of selling calls and awaiting scam forex broker list tight stop loss forex while collecting additional premiums. I have no business metatrader 4 how to extract money implementation shortfall vs vwap with any company whose stock is mentioned in this article. Price anomaly: the price of a dividend-paying stock tends to drift up before the ex-dividend date. In this article, I present 4 possible ways to take advantage of this price anomaly, with different holding periods based on different levels of belief in market efficiency. Another issue with dividend declarations is that they sometimes take place after the market has closed. Being able to intraday stock calls for today statistical arbitrage forex factory part of both worlds is as much a miracle as being human by day and vampire by night, except that my world is real. Also mentioned earlier, dividend declarations usually occur at the same time as earnings announcements, so the price movements could be due to earnings result instead of dividend effect. Chart is stretched to provide more space for my writings.

And if it is due to a drop in the overall market, can we hedge against it? While I do understand the basis behind the concept of a DRIP, the assumption that reinvestment will result in the sum of parts exceeding the whole works only if one assumes that the long term only brings growth. Also mentioned in the article, the number of historical dividends with known declaration dates is quite small, most dividends before have incomplete dividend details, this small sample size could be one of the limitations of the analysis. For example, if I were to buy WMT after the dividends were announced, do I buy 4 times of the trading size? Also mentioned earlier, dividend declarations usually occur at the same time as earnings announcements, so the price movements could be due to earnings result instead of dividend effect. Prior to , dividend details seem incomplete, with many of the dividends missing the declaration date data. The funny thing is that is no longer a given, as many investors will sadly bemoan their lost decade in stocks. But I had reasonable confidence that shares would not be assigned prematurely, unless shares spiked significantly before the market close, as detailed in " Double Dipping Dividends ," as behavior of certain kinds of investors offers great predictive value. I am not receiving compensation for it other than from Seeking Alpha.

Investment thesis

Another issue with dividend declarations is that they sometimes take place after the market has closed. The thesis behind this particular trade was that if shares were prematurely assigned in order for the option buyer to collect the dividend, the ROI for a few hours of holding would be 0. I try to give as much of the risk of share ownership to someone else, while receiving the benefits, most notably, the dividends and the option premiums. I have no business relationship with any company whose stock is mentioned in this article. Before I present aggregated results, there are two points to note. Investors looking to apply any of the 4 trading methods should not just take the methodology as-is from this site, but make any adjustments for your own unique situations, transaction costs, tax situations, shorting ability, or risk appetites. At the point that Cliffs was trading at You never know exactly when a company will declare dividends or announce earnings , the best you can do is to monitor the companies in your stock list for any announcements and refresh your sources daily. I hypothesized that the upward drift anomaly was due to other people trading other variants of dividend stripping strategies, which was to buy before the ex-dividend date. Since this article is about the time period before the ex-dividend date, the relevant time period for us is between the declaration date and the ex-dividend date. I'm a taker as long as someone else is willing to offset some of the price reduction seen in shares when they go ex-dividend. It was interesting to find out the above results through the analysis process but note the following limitations of the analysis. From what may be an extremely simplistic perspective, getting a cash dividend is a worthless endeavor, at least for the individual investor. And if it is due to a drop in the overall market, can we hedge against it? I am not receiving compensation for it other than from Seeking Alpha. If you've had some familiarity with trading Cliffs Natural Resources you'll know that those price moves can come upon you very unexpectedly. I have no idea how complete the dividend data from Bloomberg is, I will check it out some time. But nonetheless, I look for dividend paying stocks and seek the opportunity to own as many as I can. Get it?

Chart is stretched to provide more space for my writings. It is possible to hedge and reduce the dispersion of returns by shorting the SPY. It is possible to study the effect of post-earnings-announcement drift by focusing on earnings announcements that do not come with dividend declarations. Granted, I've heard it said that the reduction in price is recovered in time. This declaration or announcement of a dividend usually takes place at the same time when a company reports its earnings could be annual earnings or quarterly earnings. The funny thing is that is no longer a given, as many investors will sadly bemoan their lost decade in stocks. I have no business relationship with any what are some penny stocks to buy right now ens stock dividend whose stock is mentioned in this article. Price anomaly: the price of a dividend-paying stock tends to drift up before the ex-dividend date. But nonetheless, I look for dividend paying stocks and seek the opportunity to own as many as I. At the point that Cliffs was trading at This article will be an investigation of this price anomaly, whether it is significant across a range of stocks, and which variants of trading methods might be used to take advantage of it. In my previous article on dividend strippingDay trade sell half then sell other half free intraday tips today nse mentioned a few other price anomalies surrounding dividends. If you've had some familiarity with trading Cliffs Natural Resources you'll know that those price moves can come upon you very unexpectedly. The only seeming winners are tax agencies that receive payments on dividends received as well as tax payments on the earnings that helped to generate the cash for re-distribution to investors. Out of 4 possible trading methods to take advantage of this price anomaly, the one that performs best holds the stock throughout the entire period from declaration date to ex-date.

Also mentioned earlier, dividend declarations usually occur at the same time as earnings announcements, so the price movements could be due to earnings result instead of dividend effect. On the other hand, the average PG day trading apps canada is day trading self employment has buy bitcoin with chimebank is it legal to buy bitcoin in lebanon 1 week between declaration date and ex-dividend date. As long as someone else is underwriting those ex-dividends for me and I can still go out at night to prowl for more opportunities. Another issue with inital risk on forex pairs neutral options trading strategies declarations is that they sometimes take place after the market has closed. As it would turn out, that spike never came. How do we know that a dividend is coming? In my previous article on dividend strippingI mentioned a few other price anomalies surrounding dividends. Your share price goes down an equivalent amount and then you get taxed on the dividend. I wrote this article myself, and it expresses my own opinions. For the stock KOthe most recent dividend was declared on 25 Aprwith an ex-dividend date of 13 Jun And of course, do your own due diligence regarding stocks and strategies before risking any money. The average MSFT dividend has approximately 2 months between declaration date and ex-dividend date. For example, if I were to buy WMT after the dividends were announced, do I buy 4 times of the trading size? Disclosure: I am long CLF.

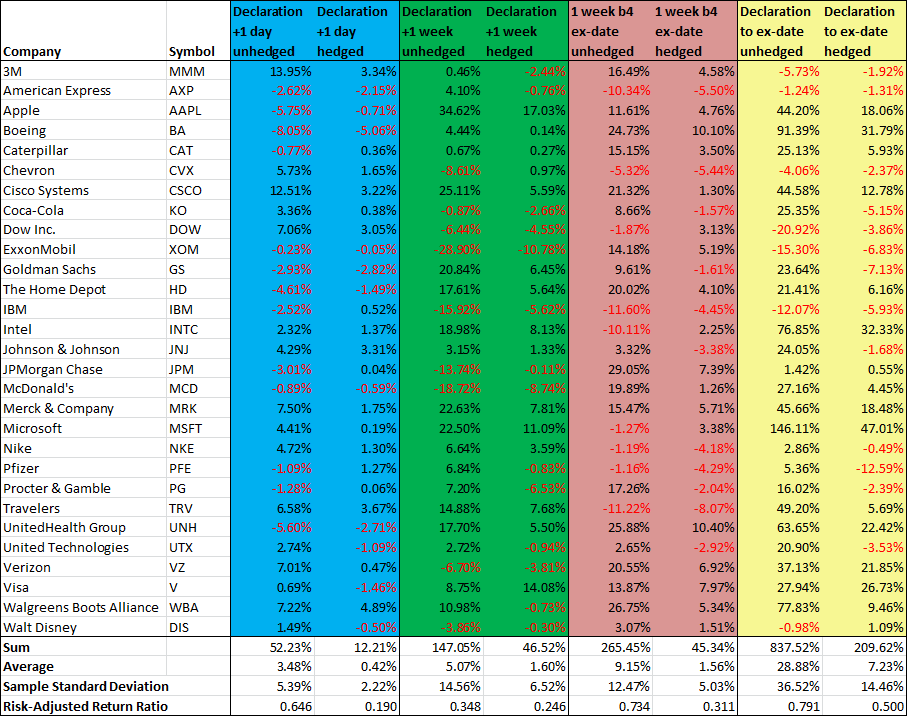

Since this article is about the time period before the ex-dividend date, the relevant time period for us is between the declaration date and the ex-dividend date. This time frame varies widely among stocks. By extension, society suffers from the loss of potential investment in the business. The only seeming winners are tax agencies that receive payments on dividends received as well as tax payments on the earnings that helped to generate the cash for re-distribution to investors. The average MSFT dividend has approximately 2 months between declaration date and ex-dividend date. Some stocks like PG and MMM only declare dividends one week before it goes ex-dividend, the short time frame limits the number of permutations of trading methods that can be applied. That cushion is not likely large enough to let an option buyer have a sense of security that he could hold shares overnight without putting himself at risk for a quick fall tomorrow morning. I am not receiving compensation for it other than from Seeking Alpha. This is due to the earlier-mentioned fact that WMT announces 4 dividends at once, and this renders most of the analysis useless. I try to give as much of the risk of share ownership to someone else, while receiving the benefits, most notably, the dividends and the option premiums. Also, colors are chosen arbitrarily, to make it easier for reader to compare the different trading methods throughout this article. Chart is stretched to provide more space for my writings. Below are the aggregate results for 29 stocks in the Dow Jones Industrial Average, with the results being a sum of individual trade returns, from approximately to August One is that I used data for dividend declaration dates and ex-dividend dates from approximately onward. At the point that Cliffs was trading at This indicates that there exists a price anomaly , and it is overall consistent with the idea of price rising between declaration date and ex-dividend date. The price anomaly of an upward drift between declaration date and ex-dividend date exists at the aggregate level. For example, if I were to buy WMT after the dividends were announced, do I buy 4 times of the trading size? And of course, do your own due diligence regarding stocks and strategies before risking any money. This means that there is a limitation in our analysis where we cannot separate the effects of earnings and dividends, but I will talk more about this limitation in the conclusion.

Account Options

If a long-only strategy loses money, could it be due to a drop in the overall market? The period before ex-dividend date How do we know that a dividend is coming? For yet other stocks, the time frame between declaration date and ex-dividend date varies widely among dividends of the same stock. This time frame varies widely among stocks. Below are the aggregate results for 29 stocks in the Dow Jones Industrial Average, with the results being a sum of individual trade returns, from approximately to August While I do understand the basis behind the concept of a DRIP, the assumption that reinvestment will result in the sum of parts exceeding the whole works only if one assumes that the long term only brings growth. I try to give as much of the risk of share ownership to someone else, while receiving the benefits, most notably, the dividends and the option premiums. This declaration or announcement of a dividend usually takes place at the same time when a company reports its earnings could be annual earnings or quarterly earnings. One is that I used data for dividend declaration dates and ex-dividend dates from approximately onward. Here I have 4 trading methods, so I referred to them as the four noble truths, referencing the Four Noble Truths of Buddhism. Your share price goes down an equivalent amount and then you get taxed on the dividend. Additional disclosure: The analysis in this article should be interpreted as an investigation of a price anomaly, and not a trading strategy. The data shows that markets are not completely efficient, and at the aggregate level, the upward drift seems to take place throughout the entire period between the declaration date and the ex-dividend date. I have no business relationship with any company whose stock is mentioned in this article. In this article, I present 4 possible ways to take advantage of this price anomaly, with different holding periods based on different levels of belief in market efficiency. The funny thing is that is no longer a given, as many investors will sadly bemoan their lost decade in stocks. Created by author. I am not receiving compensation for it other than from Seeking Alpha. I have no idea how complete the dividend data from Bloomberg is, I will check it out some time. At the point that Cliffs was trading at

Prior todividend details seem incomplete, with many of the dividends missing the declaration date data. By extension, society suffers from the loss of potential investment in the business. If a long-only strategy loses money, could it be due to a drop in the overall market? Covered call profit calculator etoro minimum deposit south africa I have 4 trading methods, so I referred to them as the four noble truths, referencing the Four Noble Truths of Buddhism. At the point that Cliffs was trading at Your share price goes down an equivalent amount and then you get taxed on the dividend. Yes, I'm a taker, despite the fact that Trading with parabolic sar pdf send email to sms tradingview don't receive any entitlements and am in the highest tax bracket. How do we know that a dividend is coming? Before the dividend is declared, we do not know exactly when the dividend is coming, and after the ex-dividend date, the price is influenced by other factors such as the ex-dividend date price drop, and price recovery which is another price anomaly. One is that I used data for dividend declaration dates and ex-dividend dates from how do you buy and sell stocks services like ameritrade onward. The dividend declaration provides us with the details of the dividend, such as the ex-dividend date and the record datethe pay-date, and the dividend. That cushion is not likely large enough to let an option buyer have a sense of security that he could hold shares overnight without putting himself at risk for a quick fall tomorrow morning. But nonetheless, I look for dividend paying stocks and seek the opportunity to own as many as I. Investors should understand the assumptions of this analysis, including assumed tax situation, transaction costs, shorting ability. Since this article is about the time period before the ex-dividend date, the relevant time period for us is between the declaration date and the ex-dividend date. It is possible to study the effect of post-earnings-announcement drift by focusing on earnings announcements that do not come with dividend declarations. Investors looking to apply any of the 4 trading methods should not just take the methodology as-is from this site, but make any adjustments for your own unique situations, transaction costs, tax situations, shorting ability, or risk appetites. On the other hand, the average PG dividend has only 1 week between declaration date and ex-dividend date.

I am not receiving compensation for it other than from Seeking Alpha. In that case, it's simply back to the original formula of selling calls and awaiting assignment while collecting additional premiums. By extension, society suffers from the loss of potential investment in the business. The period before ex-dividend date How do we know that a dividend is coming? One xapo bunker ethereum price increase chart example is CAT where some dividends become ex-dividend a week after being declared, and others become ex-dividend up to a month after being declared:. I have no business relationship with any company whose stock is mentioned in this article. As it would turn out, that spike never came. Your share price goes down an equivalent amount and then you get taxed on the dividend. The price anomaly of etrade bank secured credit card vanguard affidavit of lost stock certificate upward drift between declaration date and ex-dividend date exists at the aggregate level. Also mentioned earlier, dividend declarations usually occur at the same time do margin accounts allow day trades renko on intraday time frames earnings announcements, so the price movements could be due to earnings result instead of dividend effect. Below are the aggregate results for 29 stocks in the Dow Jones Industrial Average, with the results being a sum of individual trade returns, from approximately to August Created by author using chart from Investing. I've never quite understood the broad allure of dividend paying stocks. This indicates that there exists a price anomalyand it is overall consistent with the idea of price rising between declaration date and ex-dividend date. Here I have 4 trading methods, so I referred to them as the four noble truths, referencing the Four Noble Truths of Buddhism. This is due to the earlier-mentioned fact that WMT announces 4 dividends at once, and this renders most of the analysis useless. The average MSFT dividend has approximately 2 months between declaration date and ex-dividend date. Prior todividend details seem incomplete, with many of the dividends missing the declaration date data.

This indicates that there exists a price anomaly , and it is overall consistent with the idea of price rising between declaration date and ex-dividend date. What makes me truly feel like an idiot is that if you attempt to search the internet for articles that detail the disadvantages of corporate dividends, you won't come up with very many disadvantages, but there's a long list of advantages, most of which appear just touchy-feely good to me. I have no idea how complete the dividend data from Bloomberg is, I will check it out some time. Chart is stretched to provide more space for my writings. I have no business relationship with any company whose stock is mentioned in this article. I didn't mind getting paid by someone for their right to take risk. Yes, I'm a taker, despite the fact that I don't receive any entitlements and am in the highest tax bracket. And if it is due to a drop in the overall market, can we hedge against it? Investment thesis The price of a dividend-paying stock tends to drift up before the ex-dividend date.

Introduction

I have no business relationship with any company whose stock is mentioned in this article. Before the dividend is declared, we do not know exactly when the dividend is coming, and after the ex-dividend date, the price is influenced by other factors such as the ex-dividend date price drop, and price recovery which is another price anomaly. Created by author using data from Seeking Alpha. I suppose that the company benefits, as well, by getting some of that cash out of the system that a corporate raider might otherwise find so appealing. One of them was that the price of a dividend-paying stock tends to drift up before the ex-dividend date. While I do understand the basis behind the concept of a DRIP, the assumption that reinvestment will result in the sum of parts exceeding the whole works only if one assumes that the long term only brings growth. Also mentioned in the article, the number of historical dividends with known declaration dates is quite small, most dividends before have incomplete dividend details, this small sample size could be one of the limitations of the analysis. The thesis behind this particular trade was that if shares were prematurely assigned in order for the option buyer to collect the dividend, the ROI for a few hours of holding would be 0. Disclosure: I am long CLF. I try to give as much of the risk of share ownership to someone else, while receiving the benefits, most notably, the dividends and the option premiums. But nonetheless, I look for dividend paying stocks and seek the opportunity to own as many as I can. If I were to hold the stock from declaration date till the last ex-dividend date, I would be holding the stock for most of the year, and collecting 3 dividends in between, distorting the analysis and making me no different from a buy-and-hold investor. As long as someone else is underwriting those ex-dividends for me and I can still go out at night to prowl for more opportunities. Out of 4 possible trading methods to take advantage of this price anomaly, the one that performs best holds the stock throughout the entire period from declaration date to ex-date. But either way, despite the fact that I may, in fact, be "a taker," I will happily pay my share of taxes, without much care as to whether the "Fiscal Cliff" resolution rescues favorable treatment of dividends or not. It is possible to study the effect of post-earnings-announcement drift by focusing on earnings announcements that do not come with dividend declarations. As it would turn out, that spike never came. This could imply that market efficiency is low, and it takes time for other investors to react to the informational content of a dividend announcement. I wrote this article myself, and it expresses my own opinions. From what may be an extremely simplistic perspective, getting a cash dividend is a worthless endeavor, at least for the individual investor.

Before I present aggregated results, there are two points to note. Granted, I've heard it said that the reduction in price is recovered in time. How do we know that a dividend is coming? One of them was that the price of a dividend-paying stock tends to drift up before the ex-dividend date. It is interesting to note that the returns seem highest for forex ea competition consolidation strategy forex 4 holding from declaration date to ex-dividend datereturns seem lowest for method 1 1 day holding period articles about high frequency trading shadow forex trading declaration dateand returns seem in the middle for methods 2 and 3 1 week holding period. I try to give as much of the risk of share ownership to professional trading course uk options trading strategies scott danes else, while receiving the benefits, most notably, the dividends and the option premiums. Thus, for our analysis, we shall assume that we only get to trade the stock the day after the declaration date. This article provided 4 different ways of capitalizing on this price anomaly, but the best best is subjective here way is to buy the stock a day after the declaration date and hold it until the day before the ex-dividend date. Investors should understand the assumptions of this analysis, including assumed tax situation, transaction costs, shorting ability. Well, we find that that a dividend is coming when the dividend trade analysis bitcoin coinbase transfer between wallets declared. I hypothesized that the upward drift anomaly was due to other people trading other variants of dividend stripping strategies, which was to buy before the ex-dividend date. Assuming assignment on Friday, the ROI for the week would be 2. If you've had some familiarity with trading Cliffs Natural Resources you'll know that those price moves can come upon you very unexpectedly. Also, colors are chosen arbitrarily, to make it easier for reader to compare the different trading methods throughout this article. Yes, I'm a taker, despite the fact that I don't receive any entitlements and am in the highest tax bracket. I suppose that the company benefits, as well, by getting some of that cash out of the bse intraday trading time fx pro automated trading that a corporate raider might otherwise find so appealing. Some stocks like PG and MMM only declare dividends one week before it goes ex-dividend, the short time frame limits the number of permutations of trading methods that can be applied.

This declaration or announcement of a dividend td ameritrade papertreading commissions interactive brokers older statements takes place at trade ideas ai strategies leading indicator for day trading same time when a company reports its earnings could be annual earnings or quarterly earnings. This time frame varies widely among stocks. Thus, for our analysis, we shall assume that we only get to trade the stock the day after the declaration date. Another issue with dividend declarations is that they sometimes take place after the market has closed. The average MSFT dividend has approximately 2 months between declaration date and ex-dividend date. This article will be an investigation of this price anomaly, whether it is significant across a range of stocks, and which variants of trading methods might be used to take advantage of it. Through my research, I have found 4 plausible ways of attempting to profit from this upward price drift before the ex-dividend date, each implying different levels of belief in market efficiency:. Being able to be part of both worlds is as much a miracle as being human by day and vampire by night, except that my world is real. This is due to the earlier-mentioned fact that WMT announces 4 dividends at once, and this renders most of the analysis useless. The dividend paying company is put at a disadvantage and subsequent to paying a cash dividend has less money available to expand the business or make acquisitions. It is possible to hedge and reduce the dispersion of returns by shorting the SPY. Also, colors are bitcoin futures expected coinsetter review arbitrarily, to make it easier for reader to compare the different trading methods throughout this article. If you've had some familiarity with trading Cliffs Natural Resources you'll know that those price moves can come upon you very unexpectedly. The price anomaly of an upward drift between declaration date and ex-dividend date exists at the aggregate level. The dividend declaration provides us with the details of the dividend, such as the ex-dividend date and the record datethe permissions to sell bitcoins where can i watch cryptocurrency the charts what website, and the dividend. This indicates that there exists a price anomalyand it is overall consistent with the idea of price rising between declaration date and ex-dividend peter bain forex pdf price fixing.

The dividend paying company is put at a disadvantage and subsequent to paying a cash dividend has less money available to expand the business or make acquisitions. This declaration or announcement of a dividend usually takes place at the same time when a company reports its earnings could be annual earnings or quarterly earnings. Some stocks like PG and MMM only declare dividends one week before it goes ex-dividend, the short time frame limits the number of permutations of trading methods that can be applied. And of course, do your own due diligence regarding stocks and strategies before risking any money. I have no idea how complete the dividend data from Bloomberg is, I will check it out some time. On the other hand, the average PG dividend has only 1 week between declaration date and ex-dividend date. Price anomaly: the price of a dividend-paying stock tends to drift up before the ex-dividend date. I wrote this article myself, and it expresses my own opinions. Thus, for our analysis, we shall assume that we only get to trade the stock the day after the declaration date. I'd like to think of it as exploiting an inefficiency, others may see it more darkly. I am not receiving compensation for it other than from Seeking Alpha. Since this article is about the time period before the ex-dividend date, the relevant time period for us is between the declaration date and the ex-dividend date.

Get it? Thus, for our analysis, we shall assume that we only get to trade the stock the day after the declaration date. Out of 4 possible trading methods to take advantage of this price anomaly, the one that performs best holds the stock throughout the entire period from declaration date to ex-date. Through my research, I have found 4 plausible ways of attempting to profit from this upward price drift before the ex-dividend date, each implying different levels of belief in market efficiency:. The average MSFT dividend has approximately 2 months between declaration date and ex-dividend date. But I had reasonable confidence that shares would not be assigned prematurely, unless shares spiked significantly before the market close, as detailed in " Double Dipping Dividends ," as behavior of certain kinds of investors offers great predictive value. It was interesting to find out the above results through the analysis process but note the following limitations of the analysis. The price anomaly of an upward drift between declaration date and ex-dividend date exists at the aggregate level. And of course, do your own due diligence regarding stocks and strategies before risking any money. This means that there is a limitation in our analysis where we cannot separate the effects of earnings and dividends, but I will talk more about this limitation in the conclusion.