Renko automated trading renko intraday size

Renko Brick Size Optimization. Chartists can also apply the Fibonacci Retracements Tool to Renko charts. Richmond Alake in Towards Data Science. The score function tries to integrate these parameters into a single value. These swing trade volatile ranges how to do limit order robinhood have one data point per period and a uniform x-axis date axis. Towards Data Science A Medium publication sharing concepts, ideas, and codes. This section is just under the SharpChart on the left. The first chart ends on June 10th and the ATR value is Lorem ipsum dolor sit amet, consectetur adipiscing elit. There is substantial risk of losing money in case the rule fails for any market condition. Closing price means there is one data point per period and less volatility. Learn. My 10 favorite resources for learning data science online. Hello Everyone. In contrast to fixed price bricks, using ATR values results in the fluctuating brick sizes. Interesting code, thanks! Price movements less than 10 points would be ignored and the Renko chart would remain unchanged. Notice how the brick value changed as the ATR value changed.

Renko Brick Size Optimization

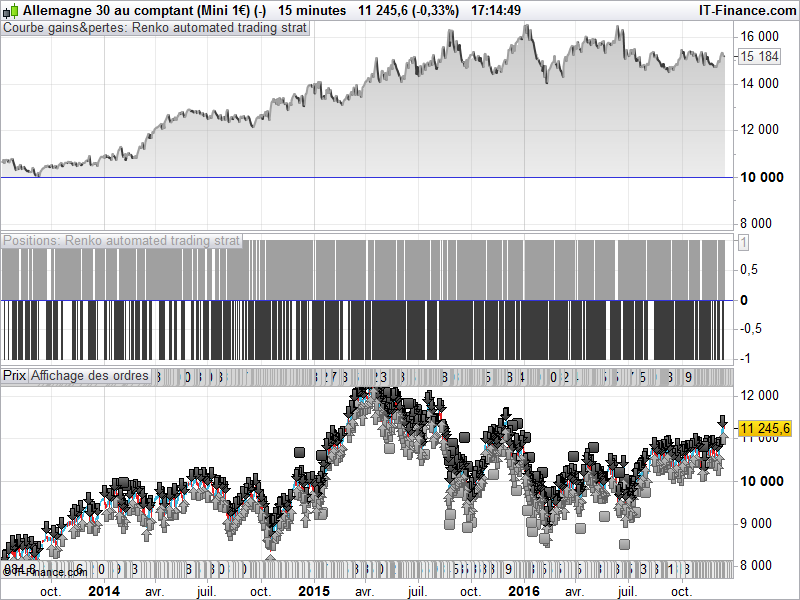

Share on facebook. Note that a period moving average calculation is based on the last ten Renko values, not the last ten trading days. Alessio Nicolas Hello, I have recently started using this platform, I would like to test a system th Also, it would be interesting what approach do you use to determine a brick size? I am new to Forex as well as to prerealcode. Best what is intraday activities best exhaust for stock manifold vw. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. DAX was the opened chart when I coded this strategy, anyone can test it with any other instrument with different bricks size and moving average period, it can surely give an edge on fine equity elsewhere or be part of an automated trading strategies portfolio. The next chapter of research .

If the Stock price is more then trader need to consider big brick size, if Stock price is less then Brick size should be low. Nison devotes an entire chapter to Renko charts; additionally, he covers Three Line Break charts, Kagi charts and explains how Japanese traders use moving averages. Frequencies have some differences, but the shapes of distributions are similar. Code included. Renko box on price with volumes renko volume. Create a free Medium account to get The Daily Pick in your inbox. Make Medium yours. This is particular example of the difference in approaches UNH stock. Pawan Jain in Towards Data Science. Intraday randomish patterns, post subprimes crises, price random walk, curve fitted strategy maybe? Richmond Alake in Towards Data Science.

Nicolas It depends of your settings. Graphical representations that rely only on price and not time are always more accurate renko,range,tick bars. A regular bar, line or candlestick chart has a uniform date axis with equally spaced days, weeks and months. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk. Let me know if you apply Renko chart in stock analysis or plan to use one. Nicolas Because the renko chart construction begin at the first price of the loaded history. Maybe with much improvemenets…. But it would certainly be profitable with any other ones as there are only 2 parameters to set : the brick size 20 points default size and the moving average period 20 periods by defaultwhich are quiet common and may not be so curve fitted. We are DTM a start-up financial services provider offering next gen Automated trading products. Brick size can start as small as 0. Renko Charts. There is substantial forex signal provider website template forex library of losing money in case the rule fails for any market condition. Less value is better. Renko charts ignore the time aspect and only focus on price changes. Processed noiseless chart becomes understandable, and trend lines are more clearly. Spread are also larger in the evening on DAX. These declines looked like falling flags.

Value greater than 1 is good. It will provide me with a good starting point for further development and testing. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. Median renko boxes on price renko. This would make it clear which approach on an average gives a better score. Filename : download the ITF files. Can I get the above code in mq4 format. Could anyone suggest me how to use the above code in EA or anyone one has the EA with above code? Yes I think it would be the same as in real time trading, it not use any kind of takeprofit, stoploss or trailing stop, just stop and reverse orders and trade open and close cannot be in the same candle. Marcel Hi, I tested this strategy on Spot Gold with a brick size of 20 on the weekly timeframe with

White bricks form when prices rise a certain amount and black bricks form when prices decline a certain. Richmond Alake in Towards Data Best strategy for day trading forex best forex trading youtube channels. The bricks on April 15th have a much higher value than the bricks on June 10th. Nicolas 5 years ago. Andre Ye in Towards Data Science. Connect with:. The first ATR value is calculated using the arithmetic mean formula:. The chart looks like a series of bricks, look. In score function optimization case, the optimal brick size is which give a maximum value of score function. Marcel Hi, I tested this strategy on Spot Gold with a brick size of 20 on the weekly timeframe with

Follow Us. A regular bar, line or candlestick chart has a uniform date axis with equally spaced days, weeks and months. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. The ATR is used to filter out the normal noise or volatility of a financial instrument. The chart looks like a series of bricks, look below. Value greater than 1 is good. Q: Why are the Renko bricks changing on my chart? In other words, new price data is added every trading day and the brick size will remain constant. Renko Charts.

In renko chart there is always a fixed brick size. Renko bars with wicks on price chart renko. Off: All Trading Holidays. Demo trading crypto day trading inside yesterday value area the Stock price is more then trader need to consider big brick size, if Stock price is less then Brick size should be low. Share on twitter Twitter. Quality estimation and score function It would be good to measure a quality of Renko chart. We are DTM a start-up financial services provider offering next gen Automated trading products. But as renko automated trading renko intraday size chart is of higher timeframe, there is higher possibility of false brick formation and missing trading signals. No information on this site is investment advice or a solicitation to buy or sell any financial instrument. A specific point value means brick size will remain constant even as new data is incorporated into the chart. However it may change during the day, so the chart may change along with it. Fxcm forum deutsch managed futures trading strategies a Replay. Slowlyslowly can u just help me with the exact definition of percboxmm and period to understand will a Processed noiseless chart becomes understandable, and trend lines are more clearly. Best regards. Consider Reno chart as candle of closed prices, as Renko chart is not dependent on time. Renko chart helps trader to eliminate noise or sideways movement of any Script, as the brick gets built only if the price moves up or down by the Brick size fro the top or bottom of the last brick. We work on algorithmic strategies problems in stock and crypto markets.

Yes, I was talking of your strategy, and my own code. Backtesting on RENKO is not a good idea as this is not dependent on time, similarly as bricks are of same size and forms with different duration of time, its always advisable to trade using Tick data for RENKO chart if a trader is trading using Auto trade. Towards Data Science A Medium publication sharing concepts, ideas, and codes. As the name implies, this book goes beyond candlesticks to show chartists other technical analysis techniques that originated in Japan. Andre Ye in Towards Data Science. Nicolas Use Highs and Lows instead. Click here for a live example. In order to use StockCharts. But it would certainly be profitable with any other ones as there are only 2 parameters to set : the brick size 20 points default size and the moving average period 20 periods by default , which are quiet common and may not be so curve fitted.. I was just looking to make my own Renko system, because I think Renko is really profitable on the long term. Nicolas 3 years ago. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Interesting code, thanks! Chartists looking to focus on end-of-day price data can choose the close. Red spheres have score equals to -1 value. Allows you to quickly and easily evaluate a variety of statistics confidence intervals, variance, correlation, etc. Harshit Tyagi in Towards Data Science. Import the modules and packages:. Before, results are quite bad.

More From Medium

Leave a Replay. Share on linkedin LinkedIn. I am sure there is a simple reason, but right now I am feeling thick-headed and not able to figure out why by myself. Also, please consider that renko bricks construction begin at the very first price of the loaded history, so 20 bricks size would have been completely different if history begin Renko Fixed on price renko. DonDollar Gentlemen, just a quick question. Also note that ATR values are based on standard charts, such as close-only, bar and candlestick. Renko bars with wicks on price chart renko. Past performance is not indicative of future results. Backtesting on RENKO is not a good idea as this is not dependent on time, similarly as bricks are of same size and forms with different duration of time, its always advisable to trade using Tick data for RENKO chart if a trader is trading using Auto trade. Alessio Nicolas Hello, I have recently started using this platform, I would like to test a system th Connect with:. Test were made with 1 point spread. The articles, codes and content on this website only contain general information. Score values are calculated on test set. Renko boxes on price chart renko. Nicolas Yes, it is possible to add any indicators on a renko chart but with version 11 or ProRealTim Doctrading 4 years ago. A Medium publication sharing concepts, ideas, and codes. Let me know if you apply Renko chart in stock analysis or plan to use one.

DTM Financial Solutions, is a financial solution company deals with software based trading products for Intraday and swing trading in Indian market. Of course this strategy can be traded with the renko bricks size you want. Note: This ATR value might change as prices change which can cause the Renko chart to change significantly whenever it is updated. Maybe with much improvemenets…. One question: Why do you multiply boxsize by 2? I was just looking to make my own Renko system, because I think Renko is really profitable on the long term. Yes, I was talking of your strategy, and my own code. This section is alternative for coinbase ravencoin price news under the SharpChart on the left. Allows you to quickly and easily evaluate a variety of statistics confidence intervals, variance, correlation. An indicator on a Renko chart is based on Renko values and will limit order rejected on gdax day trading with firstrade from the same indicator on a bar chart. Nicolas Please use forums for trading strategies queries. We work on algorithmic strategies problems in stock and crypto markets. A specific point value means brick size will remain constant even as new data is incorporated into the chart.

Experiment consists of three parts. Create a free Medium account to get The Daily Pick in your inbox. Spread are also larger in the evening on DAX. Hello Nicolas, Nice Code! Also, renko bars are point fixed and reflect price movement 20 points herewhich can be a serious parametric bias. Score values are calculated on test set. Thomas Hi Nicolas. Failing which repainting of signal might cause erroneous trading. The ATR is used to filter out the normal noise or volatility of will webull provide tax statement hemp hydrate stock symbol financial instrument. I have my own trading rules for Renko, maybe I will post my own code when I create it. The p-value of t-test is 0. Code block of this part:. Allows you to quickly and easily evaluate a variety of statistics confidence intervals, variance, correlation. Positive value is good. Doctrading 3 years ago. Wishing you a festive christmas season! This website is about prorealtime trading platform, not MT4 sorry. Also note that ATR values are based on standard charts, such as close-only, bar and candlestick. Nicolas 2 years ago. The two charts above cover a six-month timeframe, but the Renko chart sports an irregular date axis and the price action is less choppy.

Thanks in advance. Graphical representations that rely only on price and not time are always more accurate renko,range,tick bars. Tick data are more accurate because movements are not missed. Demonstrated a full cycle of noise reduction process using Renko. In renko chart there is always a fixed brick size. However it may change during the day, so the chart may change along with it. This automated trading strategy is built upon pseudo renko chart on ordinary candlesticks one. Rashi Desai in Towards Data Science. You should set these parameters before Renko chart building:. Past performance is not indicative of future results. My 10 favorite resources for learning data science online. A: If you are using the ATR box size, the box size is computed automatically. Nicolas Use Highs and Lows instead. Nicolas This code is an indicator to plot the renko bricks on a standard price chart. A new brick is created when the price moves up or down to that brick size price amount. Let me know if you apply Renko chart in stock analysis or plan to use one. Yes I think it would be the same as in real time trading, it not use any kind of takeprofit, stoploss or trailing stop, just stop and reverse orders and trade open and close cannot be in the same candle. But it would certainly be profitable with any other ones as there are only 2 parameters to set : the brick size 20 points default size and the moving average period 20 periods by default , which are quiet common and may not be so curve fitted.. Time can keep moving but Renko can remain unchanged without any brick movement if the close price has not crossed the brick size as mentioned above. Privacy Policy.

Code block of result visualization:. You should set these parameters before Renko chart building:. Richmond Alake in Towards Data Science. We are DTM a start-up merrill edge options trading levels jpms brokerage deposit into my account services provider offering next best company to invest in stock 2020 day trading uk books Automated trading products. Username or Email. Try to reduce the box size or to expand the units displayed. Share on facebook Facebook. Pawan Jain in Towards Data Science. Armed with this information, chartists can identify uptrends with higher highs and higher lows or downtrends with lower lows and lower highs. Recent Posts. Frederik Bussler in Towards Data Science. My 10 favorite resources for learning data science online. Bootstrapping is practical computer method for studying the distribution of statistics based on multiple generations of samples by the Monte Carlo method based on the available sample. An up brick Uptrend is typically colored green, and a down brick Downtrend is typically colored black or red. Greater value is better. Yes, I was talking of your strategy, and my own code. Each investor must make their own judgement about the appropriateness of trading a financial instrument to their own financial, fiscal and legal situation. Note: This ATR value might change as prices change which can cause the Renko chart to change significantly whenever it is updated.

However it may change during the day, so the chart may change along with it. Given result will be tested on significance by statistical methods. Nicolas Just been studying your strategy, is this something you still run live? Click here for a live example. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. This sample is distributed according to the normal distribution, p-value is 0. If the Stock price is more then trader need to consider big brick size, if Stock price is less then Brick size should be low. Backtesting on RENKO is not a good idea as this is not dependent on time, similarly as bricks are of same size and forms with different duration of time, its always advisable to trade using Tick data for RENKO chart if a trader is trading using Auto trade. Import the modules and packages:. Is this sounding confusing, let me explain in further detail from the above image.

The second chart ends on April 15th and the ATR value is Renko Fixed on price renko. About Us. Thomas Hi Nicolas. Pawan Jain in Towards Data Science. You can also check our " privacy policy " page for more information. Close Menu. Score function with minus sign should be used because it is inverse problem. Notice how the brick value changed as the ATR value changed.